U.S. Dairy Dry Product Stocks Update – Jul ’21

Executive Summary

U.S. dairy dry product stock figures provided by the USDA were recently updated with values spanning through May ’21. Highlights from the updated report include:

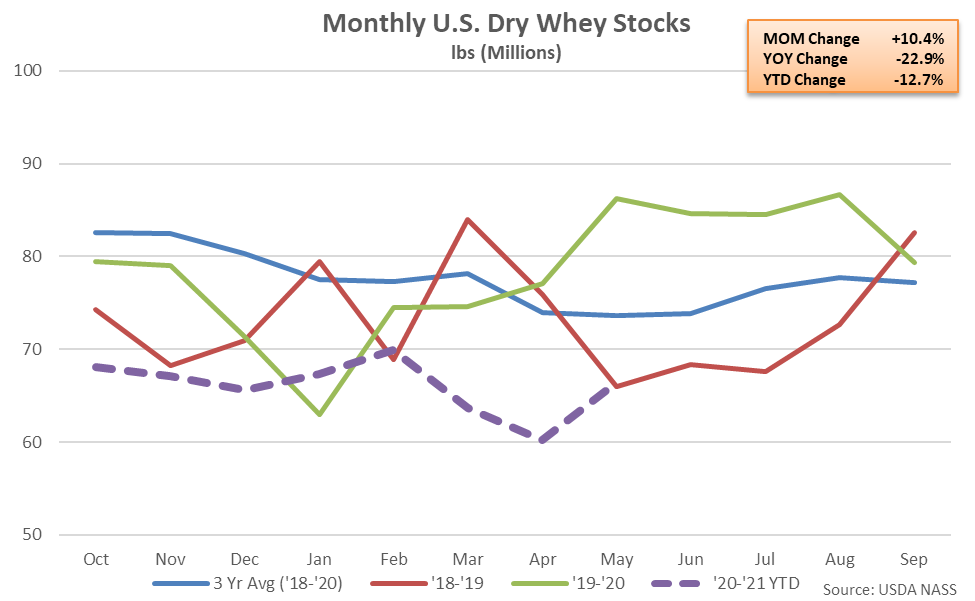

- U.S. dry whey stocks remained lower on a YOY basis for the eighth time in the past nine months throughout May ’21, finishing 22.9% below previous year figures.

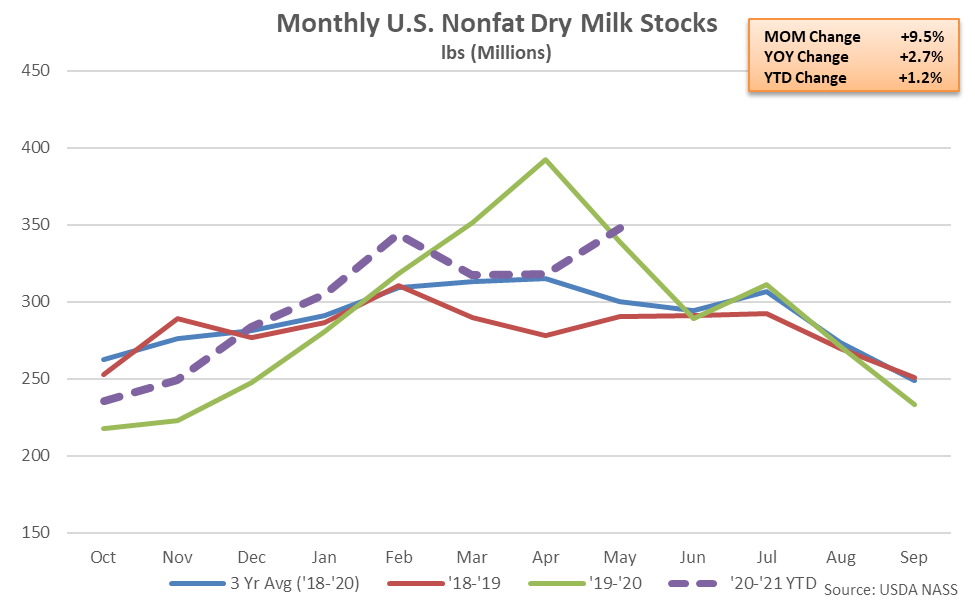

- U.S. nonfat dry milk stocks increased contraseasonally to a record high seasonal level, finishing 2.7% above previous year levels.

Additional Report Details

Dry Whey – Stocks Remain Lower YOY for the Eighth Time in Nine Months, Down 22.9%

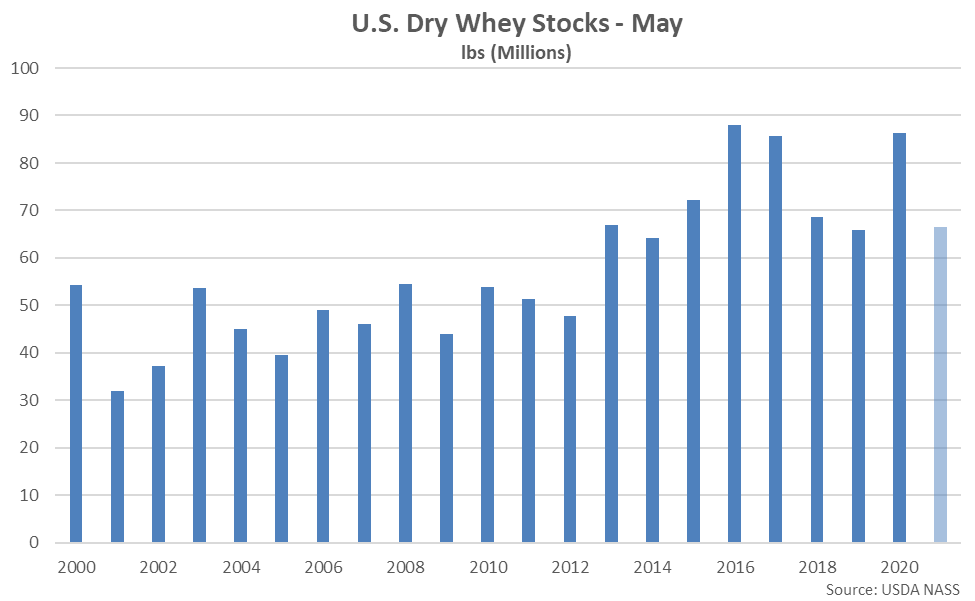

According to the USDA, May ’21 month-end dry whey stocks rebounded from the four and a half low level experienced throughout the previous month but remained 22.9% below previous year levels. The YOY decline in dry whey stocks was the eighth experienced throughout the past nine months and the largest experienced throughout the past 29 months on a percentage basis.

The month-over-month increase in dry whey stocks of 6.3 million pounds, or 10.4%, was larger than the ten year average April – May seasonal build in dry whey stocks of 0.2 million pounds, or 0.1%. Dry whey production declined 7.6% on a YOY basis throughout May ’21, finishing below previous year figures for the eighth time in the past ten months.

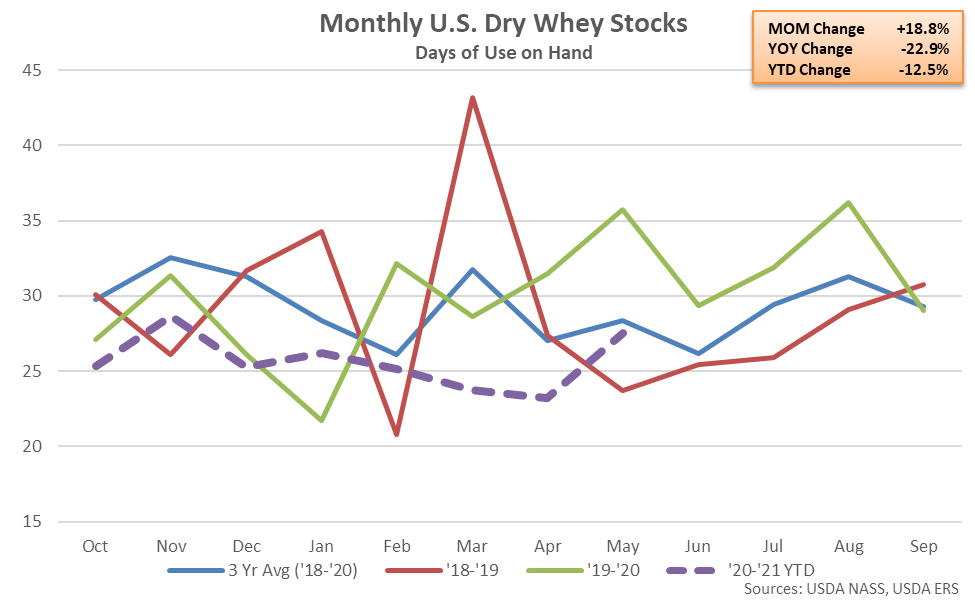

On a days of usage basis, May ’21 U.S. dry whey stocks also remained lower YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of May, dry whey stocks on a days of usage basis finished 22.9% lower YOY, declining on a YOY basis for the eighth time in the past nine months.

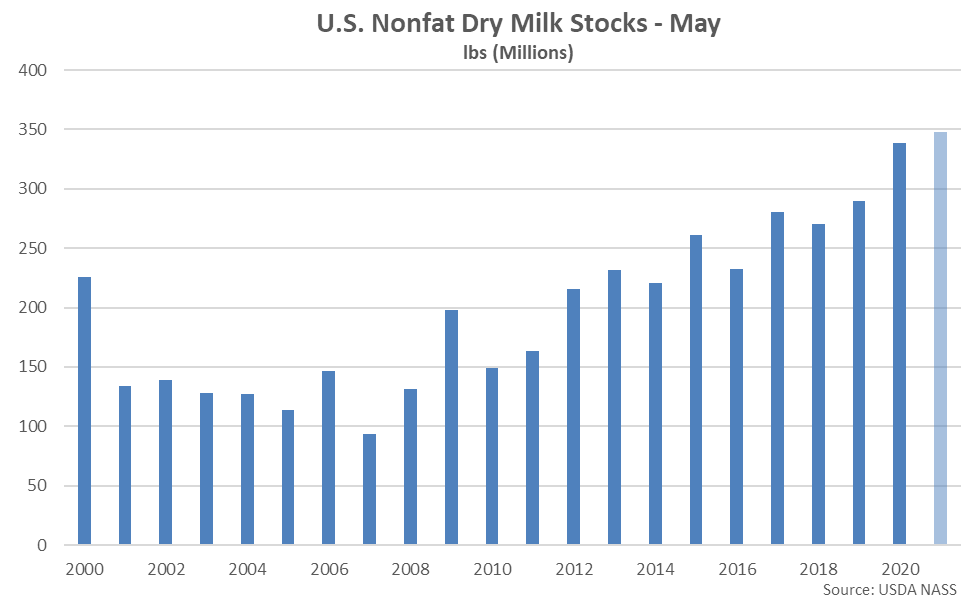

Nonfat Dry Milk – Stocks Increase Contraseasonally to a Record High Seasonal Level, up 2.7% YOY

May ’21 month-end nonfat dry milk (NFDM) stocks increased contraseasonally from the previous month while finishing 2.7% above previous year levels, reaching a record high seasonal level. The contraseasonal increase in NFDM stocks was in addition to a 5.2% upward revision to the previous month’s stock figure.

The month-over-month increase in NFDM stocks of 30.1 million pounds was a contraseasonal move when compared to the ten year average April – May seasonal decline in stocks of 2.9 million pounds. NFDM production increased 30.6% on a YOY basis throughout May ’21, reaching a record high seasonal level.

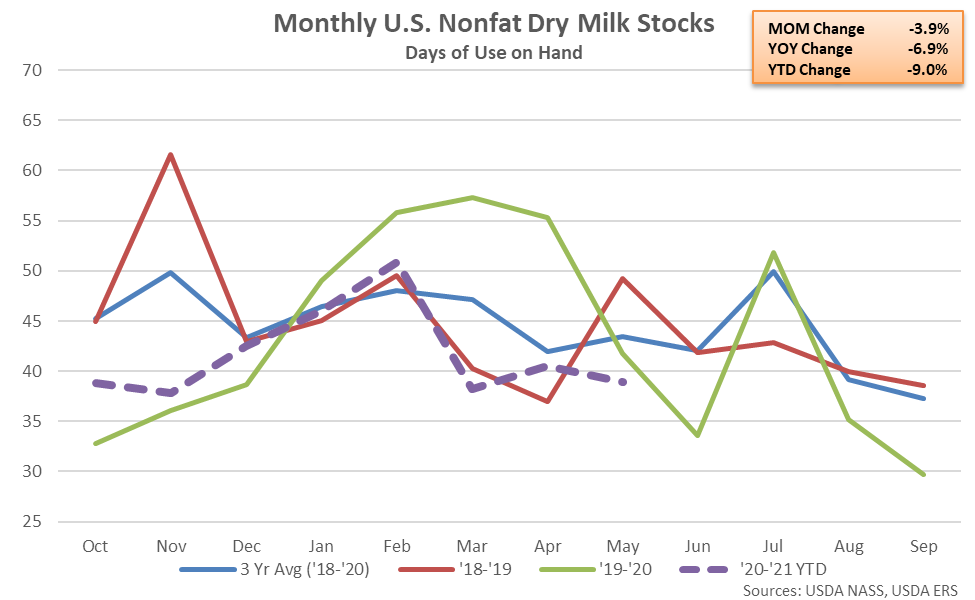

On a days of usage basis, May ’21 U.S. NFDM stocks remained lower YOY. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of May, NFDM stocks on a days of usage basis finished 6.9% below previous year figures, declining on a YOY basis for the fifth consecutive month.

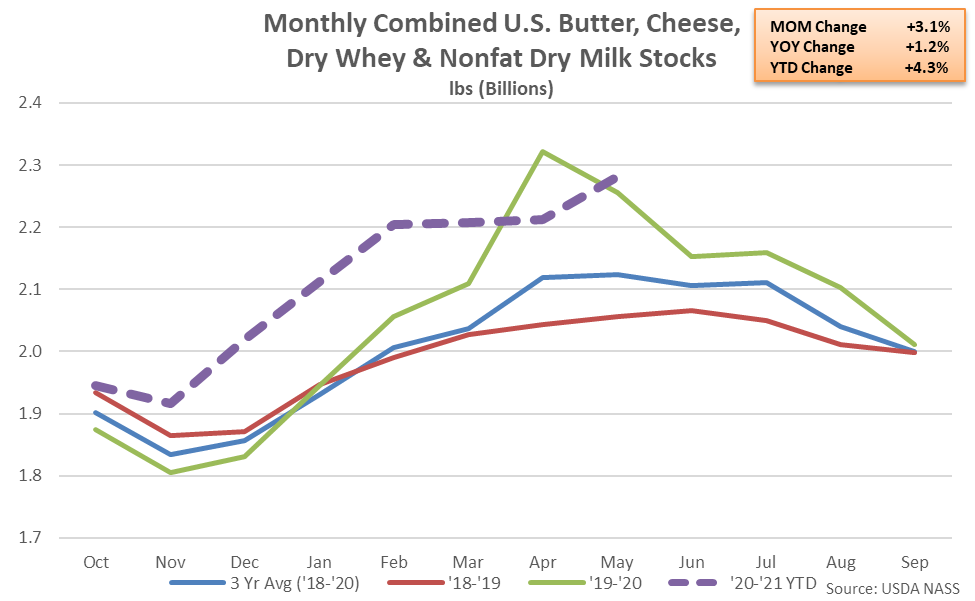

Combined Dairy Product Stocks – Stocks Rebound to a Record High Seasonal Level, Finish up 1.2% YOY

May ’21 combined stocks of butter, cheese, dry whey and NFDM increased to the second highest monthly figure on record, finishing 1.2% above previous year levels and reaching a record high seasonal level for the month of May. Combined dairy product stocks have reached record high seasonal levels over 15 of the past 16 months through May ’21.