U.S. Livestock Cold Storage Update – Sep ’21

Executive Summary

U.S. cold storage figures provided by the USDA were recently updated with values spanning through Aug ’21. Highlights from the updated report include:

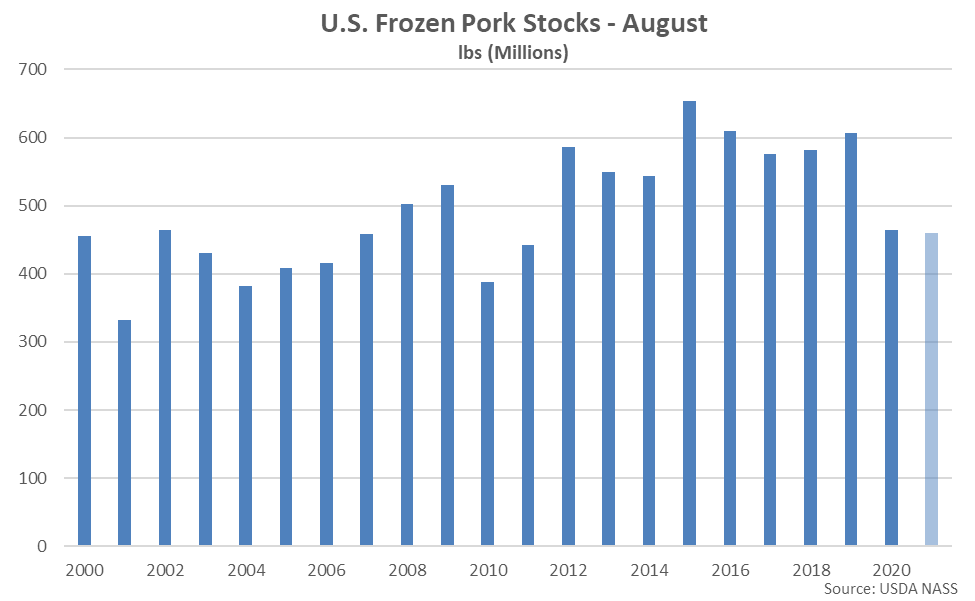

- U.S. pork stocks remained lower on a YOY basis for the 17th consecutive month throughout Aug ’21, finishing 1.0% below previous year volumes and reaching a ten year low seasonal level.

- U.S. beef stocks remained at a seven year low seasonal level throughout Aug ’21, finishing 7.7% below previous year levels.

- U.S. chicken stocks remained lower on a YOY basis for the 13th consecutive month throughout Aug ’21, finishing 19.9% below previous year volumes and reaching a six and a half year low level, overall.

Additional Report Details

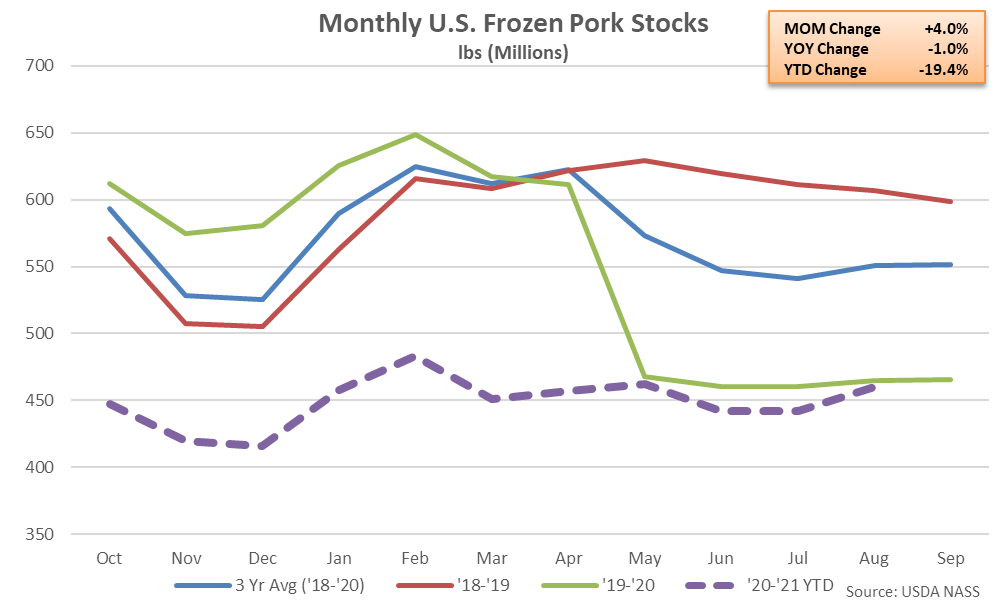

Pork – Stocks Finish 1.0% Below the Previous Year, Reaching a Ten Year Low Seasonal Level

According to the USDA, Aug ’21 U.S. frozen pork stocks rebounded to a three month high level but remained 1.0% below previous year volumes, reaching a ten year low seasonal level. The YOY decline in pork stocks was the 17th experienced in a row but the smallest experienced throughout the period. Frozen pork stocks had finished higher on a YOY basis over 11 consecutive months prior to the 17 most recent YOY declines. The month-over-month increase in pork stocks of 17.7 million pound, or 4.0%, was slightly larger than the ten year average July – August seasonal build in stocks of 12.1 million pounds, or 2.1%.

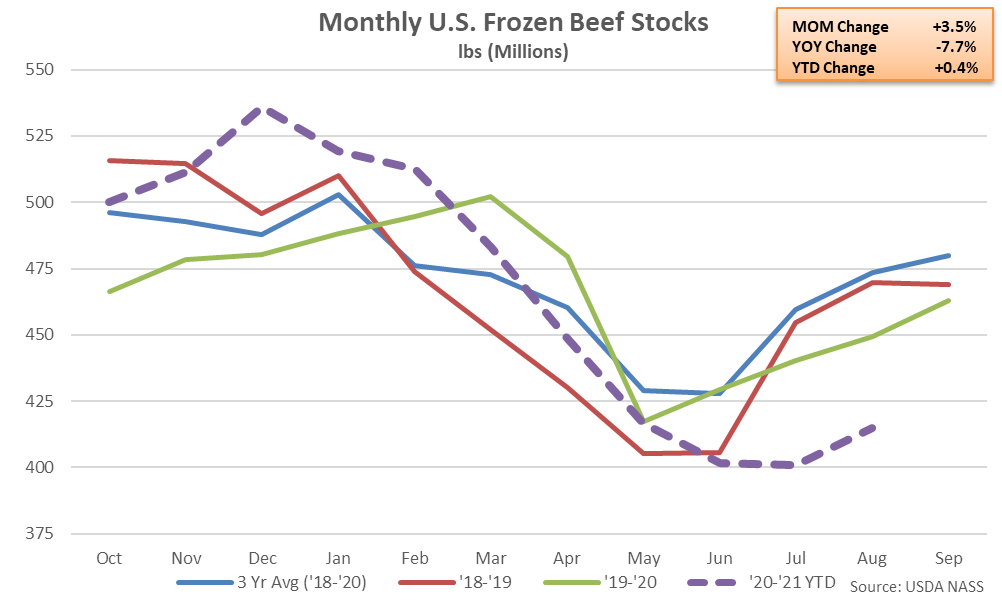

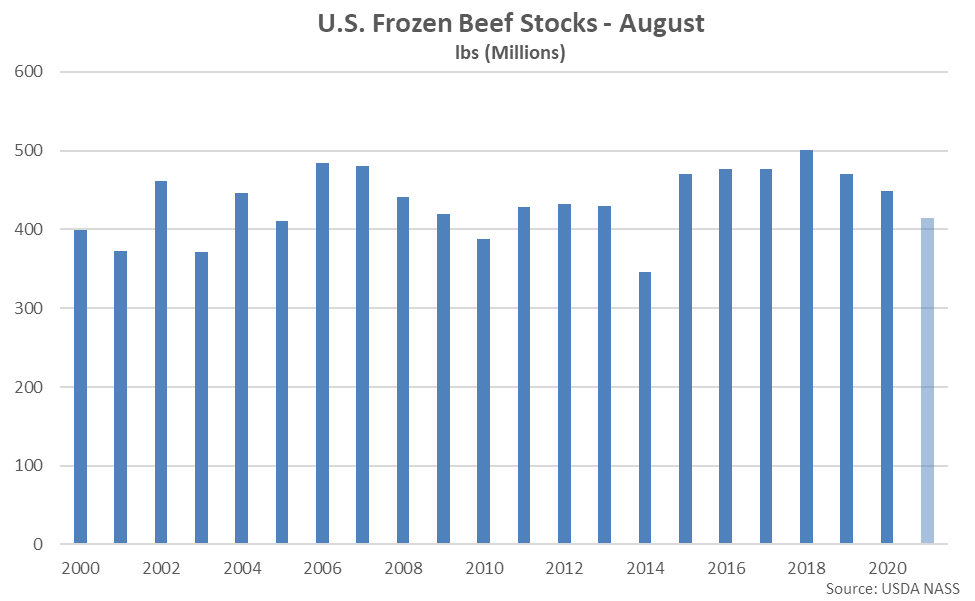

Beef – Stocks Remain at a Seven Year Low Seasonal Level, Finish 7.7% Lower YOY

Aug ’21 U.S. frozen beef stocks increased seasonally from the six and a half year low level experienced throughout the previous year but remained 7.7% below previous year volumes. Beef stocks remained at a seven year low seasonal level for the third consecutive month throughout Aug ’21, finishing below previous year levels for the sixth consecutive month. The month-over-month increase in beef stocks of 14.1 million pounds, or 3.5%, was larger than the ten year average July – August seasonal build in stocks of 3.5 million pounds, or 0.7%.

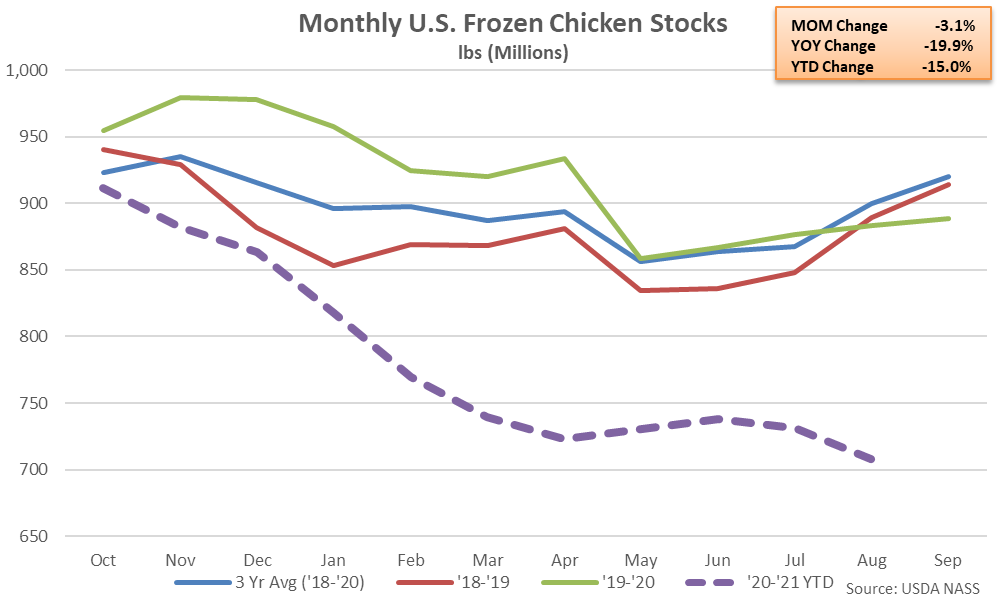

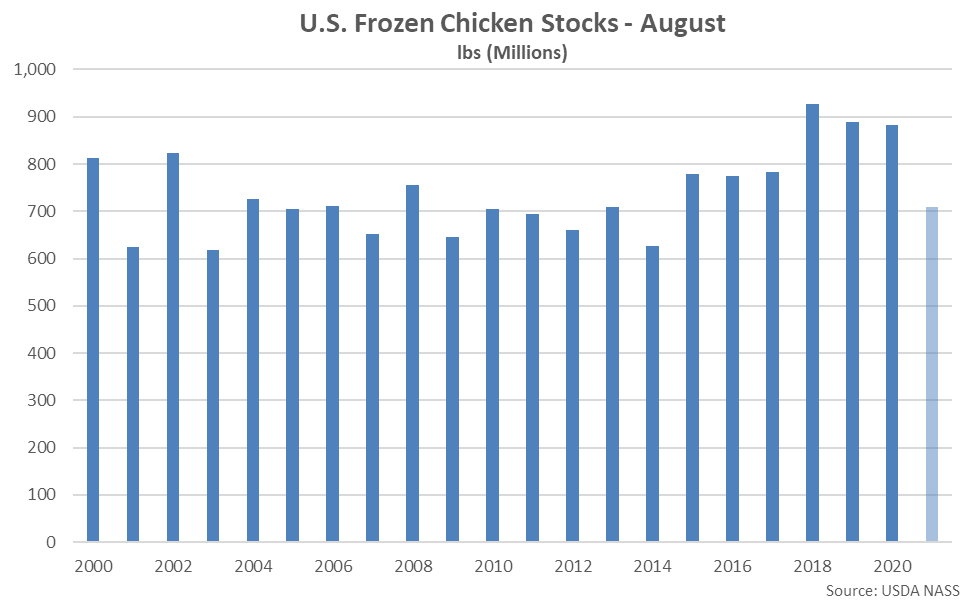

Chicken – Stocks Decline to a Six and a Half Year Low Level, Down 19.9% YOY

U.S. frozen chicken stocks declined to a six and a half year low level throughout Aug ’21, finishing 19.9% below previous year levels. Chicken stocks reached a seven year low seasonal level for the month of August, finishing lower on a YOY basis for the 13th consecutive month. Chicken stocks had finished higher on a YOY basis over ten consecutive months prior to finishing lower over each of the past 13 months. The month-over-month decline in chicken stocks of 22.9 million pounds, or 3.1%, was larger than the ten year average July – August seasonal decline in stocks of 0.8 million pounds, or 0.2%.

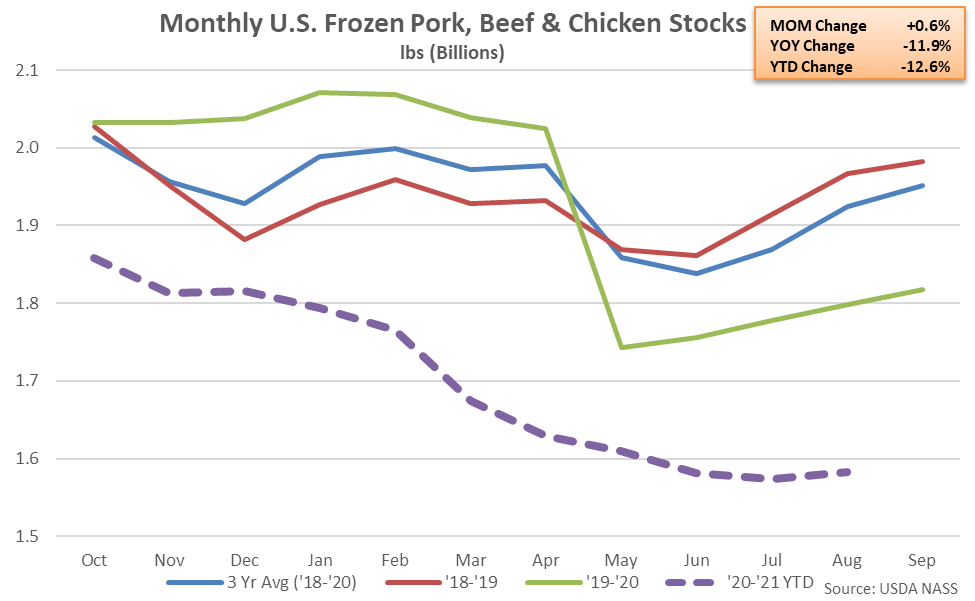

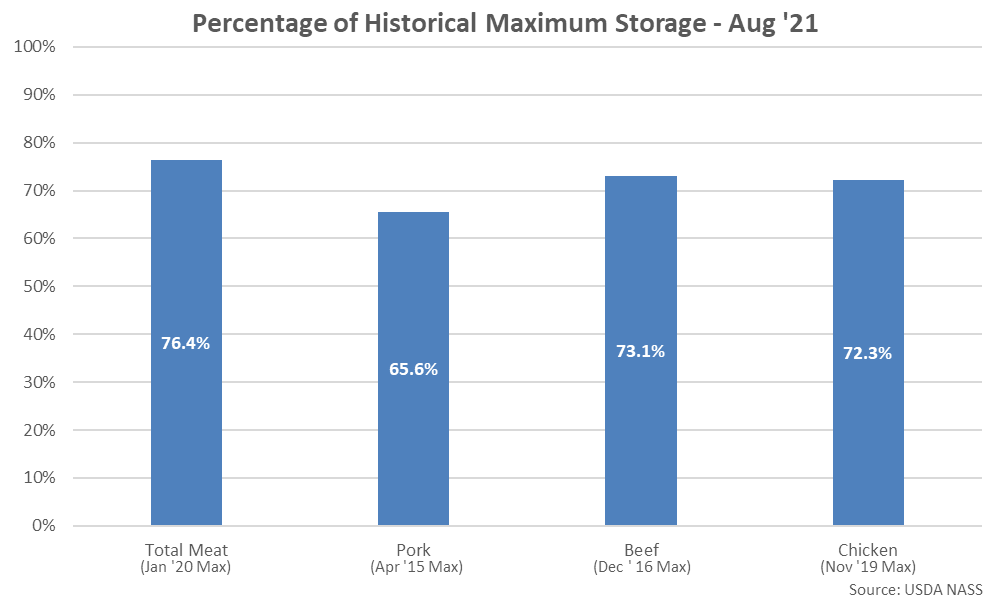

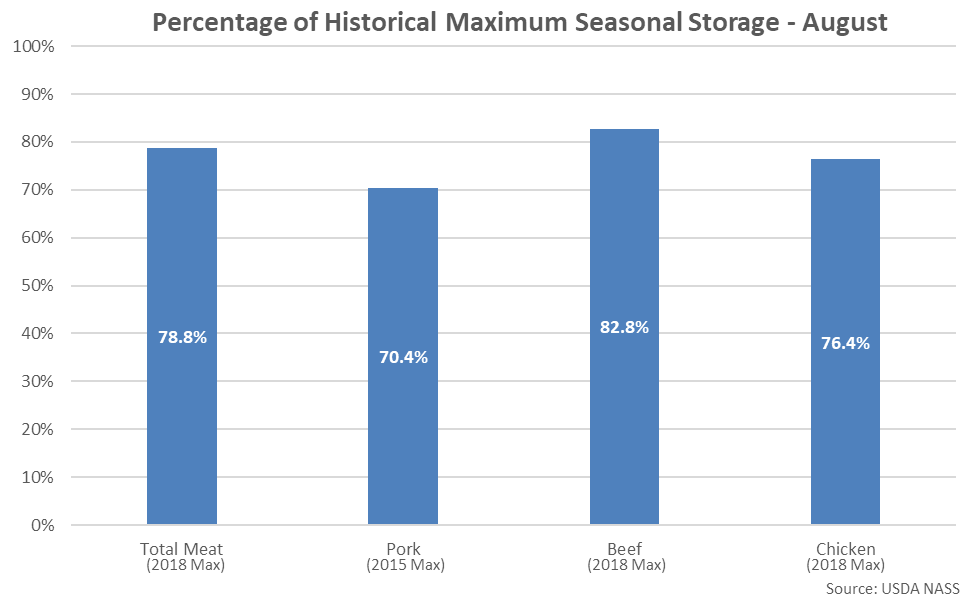

Overall, Aug ’21 combined U.S. pork, beef and chicken stocks finished 24% below the monthly record high level experienced throughout Jan ’20. Individually, Aug ’21 beef and chicken stocks finished 27% and 28% below their respective record high historical storage levels, while pork stocks finished 34% below the maximum historical storage level.

Aug ’21 combined U.S. pork, beef and chicken stocks remained at a seven year low seasonal level, finishing 21% below the record high seasonal level experienced during August of 2018. Individually, Aug ’21 beef and chicken stocks finished 17% and 24% below their respective record high seasonal storage levels, while pork stocks finished 30% below the record high seasonal storage level.

The Aug ’21 YOY decline in combined U.S. pork, beef and chicken stocks was the 16th experienced in a row. Combined U.S. pork, beef and chicken stocks rebounded slightly from the six and a half year low level experienced throughout the previous month, however.