Crop Progress Update – 9/28/20

According to the USDA, the current corn crop identified to be in good or excellent condition remained unchanged from the previous week, finishing consistent with analyst expectations. The corn harvest progress finished below analyst expectations, however.

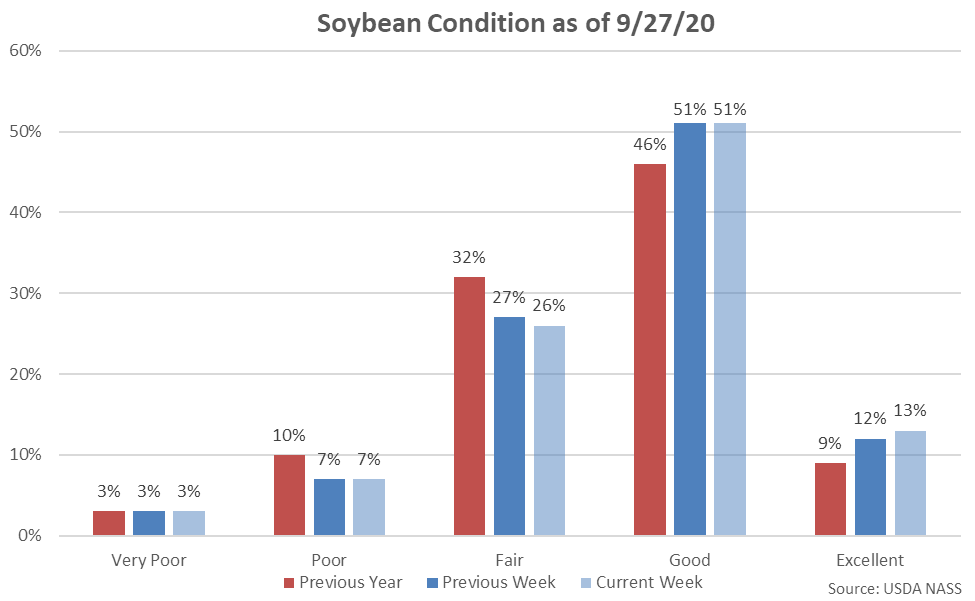

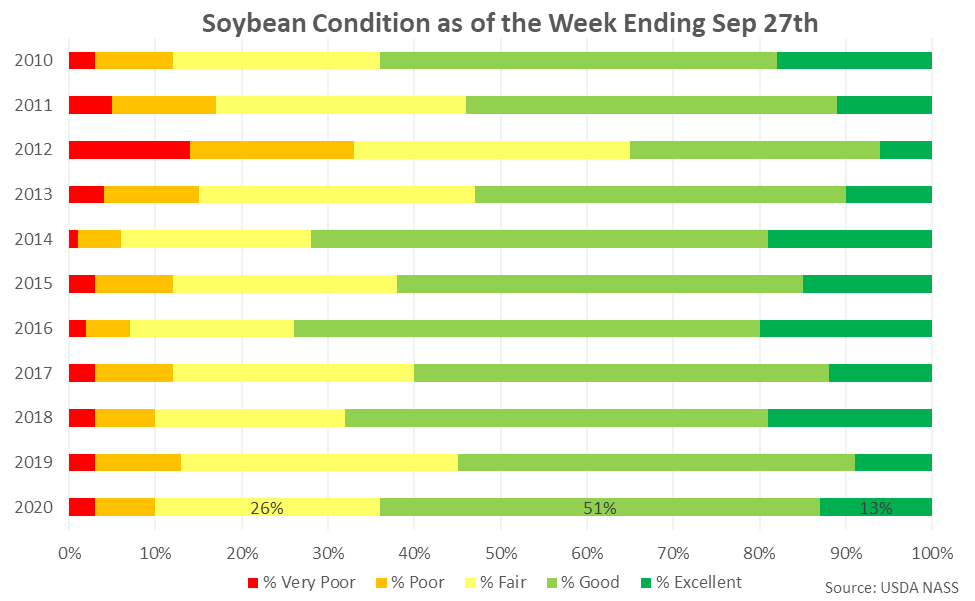

The current soybean crop identified to be in good or excellent condition increased slightly from the previous week, finishing above analyst expectations, while the soybean harvest progress also finished above analyst expectations.

Corn:

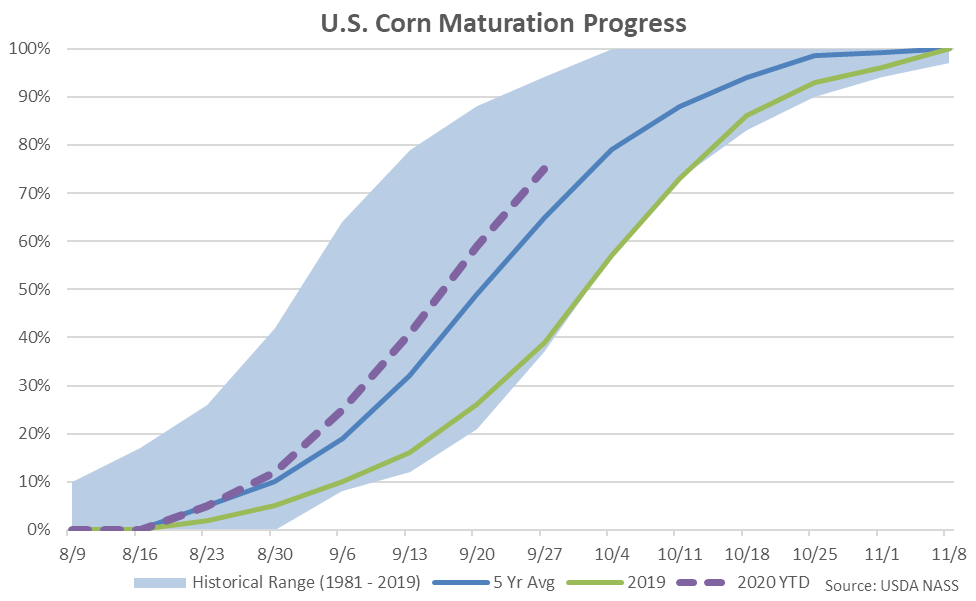

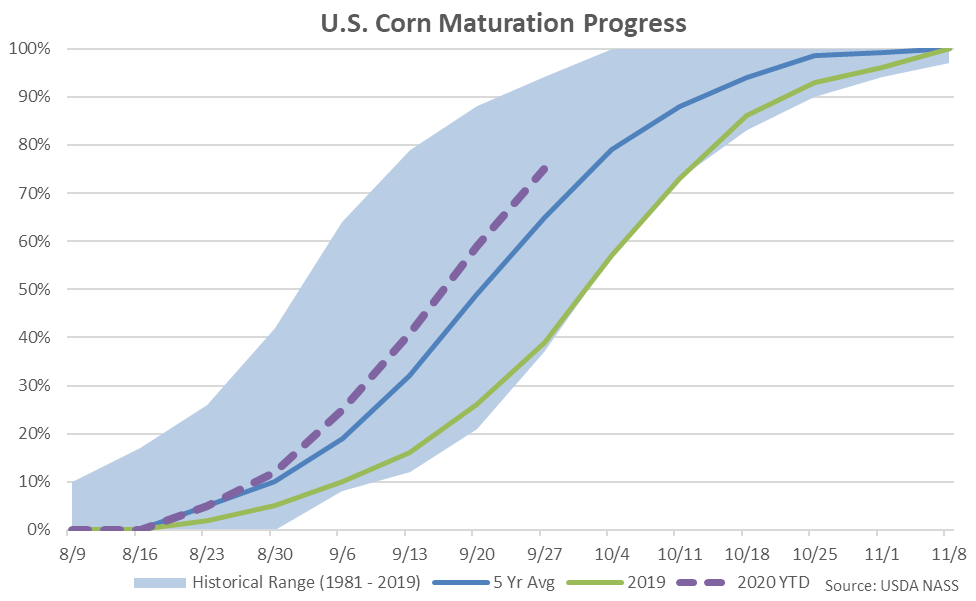

Corn maturation as of the week ending Sep 27th was 75% completed, finishing ahead of last year’s pace of 39% completed and the five year average pace of 65% completed.

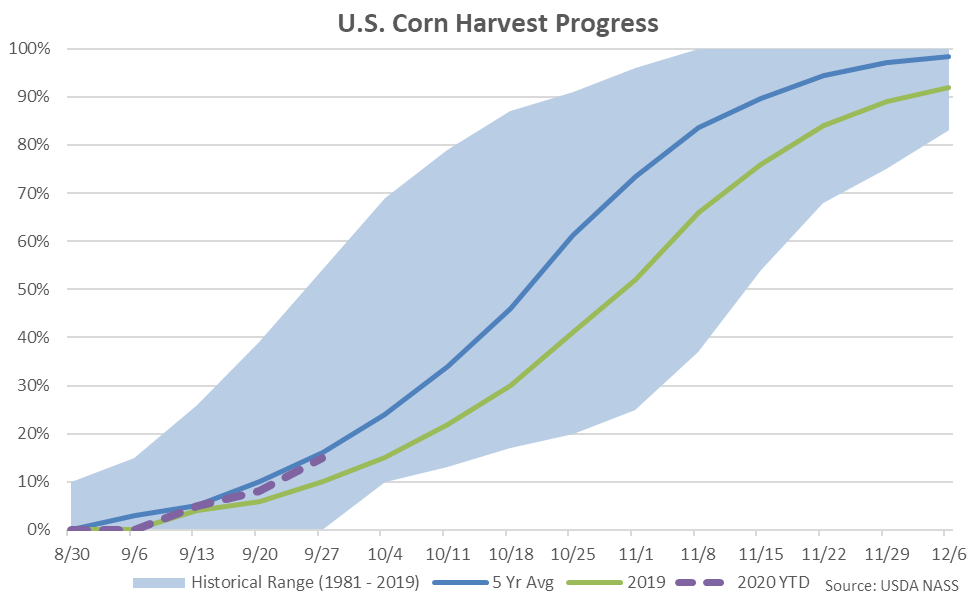

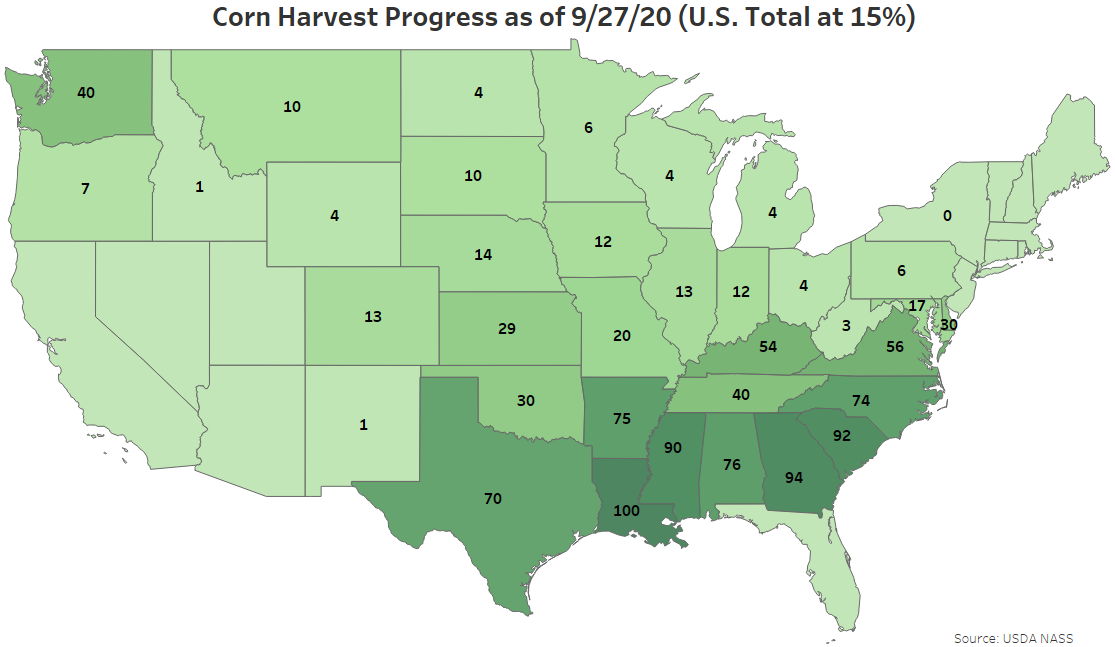

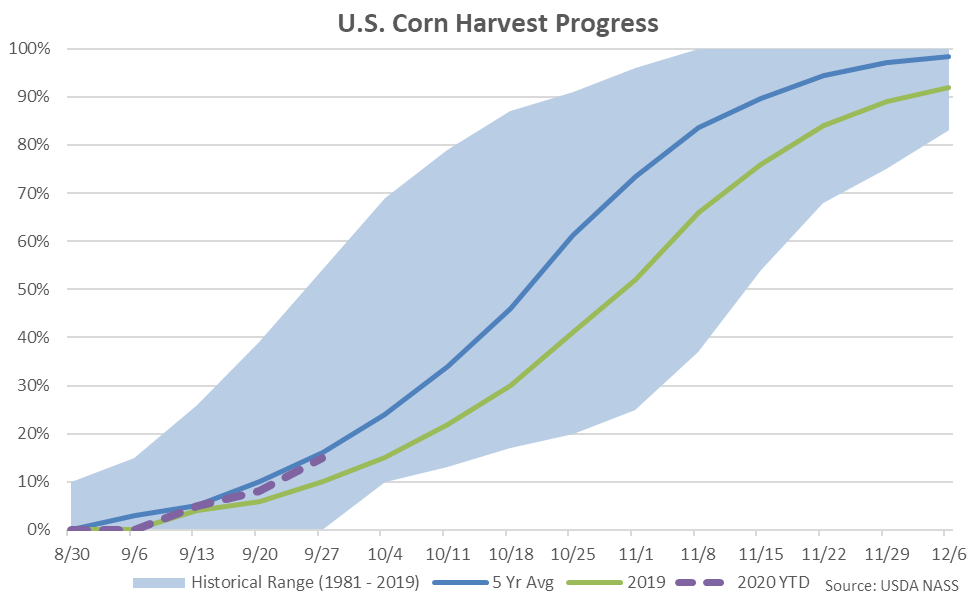

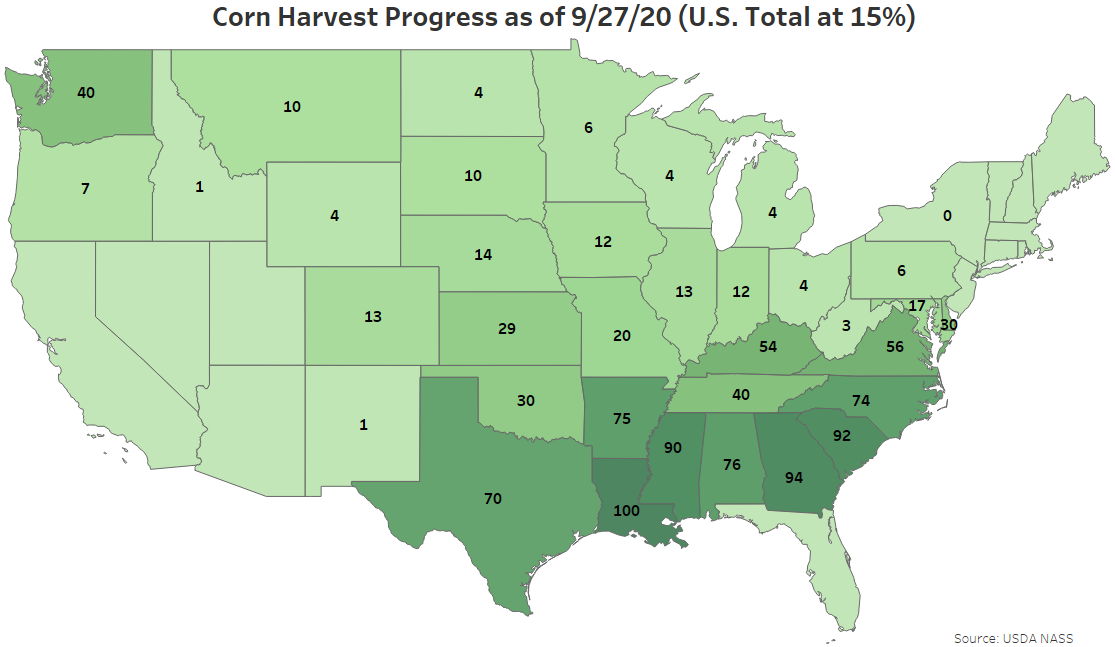

Corn harvesting as of the week ending Sep 27th was 15% completed, finishing ahead of last year’s pace of ten percent completed but slightly below the five year average pace of 16% completed. Corn harvest progress finished below analyst expectations of 17% completed.

Corn harvesting as of the week ending Sep 27th was 15% completed, finishing ahead of last year’s pace of ten percent completed but slightly below the five year average pace of 16% completed. Corn harvest progress finished below analyst expectations of 17% completed.

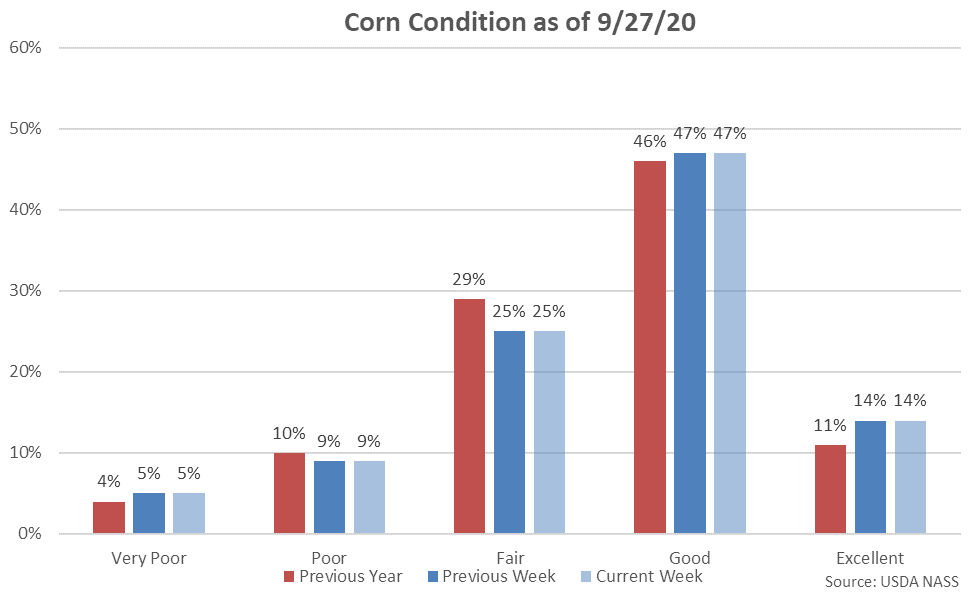

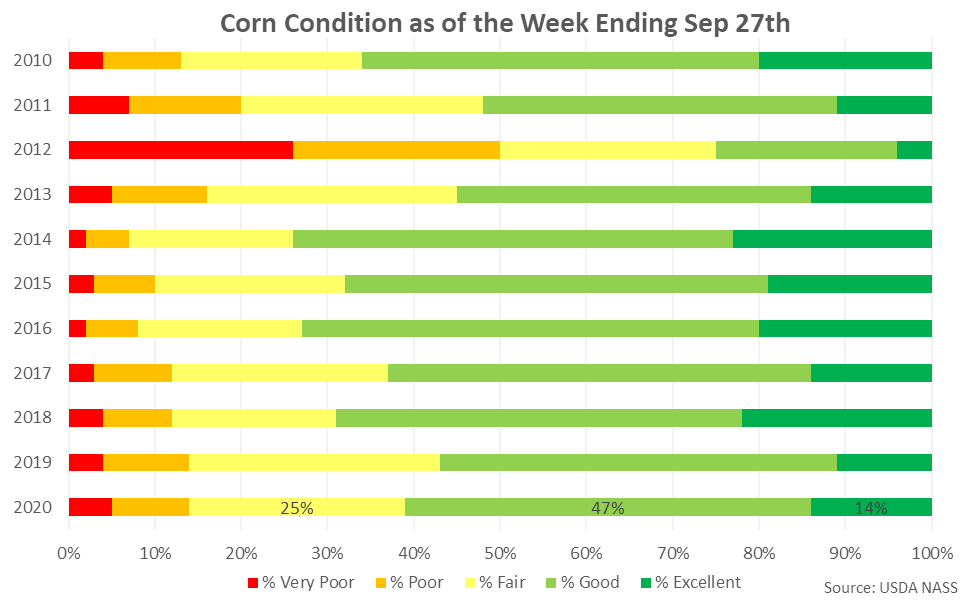

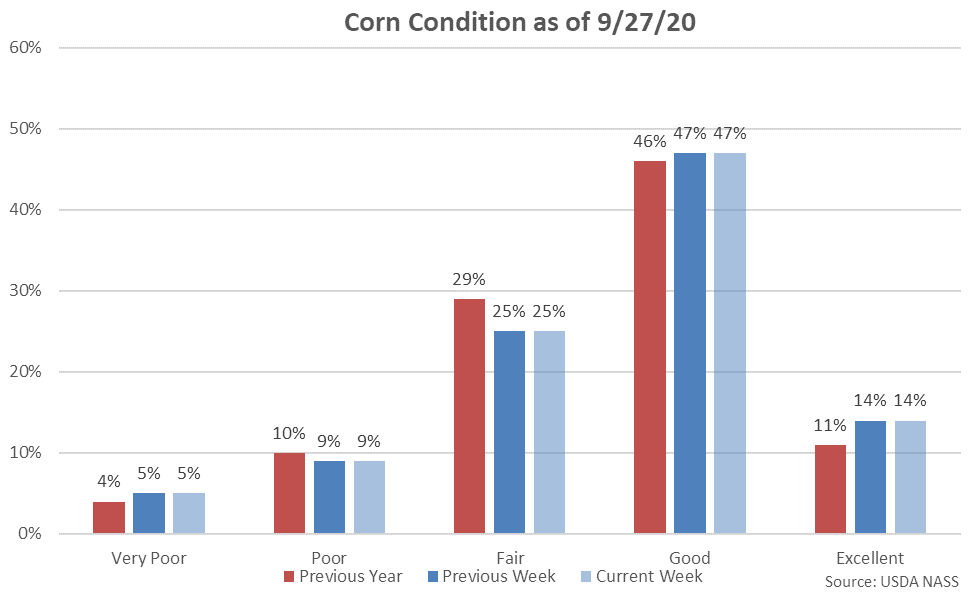

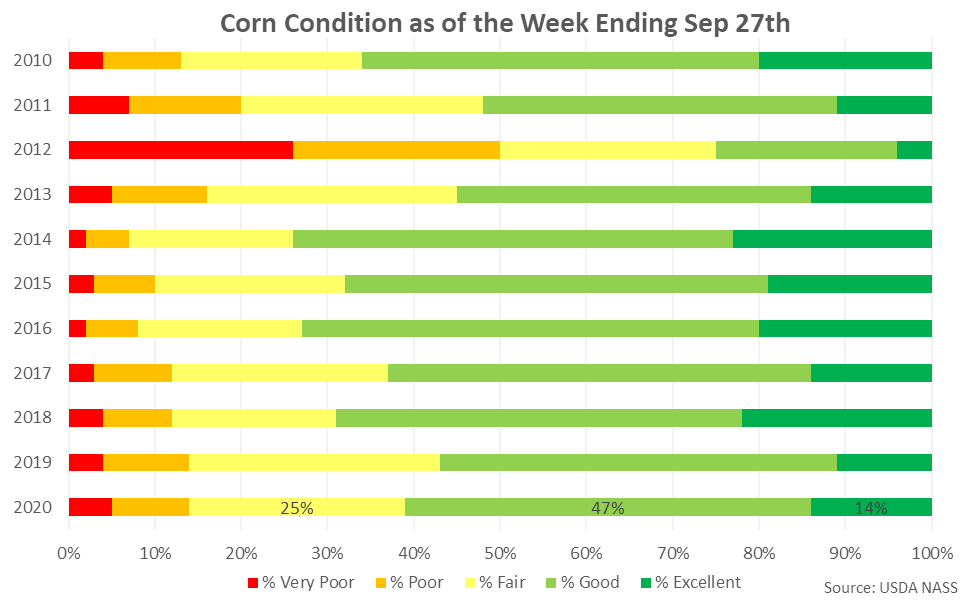

61% of the current corn crop was identified to be in good or excellent condition as of the week ending Sep 27th, unchanged from the previous week. The current corn crop identified to be in good or excellent condition finished consistent with analyst expectations. 14% of the current corn crop was identified as poor or very poor, also unchanged from the previous week.

61% of the current corn crop was identified to be in good or excellent condition as of the week ending Sep 27th, unchanged from the previous week. The current corn crop identified to be in good or excellent condition finished consistent with analyst expectations. 14% of the current corn crop was identified as poor or very poor, also unchanged from the previous week.

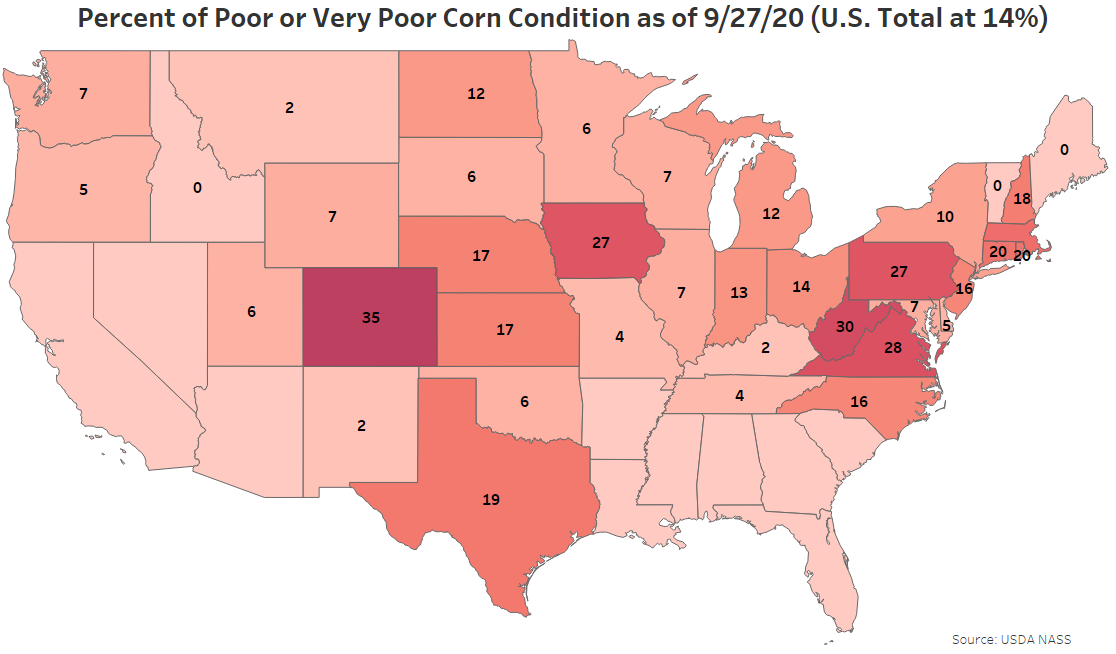

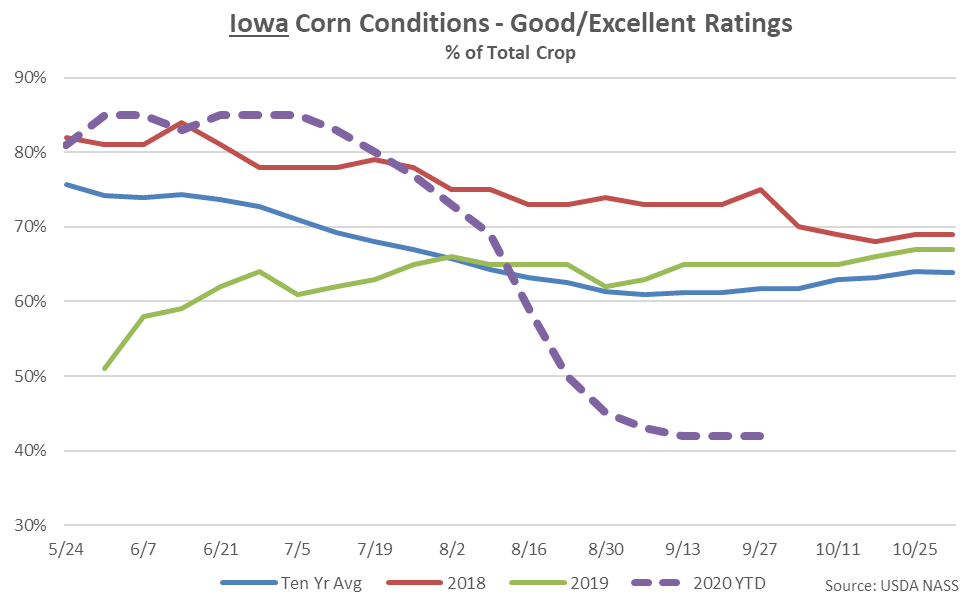

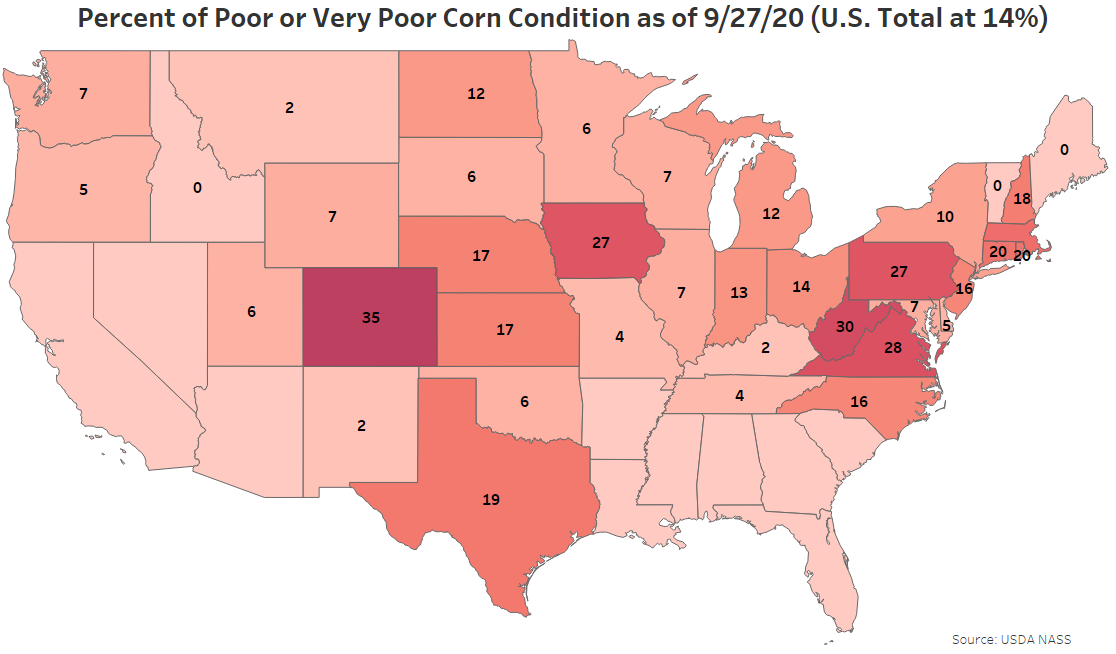

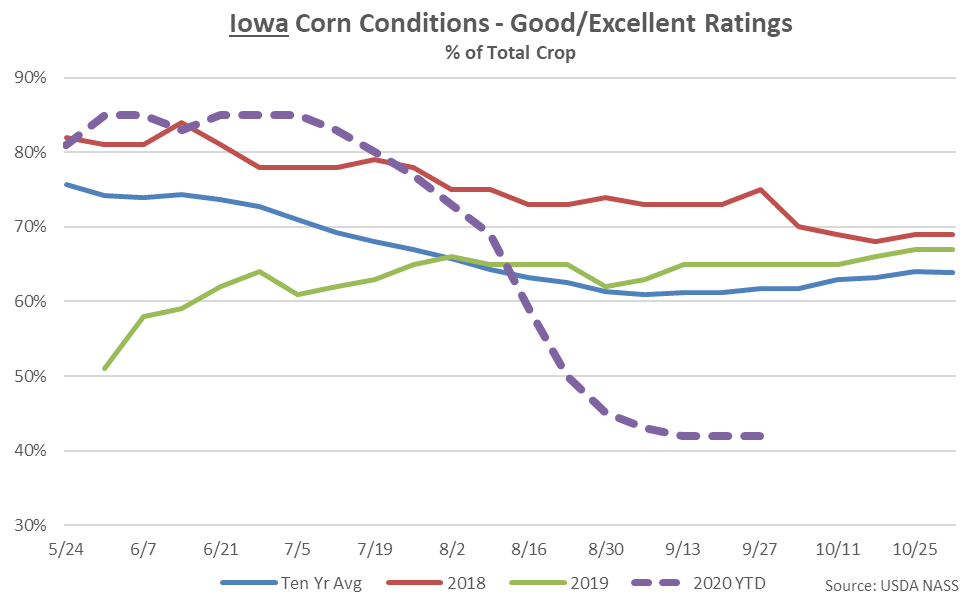

27% of the Iowa corn crop was identified to be in poor or very poor condition as of the week ending Sep 27th, up one percent from the previous week. Millions of acres of Iowa corn and soybean crops were heavily damaged by the early August derecho. Just 42% of the Iowa corn crop was identified to be in good or excellent condition, reaching a seven year seasonal low level.

27% of the Iowa corn crop was identified to be in poor or very poor condition as of the week ending Sep 27th, up one percent from the previous week. Millions of acres of Iowa corn and soybean crops were heavily damaged by the early August derecho. Just 42% of the Iowa corn crop was identified to be in good or excellent condition, reaching a seven year seasonal low level.

Soybeans:

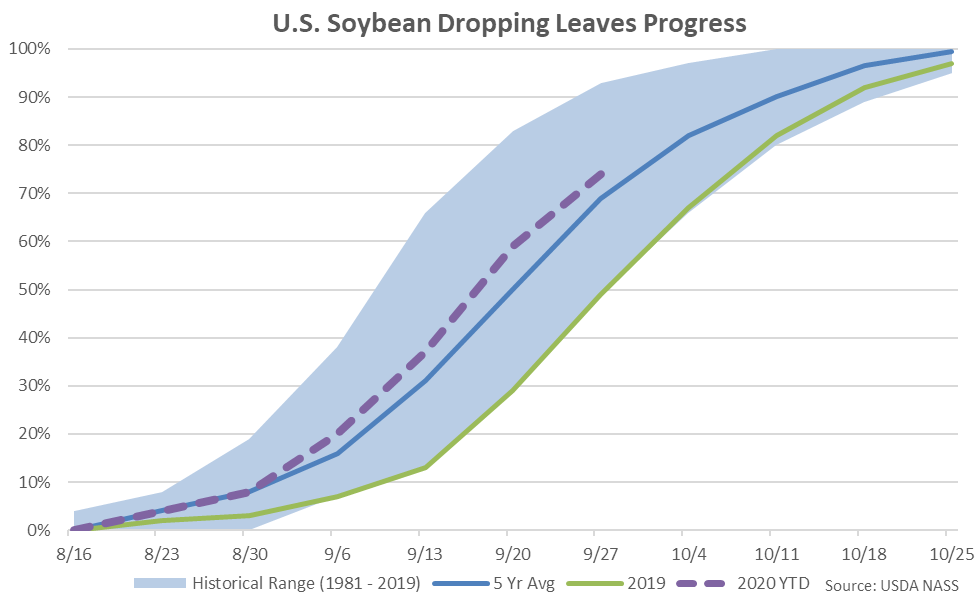

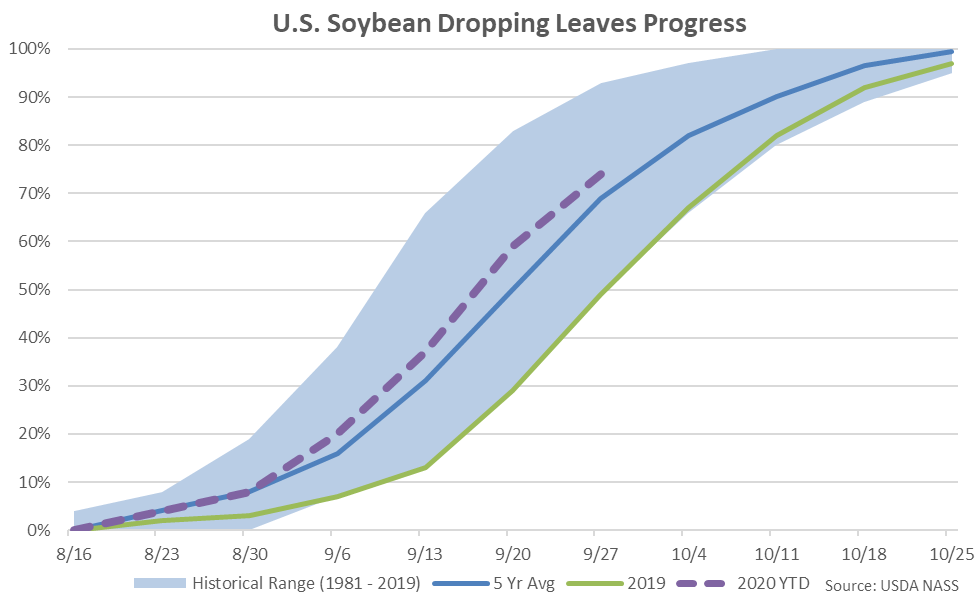

Soybean leaf dropping was 74% completed as of the week ending Sep 27th, finishing ahead of last year’s pace of 49% completed and the five year average pace of 69% completed.

Soybeans:

Soybean leaf dropping was 74% completed as of the week ending Sep 27th, finishing ahead of last year’s pace of 49% completed and the five year average pace of 69% completed.

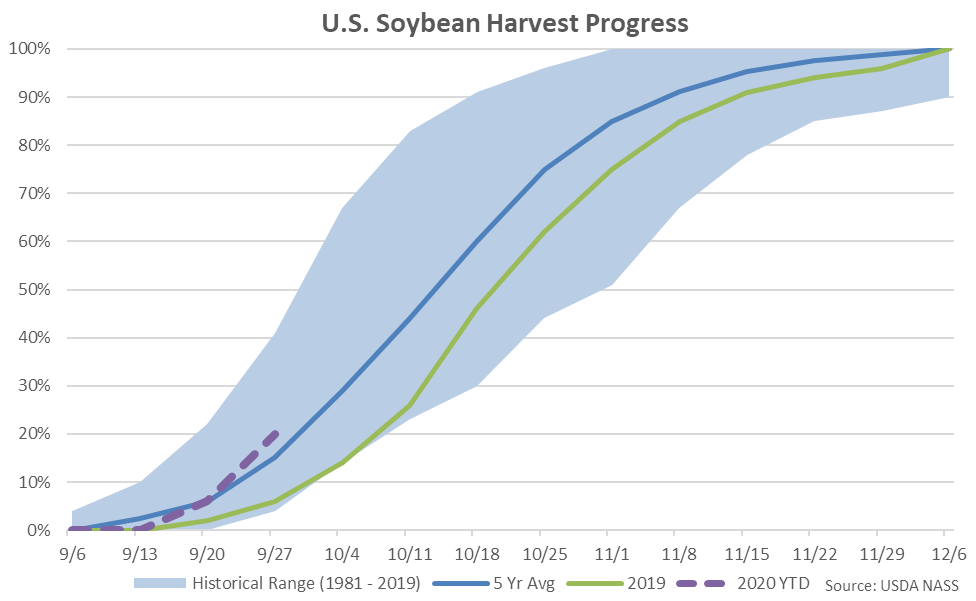

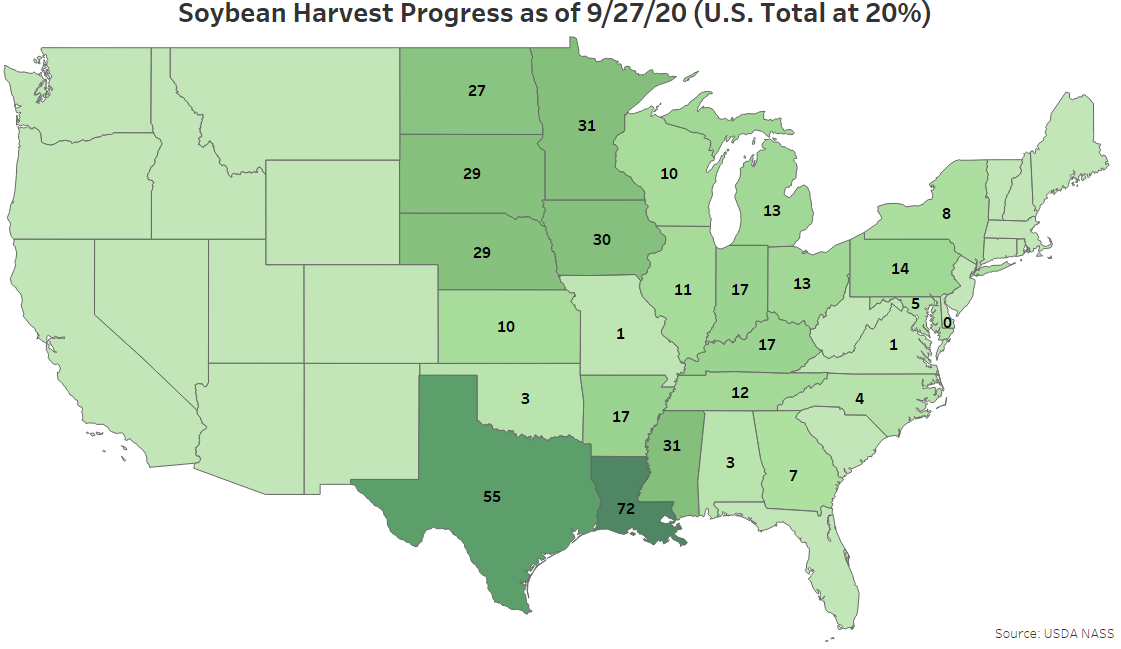

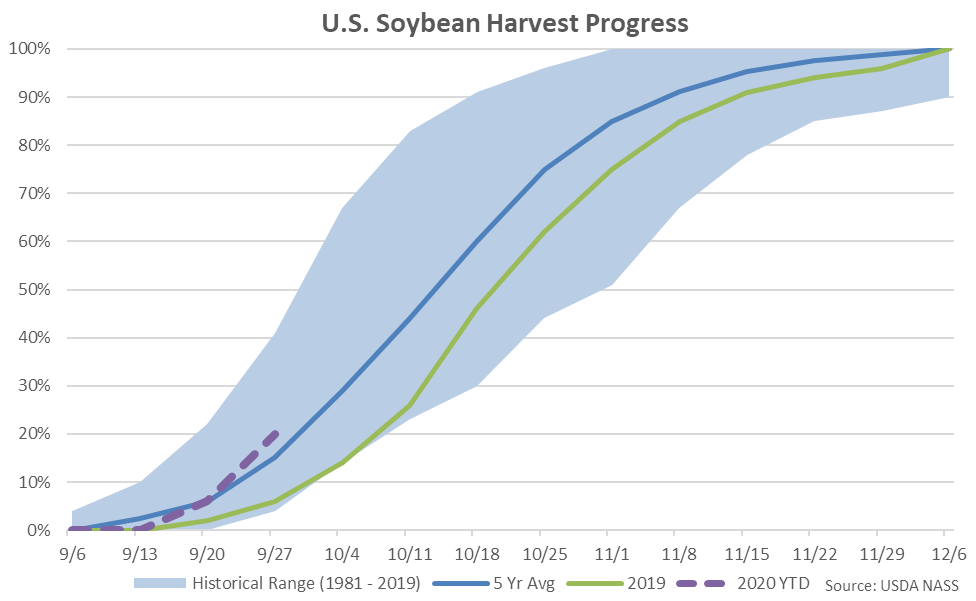

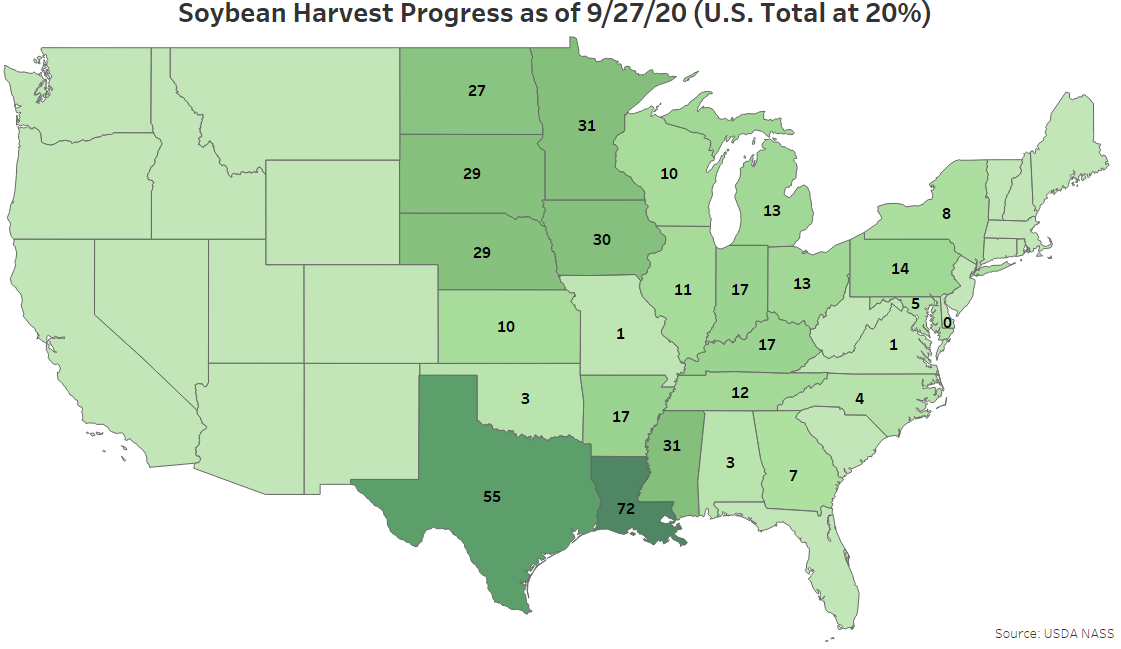

Soybean harvesting as of the week ending Sep 27th was 20% completed, finishing ahead of last year’s pace of six percent completed and the five year average pace of 15% completed. Soybean harvest progress finished above analyst expectations of 18% completed.

Soybean harvesting as of the week ending Sep 27th was 20% completed, finishing ahead of last year’s pace of six percent completed and the five year average pace of 15% completed. Soybean harvest progress finished above analyst expectations of 18% completed.

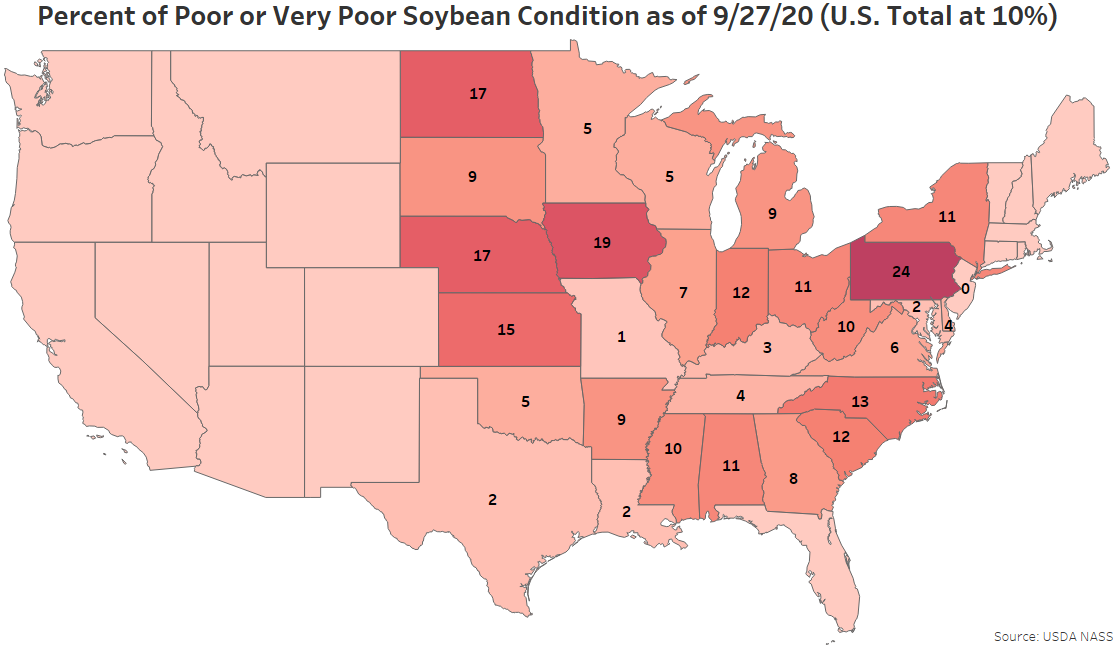

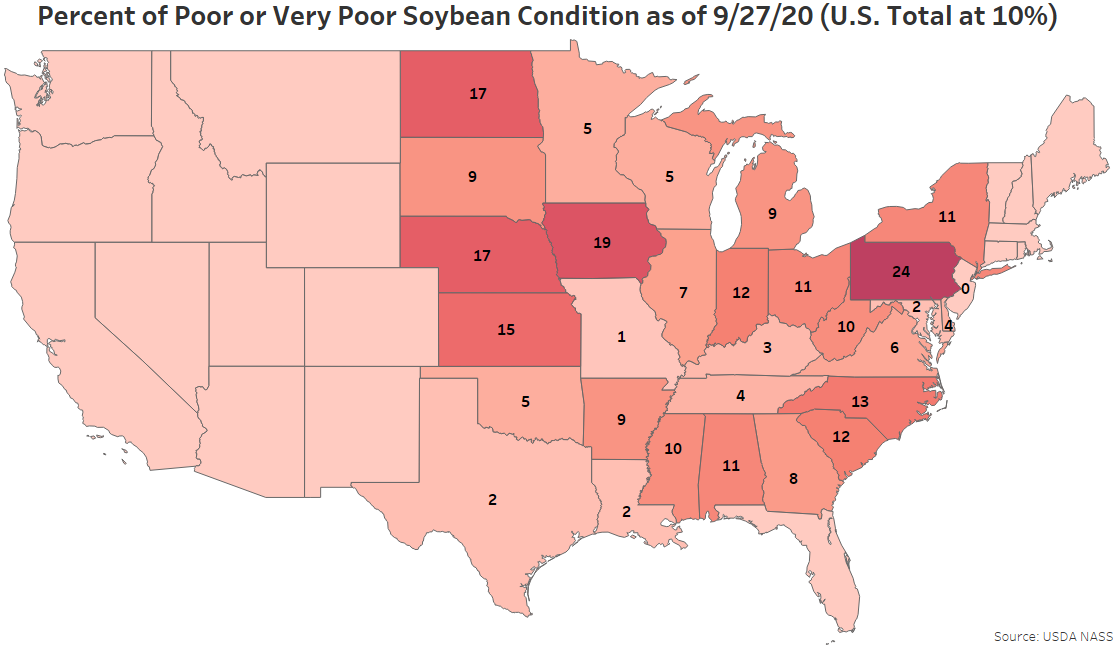

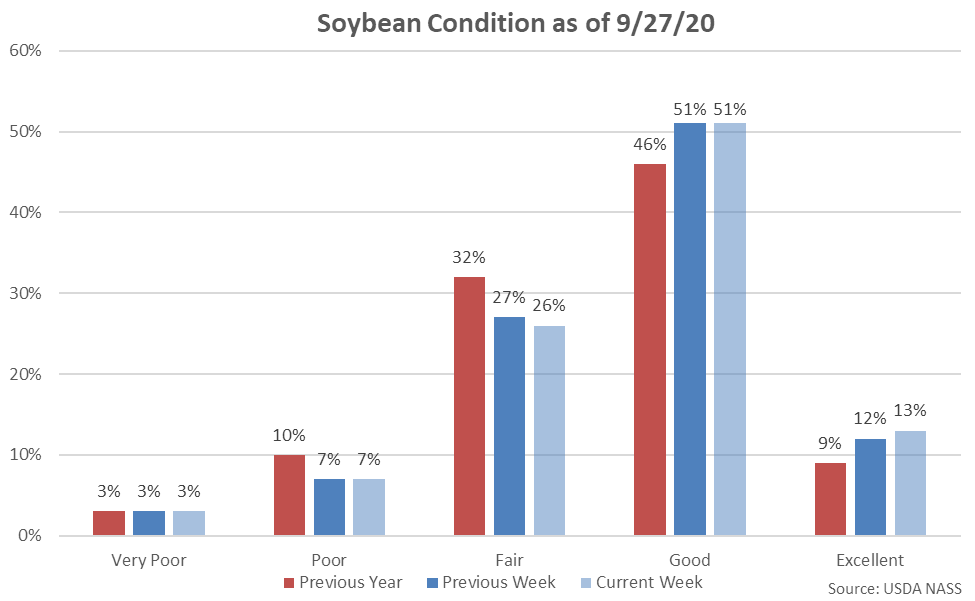

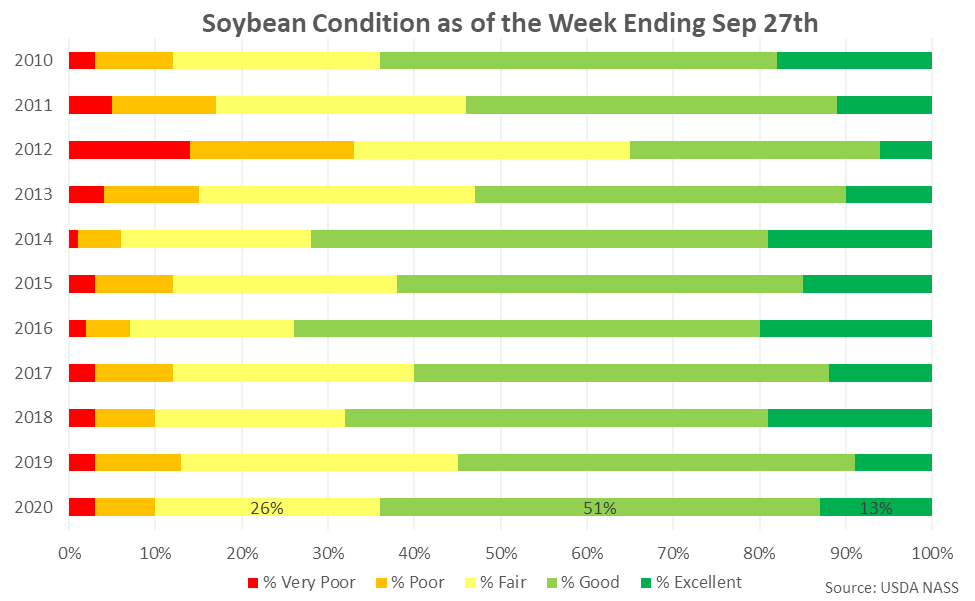

64% of the current soybean crop was identified to be in good or excellent condition as of the week ending Sep 27th, up one percent from the previous week. The current soybean crop identified to be in good or excellent condition finished slightly above analyst expectations of 63%. Ten percent of the current soybean crop was identified as poor or very poor, unchanged from the previous week.

64% of the current soybean crop was identified to be in good or excellent condition as of the week ending Sep 27th, up one percent from the previous week. The current soybean crop identified to be in good or excellent condition finished slightly above analyst expectations of 63%. Ten percent of the current soybean crop was identified as poor or very poor, unchanged from the previous week.

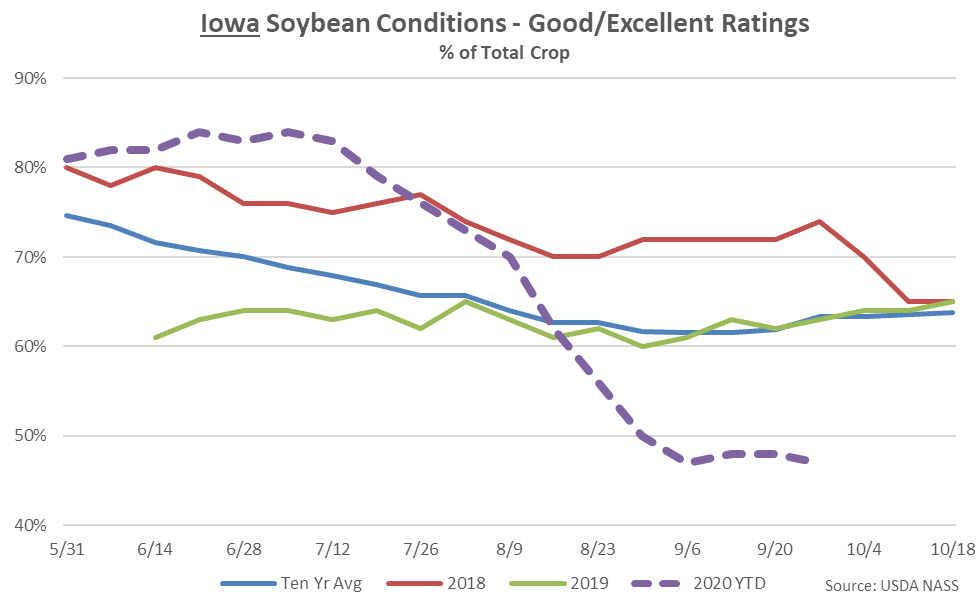

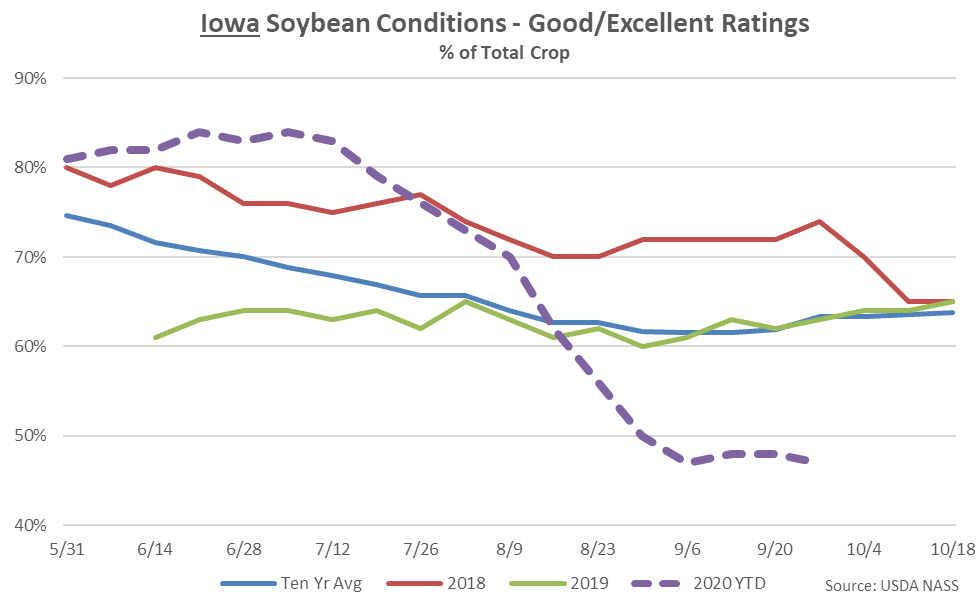

19% of the Iowa soybean crop was identified to be in poor or very poor condition as of the week ending Sep 27th, unchanged from the previous week. 47% of the Iowa soybean crop was identified to be in good or excellent condition, down one percent from the previous week and remaining at a seven year seasonal low level.

19% of the Iowa soybean crop was identified to be in poor or very poor condition as of the week ending Sep 27th, unchanged from the previous week. 47% of the Iowa soybean crop was identified to be in good or excellent condition, down one percent from the previous week and remaining at a seven year seasonal low level.

Corn harvesting as of the week ending Sep 27th was 15% completed, finishing ahead of last year’s pace of ten percent completed but slightly below the five year average pace of 16% completed. Corn harvest progress finished below analyst expectations of 17% completed.

Corn harvesting as of the week ending Sep 27th was 15% completed, finishing ahead of last year’s pace of ten percent completed but slightly below the five year average pace of 16% completed. Corn harvest progress finished below analyst expectations of 17% completed.

61% of the current corn crop was identified to be in good or excellent condition as of the week ending Sep 27th, unchanged from the previous week. The current corn crop identified to be in good or excellent condition finished consistent with analyst expectations. 14% of the current corn crop was identified as poor or very poor, also unchanged from the previous week.

61% of the current corn crop was identified to be in good or excellent condition as of the week ending Sep 27th, unchanged from the previous week. The current corn crop identified to be in good or excellent condition finished consistent with analyst expectations. 14% of the current corn crop was identified as poor or very poor, also unchanged from the previous week.

27% of the Iowa corn crop was identified to be in poor or very poor condition as of the week ending Sep 27th, up one percent from the previous week. Millions of acres of Iowa corn and soybean crops were heavily damaged by the early August derecho. Just 42% of the Iowa corn crop was identified to be in good or excellent condition, reaching a seven year seasonal low level.

27% of the Iowa corn crop was identified to be in poor or very poor condition as of the week ending Sep 27th, up one percent from the previous week. Millions of acres of Iowa corn and soybean crops were heavily damaged by the early August derecho. Just 42% of the Iowa corn crop was identified to be in good or excellent condition, reaching a seven year seasonal low level.

Soybeans:

Soybean leaf dropping was 74% completed as of the week ending Sep 27th, finishing ahead of last year’s pace of 49% completed and the five year average pace of 69% completed.

Soybeans:

Soybean leaf dropping was 74% completed as of the week ending Sep 27th, finishing ahead of last year’s pace of 49% completed and the five year average pace of 69% completed.

Soybean harvesting as of the week ending Sep 27th was 20% completed, finishing ahead of last year’s pace of six percent completed and the five year average pace of 15% completed. Soybean harvest progress finished above analyst expectations of 18% completed.

Soybean harvesting as of the week ending Sep 27th was 20% completed, finishing ahead of last year’s pace of six percent completed and the five year average pace of 15% completed. Soybean harvest progress finished above analyst expectations of 18% completed.

64% of the current soybean crop was identified to be in good or excellent condition as of the week ending Sep 27th, up one percent from the previous week. The current soybean crop identified to be in good or excellent condition finished slightly above analyst expectations of 63%. Ten percent of the current soybean crop was identified as poor or very poor, unchanged from the previous week.

64% of the current soybean crop was identified to be in good or excellent condition as of the week ending Sep 27th, up one percent from the previous week. The current soybean crop identified to be in good or excellent condition finished slightly above analyst expectations of 63%. Ten percent of the current soybean crop was identified as poor or very poor, unchanged from the previous week.

19% of the Iowa soybean crop was identified to be in poor or very poor condition as of the week ending Sep 27th, unchanged from the previous week. 47% of the Iowa soybean crop was identified to be in good or excellent condition, down one percent from the previous week and remaining at a seven year seasonal low level.

19% of the Iowa soybean crop was identified to be in poor or very poor condition as of the week ending Sep 27th, unchanged from the previous week. 47% of the Iowa soybean crop was identified to be in good or excellent condition, down one percent from the previous week and remaining at a seven year seasonal low level.