U.S. Ethanol Exports Update – Aug ’20

Jun ’20 U.S. Ethanol Export Volumes Rebounded From the Previous Month’s 47 Month Low

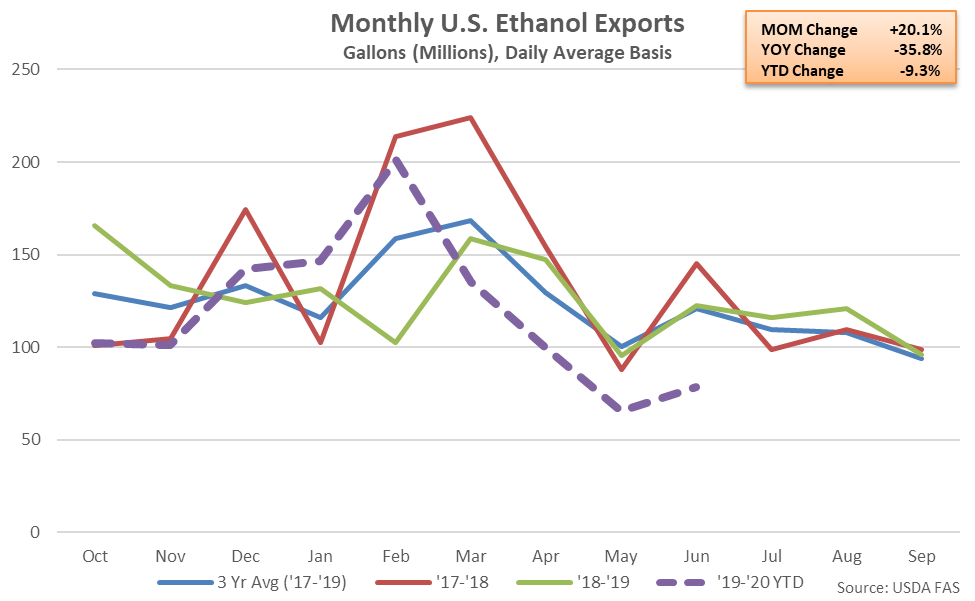

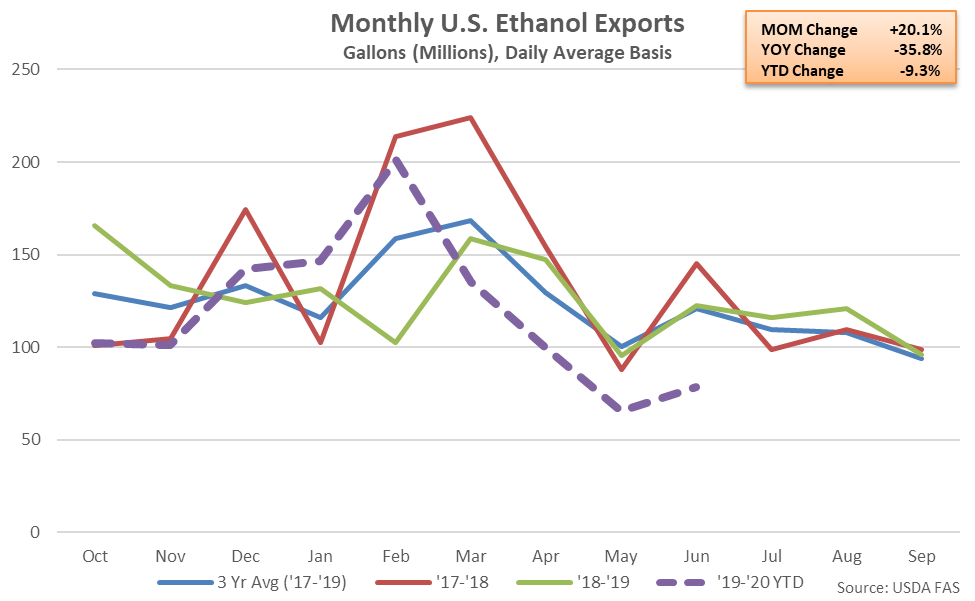

Jun ’20 U.S. Ethanol Export Volumes Increased 20.1% MOM but Remained Down 35.8% YOY

Jun ’20 U.S. Ethanol Export Volumes Increased 20.1% MOM but Remained Down 35.8% YOY

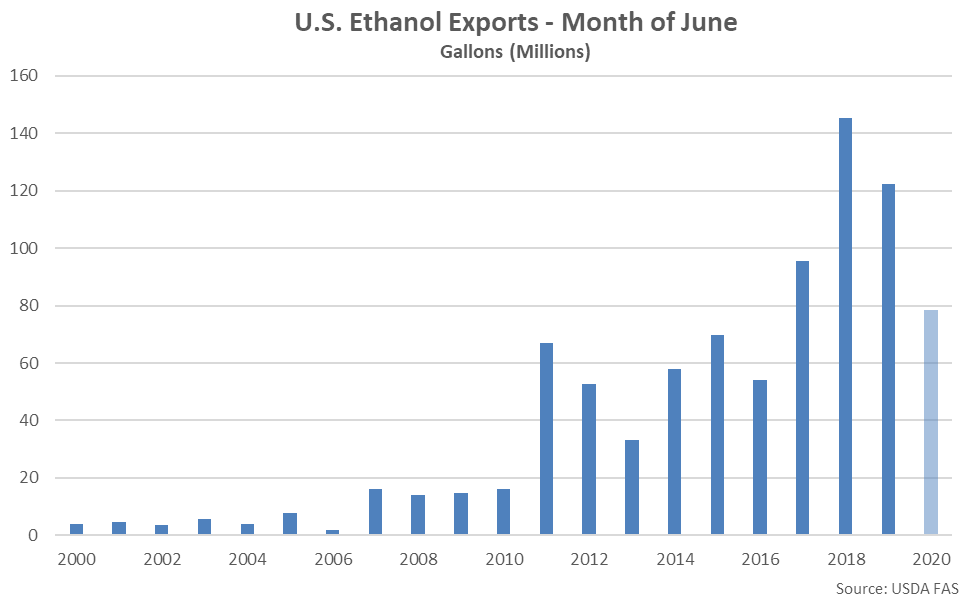

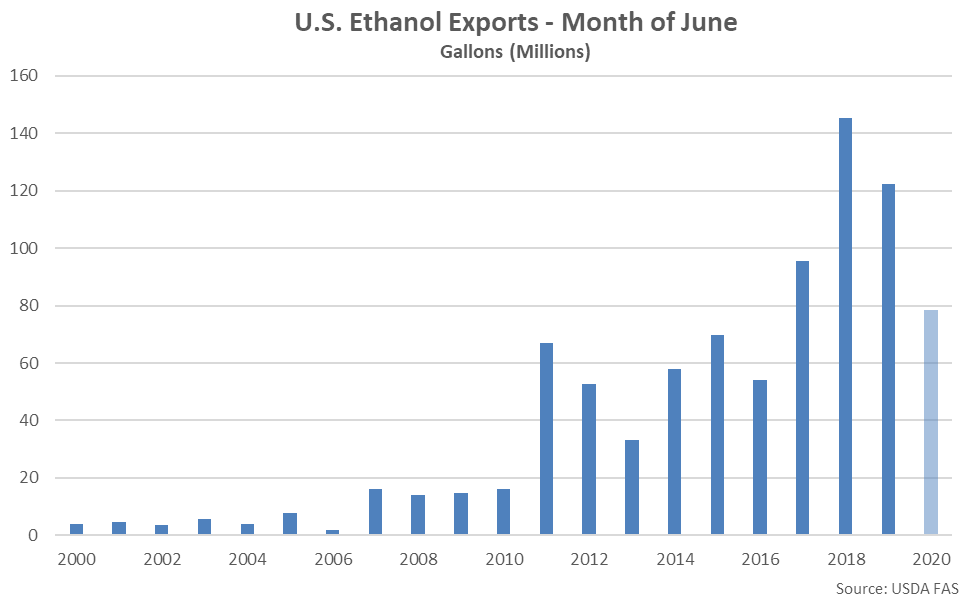

Jun ’20 U.S. Ethanol Export Volumes Reached a Four Year Seasonal Low Level

Jun ’20 U.S. Ethanol Export Volumes Reached a Four Year Seasonal Low Level

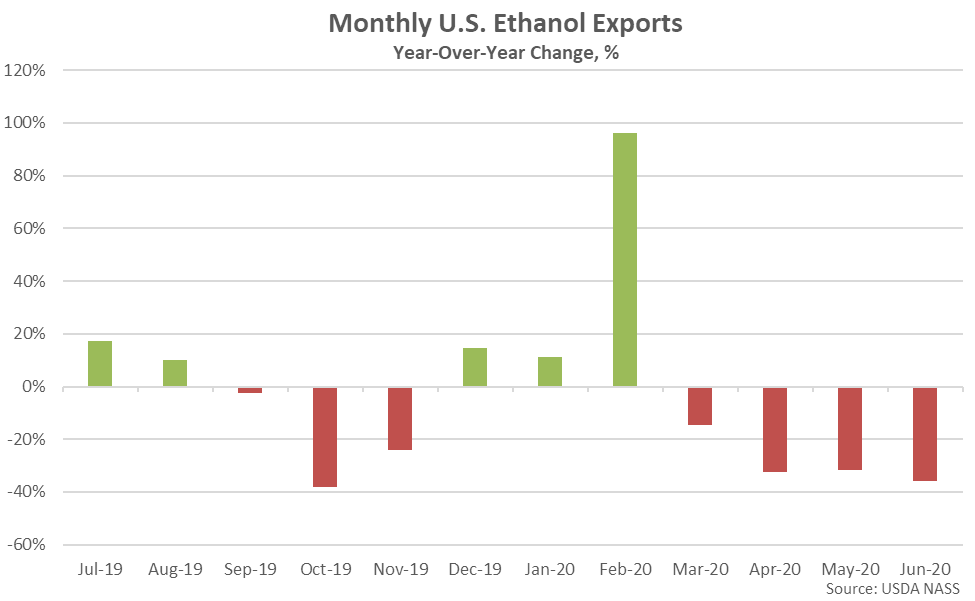

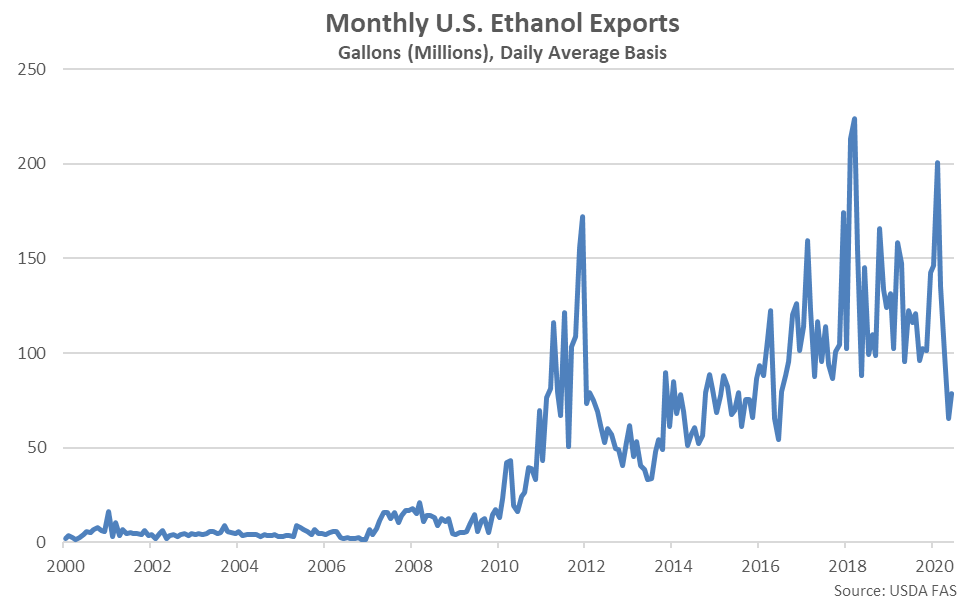

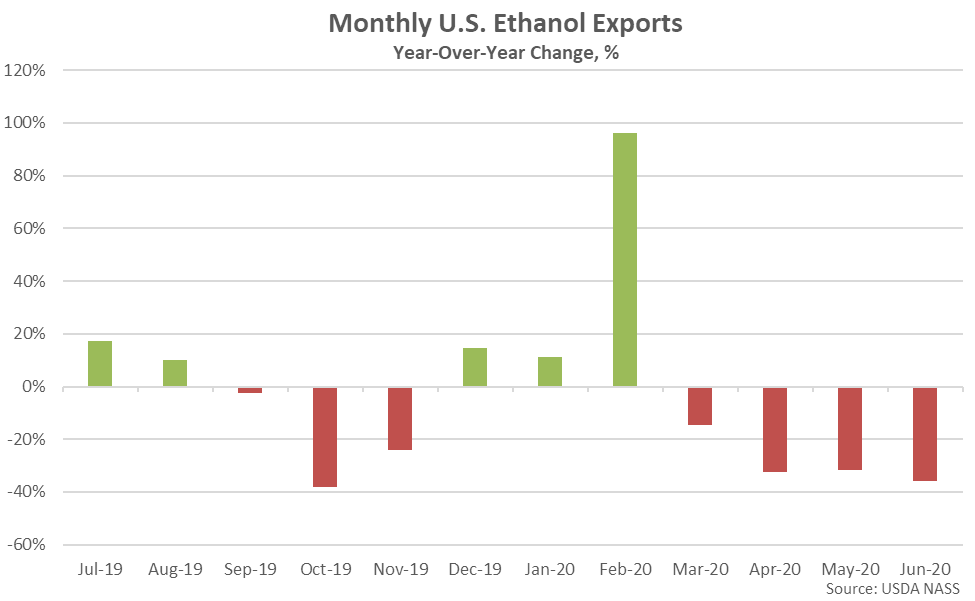

The Jun ’20 YOY Decline in U.S. Ethanol Export Volumes was the Fourth Experienced in a Row

The Jun ’20 YOY Decline in U.S. Ethanol Export Volumes was the Fourth Experienced in a Row

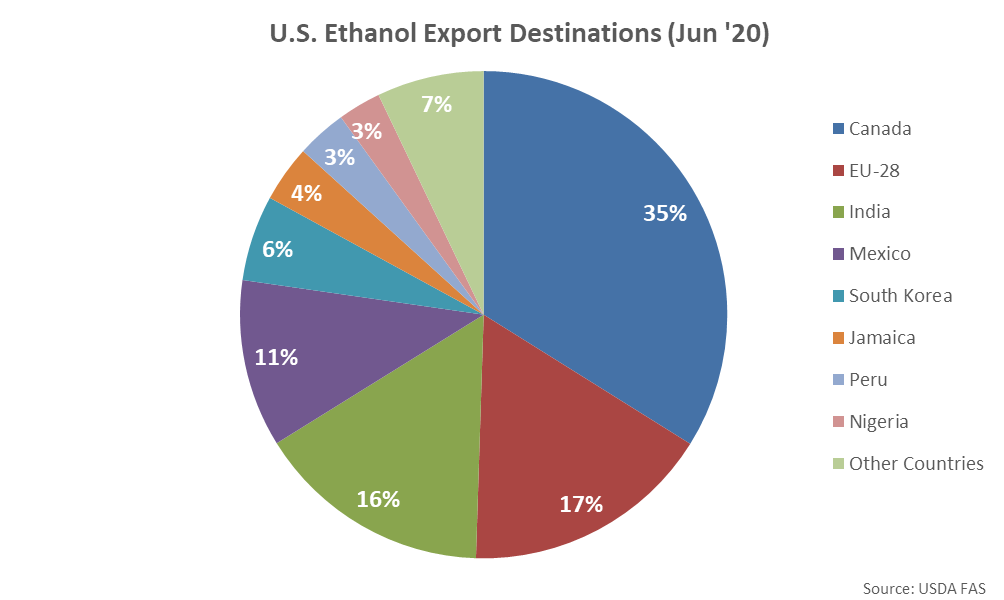

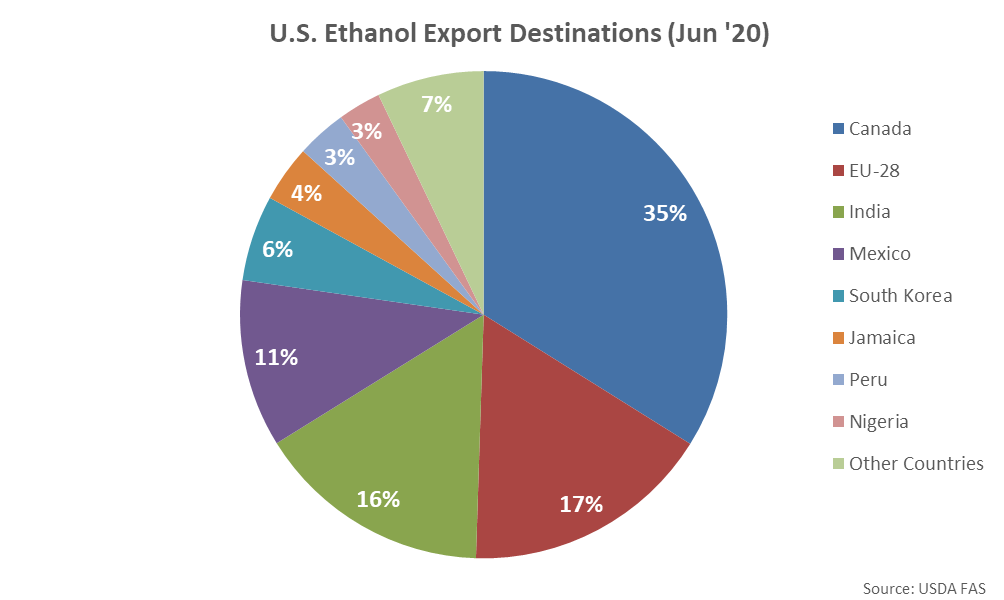

Canada and the EU-28 Were the Top Destinations for U.S. Ethanol Exports During Jun ’20

Canada and the EU-28 Were the Top Destinations for U.S. Ethanol Exports During Jun ’20

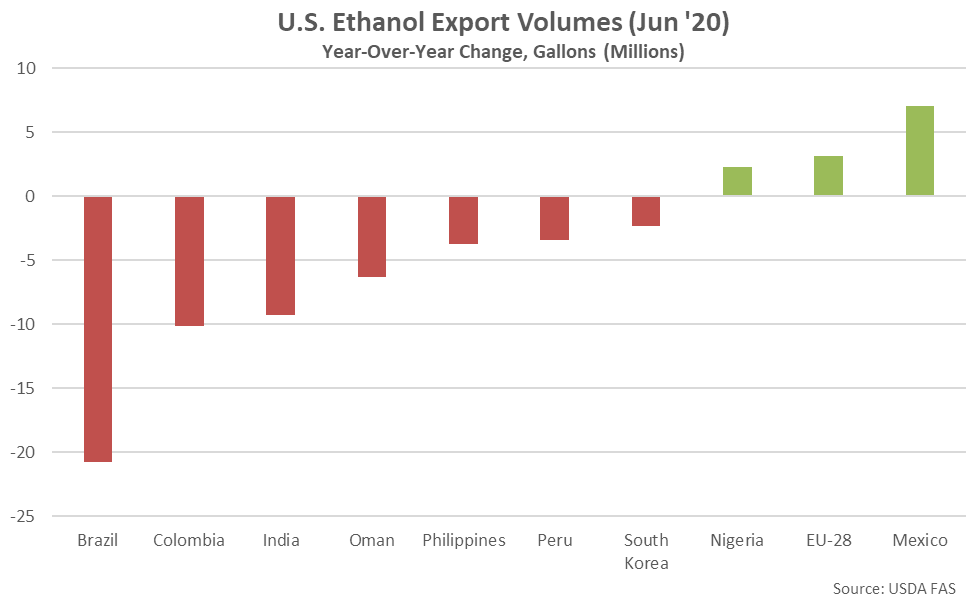

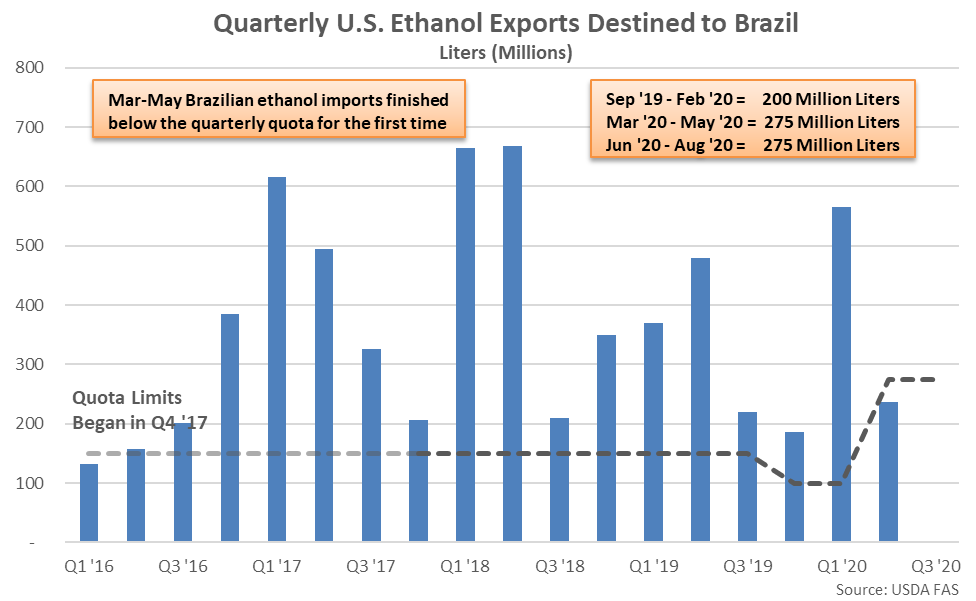

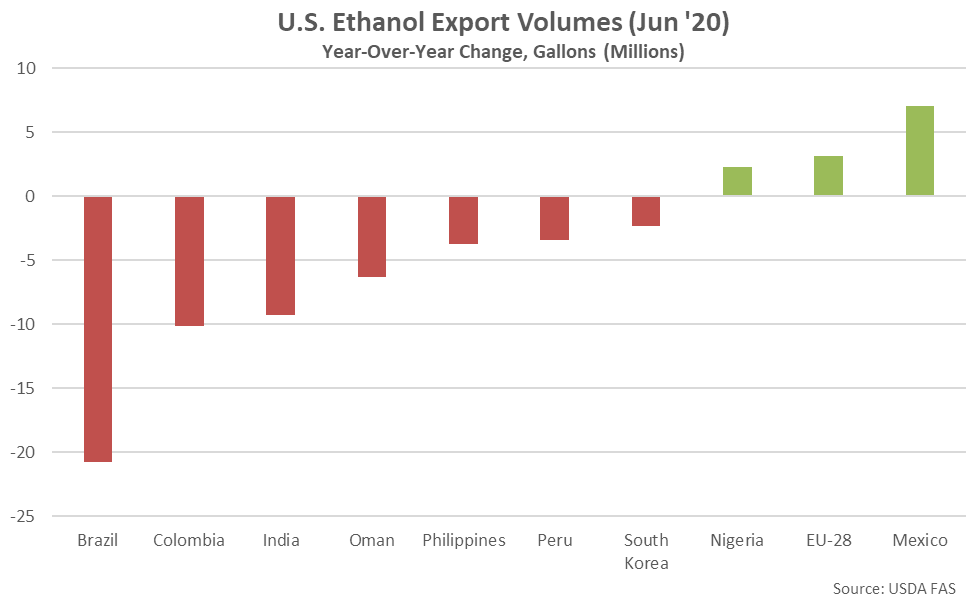

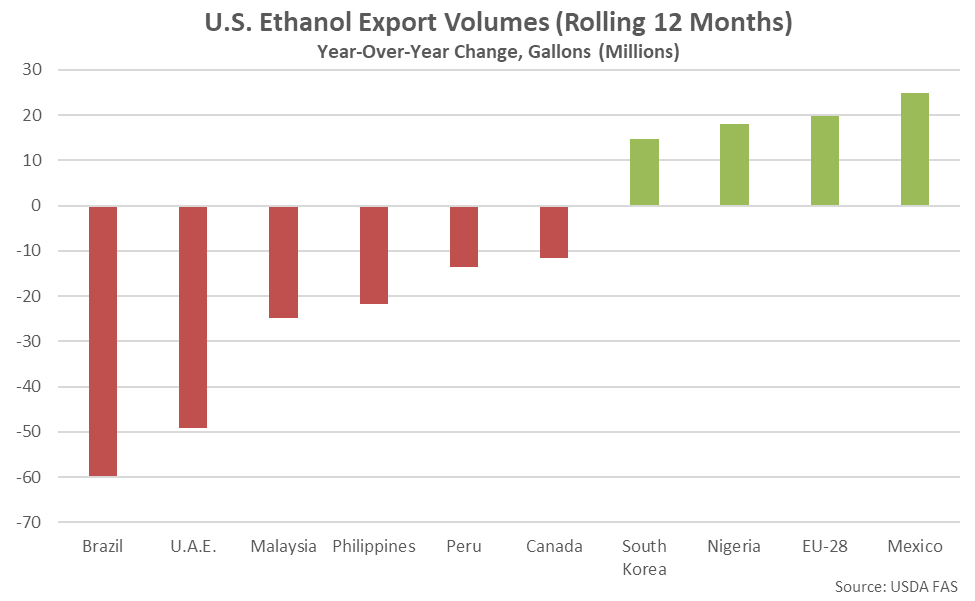

Jun ’20 U.S. Ethanol Volumes Destined to Brazil Declined Most Significantly YOY

Jun ’20 U.S. Ethanol Volumes Destined to Brazil Declined Most Significantly YOY

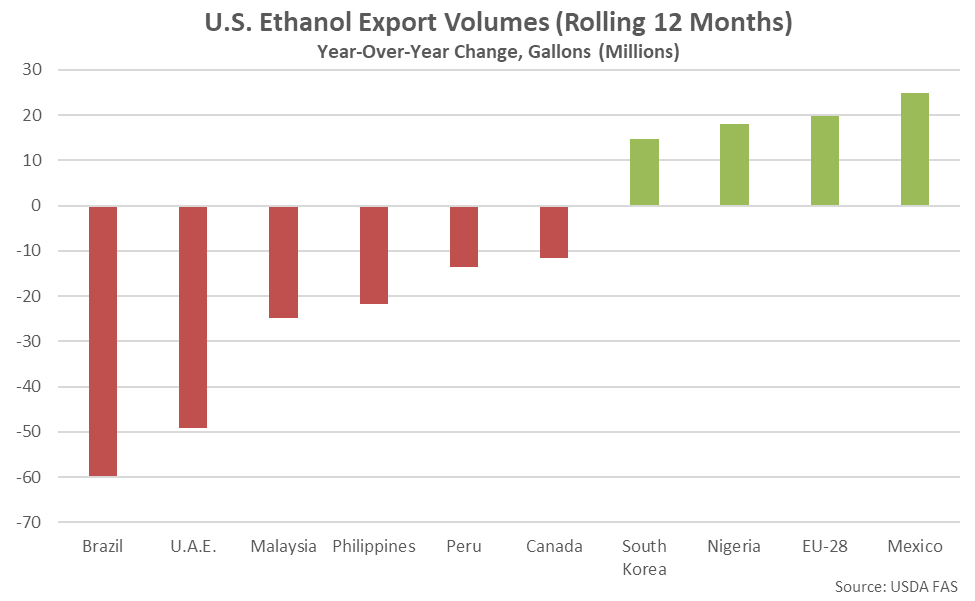

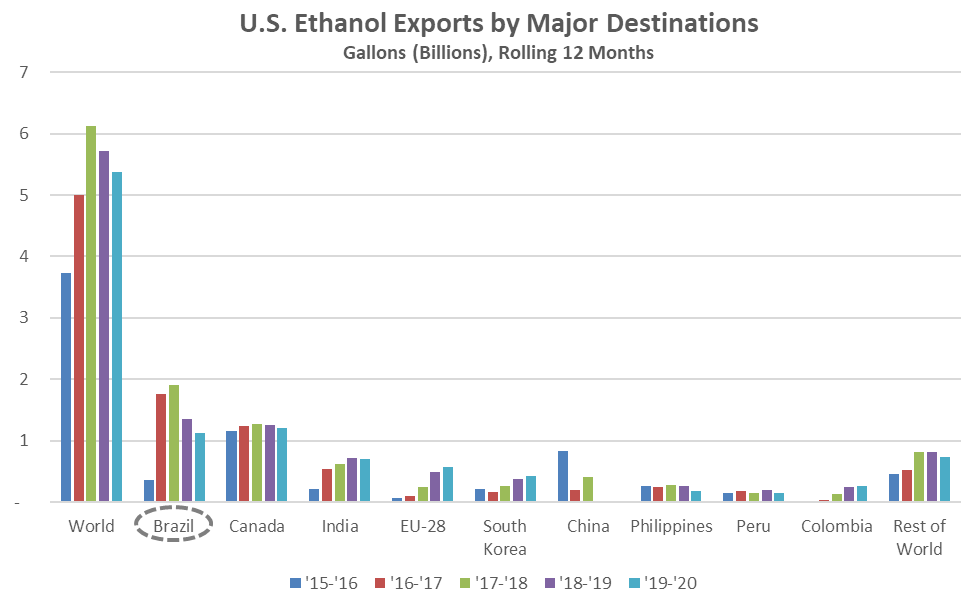

U.S. Ethanol Export Volumes Destined to Brazil Down the Most Over the Past 12 Months

U.S. Ethanol Export Volumes Destined to Brazil Down the Most Over the Past 12 Months

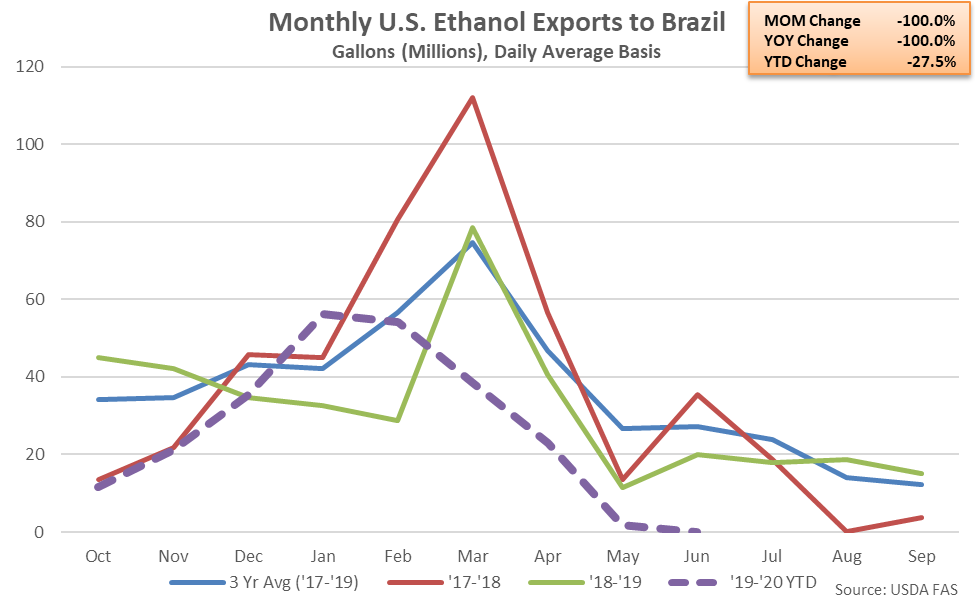

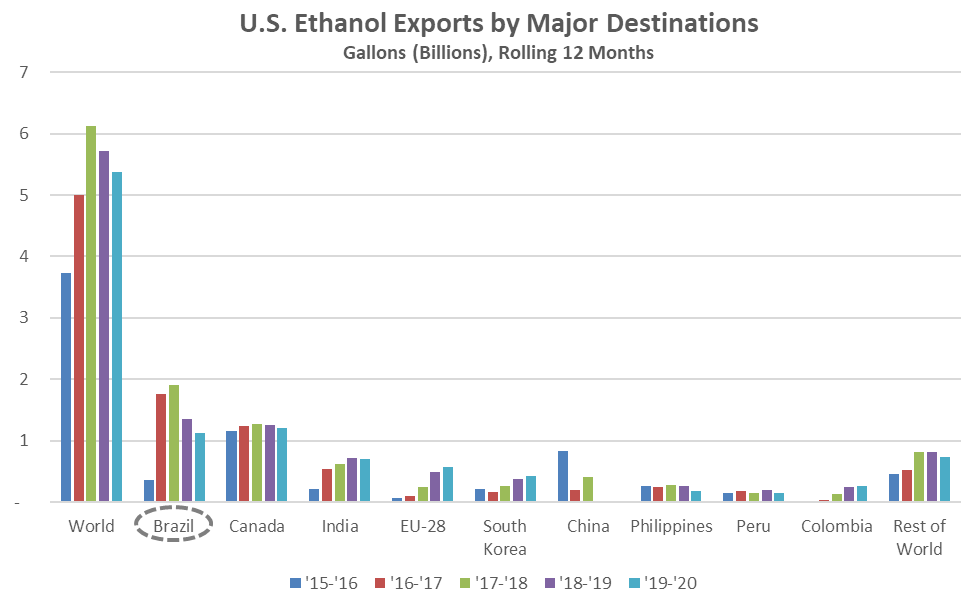

U.S. Ethanol Export Volumes Destined to Brazil are on Pace to Reach a Four Year Low Level

U.S. Ethanol Export Volumes Destined to Brazil are on Pace to Reach a Four Year Low Level

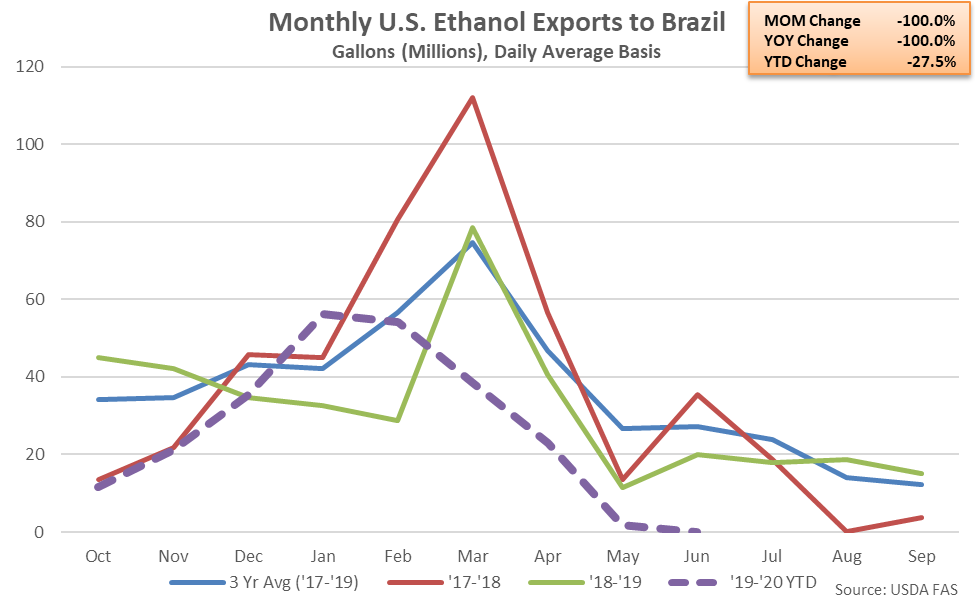

Jun ’20 U.S. Ethanol Exports to Brazil Declined to a Four and a Half Year Low Level

Jun ’20 U.S. Ethanol Exports to Brazil Declined to a Four and a Half Year Low Level

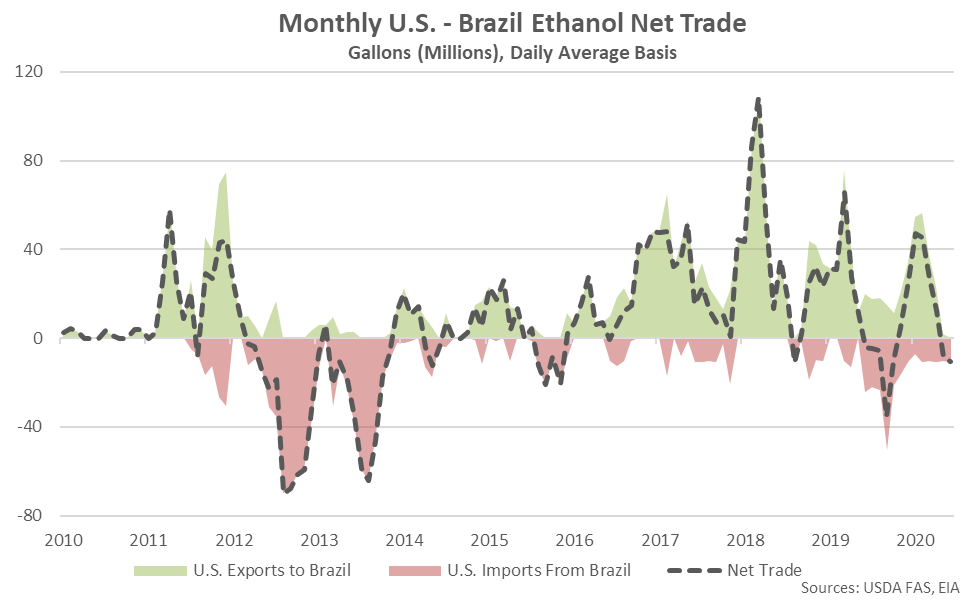

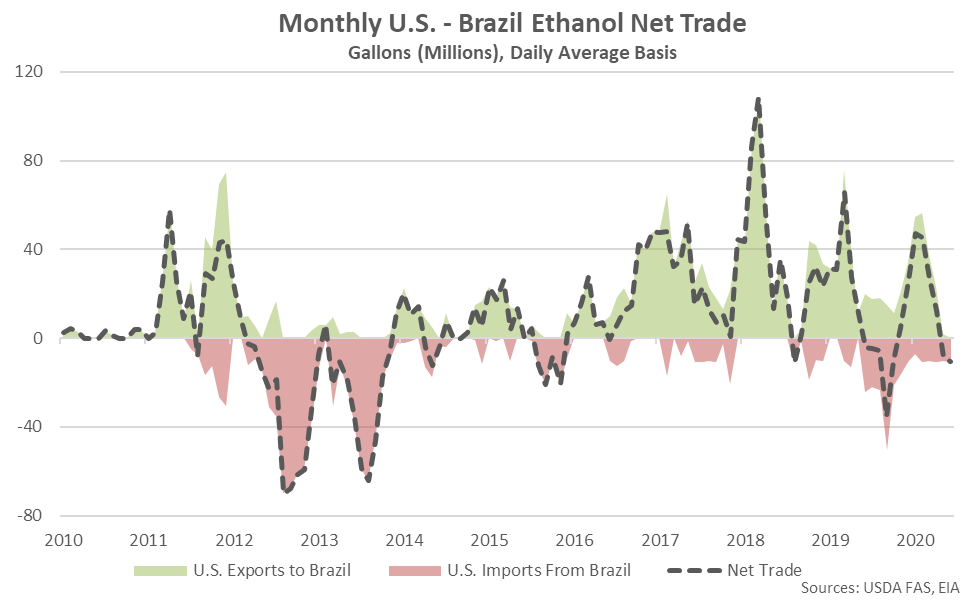

Jun ’20 U.S-Brazil Net Trade is Expected to Finish Negative for the Second Consecutive Month

Jun ’20 U.S-Brazil Net Trade is Expected to Finish Negative for the Second Consecutive Month

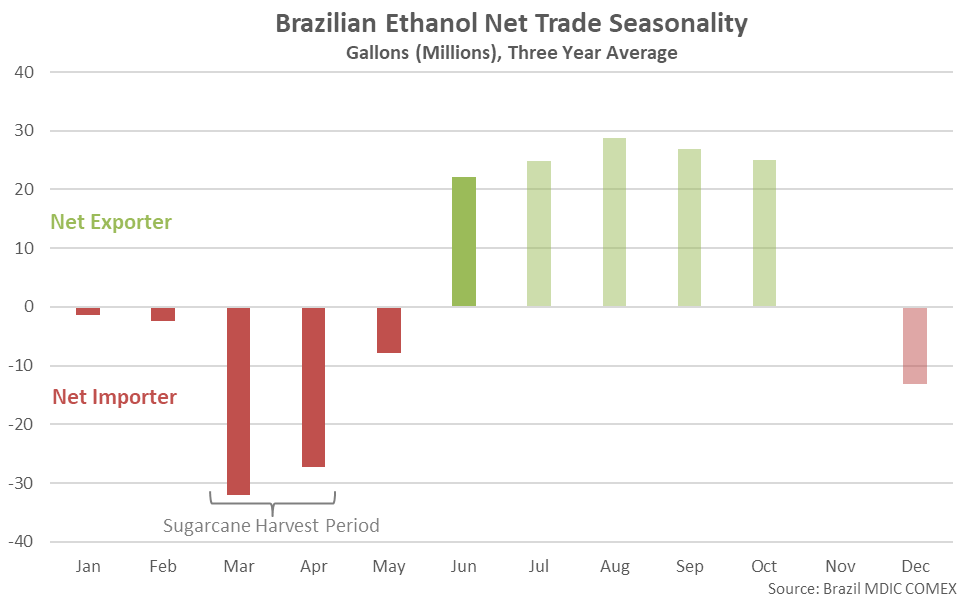

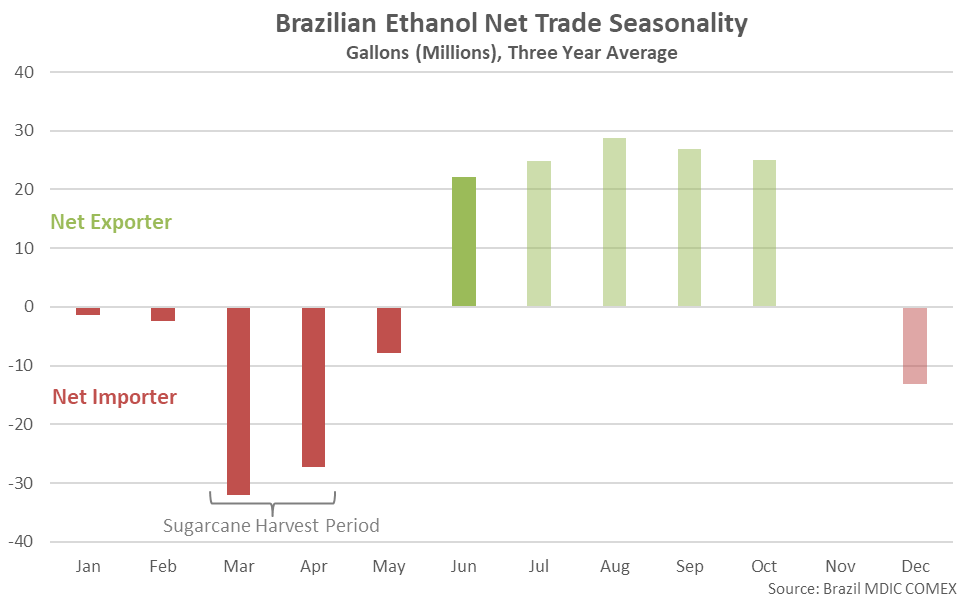

Brazil is Typically a Net Exporter of Ethanol Throughout the Month of June

Brazil is Typically a Net Exporter of Ethanol Throughout the Month of June

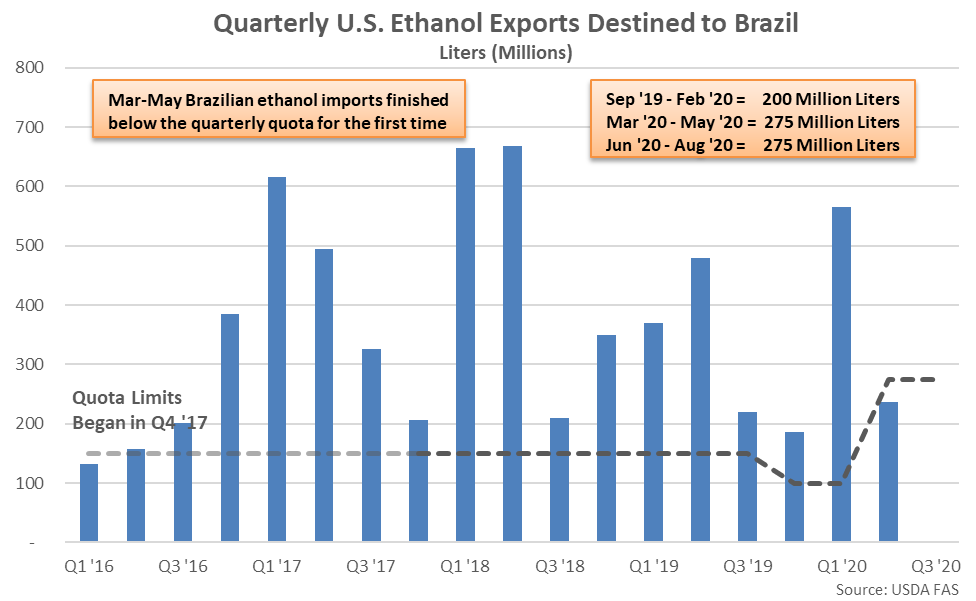

A 20% Tariff on U.S. Ethanol Exports Destined to Brazil Took Effect Beginning Dec ’17

A 20% Tariff on U.S. Ethanol Exports Destined to Brazil Took Effect Beginning Dec ’17

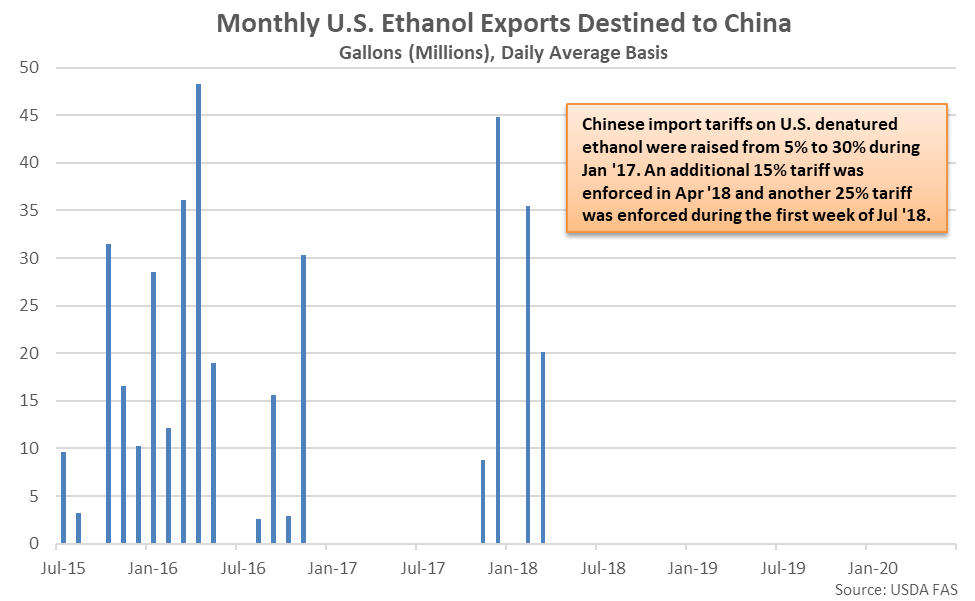

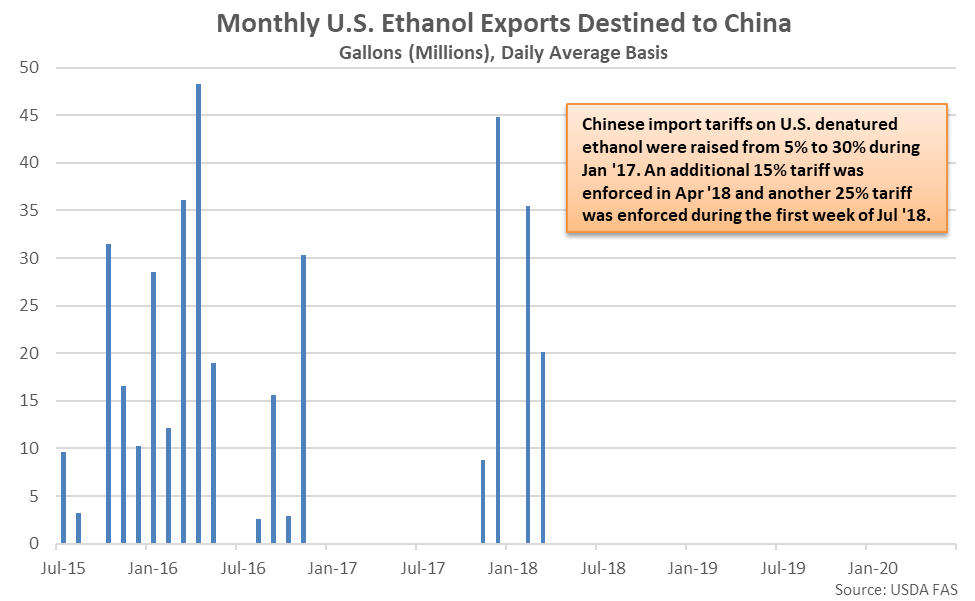

Jun ’20 U.S. Ethanol Export Volumes Destined to China Remained Minimal

Jun ’20 U.S. Ethanol Export Volumes Destined to China Remained Minimal

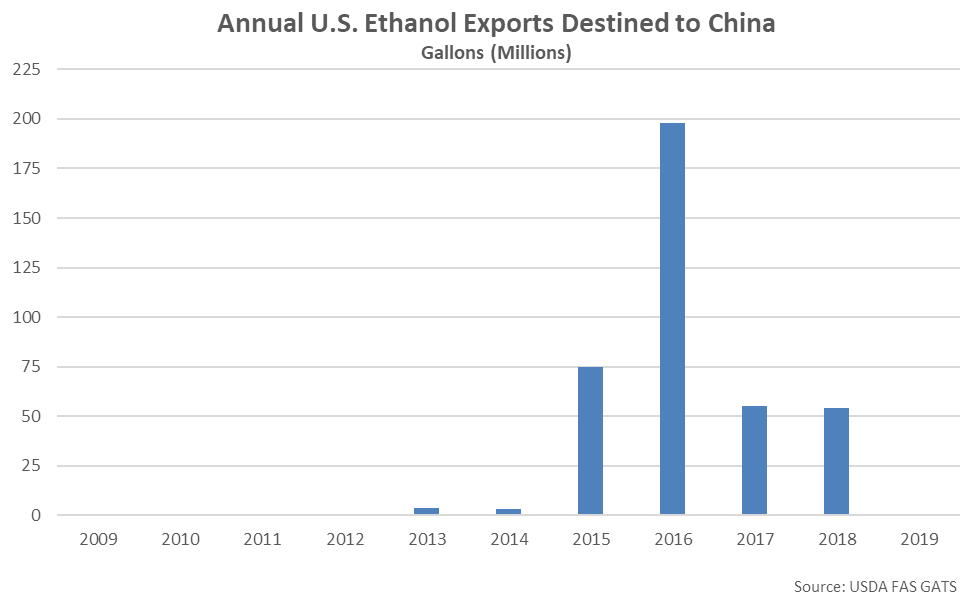

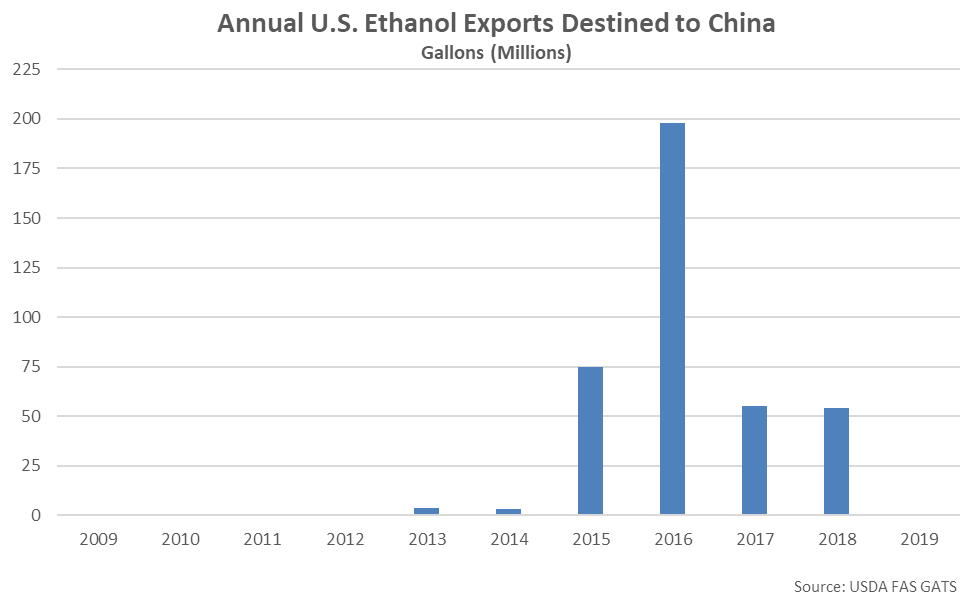

2019 Annual U.S. Ethanol Export Volumes Destined to China Reached a Seven Year Low Level

2019 Annual U.S. Ethanol Export Volumes Destined to China Reached a Seven Year Low Level

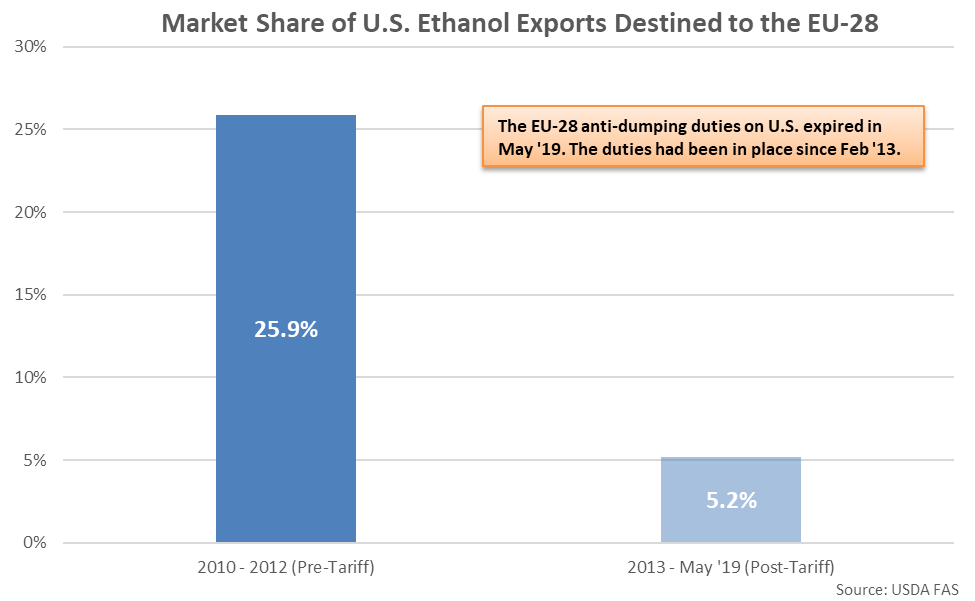

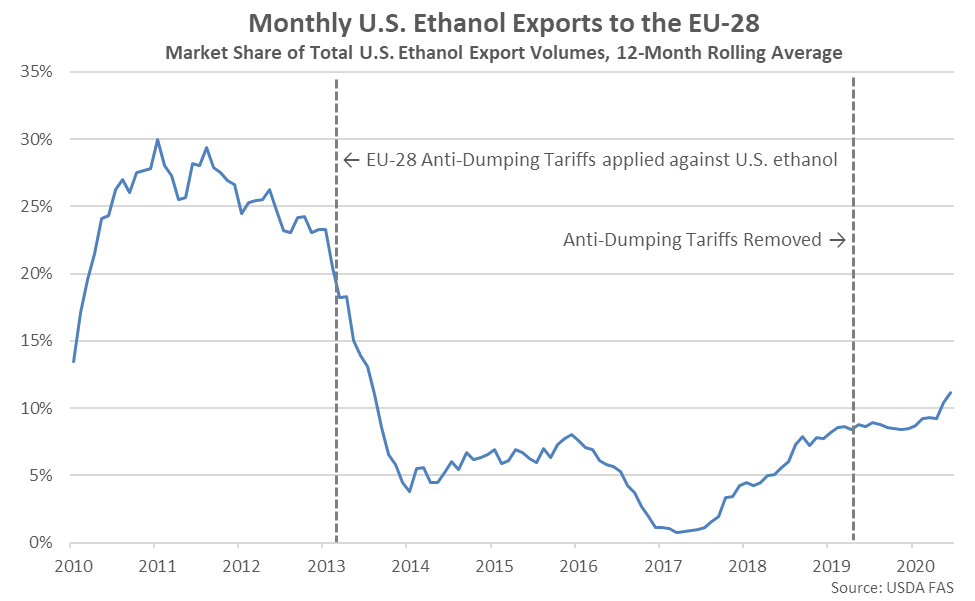

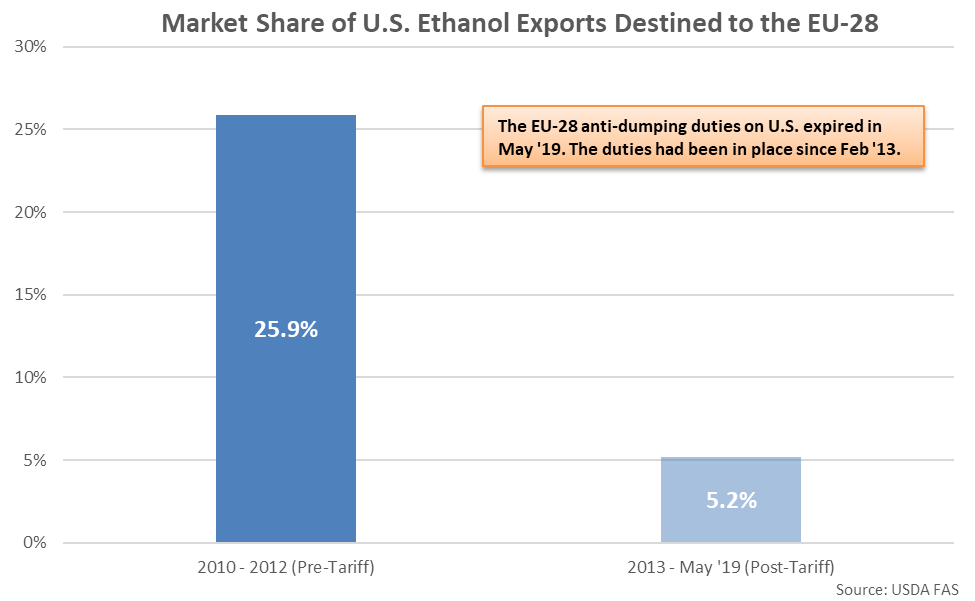

The EU-28 Declined to Reinstate Anti-Dumping Duties on U.S. Ethanol Exports During Jun ’19

The EU-28 Declined to Reinstate Anti-Dumping Duties on U.S. Ethanol Exports During Jun ’19

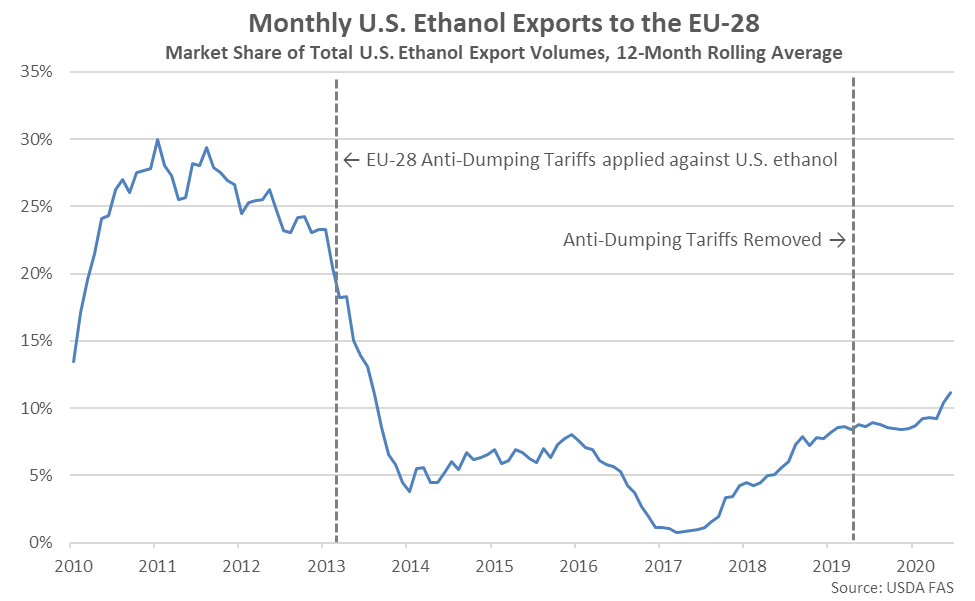

12-Mo Rolling Average EU-28 Market Share Increased to a Six and a Half Year High Level

12-Mo Rolling Average EU-28 Market Share Increased to a Six and a Half Year High Level

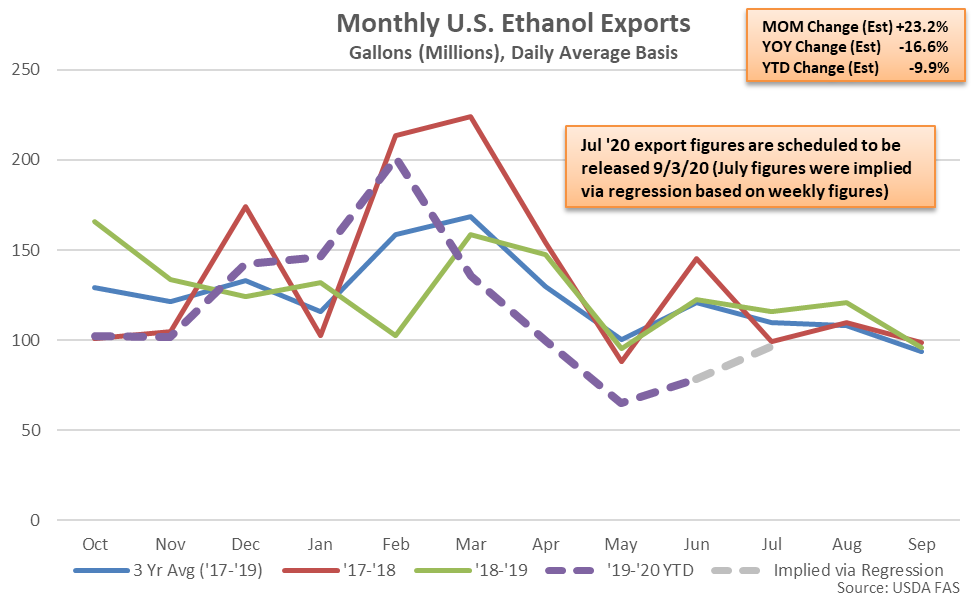

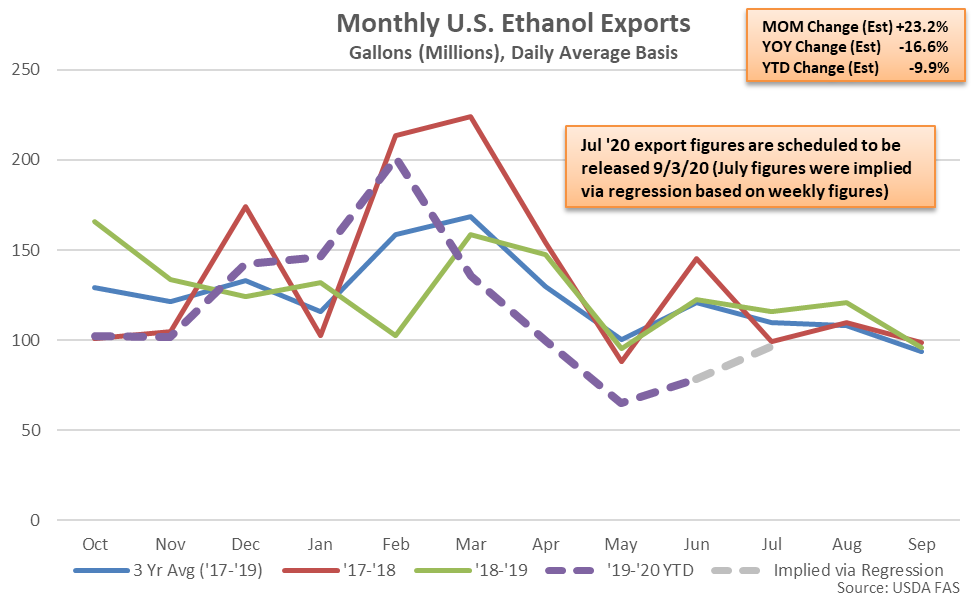

Jul ’20 Ethanol Exports are Projected to Remain Lower YOY, Down 16.6%

Jul ’20 Ethanol Exports are Projected to Remain Lower YOY, Down 16.6%

Jun ’20 U.S. Ethanol Export Volumes Increased 20.1% MOM but Remained Down 35.8% YOY

Jun ’20 U.S. Ethanol Export Volumes Increased 20.1% MOM but Remained Down 35.8% YOY

Jun ’20 U.S. Ethanol Export Volumes Reached a Four Year Seasonal Low Level

Jun ’20 U.S. Ethanol Export Volumes Reached a Four Year Seasonal Low Level

The Jun ’20 YOY Decline in U.S. Ethanol Export Volumes was the Fourth Experienced in a Row

The Jun ’20 YOY Decline in U.S. Ethanol Export Volumes was the Fourth Experienced in a Row

Canada and the EU-28 Were the Top Destinations for U.S. Ethanol Exports During Jun ’20

Canada and the EU-28 Were the Top Destinations for U.S. Ethanol Exports During Jun ’20

Jun ’20 U.S. Ethanol Volumes Destined to Brazil Declined Most Significantly YOY

Jun ’20 U.S. Ethanol Volumes Destined to Brazil Declined Most Significantly YOY

U.S. Ethanol Export Volumes Destined to Brazil Down the Most Over the Past 12 Months

U.S. Ethanol Export Volumes Destined to Brazil Down the Most Over the Past 12 Months

U.S. Ethanol Export Volumes Destined to Brazil are on Pace to Reach a Four Year Low Level

U.S. Ethanol Export Volumes Destined to Brazil are on Pace to Reach a Four Year Low Level

Jun ’20 U.S. Ethanol Exports to Brazil Declined to a Four and a Half Year Low Level

Jun ’20 U.S. Ethanol Exports to Brazil Declined to a Four and a Half Year Low Level

Jun ’20 U.S-Brazil Net Trade is Expected to Finish Negative for the Second Consecutive Month

Jun ’20 U.S-Brazil Net Trade is Expected to Finish Negative for the Second Consecutive Month

Brazil is Typically a Net Exporter of Ethanol Throughout the Month of June

Brazil is Typically a Net Exporter of Ethanol Throughout the Month of June

A 20% Tariff on U.S. Ethanol Exports Destined to Brazil Took Effect Beginning Dec ’17

A 20% Tariff on U.S. Ethanol Exports Destined to Brazil Took Effect Beginning Dec ’17

Jun ’20 U.S. Ethanol Export Volumes Destined to China Remained Minimal

Jun ’20 U.S. Ethanol Export Volumes Destined to China Remained Minimal

2019 Annual U.S. Ethanol Export Volumes Destined to China Reached a Seven Year Low Level

2019 Annual U.S. Ethanol Export Volumes Destined to China Reached a Seven Year Low Level

The EU-28 Declined to Reinstate Anti-Dumping Duties on U.S. Ethanol Exports During Jun ’19

The EU-28 Declined to Reinstate Anti-Dumping Duties on U.S. Ethanol Exports During Jun ’19

12-Mo Rolling Average EU-28 Market Share Increased to a Six and a Half Year High Level

12-Mo Rolling Average EU-28 Market Share Increased to a Six and a Half Year High Level

Jul ’20 Ethanol Exports are Projected to Remain Lower YOY, Down 16.6%

Jul ’20 Ethanol Exports are Projected to Remain Lower YOY, Down 16.6%