U.S. Dairy Dry Product Stocks Update – May ’22

Executive Summary

U.S. dairy dry product stock figures provided by the USDA were recently updated with values spanning through Mar ’22. Highlights from the updated report include:

- U.S. dry whey stocks finished above previous year levels for the first time in the past 14 months throughout Mar ’22, increasing by 7.1%.

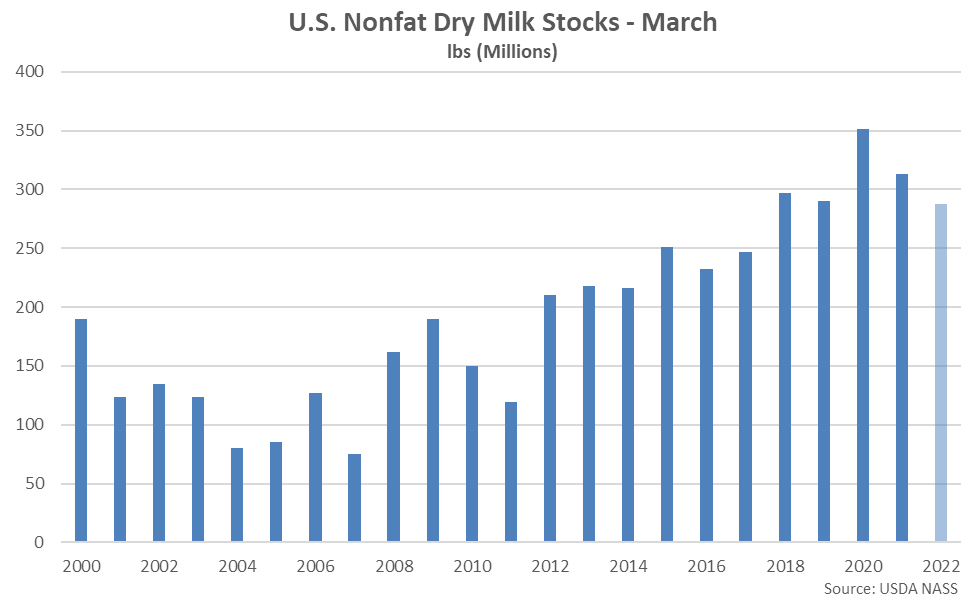

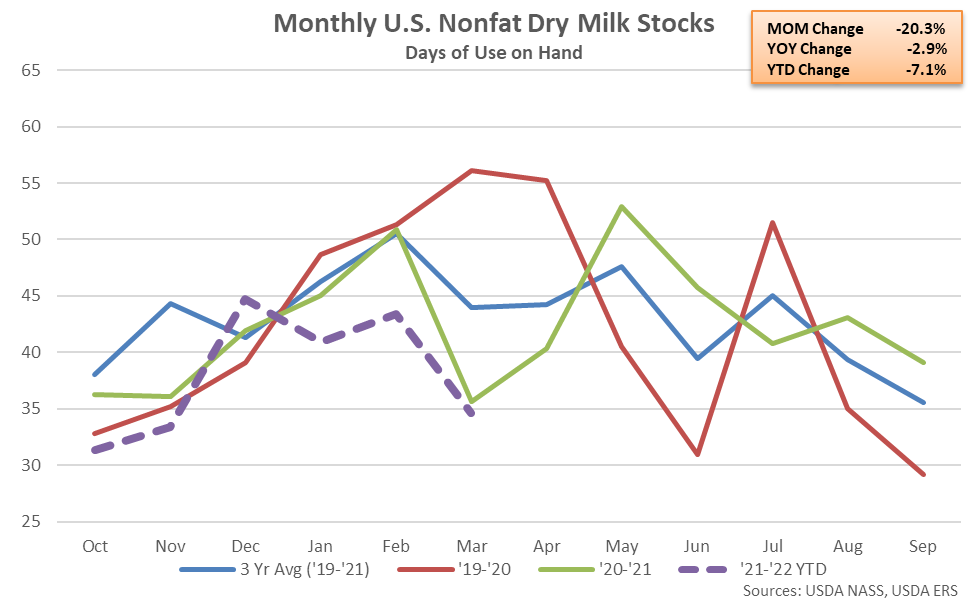

- Mar ’22 U.S. nonfat dry milk stocks declined contraseasonally from the previous month while finishing 8.0% below previous year figures. Nonfat dry milk stocks remained at a five year low seasonal level for the fourth consecutive month.

Additional Report Details

Dry Whey – Stocks Finish Above Previous Year Levels for the First Time in 14 Months, up 7.1%

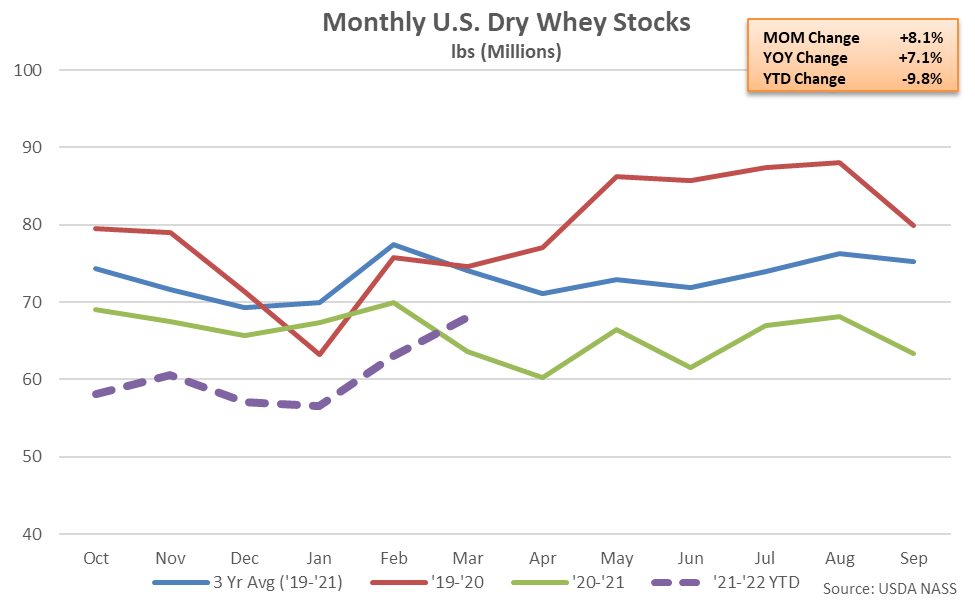

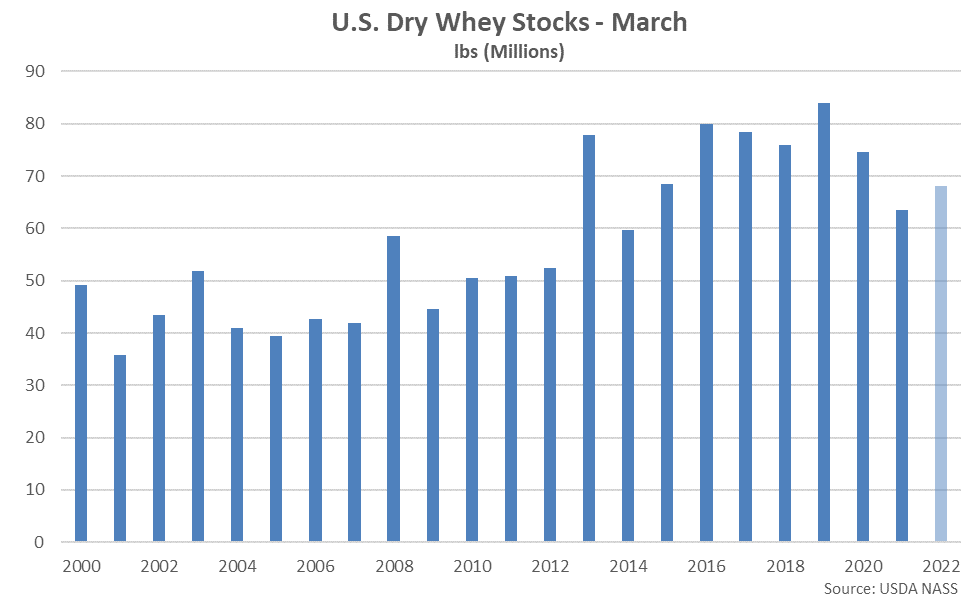

According to the USDA, Mar ’22 month-end dry whey stocks increased seasonally to a seven month high level while finishing 7.1% above previous year levels. The YOY increase in dry whey stocks was the first experienced throughout the past 14 months and the largest experienced throughout the past 19 months on a percentage basis.

The month-over-month increase in dry whey stocks of 5.1 million pounds, or 8.1%, was larger than the ten year average February – March seasonal build in dry whey stocks of 0.4%. Dry whey production increased 6.6% on a YOY basis throughout Mar ’22, increasing on a YOY basis for the first time in the past four months.

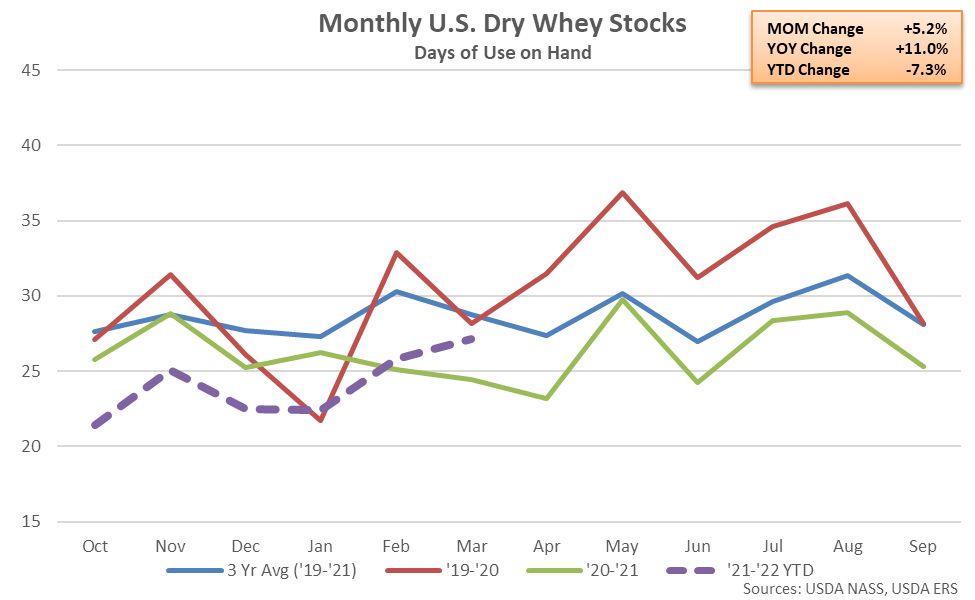

On a days of usage basis, Mar ’22 U.S. dry whey stocks also finished above previous year levels. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of March, dry whey stocks on a days of usage basis finished 11.0% above previous year levels, finishing higher for the second consecutive month.

Nonfat Dry Milk – Stocks Remain at a Five Year Low Seasonal Level, Down 8.0% YOY

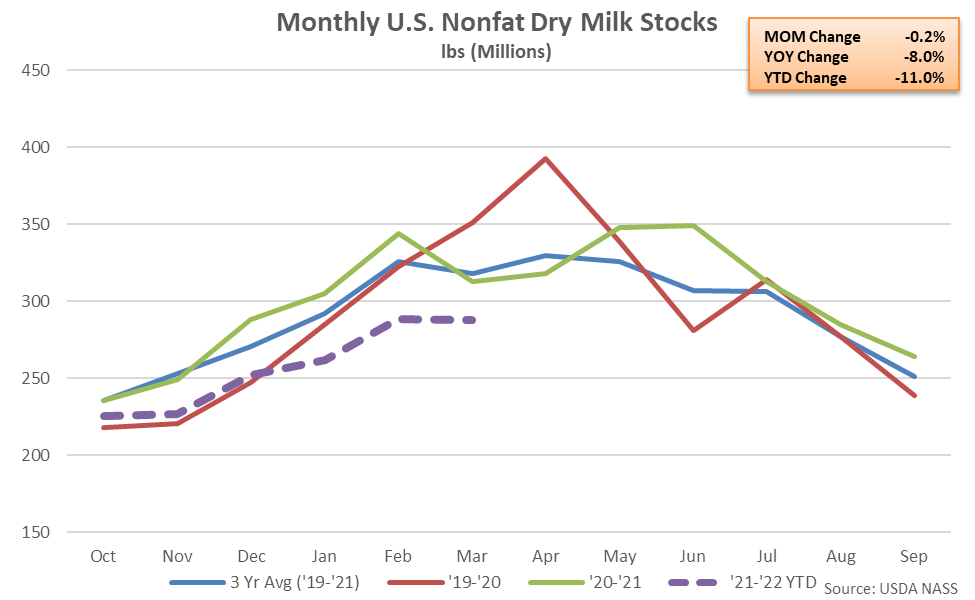

Mar ’22 month-end nonfat dry milk (NFDM) stocks declined contraseasonally from the previous month while finishing 8.0% below previous year levels, remaining at a five year low seasonal level for the fourth consecutive month. The YOY decline in NFDM stocks was the sixth experienced in a row.

The month-over-month decline in NFDM stocks of 0.4 million pounds, or 0.2%, was a contraseasonal move when compared to the ten year average February – March seasonal build in stocks of 3.5 million pounds, or 2.5%. NFDM production declined 3.9% on a YOY basis throughout Mar ’22, finishing below previous year levels for the eighth time in the past nine months.

On a days of usage basis, Mar ’22 U.S. NFDM stocks also finished lower YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of March, NFDM stocks on a days of usage basis finished 2.9% below previous year figures, declining on a YOY basis for the fifth time in the past six months and reaching a five year low seasonal level.

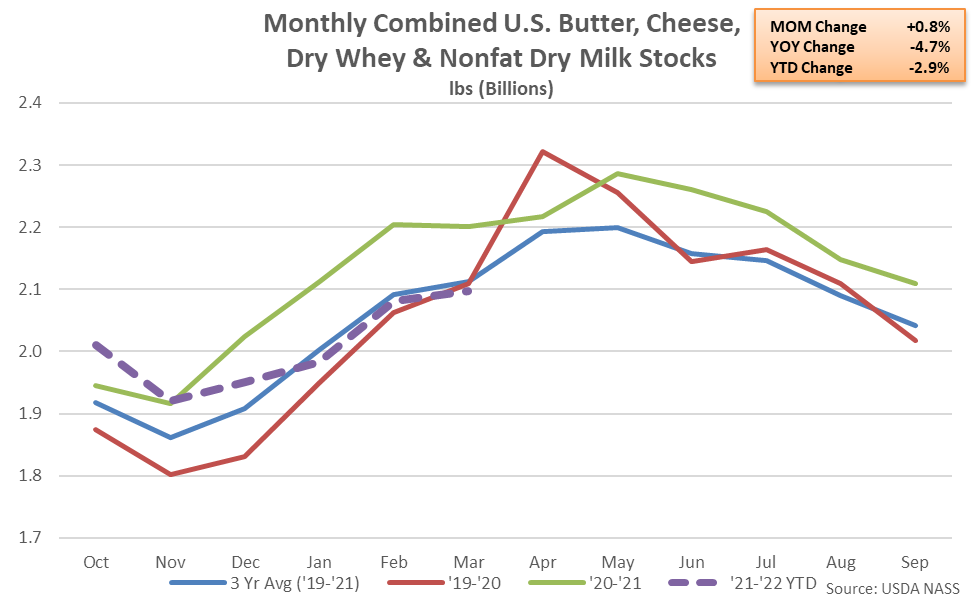

Combined Dairy Product Stocks – Stocks Remain Lower YOY for the Fourth Consecutive Month

Combined stocks of butter, cheese, dry whey and NFDM finished 4.7% below previous year levels throughout Mar ’22, declining on a YOY basis for the fourth consecutive month. A 14.6% YOY decline in Class IV milk product (butter and nonfat dry milk) stock volumes was significantly larger than the 0.4% YOY decline in Class III milk product (cheese & dry whey) stock volumes experienced throughout the month.