U.S. Dry Product Stocks Update – Dec ’15

Dry Whey – Stocks Continue to Draw Down Seasonally, Remain Higher on YOY Basis

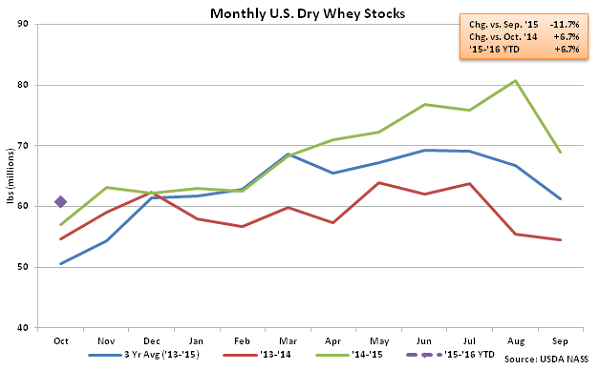

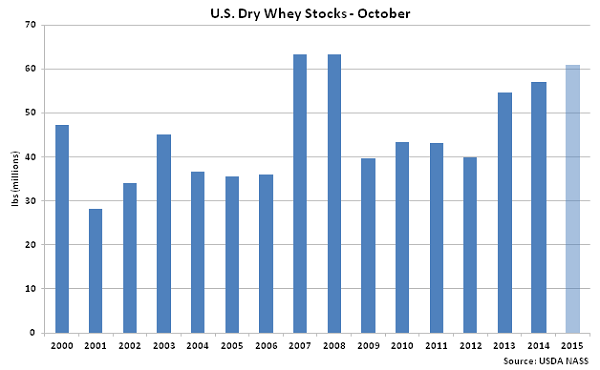

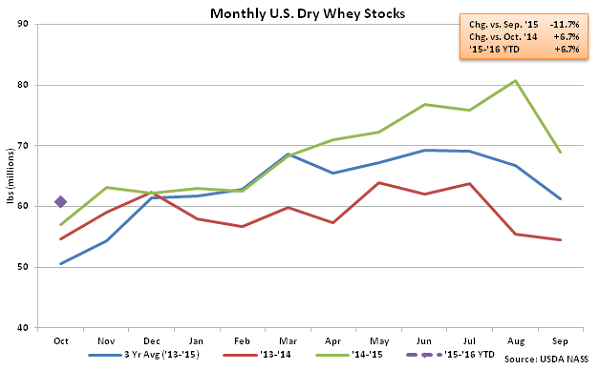

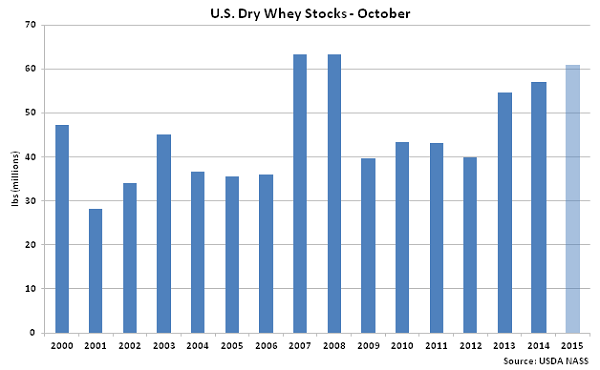

Oct ’15 month-end dry whey stocks remained higher on a YOY basis, finishing 6.7% above the previous year as production continues to expand. Oct ’15 total dry whey stocks of 60.9 million lbs declined 11.7% MOM but remained 20.4% higher than the three year average October month-end dry whey stocks. The MOM decline of 11.7%, or 8.1 million lbs, was larger than the ten year average September – October seasonal decline in dry whey stocks of 6.1%, or 3.4 million lbs, however Oct ’15 dry whey stocks remained at a six year high for the month of October.

Oct ’15 month-end dry whey stocks remained higher on a YOY basis, finishing 6.7% above the previous year as production continues to expand. Oct ’15 total dry whey stocks of 60.9 million lbs declined 11.7% MOM but remained 20.4% higher than the three year average October month-end dry whey stocks. The MOM decline of 11.7%, or 8.1 million lbs, was larger than the ten year average September – October seasonal decline in dry whey stocks of 6.1%, or 3.4 million lbs, however Oct ’15 dry whey stocks remained at a six year high for the month of October.

NFDM – Stocks Finish Slightly Below the Previous Year’s Record October Stocks Level

NFDM – Stocks Finish Slightly Below the Previous Year’s Record October Stocks Level

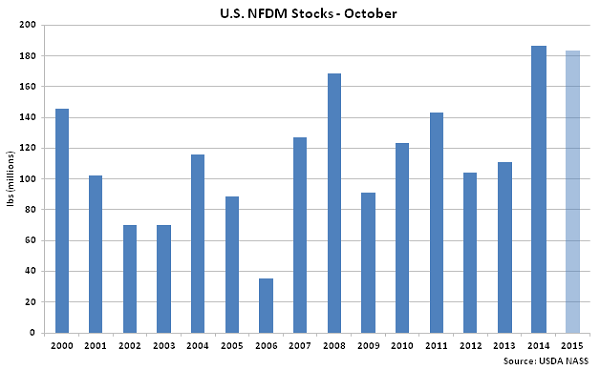

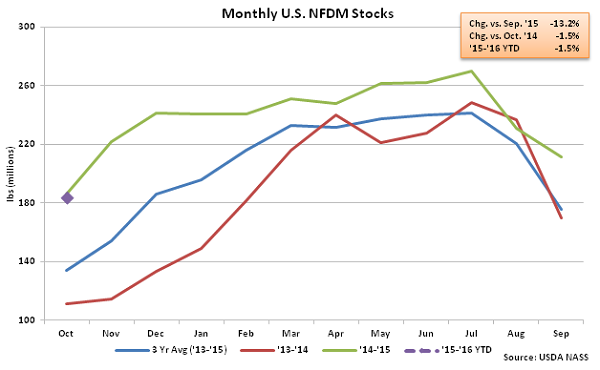

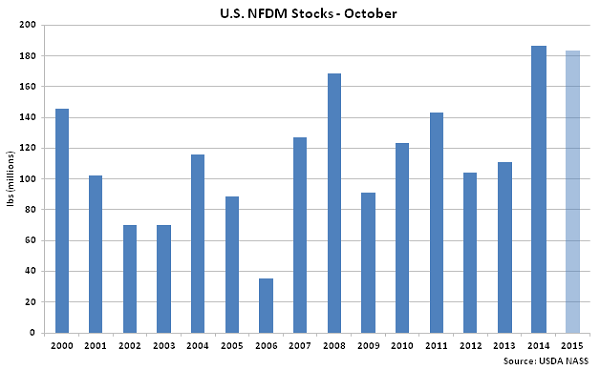

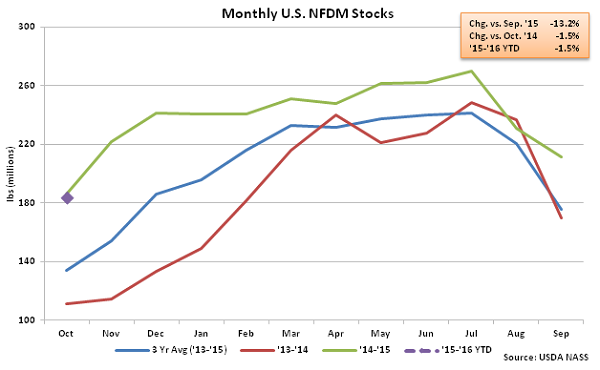

Oct ’15 month-end NFDM stocks of 183.6 million pounds finished 1.5% below the previous year’s record October stocks but remained at the second largest October figure on record. Oct ’15 month-end NFDM stocks also declined MOM by 13.2%, or 28.0 million pounds, which was significantly more than the ten year average September – October seasonal decline in NFDM stocks of 7.8%, or 8.5 million lbs. Oct ’15 NFDM production declined YOY for only the second time in the past 21 months, contributing to the decline in stocks. Despite the YOY decline, NFDM stocks remained significantly higher than the three year average October NFDM stocks, finishing up 37.1%.

Oct ’15 month-end NFDM stocks of 183.6 million pounds finished 1.5% below the previous year’s record October stocks but remained at the second largest October figure on record. Oct ’15 month-end NFDM stocks also declined MOM by 13.2%, or 28.0 million pounds, which was significantly more than the ten year average September – October seasonal decline in NFDM stocks of 7.8%, or 8.5 million lbs. Oct ’15 NFDM production declined YOY for only the second time in the past 21 months, contributing to the decline in stocks. Despite the YOY decline, NFDM stocks remained significantly higher than the three year average October NFDM stocks, finishing up 37.1%.

Oct ’15 month-end dry whey stocks remained higher on a YOY basis, finishing 6.7% above the previous year as production continues to expand. Oct ’15 total dry whey stocks of 60.9 million lbs declined 11.7% MOM but remained 20.4% higher than the three year average October month-end dry whey stocks. The MOM decline of 11.7%, or 8.1 million lbs, was larger than the ten year average September – October seasonal decline in dry whey stocks of 6.1%, or 3.4 million lbs, however Oct ’15 dry whey stocks remained at a six year high for the month of October.

Oct ’15 month-end dry whey stocks remained higher on a YOY basis, finishing 6.7% above the previous year as production continues to expand. Oct ’15 total dry whey stocks of 60.9 million lbs declined 11.7% MOM but remained 20.4% higher than the three year average October month-end dry whey stocks. The MOM decline of 11.7%, or 8.1 million lbs, was larger than the ten year average September – October seasonal decline in dry whey stocks of 6.1%, or 3.4 million lbs, however Oct ’15 dry whey stocks remained at a six year high for the month of October.

NFDM – Stocks Finish Slightly Below the Previous Year’s Record October Stocks Level

NFDM – Stocks Finish Slightly Below the Previous Year’s Record October Stocks Level

Oct ’15 month-end NFDM stocks of 183.6 million pounds finished 1.5% below the previous year’s record October stocks but remained at the second largest October figure on record. Oct ’15 month-end NFDM stocks also declined MOM by 13.2%, or 28.0 million pounds, which was significantly more than the ten year average September – October seasonal decline in NFDM stocks of 7.8%, or 8.5 million lbs. Oct ’15 NFDM production declined YOY for only the second time in the past 21 months, contributing to the decline in stocks. Despite the YOY decline, NFDM stocks remained significantly higher than the three year average October NFDM stocks, finishing up 37.1%.

Oct ’15 month-end NFDM stocks of 183.6 million pounds finished 1.5% below the previous year’s record October stocks but remained at the second largest October figure on record. Oct ’15 month-end NFDM stocks also declined MOM by 13.2%, or 28.0 million pounds, which was significantly more than the ten year average September – October seasonal decline in NFDM stocks of 7.8%, or 8.5 million lbs. Oct ’15 NFDM production declined YOY for only the second time in the past 21 months, contributing to the decline in stocks. Despite the YOY decline, NFDM stocks remained significantly higher than the three year average October NFDM stocks, finishing up 37.1%.