EIA Drilling Productivity Report Update – Apr ’16

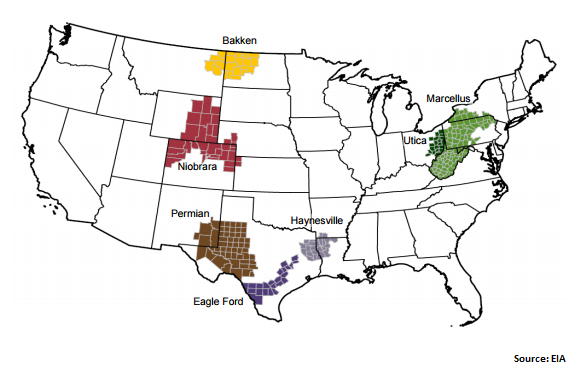

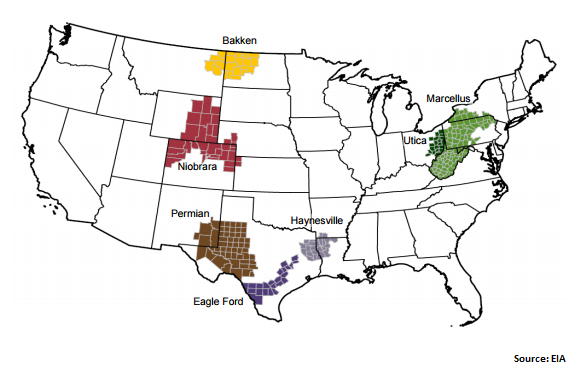

According to the EIA’s April Drilling Productivity Report, U.S. oil output is expected to continue to decline through May ’16. The Drilling Productivity Report uses recent data on the total number of drilling rigs in operation, estimates of drilling productivity, and estimated changes in production from existing wells to provide estimated changes in oil production for the seven key regions shown below. The seven regions analyzed have accounted for 95% of domestic oil production growth from 2011-2013.

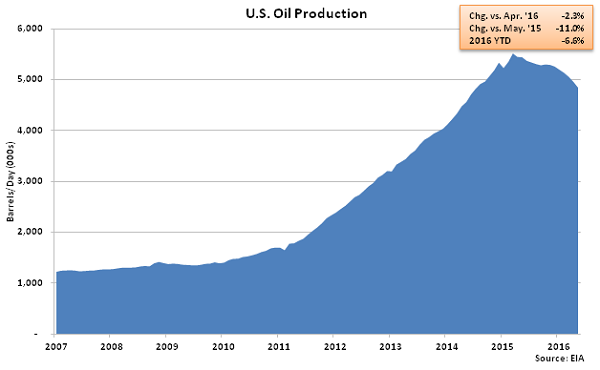

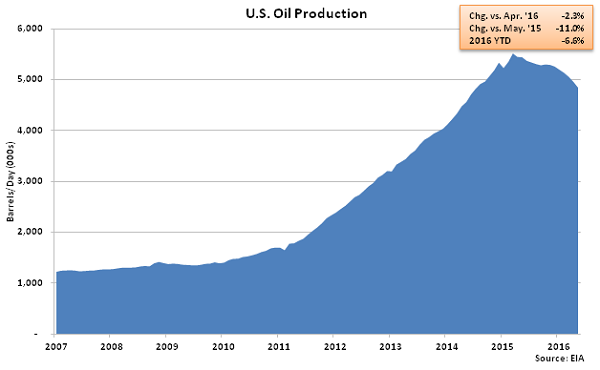

Apr ’16 production was revised higher by approximately 72,000 barrels per day (bpd), or 1.6%, but is expected to remain 99,000 bpd, or 2.0%, below Mar ’16 production levels. May ’16 production is expected to decline an additional 115,000 bpd, or 2.3%, from the Apr ’16 revised production levels to 4.84 million bpd, a 22 month low and 11.0% below the previous year.

Apr ’16 production was revised higher by approximately 72,000 barrels per day (bpd), or 1.6%, but is expected to remain 99,000 bpd, or 2.0%, below Mar ’16 production levels. May ’16 production is expected to decline an additional 115,000 bpd, or 2.3%, from the Apr ’16 revised production levels to 4.84 million bpd, a 22 month low and 11.0% below the previous year.

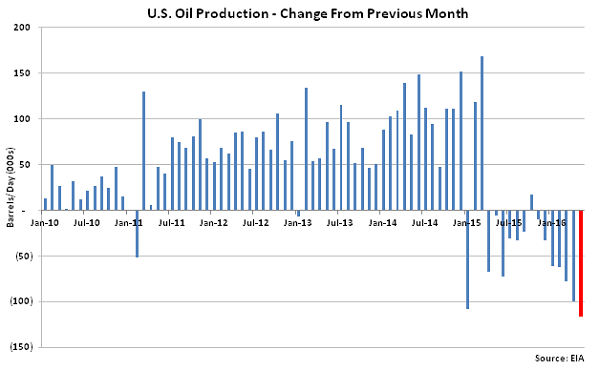

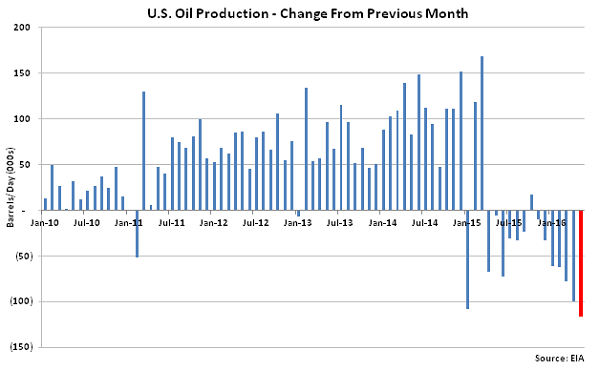

Projected MOM declines in oil production have been exhibited over 11 of the past 12 months through May ’16. The May ’16 projected declined in oil production was the largest experienced since the report was originated in 2007.

Projected MOM declines in oil production have been exhibited over 11 of the past 12 months through May ’16. The May ’16 projected declined in oil production was the largest experienced since the report was originated in 2007.

Projected MOM declines in oil production continue to be led by the Eagle Ford, Bakken and Niobrara regions. The aforementioned regions are expected to experience MOM production declines of 62,000 bpd (5.0%), 31,000 bpd (2.9%) and 16,000 bpd (3.8%), respectively in Apr ’16. Projected MOM declines in oil production were widespread across other major growth areas, including the first projected MOM declines in production within the Permian and Utica regions experienced in the past nine and 22 months, respectively.

Projected MOM declines in oil production continue to be led by the Eagle Ford, Bakken and Niobrara regions. The aforementioned regions are expected to experience MOM production declines of 62,000 bpd (5.0%), 31,000 bpd (2.9%) and 16,000 bpd (3.8%), respectively in Apr ’16. Projected MOM declines in oil production were widespread across other major growth areas, including the first projected MOM declines in production within the Permian and Utica regions experienced in the past nine and 22 months, respectively.

Apr ’16 production was revised higher by approximately 72,000 barrels per day (bpd), or 1.6%, but is expected to remain 99,000 bpd, or 2.0%, below Mar ’16 production levels. May ’16 production is expected to decline an additional 115,000 bpd, or 2.3%, from the Apr ’16 revised production levels to 4.84 million bpd, a 22 month low and 11.0% below the previous year.

Apr ’16 production was revised higher by approximately 72,000 barrels per day (bpd), or 1.6%, but is expected to remain 99,000 bpd, or 2.0%, below Mar ’16 production levels. May ’16 production is expected to decline an additional 115,000 bpd, or 2.3%, from the Apr ’16 revised production levels to 4.84 million bpd, a 22 month low and 11.0% below the previous year.

Projected MOM declines in oil production have been exhibited over 11 of the past 12 months through May ’16. The May ’16 projected declined in oil production was the largest experienced since the report was originated in 2007.

Projected MOM declines in oil production have been exhibited over 11 of the past 12 months through May ’16. The May ’16 projected declined in oil production was the largest experienced since the report was originated in 2007.

Projected MOM declines in oil production continue to be led by the Eagle Ford, Bakken and Niobrara regions. The aforementioned regions are expected to experience MOM production declines of 62,000 bpd (5.0%), 31,000 bpd (2.9%) and 16,000 bpd (3.8%), respectively in Apr ’16. Projected MOM declines in oil production were widespread across other major growth areas, including the first projected MOM declines in production within the Permian and Utica regions experienced in the past nine and 22 months, respectively.

Projected MOM declines in oil production continue to be led by the Eagle Ford, Bakken and Niobrara regions. The aforementioned regions are expected to experience MOM production declines of 62,000 bpd (5.0%), 31,000 bpd (2.9%) and 16,000 bpd (3.8%), respectively in Apr ’16. Projected MOM declines in oil production were widespread across other major growth areas, including the first projected MOM declines in production within the Permian and Utica regions experienced in the past nine and 22 months, respectively.