Quarterly Argentina Milk Production Update – Sep ’19

Executive Summary

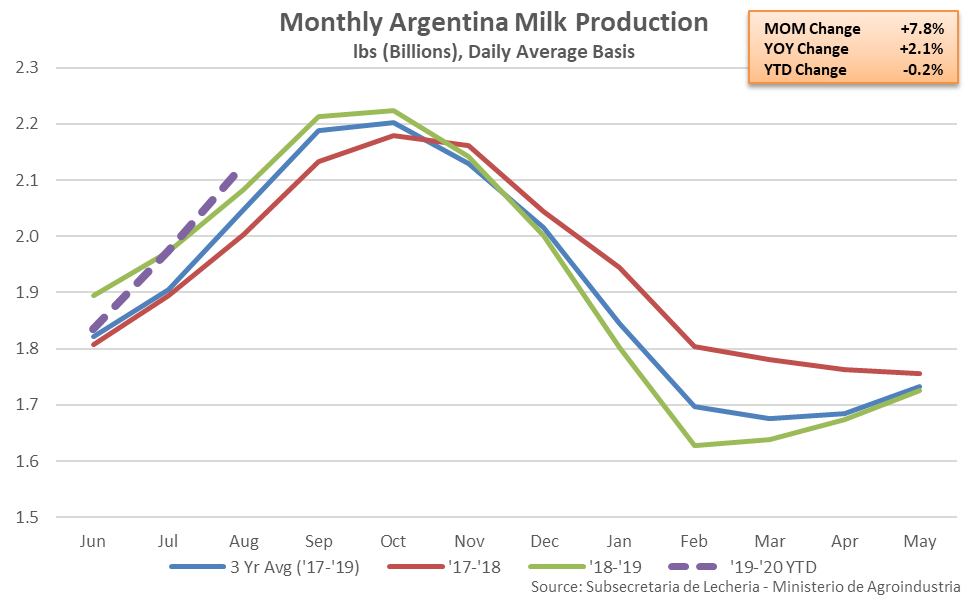

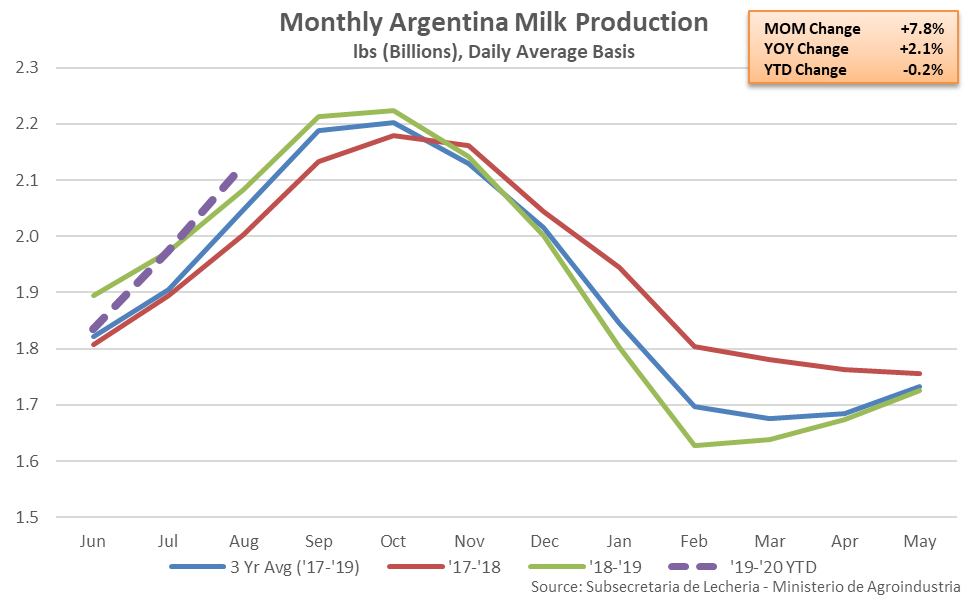

Argentine milk production figures provided by the Argentina Ministry of Agriculture were recently updated with values spanning through the end of the first quarter of the ’19-’20 production season. Highlights from the updated report include:

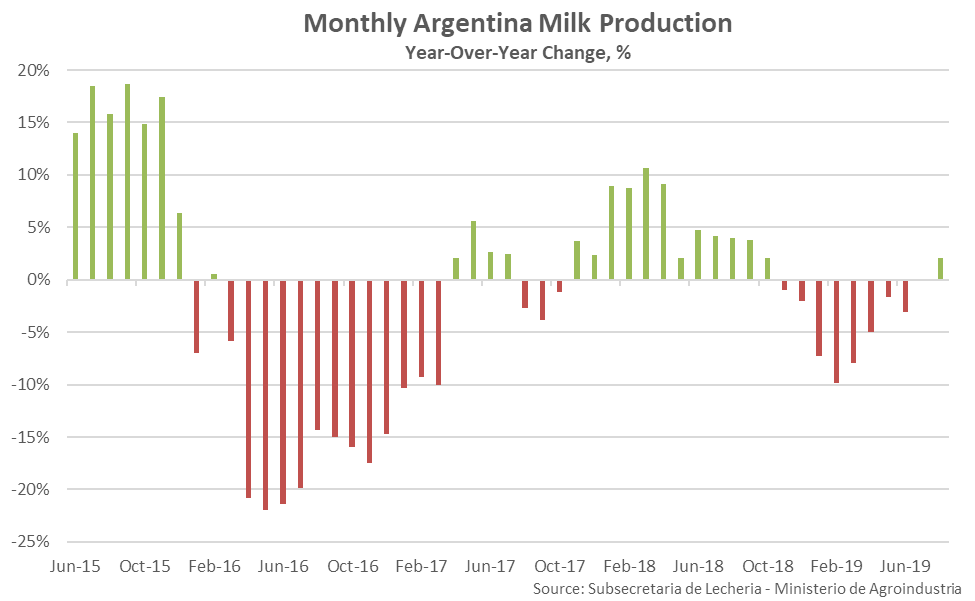

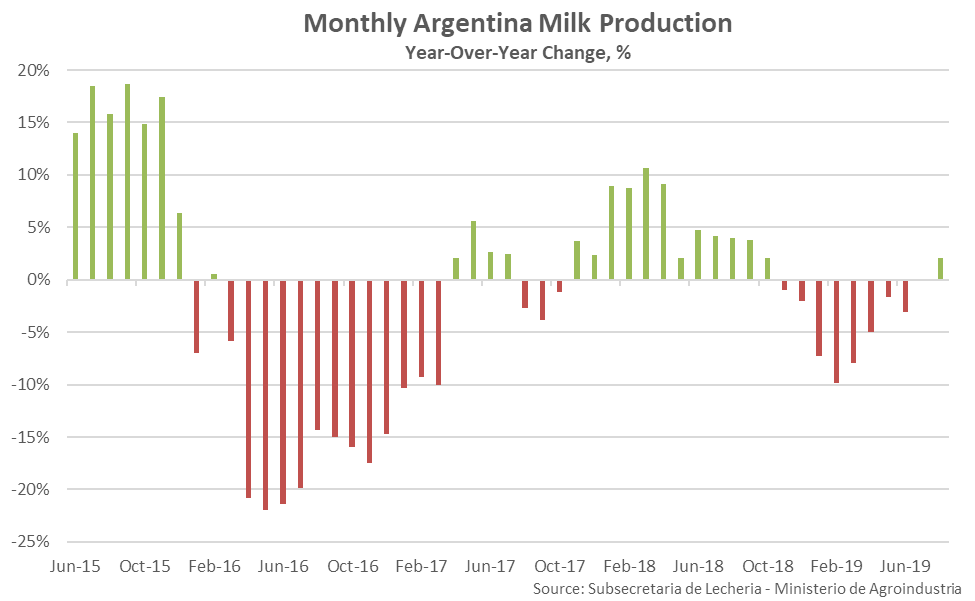

USDA is projecting a 0.3% YOY decline in Argentine milk production throughout the 2019 calendar year as declines experienced throughout the early months of the year are expected to offset increases in production projected throughout the second half of the calendar year. High temperatures and humidity experienced throughout the first quarter of the year contributed to significant YOY declines in production, however lower feed costs, greater industry efficiency and a recovery in prices are expected to more than offset rising inflation rates in months to come. A significant devaluation in the Argentine peso has resulted in increased operating costs, particularly for producers that purchase inputs priced in U.S. dollars and collect their milk checks in Argentine pesos. Financing has become increasing limited as the Argentine government was forced to raise interest rates by over 70% in order to mitigate the currency devaluation. 2019 YTD Argentine milk production volumes have declined by 4.0% on a YOY basis throughout the first eight months of the calendar year.

USDA is projecting a 0.3% YOY decline in Argentine milk production throughout the 2019 calendar year as declines experienced throughout the early months of the year are expected to offset increases in production projected throughout the second half of the calendar year. High temperatures and humidity experienced throughout the first quarter of the year contributed to significant YOY declines in production, however lower feed costs, greater industry efficiency and a recovery in prices are expected to more than offset rising inflation rates in months to come. A significant devaluation in the Argentine peso has resulted in increased operating costs, particularly for producers that purchase inputs priced in U.S. dollars and collect their milk checks in Argentine pesos. Financing has become increasing limited as the Argentine government was forced to raise interest rates by over 70% in order to mitigate the currency devaluation. 2019 YTD Argentine milk production volumes have declined by 4.0% on a YOY basis throughout the first eight months of the calendar year.

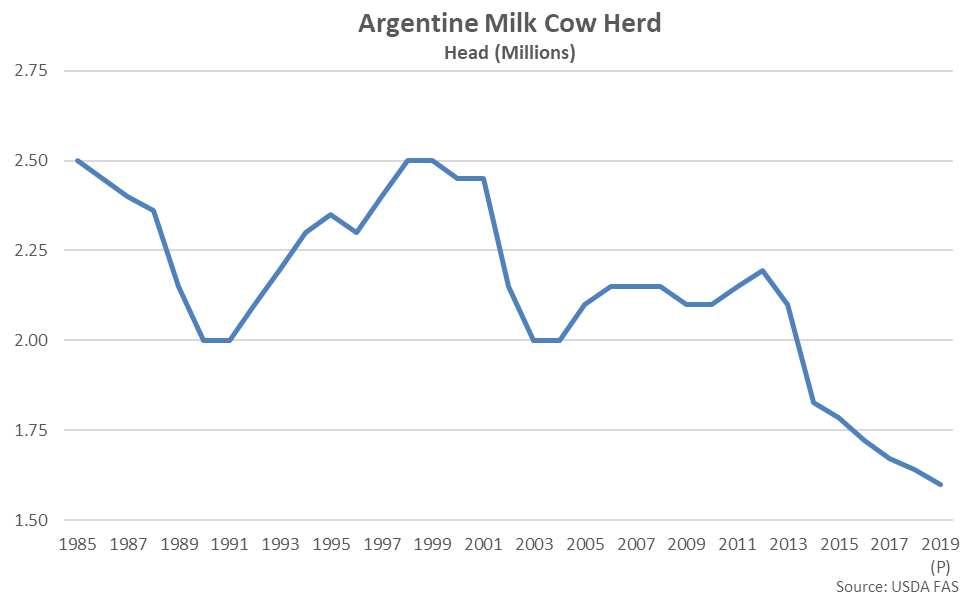

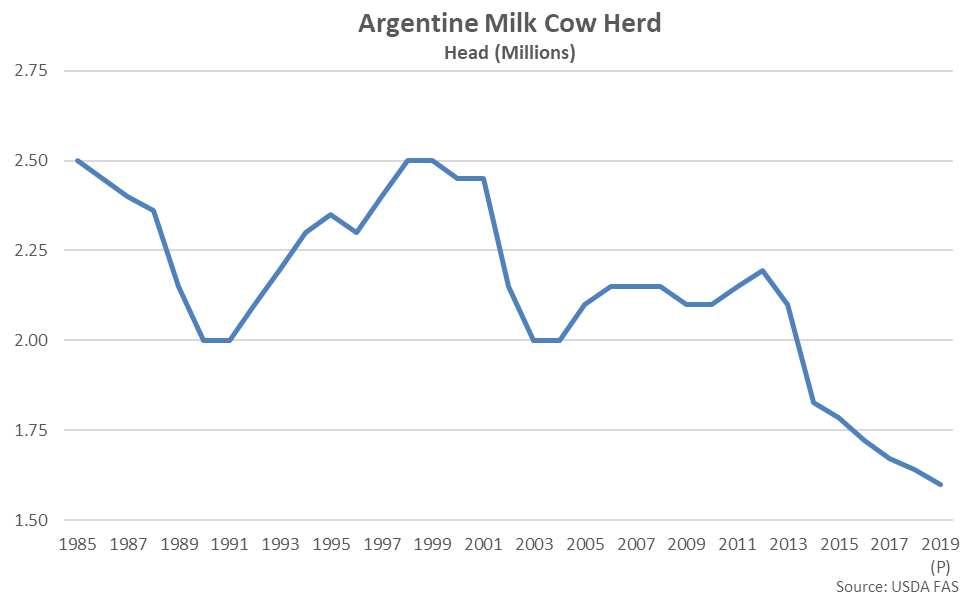

Recently experienced adverse conditions contributed to the Argentine dairy cow herd declining to a long-term record low level throughout 2018, finishing lower for the sixth consecutive year. Declines in the Argentine dairy cow herd are expected to continue as USDA is projecting the Argentine dairy cow herd to decline 2.6% throughout 2019, finishing at the lowest level on record. Declines in the Argentine dairy cow herd are expected as the consolidation of operations continues along with the culling of less productive cows.

Recently experienced adverse conditions contributed to the Argentine dairy cow herd declining to a long-term record low level throughout 2018, finishing lower for the sixth consecutive year. Declines in the Argentine dairy cow herd are expected to continue as USDA is projecting the Argentine dairy cow herd to decline 2.6% throughout 2019, finishing at the lowest level on record. Declines in the Argentine dairy cow herd are expected as the consolidation of operations continues along with the culling of less productive cows.

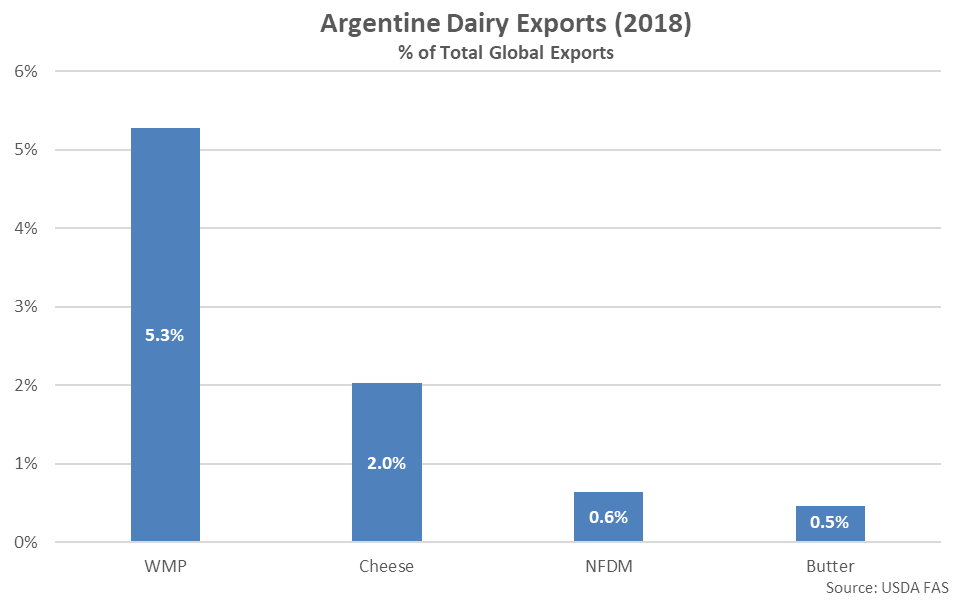

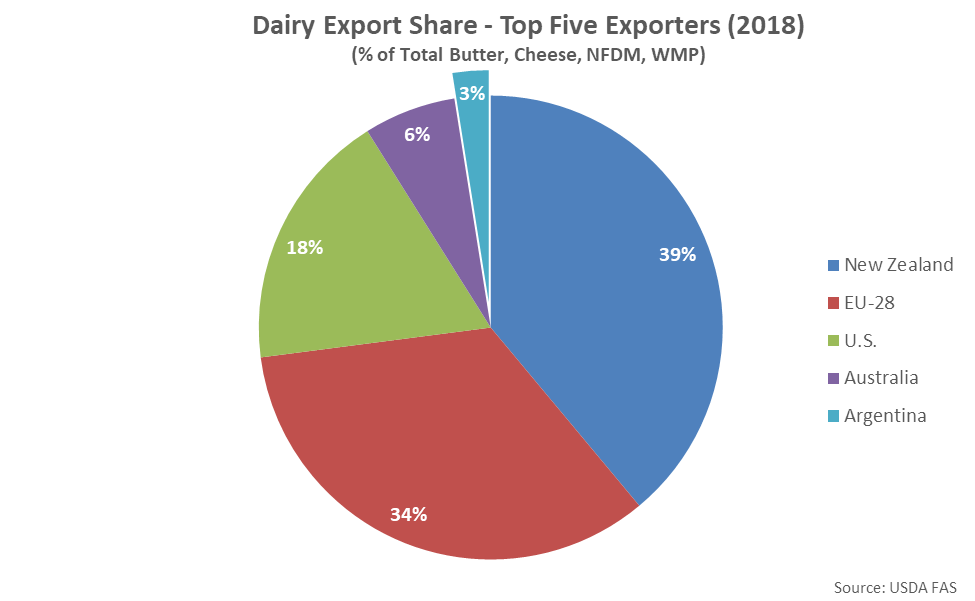

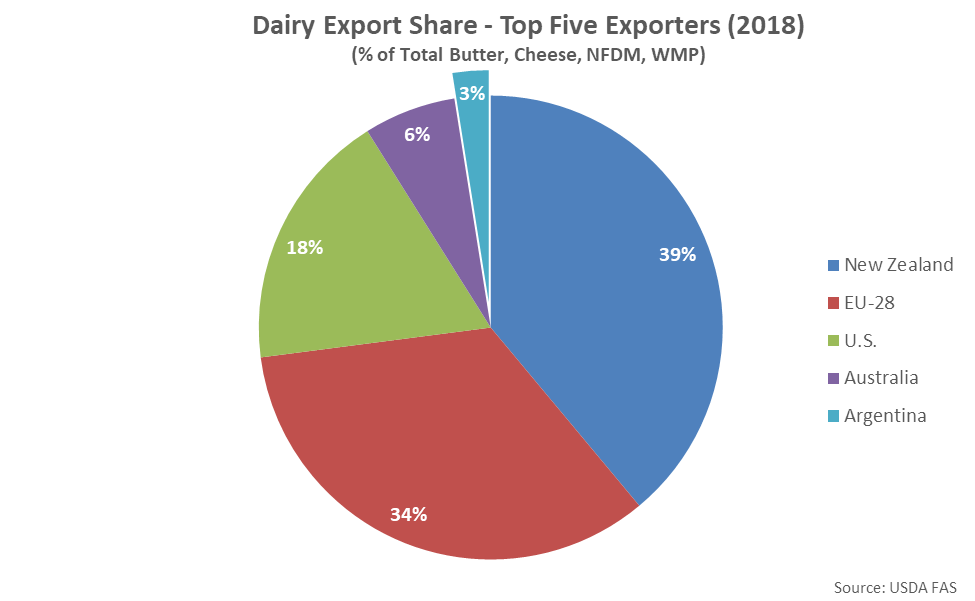

Argentina is the second largest milk producing country in South America, trailing only Brazil, and the fifth largest global dairy exporter, trailing only New Zealand, the EU-28, the U.S. and Australia. Of the aforementioned major dairy exporting regions, Argentina accounted for 3.7% of total combined milk production and 2.5% of combined butter, cheese, nonfat dry milk (NFDM) and whole milk powder (WMP) export volumes throughout 2018.

Argentina is the second largest milk producing country in South America, trailing only Brazil, and the fifth largest global dairy exporter, trailing only New Zealand, the EU-28, the U.S. and Australia. Of the aforementioned major dairy exporting regions, Argentina accounted for 3.7% of total combined milk production and 2.5% of combined butter, cheese, nonfat dry milk (NFDM) and whole milk powder (WMP) export volumes throughout 2018.

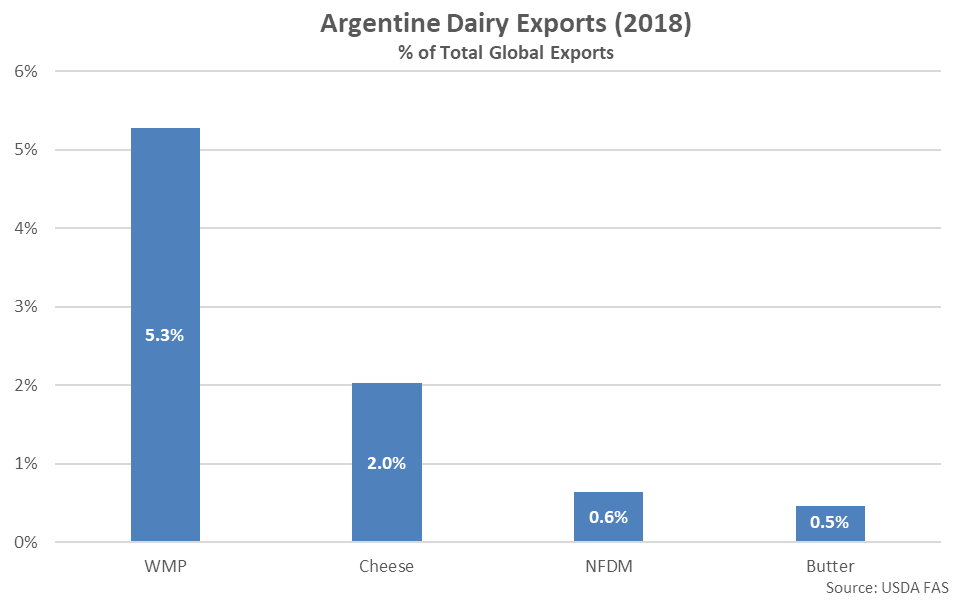

The bulk of Argentine dairy exports are in the form of WMP and cheese. Argentina was the third largest exporter of WMP throughout 2018, trailing only New Zealand and the EU-28, accounting for 5.3% of global WMP export volumes. From a global perspective, WMP markets may be most affected by a continued decline in Argentine milk production.

The bulk of Argentine dairy exports are in the form of WMP and cheese. Argentina was the third largest exporter of WMP throughout 2018, trailing only New Zealand and the EU-28, accounting for 5.3% of global WMP export volumes. From a global perspective, WMP markets may be most affected by a continued decline in Argentine milk production.

- Argentine milk production increased on a YOY basis for the first time in the past ten months during Aug ’19, finishing up 0.2%. YOY increases in Argentine milk production are expected to continue throughout the final months of the 2019 calendar year as lower feed costs, greater industry efficiency and a recovery in prices are expected to more than offset rising inflation rates.

- Low farmgate milk prices, poor weather, high inflation and increased production costs contributed to the Argentine dairy cow herd declining to a long-term record low level throughout 2018. USDA is projecting a continued reduction in the Argentine dairy cow herd through 2019 as the consolidation of operations continues along with the culling of less productive cows.

- Argentina is the fifth largest global dairy exporter, accounting for 2.5% of combined butter, cheese, nonfat dry milk and whole milk powder exports throughout 2018. The bulk of Argentine dairy exports are in the form of whole milk powder and cheese.

USDA is projecting a 0.3% YOY decline in Argentine milk production throughout the 2019 calendar year as declines experienced throughout the early months of the year are expected to offset increases in production projected throughout the second half of the calendar year. High temperatures and humidity experienced throughout the first quarter of the year contributed to significant YOY declines in production, however lower feed costs, greater industry efficiency and a recovery in prices are expected to more than offset rising inflation rates in months to come. A significant devaluation in the Argentine peso has resulted in increased operating costs, particularly for producers that purchase inputs priced in U.S. dollars and collect their milk checks in Argentine pesos. Financing has become increasing limited as the Argentine government was forced to raise interest rates by over 70% in order to mitigate the currency devaluation. 2019 YTD Argentine milk production volumes have declined by 4.0% on a YOY basis throughout the first eight months of the calendar year.

USDA is projecting a 0.3% YOY decline in Argentine milk production throughout the 2019 calendar year as declines experienced throughout the early months of the year are expected to offset increases in production projected throughout the second half of the calendar year. High temperatures and humidity experienced throughout the first quarter of the year contributed to significant YOY declines in production, however lower feed costs, greater industry efficiency and a recovery in prices are expected to more than offset rising inflation rates in months to come. A significant devaluation in the Argentine peso has resulted in increased operating costs, particularly for producers that purchase inputs priced in U.S. dollars and collect their milk checks in Argentine pesos. Financing has become increasing limited as the Argentine government was forced to raise interest rates by over 70% in order to mitigate the currency devaluation. 2019 YTD Argentine milk production volumes have declined by 4.0% on a YOY basis throughout the first eight months of the calendar year.

Recently experienced adverse conditions contributed to the Argentine dairy cow herd declining to a long-term record low level throughout 2018, finishing lower for the sixth consecutive year. Declines in the Argentine dairy cow herd are expected to continue as USDA is projecting the Argentine dairy cow herd to decline 2.6% throughout 2019, finishing at the lowest level on record. Declines in the Argentine dairy cow herd are expected as the consolidation of operations continues along with the culling of less productive cows.

Recently experienced adverse conditions contributed to the Argentine dairy cow herd declining to a long-term record low level throughout 2018, finishing lower for the sixth consecutive year. Declines in the Argentine dairy cow herd are expected to continue as USDA is projecting the Argentine dairy cow herd to decline 2.6% throughout 2019, finishing at the lowest level on record. Declines in the Argentine dairy cow herd are expected as the consolidation of operations continues along with the culling of less productive cows.

Argentina is the second largest milk producing country in South America, trailing only Brazil, and the fifth largest global dairy exporter, trailing only New Zealand, the EU-28, the U.S. and Australia. Of the aforementioned major dairy exporting regions, Argentina accounted for 3.7% of total combined milk production and 2.5% of combined butter, cheese, nonfat dry milk (NFDM) and whole milk powder (WMP) export volumes throughout 2018.

Argentina is the second largest milk producing country in South America, trailing only Brazil, and the fifth largest global dairy exporter, trailing only New Zealand, the EU-28, the U.S. and Australia. Of the aforementioned major dairy exporting regions, Argentina accounted for 3.7% of total combined milk production and 2.5% of combined butter, cheese, nonfat dry milk (NFDM) and whole milk powder (WMP) export volumes throughout 2018.

The bulk of Argentine dairy exports are in the form of WMP and cheese. Argentina was the third largest exporter of WMP throughout 2018, trailing only New Zealand and the EU-28, accounting for 5.3% of global WMP export volumes. From a global perspective, WMP markets may be most affected by a continued decline in Argentine milk production.

The bulk of Argentine dairy exports are in the form of WMP and cheese. Argentina was the third largest exporter of WMP throughout 2018, trailing only New Zealand and the EU-28, accounting for 5.3% of global WMP export volumes. From a global perspective, WMP markets may be most affected by a continued decline in Argentine milk production.