Biweekly U.S. Oil Rig Count Update – 11/18/15

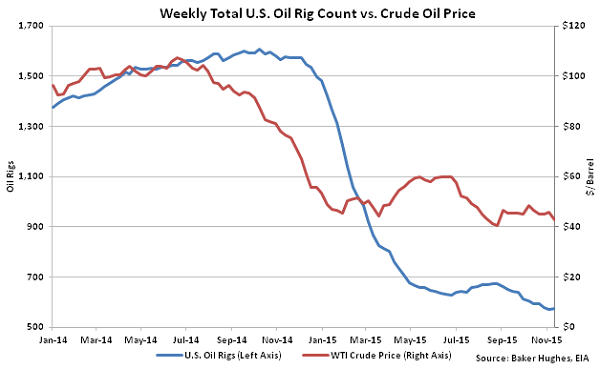

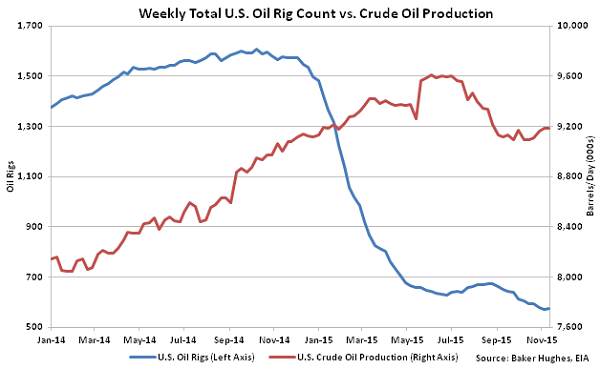

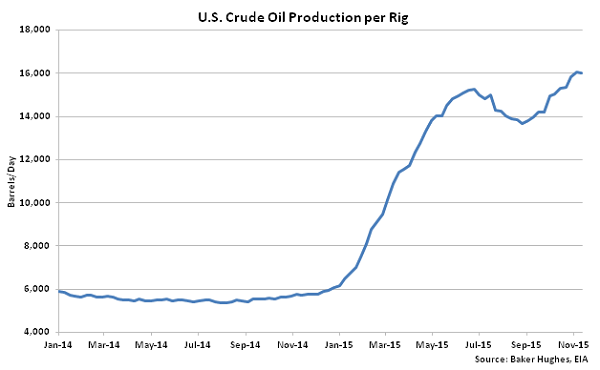

According to Baker Hughes, U.S. oil rig counts declined by six during the week ending Nov 6th but rebounded by two during the week ending Nov 13th to a total of 574. Oil rig counts had reached a five year low prior to the slight rebound during the week ending Nov 13th. Crude oil production remains higher on a YOY basis but has declined from recent high output levels despite production per rig increasing to a new six year high during the week ending Nov 6th. The trend of declining crude oil production is expected to continue as drilling productivity estimates show declining production in coming months throughout areas accounting for 95% of recent production gains.

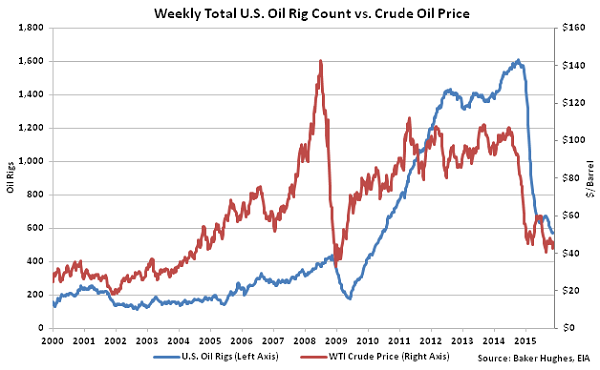

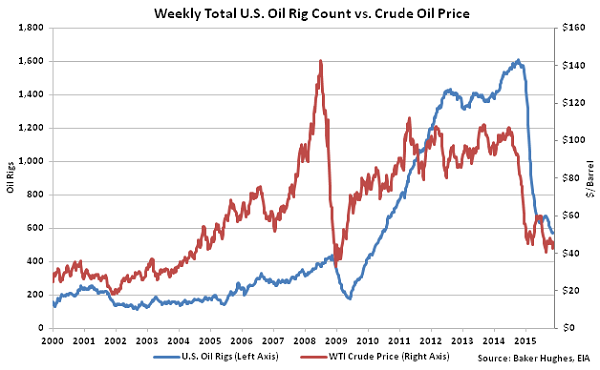

U.S. Oil Rig Counts Declined in Response to Depressed Crude Oil Prices

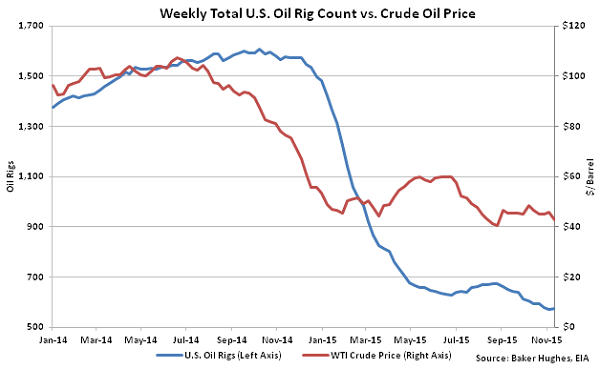

U.S. Oil Rig Counts Peaked in Late 2014, Prior to the Recent Declines

U.S. Oil Rig Counts Peaked in Late 2014, Prior to the Recent Declines

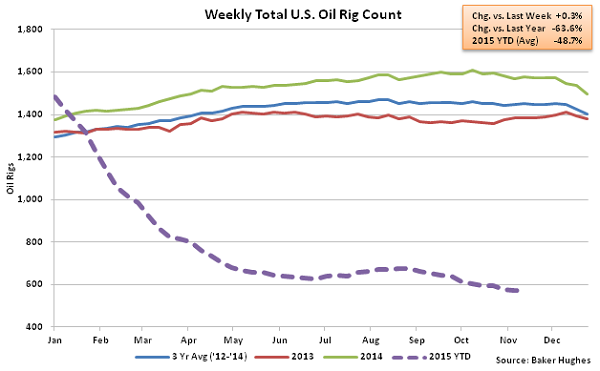

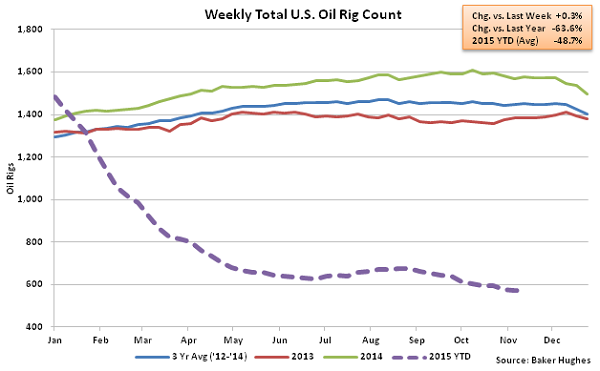

Nov 13th U.S. Oil Rigs Increased 0.3% From the Previous Week but Remain Down 63.6% YOY

Nov 13th U.S. Oil Rigs Increased 0.3% From the Previous Week but Remain Down 63.6% YOY

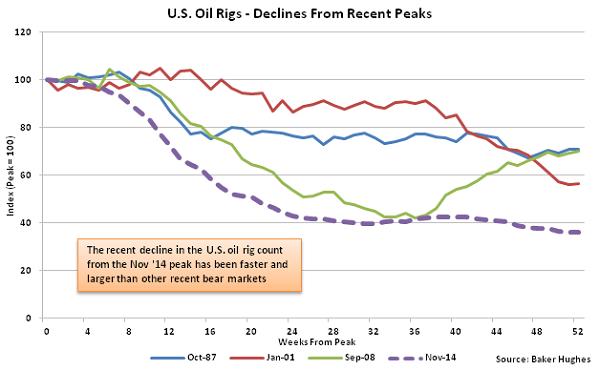

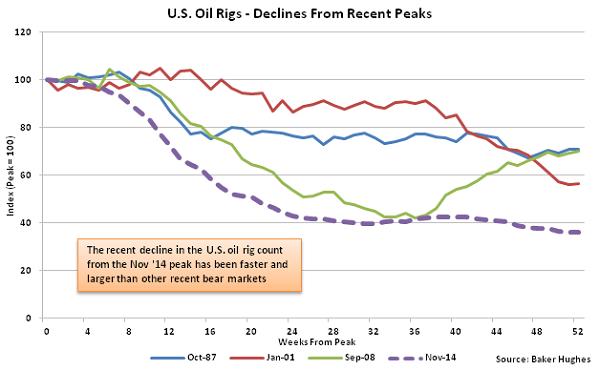

The Recent Decline in U.S. Oil Rig Counts Since the Nov ’14 Peak has Been Significant

The Recent Decline in U.S. Oil Rig Counts Since the Nov ’14 Peak has Been Significant

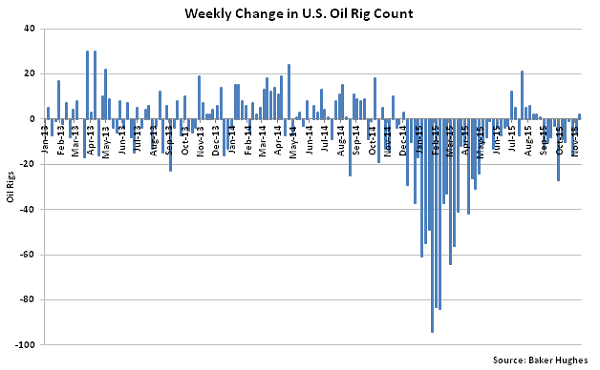

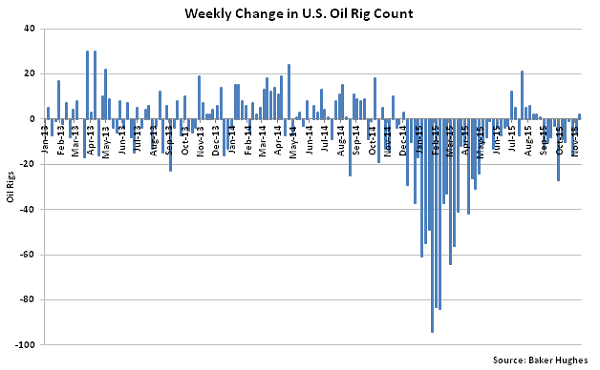

Declines in U.S. Oil Rig Counts Have Decelerated Since February

Declines in U.S. Oil Rig Counts Have Decelerated Since February

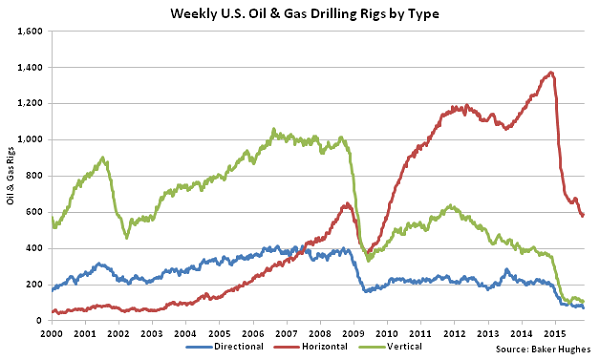

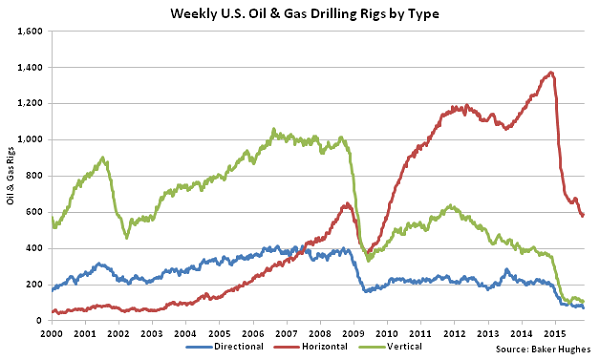

Declines in Vertical Rigs Remain the Most Significant on a Percentage Basis

Declines in Vertical Rigs Remain the Most Significant on a Percentage Basis

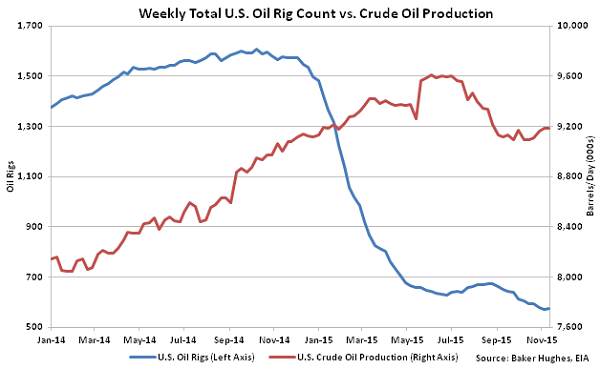

Crude Oil Production Has Declined From Recent Peak Output Levels but Remains up 2.0% YOY

Crude Oil Production Has Declined From Recent Peak Output Levels but Remains up 2.0% YOY

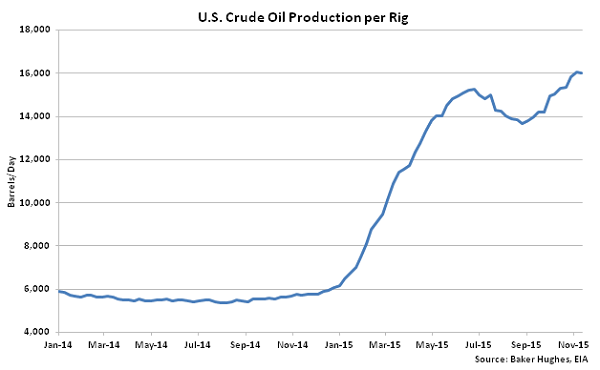

Crude Oil Production per Rig Increased to a Six Year High During the Week Ending Nov 6th

Crude Oil Production per Rig Increased to a Six Year High During the Week Ending Nov 6th

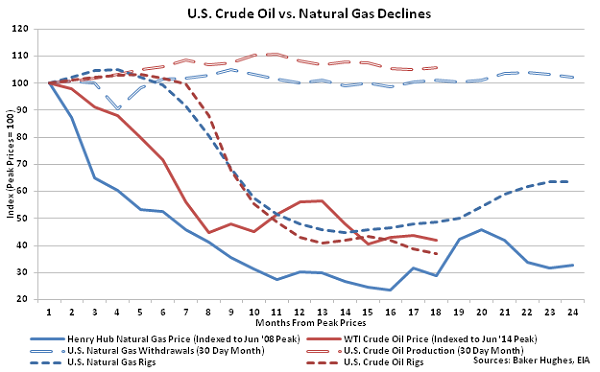

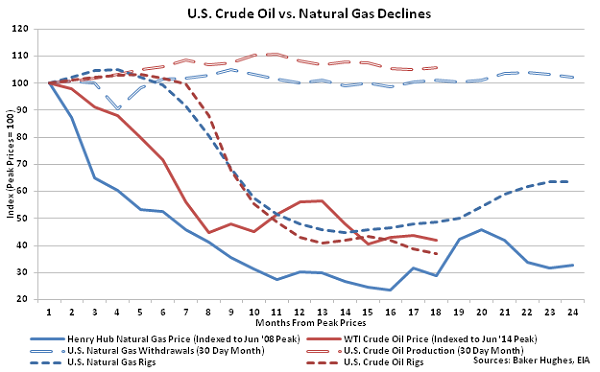

Resilient Production Despite a Collapse in Price & Rigs on Same Trajectory as ’08 Natural Gas

Resilient Production Despite a Collapse in Price & Rigs on Same Trajectory as ’08 Natural Gas

U.S. Oil Rig Counts Peaked in Late 2014, Prior to the Recent Declines

U.S. Oil Rig Counts Peaked in Late 2014, Prior to the Recent Declines

Nov 13th U.S. Oil Rigs Increased 0.3% From the Previous Week but Remain Down 63.6% YOY

Nov 13th U.S. Oil Rigs Increased 0.3% From the Previous Week but Remain Down 63.6% YOY

The Recent Decline in U.S. Oil Rig Counts Since the Nov ’14 Peak has Been Significant

The Recent Decline in U.S. Oil Rig Counts Since the Nov ’14 Peak has Been Significant

Declines in U.S. Oil Rig Counts Have Decelerated Since February

Declines in U.S. Oil Rig Counts Have Decelerated Since February

Declines in Vertical Rigs Remain the Most Significant on a Percentage Basis

Declines in Vertical Rigs Remain the Most Significant on a Percentage Basis

Crude Oil Production Has Declined From Recent Peak Output Levels but Remains up 2.0% YOY

Crude Oil Production Has Declined From Recent Peak Output Levels but Remains up 2.0% YOY

Crude Oil Production per Rig Increased to a Six Year High During the Week Ending Nov 6th

Crude Oil Production per Rig Increased to a Six Year High During the Week Ending Nov 6th

Resilient Production Despite a Collapse in Price & Rigs on Same Trajectory as ’08 Natural Gas

Resilient Production Despite a Collapse in Price & Rigs on Same Trajectory as ’08 Natural Gas