Brazilian Trade Update – Dec ’20

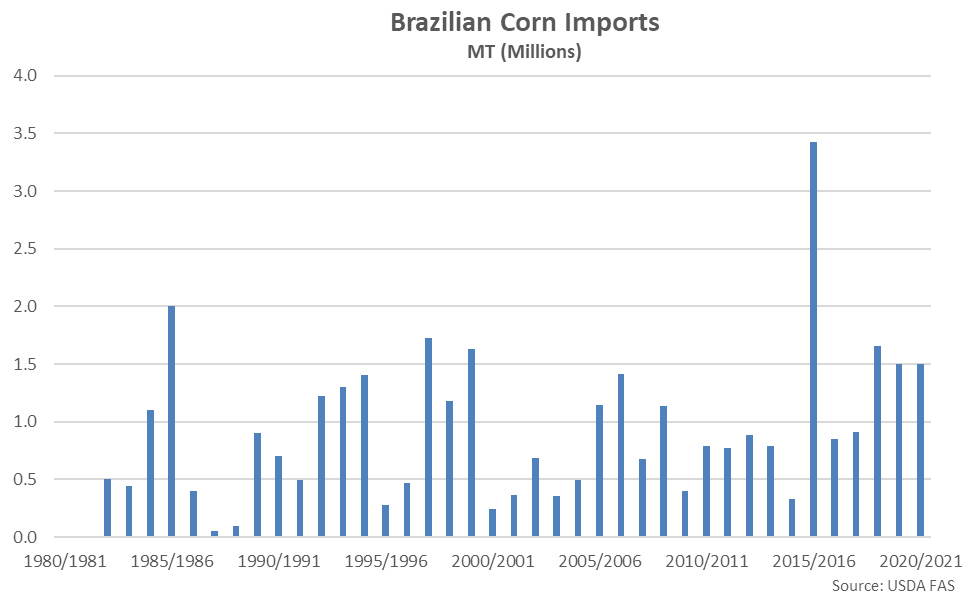

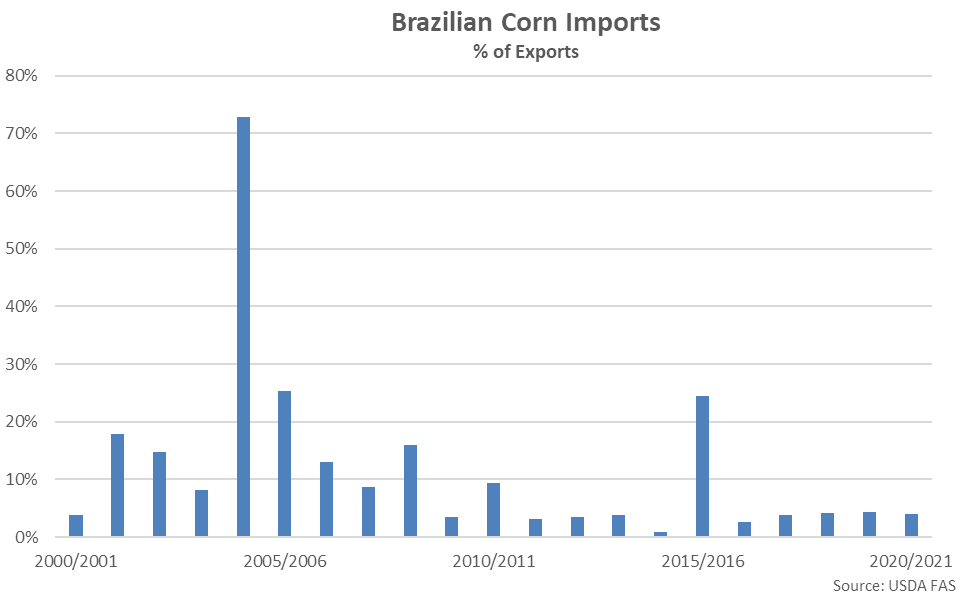

Recent reports of Brazilian food staple imports have surfaced following increases in domestic prices. A more than 30% depreciation in the Brazilian real against the U.S. dollar has contributed to higher Brazilian prices throughout 2020. The charts below provide a historical perspective on Brazilian agricultural imports on both an absolute basis and relative to export volumes.

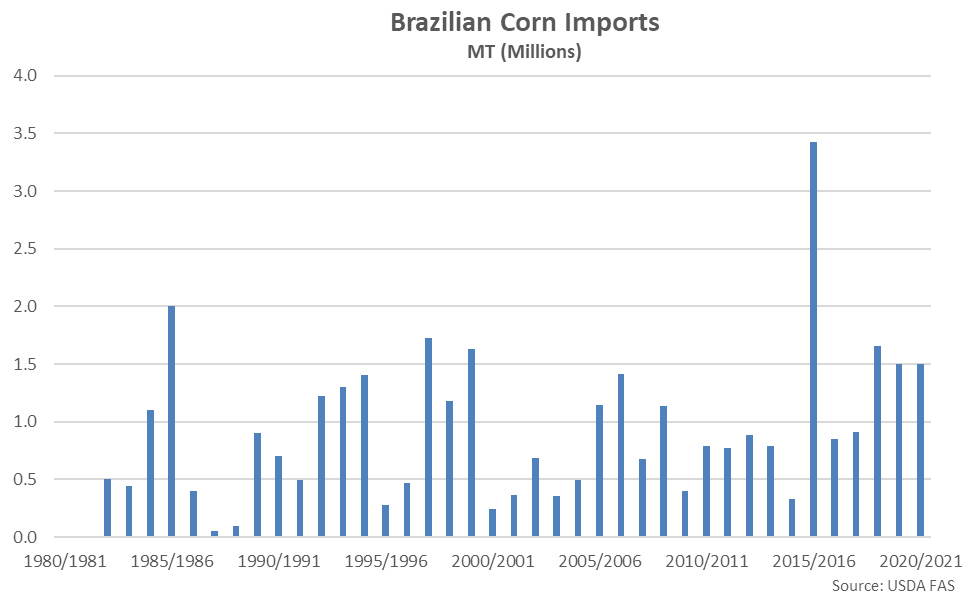

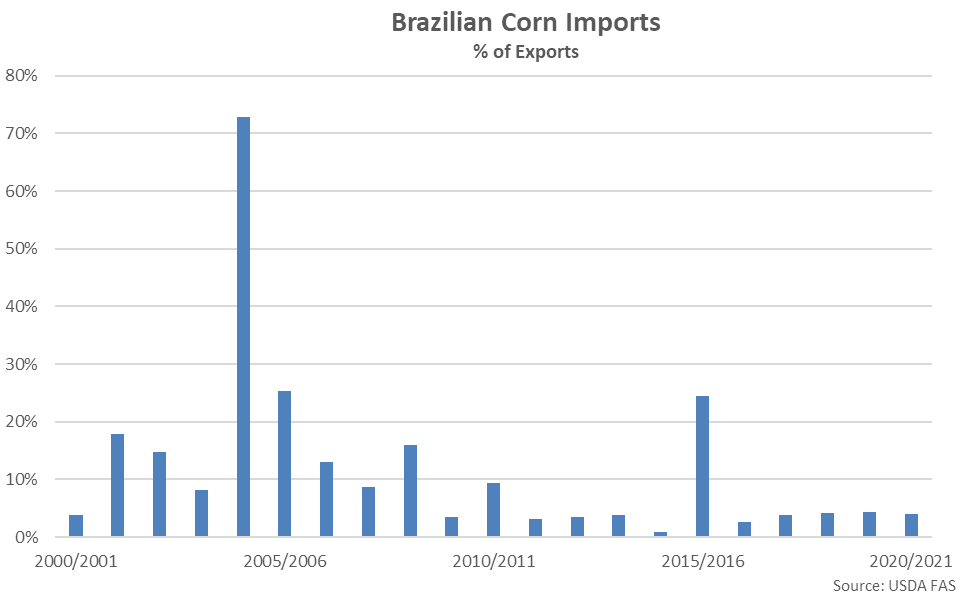

Corn

Brazilian corn imports are expected to remain below the ’15-’16 record high levels according to the latest update provided by the USDA, although the Brazilian government eliminated import tariffs for corn during mid-October. An eight percent tariff on corn imports originating from outside the Mercosur trade bloc will go back into effect beginning in April of 2021. In addition, import license requirements were changed in early-November to facilitate imports of GMO corn from the U.S.

Brazilian corn imports have historically remained at a small fraction of export volumes, ranging from between one percent and 25% of export volumes since 2000. Brazil is one of the largest corn exporters in the world, accounting for approximately 20% of global corn exports throughout the past several years.

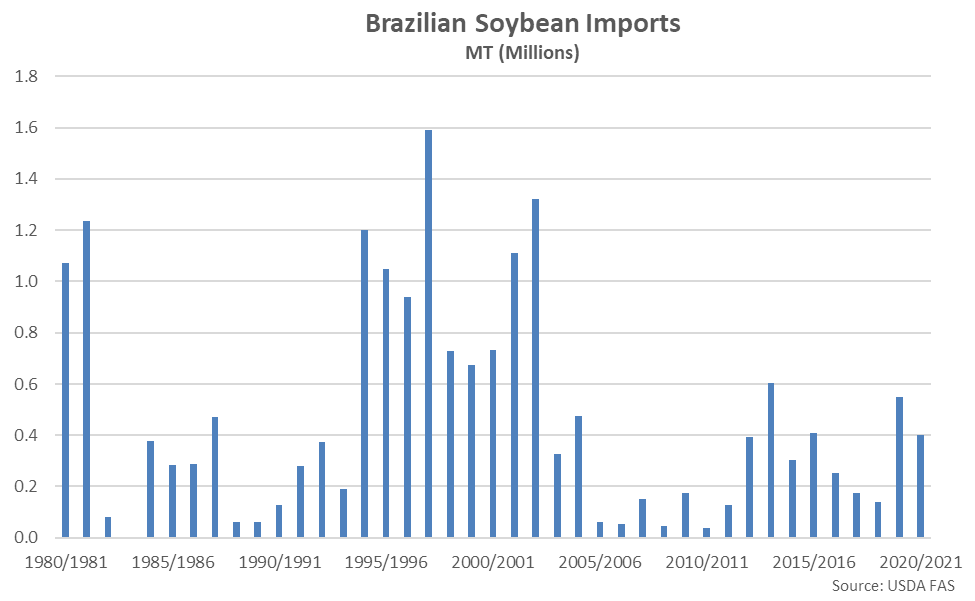

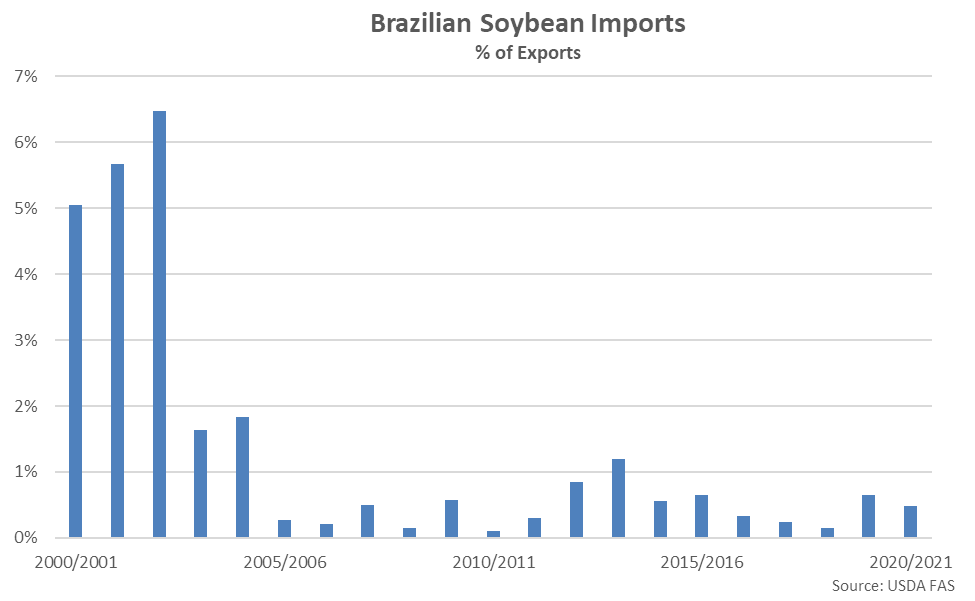

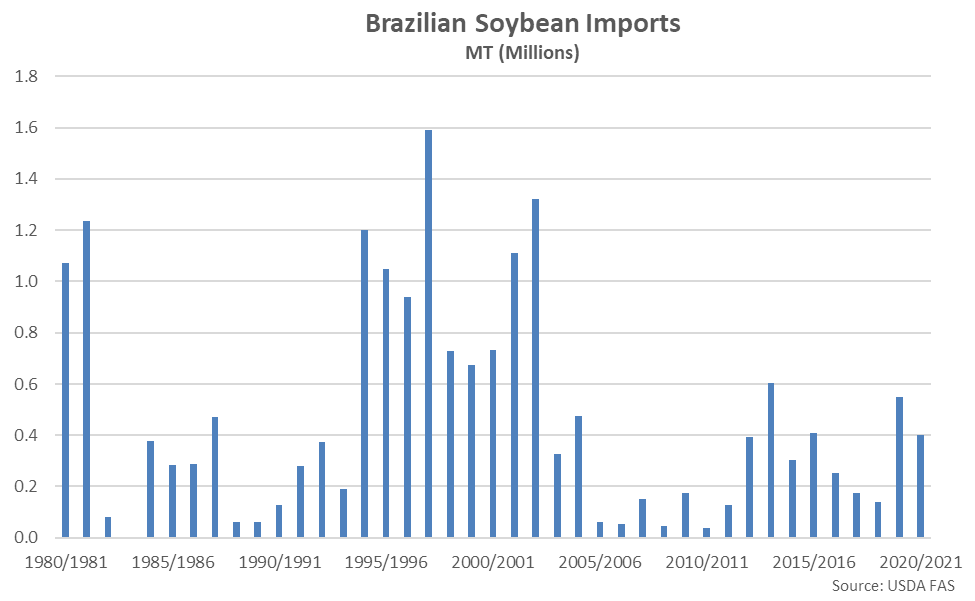

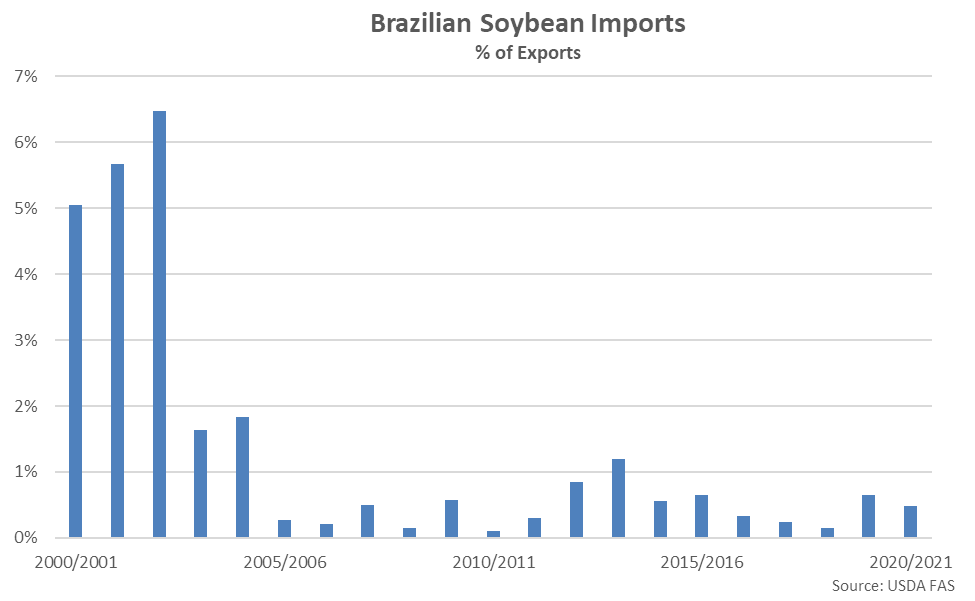

Soybeans

Reports of Brazilian soybean imports are perhaps of most interest due to Brazil traditionally being the largest global exporter of soybeans. Brazilian soybean imports are expected to remain below previous year figures according to the latest update provided by the USDA, although the Brazilian government recently eliminated an eight percent tariff on soybean imports originating from outside the Mercosur trade bloc through mid-Jan ’21 while import license requirements were changed in early-November to facilitate imports of GMO soybeans from the U.S. In addition, in mid-November, the Brazilian National Energy Policy Council published a resolution to allow the use of imported soybeans and soybean oil in the production of biodiesel.

Brazilian soybean imports have historically remained at a small fraction of export volumes, ranging from between 0.1% and 6.5% of export volumes since 2000. Brazil is typically by far the largest global exporter of soybeans, accounting for over half of global exports over the past several years.

Soybeans

Reports of Brazilian soybean imports are perhaps of most interest due to Brazil traditionally being the largest global exporter of soybeans. Brazilian soybean imports are expected to remain below previous year figures according to the latest update provided by the USDA, although the Brazilian government recently eliminated an eight percent tariff on soybean imports originating from outside the Mercosur trade bloc through mid-Jan ’21 while import license requirements were changed in early-November to facilitate imports of GMO soybeans from the U.S. In addition, in mid-November, the Brazilian National Energy Policy Council published a resolution to allow the use of imported soybeans and soybean oil in the production of biodiesel.

Brazilian soybean imports have historically remained at a small fraction of export volumes, ranging from between 0.1% and 6.5% of export volumes since 2000. Brazil is typically by far the largest global exporter of soybeans, accounting for over half of global exports over the past several years.

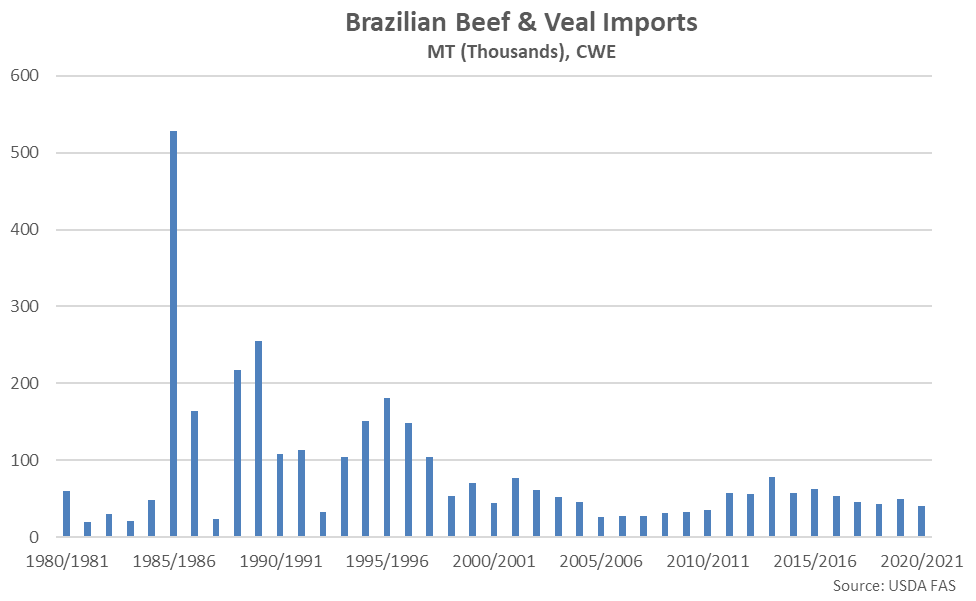

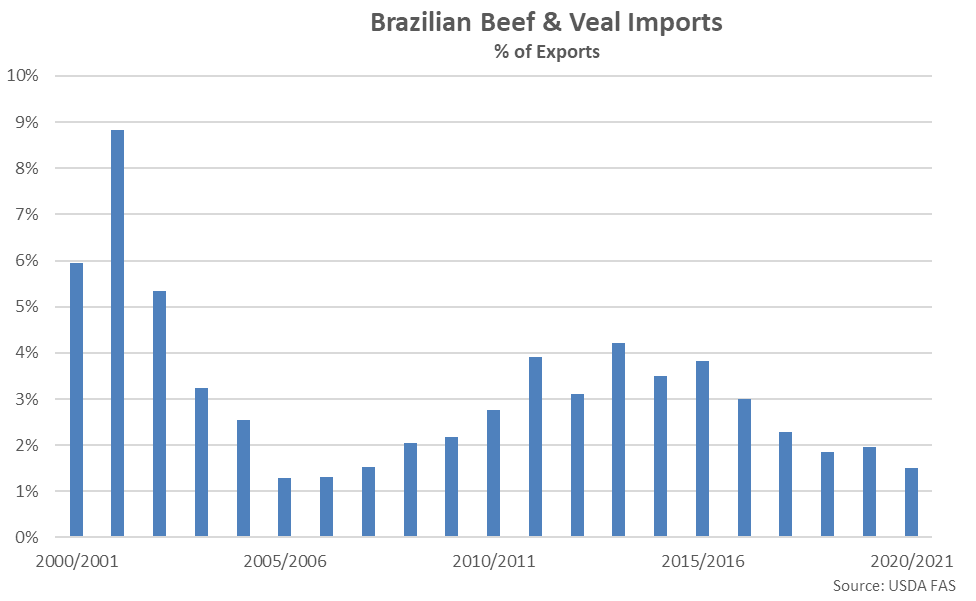

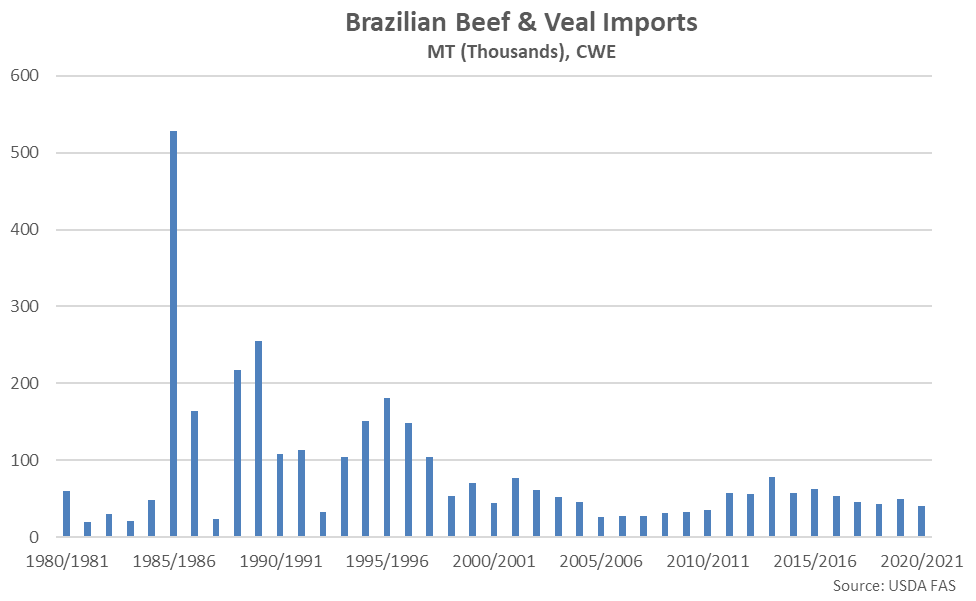

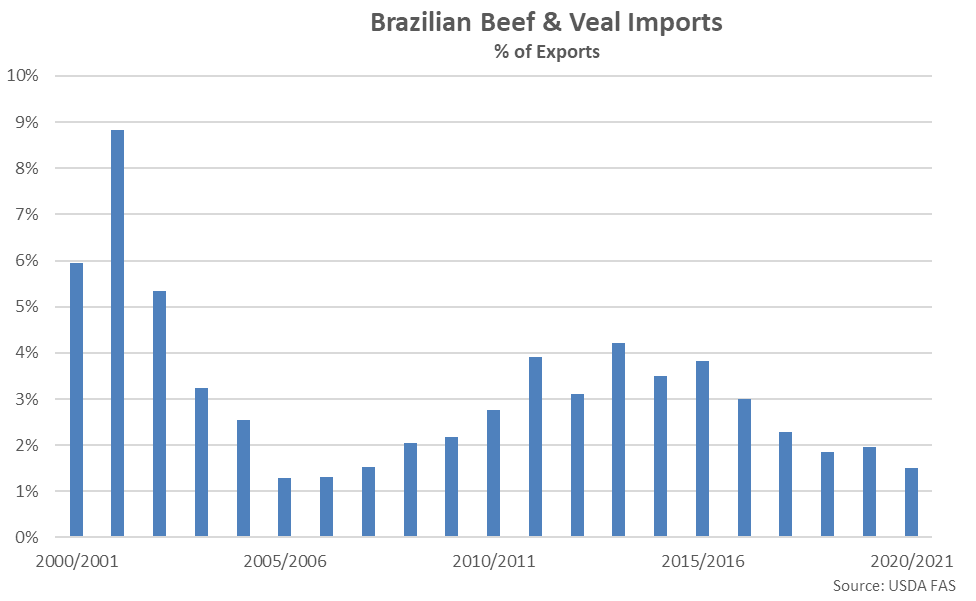

Beef

Brazil has historically been a consistently minor importer of beef, with import volumes remaining below 100,000 metric tons over each of the past 23 years. Brazil beef imports have historically remained at a small fraction of export volumes, ranging from between one percent and nine percent of export volumes since 2000.

Beef

Brazil has historically been a consistently minor importer of beef, with import volumes remaining below 100,000 metric tons over each of the past 23 years. Brazil beef imports have historically remained at a small fraction of export volumes, ranging from between one percent and nine percent of export volumes since 2000.

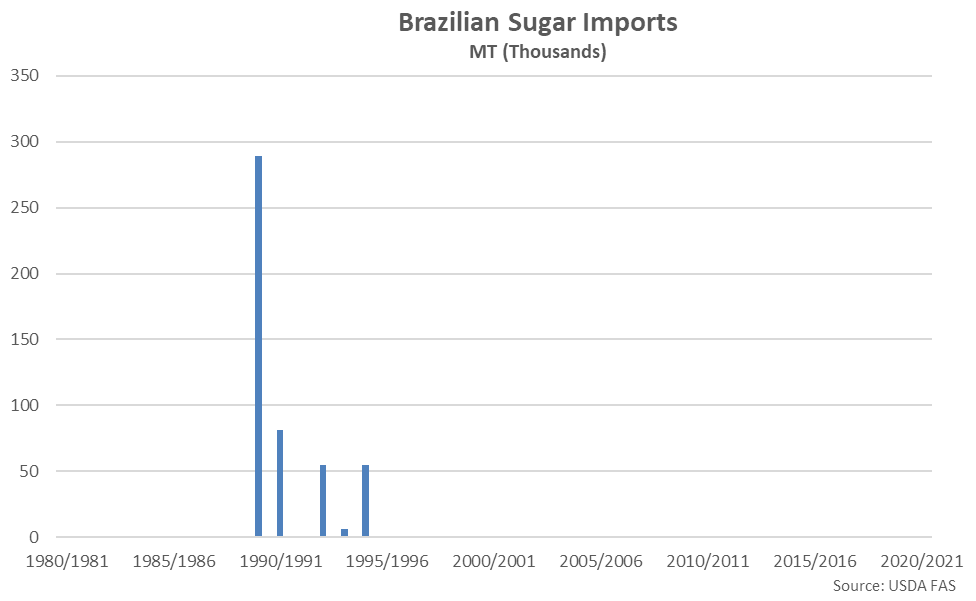

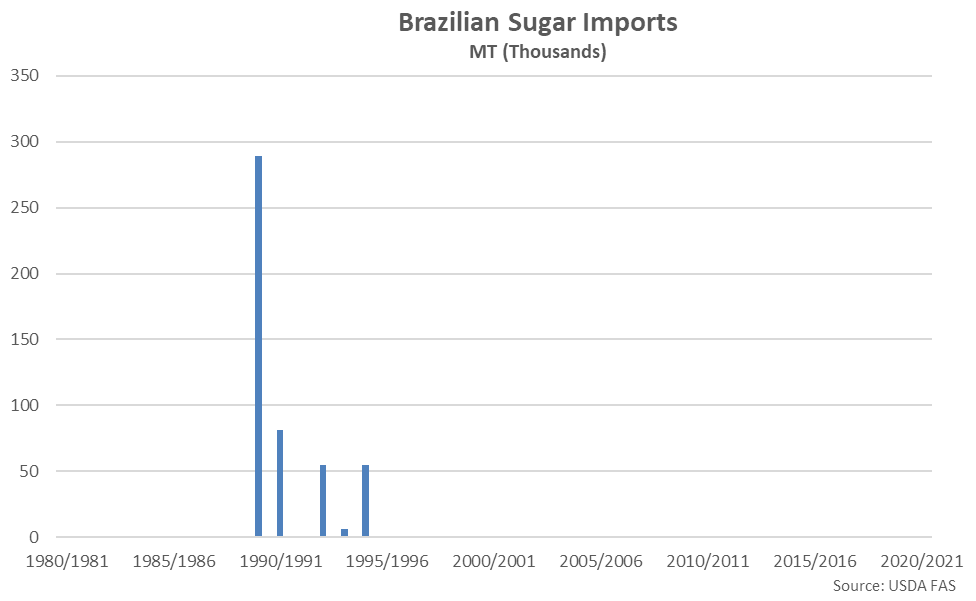

Sugar

Brazil is historically only a minor importer of sugar, particularly when volumes are normalized on a percentage of export basis. Brazil is typically by far the largest global exporter of sugar, accounting for over a third of global exports over the past several years.

Sugar

Brazil is historically only a minor importer of sugar, particularly when volumes are normalized on a percentage of export basis. Brazil is typically by far the largest global exporter of sugar, accounting for over a third of global exports over the past several years.

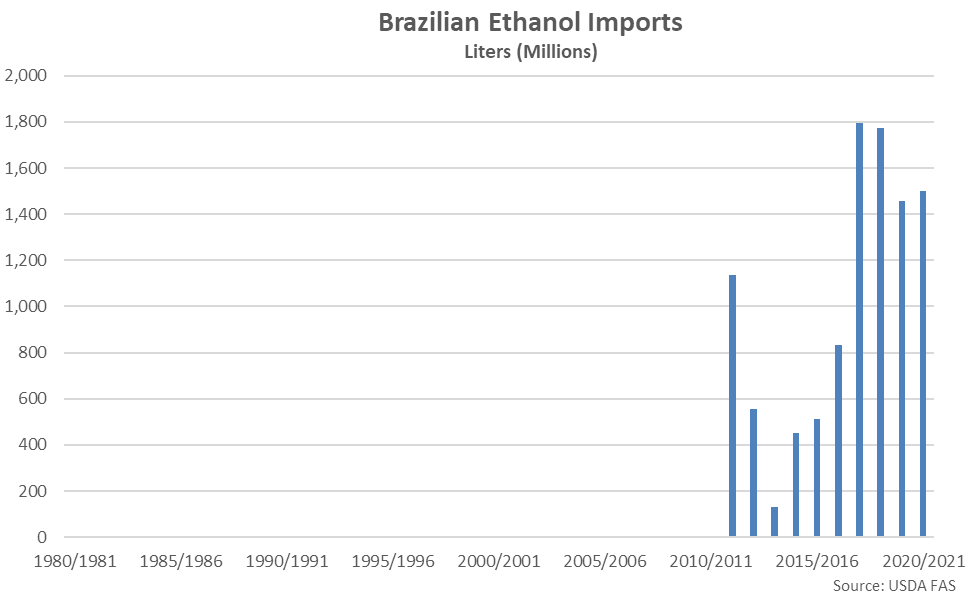

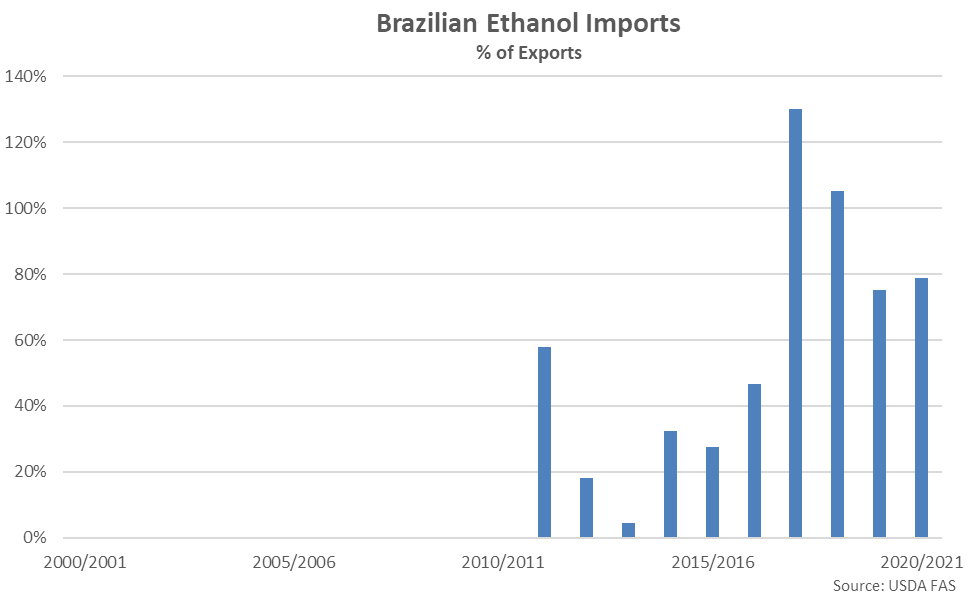

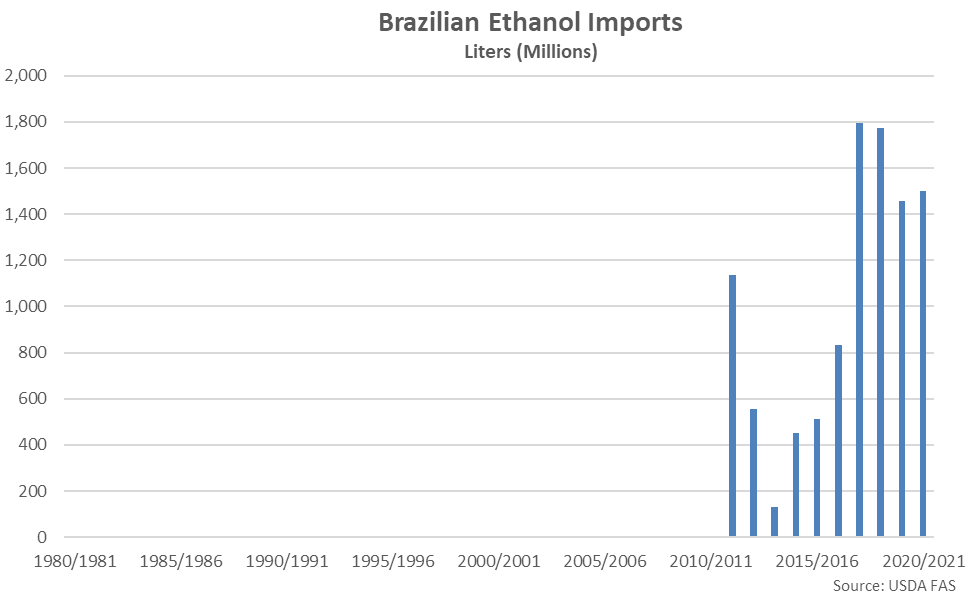

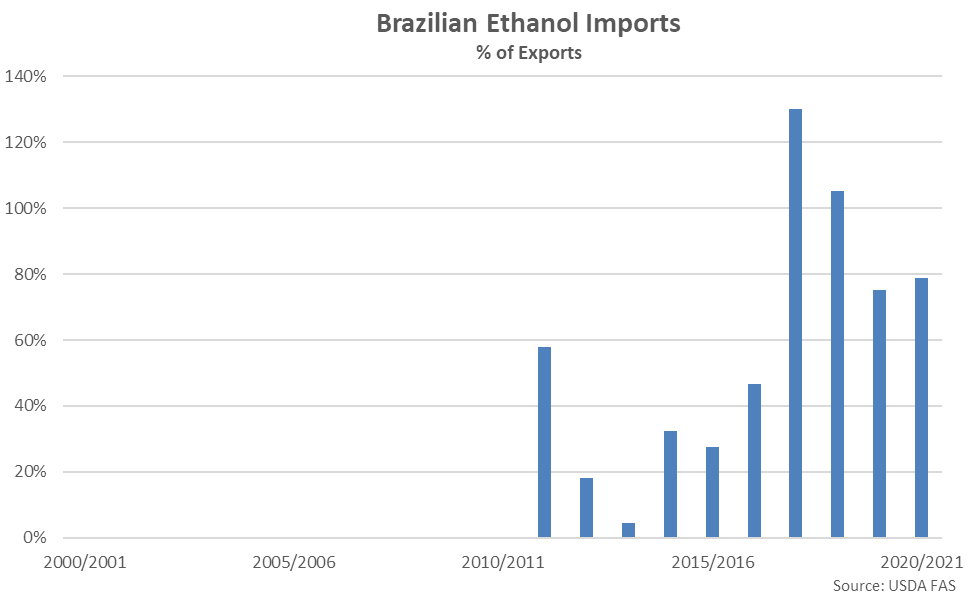

Ethanol

Brazilian ethanol imports are expected to remain below the ’17-’18 record high levels according to the latest update provided by the USDA, but remain at elevated levels, overall. Brazilian ethanol imports have ranged from 75% – 130% of export volumes throughout the past four years. Brazilian ethanol net trade ranges widely throughout the year due to sugarcane harvest seasonality. Nearly all Brazilian ethanol imports have originated from within the U.S., historically.

Ethanol

Brazilian ethanol imports are expected to remain below the ’17-’18 record high levels according to the latest update provided by the USDA, but remain at elevated levels, overall. Brazilian ethanol imports have ranged from 75% – 130% of export volumes throughout the past four years. Brazilian ethanol net trade ranges widely throughout the year due to sugarcane harvest seasonality. Nearly all Brazilian ethanol imports have originated from within the U.S., historically.

Soybeans

Reports of Brazilian soybean imports are perhaps of most interest due to Brazil traditionally being the largest global exporter of soybeans. Brazilian soybean imports are expected to remain below previous year figures according to the latest update provided by the USDA, although the Brazilian government recently eliminated an eight percent tariff on soybean imports originating from outside the Mercosur trade bloc through mid-Jan ’21 while import license requirements were changed in early-November to facilitate imports of GMO soybeans from the U.S. In addition, in mid-November, the Brazilian National Energy Policy Council published a resolution to allow the use of imported soybeans and soybean oil in the production of biodiesel.

Brazilian soybean imports have historically remained at a small fraction of export volumes, ranging from between 0.1% and 6.5% of export volumes since 2000. Brazil is typically by far the largest global exporter of soybeans, accounting for over half of global exports over the past several years.

Soybeans

Reports of Brazilian soybean imports are perhaps of most interest due to Brazil traditionally being the largest global exporter of soybeans. Brazilian soybean imports are expected to remain below previous year figures according to the latest update provided by the USDA, although the Brazilian government recently eliminated an eight percent tariff on soybean imports originating from outside the Mercosur trade bloc through mid-Jan ’21 while import license requirements were changed in early-November to facilitate imports of GMO soybeans from the U.S. In addition, in mid-November, the Brazilian National Energy Policy Council published a resolution to allow the use of imported soybeans and soybean oil in the production of biodiesel.

Brazilian soybean imports have historically remained at a small fraction of export volumes, ranging from between 0.1% and 6.5% of export volumes since 2000. Brazil is typically by far the largest global exporter of soybeans, accounting for over half of global exports over the past several years.

Beef

Brazil has historically been a consistently minor importer of beef, with import volumes remaining below 100,000 metric tons over each of the past 23 years. Brazil beef imports have historically remained at a small fraction of export volumes, ranging from between one percent and nine percent of export volumes since 2000.

Beef

Brazil has historically been a consistently minor importer of beef, with import volumes remaining below 100,000 metric tons over each of the past 23 years. Brazil beef imports have historically remained at a small fraction of export volumes, ranging from between one percent and nine percent of export volumes since 2000.

Sugar

Brazil is historically only a minor importer of sugar, particularly when volumes are normalized on a percentage of export basis. Brazil is typically by far the largest global exporter of sugar, accounting for over a third of global exports over the past several years.

Sugar

Brazil is historically only a minor importer of sugar, particularly when volumes are normalized on a percentage of export basis. Brazil is typically by far the largest global exporter of sugar, accounting for over a third of global exports over the past several years.

Ethanol

Brazilian ethanol imports are expected to remain below the ’17-’18 record high levels according to the latest update provided by the USDA, but remain at elevated levels, overall. Brazilian ethanol imports have ranged from 75% – 130% of export volumes throughout the past four years. Brazilian ethanol net trade ranges widely throughout the year due to sugarcane harvest seasonality. Nearly all Brazilian ethanol imports have originated from within the U.S., historically.

Ethanol

Brazilian ethanol imports are expected to remain below the ’17-’18 record high levels according to the latest update provided by the USDA, but remain at elevated levels, overall. Brazilian ethanol imports have ranged from 75% – 130% of export volumes throughout the past four years. Brazilian ethanol net trade ranges widely throughout the year due to sugarcane harvest seasonality. Nearly all Brazilian ethanol imports have originated from within the U.S., historically.