Mexican Milk Production Update – Jan ’22

Executive Summary

Mexican milk production figures provided by the Mexican Agri-Food and Fisheries Information Service were recently updated with values spanning through the end of the 2021 calendar year. Highlights from the updated figures include:

- Mexican milk production increased on a YOY basis for the 97th consecutive month during Dec ’21, finishing up 2.7%. 2021 annual Mexican milk production volumes increased by 2.5% on a YOY basis, reaching a 14 year high growth rate. The USDA expects Mexican milk production volumes will increase by an additional 1.0% throughout 2022.

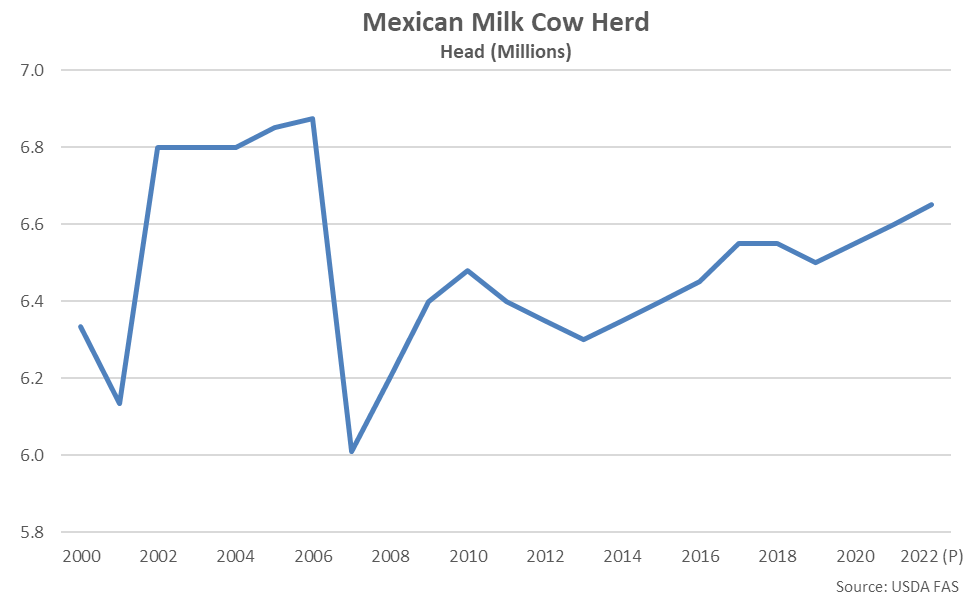

- The Mexican dairy cow herd is projected to rebound to a 16 year high level throughout 2022, finishing above previous year levels for the seventh time in the past nine years.

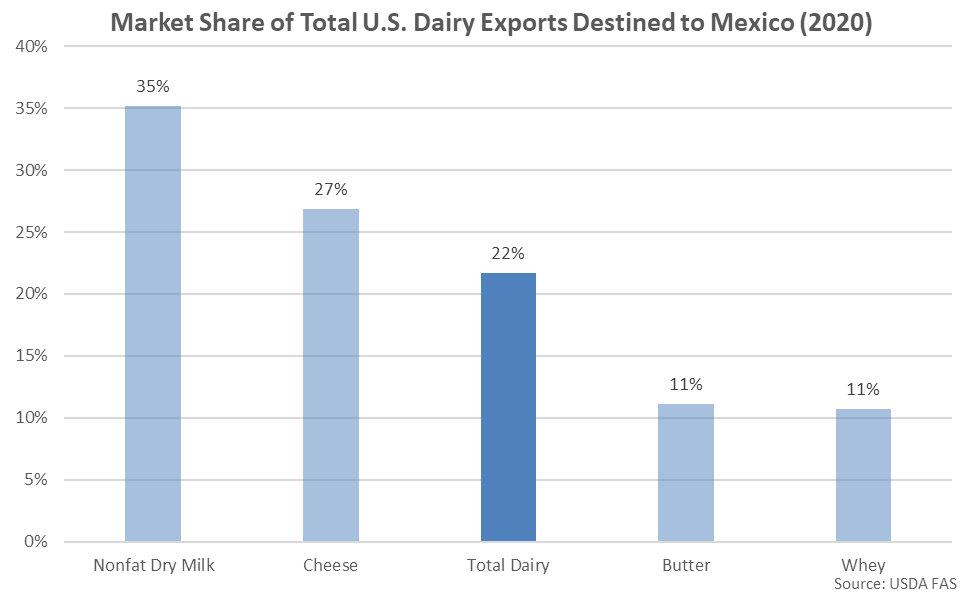

- Mexico has been the largest importer of U.S. dairy products over 18 consecutive years through 2020. Mexico was the largest importer of both U.S. nonfat dry milk and cheese throughout 2020, while accounting for a considerably smaller market share of U.S. butter and whey export volumes.

Additional Report Details

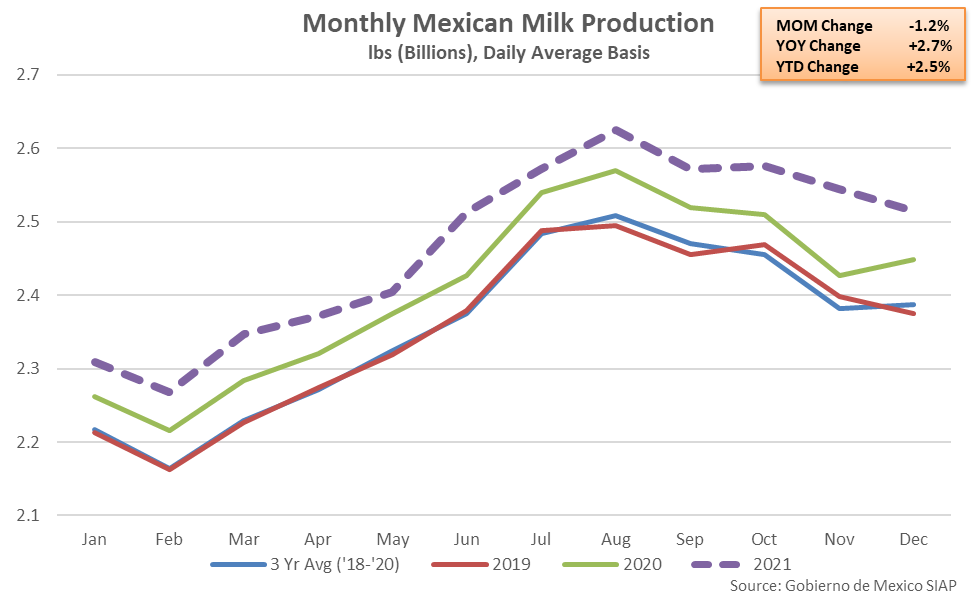

According to the Mexican Agri-Food and Fisheries Information Service, Dec ’21 Mexican milk production volumes remained higher on a YOY basis for the 97th consecutive month, finishing up 2.7%. Production gains have continued despite ongoing pandemic-related macroeconomic shocks.

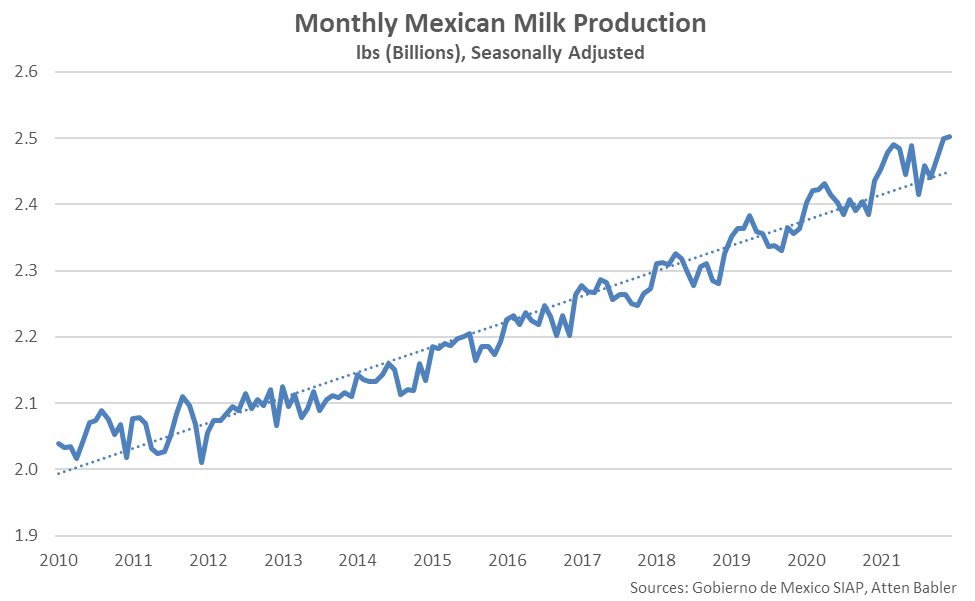

Mexican milk production volumes have increased by a compound annual growth rate of 1.8% over the past ten years. Mexican milk production volumes have finished above long-term average growth rates over 23 of the past 27 months through Dec ’21 as better herd genetics and improved technology have more than offset recently experienced adverse economic conditions. 2021 annual Mexican milk production volumes increased by 2.5% on a YOY basis, reaching a 14 year high growth rate. The USDA expects Mexican milk production volumes will increase by an additional 1.0% on a YOY basis throughout the 2022 calendar year. Low milk prices and continued high feed costs are expected to put some downward pressure on production growth going forward.

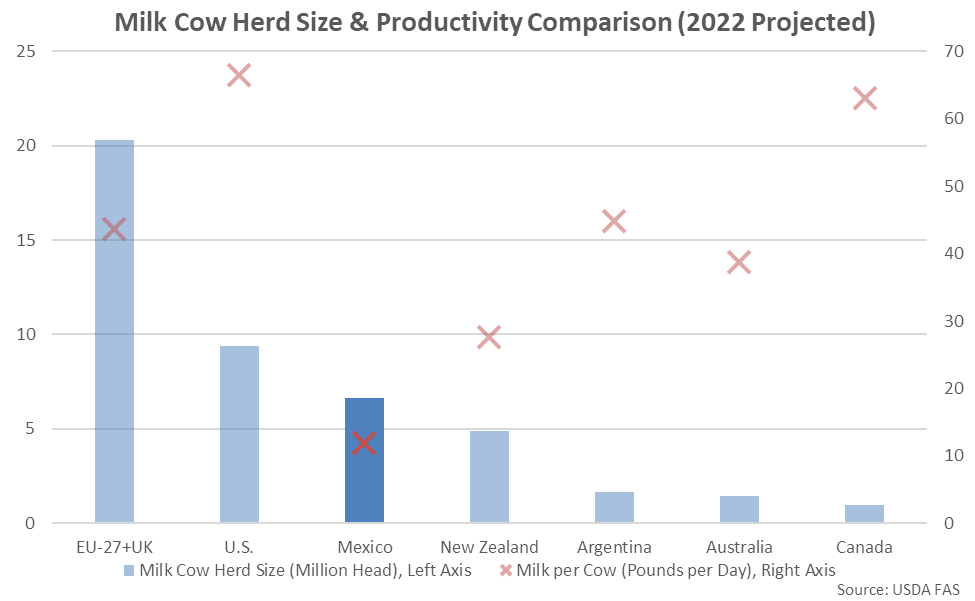

The USDA is projecting the Mexican milk cow herd will reach a 16 year high level of 6.65 million head throughout 2022, finishing 0.8% above previous year levels. The YOY increase in the Mexican milk cow herd would be the seventh experienced throughout the past nine years.

The Mexican milk cow herd is equivalent to approximately 70% of the total U.S. milk cow herd and is nearly seven times as large as the Canadian milk cow herd. Per cow productivity remains poor compared to the U.S., Canada and major dairy exporting regions, however, despite recent improvements in herd genetics and technology. U.S. and Canadian milk cows each produce greater than five times the yields Mexican cows do, on average. Mexican milk per cow yields have increased by a compound annual growth rate of 1.0% throughout the past ten years, slightly below the U.S. and Canadian growth rates experienced over the period.

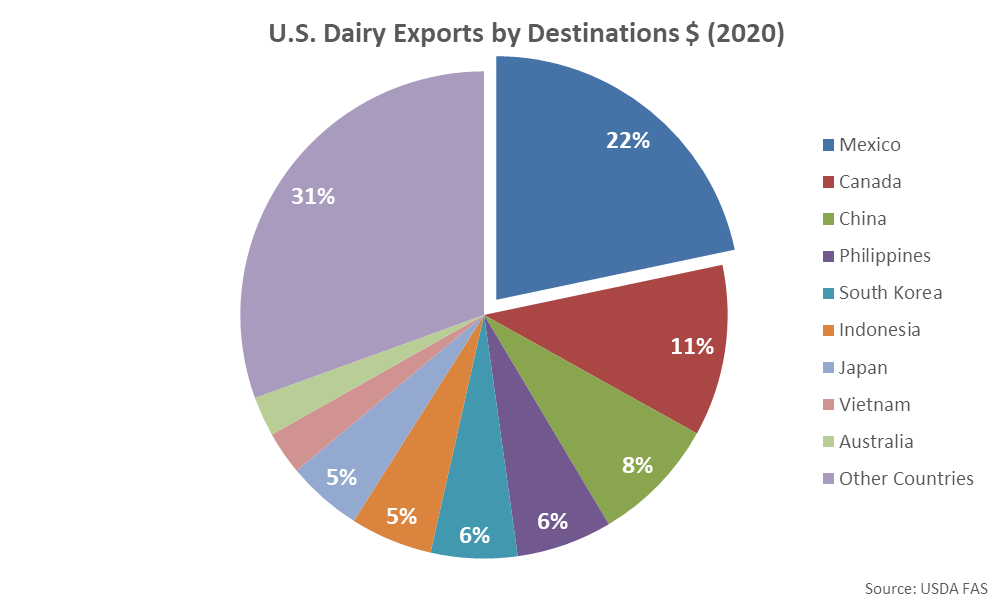

Because of the close proximity of the two countries, Mexico has been the largest importer of U.S. dairy products, historically. Mexico accounted for 22% of total U.S. dairy exports throughout 2020, finishing as the largest importer of U.S. dairy products for the 18th consecutive year. Mexico has remained the largest importer of U.S. dairy products heading into the final month of the 2021 calendar year, accounting for 23% of total U.S. dairy exports.

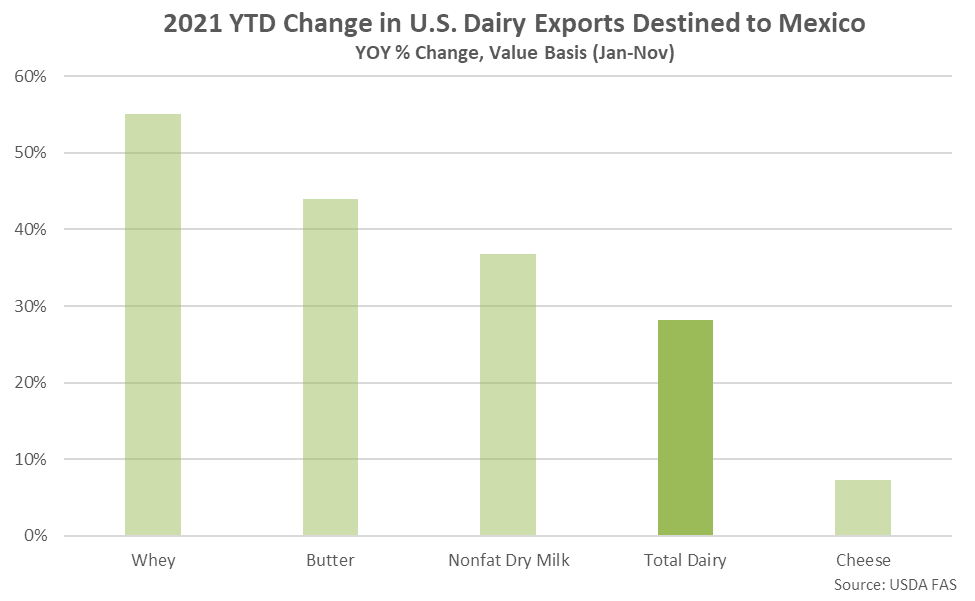

Mexico was the largest importer of both U.S. nonfat dry milk and cheese throughout 2020. Mexico accounted for a considerably smaller market share of U.S. butter (third behind Canada and Saudi Arabia) and whey (second behind China) imports throughout the 2020 calendar year.

U.S. dairy exports destined to Mexico have increased 28.1% on a YOY basis heading into the final month of the 2021 calendar year, leading all export destinations for U.S. dairy products on an absolute basis. Growth in U.S. dairy exports destined to Mexico has been led by whey, followed by butter and nonfat dry milk.