June ’15 USDA Planted Acreage Report

Corn – Neutral

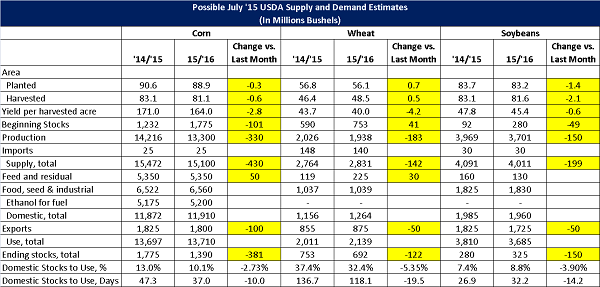

o The acreage projection of 88.9 million acres planted was just below the 89.3 million acres average estimate and but well below the 90.6 million planted last year.

o The focus will now turn predominately to weather, pollination, and demand. Increased planting of sorghum and other coarse grains may continue to limit overall feed and export demand growth.

o Carryout domestically will likely be lowered by the USDA on weaker yields but slow export sales and larger foreign production could be partially offsetting.

Soybeans – Neutral

o The acreage projection of 85.1 million acres was in line with the 85.2 million acre average estimate but it is anticipated that actual acreage will come in 2 million less after prevent plant and flooded area is accounted for in future reporting.

o Carryout both domestically and globally will be projected to decline fairly sharply by analysts as poor US weather impacts total production estimates.

Wheat – Neutral

o The acreage projection of 56.1 million acres planted was slightly above the 55.9 million acres average estimate but below the 56.8 million planted last year.

o Carryout both domestically will be projected to decline as production reports and poor quality impact supply estimates for 2015/2016.

Click below for a downloadable PDF.

June ’15 USDA Planted Acreage Report

Corn – Neutral

o The acreage projection of 88.9 million acres planted was just below the 89.3 million acres average estimate and but well below the 90.6 million planted last year.

o The focus will now turn predominately to weather, pollination, and demand. Increased planting of sorghum and other coarse grains may continue to limit overall feed and export demand growth.

o Carryout domestically will likely be lowered by the USDA on weaker yields but slow export sales and larger foreign production could be partially offsetting.

Soybeans – Neutral

o The acreage projection of 85.1 million acres was in line with the 85.2 million acre average estimate but it is anticipated that actual acreage will come in 2 million less after prevent plant and flooded area is accounted for in future reporting.

o Carryout both domestically and globally will be projected to decline fairly sharply by analysts as poor US weather impacts total production estimates.

Wheat – Neutral

o The acreage projection of 56.1 million acres planted was slightly above the 55.9 million acres average estimate but below the 56.8 million planted last year.

o Carryout both domestically will be projected to decline as production reports and poor quality impact supply estimates for 2015/2016.

Click below for a downloadable PDF.

June ’15 USDA Planted Acreage Report