June ’16 USDA Planted Acreage Report

Corn – Bearish

o The acreage projection of 94.1 million acres planted was up from 93.6 million in March but well above the 92.9 million average trade estimates.

o The focus will now turn predominately to weather and pollination in July.

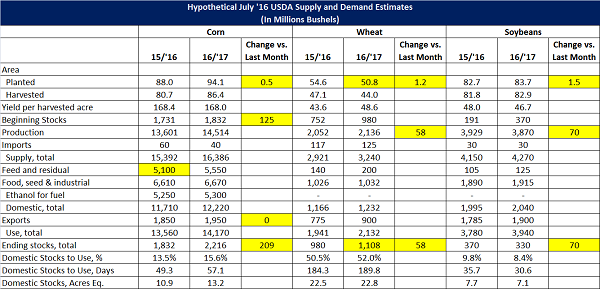

o Projected carry-outs will likely be north of 2.2 billion in the July report which would be the highest since 1988.

Soybeans – Neutral

o The acreage projection of 83.7 million acres planted was up from 82.2 million in March and in line with the 83.8 million average trade estimates.

o Soybeans will likely stay supported until August weather comes into clearer view when yields are typically made or lost.

Wheat – Bearish

o The acreage projection of 50.8 million acres planted was up from 49.6 million in March and well above the 49.9 million average trade estimates.

o Carryout is expected to climb further above last year’s historically high levels unless weather problems curtail corn production and force higher feed wheat usage.

Summary – An additional 3.2 million acres were added to corn, beans, and wheat which were about 2 million more than projected by the trade. Market focus turns now to weather in July for corn and August for soybeans. Without significant weather problems, grain balance sheets are very burdensome and soybeans remain on the tight side but manageable.

Click below for a downloadable pdf.

June ’16 USDA Planted Acreage Report

Corn – Bearish

o The acreage projection of 94.1 million acres planted was up from 93.6 million in March but well above the 92.9 million average trade estimates.

o The focus will now turn predominately to weather and pollination in July.

o Projected carry-outs will likely be north of 2.2 billion in the July report which would be the highest since 1988.

Soybeans – Neutral

o The acreage projection of 83.7 million acres planted was up from 82.2 million in March and in line with the 83.8 million average trade estimates.

o Soybeans will likely stay supported until August weather comes into clearer view when yields are typically made or lost.

Wheat – Bearish

o The acreage projection of 50.8 million acres planted was up from 49.6 million in March and well above the 49.9 million average trade estimates.

o Carryout is expected to climb further above last year’s historically high levels unless weather problems curtail corn production and force higher feed wheat usage.

Summary – An additional 3.2 million acres were added to corn, beans, and wheat which were about 2 million more than projected by the trade. Market focus turns now to weather in July for corn and August for soybeans. Without significant weather problems, grain balance sheets are very burdensome and soybeans remain on the tight side but manageable.

Click below for a downloadable pdf.

June ’16 USDA Planted Acreage Report