Grain & Oilseeds WASDE Update – May ’22

Corn – U.S. and Global Ending Stocks Above Private Estimates

- ’22-’23 U.S. ending stocks of 1.36 billion bushels near expectations

- ’22-’23 global ending stocks of 305.1 million MT above expectations

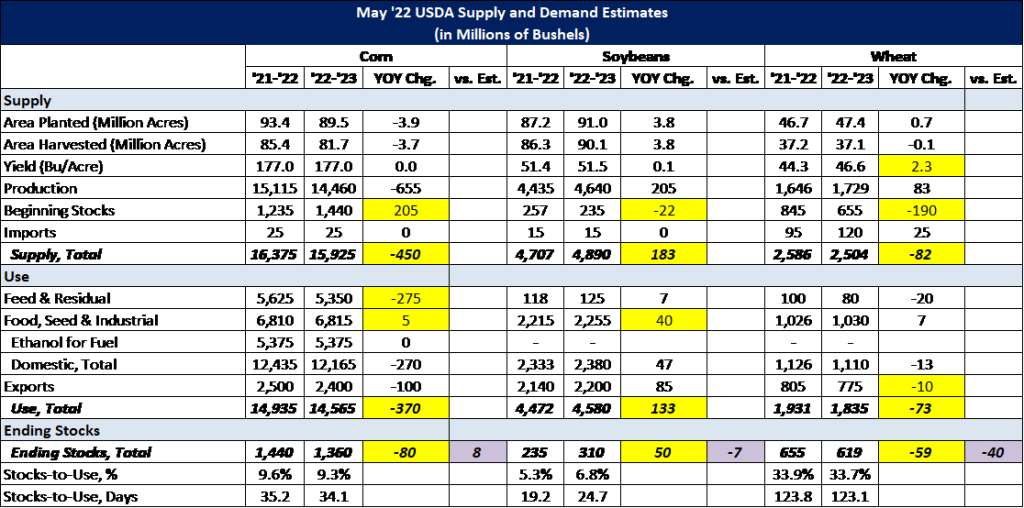

The ’22-’23 U.S. corn supply projection was below expectations on lower than anticipated trend line yield while the demand projection was also below expectations on lower feed & residual usage. ’22-’23 projected U.S. corn ending stocks of 1.36 billion bushels, or 34.1 days of use, finished at expectations.

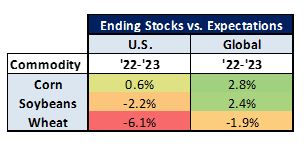

The ’22-’23 global corn ending stock projection finished 2.8% above expectations.

Soybeans – U.S. and Global Ending Stocks Mixed vs. Private Estimates

- ’22-’23 U.S. ending stocks of 310 million bushels below expectations

- ’22-’23 global ending stocks of 99.6 million MT above expectations

The ’22-’23 U.S. soybean supply projection was in line with expectations on yield and acres and the U.S. soybean demand projection similarly fell within expected ranges. ’22-’23 projected U.S. soybean ending stocks of 310 million bushels, or 24.7 days of use, finished 2.2% below expectations.

The ’22-’23 global soybean ending stock projection finished 2.4% above expectations.

Wheat – U.S. and Global Ending Stocks Mixed vs. Private Estimates

- ‘22-’23 U.S. ending stocks of 619 million bushels below expectations

- ‘22-’23 global ending stocks of 267.0 million MT below expectations

The ‘22-’23 U.S. wheat supply projections were below expectations on lower harvested acreage and yield while the U.S. wheat demand projection held firm on relatively robust exports. ‘22-’23 projected U.S. wheat ending stocks of 619 million bushels, or 123.1 days of use, finished 6.1% below expectations.

The ‘22-’23 global wheat ending stock projection finished 1.9% below expectations.

Ending Stocks vs. Expectations Summary

Overall, ‘22-’23 projected domestic wheat ending stocks finished most significantly below expectations, followed by domestic soybean ending stocks. Global corn and soybean ending stocks finished above expectations.