U.S. Cattle on Feed Update – Feb ’20

Executive Summary

U.S. cattle on feed figures provided by USDA were recently updated with values spanning through the end of Jan ’20. Highlights from the updated report include:

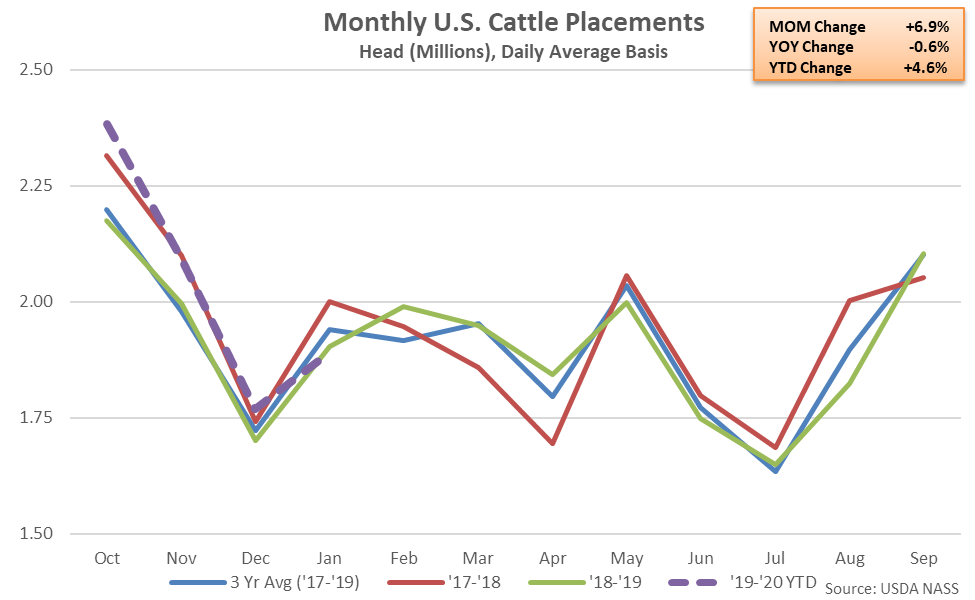

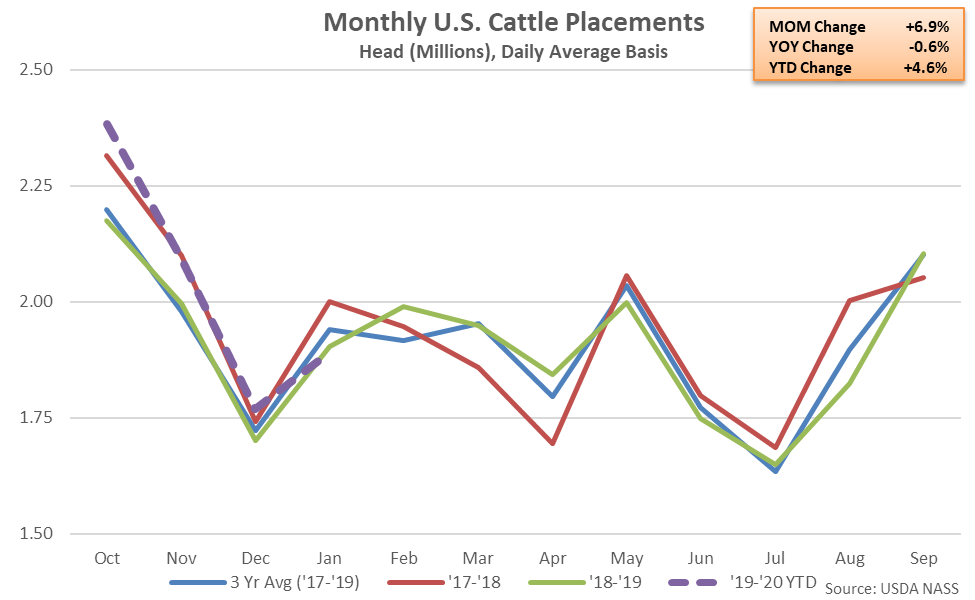

Placements in feedlots rebounded seasonally from the previous month during Jan ’20 but finished lower on a YOY basis for the first time in the past five months, declining up 0.6%. Placements finished below average analyst expectations of a 1.4% increase.

Placements for those weighing 700-799 pound declined most significantly on a YOY basis throughout Jan ’20, finishing down 3.6%, while placements weighing 800 pounds or more declined 2.0%. Placements weighing 600-699 pounds increased by 2.2% on a YOY basis throughout the month while placements weighing 600 pounds or less increased 2.6%.

Total placements in feedlots declined 1.6% on a YOY basis throughout the ’18-’19 production season, however annual placement rates remained 2.8% above three year average figures. ’19-’20 YTD marketings have rebounded 4.6% on a YOY basis throughout the first third of the production season, despite the most recent YOY decline.

Placements in feedlots rebounded seasonally from the previous month during Jan ’20 but finished lower on a YOY basis for the first time in the past five months, declining up 0.6%. Placements finished below average analyst expectations of a 1.4% increase.

Placements for those weighing 700-799 pound declined most significantly on a YOY basis throughout Jan ’20, finishing down 3.6%, while placements weighing 800 pounds or more declined 2.0%. Placements weighing 600-699 pounds increased by 2.2% on a YOY basis throughout the month while placements weighing 600 pounds or less increased 2.6%.

Total placements in feedlots declined 1.6% on a YOY basis throughout the ’18-’19 production season, however annual placement rates remained 2.8% above three year average figures. ’19-’20 YTD marketings have rebounded 4.6% on a YOY basis throughout the first third of the production season, despite the most recent YOY decline.

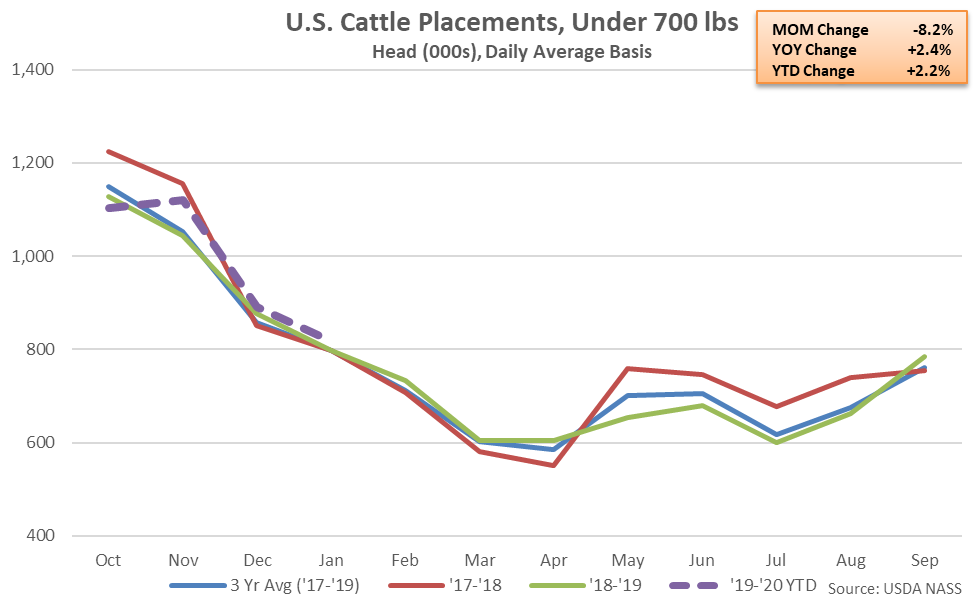

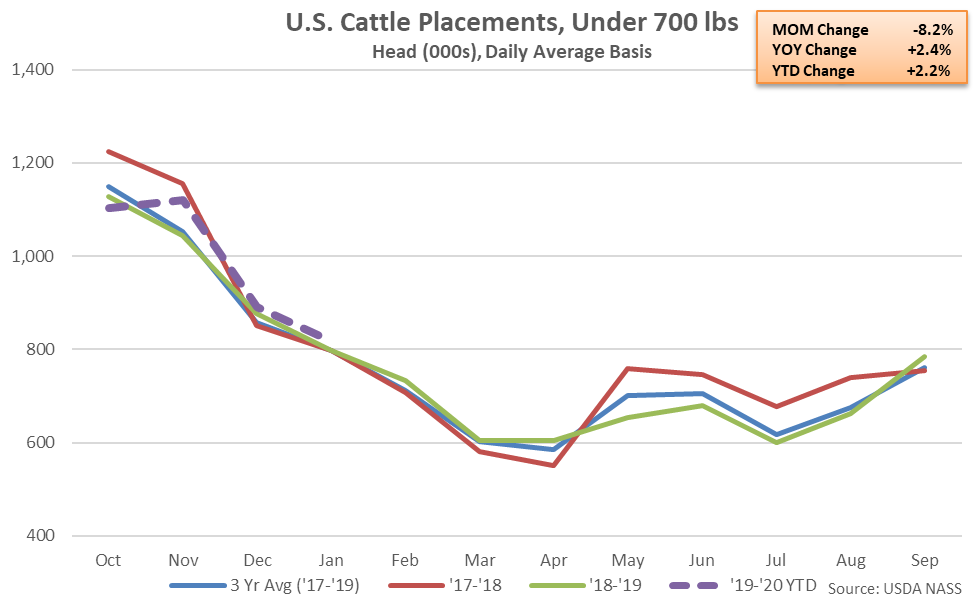

Cattle placements weighing under 700 pounds increased 2.4% on a YOY basis during Jan ’20, finishing higher for the third consecutive month. Cattle placements weighing under 700 pounds finished 3.9% lower on a YOY basis throughout the ’18-’19 production season, however ’19-’20 YTD placements weighing under 700 pounds have rebounded by 2.2% on a YOY basis throughout the first third of the production season.

Cattle placements weighing under 700 pounds increased 2.4% on a YOY basis during Jan ’20, finishing higher for the third consecutive month. Cattle placements weighing under 700 pounds finished 3.9% lower on a YOY basis throughout the ’18-’19 production season, however ’19-’20 YTD placements weighing under 700 pounds have rebounded by 2.2% on a YOY basis throughout the first third of the production season.

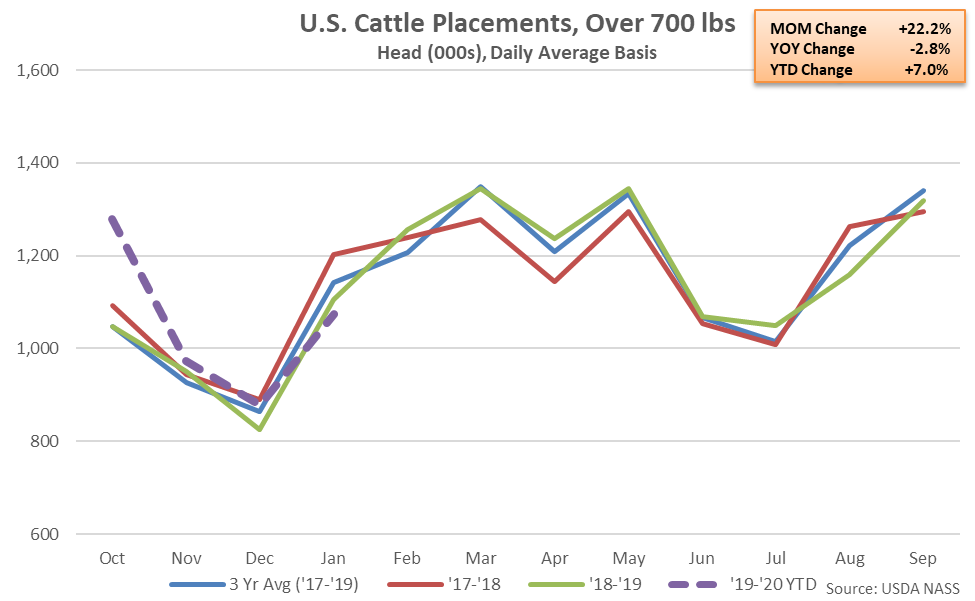

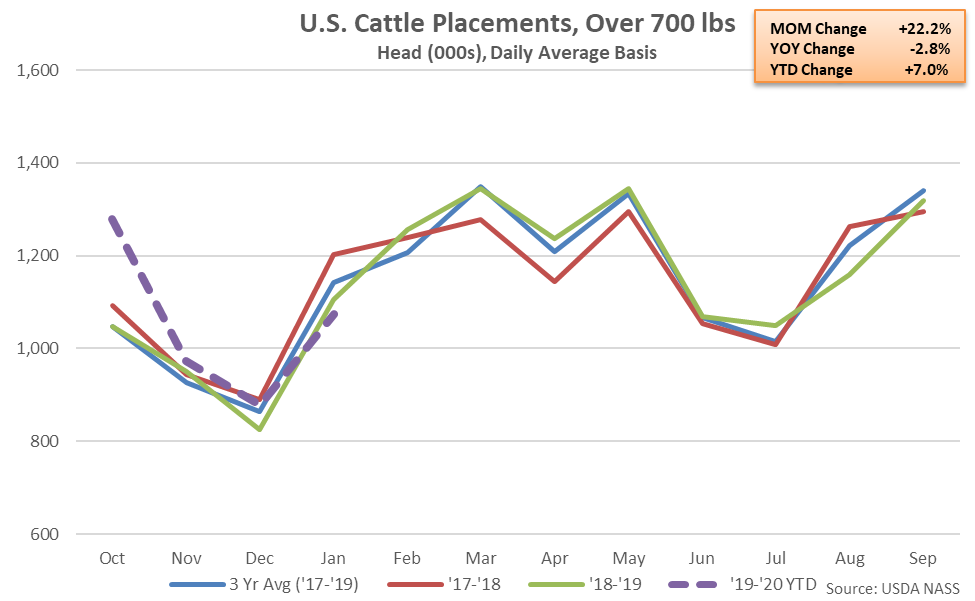

Cattle placements weighing 700 pounds or more declined 2.8% on a YOY basis during Jan ’20, finishing lower for just the second time in the past 12 months. Cattle placements weighing 700 pounds or more increased 0.1% on a YOY basis throughout the ’18-’19 production season while ’19-’20 YTD placements weighing 700 pounds or more have increased an additional 7.0% on a YOY basis throughout the first third of the production season, despite the most recent decline.

Cattle placements weighing 700 pounds or more declined 2.8% on a YOY basis during Jan ’20, finishing lower for just the second time in the past 12 months. Cattle placements weighing 700 pounds or more increased 0.1% on a YOY basis throughout the ’18-’19 production season while ’19-’20 YTD placements weighing 700 pounds or more have increased an additional 7.0% on a YOY basis throughout the first third of the production season, despite the most recent decline.

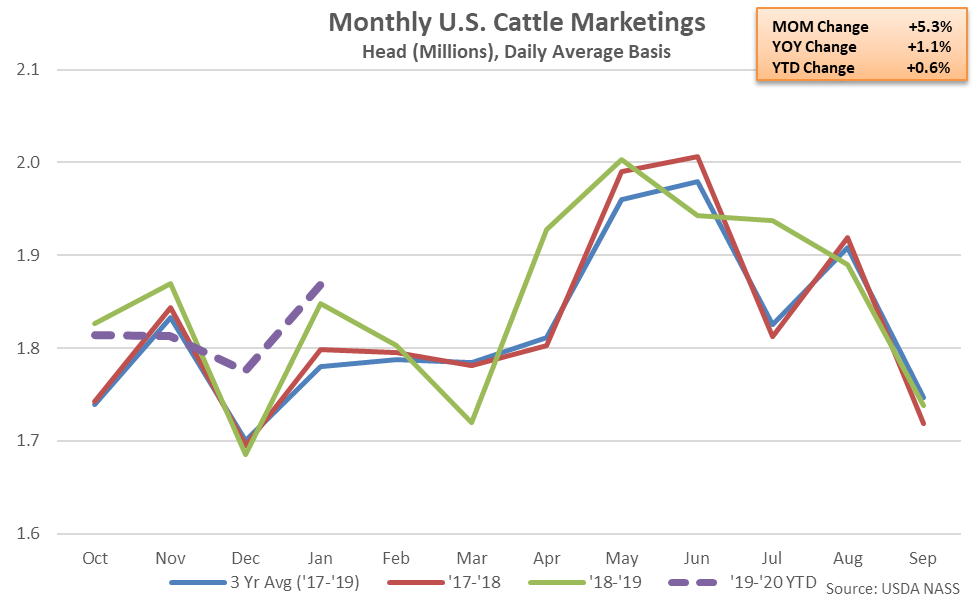

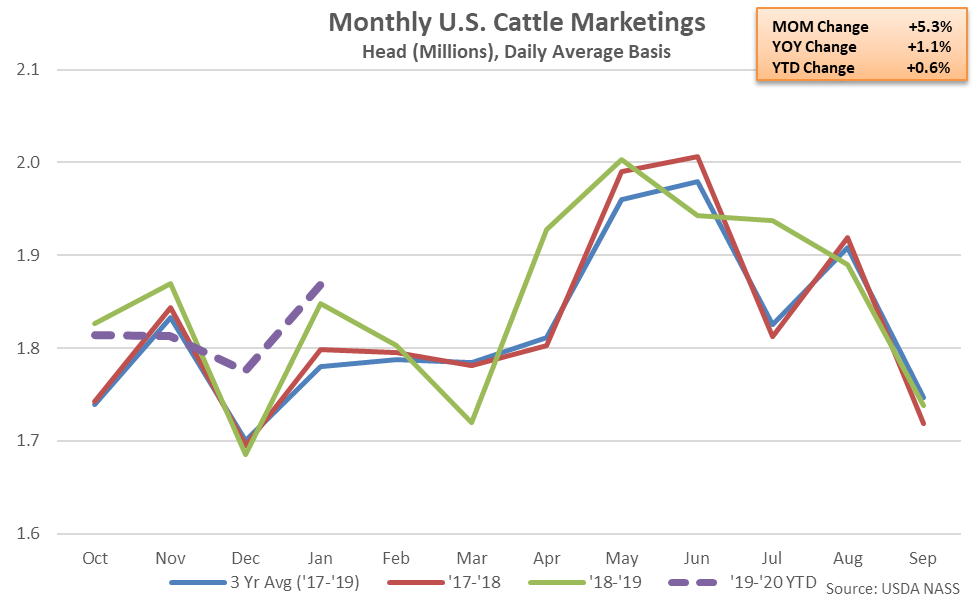

Marketings of fed cattle increased 1.1% on a YOY basis during Jan ’20, finishing higher for the second consecutive month. The increase in marketings was slightly greater than average analyst expectations of a 0.7% increase. ’18-’19 annual marketings of fed cattle increased 1.3% YOY, reaching an 11 year high, while ’19-’20 YTD marketings have increased an additional 0.6% on a YOY basis throughout the first third of the production season.

Marketings of fed cattle increased 1.1% on a YOY basis during Jan ’20, finishing higher for the second consecutive month. The increase in marketings was slightly greater than average analyst expectations of a 0.7% increase. ’18-’19 annual marketings of fed cattle increased 1.3% YOY, reaching an 11 year high, while ’19-’20 YTD marketings have increased an additional 0.6% on a YOY basis throughout the first third of the production season.

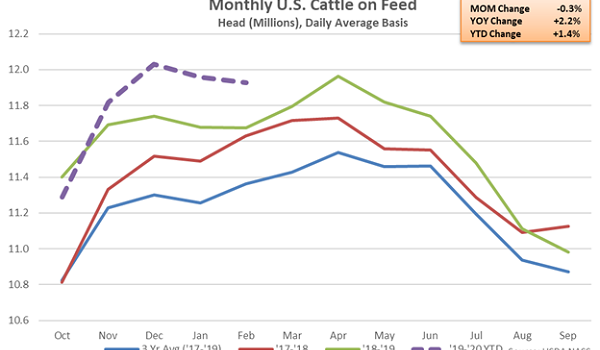

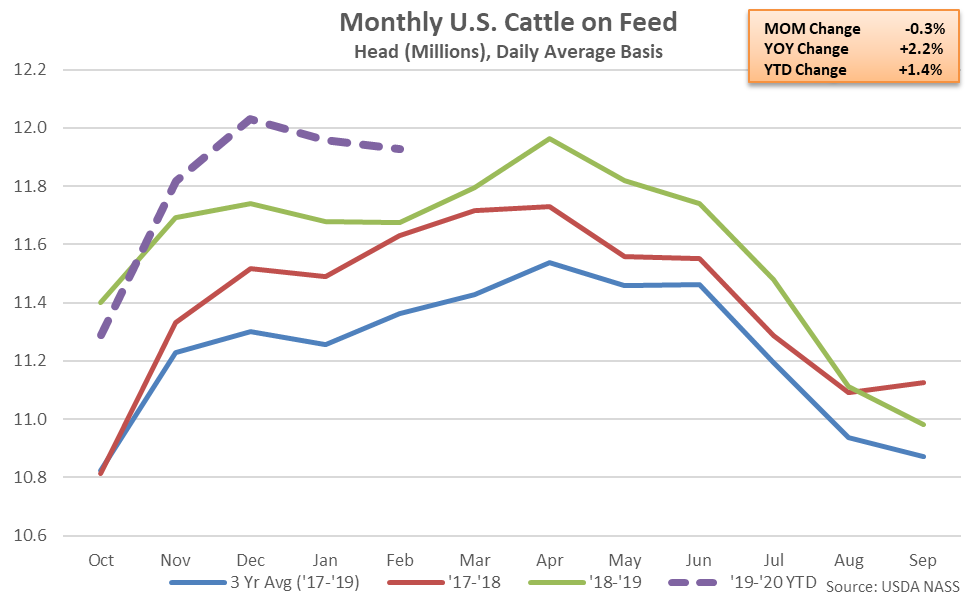

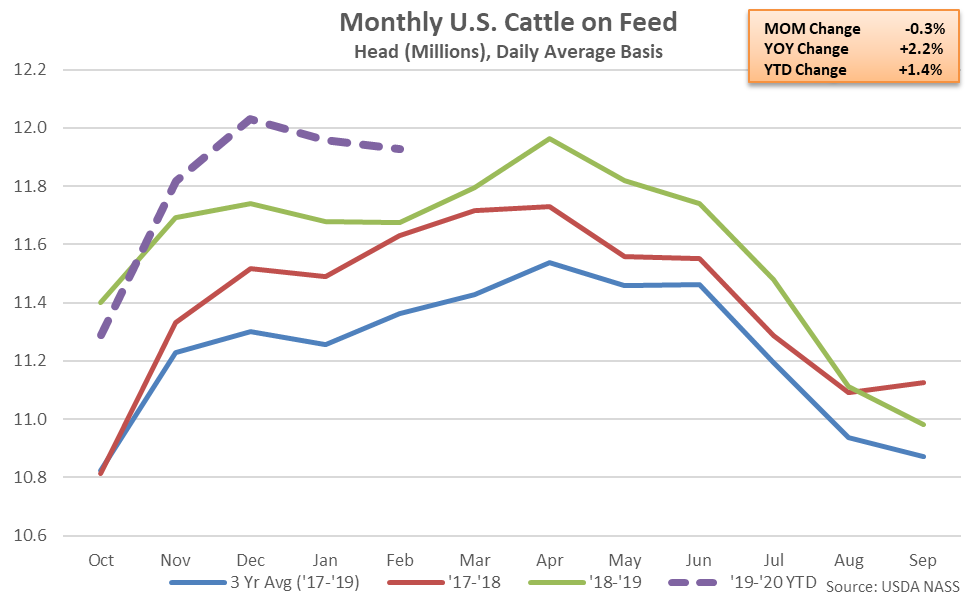

- U.S. cattle and calves on feed for the slaughter market as of Feb 1st increased on a YOY basis for the fourth consecutive month, finishing up 2.2% and reaching a 12 year high seasonal level.

- Placements in feedlots declined 1.4% YOY during Jan ’20, finishing lower on a YOY basis for the first time in the past five months.

- Marketings of fed cattle increased 1.1% on a YOY basis during Jan ’20, finishing higher on a YOY basis for the second consecutive month.

Placements in feedlots rebounded seasonally from the previous month during Jan ’20 but finished lower on a YOY basis for the first time in the past five months, declining up 0.6%. Placements finished below average analyst expectations of a 1.4% increase.

Placements for those weighing 700-799 pound declined most significantly on a YOY basis throughout Jan ’20, finishing down 3.6%, while placements weighing 800 pounds or more declined 2.0%. Placements weighing 600-699 pounds increased by 2.2% on a YOY basis throughout the month while placements weighing 600 pounds or less increased 2.6%.

Total placements in feedlots declined 1.6% on a YOY basis throughout the ’18-’19 production season, however annual placement rates remained 2.8% above three year average figures. ’19-’20 YTD marketings have rebounded 4.6% on a YOY basis throughout the first third of the production season, despite the most recent YOY decline.

Placements in feedlots rebounded seasonally from the previous month during Jan ’20 but finished lower on a YOY basis for the first time in the past five months, declining up 0.6%. Placements finished below average analyst expectations of a 1.4% increase.

Placements for those weighing 700-799 pound declined most significantly on a YOY basis throughout Jan ’20, finishing down 3.6%, while placements weighing 800 pounds or more declined 2.0%. Placements weighing 600-699 pounds increased by 2.2% on a YOY basis throughout the month while placements weighing 600 pounds or less increased 2.6%.

Total placements in feedlots declined 1.6% on a YOY basis throughout the ’18-’19 production season, however annual placement rates remained 2.8% above three year average figures. ’19-’20 YTD marketings have rebounded 4.6% on a YOY basis throughout the first third of the production season, despite the most recent YOY decline.

Cattle placements weighing under 700 pounds increased 2.4% on a YOY basis during Jan ’20, finishing higher for the third consecutive month. Cattle placements weighing under 700 pounds finished 3.9% lower on a YOY basis throughout the ’18-’19 production season, however ’19-’20 YTD placements weighing under 700 pounds have rebounded by 2.2% on a YOY basis throughout the first third of the production season.

Cattle placements weighing under 700 pounds increased 2.4% on a YOY basis during Jan ’20, finishing higher for the third consecutive month. Cattle placements weighing under 700 pounds finished 3.9% lower on a YOY basis throughout the ’18-’19 production season, however ’19-’20 YTD placements weighing under 700 pounds have rebounded by 2.2% on a YOY basis throughout the first third of the production season.

Cattle placements weighing 700 pounds or more declined 2.8% on a YOY basis during Jan ’20, finishing lower for just the second time in the past 12 months. Cattle placements weighing 700 pounds or more increased 0.1% on a YOY basis throughout the ’18-’19 production season while ’19-’20 YTD placements weighing 700 pounds or more have increased an additional 7.0% on a YOY basis throughout the first third of the production season, despite the most recent decline.

Cattle placements weighing 700 pounds or more declined 2.8% on a YOY basis during Jan ’20, finishing lower for just the second time in the past 12 months. Cattle placements weighing 700 pounds or more increased 0.1% on a YOY basis throughout the ’18-’19 production season while ’19-’20 YTD placements weighing 700 pounds or more have increased an additional 7.0% on a YOY basis throughout the first third of the production season, despite the most recent decline.

Marketings of fed cattle increased 1.1% on a YOY basis during Jan ’20, finishing higher for the second consecutive month. The increase in marketings was slightly greater than average analyst expectations of a 0.7% increase. ’18-’19 annual marketings of fed cattle increased 1.3% YOY, reaching an 11 year high, while ’19-’20 YTD marketings have increased an additional 0.6% on a YOY basis throughout the first third of the production season.

Marketings of fed cattle increased 1.1% on a YOY basis during Jan ’20, finishing higher for the second consecutive month. The increase in marketings was slightly greater than average analyst expectations of a 0.7% increase. ’18-’19 annual marketings of fed cattle increased 1.3% YOY, reaching an 11 year high, while ’19-’20 YTD marketings have increased an additional 0.6% on a YOY basis throughout the first third of the production season.