U.S. Cattle & Hogs Production Update – May ’20

Executive Summary

U.S. cattle & hog production figures provided by the USDA were recently updated with values spanning through Apr ’20. Highlights from the updated report include:

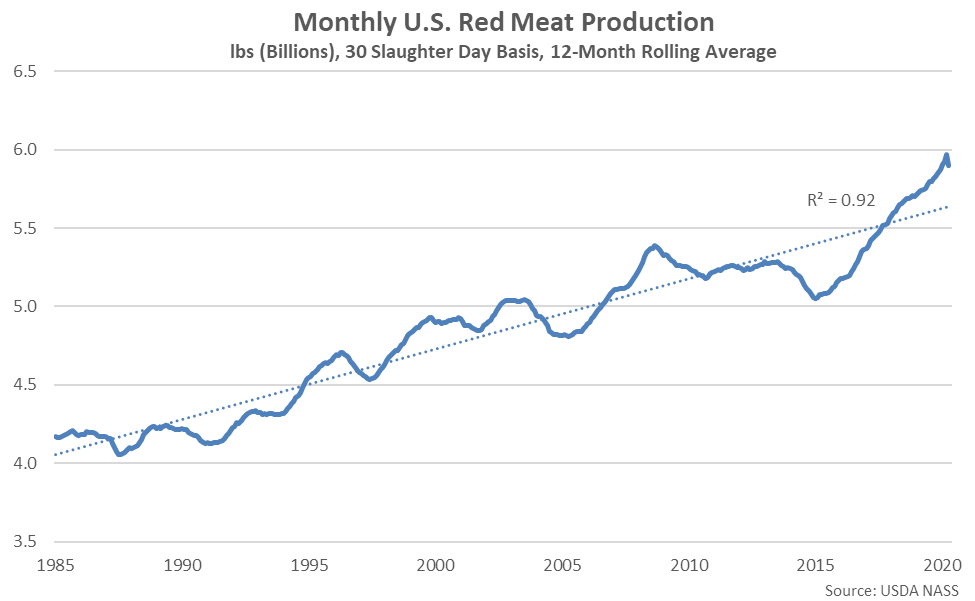

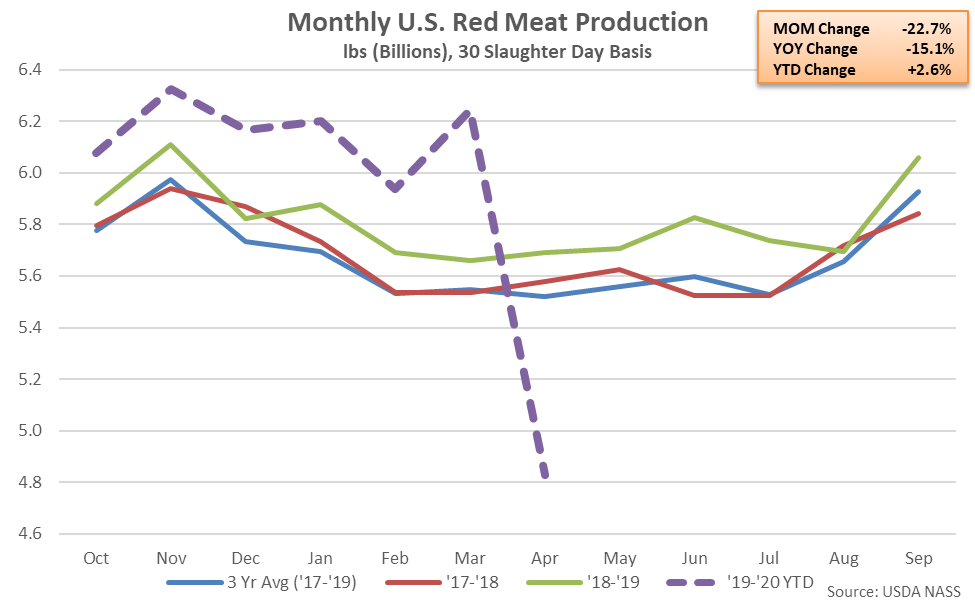

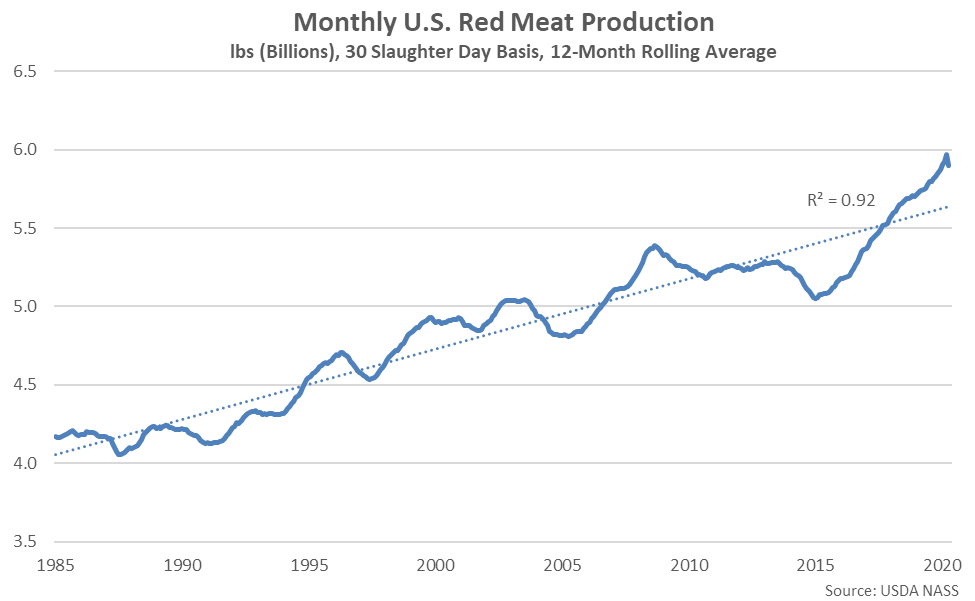

Total 12-month rolling average red meat production remained above trendline for the 32nd consecutive month throughout Apr ’20, although the Apr ’20 deviation from trendline declined from the record high level experienced throughout the previous month.

Total 12-month rolling average red meat production remained above trendline for the 32nd consecutive month throughout Apr ’20, although the Apr ’20 deviation from trendline declined from the record high level experienced throughout the previous month.

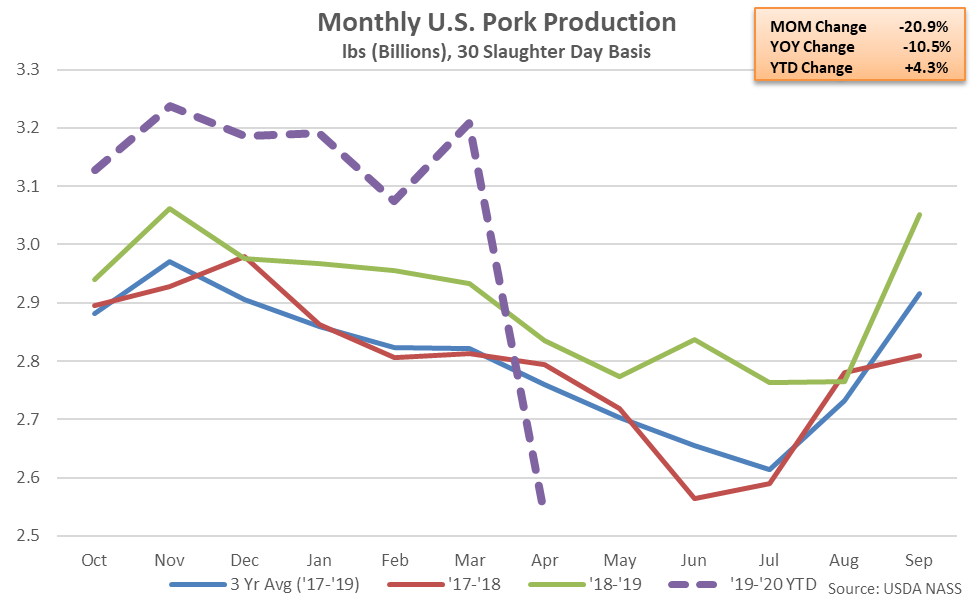

Pork – Production Declines to a Two and a Half Year Low Level, Finishes Down 10.5% YOY

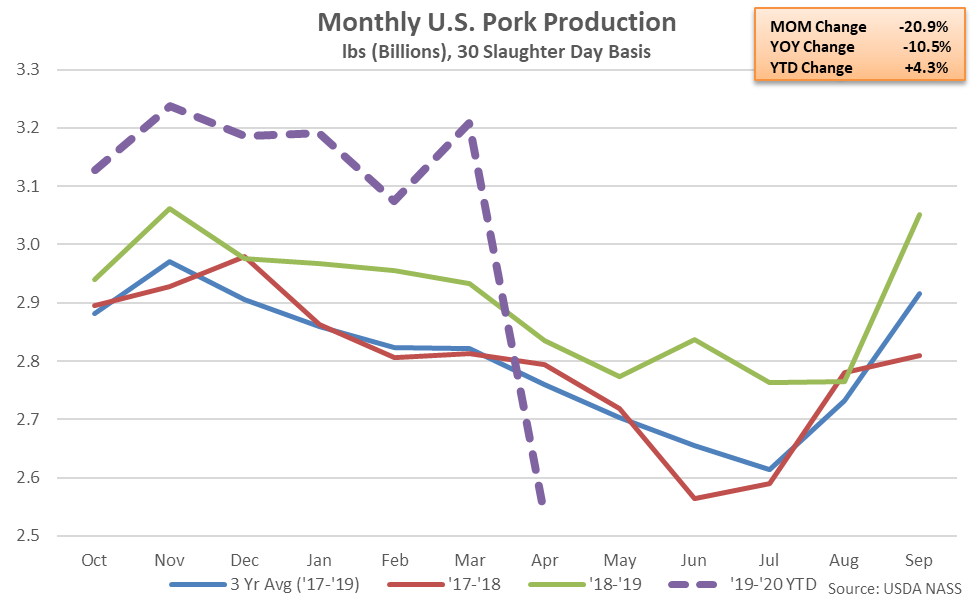

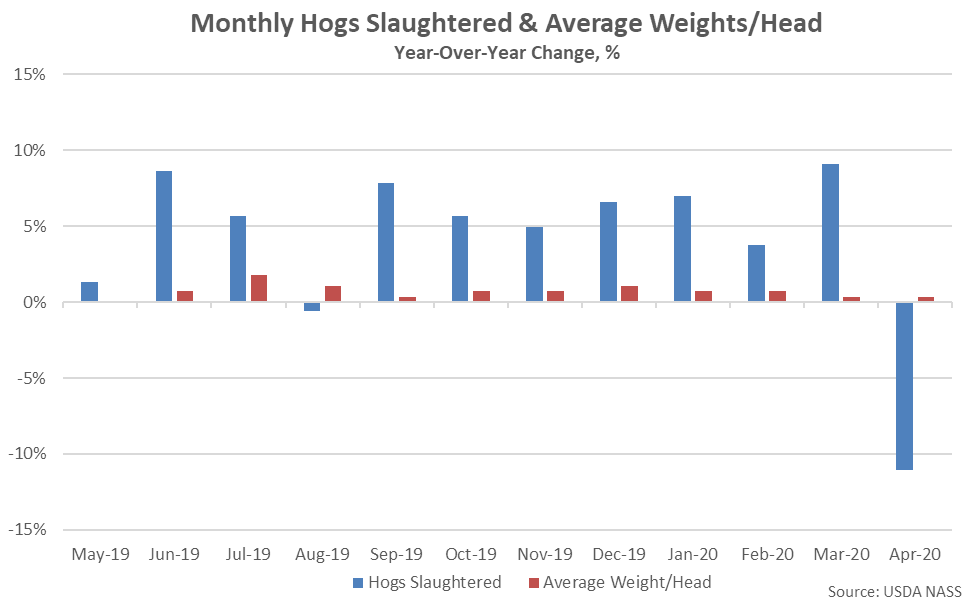

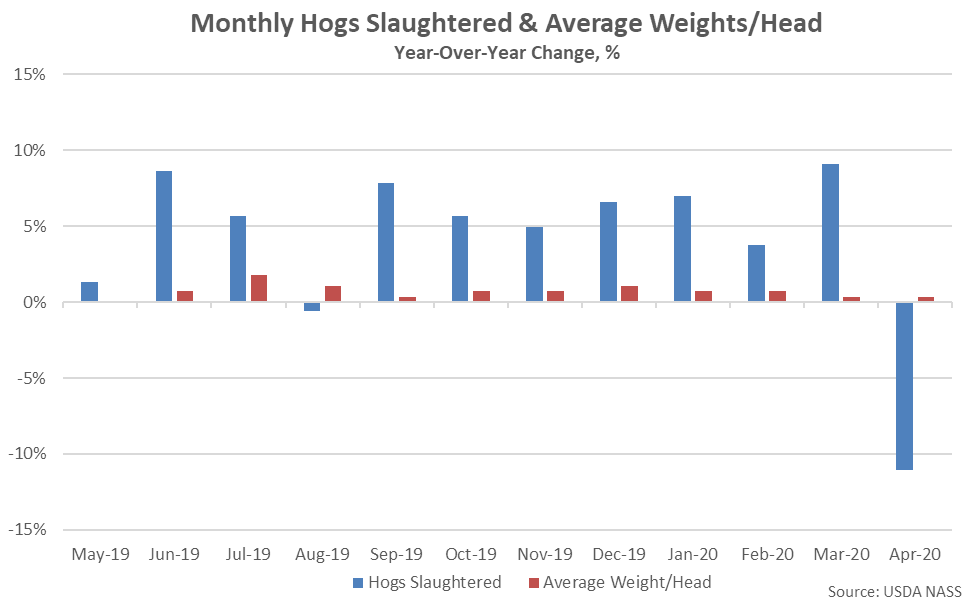

Apr ’20 U.S. pork production declined 20.9% from the previous month, finishing 10.5% lower on a YOY basis when normalizing for slaughter days and reaching a two and a half year low level, overall. The YOY decline in pork production was the first experienced throughout the past eight months and the largest experienced throughout the past 23 years on a percentage basis. The Apr ’20 total number of hogs slaughtered declined 11.1% YOY throughout the month, more than offsetting a 0.9% increase in average weights/head. The MOM decline in pork production of 20.9% was significantly larger than the ten year average March – April seasonal decline of 2.4%.

’18-’19 annual pork production increased 3.9% on a YOY basis, finishing at a record high level, while ’19-’20 YTD pork production has increased by an additional 4.3% throughout the first half of the production season, despite the most recent decline.

Pork – Production Declines to a Two and a Half Year Low Level, Finishes Down 10.5% YOY

Apr ’20 U.S. pork production declined 20.9% from the previous month, finishing 10.5% lower on a YOY basis when normalizing for slaughter days and reaching a two and a half year low level, overall. The YOY decline in pork production was the first experienced throughout the past eight months and the largest experienced throughout the past 23 years on a percentage basis. The Apr ’20 total number of hogs slaughtered declined 11.1% YOY throughout the month, more than offsetting a 0.9% increase in average weights/head. The MOM decline in pork production of 20.9% was significantly larger than the ten year average March – April seasonal decline of 2.4%.

’18-’19 annual pork production increased 3.9% on a YOY basis, finishing at a record high level, while ’19-’20 YTD pork production has increased by an additional 4.3% throughout the first half of the production season, despite the most recent decline.

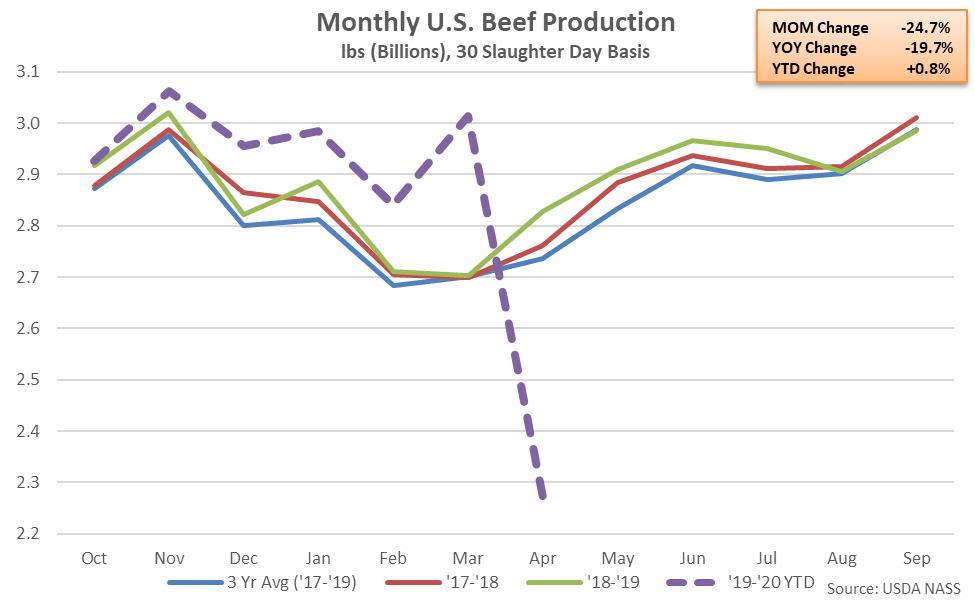

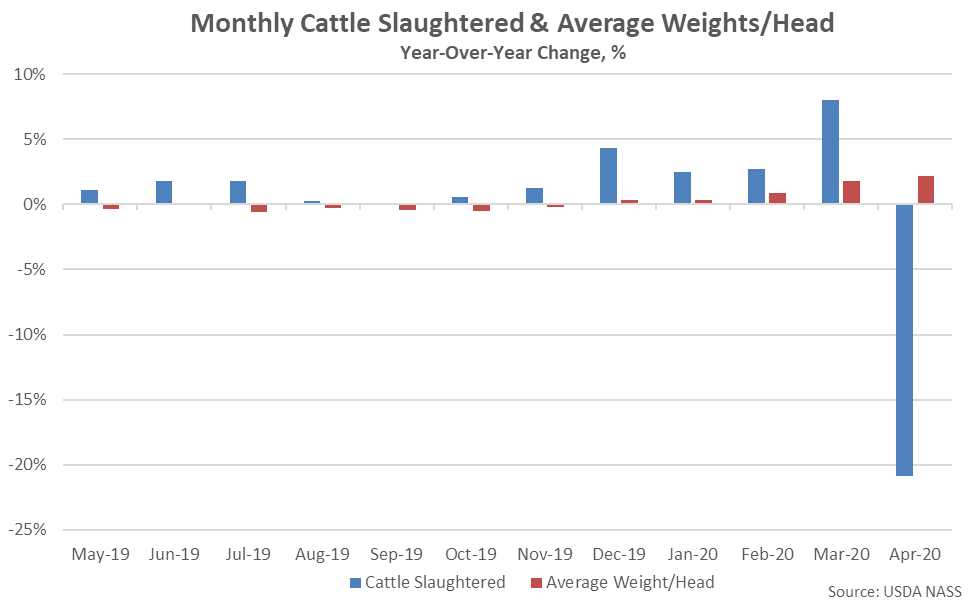

Beef – Production Declines to a 27 Year Low Level, Finishes Down 19.7% YOY

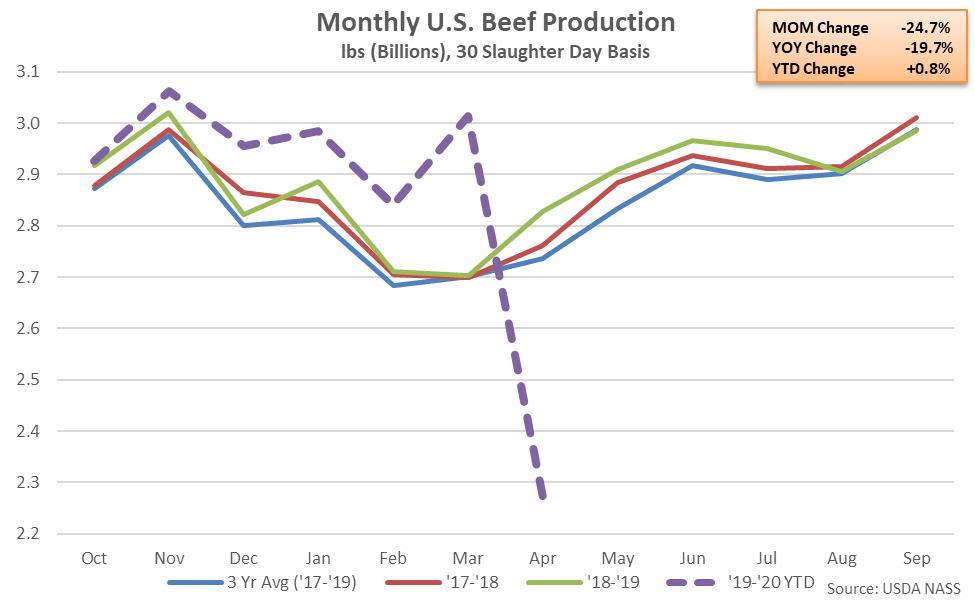

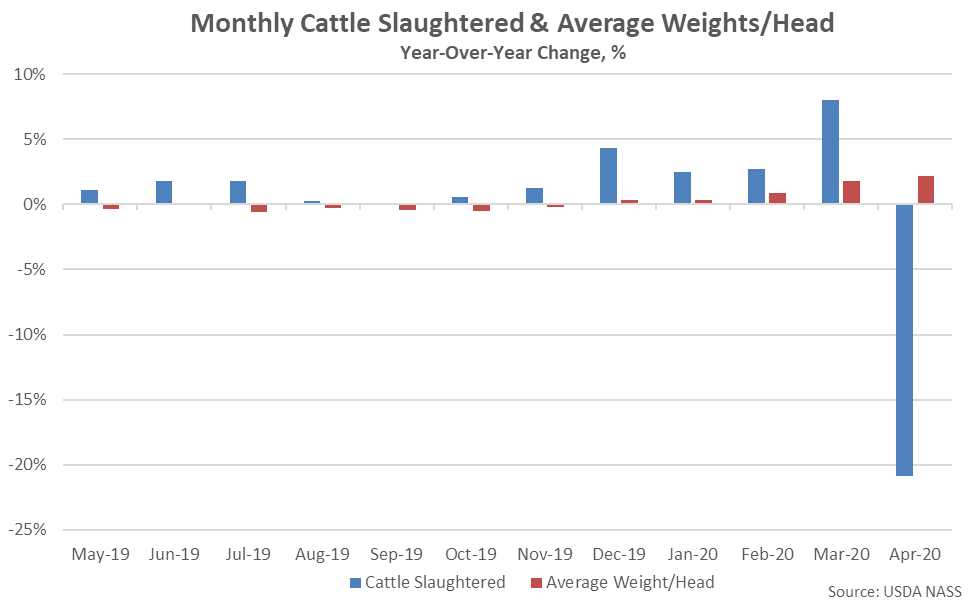

Apr ’20 U.S. beef production declined 24.7% from the previous month, finishing 19.7% lower on a YOY basis when normalizing for slaughter days and reaching a 27 year low level, overall. The YOY decline in beef production was the first experienced throughout the past seven months and the largest on record. The Apr ’20 total number of cattle slaughtered declined 20.9% YOY throughout the month, more than offsetting a 1.8% increase in average weights/head. The MOM decline in beef production of 24.7% was a contraseasonal move when compared to the ten year average March – April seasonal increase of 0.4%.

’18-’19 annual beef production increased 0.6% on a YOY basis, finishing at a 16 year high level, while ’19-’20 YTD beef production has increased by an additional 0.8% throughout the first half of the production season, despite the most recent decline.

Beef – Production Declines to a 27 Year Low Level, Finishes Down 19.7% YOY

Apr ’20 U.S. beef production declined 24.7% from the previous month, finishing 19.7% lower on a YOY basis when normalizing for slaughter days and reaching a 27 year low level, overall. The YOY decline in beef production was the first experienced throughout the past seven months and the largest on record. The Apr ’20 total number of cattle slaughtered declined 20.9% YOY throughout the month, more than offsetting a 1.8% increase in average weights/head. The MOM decline in beef production of 24.7% was a contraseasonal move when compared to the ten year average March – April seasonal increase of 0.4%.

’18-’19 annual beef production increased 0.6% on a YOY basis, finishing at a 16 year high level, while ’19-’20 YTD beef production has increased by an additional 0.8% throughout the first half of the production season, despite the most recent decline.

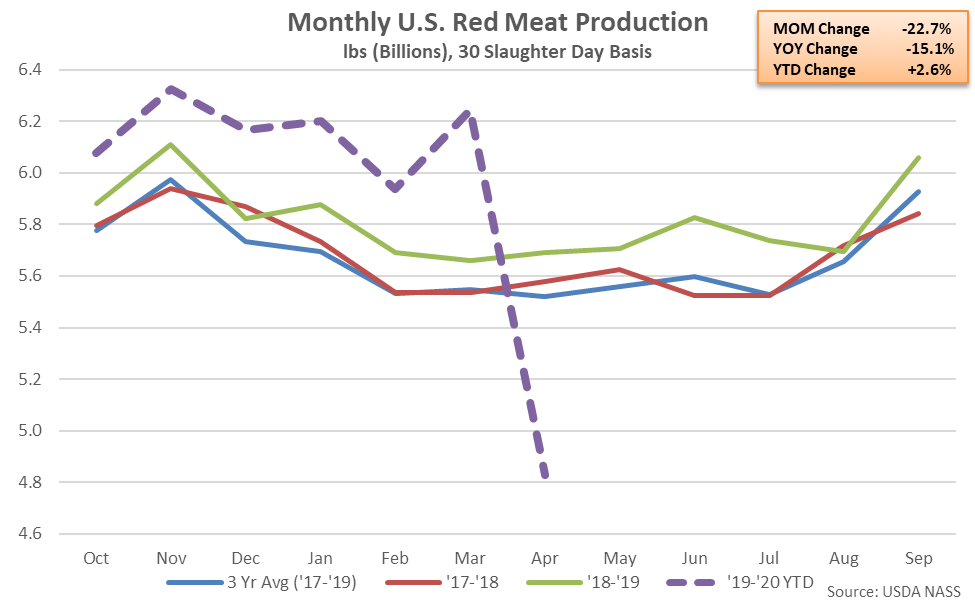

- U.S. commercial red meat production declined 15.1% on a YOY basis during Apr ’20, reaching a 14 year low level, as several major packing plants were closed due to COVID-19. The YOY decline in total red meat production was the first experienced throughout the past eight months and the largest experienced on record.

- U.S. pork production declined 10.5% on a YOY basis during Apr ’20, declining to a two and a half year low level. The total number of hogs slaughtered declined 11.1% YOY throughout the month, more than offsetting a 0.9% increase in average weights/head.

- U.S. beef production declined 19.7% on a YOY basis during Apr ’20, reaching a 27 year low level. The total number of cattle slaughtered declined 20.9% YOY throughout the month, more than offsetting a 0.4% increase in average weights/head.

Total 12-month rolling average red meat production remained above trendline for the 32nd consecutive month throughout Apr ’20, although the Apr ’20 deviation from trendline declined from the record high level experienced throughout the previous month.

Total 12-month rolling average red meat production remained above trendline for the 32nd consecutive month throughout Apr ’20, although the Apr ’20 deviation from trendline declined from the record high level experienced throughout the previous month.

Pork – Production Declines to a Two and a Half Year Low Level, Finishes Down 10.5% YOY

Apr ’20 U.S. pork production declined 20.9% from the previous month, finishing 10.5% lower on a YOY basis when normalizing for slaughter days and reaching a two and a half year low level, overall. The YOY decline in pork production was the first experienced throughout the past eight months and the largest experienced throughout the past 23 years on a percentage basis. The Apr ’20 total number of hogs slaughtered declined 11.1% YOY throughout the month, more than offsetting a 0.9% increase in average weights/head. The MOM decline in pork production of 20.9% was significantly larger than the ten year average March – April seasonal decline of 2.4%.

’18-’19 annual pork production increased 3.9% on a YOY basis, finishing at a record high level, while ’19-’20 YTD pork production has increased by an additional 4.3% throughout the first half of the production season, despite the most recent decline.

Pork – Production Declines to a Two and a Half Year Low Level, Finishes Down 10.5% YOY

Apr ’20 U.S. pork production declined 20.9% from the previous month, finishing 10.5% lower on a YOY basis when normalizing for slaughter days and reaching a two and a half year low level, overall. The YOY decline in pork production was the first experienced throughout the past eight months and the largest experienced throughout the past 23 years on a percentage basis. The Apr ’20 total number of hogs slaughtered declined 11.1% YOY throughout the month, more than offsetting a 0.9% increase in average weights/head. The MOM decline in pork production of 20.9% was significantly larger than the ten year average March – April seasonal decline of 2.4%.

’18-’19 annual pork production increased 3.9% on a YOY basis, finishing at a record high level, while ’19-’20 YTD pork production has increased by an additional 4.3% throughout the first half of the production season, despite the most recent decline.

Beef – Production Declines to a 27 Year Low Level, Finishes Down 19.7% YOY

Apr ’20 U.S. beef production declined 24.7% from the previous month, finishing 19.7% lower on a YOY basis when normalizing for slaughter days and reaching a 27 year low level, overall. The YOY decline in beef production was the first experienced throughout the past seven months and the largest on record. The Apr ’20 total number of cattle slaughtered declined 20.9% YOY throughout the month, more than offsetting a 1.8% increase in average weights/head. The MOM decline in beef production of 24.7% was a contraseasonal move when compared to the ten year average March – April seasonal increase of 0.4%.

’18-’19 annual beef production increased 0.6% on a YOY basis, finishing at a 16 year high level, while ’19-’20 YTD beef production has increased by an additional 0.8% throughout the first half of the production season, despite the most recent decline.

Beef – Production Declines to a 27 Year Low Level, Finishes Down 19.7% YOY

Apr ’20 U.S. beef production declined 24.7% from the previous month, finishing 19.7% lower on a YOY basis when normalizing for slaughter days and reaching a 27 year low level, overall. The YOY decline in beef production was the first experienced throughout the past seven months and the largest on record. The Apr ’20 total number of cattle slaughtered declined 20.9% YOY throughout the month, more than offsetting a 1.8% increase in average weights/head. The MOM decline in beef production of 24.7% was a contraseasonal move when compared to the ten year average March – April seasonal increase of 0.4%.

’18-’19 annual beef production increased 0.6% on a YOY basis, finishing at a 16 year high level, while ’19-’20 YTD beef production has increased by an additional 0.8% throughout the first half of the production season, despite the most recent decline.