U.S. Cattle on Feed Update – Jan ’20

Executive Summary

U.S. cattle on feed figures provided by USDA were recently updated with values spanning through the end of Dec ’19. Highlights from the updated report include:

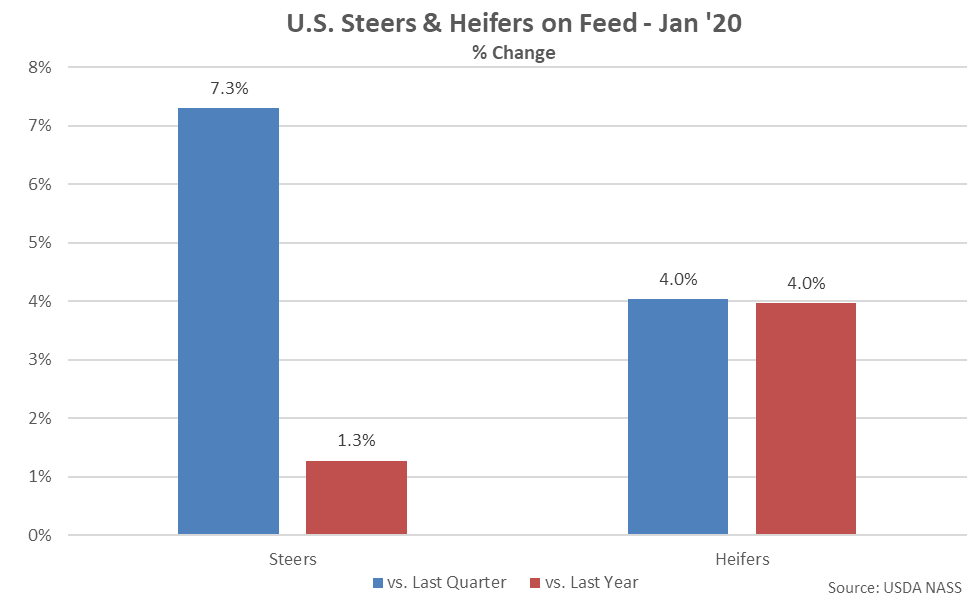

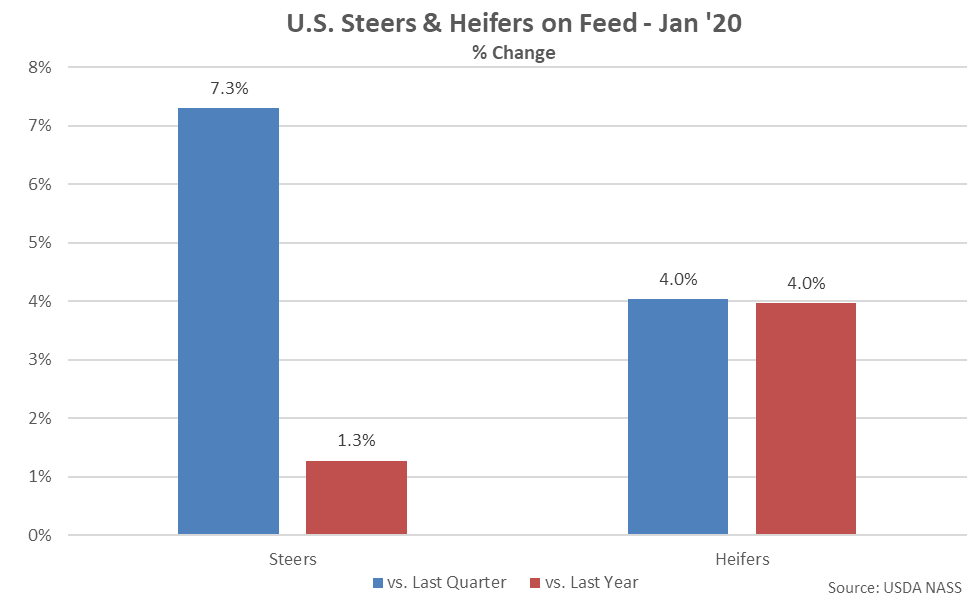

The Jan ’20 cattle on feed inventory included 7.37 million steers and steer calves, up 1.3% from 2019 levels, and 4.59 million heifers and heifer calves, up 4.0% from the previous year.

The Jan ’20 cattle on feed inventory included 7.37 million steers and steer calves, up 1.3% from 2019 levels, and 4.59 million heifers and heifer calves, up 4.0% from the previous year.

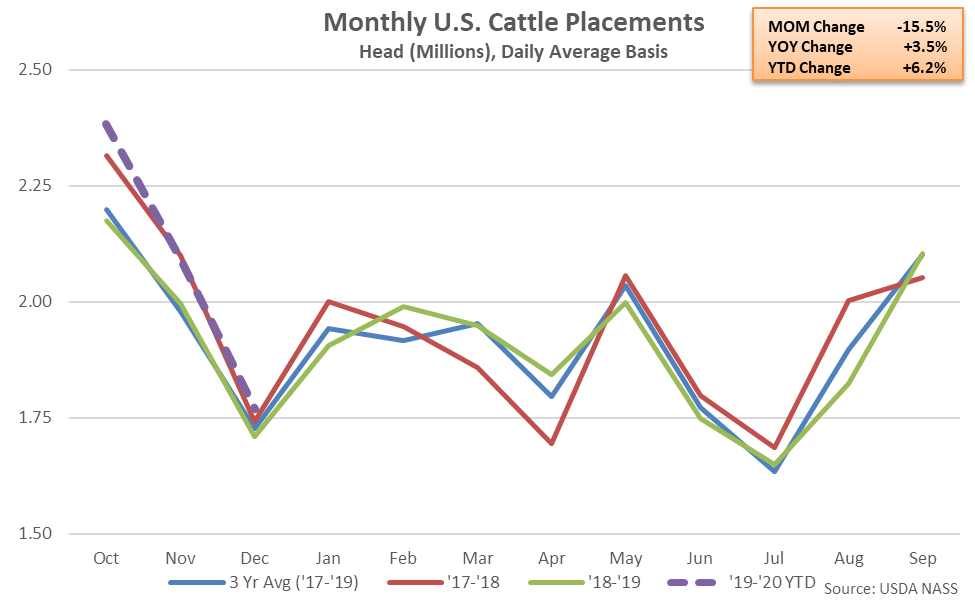

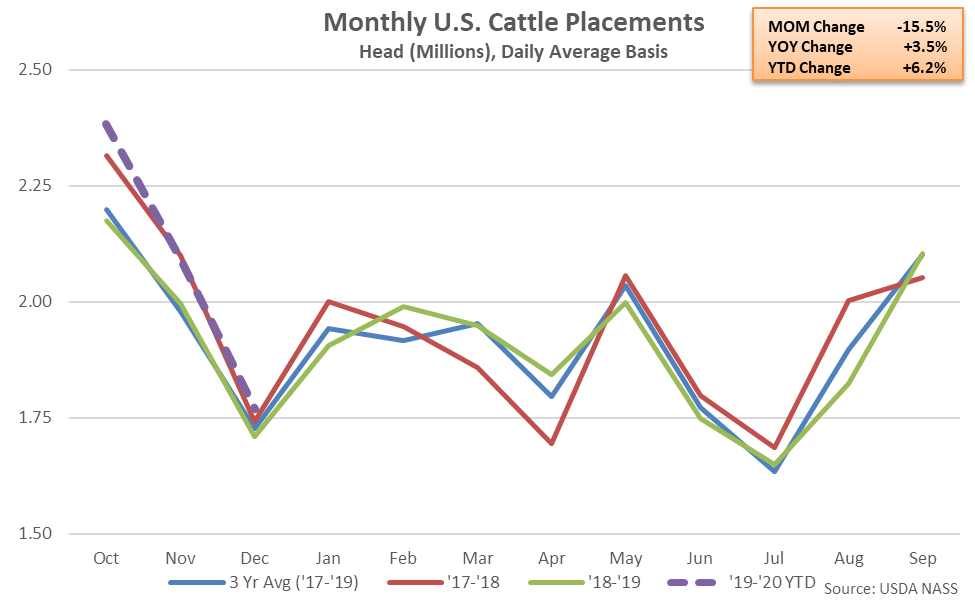

Dec ’19 placements in feedlots continued to decline seasonally from the previous month but remained higher on a YOY basis for the fourth consecutive month, finishing up 3.5%. The increase in placements was fairly consistent with average analyst expectations of a 3.2% increase.

Placements for those weighing 800 pounds or more increased most significantly on a YOY basis throughout Dec ’19, finishing up 7.6%, followed by placements weighing 400 pounds or less (+4.5%) and placements weighing 700-799 pounds (+2.7%). Placements weighing 600-699 pounds declined by 1.1% on a YOY basis throughout the month.

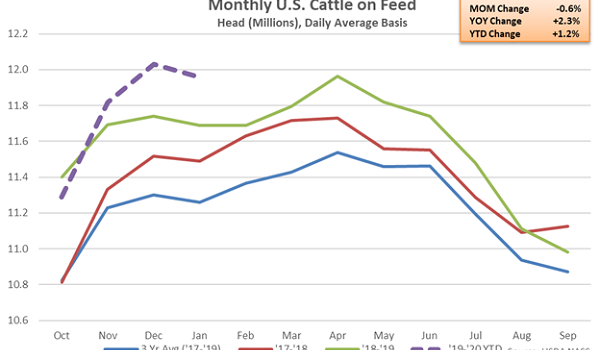

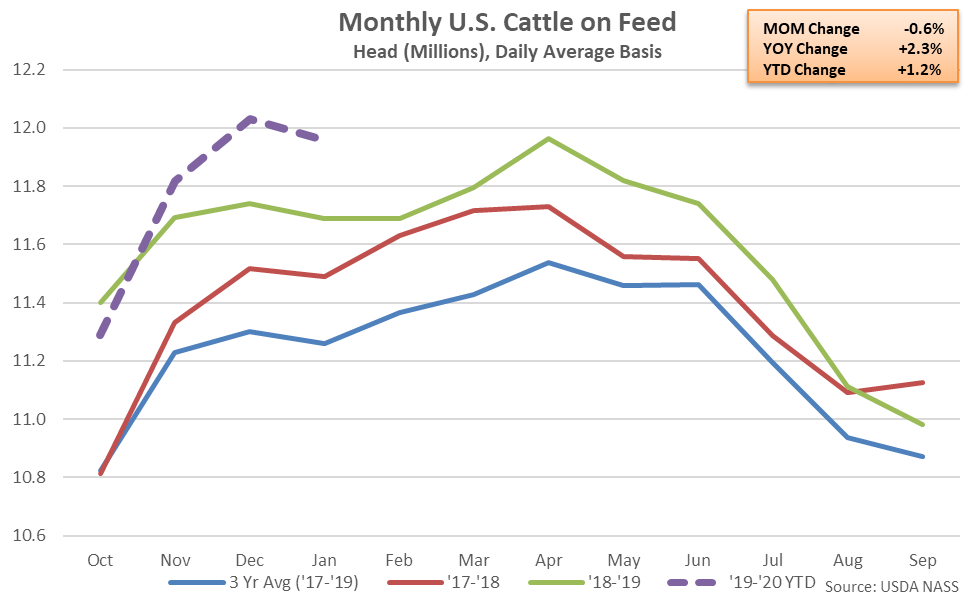

Total placements in feedlots declined 1.6% on a YOY basis throughout the ’18-’19 production season, however annual placement rates remained 2.8% above three year average figures. ’19-’20 YTD marketings have rebounded 6.2% on a YOY basis throughout the first quarter of the production season and are on pace to reach a 12 year high level.

Dec ’19 placements in feedlots continued to decline seasonally from the previous month but remained higher on a YOY basis for the fourth consecutive month, finishing up 3.5%. The increase in placements was fairly consistent with average analyst expectations of a 3.2% increase.

Placements for those weighing 800 pounds or more increased most significantly on a YOY basis throughout Dec ’19, finishing up 7.6%, followed by placements weighing 400 pounds or less (+4.5%) and placements weighing 700-799 pounds (+2.7%). Placements weighing 600-699 pounds declined by 1.1% on a YOY basis throughout the month.

Total placements in feedlots declined 1.6% on a YOY basis throughout the ’18-’19 production season, however annual placement rates remained 2.8% above three year average figures. ’19-’20 YTD marketings have rebounded 6.2% on a YOY basis throughout the first quarter of the production season and are on pace to reach a 12 year high level.

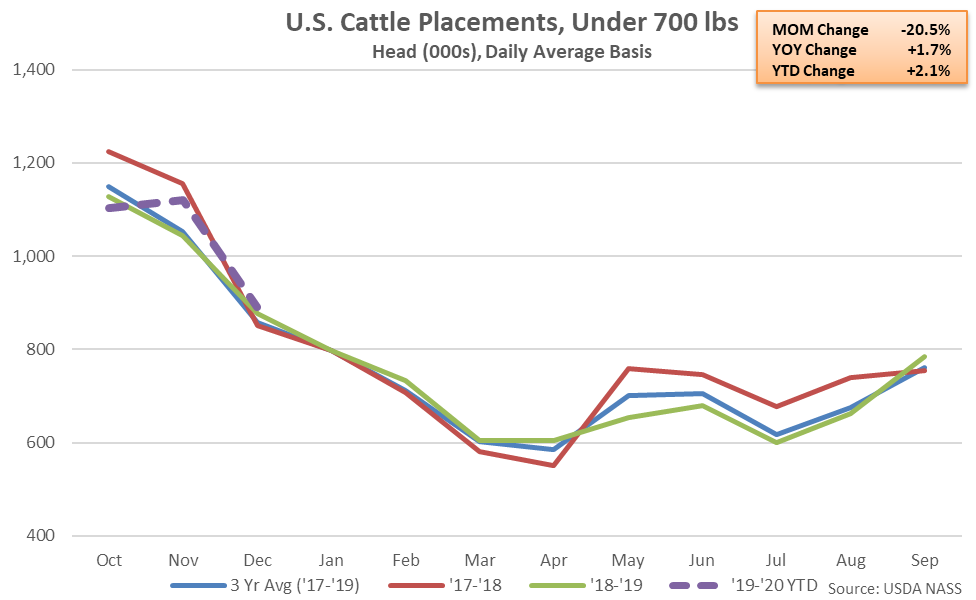

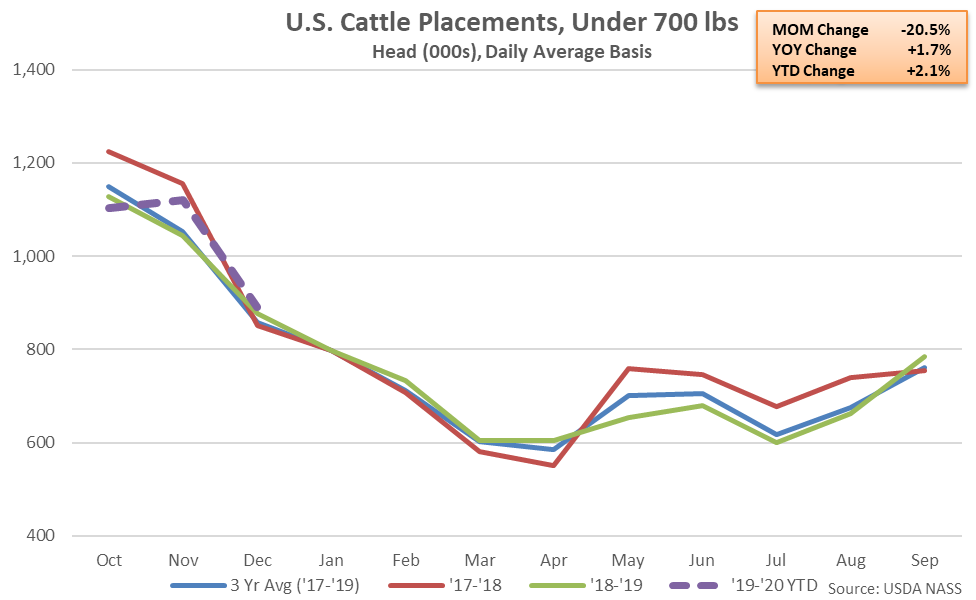

Dec ’19 cattle placements weighing under 700 pounds increased 1.7% on a YOY basis, finishing higher for the second consecutive month. Cattle placements weighing under 700 pounds finished 3.9% lower on a YOY basis throughout the ’18-’19 production season, however ’19-’20 YTD placements weighing under 700 pounds have rebounded by 2.1% on a YOY basis throughout the first quarter of the production season.

Dec ’19 cattle placements weighing under 700 pounds increased 1.7% on a YOY basis, finishing higher for the second consecutive month. Cattle placements weighing under 700 pounds finished 3.9% lower on a YOY basis throughout the ’18-’19 production season, however ’19-’20 YTD placements weighing under 700 pounds have rebounded by 2.1% on a YOY basis throughout the first quarter of the production season.

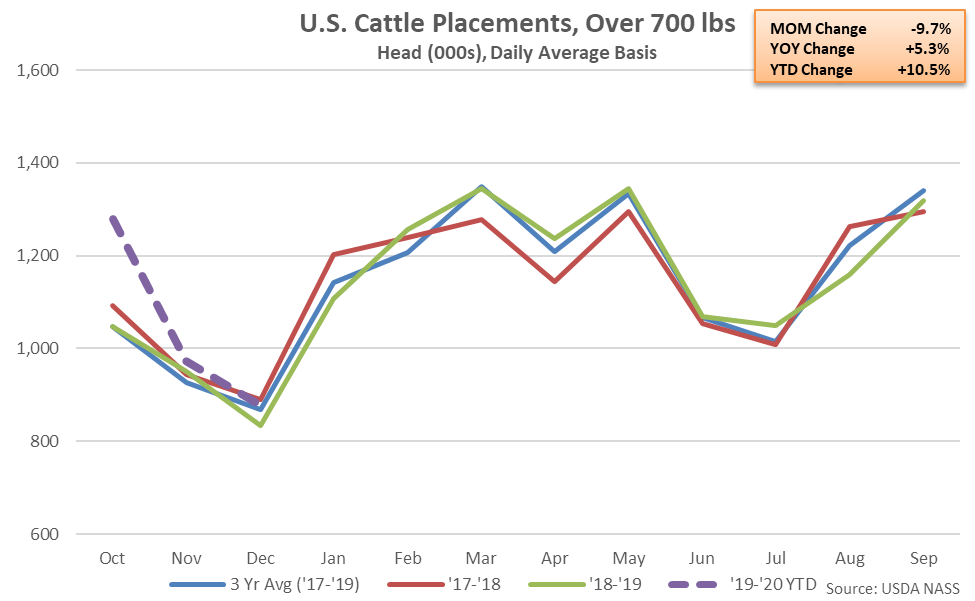

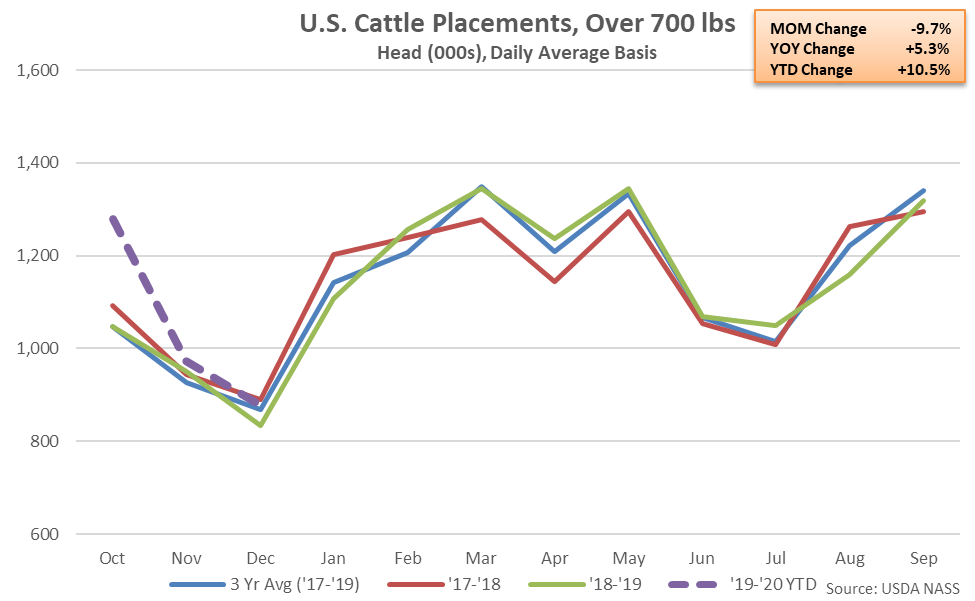

Dec ’19 cattle placements weighing 700 pounds or more increased 5.3% on a YOY basis, finishing higher for the tenth time in the past 11 months. Cattle placements weighing 700 pounds or more increased 0.1% on a YOY basis throughout the ’18-’19 production season while ’19-’20 YTD placements weighing 700 pounds or more have increased an additional 10.5% on a YOY basis throughout the first quarter of the production season and are on pace to reach a record high annual level.

Dec ’19 cattle placements weighing 700 pounds or more increased 5.3% on a YOY basis, finishing higher for the tenth time in the past 11 months. Cattle placements weighing 700 pounds or more increased 0.1% on a YOY basis throughout the ’18-’19 production season while ’19-’20 YTD placements weighing 700 pounds or more have increased an additional 10.5% on a YOY basis throughout the first quarter of the production season and are on pace to reach a record high annual level.

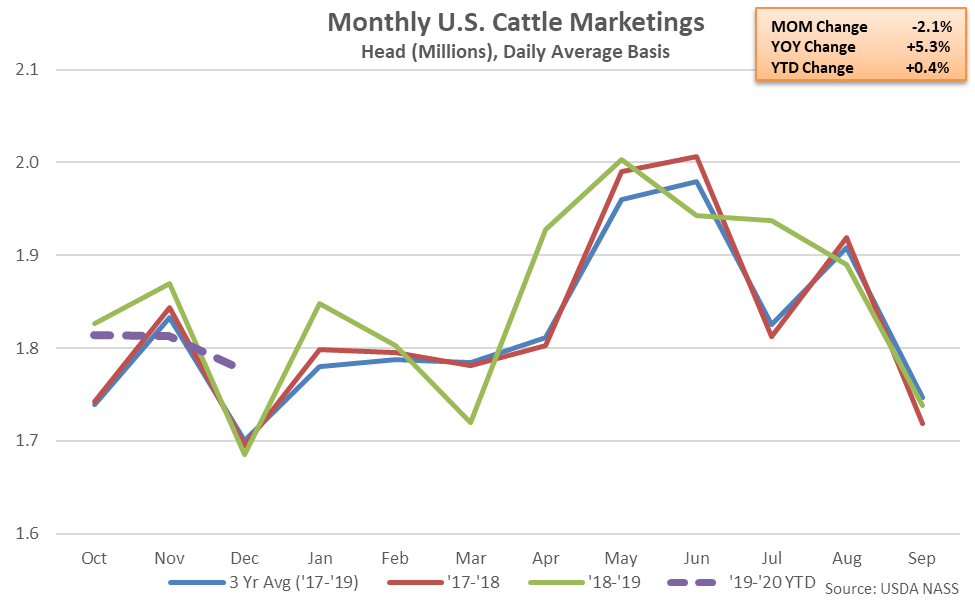

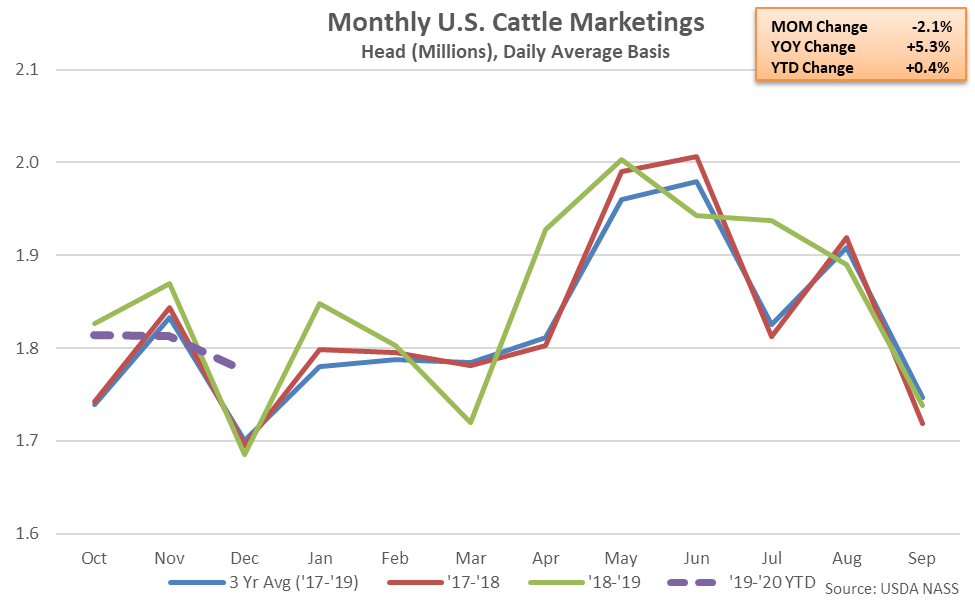

Marketings of fed cattle during Dec ’19 finished 5.3% above December of last year, increasing on a YOY basis for the first time in the past three months. The increase in marketings was consistent with average analyst expectations of a 5.2% increase. ’18-’19 annual marketings of fed cattle increased 1.3% YOY, reaching an 11 year high, while ’19-’20 YTD marketings have increased an additional 0.4% on a YOY basis throughout the first quarter of the production season.

Marketings of fed cattle during Dec ’19 finished 5.3% above December of last year, increasing on a YOY basis for the first time in the past three months. The increase in marketings was consistent with average analyst expectations of a 5.2% increase. ’18-’19 annual marketings of fed cattle increased 1.3% YOY, reaching an 11 year high, while ’19-’20 YTD marketings have increased an additional 0.4% on a YOY basis throughout the first quarter of the production season.

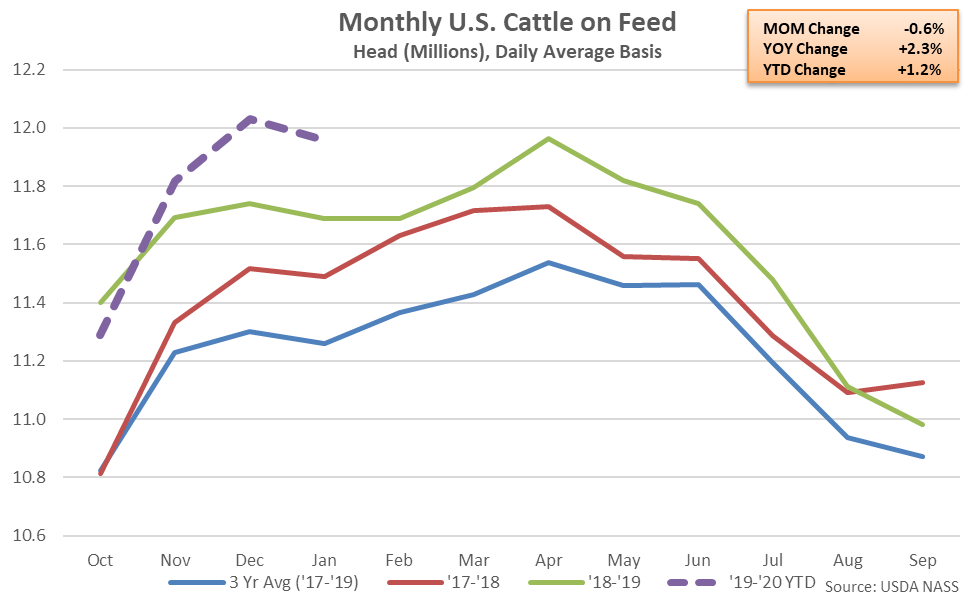

- U.S. cattle and calves on feed for the slaughter market as of Jan 1st increased on a YOY basis for the third consecutive month, finishing up 2.3% and reaching a 12 year high seasonal level. The YOY increase in the cattle on feed supply was consistent with average analyst expectations of a 2.2% increase.

- Dec ’19 placements in feedlots increased 3.5% YOY, finishing higher on a YOY basis for the fourth consecutive month. The YOY increase in placements was fairly consistent with average analyst expectations of a 3.2% increase.

- Dec ’19 marketings of fed cattle increased 5.3% on a YOY basis, finishing higher on a YOY basis for the first time in the past three months. The YOY increase in marketings was consistent with average analyst expectations of a 5.2% increase.

The Jan ’20 cattle on feed inventory included 7.37 million steers and steer calves, up 1.3% from 2019 levels, and 4.59 million heifers and heifer calves, up 4.0% from the previous year.

The Jan ’20 cattle on feed inventory included 7.37 million steers and steer calves, up 1.3% from 2019 levels, and 4.59 million heifers and heifer calves, up 4.0% from the previous year.

Dec ’19 placements in feedlots continued to decline seasonally from the previous month but remained higher on a YOY basis for the fourth consecutive month, finishing up 3.5%. The increase in placements was fairly consistent with average analyst expectations of a 3.2% increase.

Placements for those weighing 800 pounds or more increased most significantly on a YOY basis throughout Dec ’19, finishing up 7.6%, followed by placements weighing 400 pounds or less (+4.5%) and placements weighing 700-799 pounds (+2.7%). Placements weighing 600-699 pounds declined by 1.1% on a YOY basis throughout the month.

Total placements in feedlots declined 1.6% on a YOY basis throughout the ’18-’19 production season, however annual placement rates remained 2.8% above three year average figures. ’19-’20 YTD marketings have rebounded 6.2% on a YOY basis throughout the first quarter of the production season and are on pace to reach a 12 year high level.

Dec ’19 placements in feedlots continued to decline seasonally from the previous month but remained higher on a YOY basis for the fourth consecutive month, finishing up 3.5%. The increase in placements was fairly consistent with average analyst expectations of a 3.2% increase.

Placements for those weighing 800 pounds or more increased most significantly on a YOY basis throughout Dec ’19, finishing up 7.6%, followed by placements weighing 400 pounds or less (+4.5%) and placements weighing 700-799 pounds (+2.7%). Placements weighing 600-699 pounds declined by 1.1% on a YOY basis throughout the month.

Total placements in feedlots declined 1.6% on a YOY basis throughout the ’18-’19 production season, however annual placement rates remained 2.8% above three year average figures. ’19-’20 YTD marketings have rebounded 6.2% on a YOY basis throughout the first quarter of the production season and are on pace to reach a 12 year high level.

Dec ’19 cattle placements weighing under 700 pounds increased 1.7% on a YOY basis, finishing higher for the second consecutive month. Cattle placements weighing under 700 pounds finished 3.9% lower on a YOY basis throughout the ’18-’19 production season, however ’19-’20 YTD placements weighing under 700 pounds have rebounded by 2.1% on a YOY basis throughout the first quarter of the production season.

Dec ’19 cattle placements weighing under 700 pounds increased 1.7% on a YOY basis, finishing higher for the second consecutive month. Cattle placements weighing under 700 pounds finished 3.9% lower on a YOY basis throughout the ’18-’19 production season, however ’19-’20 YTD placements weighing under 700 pounds have rebounded by 2.1% on a YOY basis throughout the first quarter of the production season.

Dec ’19 cattle placements weighing 700 pounds or more increased 5.3% on a YOY basis, finishing higher for the tenth time in the past 11 months. Cattle placements weighing 700 pounds or more increased 0.1% on a YOY basis throughout the ’18-’19 production season while ’19-’20 YTD placements weighing 700 pounds or more have increased an additional 10.5% on a YOY basis throughout the first quarter of the production season and are on pace to reach a record high annual level.

Dec ’19 cattle placements weighing 700 pounds or more increased 5.3% on a YOY basis, finishing higher for the tenth time in the past 11 months. Cattle placements weighing 700 pounds or more increased 0.1% on a YOY basis throughout the ’18-’19 production season while ’19-’20 YTD placements weighing 700 pounds or more have increased an additional 10.5% on a YOY basis throughout the first quarter of the production season and are on pace to reach a record high annual level.

Marketings of fed cattle during Dec ’19 finished 5.3% above December of last year, increasing on a YOY basis for the first time in the past three months. The increase in marketings was consistent with average analyst expectations of a 5.2% increase. ’18-’19 annual marketings of fed cattle increased 1.3% YOY, reaching an 11 year high, while ’19-’20 YTD marketings have increased an additional 0.4% on a YOY basis throughout the first quarter of the production season.

Marketings of fed cattle during Dec ’19 finished 5.3% above December of last year, increasing on a YOY basis for the first time in the past three months. The increase in marketings was consistent with average analyst expectations of a 5.2% increase. ’18-’19 annual marketings of fed cattle increased 1.3% YOY, reaching an 11 year high, while ’19-’20 YTD marketings have increased an additional 0.4% on a YOY basis throughout the first quarter of the production season.