Quarterly Australian Milk Production Update – Feb ’22

Executive Summary

Australian milk production figures provided by Dairy Australia were recently updated with values spanning through the end of the first half of the ’21-’22 production season. Highlights from the updated report include:

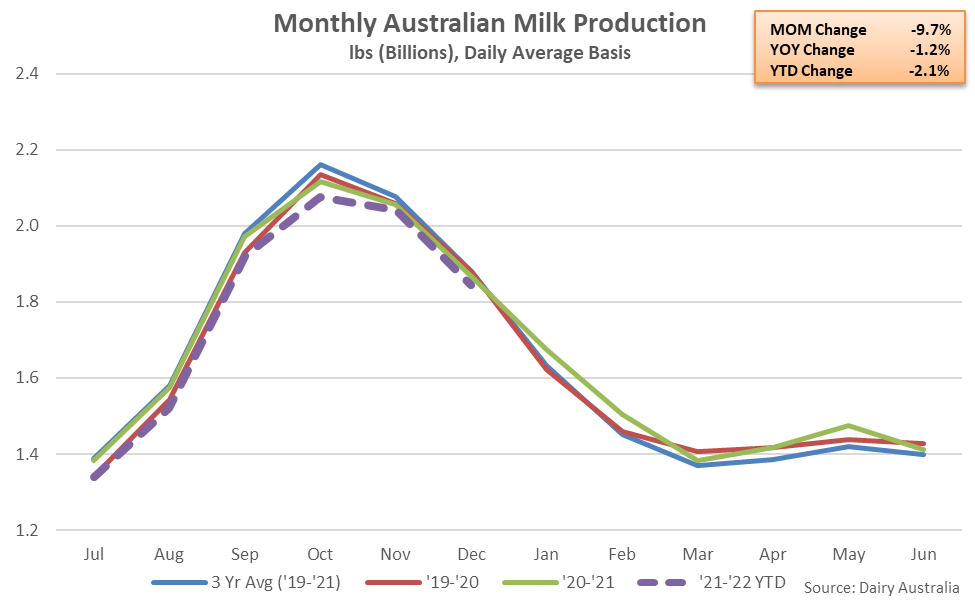

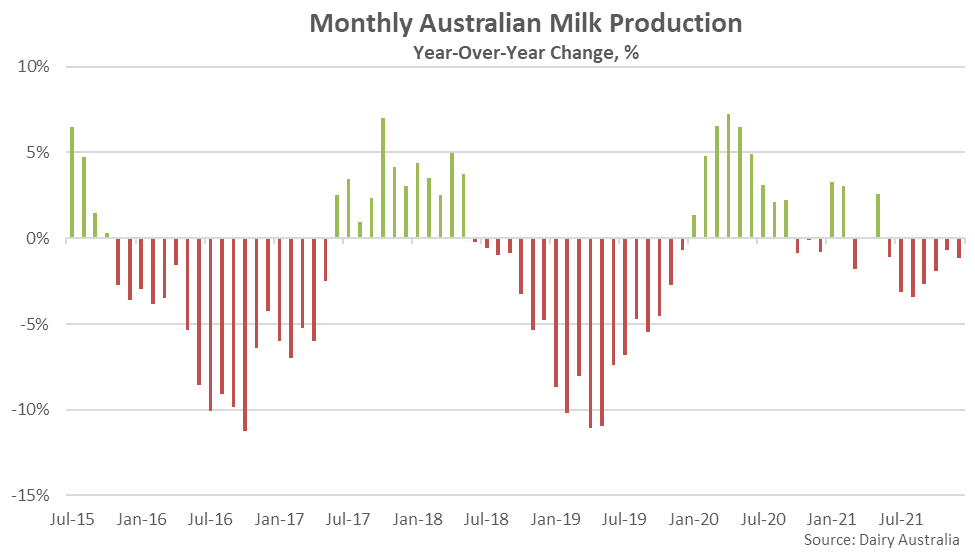

- Australian milk production remained lower on a YOY basis for the seventh consecutive month throughout Dec ’21, finishing down 1.2%. ’21-’22 YTD Australian milk production volumes have declined 2.1% on a YOY basis throughout the first half of the production season and are on pace to reach a 26 year low level.

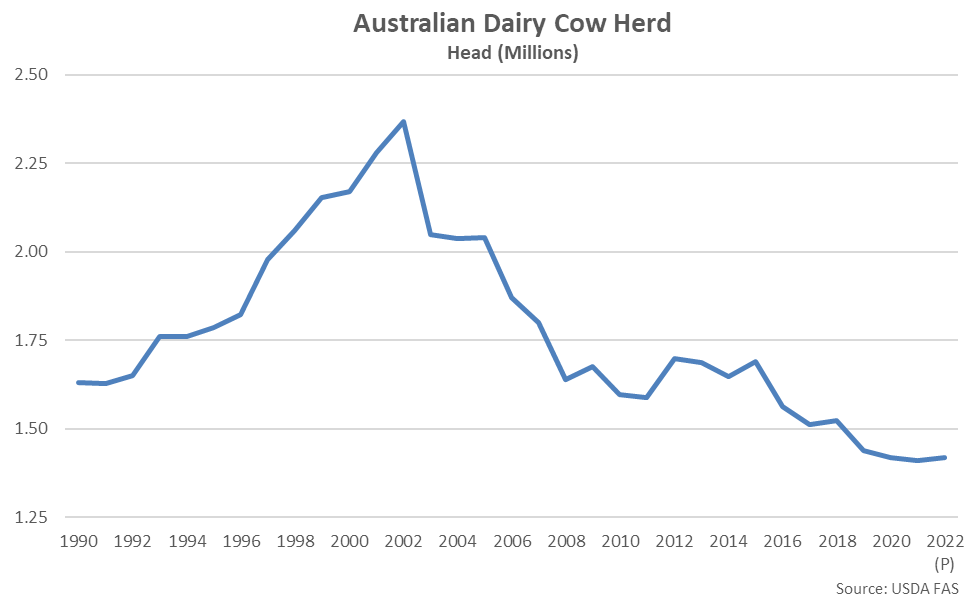

- The Australian dairy cow herd reached a record low level throughout 2021 as some dairy producers continued to exit the industry while high beef prices encouraged others to shift to beef production. The USDA projects the Australian dairy cow herd will rebound slightly throughout the 2022 calendar year.

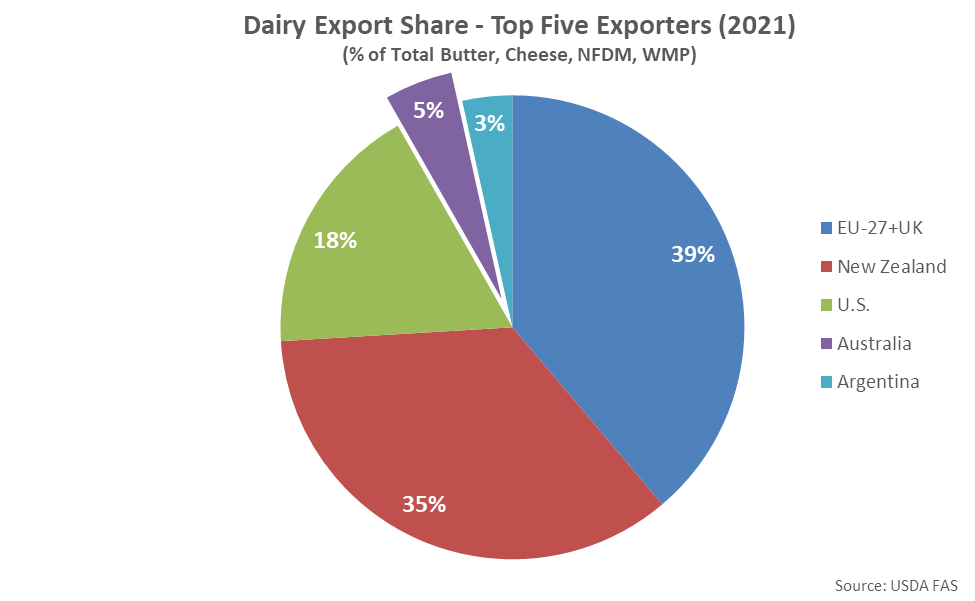

- Australia is the fourth largest global dairy exporter, trailing only the EU-27+UK, New Zealand and the U.S. The bulk of Australian dairy exports are in the form of nonfat dry milk and cheese.

Additional Report Details

According to Dairy Australia, Australian milk production volumes remained lower on a YOY basis for the seventh consecutive month throughout Dec ’21, finishing down 1.2%. Recent wet weather has negatively impacted Australian milk production volumes, while labor shortages associated with COVID-19 lockdowns have resulted in additional challenges for dairy producers.

’20-’21 annual Australian milk production volumes finished 0.9% above the 24 year low level experienced throughout the previous production season, rebounding to a three year high level. According to the USDA, improved fodder and grain availability, coupled with strong milk prices, helped strengthen milk production volumes throughout the year.

’21-’22 YTD production volumes have declined by 2.1% on a YOY basis throughout the first half of the production season and are on pace to reach a 26 year low level. The USDA expects Australian milk production volumes will increase by 1.1% throughout the 2022 calendar year, however, on improved fodder and grain availability, increased irrigation water availability, and strong milk prices.

Low pasture volumes and supplementary feed on hand contributed to the Australian dairy cow herd contracting by 5.6% throughout 2019. Australian dairy herd figures declined by an additional 1.4% throughout 2020, despite improvements in pasture conditions, due to biological lags in herd rebuilding. The Australian dairy cow herd declined by an additional 0.7% throughout 2021, reaching the lowest figure on record, as some dairy producers continued to exit the industry while high beef prices encouraged others to shift to beef production. The USDA is projecting the Australian dairy cow herd will rebound slightly throughout the 2022 calendar year, however, due to anticipated improvement in labor availability.

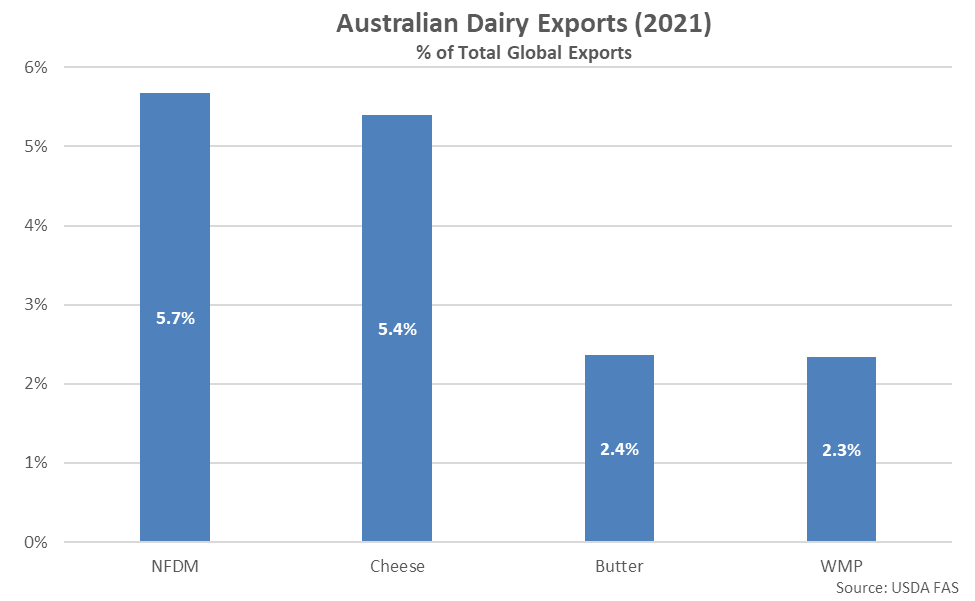

Australia is the fourth largest global dairy exporter, trailing only the EU-27+UK, New Zealand and the U.S. Of the top five dairy exporting regions accounting for over 90% of total global dairy exports, Australia accounted for 2.9% of total combined milk production and 4.8% of combined butter, cheese, nonfat dry milk (NFDM) and whole milk powder (WMP) export volumes throughout 2021.

The bulk of Australian dairy exports are in the form of NFDM and cheese. Australia was the fourth largest exporter of NFDM and the fifth largest exporter of cheese throughout 2021, accounting for 5.7% of global NFDM export volumes and 5.4% of global cheese export volumes.