Grain & Oilseeds WASDE Update – Jan ’21

Corn – U.S. and Global Ending Stocks Mixed vs. Private Estimates

Corn – U.S. and Global Ending Stocks Mixed vs. Private Estimates

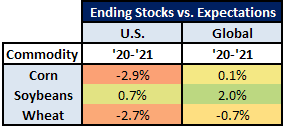

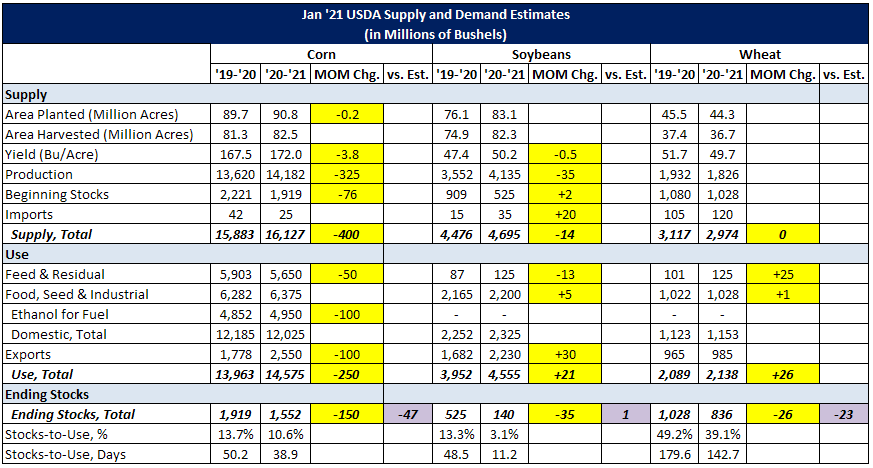

- ’20-’21 U.S. ending stocks of 1.552 billion bushels below expectations

- ’20-’21 global ending stocks of 283.8 million MT slightly above expectations

- ’20-’21 U.S. ending stocks of 140 million bushels slightly above expectations

- ’20-’21 global ending stocks of 84.3 million MT above expectations

- ’20-’21 U.S. ending stocks of 836 million bushels below expectations

- ’20-’21 global ending stocks of 313.2 million MT slightly below expectations