Corn & Soybean Drought Update – 5/5/22

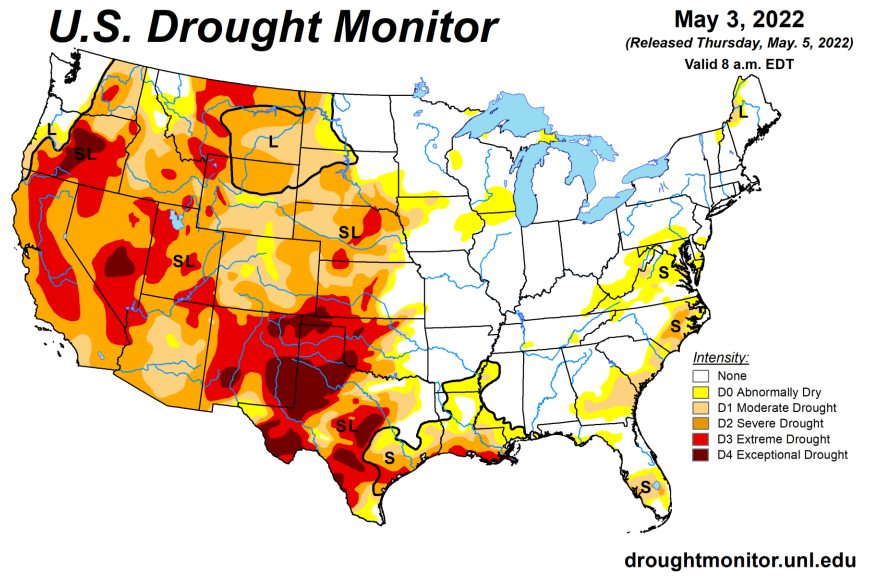

According to the USDA, the percentage of corn and soybeans located within an area experiencing a drought declined to 13 and 14 week low levels, respectively, throughout the week ending May 3rd.

U.S. Drought Monitor:

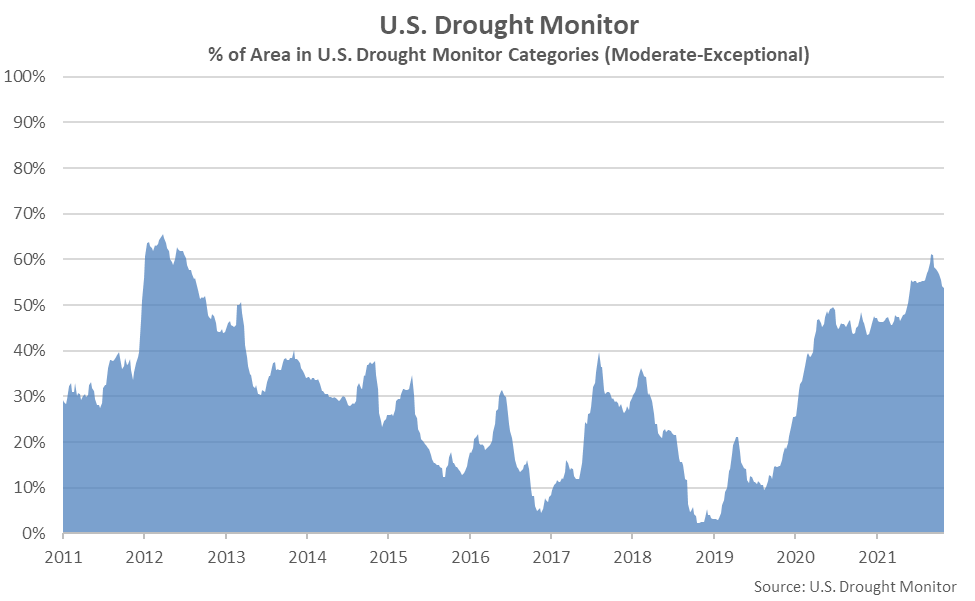

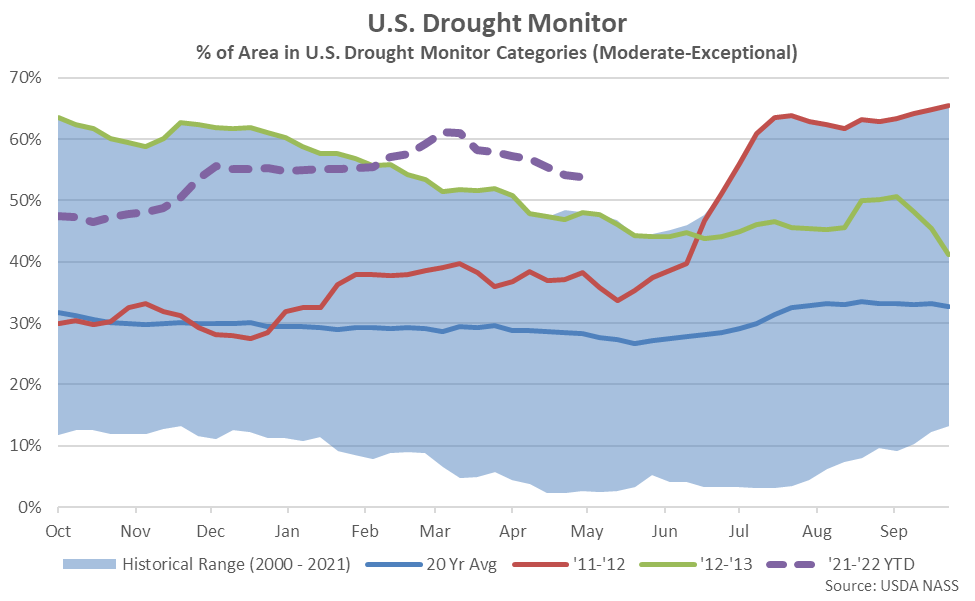

The U.S. Drought Monitor showed 54% of the continental U.S. being in a moderate-to-exceptional drought state as of May 3rd, down less than one percent from the previous week and reaching a 22 week low level.

The percentage of the U.S. in a moderate-to-exceptional drought state remained at a record high seasonal level for the 12th consecutive week, however. U.S. Drought Monitor figures have been compiled since 2000.

Corn:

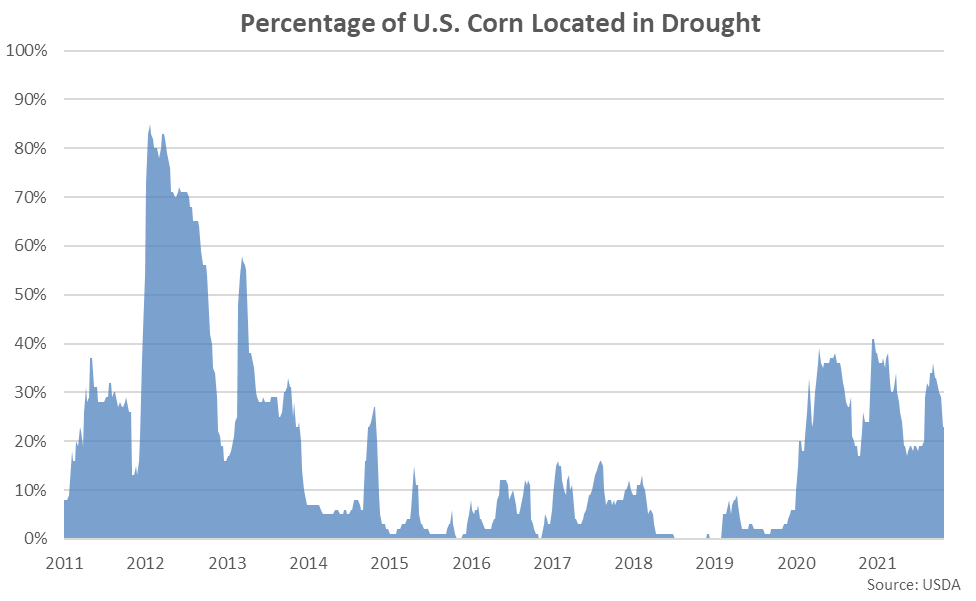

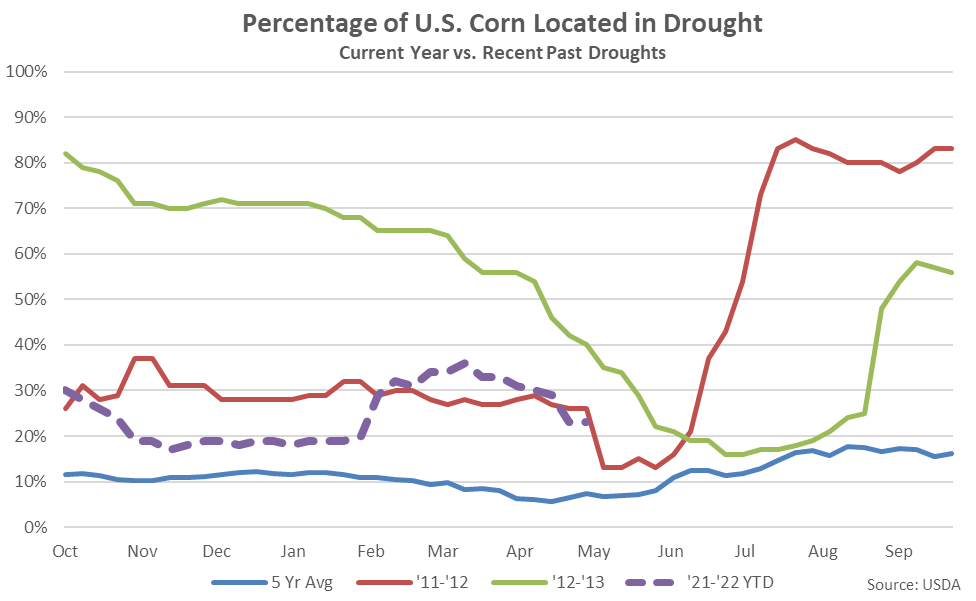

Approximately 23% of corn production was within an area experiencing a drought as of May 3rd, unchanged from the previous week and reaching a 13 week low level.

The percentage of U.S. corn located in a drought state finished below the previous year seasonal level of 26% but remained above the five year average seasonal level of just seven percent. U.S. corn located in a drought state remained significantly below the 2013 record high seasonal level of 40%. Percentage of U.S. corn located in a drought state figures have been compiled since mid-2011.

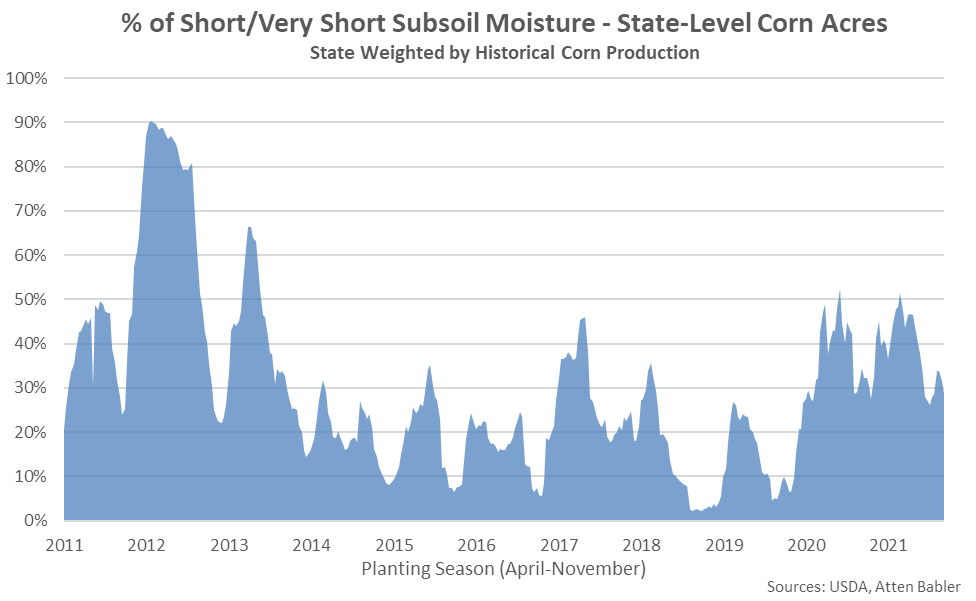

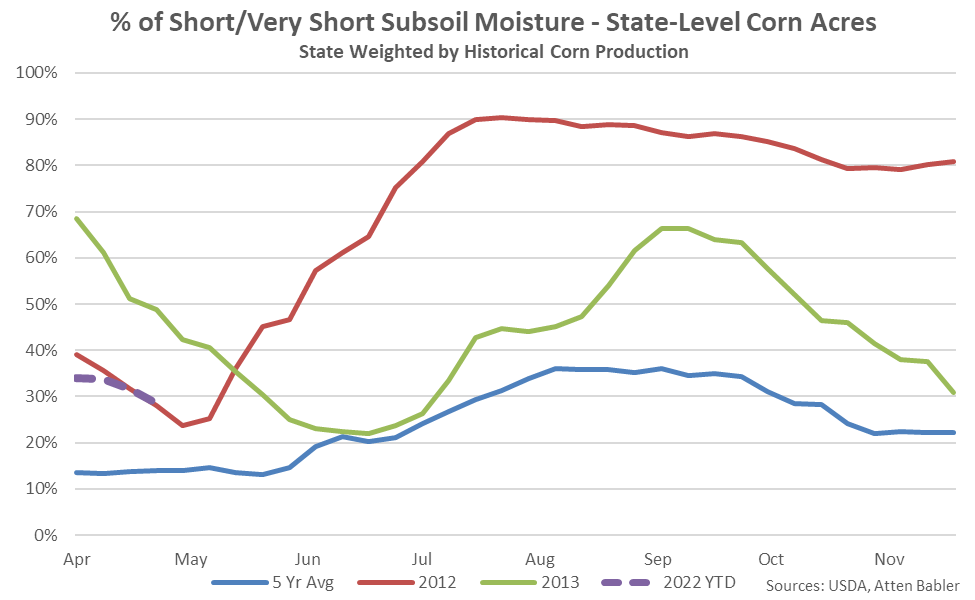

It is estimated that 29% of state-level corn acres had short-to-very short subsoil moisture as of the week ending May 1st, down three percent from the previous week and reaching a five week low level.

The percentage of U.S. corn with short-to-very short subsoil moisture finished below previous year level of 34% during the week ending May 1st while remaining below the 2013 record high seasonal level of 49%.

Soybeans:

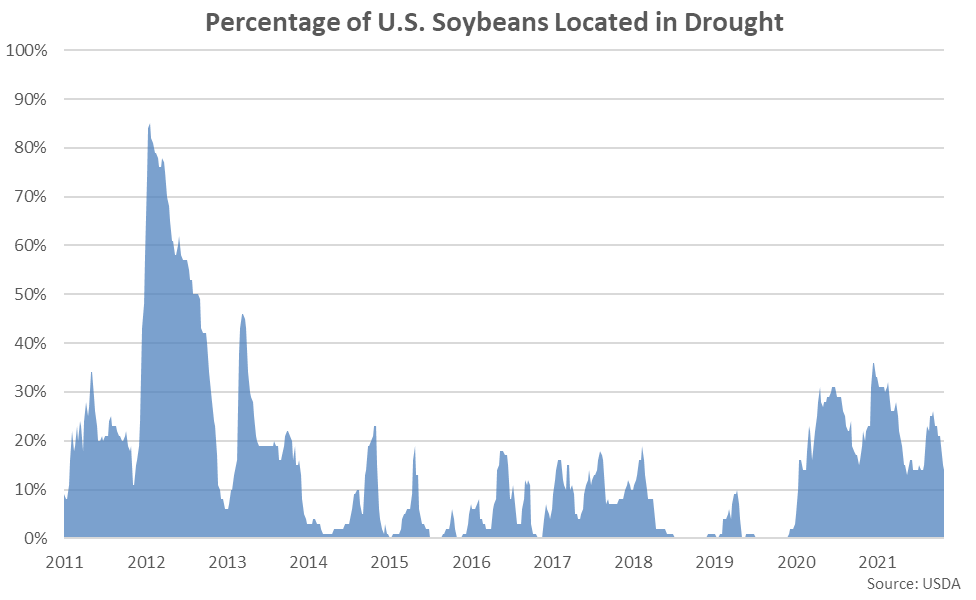

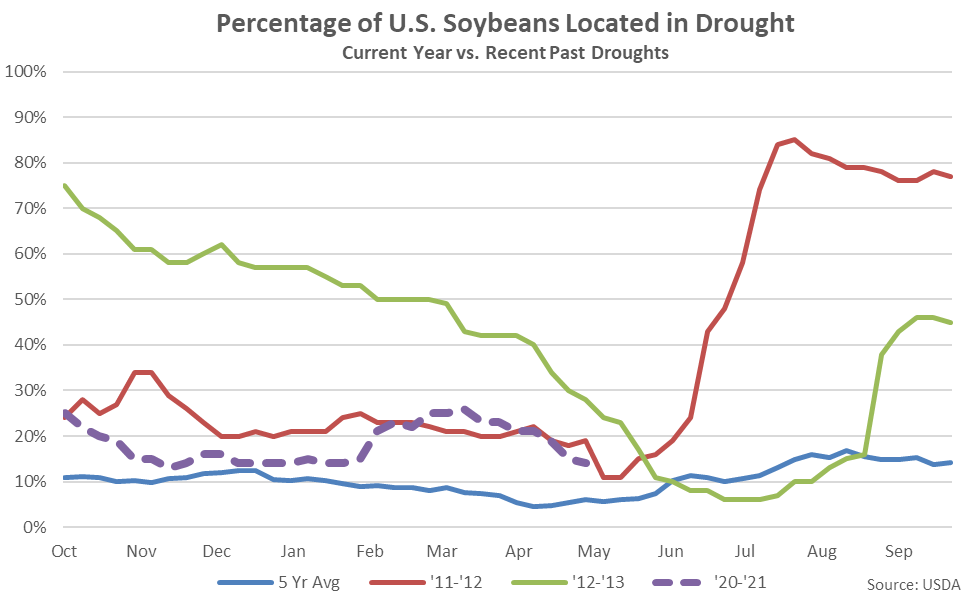

Approximately 14% of soybean production was within an area experiencing a drought as of May 3rd, down one percent from the previous week and reaching a 14 week low level.

The percentage of U.S. soybeans located in a drought state finished below the previous year seasonal level of 22% but remained above the five year average seasonal level of just six percent. U.S. soybeans located in a drought state remained significantly below the 2013 record high seasonal level of 28%. Percentage of U.S. soybeans located in a drought state figures have been compiled since mid-2011.

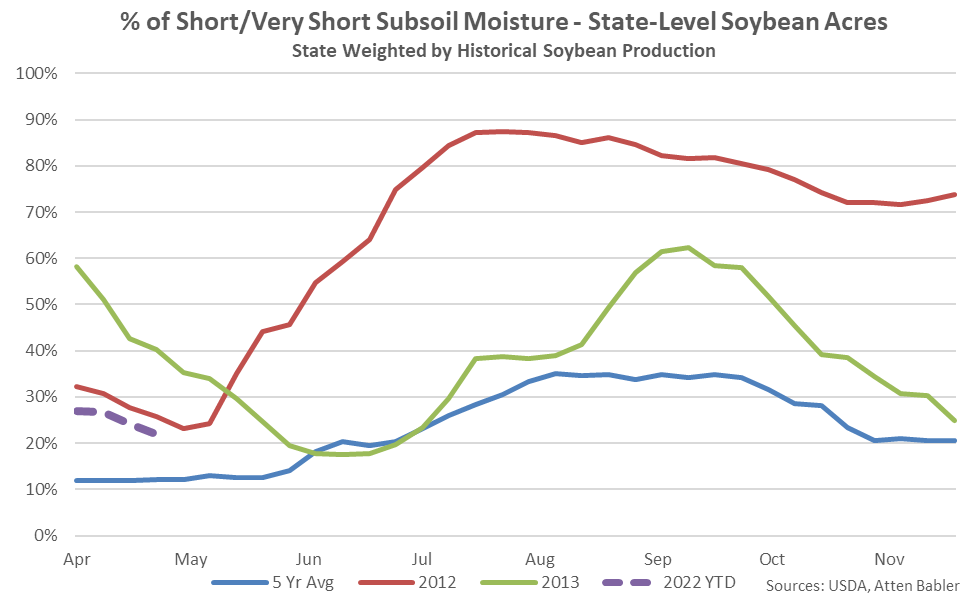

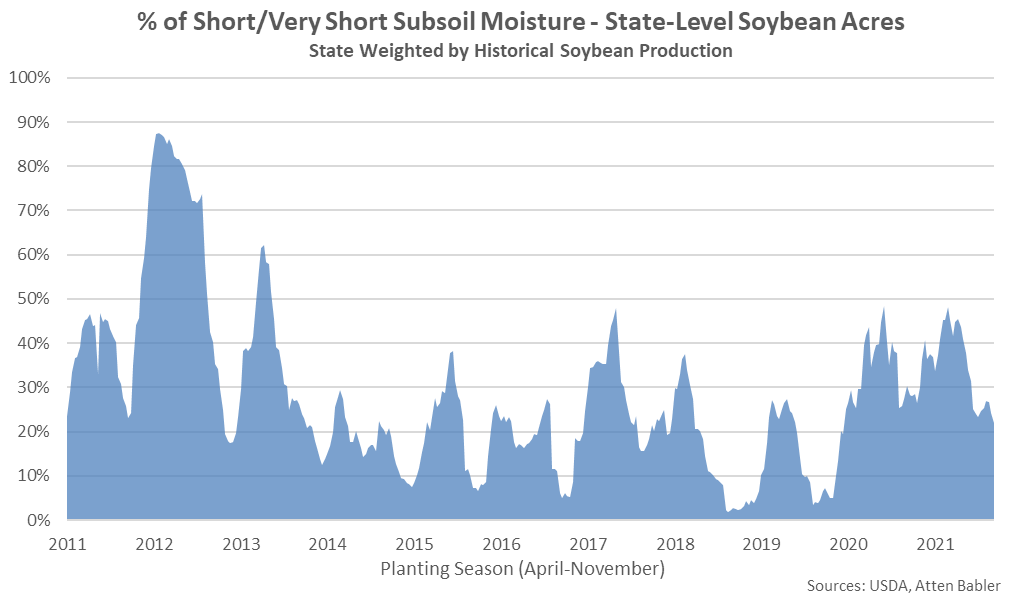

It is estimated that 22% of state-level soybean acres had short-to-very short subsoil moisture as of the week ending May 1st, down two percent from the previous week and reaching a one and a half year low level.

The percentage of U.S. soybeans with short-to-very short subsoil moisture finished below the previous year level of 30% during the week ending May 1st while remaining below the 2013 record high seasonal level of 40%.