Soybean Complex Crushing & Stocks Update – Nov ’21

Executive Summary

U.S. soybean crush and stocks figures provided by the USDA were recently updated with values spanning through Sep ’21. Highlights from the updated report include:

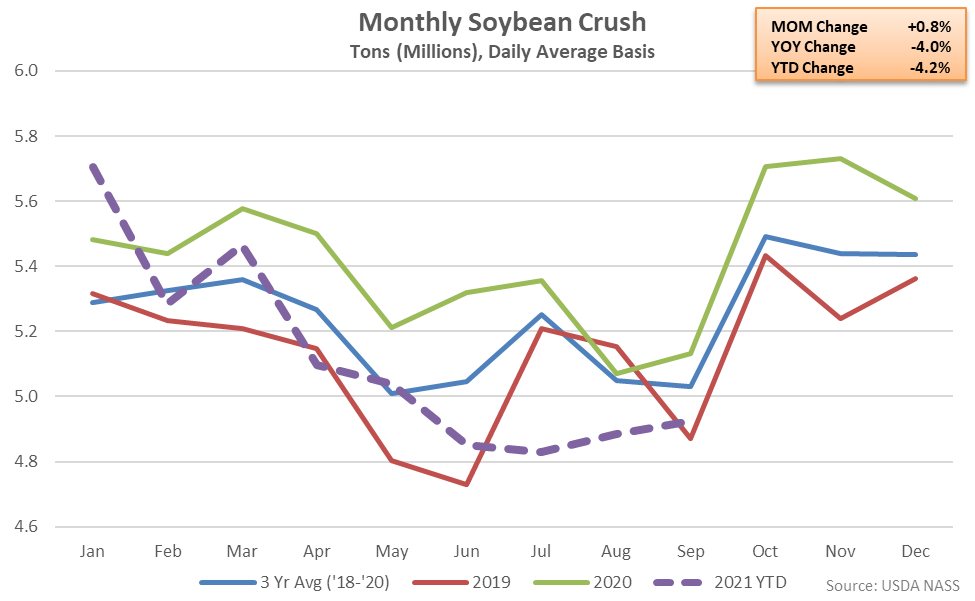

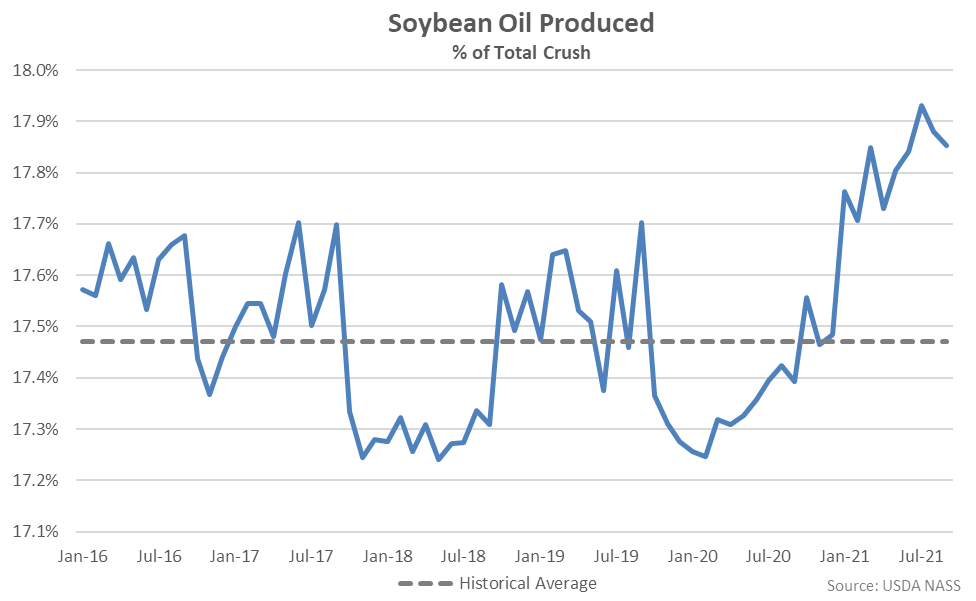

- U.S. soybean crushings declined 4.0% on a YOY basis throughout Sep ’21, finishing lower for the eighth consecutive month. Soybean oil produced as a percentage of total crush remained near recently experienced record high levels.

- Sep ’21 U.S. soybean cake & meal stocks declined to a five year low seasonal level, finishing 1.9% below the previous year.

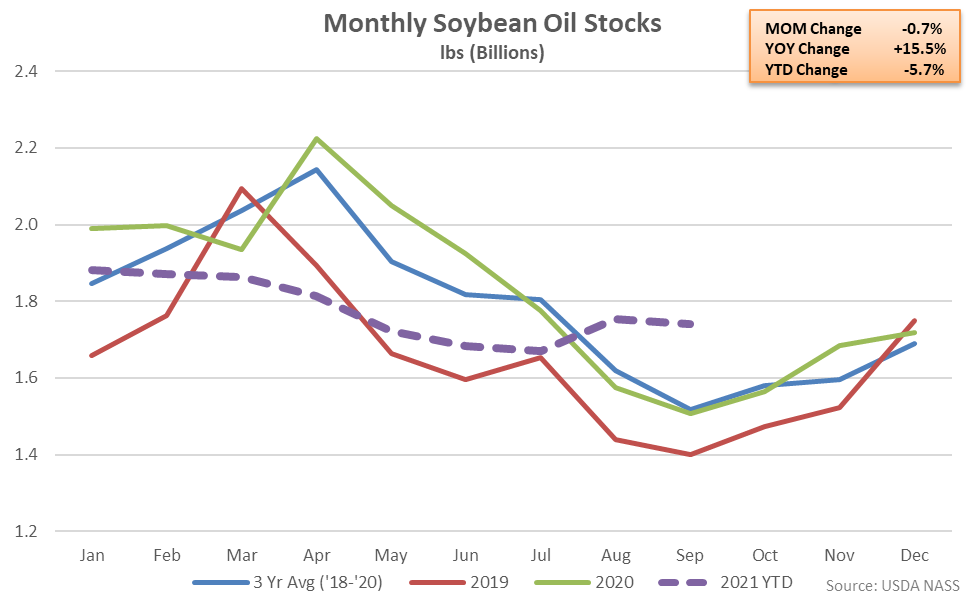

- U.S. soybean oil stocks reached a record high seasonal level, finishing 15.5% above previous year levels. The YOY increase in soybean oil stocks was the largest experienced throughout the past 15 months.

Additional Report Details

Soybean Crushing – Crush Declines YOY for the Eighth Consecutive Month, Down 4.0%

According to the USDA, Sep ’21 U.S. soybean crushings remained lower on a YOY basis for the eighth consecutive month, finishing 4.0% below previous year figures. Soybean crushings had reached record high seasonal levels over five consecutive months through Jan ’21, prior to declining on a YOY basis throughout the eight most recent months of available data.

Sep ’21 YOY declines in soybean crushings were largest throughout Iowa, followed by the West Central states of Kansas, Missouri and Nebraska. 2020 annual soybean crushings finished 5.6% higher on a YOY basis, reaching a record high annual level, however 2021 YTD crushings have declined by 4.2% throughout the first three quarters of the calendar year.

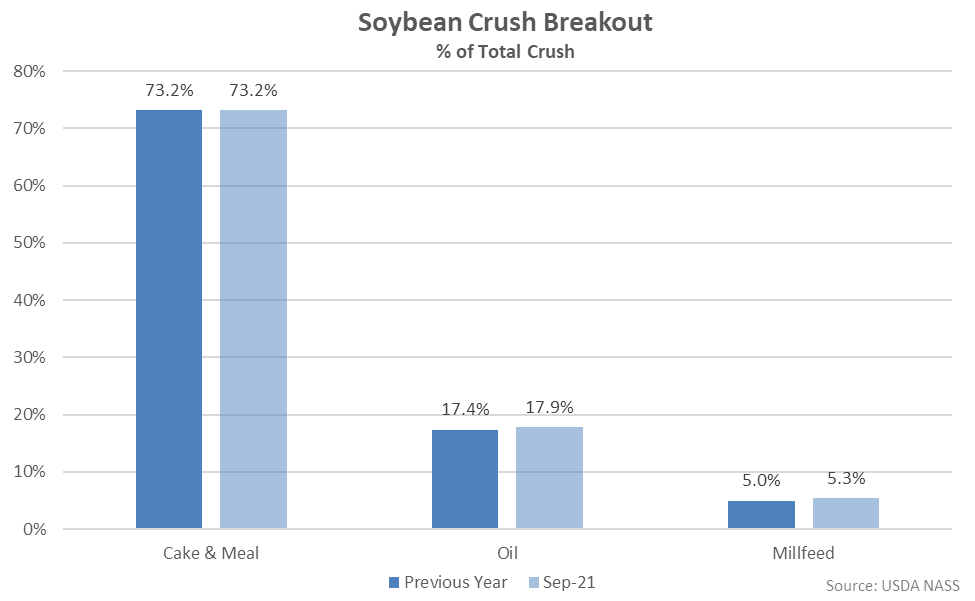

Cake & meal accounted for 73.2% of the total soybean crush throughout Sep ’21, finishing equal to the previous year figure, while oil accounted for 17.9% of the total soybean crush, up from the previous year.

Sep ’21 soybean oil produced as a percentage of total crush continued to decline slightly from the record high monthly level experienced throughout Jul ’21 but remained at the third highest level on record. Soybean oil produced as a percentage of total crush has finished above historical average figures over ten consecutive months through September.

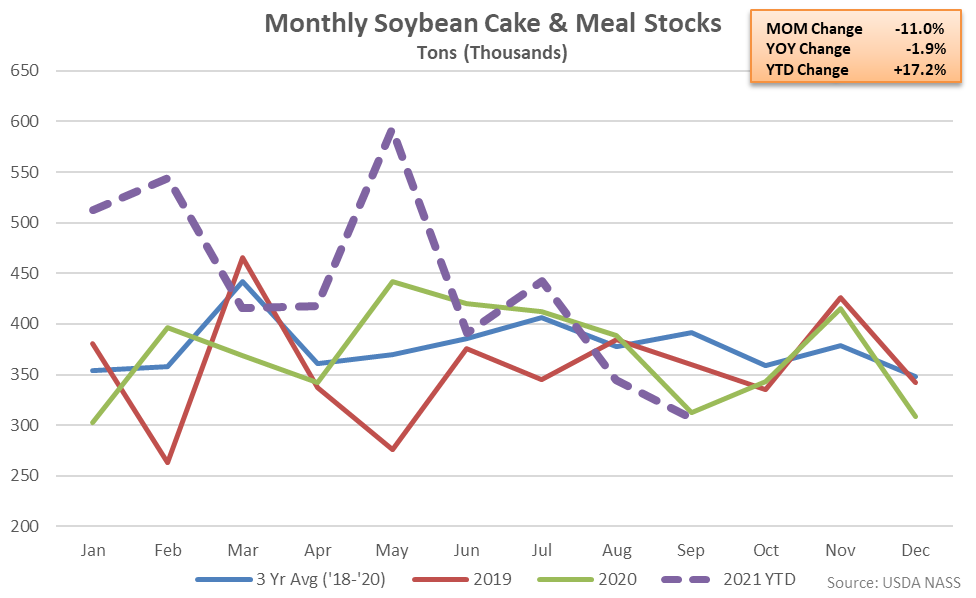

Soybean Cake & Meal Stocks – Stocks Reach a Five Year Low Seasonal Level, Down 1.9% YOY

Sep ’21 U.S. soybean cake & meal stocks declined to a 20 month low level, finishing 1.9% below previous year levels and reaching a five year low seasonal level. The YOY decline in soybean cake & meal stocks was the third experienced throughout the past four months. The month-over-month decline in soybean cake & meal stocks of 11.0% was a contraseasonal move when compared to the five year average August – September seasonal build in stocks of 5.9%.

Soybean Oil Stocks – Stocks Reach a Record High Seasonal Level, up 15.5% YOY

Sep ’21 U.S. soybean oil stocks declined from the four month high level experienced throughout the previous month but remained 15.5% above previous year levels, reaching a record high seasonal level. The YOY increase in soybean oil stocks was the second experienced in a row and the largest experienced throughout the past 15 months on a percentage basis. The month-over-month decline in soybean oil stocks of 0.7% was smaller than the five year average August – September seasonal decline of 7.6%.