U.S. Milk Production Update – Oct ’21

Executive Summary

U.S. milk production figures provided by the USDA were recently updated with values spanning through Sep ’21. Highlights from the updated report include:

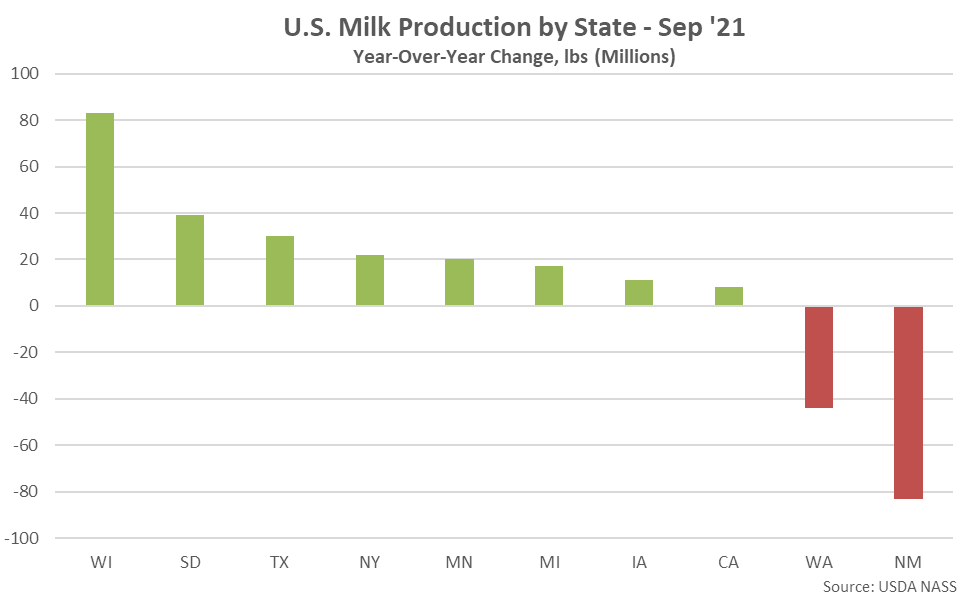

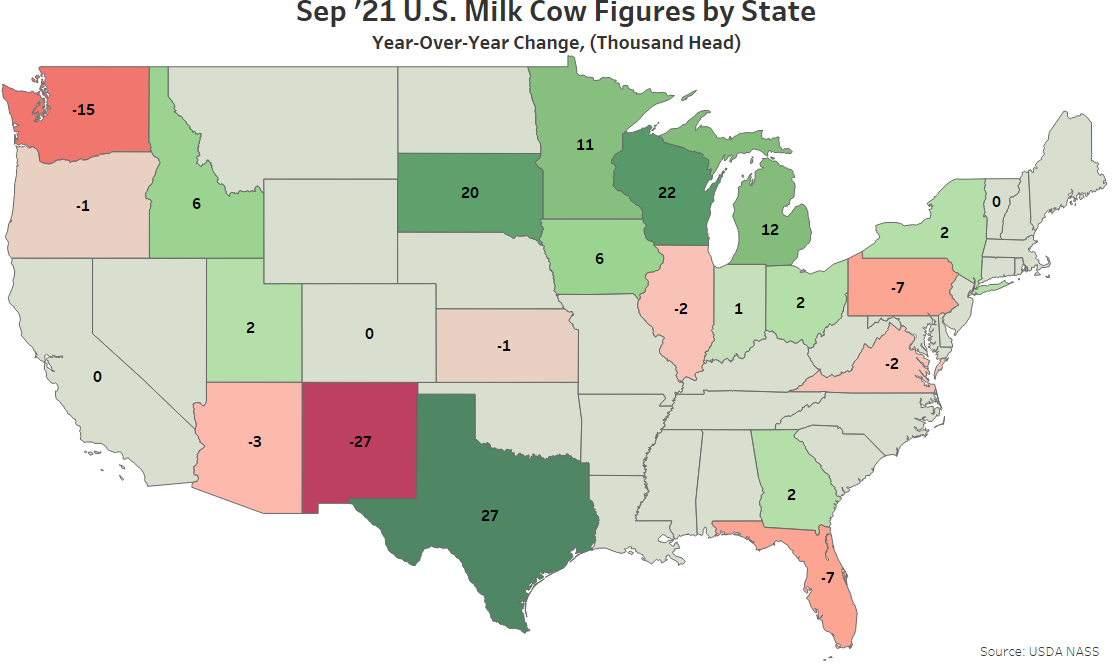

- U.S. milk production increased on a YOY basis for the 26th time in the past 27 months throughout Sep ’21, finishing 0.2% above the previous year and remaining at a record high seasonal level. The YOY increase in milk production volumes was the smallest experienced throughout the past 16 months, however. YOY increases in production on an absolute basis were led by Wisconsin, followed by South Dakota and Texas. New Mexico and Washington milk production volumes finished most significantly below previous year levels.

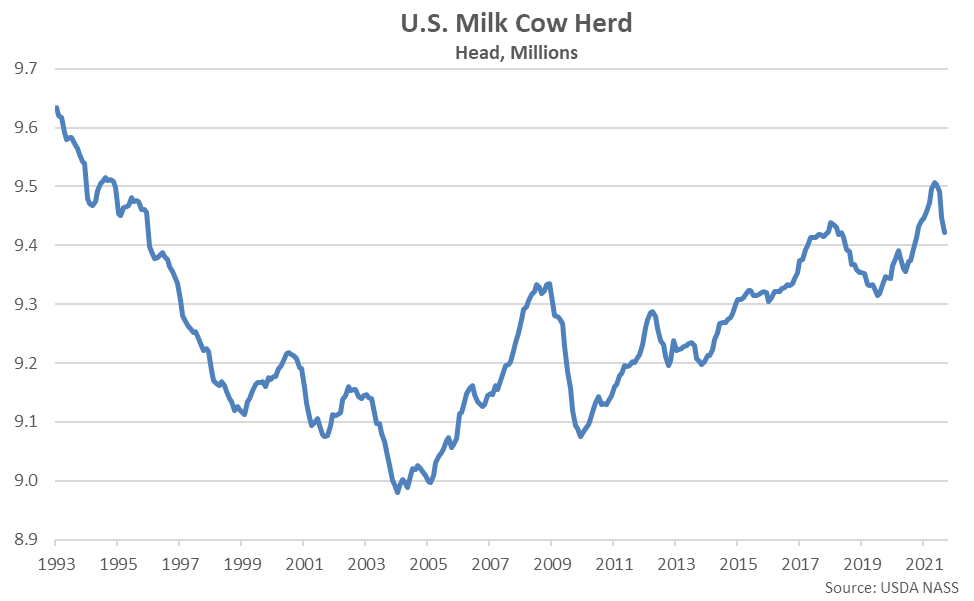

- The Aug ’21 U.S. milk cow herd figure was revised 33,000 head below levels previously stated while the Sep ’21 figure declined an additional 25,000 head from the previous month’s revised figure, reaching an 11 month low level. The U.S. milk cow herd currently stands at 9.422 million head, down 85,000 head from the 26 year high level experienced throughout May ’21 but remaining 27,000 head above the previous year.

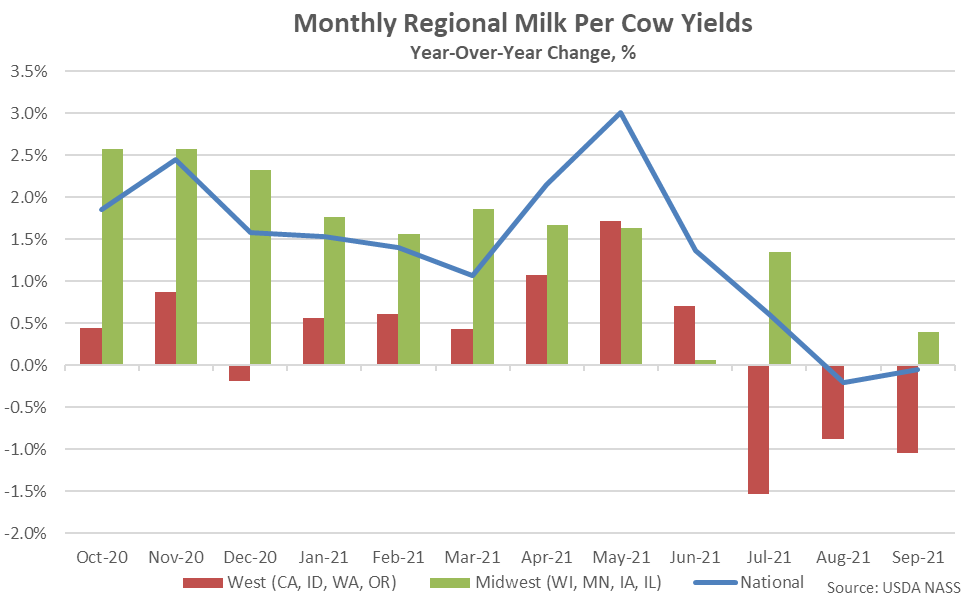

- U.S. milk per cow yields declined 0.1% on a YOY basis throughout Sep ’21, finishing below previous year levels for the second consecutive month. U.S. milk per cow yields had finished below previous year levels just once over the past five and a half years prior to the two most recent declines.

Additional Report Details

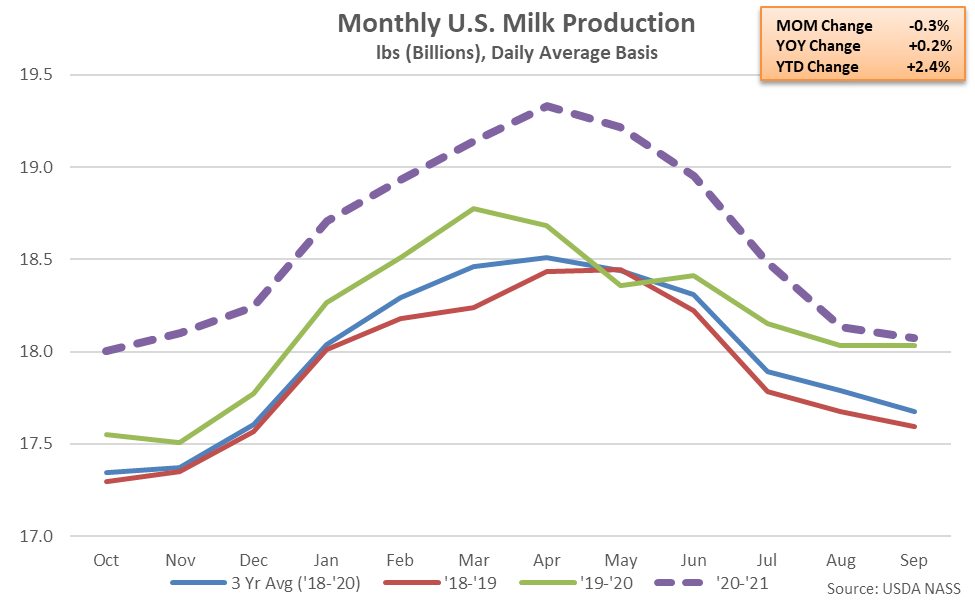

According to the USDA, Sep ’21 U.S. milk production volumes declined seasonally to an 11 month low level but remained 0.2% higher on a YOY basis, reaching a record high seasonal level. Milk production volumes have reached record high seasonal levels over 16 consecutive months through Sep ’21. The month-over-month decline in production volumes of 0.3% was smaller than the ten year average August – September seasonal decline of 1.1%.

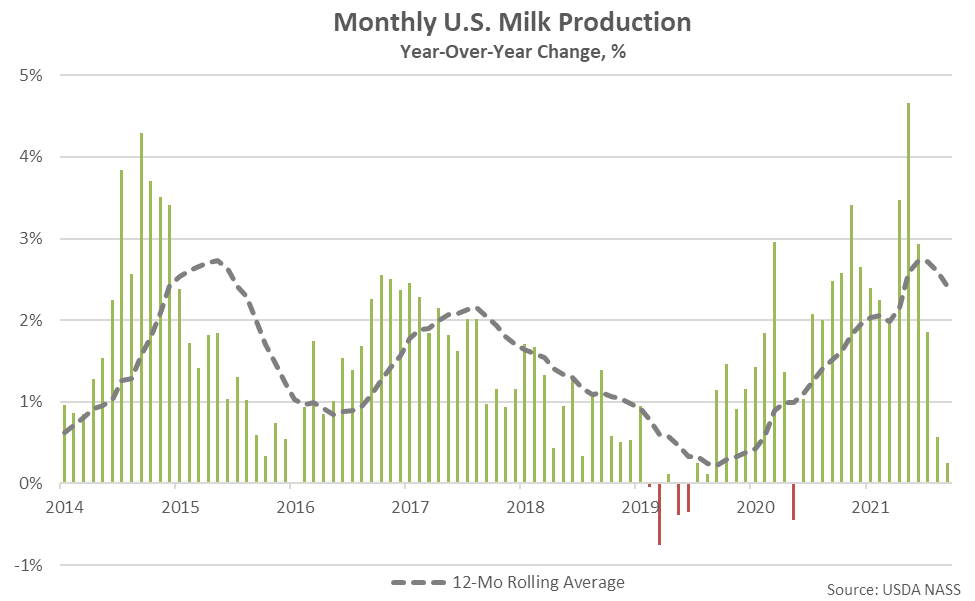

U.S. milk production volumes had finished higher on a YOY basis over 61 consecutive months from Jan ’14 – Jan ‘19, reaching the longest period of consecutive growth on record, prior to declining by a total of 0.3% from Feb ’19 – Jun ’19. Milk production volumes have rebounded throughout more recent months, finishing higher over 26 of the past 27 months through Sep ’21. The Sep ’21 YOY increase in production was the smallest experienced throughout the past 16 months, however. ’20-’21 annual U.S. milk production volumes finished 2.4% above previous year levels, reaching a 13 year high annual growth rate.

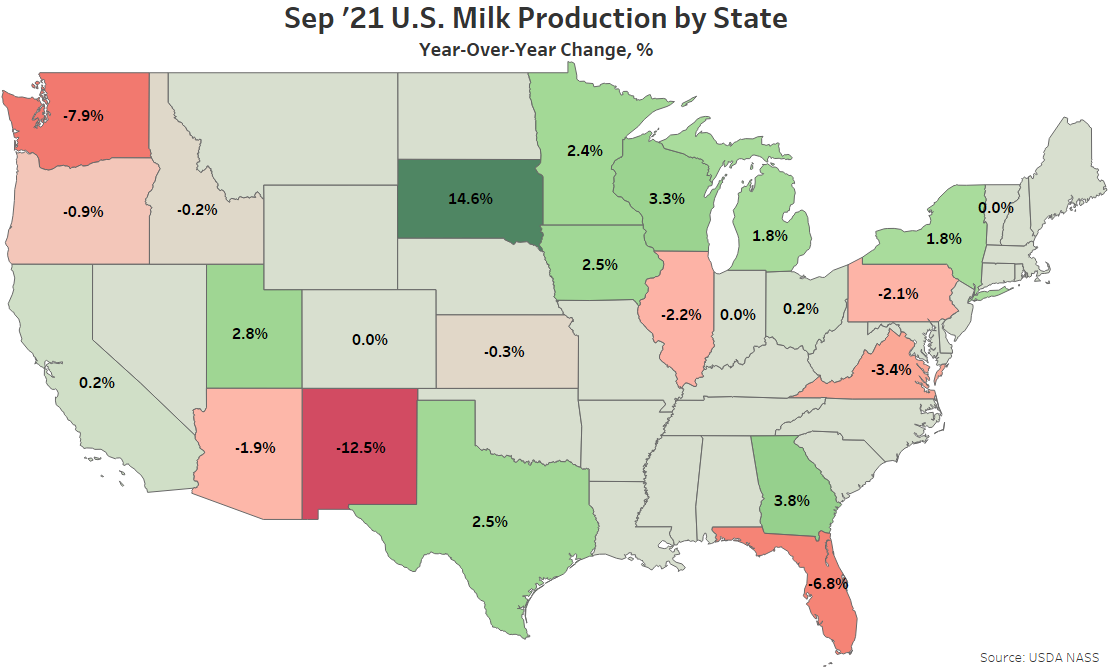

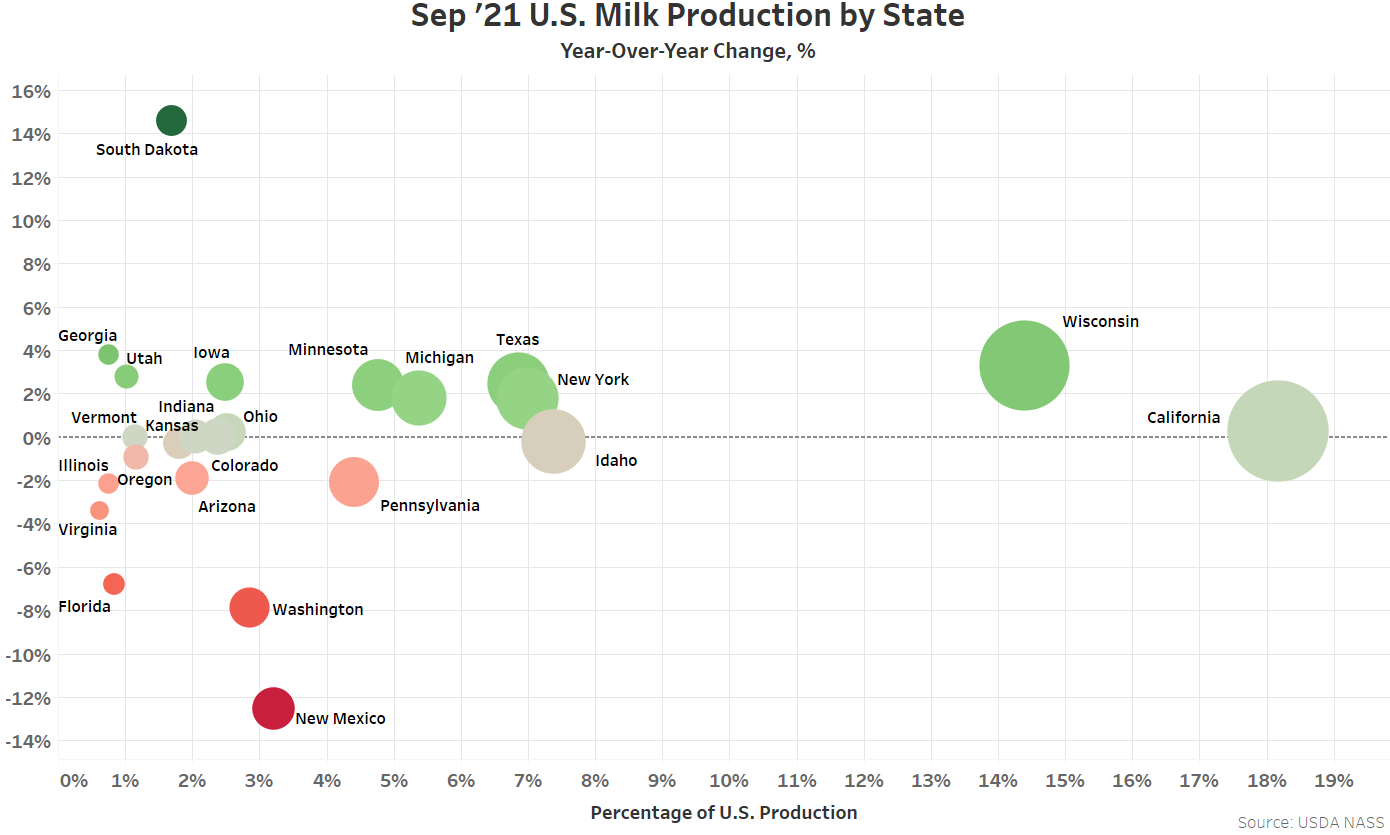

YOY increases in production on a percentage basis were led by South Dakota (+14.6%), followed by Georgia (+3.8%) and Wisconsin (+3.3%), while production volumes finished most significantly lower YOY on a percentage basis within New Mexico (-12.5%), Washington (-7.9%) and Florida (-6.8%). Overall, just 11 of the 24 states milk production figures are provided for experienced YOY increases in production throughout the month.

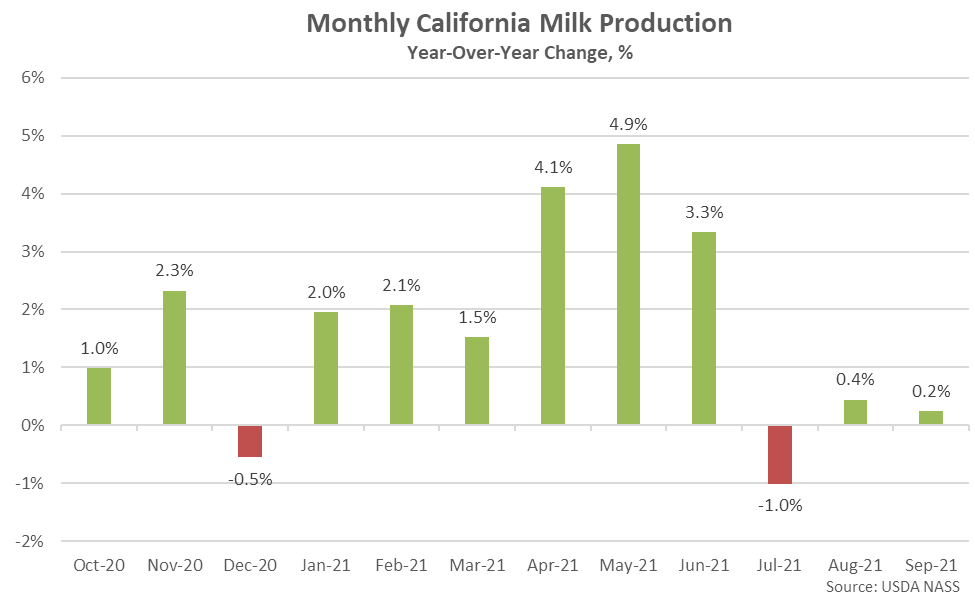

California milk production volumes finished above previous year levels for the 22nd time in the past 24 months throughout Sep ’21, increasing by 0.2%. California accounted for 18.2% of total U.S. milk production volumes throughout the month, leading all states.

Six of the top ten largest milk producing states experienced YOY increases in production throughout Sep ’21, as milk production within the top ten milk producing states increased by a weighted average of 0.2% throughout the month. The aforementioned states accounted for nearly three quarters of the total U.S. milk production experienced during Sep ’21. Production volumes outside of the top ten largest milk producing states also increased by 0.2% on a YOY basis throughout the month.

Sep ’21 YOY increases in milk production on an absolute basis were led by Wisconsin, followed by South Dakota and Texas, while YOY declines in production on an absolute basis were most significant throughout New Mexico, followed by Washington.

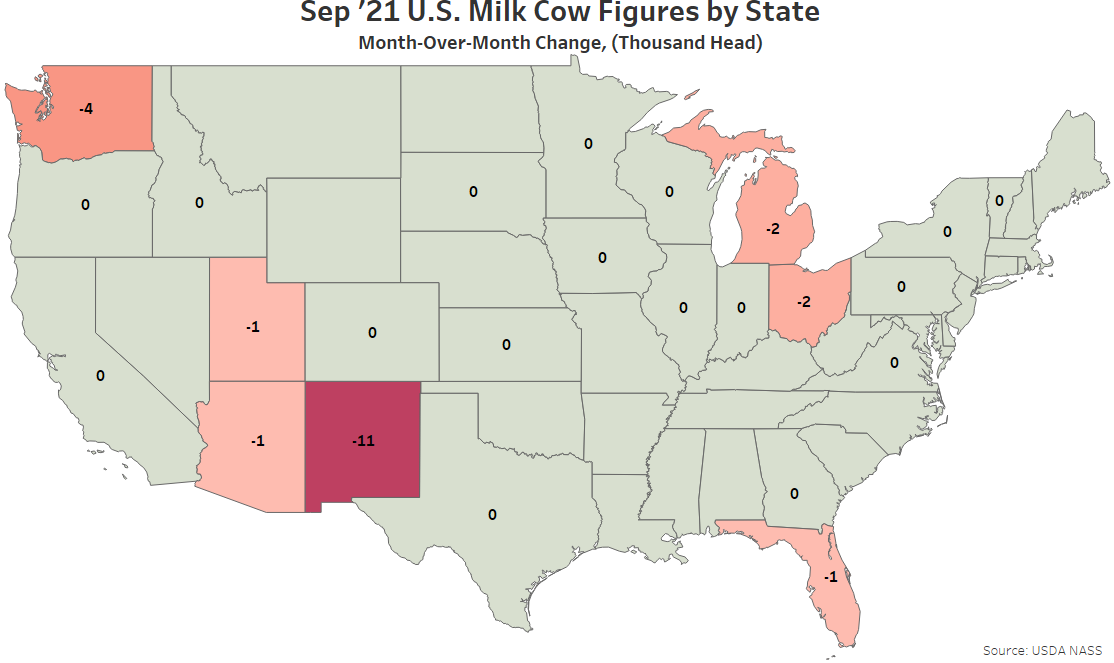

The Aug ’21 U.S. milk cow herd figure was revised 33,000 head below levels previous stated while the Sep ’21 figure declined an additional 25,000 head from the previous month’s revised figure, reaching an 11 month low level. The U.S. milk cow herd currently stands at 9.422 million head, down 85,000 head from the 26 year high level experienced throughout May ’21 but remaining 27,000 head above the previous year. The Aug ’21 revised month-over-month decline in the U.S. milk cow herd was the largest experienced throughout the past 25 years, while the Sep ’21 decline was the second largest experienced throughout the past 11 years, trailing only the August revised figure.

Month-over-month declines in milk cow herds were led by New Mexico, followed by Washington, Michigan, Ohio, Arizona, Florida and Utah.

Sep ’21 YOY increases in milk cow herds continued to be led by Texas, followed by Wisconsin and South Dakota, while the New Mexico and Washington milk cow herds finished most significantly lower on a YOY basis throughout the month.

U.S. milk per cow yields finished 0.1% below previous year levels throughout Sep ’21, finishing slightly lower on a YOY basis for the second consecutive month. U.S. milk per cow yields had finished below previous year levels just once over the past five and a half years prior to the two most recent declines. Yields experienced throughout the Midwestern states of Wisconsin, Minnesota, Iowa and Illinois increased 0.4% on a YOY basis throughout Sep ’21 however yields experienced throughout the Western states of California, Idaho, Washington and Oregon finished 1.0% below previous year levels.