Chinese Dairy Imports Update – May ’16

Executive Summary

Chinese dairy import figures provided by GTIS were recently updated with values spanning through Apr ’16. Highlights from the updated report include:

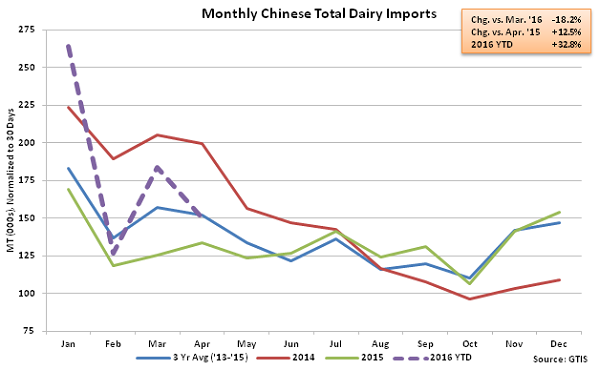

• Total Chinese dairy import volumes declined 18.2% MOM on a daily average basis but increased on a YOY basis for the ninth consecutive month during Apr ‘16, finishing up 12.5%.

• Chinese dairy import volumes originating from within the EU-28 increased to a new monthly record high for the second consecutive month during Apr ’16.

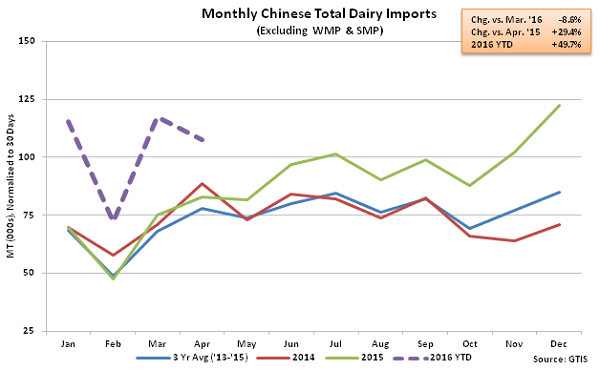

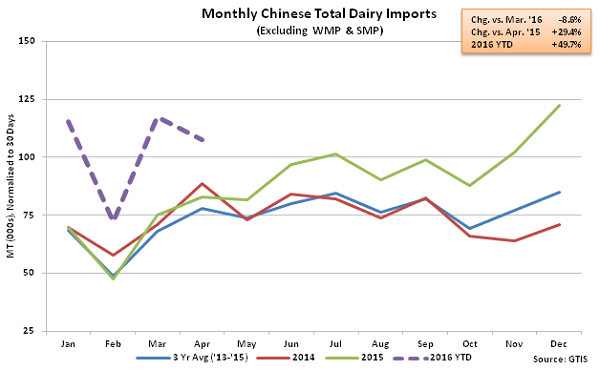

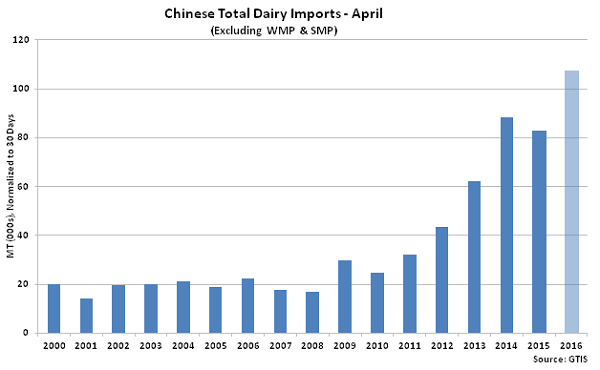

• Apr ’16 Chinese dairy imports excluding whole milk powder and skim milk powder remained particularly strong, finishing up 29.4% YOY to a new record high for the month of April.

Additional Report Details

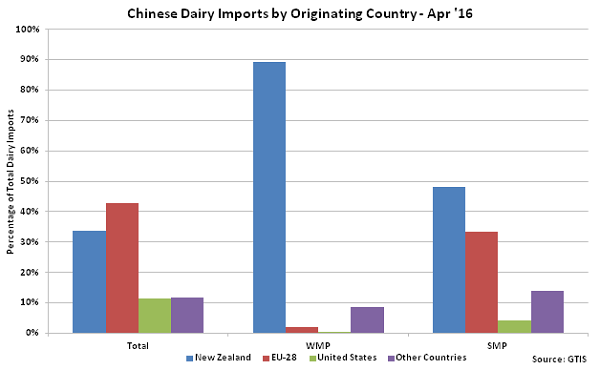

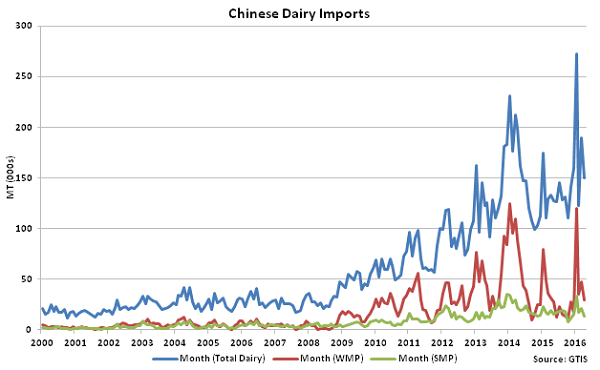

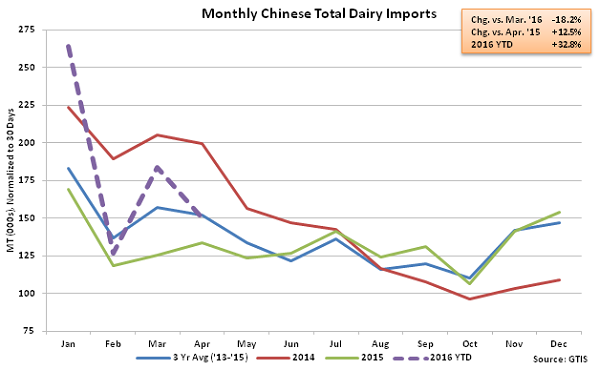

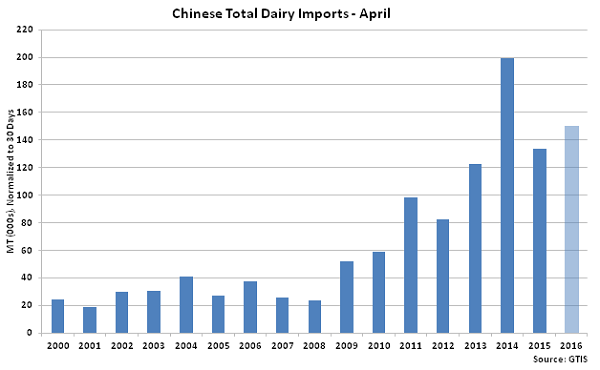

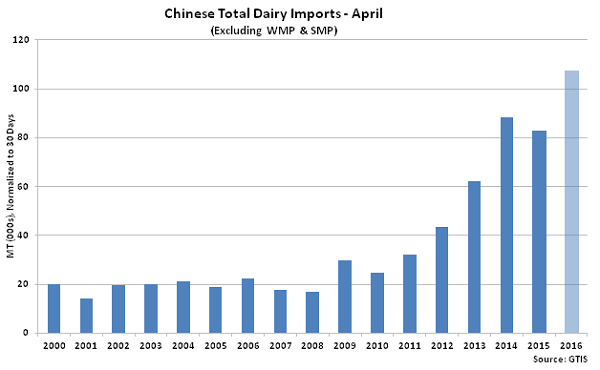

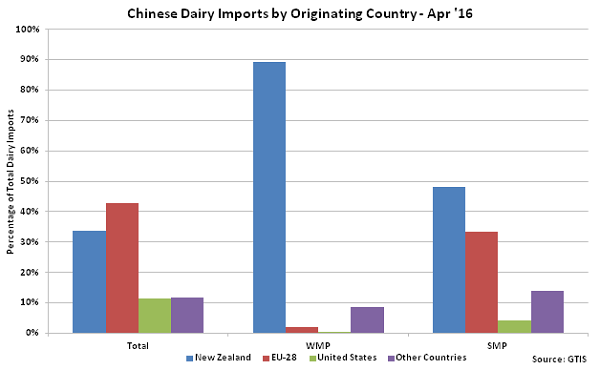

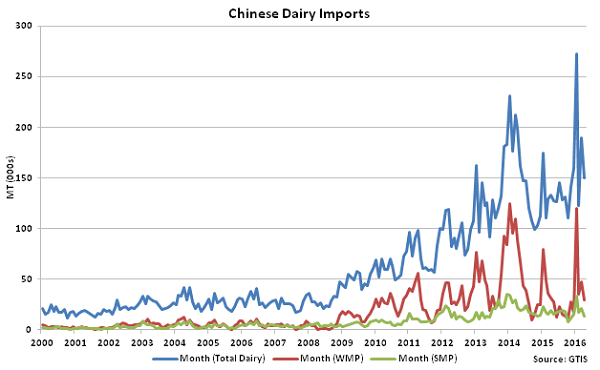

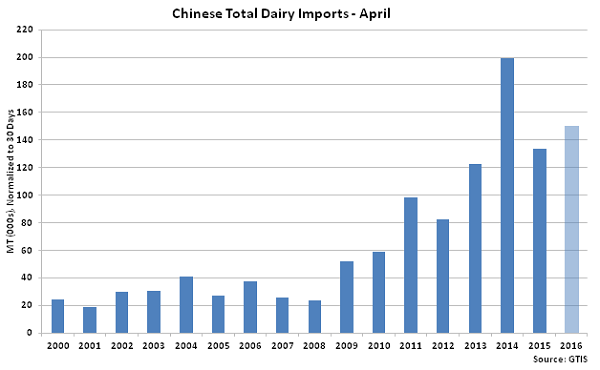

According to GTIS, Apr ’16 total Chinese dairy import volumes declined 18.2% MOM on a daily average basis but remained up 12.5% YOY, finishing at the second highest level for the month of April on record. Total Chinese dairy import volumes have increased YOY for nine consecutive months through April however the March – April MOM decline in import volumes of 18.2% was significantly larger than the ten year average seasonal decline of 4.6%. Total Chinese dairy import volumes originating from New Zealand declined 7.9% YOY while import volumes originating from within the EU-28 increased to a new monthly record high during Apr ’16, finishing 69.4% higher on a YOY basis.

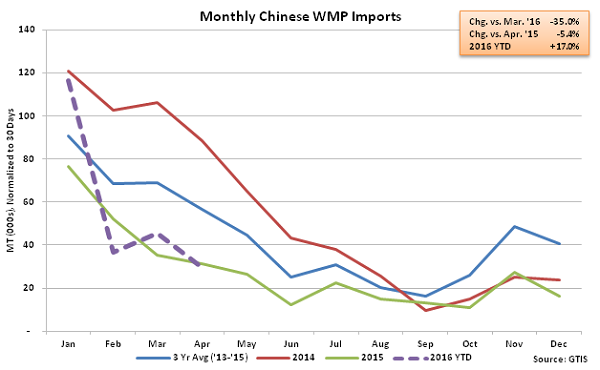

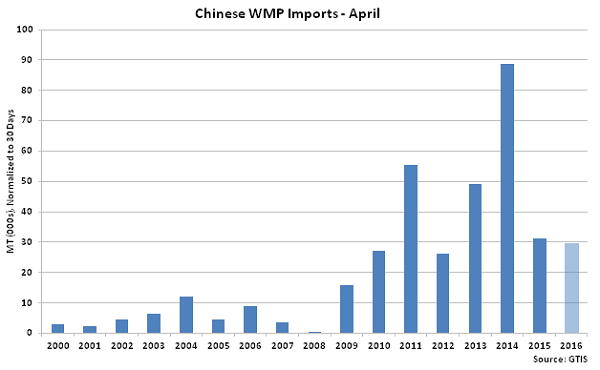

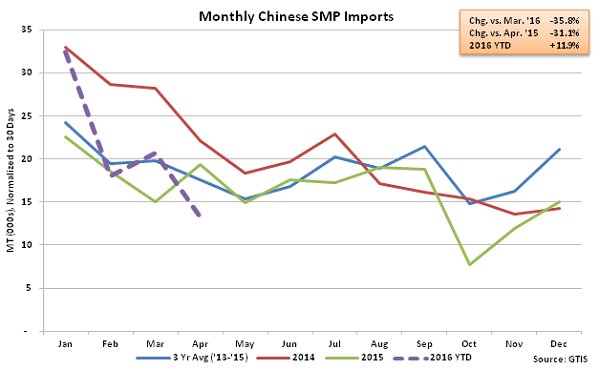

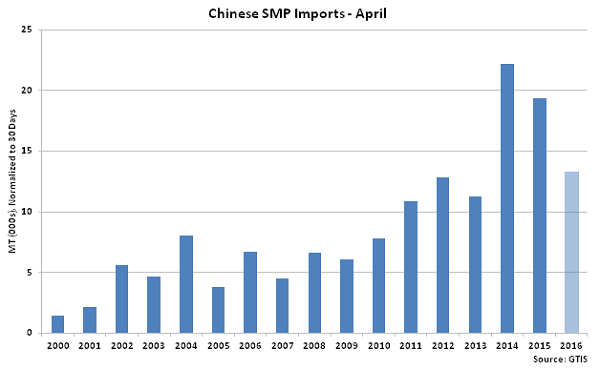

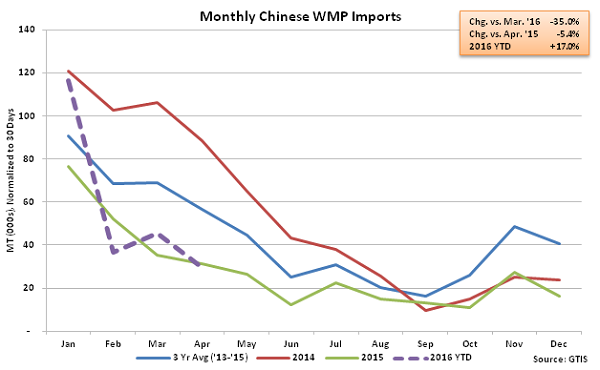

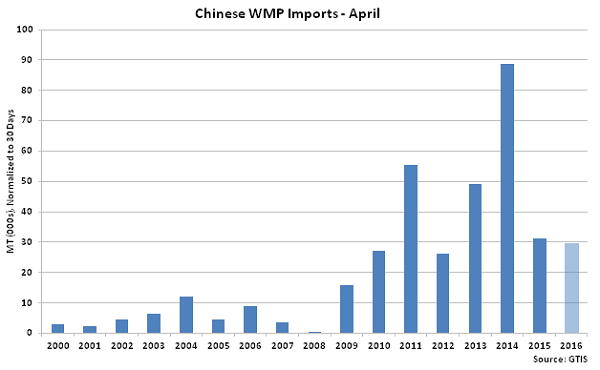

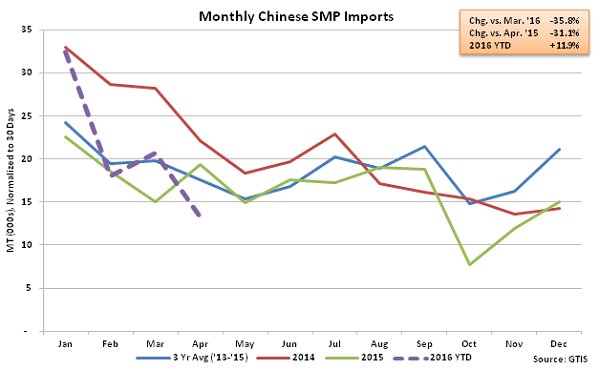

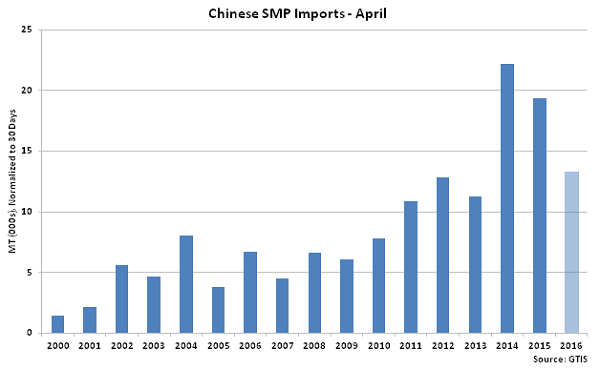

Apr ’16 Chinese powder imports remained relatively weak, declining on both a MOM and YOY basis. Apr ’16 Chinese whole milk powder (WMP) declined 35.0% MOM and 5.4% to a four year low for the month of April while skim milk powder (SMP) import volumes declined 35.8% MOM and 31.1% YOY to a three year April low. Apr ’16 Chinese dairy imports excluding WMP and SMP remained strong, however, increasing by 29.4% YOY and finishing at a new record high for the month of April.

Apr ’16 Total Chinese Dairy Import Volumes Remained Below the Jan ’16 Highs

Apr ’16 Total Chinese Dairy Import Volumes Declined 18.2% MOM, Remained up 12.5% YOY

Apr ’16 Total Chinese Dairy Import Volumes Declined 18.2% MOM, Remained up 12.5% YOY

Chinese Dairy Import Volumes Remained the Second Largest on Record for the Month of April

Chinese Dairy Import Volumes Remained the Second Largest on Record for the Month of April

Apr ’16 Chinese WMP Import Volumes Declined 35.0% MOM and 5.4% YOY

Apr ’16 Chinese WMP Import Volumes Declined 35.0% MOM and 5.4% YOY

Chinese WMP Imports Declined to a Four Year Low for the Month of April

Chinese WMP Imports Declined to a Four Year Low for the Month of April

Apr ’16 Chinese SMP Import Volumes Declined 35.8% MOM and 31.1% YOY

Apr ’16 Chinese SMP Import Volumes Declined 35.8% MOM and 31.1% YOY

Chinese SMP Imports Declined to a Three Year Low for the Month of April

Chinese SMP Imports Declined to a Three Year Low for the Month of April

Apr ’16 Chinese Dairy Imports Excluding WMP & SMP Down 8.6% MOM but up 29.4% YOY

Apr ’16 Chinese Dairy Imports Excluding WMP & SMP Down 8.6% MOM but up 29.4% YOY

Chinese Dairy Imports Excluding WMP & SMP Finished at a April Record High

Chinese Dairy Imports Excluding WMP & SMP Finished at a April Record High

The EU-28 Accounted for Over 40% of the Total Apr ’16 Chinese Dairy Import Volumes

The EU-28 Accounted for Over 40% of the Total Apr ’16 Chinese Dairy Import Volumes

Apr ’16 Total Chinese Dairy Import Volumes Declined 18.2% MOM, Remained up 12.5% YOY

Apr ’16 Total Chinese Dairy Import Volumes Declined 18.2% MOM, Remained up 12.5% YOY

Chinese Dairy Import Volumes Remained the Second Largest on Record for the Month of April

Chinese Dairy Import Volumes Remained the Second Largest on Record for the Month of April

Apr ’16 Chinese WMP Import Volumes Declined 35.0% MOM and 5.4% YOY

Apr ’16 Chinese WMP Import Volumes Declined 35.0% MOM and 5.4% YOY

Chinese WMP Imports Declined to a Four Year Low for the Month of April

Chinese WMP Imports Declined to a Four Year Low for the Month of April

Apr ’16 Chinese SMP Import Volumes Declined 35.8% MOM and 31.1% YOY

Apr ’16 Chinese SMP Import Volumes Declined 35.8% MOM and 31.1% YOY

Chinese SMP Imports Declined to a Three Year Low for the Month of April

Chinese SMP Imports Declined to a Three Year Low for the Month of April

Apr ’16 Chinese Dairy Imports Excluding WMP & SMP Down 8.6% MOM but up 29.4% YOY

Apr ’16 Chinese Dairy Imports Excluding WMP & SMP Down 8.6% MOM but up 29.4% YOY

Chinese Dairy Imports Excluding WMP & SMP Finished at a April Record High

Chinese Dairy Imports Excluding WMP & SMP Finished at a April Record High

The EU-28 Accounted for Over 40% of the Total Apr ’16 Chinese Dairy Import Volumes

The EU-28 Accounted for Over 40% of the Total Apr ’16 Chinese Dairy Import Volumes