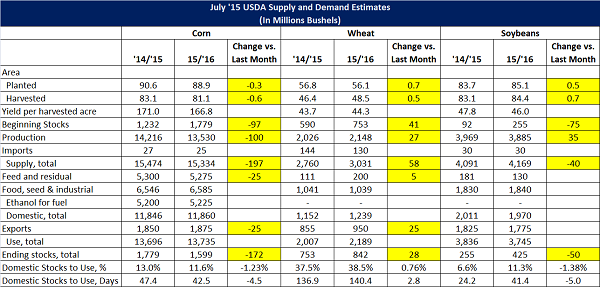

July ’15 USDA World Agriculture Supply and Demand Estimates

*Significant changes are highlighted

’14/’15 Corn

o Ethanol grind was increased 25 million bushels while feed and residual was increased 50 million leaving ending stocks near estimates at 1.779 billion.

’15/’16 Corn

o Acres were reduced reflecting June Acreage survey buy yield was left unchanged reducing production 100 million bushels in total.

o Usage for feed and exports were each reduced 25 million bushels.

o Ending stocks were projected at 1.599 billion bushels or 42.5 days of use and above private estimates.

’14/’15 Soybeans

o Crush and exports were each revised higher by 15 million bushels and residual was estimated sharply higher by 45 million bushels leaving ending stocks at 255 million near private estimates.

’15/’16 Soybeans

o Acres were increased reflecting June Acreage survey buy yield was left unchanged increasing production 35 million bushels in total.

o Crush was increased 10 million bushels leaving ending stocks above estimates at 425 million bushels or 41.4 days of use.

Other Markets

o Brazil corn production was revised higher by 2 million metric tons for both this last crop and next year’s crop on higher yield and area. This partially offset reductions in the EU and US.

o Russian and Ukraine wheat production is revised higher for 15/16 as projections about match 2014.

o US beef production for 2015 is revised lower on less placements but higher for 2016 as later placements make it to market next year. Pork and poultry are both projected higher to record levels on greater numbers and weights.

Click below for a downloadable PDF.

July ’15 USDA World Agriculture Supply and Demand Estimates

*Significant changes are highlighted

’14/’15 Corn

o Ethanol grind was increased 25 million bushels while feed and residual was increased 50 million leaving ending stocks near estimates at 1.779 billion.

’15/’16 Corn

o Acres were reduced reflecting June Acreage survey buy yield was left unchanged reducing production 100 million bushels in total.

o Usage for feed and exports were each reduced 25 million bushels.

o Ending stocks were projected at 1.599 billion bushels or 42.5 days of use and above private estimates.

’14/’15 Soybeans

o Crush and exports were each revised higher by 15 million bushels and residual was estimated sharply higher by 45 million bushels leaving ending stocks at 255 million near private estimates.

’15/’16 Soybeans

o Acres were increased reflecting June Acreage survey buy yield was left unchanged increasing production 35 million bushels in total.

o Crush was increased 10 million bushels leaving ending stocks above estimates at 425 million bushels or 41.4 days of use.

Other Markets

o Brazil corn production was revised higher by 2 million metric tons for both this last crop and next year’s crop on higher yield and area. This partially offset reductions in the EU and US.

o Russian and Ukraine wheat production is revised higher for 15/16 as projections about match 2014.

o US beef production for 2015 is revised lower on less placements but higher for 2016 as later placements make it to market next year. Pork and poultry are both projected higher to record levels on greater numbers and weights.

Click below for a downloadable PDF.

July ’15 USDA World Agriculture Supply and Demand Estimates