U.S. Dry Product Stocks Update – Jan ’15

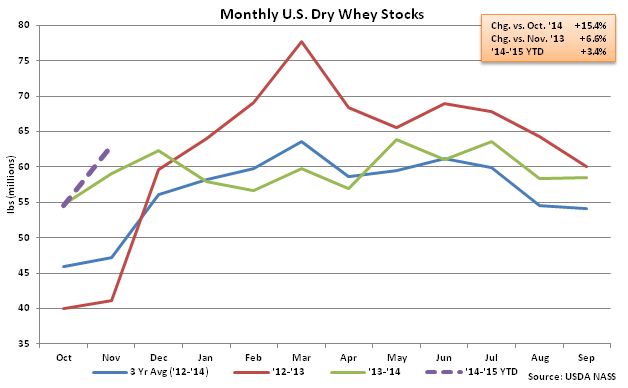

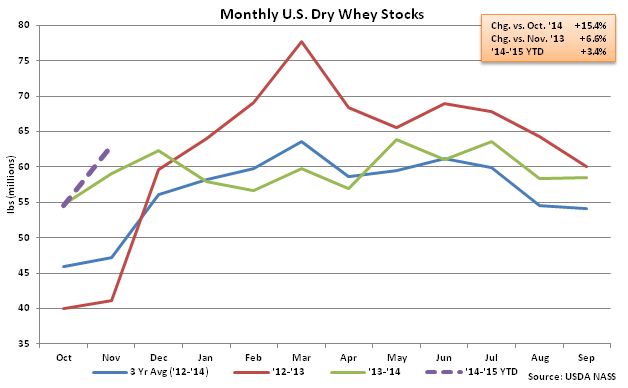

Dry Whey – Stocks Increase YOY for First Time in 11 Months

Nov ’14 dry whey stocks increased seasonally by 6.3% MOM, or 8.4 million lbs, to a total of 63.0 million lbs. Nov ’14 dry whey stocks were also up 6.6% YOY, the first YOY gain in 11 months. Stocks were 40.1% higher than the five year average November dry whey stocks.

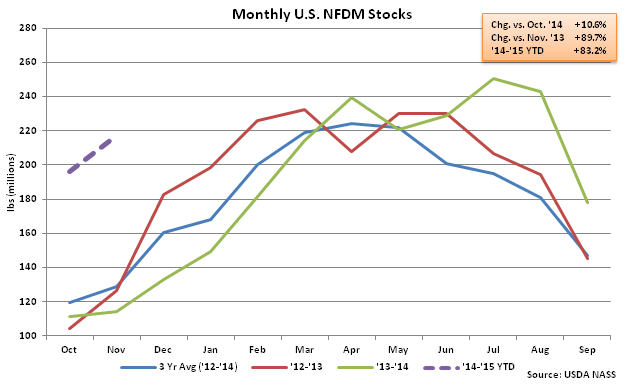

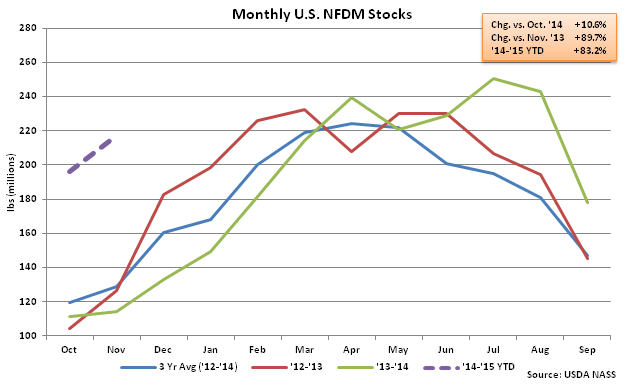

NFDM – Stocks Experienced Largest YOY Percentage Increase in Seven and a Half Years

Nov ’14 NFDM stocks increased seasonally by 10.6% MOM, or 20.8 million lbs, to a total of 216.9 million lbs. The 20.8 million lb Oct – Nov increase in NFDM stocks was over double the five year average Oct – Nov monthly increase in NFDM stocks. Nov ’14 NFDM stocks were up 83.2% YOY which was the largest YOY percentage gain in seven and a half years. Stocks were 72.2% higher than the five year average November NFDM stocks.

NFDM – Stocks Experienced Largest YOY Percentage Increase in Seven and a Half Years

Nov ’14 NFDM stocks increased seasonally by 10.6% MOM, or 20.8 million lbs, to a total of 216.9 million lbs. The 20.8 million lb Oct – Nov increase in NFDM stocks was over double the five year average Oct – Nov monthly increase in NFDM stocks. Nov ’14 NFDM stocks were up 83.2% YOY which was the largest YOY percentage gain in seven and a half years. Stocks were 72.2% higher than the five year average November NFDM stocks.

NFDM – Stocks Experienced Largest YOY Percentage Increase in Seven and a Half Years

Nov ’14 NFDM stocks increased seasonally by 10.6% MOM, or 20.8 million lbs, to a total of 216.9 million lbs. The 20.8 million lb Oct – Nov increase in NFDM stocks was over double the five year average Oct – Nov monthly increase in NFDM stocks. Nov ’14 NFDM stocks were up 83.2% YOY which was the largest YOY percentage gain in seven and a half years. Stocks were 72.2% higher than the five year average November NFDM stocks.

NFDM – Stocks Experienced Largest YOY Percentage Increase in Seven and a Half Years

Nov ’14 NFDM stocks increased seasonally by 10.6% MOM, or 20.8 million lbs, to a total of 216.9 million lbs. The 20.8 million lb Oct – Nov increase in NFDM stocks was over double the five year average Oct – Nov monthly increase in NFDM stocks. Nov ’14 NFDM stocks were up 83.2% YOY which was the largest YOY percentage gain in seven and a half years. Stocks were 72.2% higher than the five year average November NFDM stocks.