U.S. Livestock Cold Storage Update – Jan ’21

Executive Summary

U.S. cold storage figures provided by the USDA were recently updated with values spanning through Dec ’20. Highlights from the updated report include:

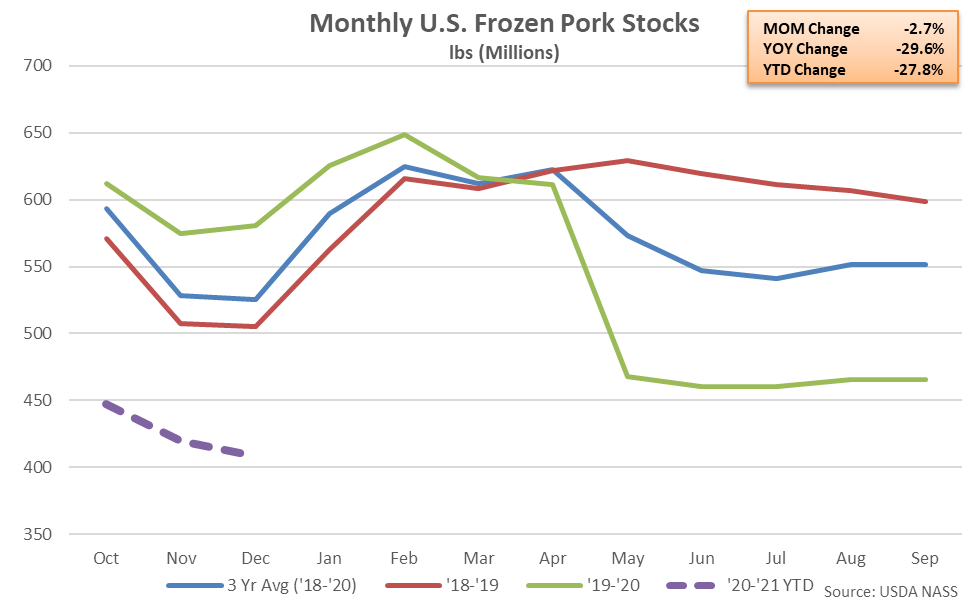

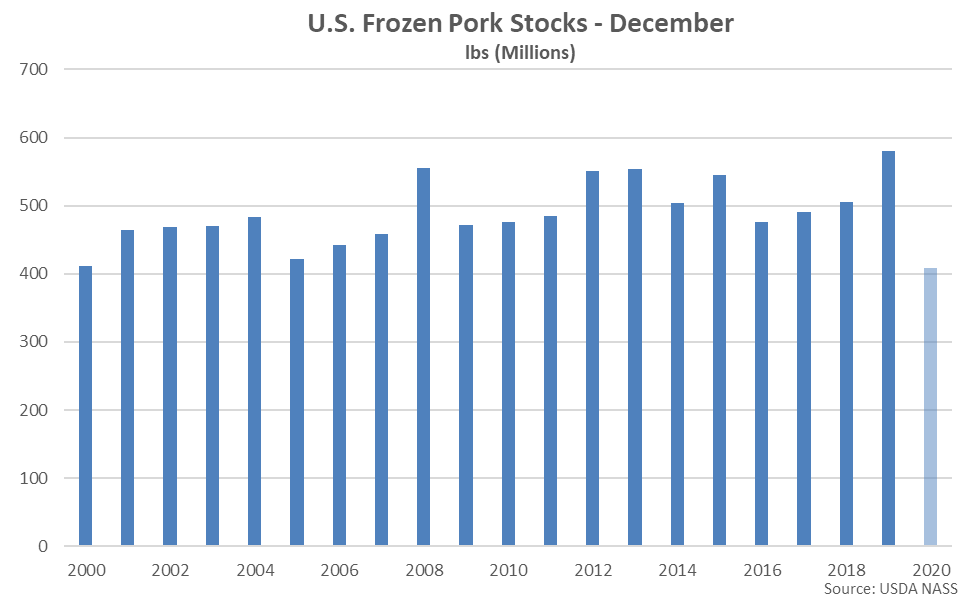

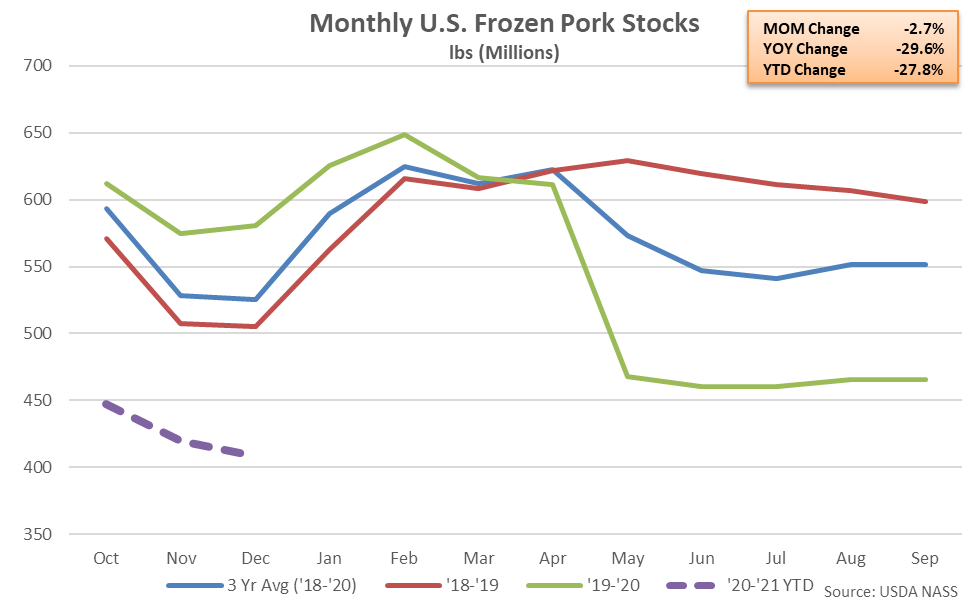

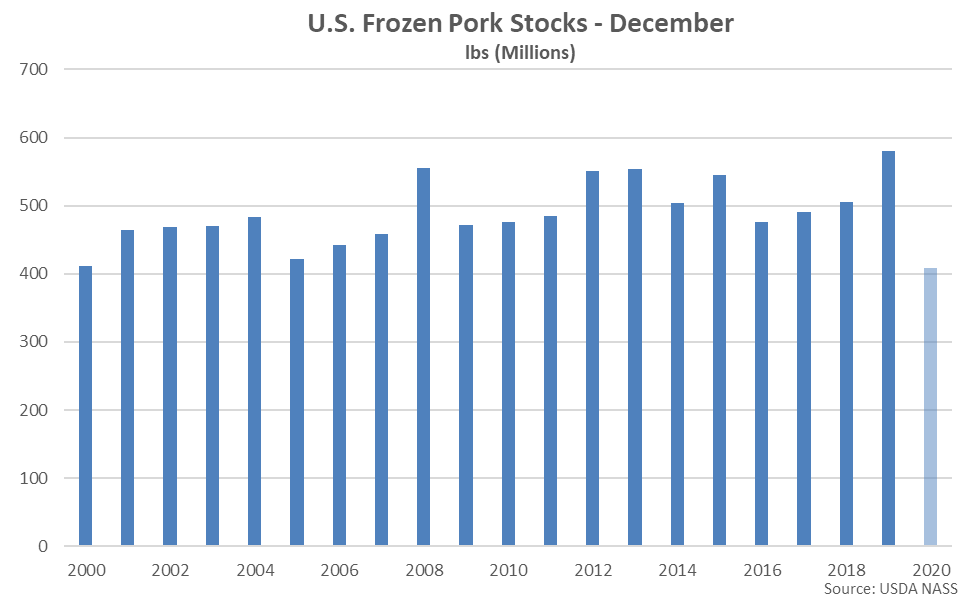

According to the USDA, U.S. frozen pork stocks declined to a ten year low level throughout Dec ’20, finishing 29.6% below previous year volumes. Pork stocks reached a 23 year low seasonal level for the month of December. The YOY decline in pork stocks was the ninth experienced in a row and the largest experienced throughout the past 34 years on a percentage basis. Frozen pork stocks had finished higher on a YOY basis over 11 consecutive months prior to the nine most recent YOY declines. The month-over-month decline in pork stocks of 11.4 million pounds, or 2.7%, was larger than the ten year average November – December seasonal decline in stocks of 5.8 million pounds, or 1.1%.

According to the USDA, U.S. frozen pork stocks declined to a ten year low level throughout Dec ’20, finishing 29.6% below previous year volumes. Pork stocks reached a 23 year low seasonal level for the month of December. The YOY decline in pork stocks was the ninth experienced in a row and the largest experienced throughout the past 34 years on a percentage basis. Frozen pork stocks had finished higher on a YOY basis over 11 consecutive months prior to the nine most recent YOY declines. The month-over-month decline in pork stocks of 11.4 million pounds, or 2.7%, was larger than the ten year average November – December seasonal decline in stocks of 5.8 million pounds, or 1.1%.

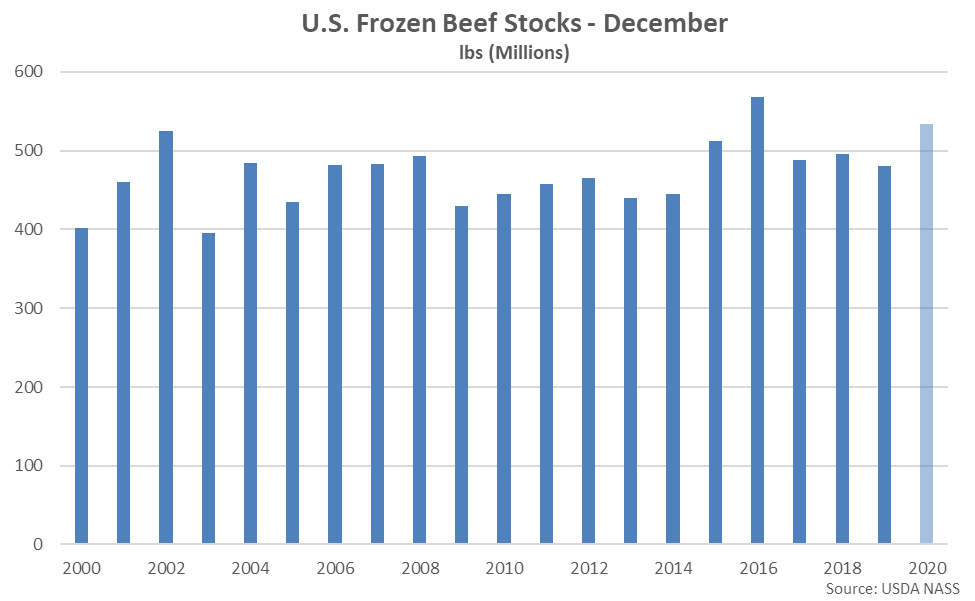

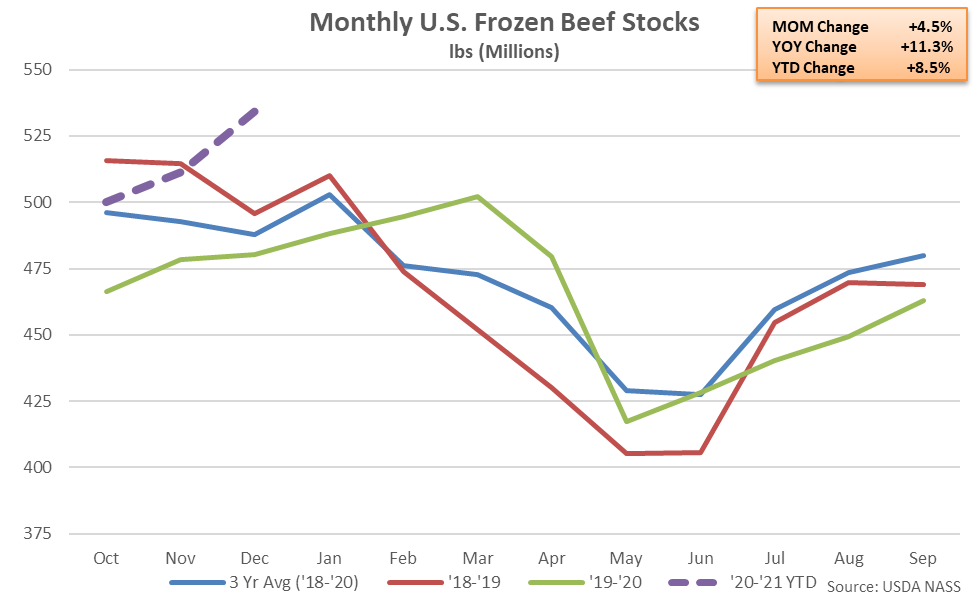

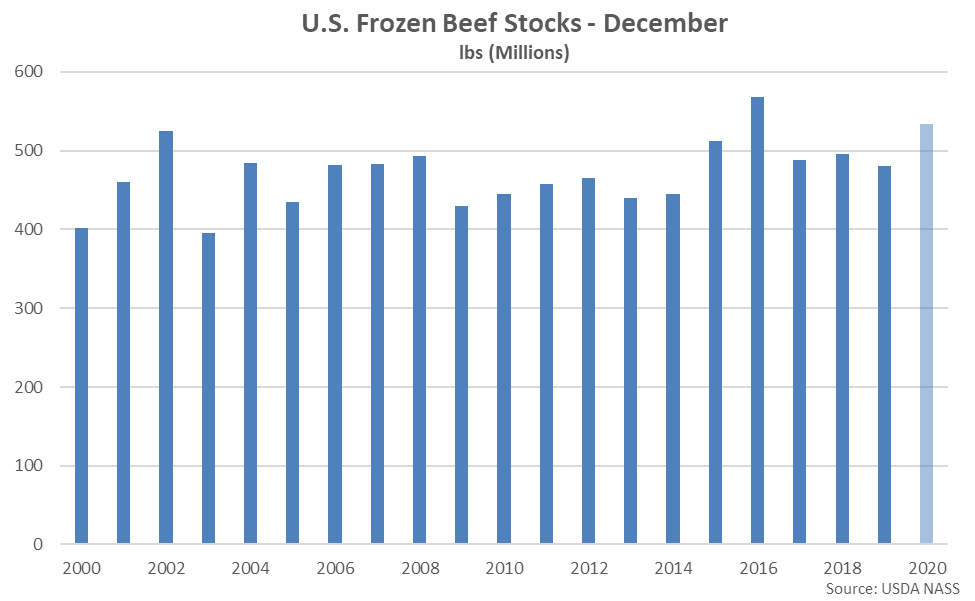

Beef – Stocks Reach a Three and a Half Year High Level, Finish up 11.3% YOY

Beef – Stocks Reach a Three and a Half Year High Level, Finish up 11.3% YOY

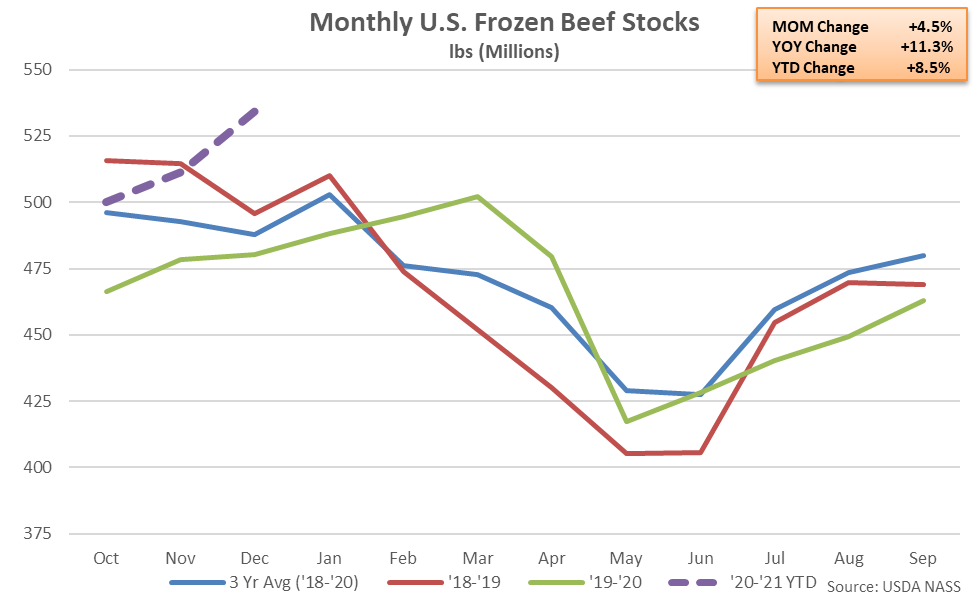

U.S. frozen beef stocks increased seasonally to a three and a half year high level throughout Dec ’20, finishing 11.3% higher on a YOY basis. Beef stocks reached a four year high seasonal level for the month of December. The YOY increase in beef stocks was the third experienced in a row and the largest experienced throughout the past eight months on a percentage basis. The MOM increase in beef stocks of 22.8 million pounds, or 4.5%, was larger than the ten year average November – December seasonal increase in stocks of 10.4 million pounds, or 2.4%.

U.S. frozen beef stocks increased seasonally to a three and a half year high level throughout Dec ’20, finishing 11.3% higher on a YOY basis. Beef stocks reached a four year high seasonal level for the month of December. The YOY increase in beef stocks was the third experienced in a row and the largest experienced throughout the past eight months on a percentage basis. The MOM increase in beef stocks of 22.8 million pounds, or 4.5%, was larger than the ten year average November – December seasonal increase in stocks of 10.4 million pounds, or 2.4%.

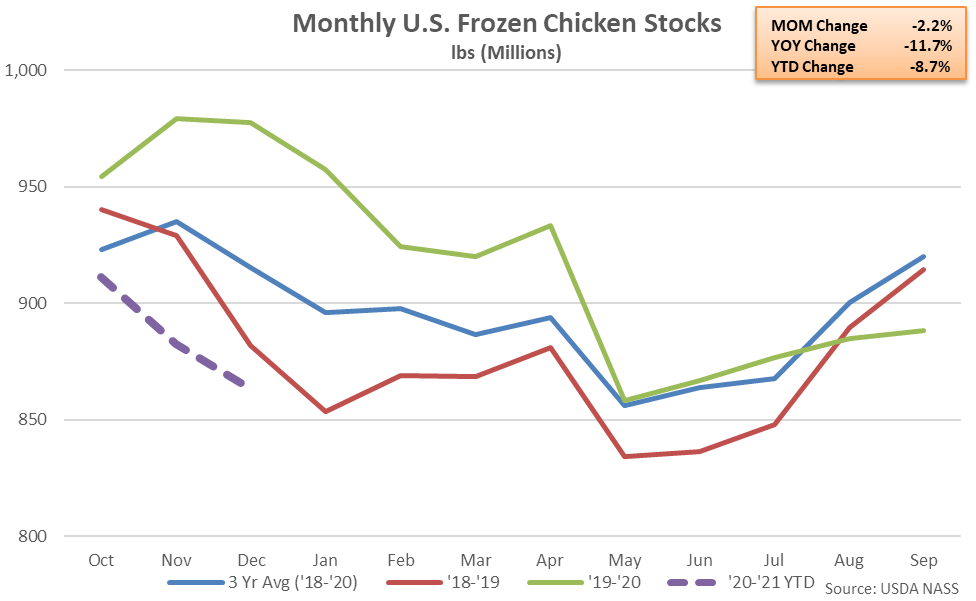

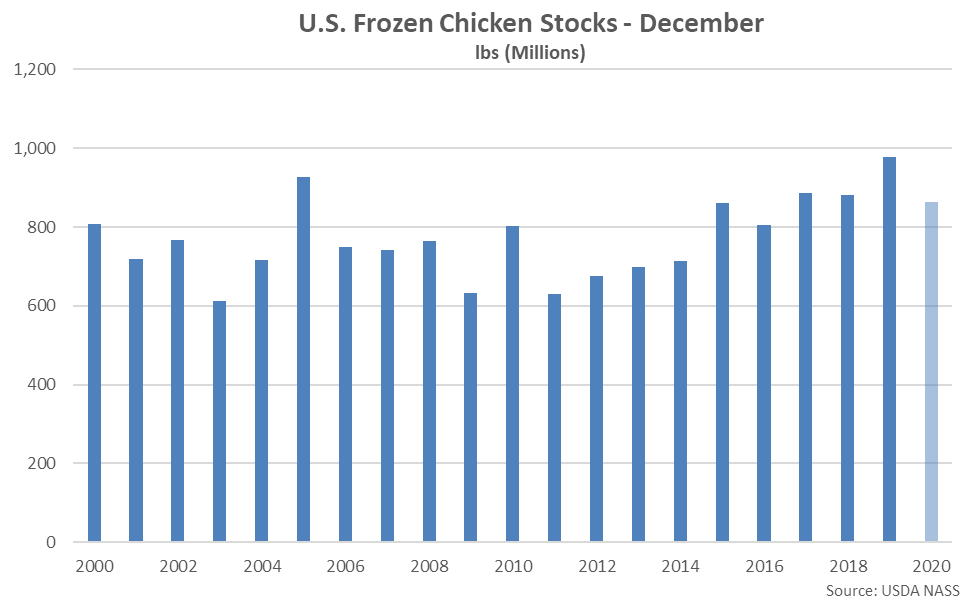

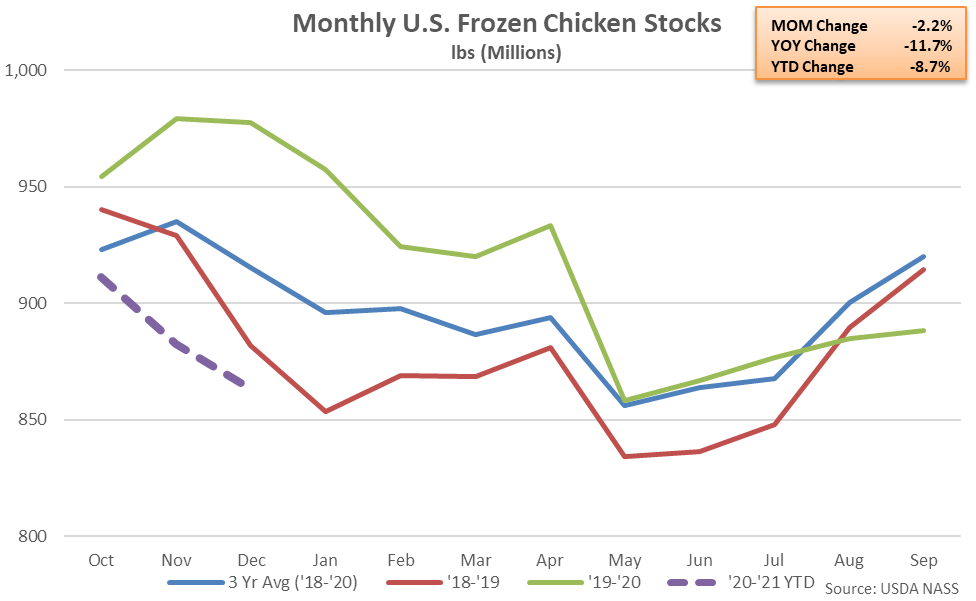

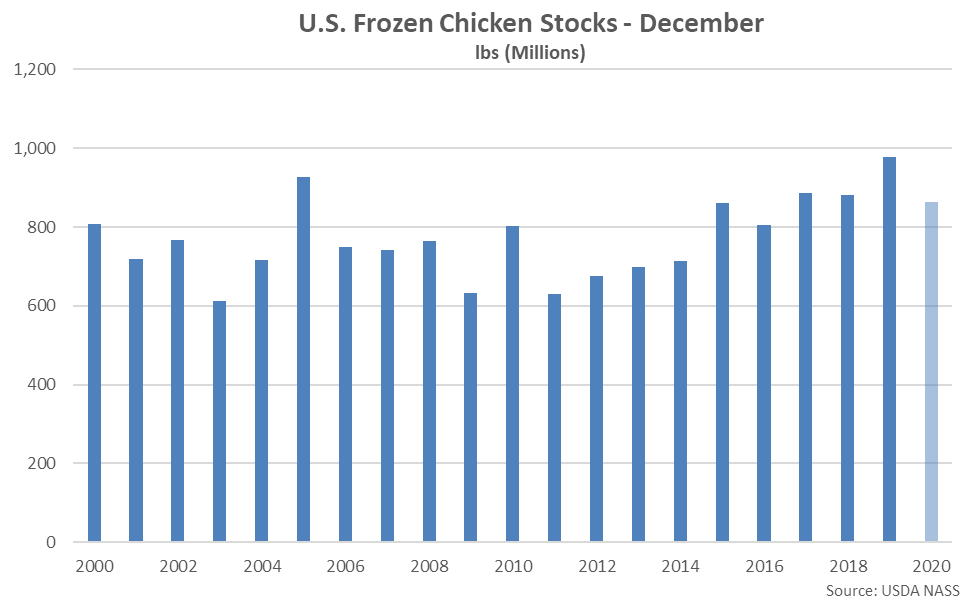

Chicken – Stocks Remain at a Four Year Low Seasonal Level, Finish Down 11.7% on a YOY Basis

Chicken – Stocks Remain at a Four Year Low Seasonal Level, Finish Down 11.7% on a YOY Basis

Dec ’20 U.S. frozen chicken stocks declined seasonally to a seven month low level while finishing 11.7% below previous year levels. Chicken stocks reached a four year low seasonal level for the month of December, finishing lower on a YOY basis for the fifth consecutive month. Chicken stocks had finished higher on a YOY basis over ten consecutive months prior to finishing lower over each of the past five months. The MOM decline in chicken stocks of 19.3 million pounds, or 2.2%, was larger than the ten year average November – December seasonal decline in stocks of 6.7 million pounds, or 0.7%.

Dec ’20 U.S. frozen chicken stocks declined seasonally to a seven month low level while finishing 11.7% below previous year levels. Chicken stocks reached a four year low seasonal level for the month of December, finishing lower on a YOY basis for the fifth consecutive month. Chicken stocks had finished higher on a YOY basis over ten consecutive months prior to finishing lower over each of the past five months. The MOM decline in chicken stocks of 19.3 million pounds, or 2.2%, was larger than the ten year average November – December seasonal decline in stocks of 6.7 million pounds, or 0.7%.

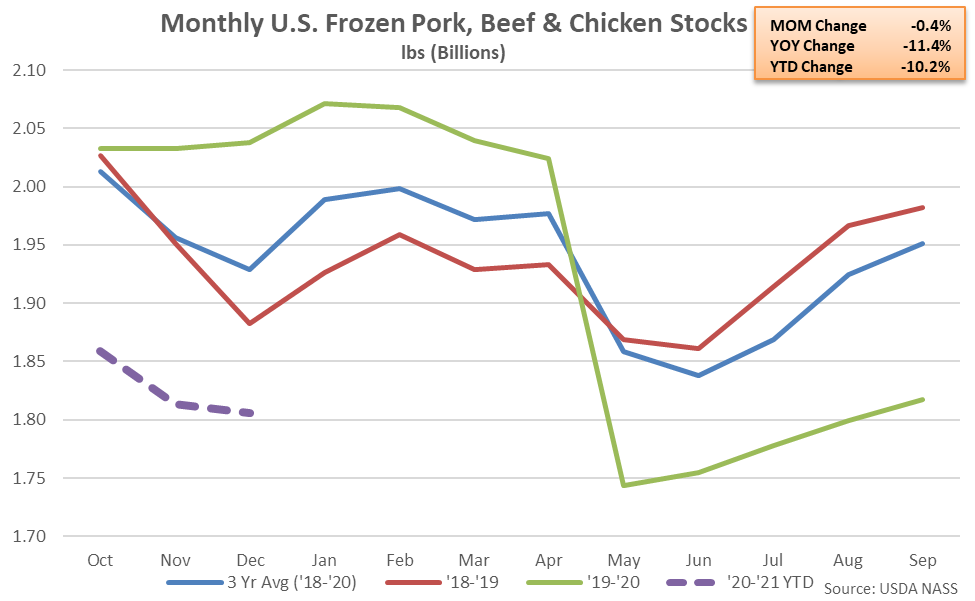

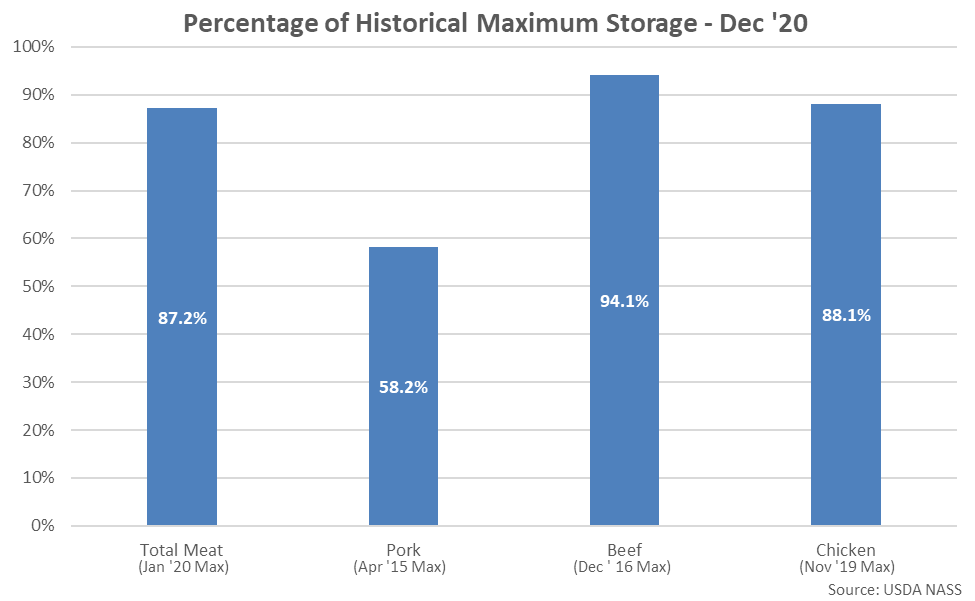

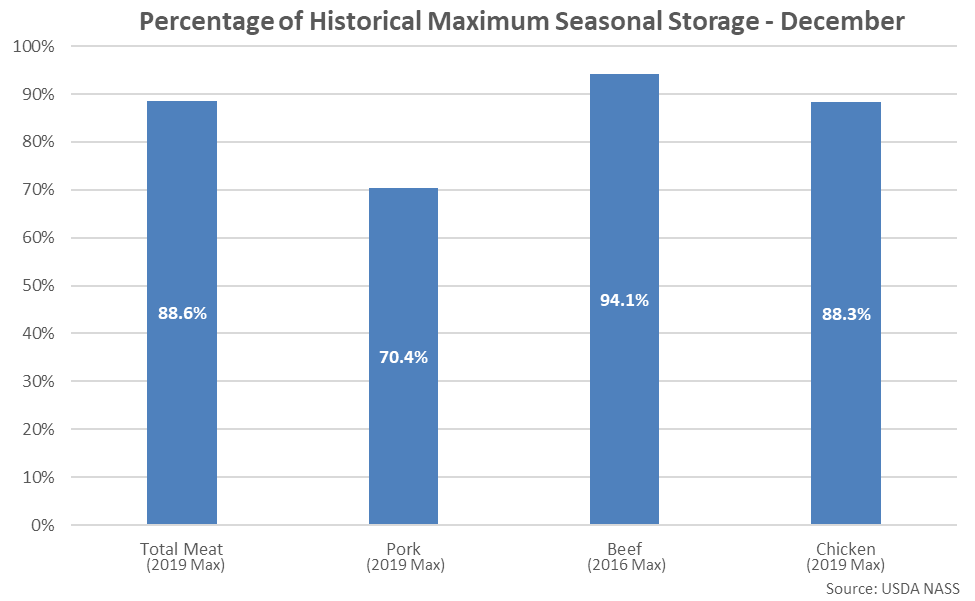

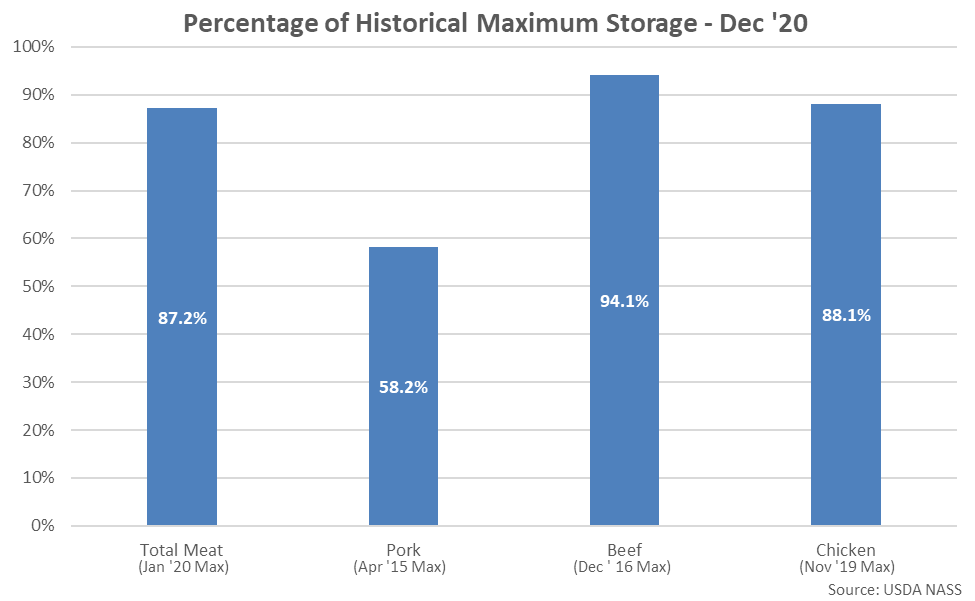

Overall, Dec ’20 combined U.S. pork, beef and chicken stocks finished 12.8% below the monthly record high level experienced throughout Jan ’20. Individually, Dec ’20 beef stocks finished six percent below the record high historical storage level, while chicken and pork stocks finished 12% and 42% below their respective maximum historical storage levels.

Overall, Dec ’20 combined U.S. pork, beef and chicken stocks finished 12.8% below the monthly record high level experienced throughout Jan ’20. Individually, Dec ’20 beef stocks finished six percent below the record high historical storage level, while chicken and pork stocks finished 12% and 42% below their respective maximum historical storage levels.

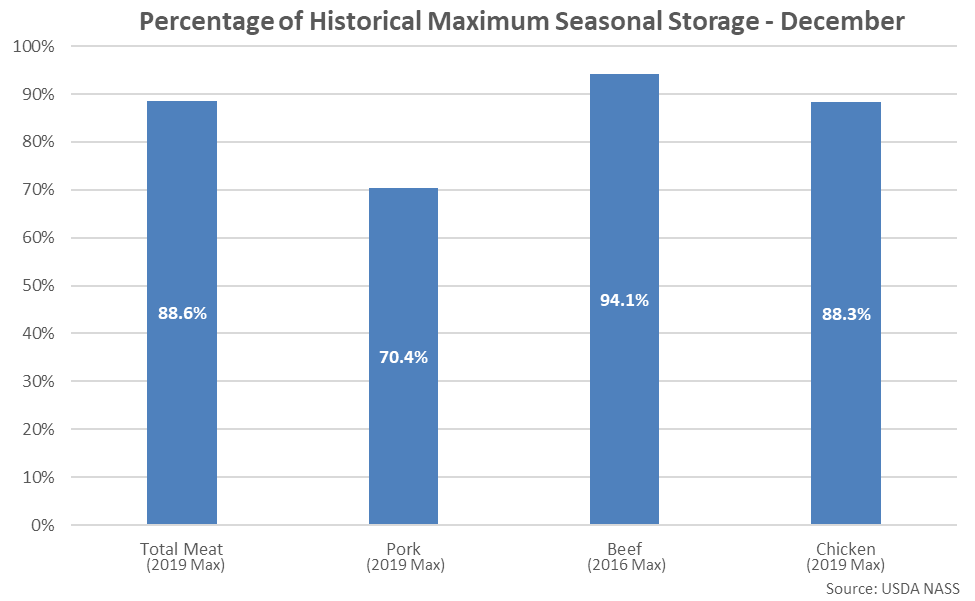

Dec ’20 combined U.S. pork, beef and chicken stocks declined to a six year low seasonal level, finishing 11.4% below the record high seasonal level experienced during December of 2019. Individually, Dec ’20 beef stocks finished six percent below the record high seasonal storage level while chicken and pork stocks finished 12% and 30% below record high seasonal storage levels, respectively.

Dec ’20 combined U.S. pork, beef and chicken stocks declined to a six year low seasonal level, finishing 11.4% below the record high seasonal level experienced during December of 2019. Individually, Dec ’20 beef stocks finished six percent below the record high seasonal storage level while chicken and pork stocks finished 12% and 30% below record high seasonal storage levels, respectively.

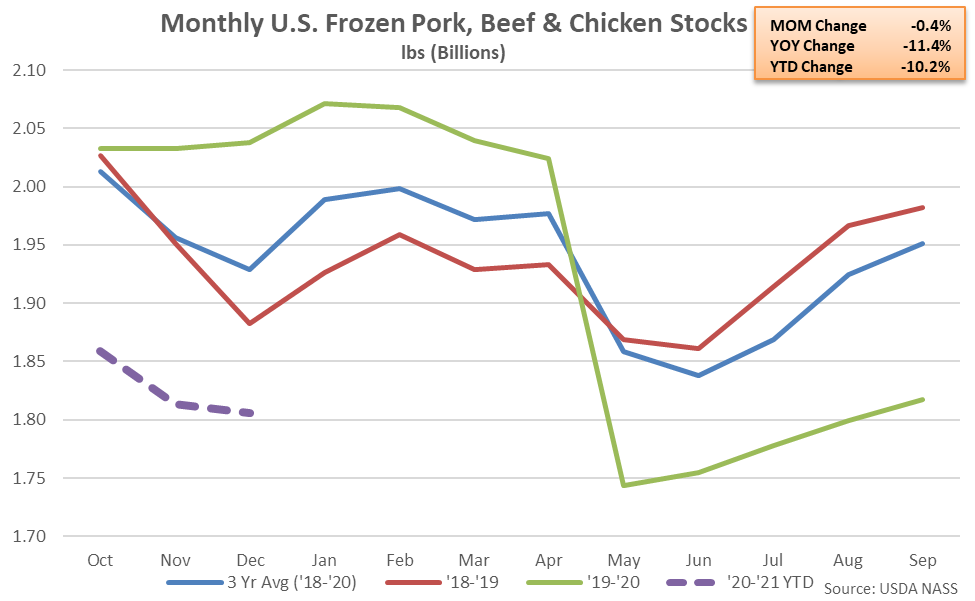

The Dec ’20 YOY decline in combined U.S. pork, beef and chicken stocks was the eighth experienced in a row and the largest experienced throughout the past six and a half years on a percentage basis.

The Dec ’20 YOY decline in combined U.S. pork, beef and chicken stocks was the eighth experienced in a row and the largest experienced throughout the past six and a half years on a percentage basis.

- U.S. pork stocks declined to a ten year low level throughout Dec ’20, finishing 29.6% below previous year volumes.

- U.S. beef stocks reached a three and a half year high level throughout Dec ’20, finishing 11.3% above previous year levels.

- U.S. chicken stocks remained at a four year low seasonal level throughout Dec ‘20, finishing 11.7% lower on a YOY basis.

According to the USDA, U.S. frozen pork stocks declined to a ten year low level throughout Dec ’20, finishing 29.6% below previous year volumes. Pork stocks reached a 23 year low seasonal level for the month of December. The YOY decline in pork stocks was the ninth experienced in a row and the largest experienced throughout the past 34 years on a percentage basis. Frozen pork stocks had finished higher on a YOY basis over 11 consecutive months prior to the nine most recent YOY declines. The month-over-month decline in pork stocks of 11.4 million pounds, or 2.7%, was larger than the ten year average November – December seasonal decline in stocks of 5.8 million pounds, or 1.1%.

According to the USDA, U.S. frozen pork stocks declined to a ten year low level throughout Dec ’20, finishing 29.6% below previous year volumes. Pork stocks reached a 23 year low seasonal level for the month of December. The YOY decline in pork stocks was the ninth experienced in a row and the largest experienced throughout the past 34 years on a percentage basis. Frozen pork stocks had finished higher on a YOY basis over 11 consecutive months prior to the nine most recent YOY declines. The month-over-month decline in pork stocks of 11.4 million pounds, or 2.7%, was larger than the ten year average November – December seasonal decline in stocks of 5.8 million pounds, or 1.1%.

Beef – Stocks Reach a Three and a Half Year High Level, Finish up 11.3% YOY

Beef – Stocks Reach a Three and a Half Year High Level, Finish up 11.3% YOY

U.S. frozen beef stocks increased seasonally to a three and a half year high level throughout Dec ’20, finishing 11.3% higher on a YOY basis. Beef stocks reached a four year high seasonal level for the month of December. The YOY increase in beef stocks was the third experienced in a row and the largest experienced throughout the past eight months on a percentage basis. The MOM increase in beef stocks of 22.8 million pounds, or 4.5%, was larger than the ten year average November – December seasonal increase in stocks of 10.4 million pounds, or 2.4%.

U.S. frozen beef stocks increased seasonally to a three and a half year high level throughout Dec ’20, finishing 11.3% higher on a YOY basis. Beef stocks reached a four year high seasonal level for the month of December. The YOY increase in beef stocks was the third experienced in a row and the largest experienced throughout the past eight months on a percentage basis. The MOM increase in beef stocks of 22.8 million pounds, or 4.5%, was larger than the ten year average November – December seasonal increase in stocks of 10.4 million pounds, or 2.4%.

Chicken – Stocks Remain at a Four Year Low Seasonal Level, Finish Down 11.7% on a YOY Basis

Chicken – Stocks Remain at a Four Year Low Seasonal Level, Finish Down 11.7% on a YOY Basis

Dec ’20 U.S. frozen chicken stocks declined seasonally to a seven month low level while finishing 11.7% below previous year levels. Chicken stocks reached a four year low seasonal level for the month of December, finishing lower on a YOY basis for the fifth consecutive month. Chicken stocks had finished higher on a YOY basis over ten consecutive months prior to finishing lower over each of the past five months. The MOM decline in chicken stocks of 19.3 million pounds, or 2.2%, was larger than the ten year average November – December seasonal decline in stocks of 6.7 million pounds, or 0.7%.

Dec ’20 U.S. frozen chicken stocks declined seasonally to a seven month low level while finishing 11.7% below previous year levels. Chicken stocks reached a four year low seasonal level for the month of December, finishing lower on a YOY basis for the fifth consecutive month. Chicken stocks had finished higher on a YOY basis over ten consecutive months prior to finishing lower over each of the past five months. The MOM decline in chicken stocks of 19.3 million pounds, or 2.2%, was larger than the ten year average November – December seasonal decline in stocks of 6.7 million pounds, or 0.7%.

Overall, Dec ’20 combined U.S. pork, beef and chicken stocks finished 12.8% below the monthly record high level experienced throughout Jan ’20. Individually, Dec ’20 beef stocks finished six percent below the record high historical storage level, while chicken and pork stocks finished 12% and 42% below their respective maximum historical storage levels.

Overall, Dec ’20 combined U.S. pork, beef and chicken stocks finished 12.8% below the monthly record high level experienced throughout Jan ’20. Individually, Dec ’20 beef stocks finished six percent below the record high historical storage level, while chicken and pork stocks finished 12% and 42% below their respective maximum historical storage levels.

Dec ’20 combined U.S. pork, beef and chicken stocks declined to a six year low seasonal level, finishing 11.4% below the record high seasonal level experienced during December of 2019. Individually, Dec ’20 beef stocks finished six percent below the record high seasonal storage level while chicken and pork stocks finished 12% and 30% below record high seasonal storage levels, respectively.

Dec ’20 combined U.S. pork, beef and chicken stocks declined to a six year low seasonal level, finishing 11.4% below the record high seasonal level experienced during December of 2019. Individually, Dec ’20 beef stocks finished six percent below the record high seasonal storage level while chicken and pork stocks finished 12% and 30% below record high seasonal storage levels, respectively.

The Dec ’20 YOY decline in combined U.S. pork, beef and chicken stocks was the eighth experienced in a row and the largest experienced throughout the past six and a half years on a percentage basis.

The Dec ’20 YOY decline in combined U.S. pork, beef and chicken stocks was the eighth experienced in a row and the largest experienced throughout the past six and a half years on a percentage basis.