Crop Progress Update – 10/5/20

According to the USDA, the current corn crop identified to be in good or excellent condition increased slightly from the previous week, finishing slightly above analyst expectations. The corn harvest progress finished slightly below analyst expectations, however.

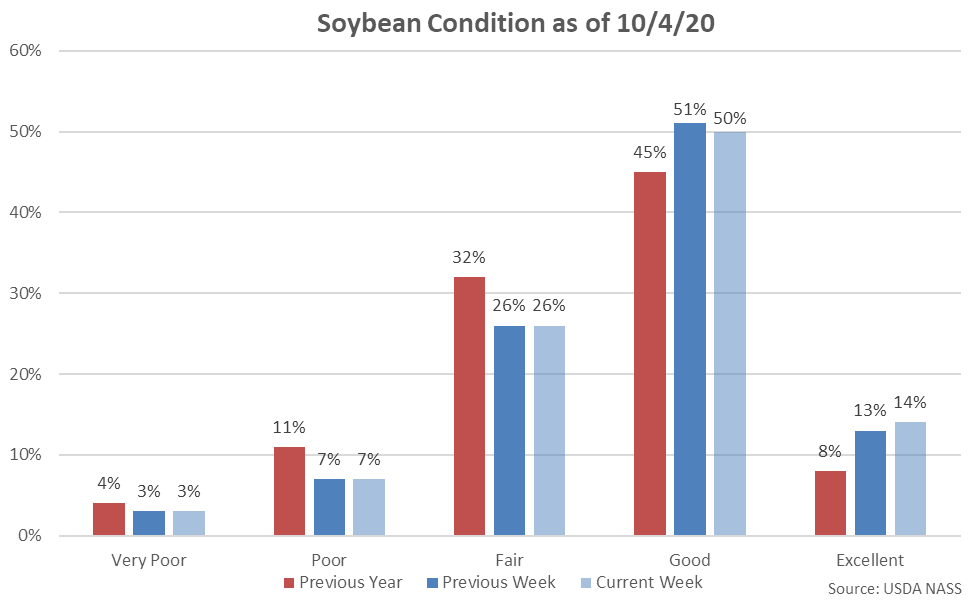

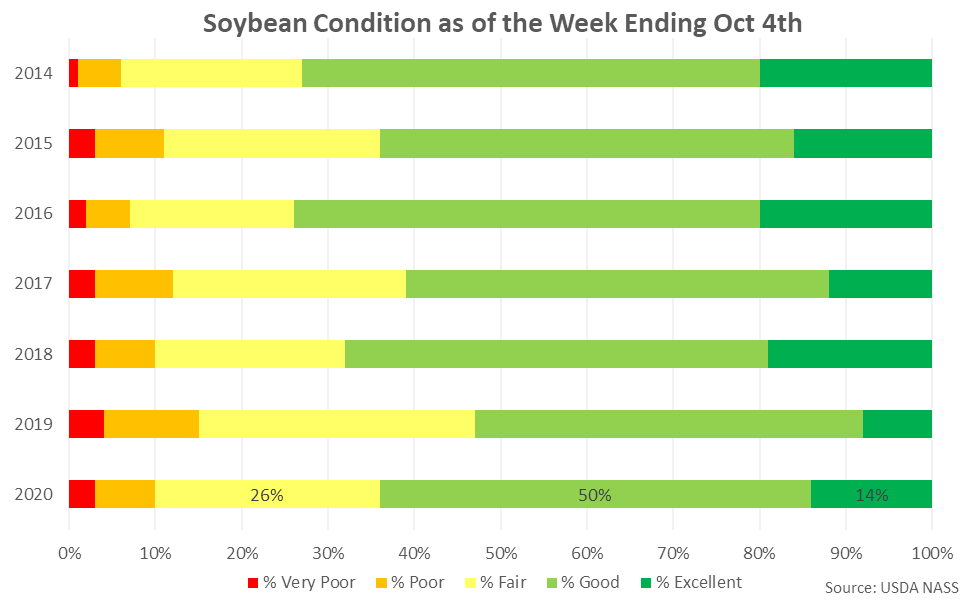

The current soybean crop identified to be in good or excellent condition was unchanged from the previous week, finishing consistent with analyst expectations, while the soybean harvest progress was also finished consistent with analyst expectations.

Corn:

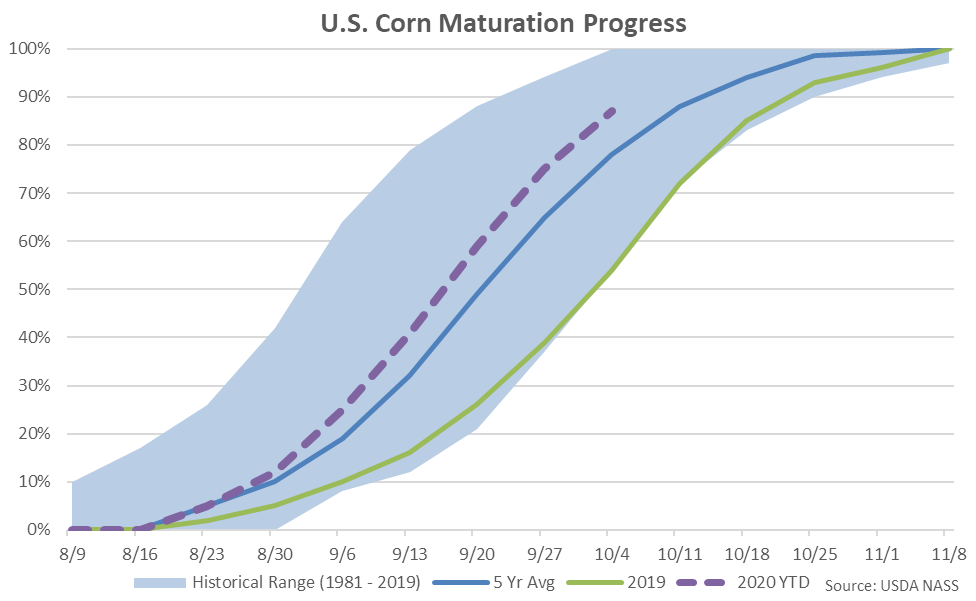

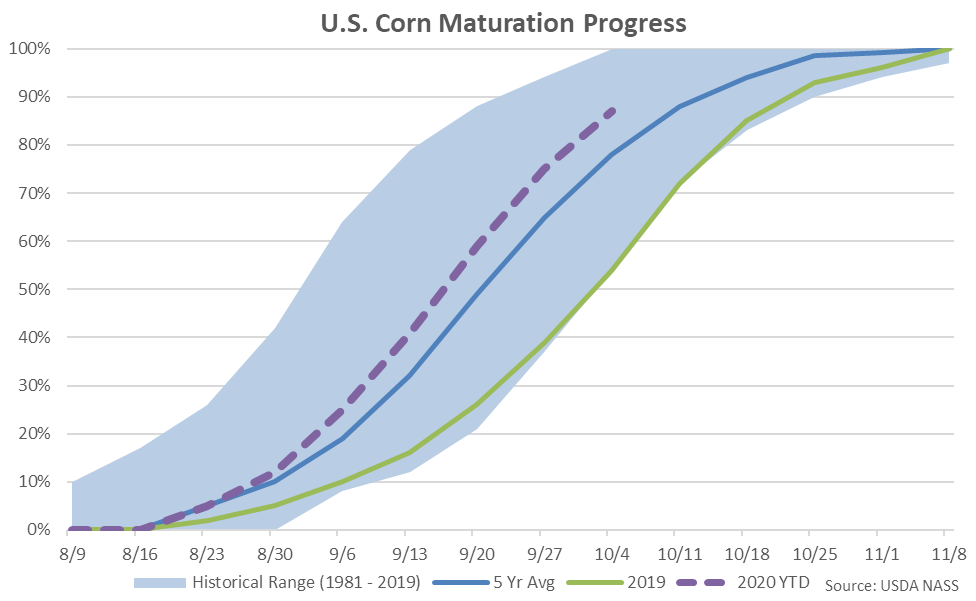

Corn maturation as of the week ending Oct 4th was 87% completed, finishing ahead of last year’s pace of 54% completed and the five year average pace of 78% completed.

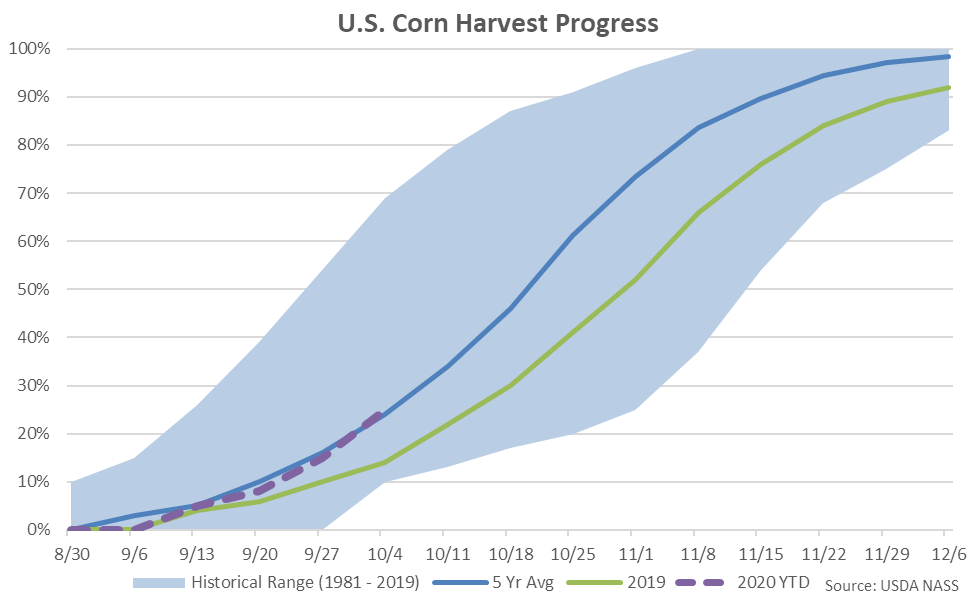

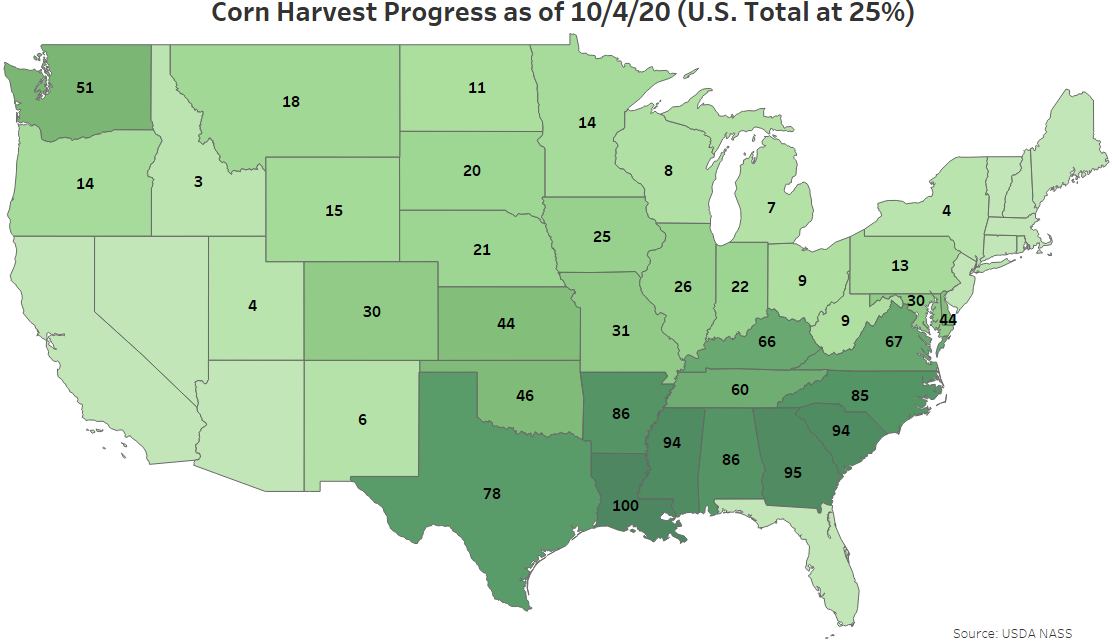

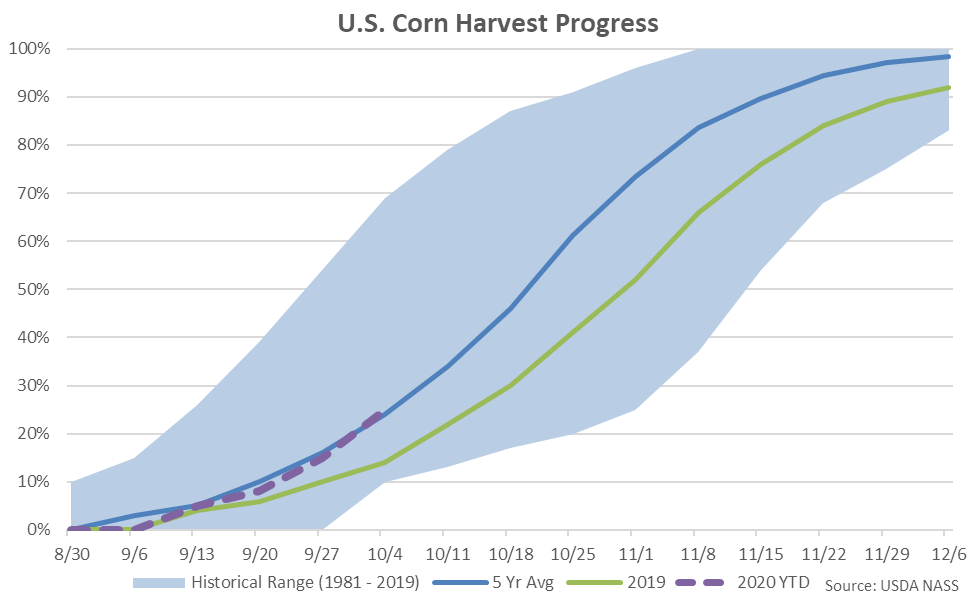

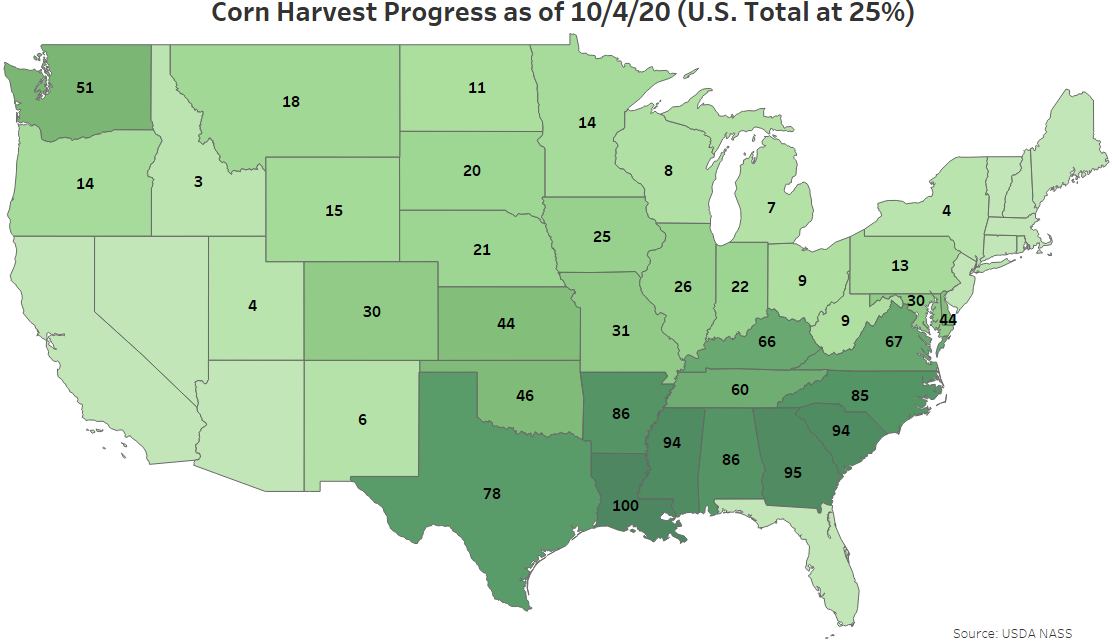

Corn harvesting as of the week ending Oct 4th was 25% completed, finishing ahead of last year’s pace of 14% completed and the five year average pace of 24% completed. Corn harvest progress finished slightly below analyst expectations of 26% completed.

Corn harvesting as of the week ending Oct 4th was 25% completed, finishing ahead of last year’s pace of 14% completed and the five year average pace of 24% completed. Corn harvest progress finished slightly below analyst expectations of 26% completed.

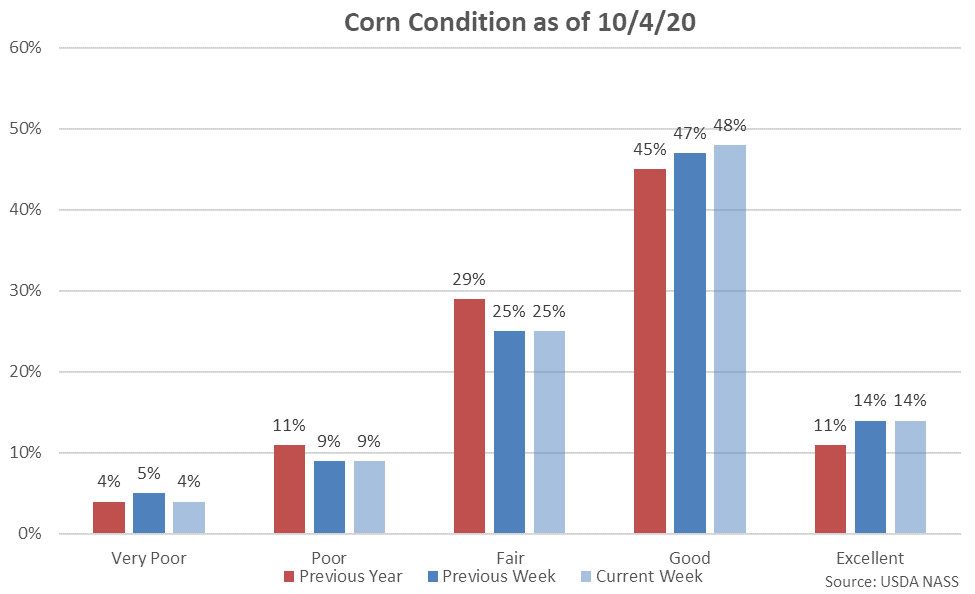

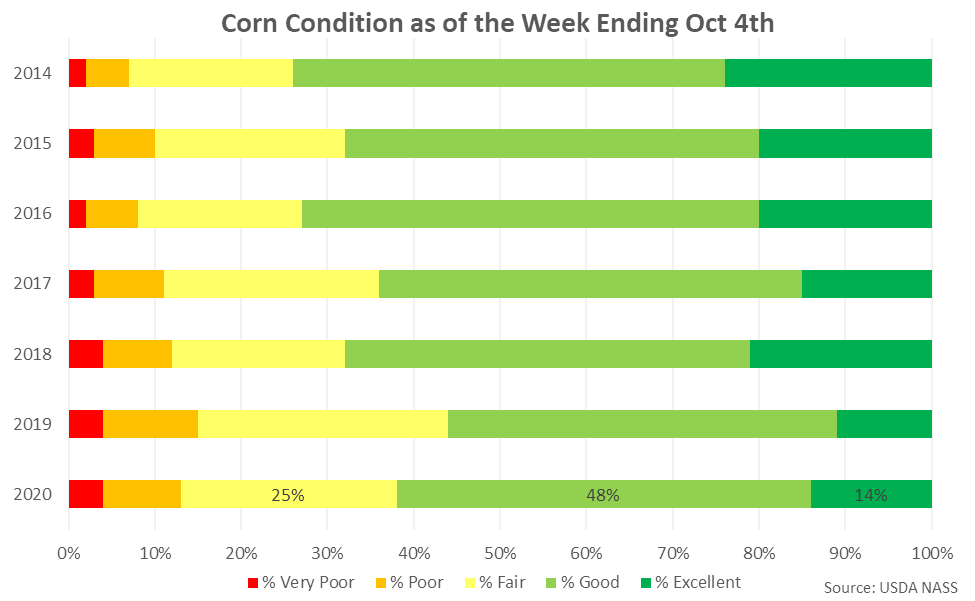

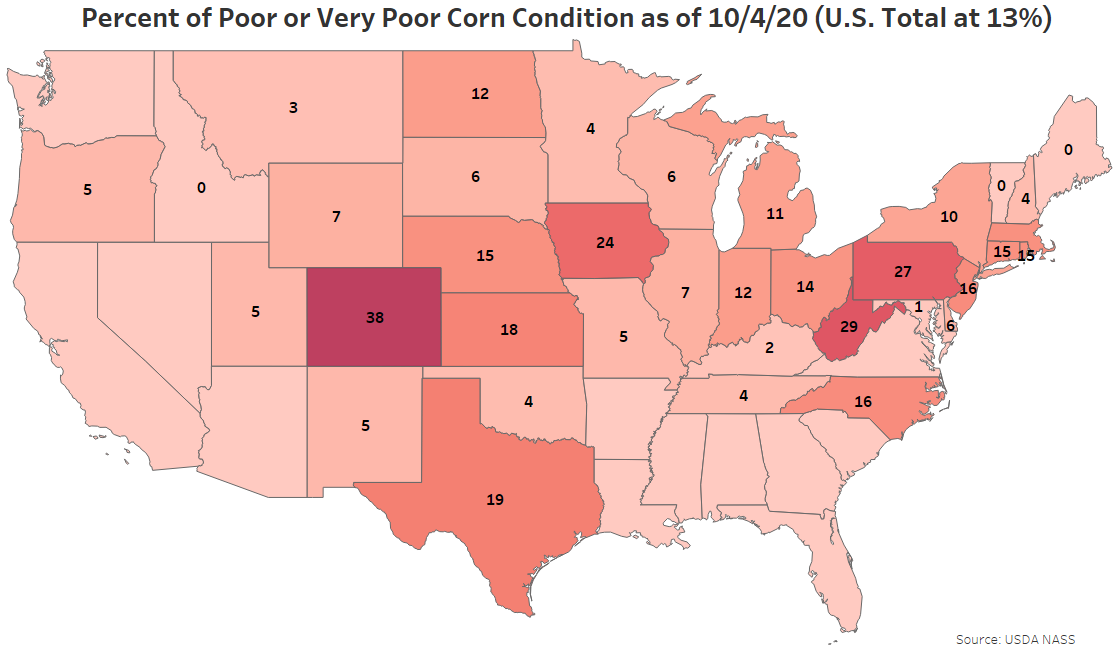

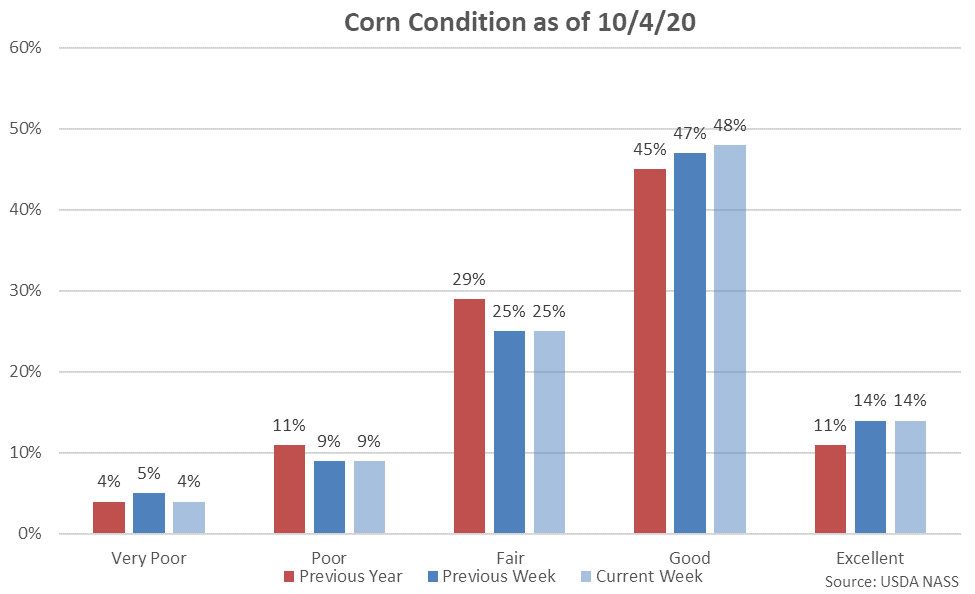

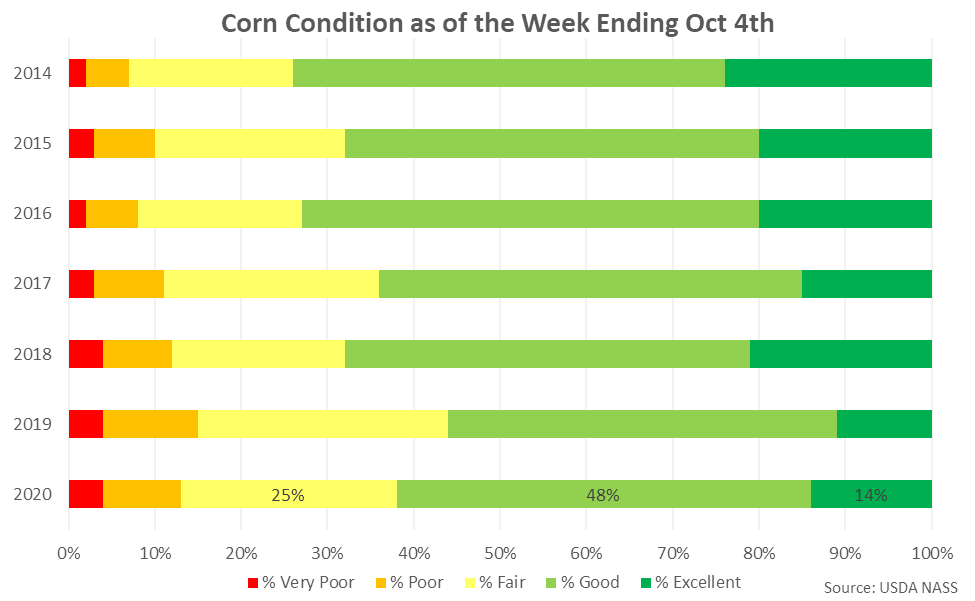

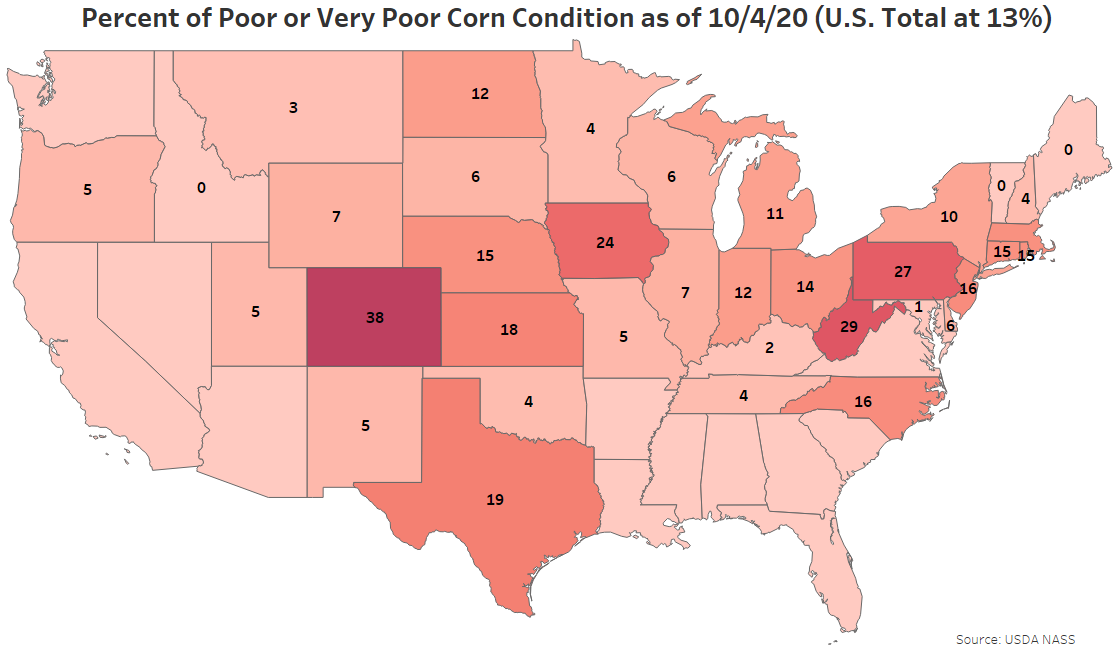

62% of the current corn crop was identified to be in good or excellent condition as of the week ending Oct 4th, up one percent from the previous week. The current corn crop identified to be in good or excellent condition finished slightly above analyst expectations of 61% completed. 13% of the current corn crop was identified as poor or very poor, down one percent from the previous week.

62% of the current corn crop was identified to be in good or excellent condition as of the week ending Oct 4th, up one percent from the previous week. The current corn crop identified to be in good or excellent condition finished slightly above analyst expectations of 61% completed. 13% of the current corn crop was identified as poor or very poor, down one percent from the previous week.

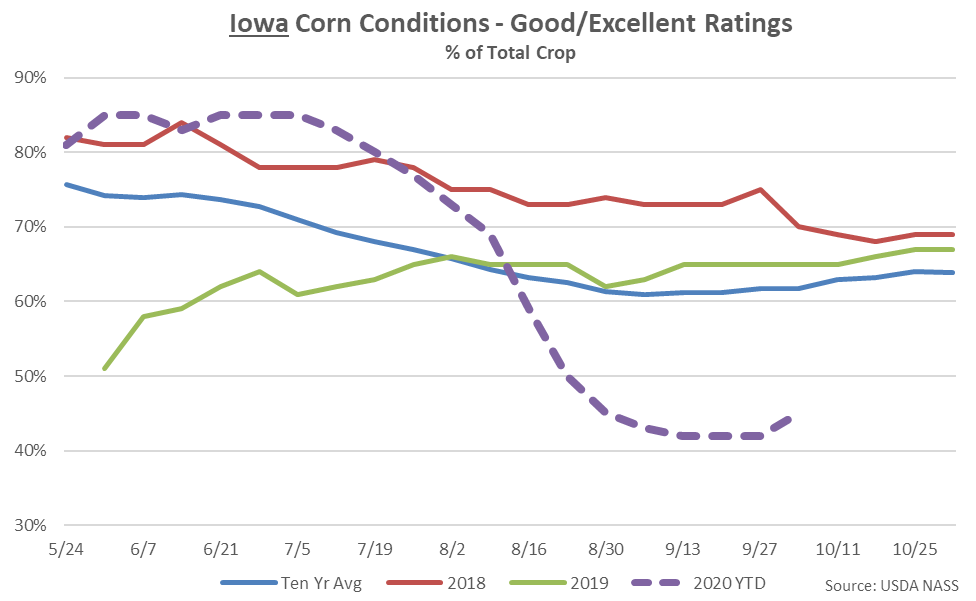

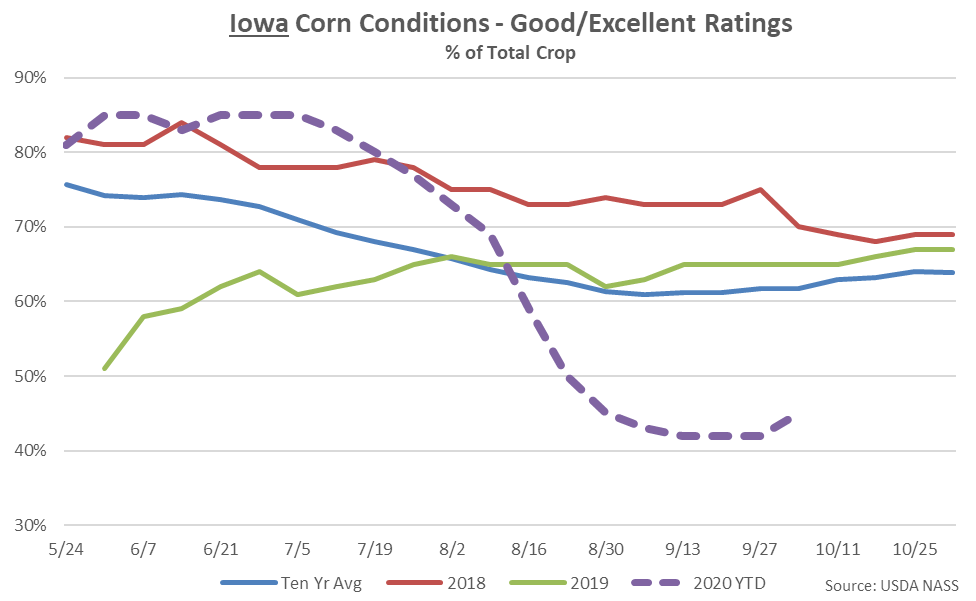

24% of the Iowa corn crop was identified to be in poor or very poor condition as of the week ending Oct 4th, down three percent from the previous week. Millions of acres of Iowa corn and soybean crops were heavily damaged by the early August derecho. 45% of the Iowa corn crop was identified to be in good or excellent condition, rebounding to a five week high level but remaining at a seven year seasonal low.

24% of the Iowa corn crop was identified to be in poor or very poor condition as of the week ending Oct 4th, down three percent from the previous week. Millions of acres of Iowa corn and soybean crops were heavily damaged by the early August derecho. 45% of the Iowa corn crop was identified to be in good or excellent condition, rebounding to a five week high level but remaining at a seven year seasonal low.

Soybeans:

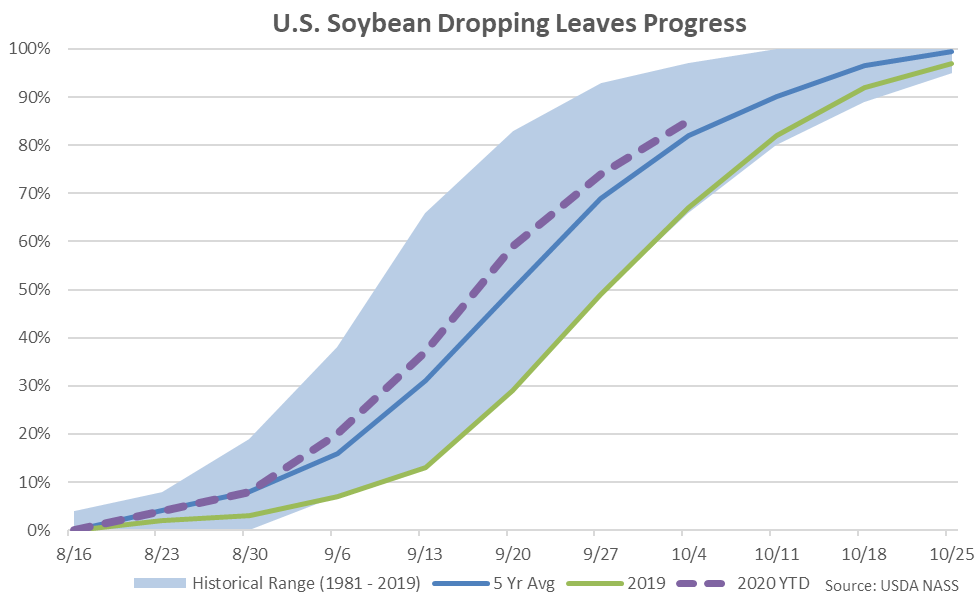

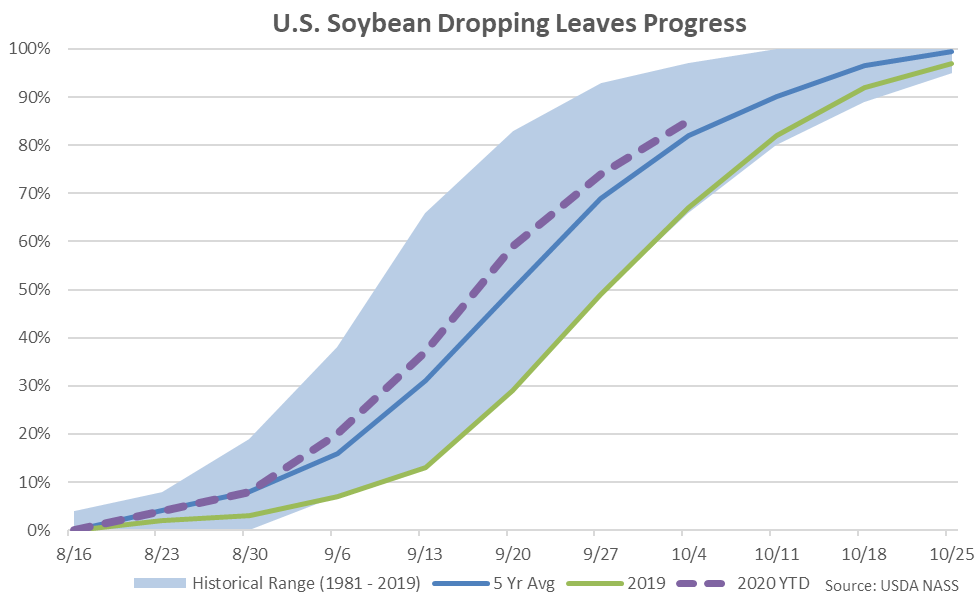

Soybean leaf dropping was 85% completed as of the week ending Oct 4th, finishing ahead of last year’s pace of 67% completed and the five year average pace of 82% completed.

Soybeans:

Soybean leaf dropping was 85% completed as of the week ending Oct 4th, finishing ahead of last year’s pace of 67% completed and the five year average pace of 82% completed.

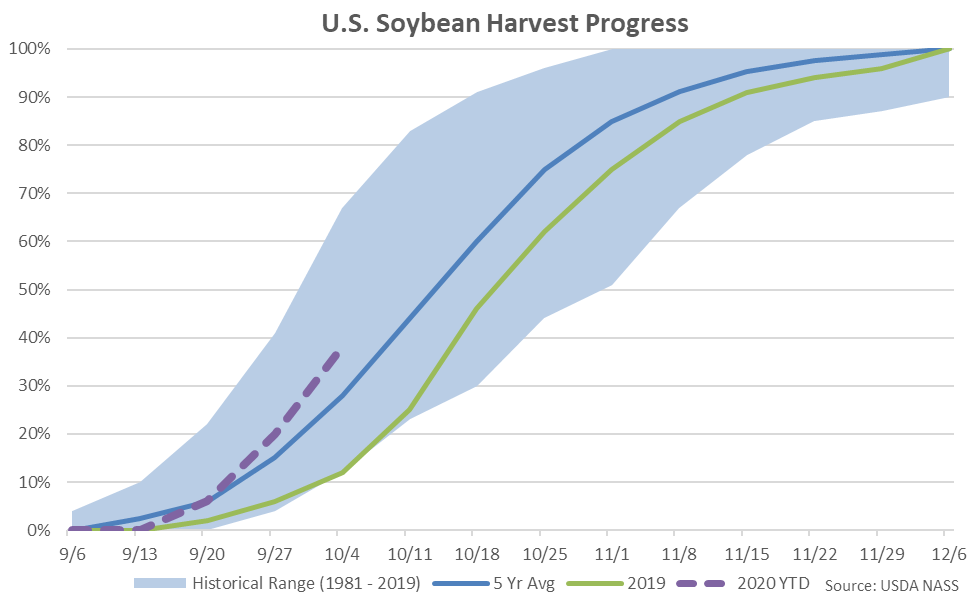

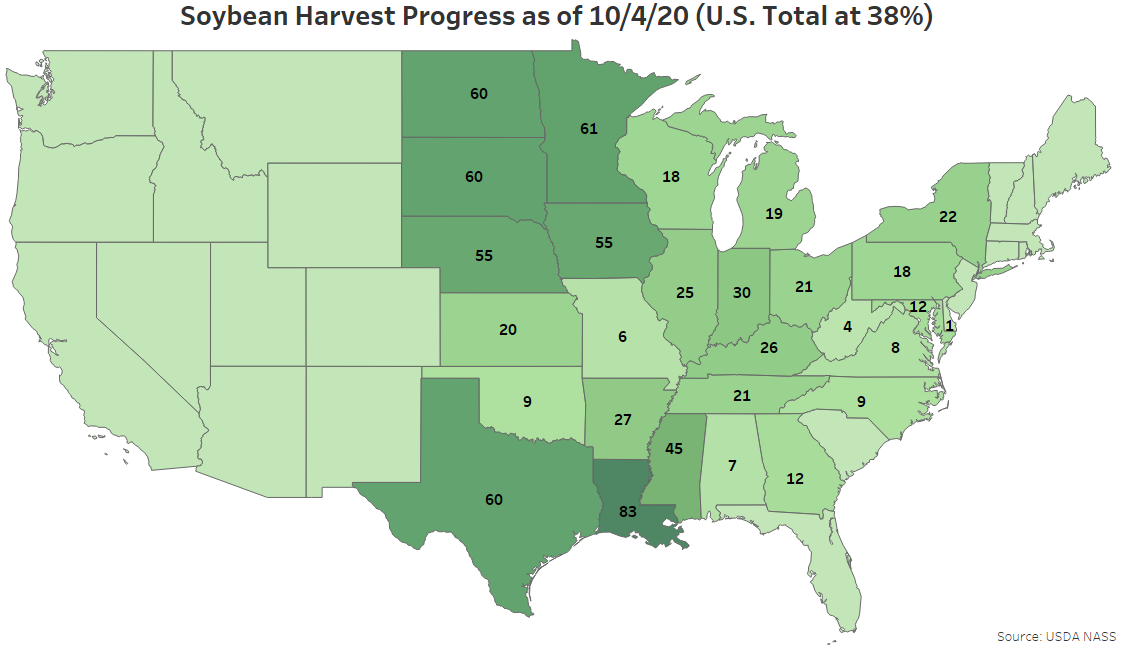

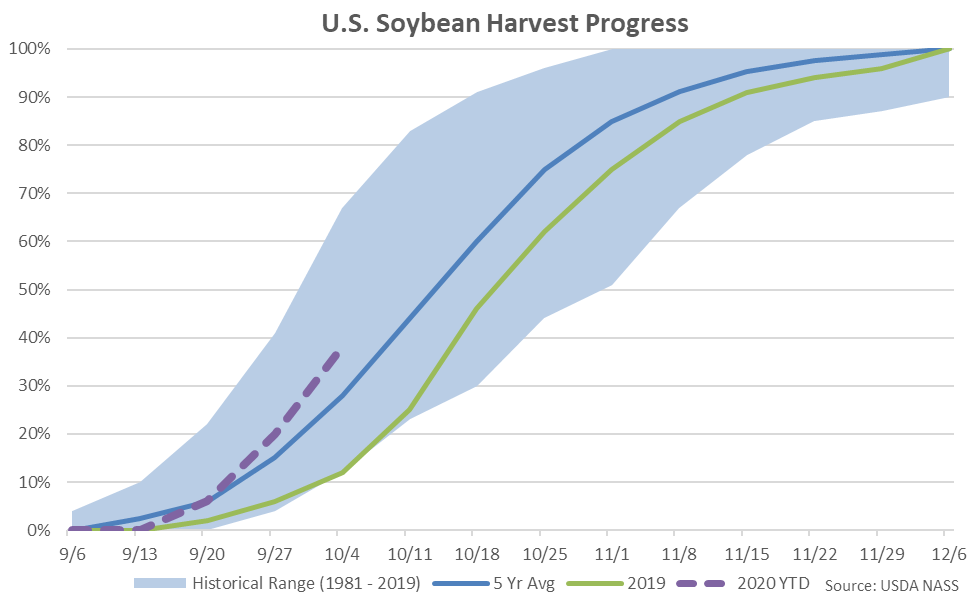

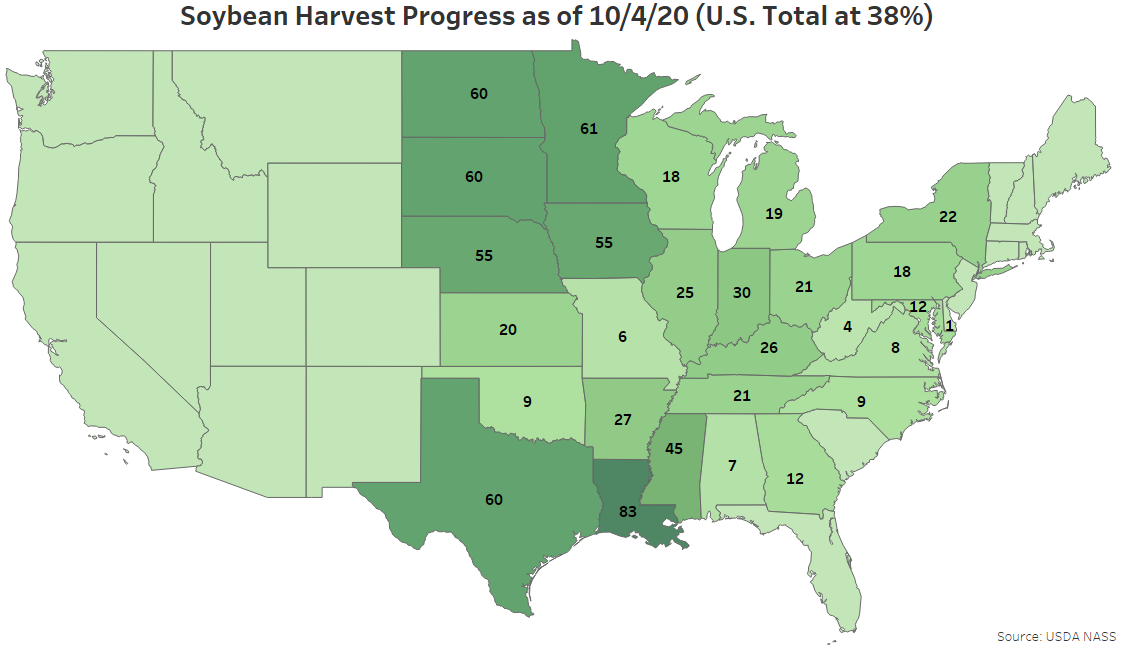

Soybean harvesting as of the week ending Oct 4th was 38% completed, finishing ahead of last year’s pace of 12% completed and the five year average pace of 28% completed. Soybean harvest progress finished above analyst expectations of 36% completed.

Soybean harvesting as of the week ending Oct 4th was 38% completed, finishing ahead of last year’s pace of 12% completed and the five year average pace of 28% completed. Soybean harvest progress finished above analyst expectations of 36% completed.

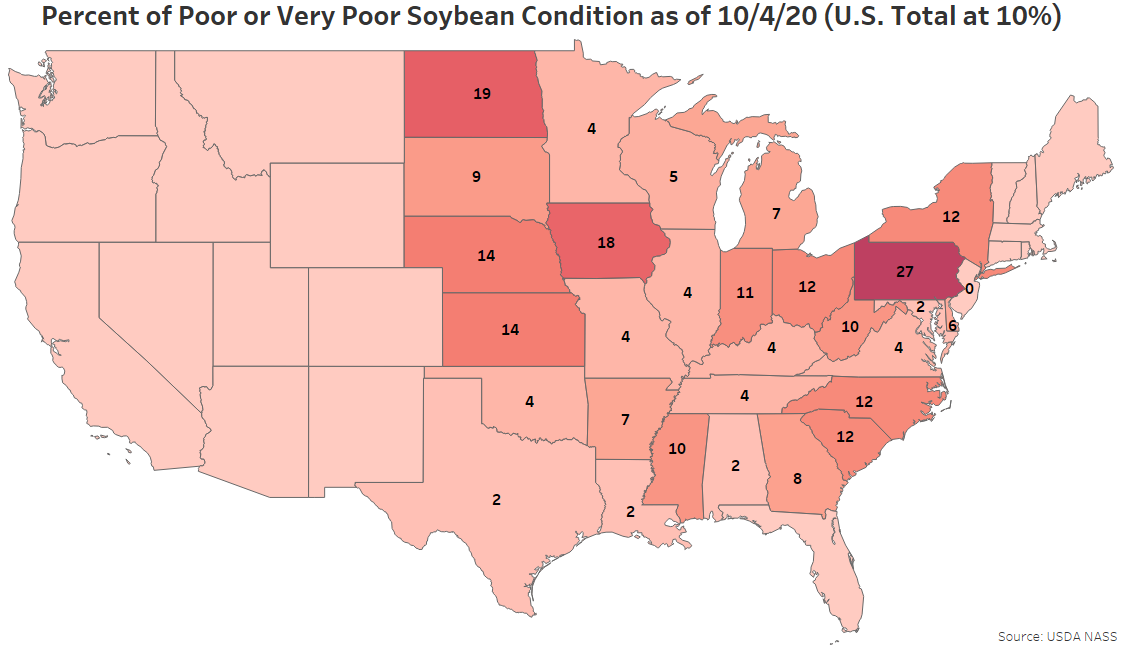

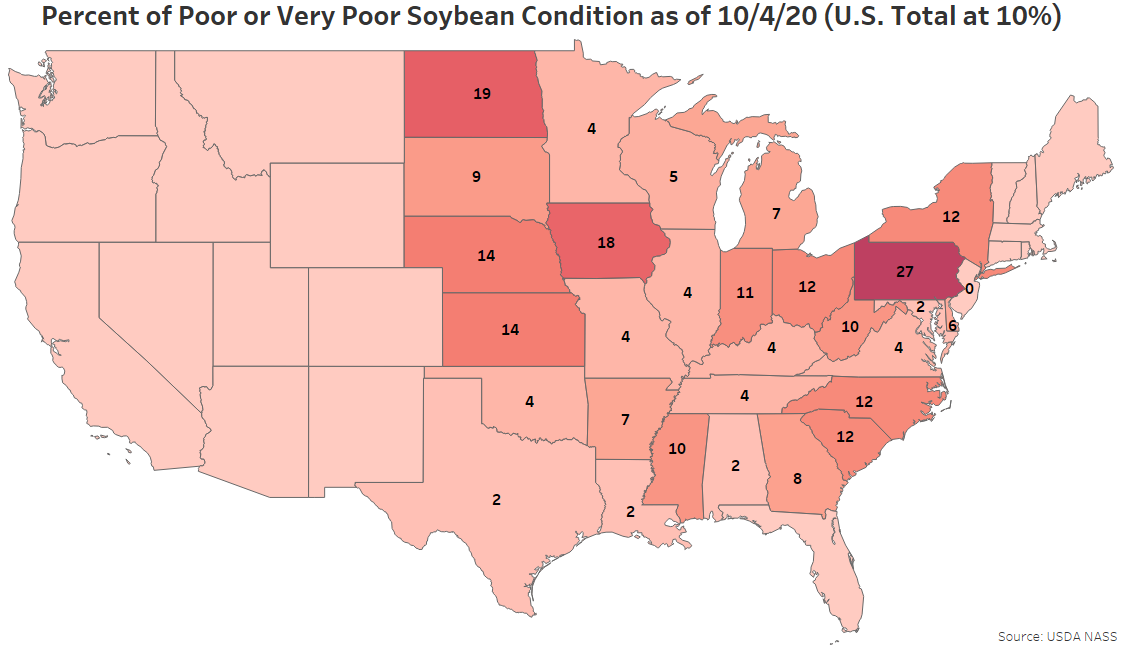

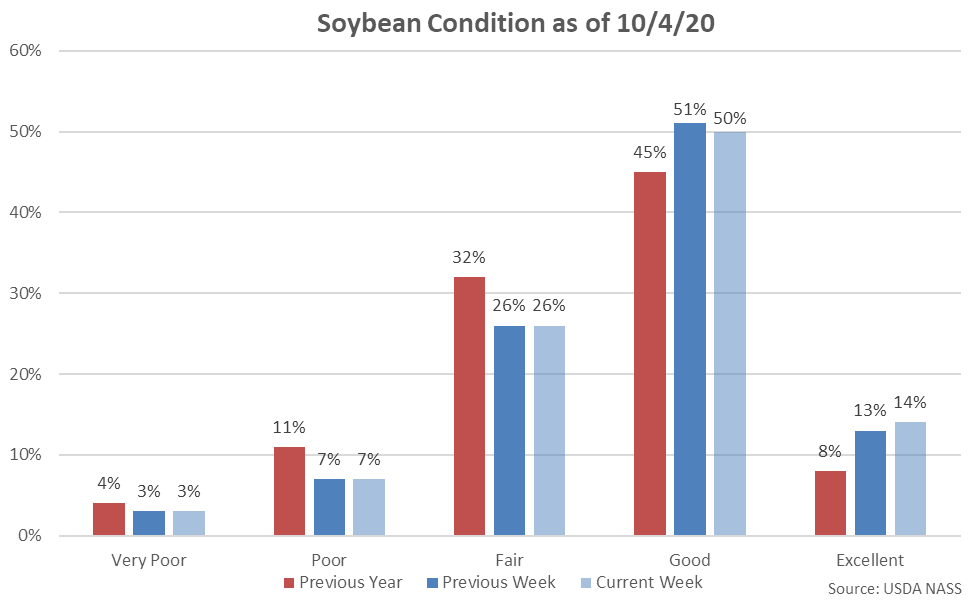

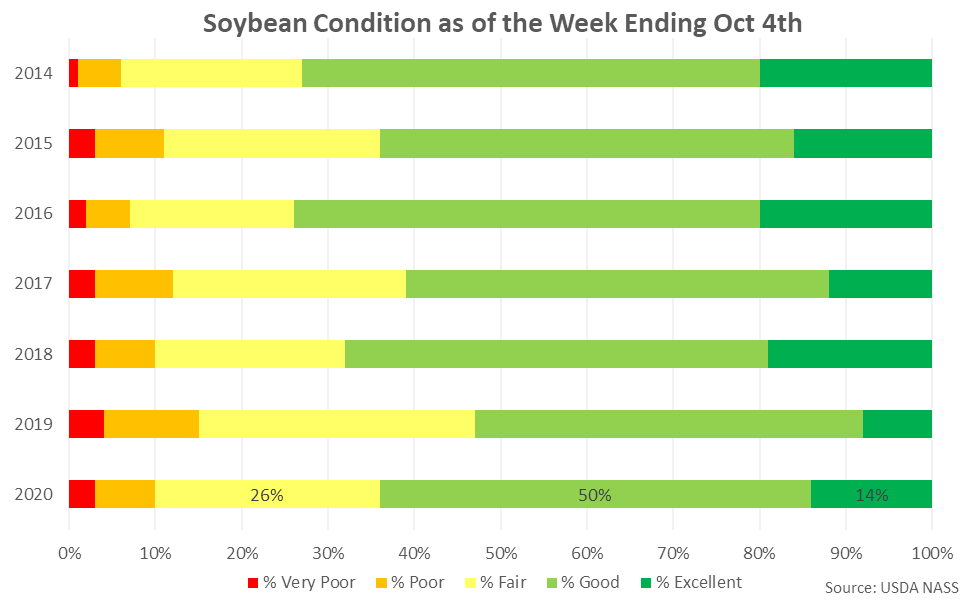

64% of the current soybean crop was identified to be in good or excellent condition as of the week ending Oct 4th, unchanged from the previous week but up one percent in the ‘excellent’ category. The current soybean crop identified to be in good or excellent condition was consistent with analyst expectations. Ten percent of the current soybean crop was identified as poor or very poor, unchanged from the previous week.

64% of the current soybean crop was identified to be in good or excellent condition as of the week ending Oct 4th, unchanged from the previous week but up one percent in the ‘excellent’ category. The current soybean crop identified to be in good or excellent condition was consistent with analyst expectations. Ten percent of the current soybean crop was identified as poor or very poor, unchanged from the previous week.

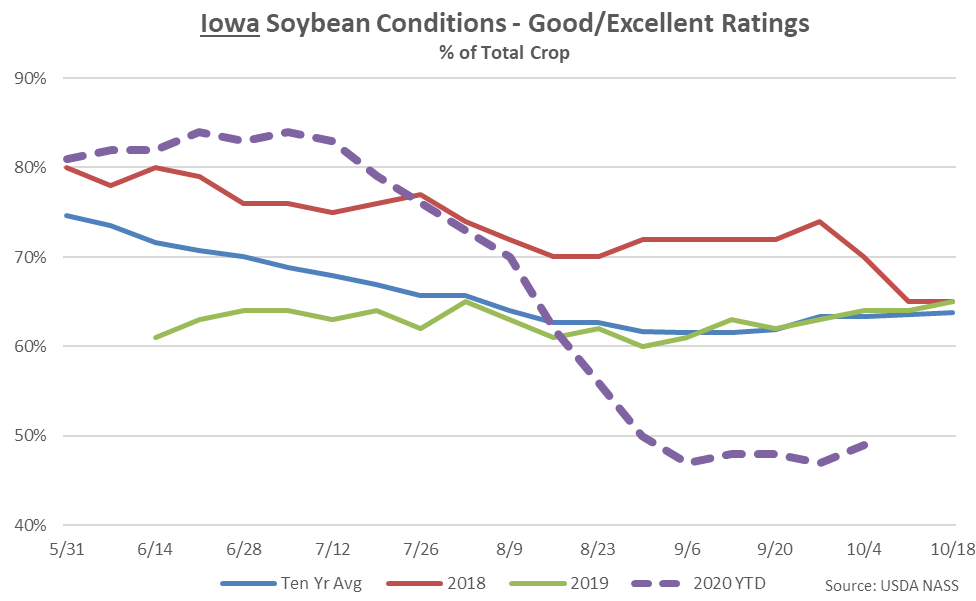

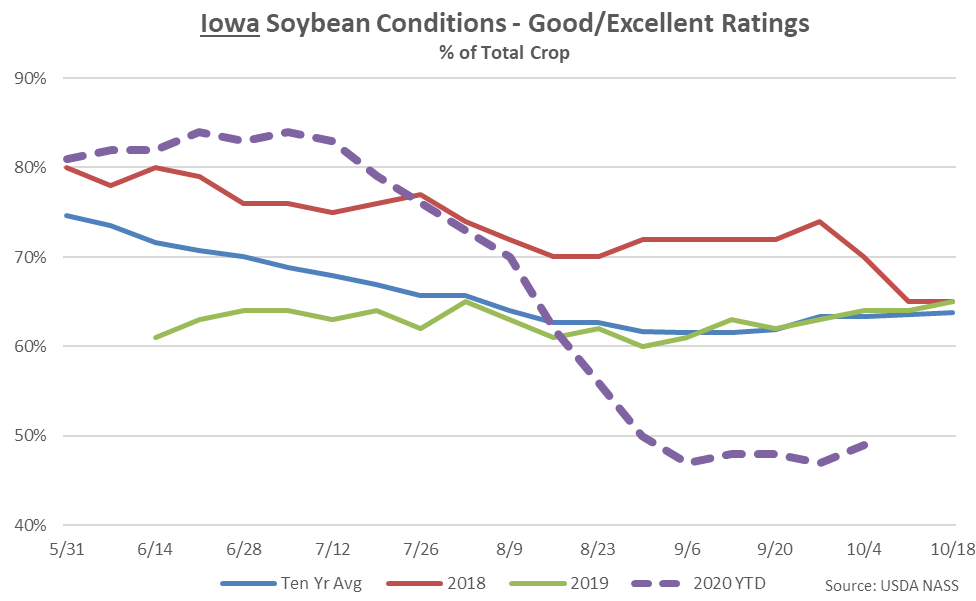

18% of the Iowa soybean crop was identified to be in poor or very poor condition as of the week ending Oct 4th, down one percent from the previous week. 49% of the Iowa soybean crop was identified to be in good or excellent condition, up two percent from the previous week but remaining at a seven year seasonal low level.

18% of the Iowa soybean crop was identified to be in poor or very poor condition as of the week ending Oct 4th, down one percent from the previous week. 49% of the Iowa soybean crop was identified to be in good or excellent condition, up two percent from the previous week but remaining at a seven year seasonal low level.

Corn harvesting as of the week ending Oct 4th was 25% completed, finishing ahead of last year’s pace of 14% completed and the five year average pace of 24% completed. Corn harvest progress finished slightly below analyst expectations of 26% completed.

Corn harvesting as of the week ending Oct 4th was 25% completed, finishing ahead of last year’s pace of 14% completed and the five year average pace of 24% completed. Corn harvest progress finished slightly below analyst expectations of 26% completed.

62% of the current corn crop was identified to be in good or excellent condition as of the week ending Oct 4th, up one percent from the previous week. The current corn crop identified to be in good or excellent condition finished slightly above analyst expectations of 61% completed. 13% of the current corn crop was identified as poor or very poor, down one percent from the previous week.

62% of the current corn crop was identified to be in good or excellent condition as of the week ending Oct 4th, up one percent from the previous week. The current corn crop identified to be in good or excellent condition finished slightly above analyst expectations of 61% completed. 13% of the current corn crop was identified as poor or very poor, down one percent from the previous week.

24% of the Iowa corn crop was identified to be in poor or very poor condition as of the week ending Oct 4th, down three percent from the previous week. Millions of acres of Iowa corn and soybean crops were heavily damaged by the early August derecho. 45% of the Iowa corn crop was identified to be in good or excellent condition, rebounding to a five week high level but remaining at a seven year seasonal low.

24% of the Iowa corn crop was identified to be in poor or very poor condition as of the week ending Oct 4th, down three percent from the previous week. Millions of acres of Iowa corn and soybean crops were heavily damaged by the early August derecho. 45% of the Iowa corn crop was identified to be in good or excellent condition, rebounding to a five week high level but remaining at a seven year seasonal low.

Soybeans:

Soybean leaf dropping was 85% completed as of the week ending Oct 4th, finishing ahead of last year’s pace of 67% completed and the five year average pace of 82% completed.

Soybeans:

Soybean leaf dropping was 85% completed as of the week ending Oct 4th, finishing ahead of last year’s pace of 67% completed and the five year average pace of 82% completed.

Soybean harvesting as of the week ending Oct 4th was 38% completed, finishing ahead of last year’s pace of 12% completed and the five year average pace of 28% completed. Soybean harvest progress finished above analyst expectations of 36% completed.

Soybean harvesting as of the week ending Oct 4th was 38% completed, finishing ahead of last year’s pace of 12% completed and the five year average pace of 28% completed. Soybean harvest progress finished above analyst expectations of 36% completed.

64% of the current soybean crop was identified to be in good or excellent condition as of the week ending Oct 4th, unchanged from the previous week but up one percent in the ‘excellent’ category. The current soybean crop identified to be in good or excellent condition was consistent with analyst expectations. Ten percent of the current soybean crop was identified as poor or very poor, unchanged from the previous week.

64% of the current soybean crop was identified to be in good or excellent condition as of the week ending Oct 4th, unchanged from the previous week but up one percent in the ‘excellent’ category. The current soybean crop identified to be in good or excellent condition was consistent with analyst expectations. Ten percent of the current soybean crop was identified as poor or very poor, unchanged from the previous week.

18% of the Iowa soybean crop was identified to be in poor or very poor condition as of the week ending Oct 4th, down one percent from the previous week. 49% of the Iowa soybean crop was identified to be in good or excellent condition, up two percent from the previous week but remaining at a seven year seasonal low level.

18% of the Iowa soybean crop was identified to be in poor or very poor condition as of the week ending Oct 4th, down one percent from the previous week. 49% of the Iowa soybean crop was identified to be in good or excellent condition, up two percent from the previous week but remaining at a seven year seasonal low level.