EIA Drilling Productivity Report Update – May ’22

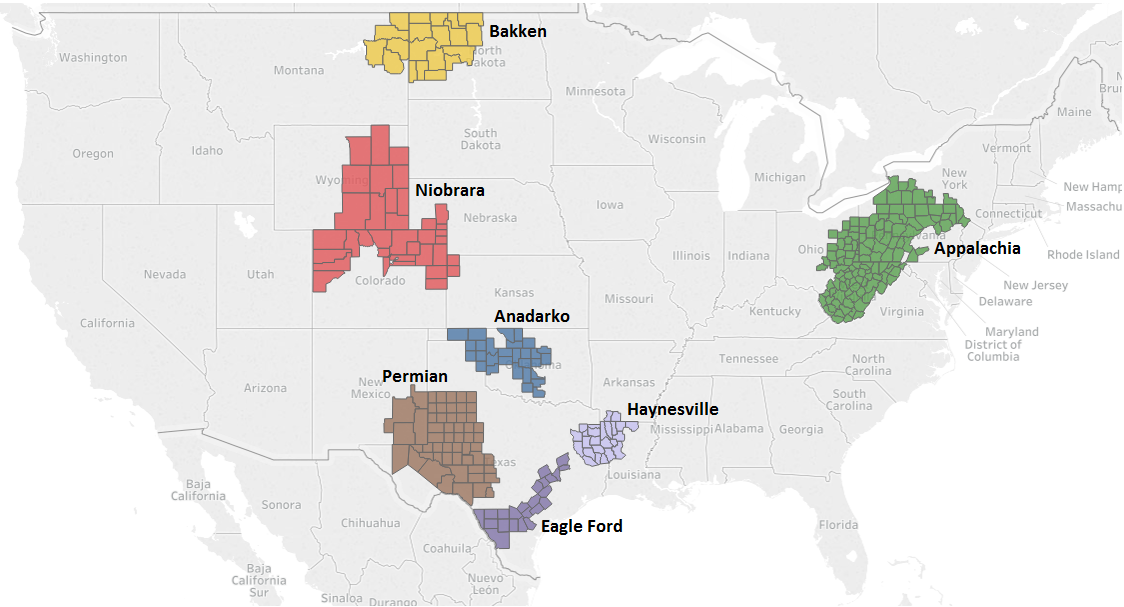

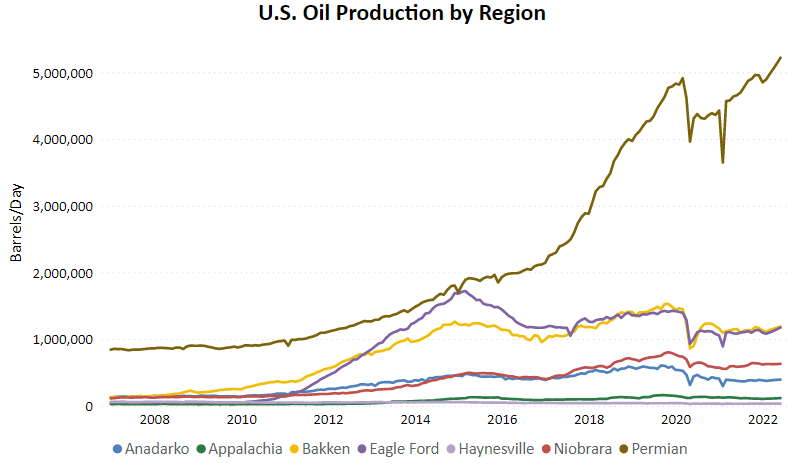

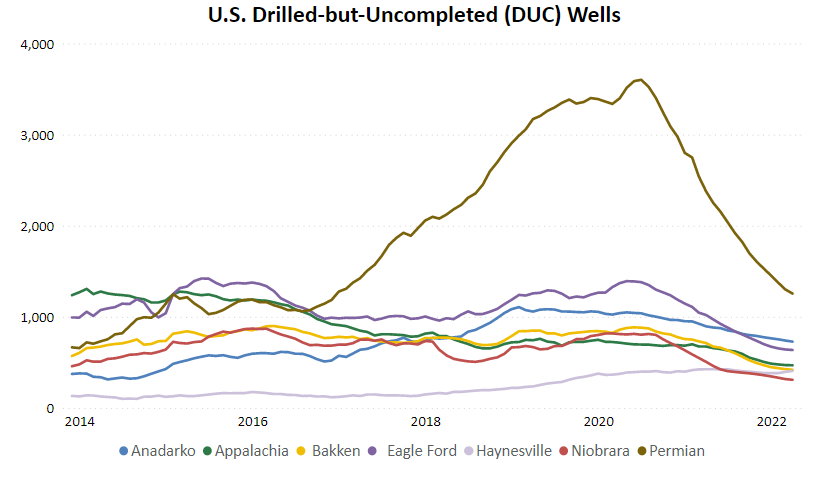

According to the EIA’s most recent Drilling Productivity Report, U.S. oil output is expected to continue expanding. The Drilling Productivity Report uses recent data on the total number of drilling rigs in operation, estimates of drilling productivity, and estimated changes in production from existing wells to provide estimated changes in oil production for the seven key regions shown below.

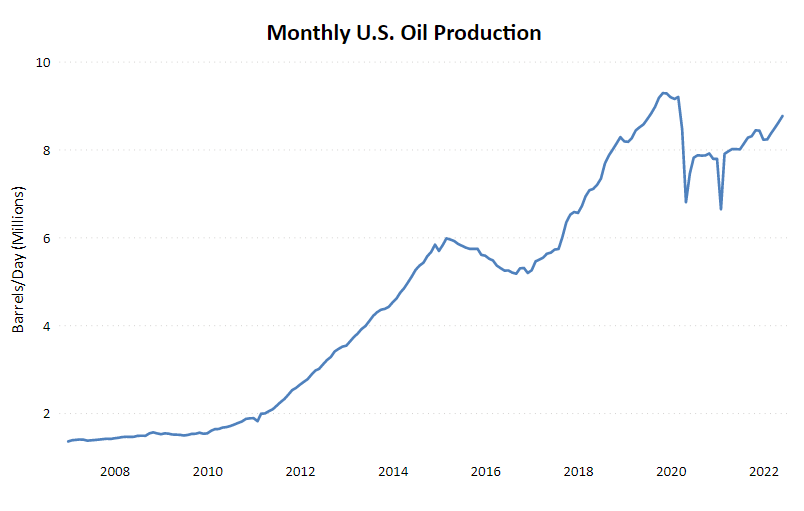

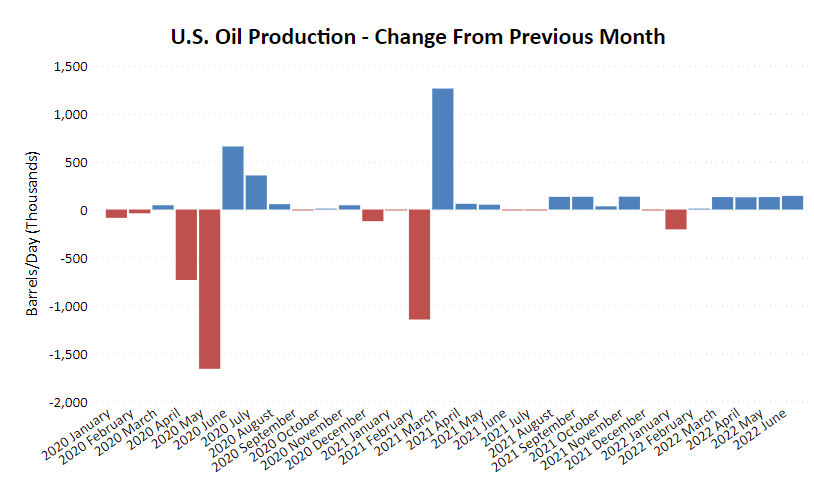

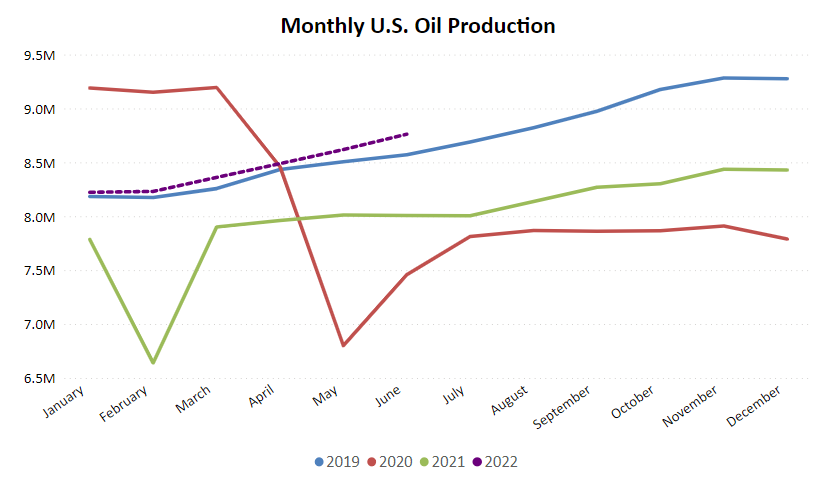

This month’s output is estimated to rise 1.5% while next month’s projected in oil production is projected to continue growing at a similar pace.

This month’s oil production volumes are expected to be above 2019 levels and approaching pre-pandemic seasonal levels. Oil production is expected to increase most significantly from the previous month within the Permian (+88k bpd), followed by the Eagle Ford (+28k bpd) and Bakken (+17k bpd). The aforementioned regions are expected to account for over 90% of the total projected increase in production levels throughout the month.

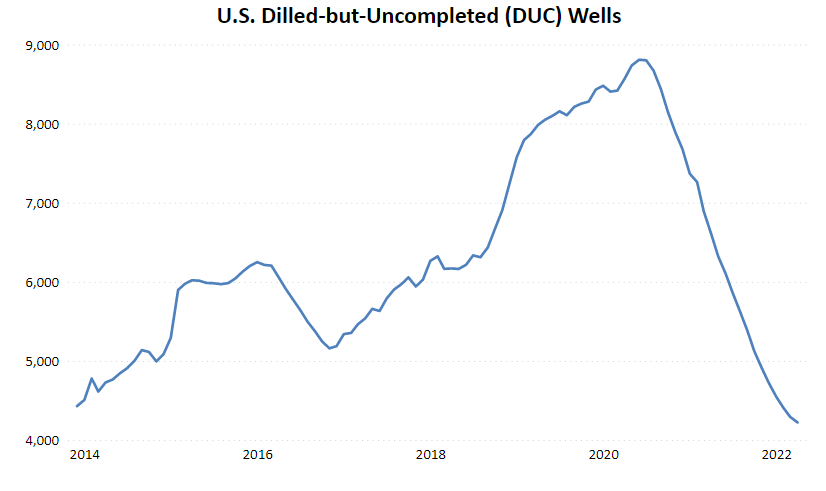

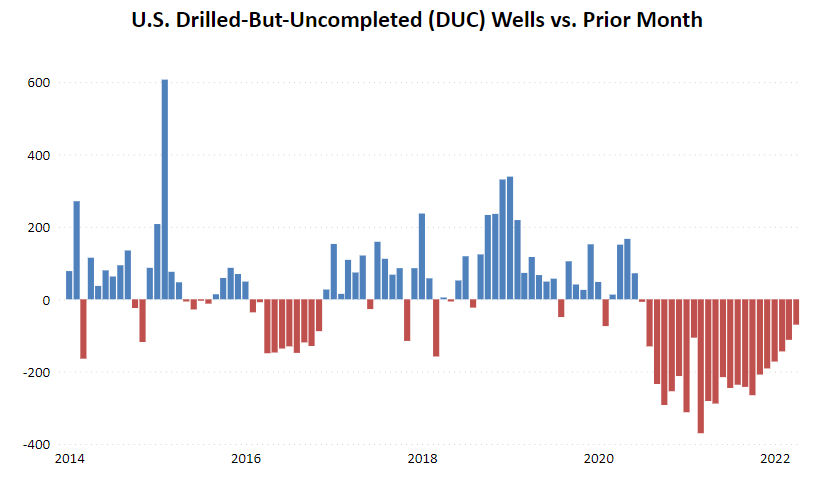

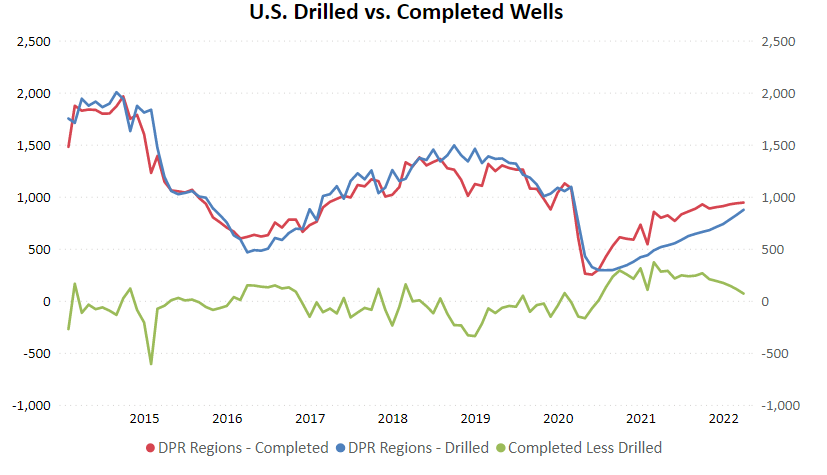

U.S. drilled-but-uncompleted (DUC) wells declined 1.6% from the previous month, reaching the lowest figure on record. DUC wells, which have been drilled by producers but have not yet been made ready for production, have been compiled since Dec ’13. The monthly decline in DUC wells was the 22nd experienced in a row but the smallest experienced over the past 14 months on both an absolute and percentage basis.

Well completions continue to exceed drilled wells but overall well completions and newly drilled wells continue to increase with rising oil production.