Soybean Complex Price & Value Update – Apr ’21

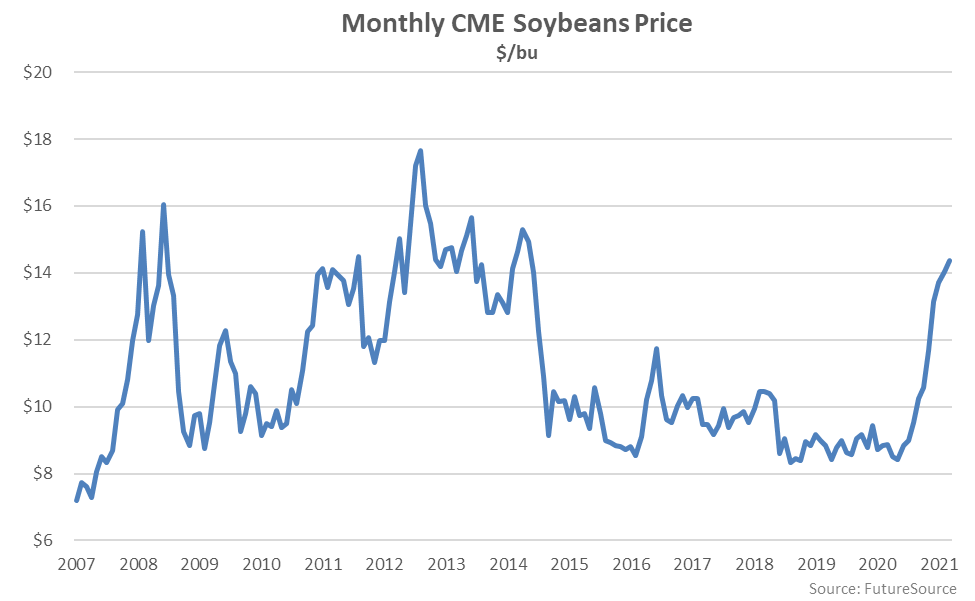

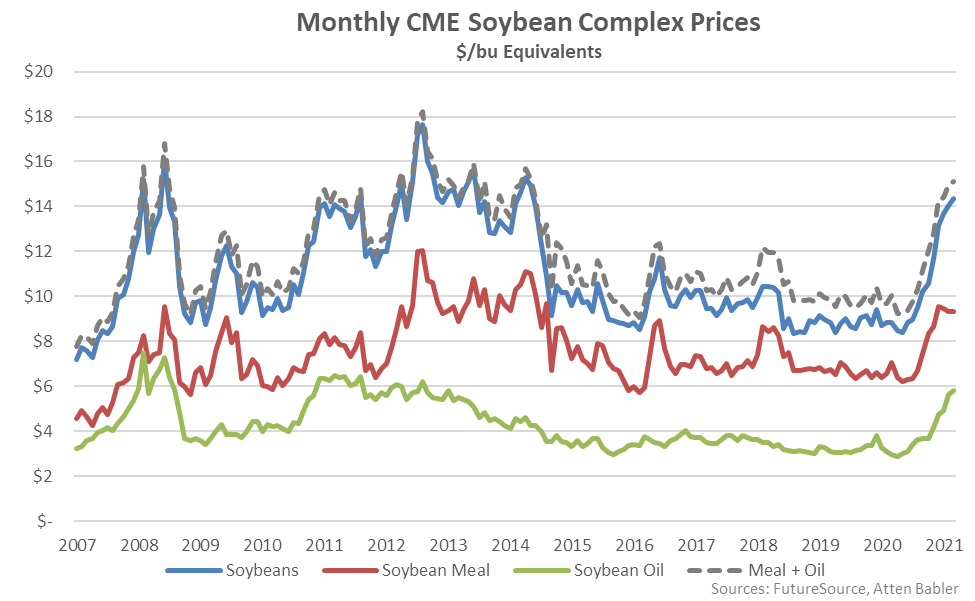

Mar ’21 CME Soybean Prices Reached a Six and a Half Year High Level

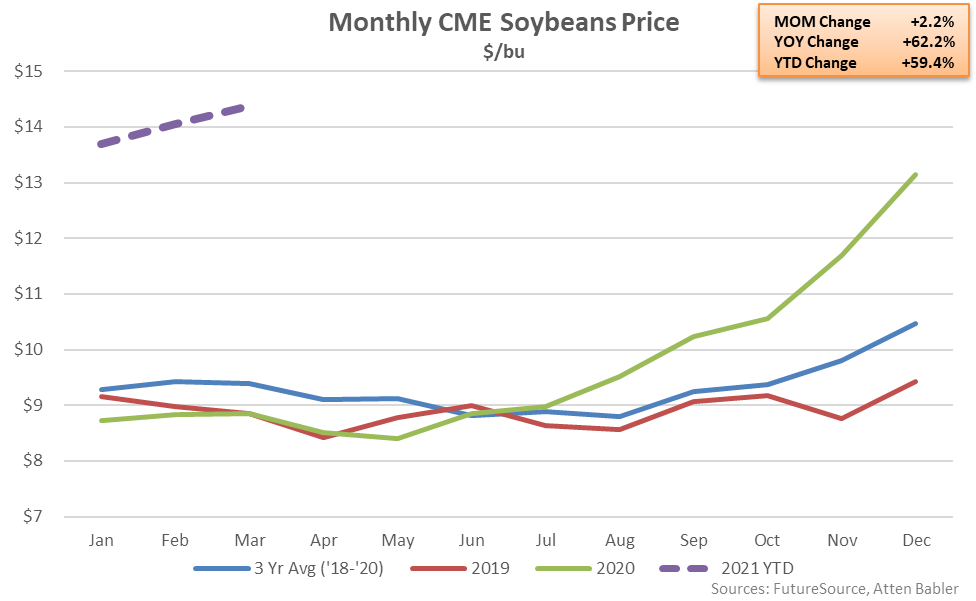

Mar ’21 CME Soybean Prices Increased 2.2% MOM and 62.2% YOY

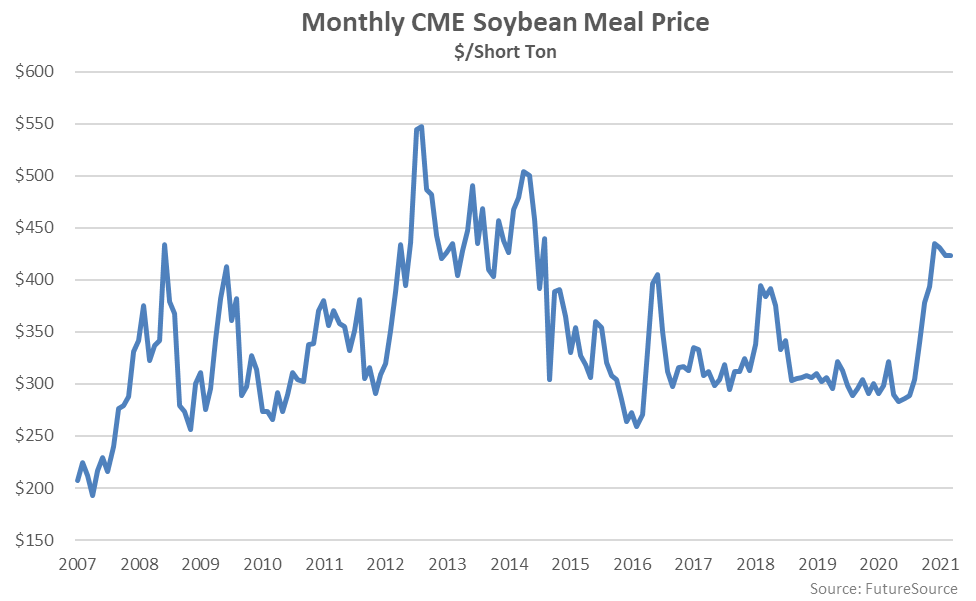

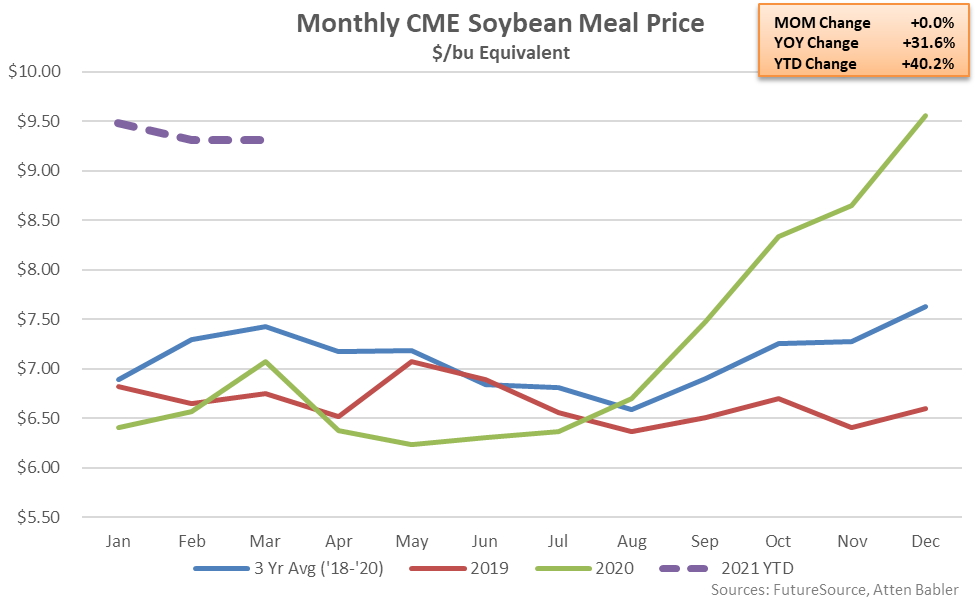

Mar ’21 CME Soybean Meal Prices Remained Near Recent Six Year High Levels

Mar ’21 CME Soybean Meal Prices Finished Flat MOM and up 31.6% YOY

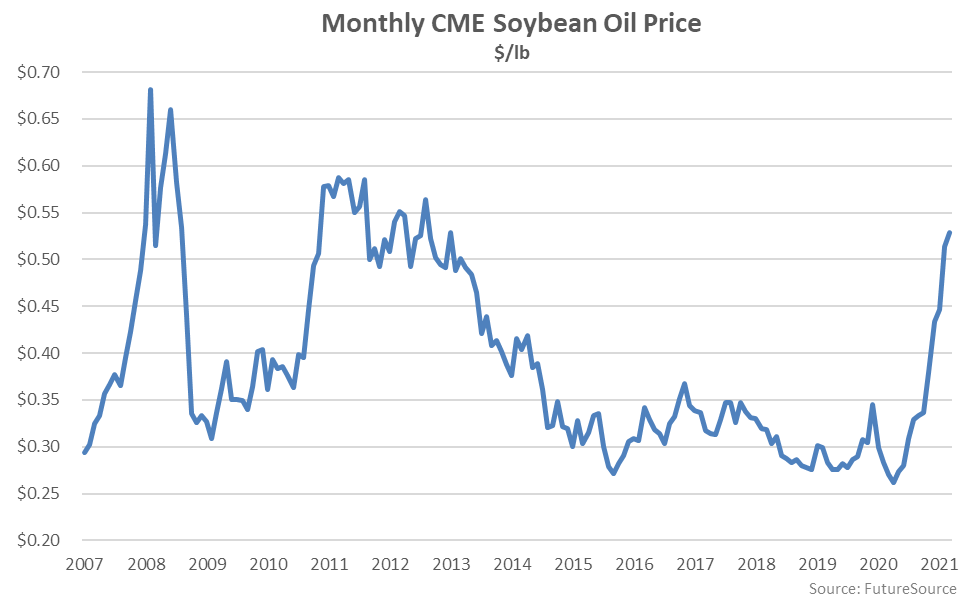

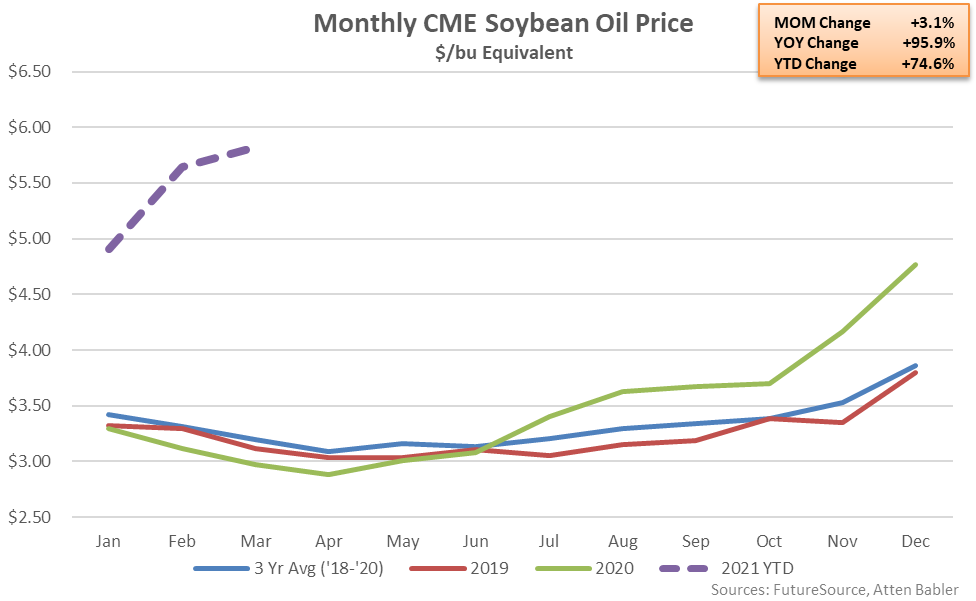

Mar ’21 CME Soybean Oil Prices Reached an Eight and a Half Year High Level

Mar ’21 CME Soybean Oil Prices Increased 3.1% MOM and 95.9% YOY

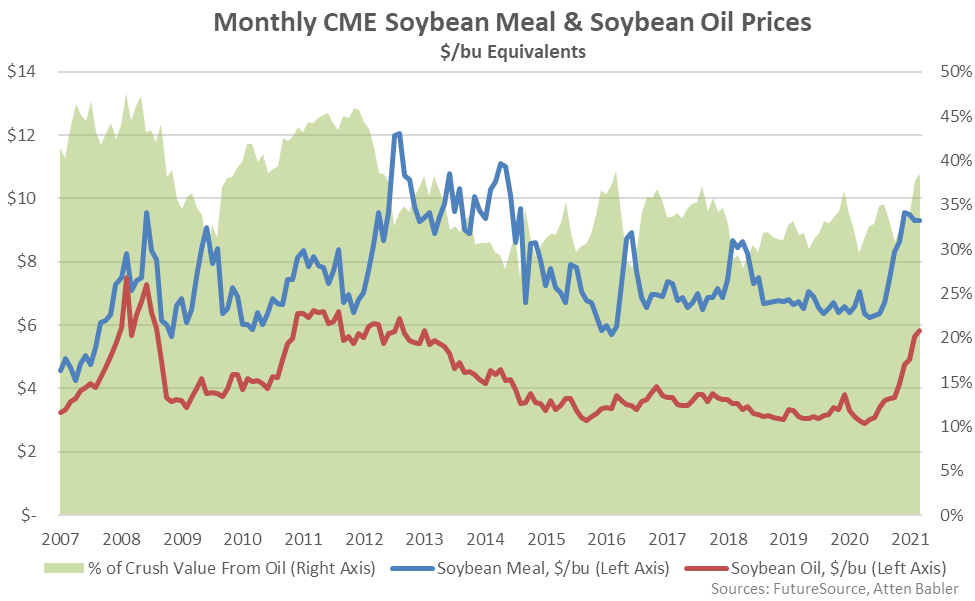

The Mar ’21 Oil Percentage of Crush Value of 38.5% Reached a Five Year High

Mar ’21 Meal + Oil Prices Finished at a $15.13/bu Eq, Compared to a Bean Price of $14.37

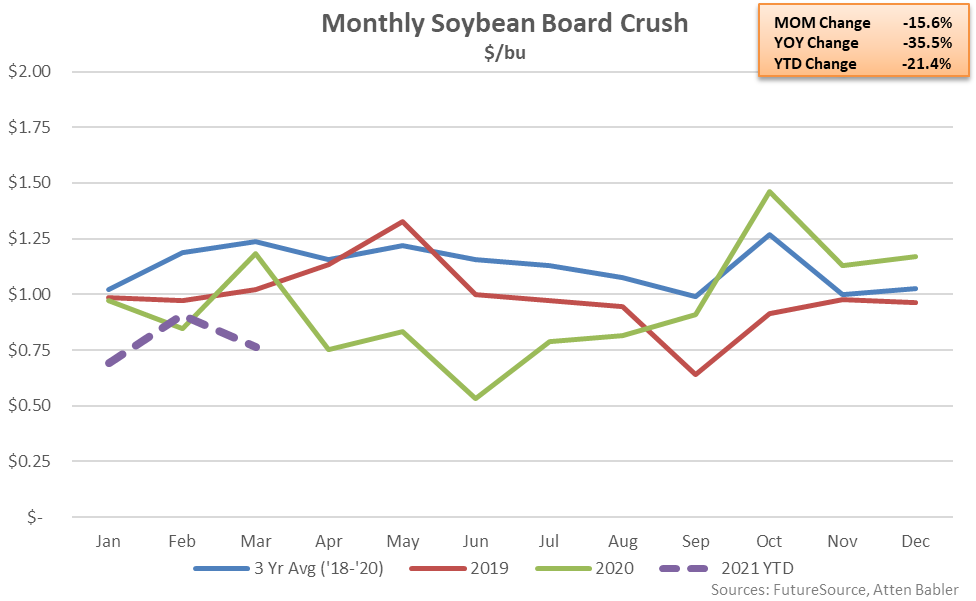

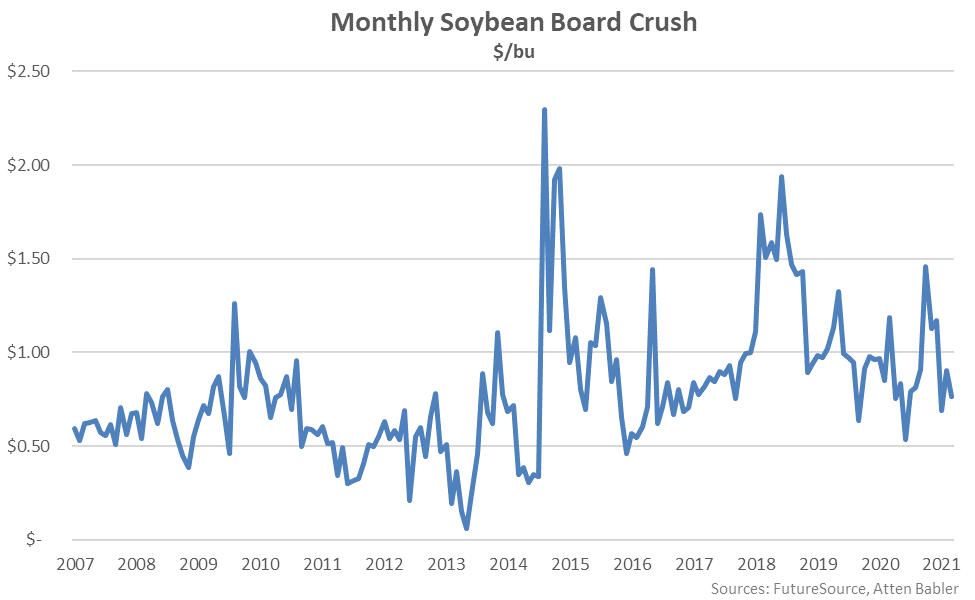

Mar ’21 Soybean Board Crush Declined From the Previous Month

Mar ’21 Soybean Board Crush Finished Down 15.6% MOM and 35.5% YOY