Grain & Oilseeds WASDE Update – Dec ’20

Corn – U.S. and Global Ending Stocks Mixed vs. Private Estimates

Corn – U.S. and Global Ending Stocks Mixed vs. Private Estimates

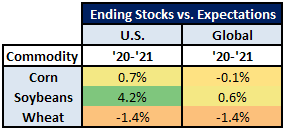

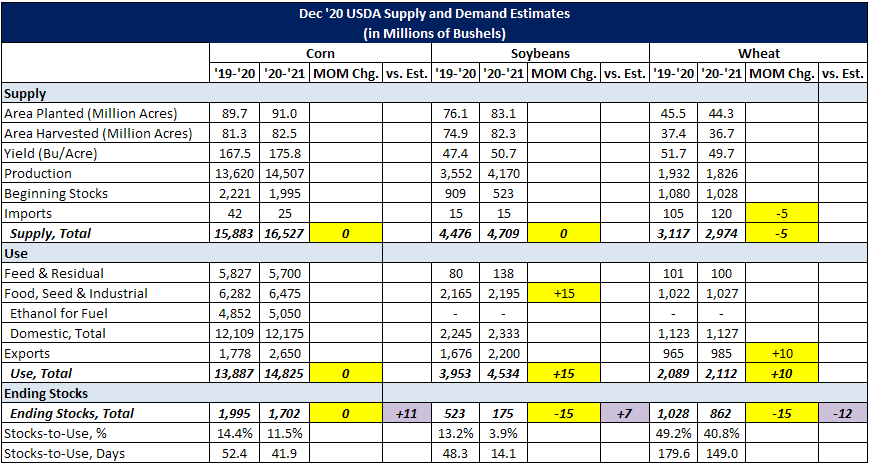

- ’20-’21 U.S. ending stocks of 1.702 billion bushels slightly above expectations

- ’20-’21 global ending stocks of 289.0 million MT slightly below expectations

- ’20-’21 U.S. ending stocks of 175 million bushels above expectations

- ’20-’21 global ending stocks of 85.6 million MT slightly above expectations

- ’20-’21 U.S. ending stocks of 862 million bushels below expectations

- ’20-’21 global ending stocks of 316.5 million MT below expectations