Soybean Complex Crushing & Stocks Update – May ’22

Executive Summary

U.S. soybean crush and stocks figures provided by the USDA were recently updated with values spanning through Mar ’22. Highlights from the updated report include:

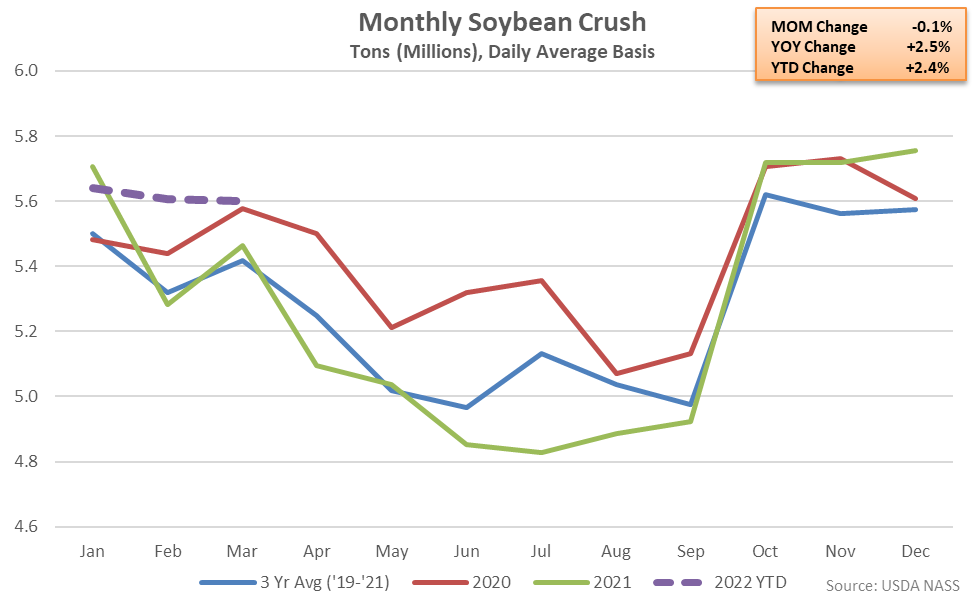

- U.S. soybean crushings finished 2.5% above previous year levels throughout Mar ’22, remaining at a record high seasonal level for the second consecutive month.

- U.S. soybean cake & meal stocks declined to a five year low seasonal level throughout Mar ’22, finishing 16.4% below previous year levels.

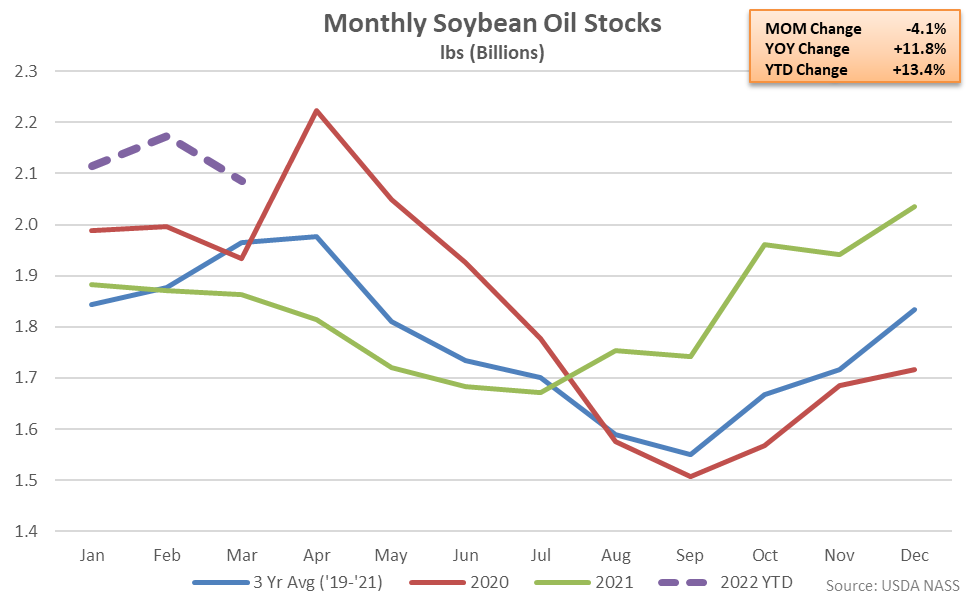

- U.S. soybean oil stocks finished at a three year high seasonal level throughout Mar ’22, up 11.8% from previous year levels.

Additional Report Details

Soybean Crushing – Crush Remains at a Record High Seasonal Level, up 2.5% YOY

According to the USDA, Mar ’22 U.S. soybean crushings remained at a record high seasonal level for the second consecutive month, finishing 2.5% above previous year levels. The YOY increase in soybean crushings was the third experienced throughout the past four months.

The North & East states of Indiana, Kentucky, Maryland, Ohio, Pennsylvania and Virginia experienced the largest YOY increase in soybean crushings throughout Mar ’22. YOY increases in soybean crushings were exhibited across all published regions throughout the month.

2021 annual soybean crushings finished 2.9% below the record high level experienced throughout the previous year. 2022 YTD soybean crushings have rebounded by 2.4% throughout the first quarter of the calendar year, however, and are on pace to reach a record high annual level.

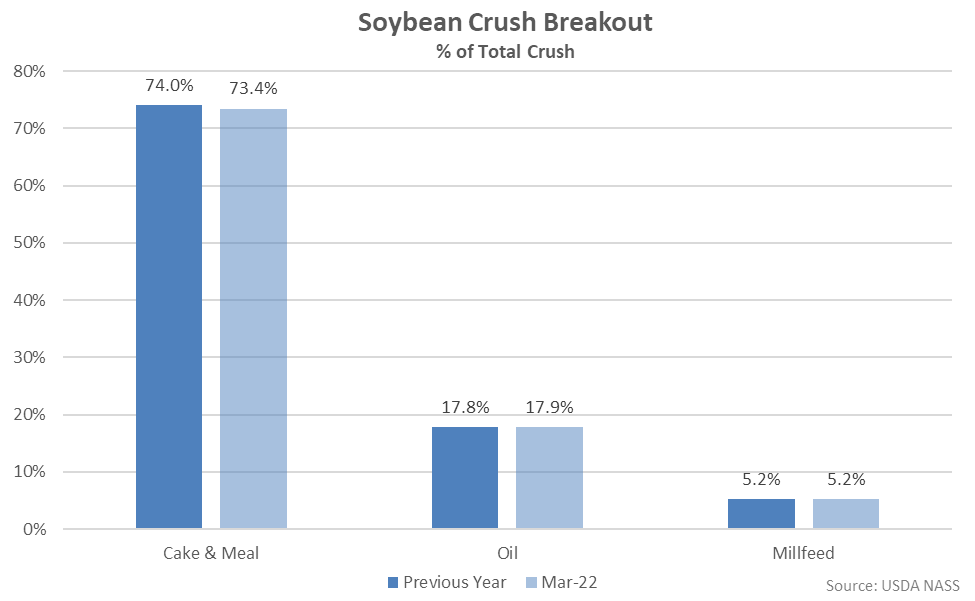

Cake & meal accounted for 73.4% of the total soybean crush throughout Mar ’22, finishing below previous year levels. Oil accounted for 17.9% of the total soybean crush, up slightly from the previous year.

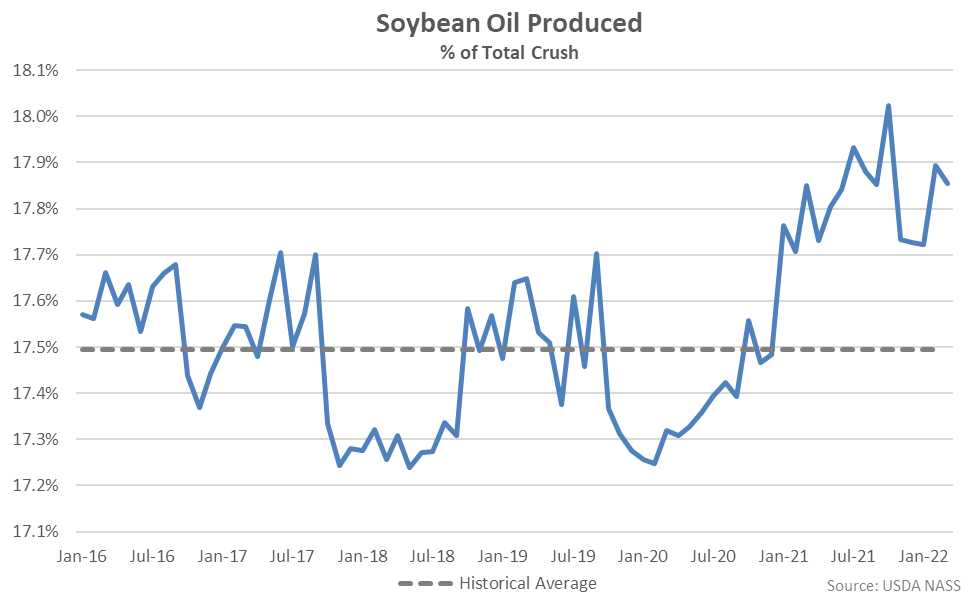

Soybean oil produced as a percentage of total crush remained above historical average levels for the 15th consecutive month throughout Mar ’22.

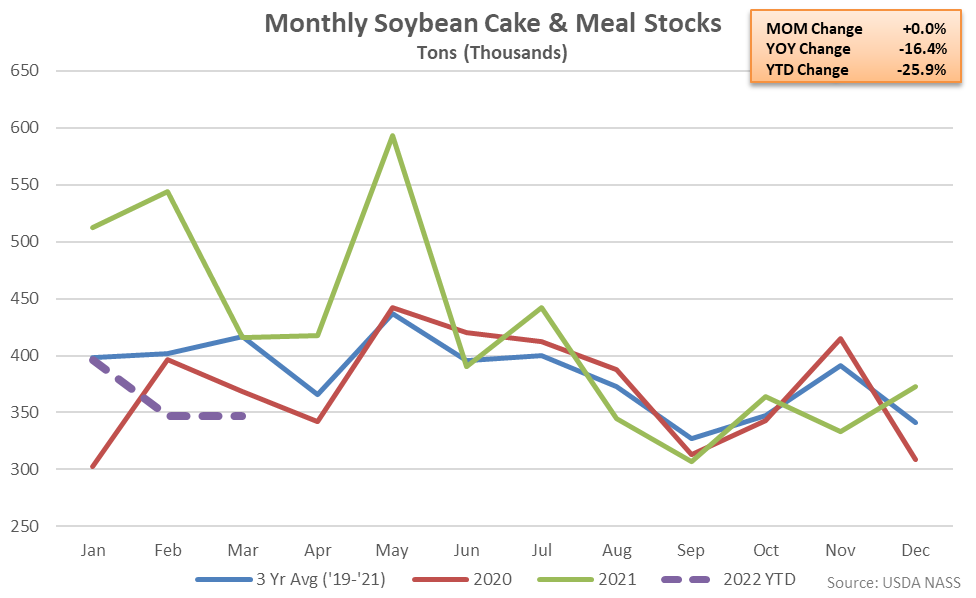

Soybean Cake & Meal Stocks – Stocks Decline to a Five Year Low Seasonal Level, Down 16.4% YOY

Mar ’22 U.S. soybean cake & meal stocks remained largely unchanged from the previous month while finishing 16.4% below previous year levels. Soybean cake & meal stocks reached a five year low seasonal level for the month of March. The YOY decline in soybean cake & meal stocks was the third experienced in a row.

Soybean Oil Stocks – Stocks Finish at a Three Year High Seasonal Level, up 11.8% YOY

Mar ’22 U.S. soybean oil stocks declined contraseasonally from the 22 month high level experienced throughout the previous month but remained 11.8% above previous year levels, reaching a three year high seasonal level. The YOY increase in soybean oil stocks was the eighth experienced in a row but the smallest experienced throughout the past seven months on a percentage basis. The month-over-month decline in soybean oil stocks of 4.1% was a contraseasonal move when compared to the five year average February – March seasonal build in stocks of 4.8%.