New Zealand Milk Production Update – Sep ’16

Executive Summary

New Zealand milk production figures provided by Dairy Companies Association of New Zealand (DCANZ) were recently updated with values spanning through Jul ’16. Highlights from the updated report include:

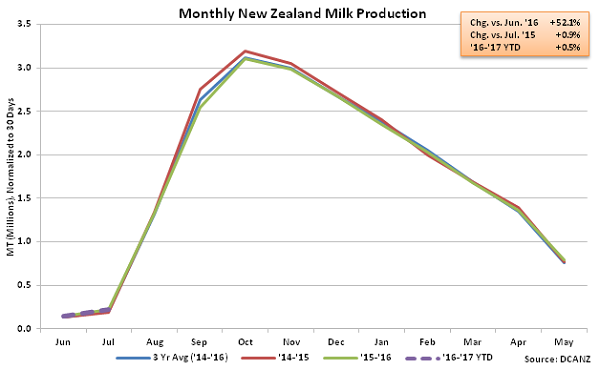

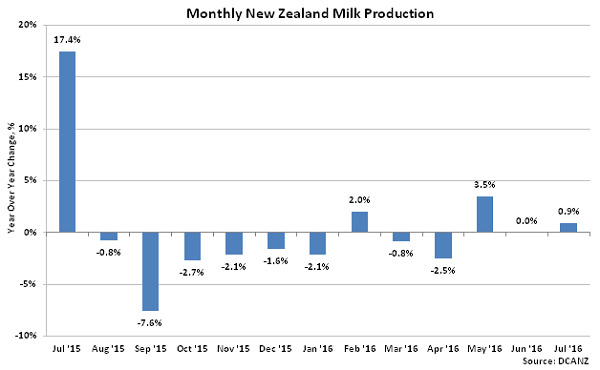

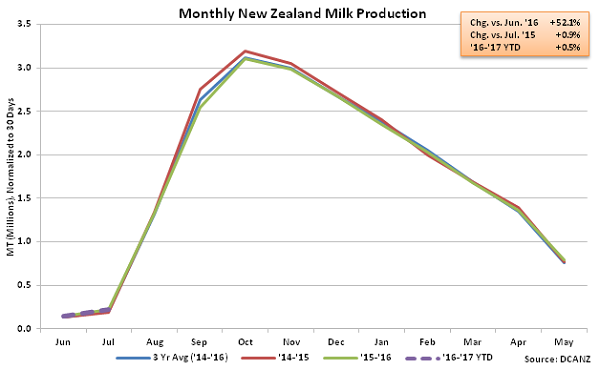

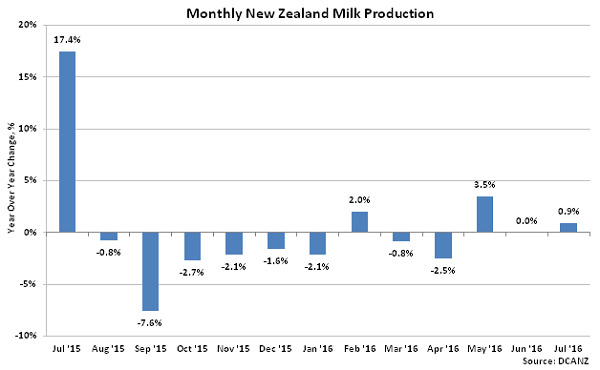

• New Zealand milk production finished up 0.9% on a YOY basis during Jul ’16, however production volumes remain near seasonal lows.

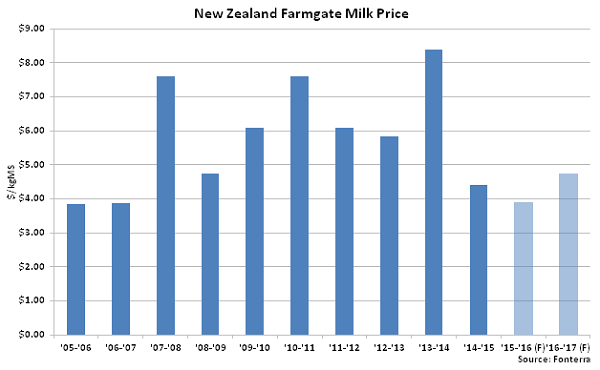

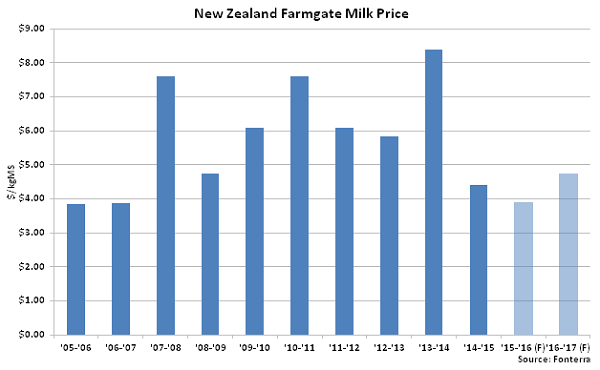

• ’16-’17 New Zealand farmgate milk price projections were raised by $0.50/kgMS to a total of $4.75/kgMS in Aug ’16 but remain below estimated breakeven levels.

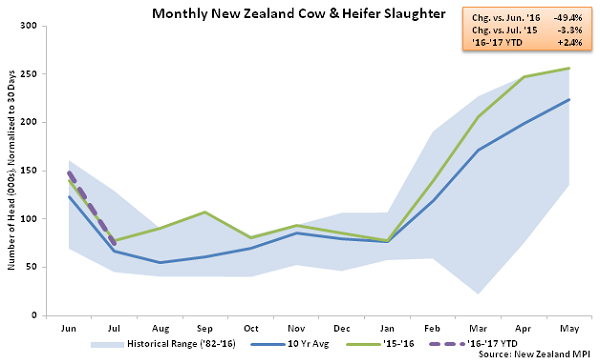

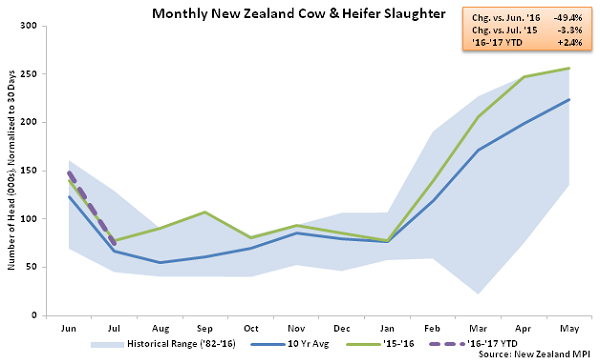

• Low farmgate milk prices have contributed to New Zealand cow & heifer slaughter rates reaching seasonal record highs during the heavy slaughter months of April and May. Jul ’16 New Zealand cow & heifer slaughter rates declined 3.3% YOY, but YTD slaughter rates remain up 2.4% throughout the first two months of the ’16-’17 production season.

Additional Report Details

According to DCANZ, Jul ’16 New Zealand milk production volumes increased 0.9% YOY but remain at minimal levels seasonally. New Zealand milk production typically reaches seasonal lows during the months of June and July as farmers dry off their herds in preparation for spring calving. July milk production has consisted of less than one percent of annual production levels throughout the past ten years.

Despite warnings of an El Niño event potentially resulting in dry conditions across New Zealand, better than anticipated growing conditions have resulted in only moderate YOY declines in milk production over recent months. ’15-’16 annual New Zealand milk production finished down just 1.9%, significantly less than Fonterra’s Mar ’16 projected annual YOY decline in milk collections of 4.0%.

Despite warnings of an El Niño event potentially resulting in dry conditions across New Zealand, better than anticipated growing conditions have resulted in only moderate YOY declines in milk production over recent months. ’15-’16 annual New Zealand milk production finished down just 1.9%, significantly less than Fonterra’s Mar ’16 projected annual YOY decline in milk collections of 4.0%.

Timely rainfall was experienced across the majority of New Zealand during the early months of 2016, reducing seasonally higher than average soil moisture deficits experienced in late 2015. Improving weather conditions contributed to YOY declines in New Zealand cow & heifer slaughter rates throughout the first quarter of 2016 however, more recently, slaughter rates have rebounded once again. ’15-’16 annual slaughter rates finished up 3.2% YOY as record seasonal highs were experienced during the heavy slaughter months of April and May. New Zealand cow & heifer slaughter rates declined 3.3% YOY during Jul ’16 but YTD slaughter rates remain up 2.4% throughout the first two months of the ’16-’17 production season.

Timely rainfall was experienced across the majority of New Zealand during the early months of 2016, reducing seasonally higher than average soil moisture deficits experienced in late 2015. Improving weather conditions contributed to YOY declines in New Zealand cow & heifer slaughter rates throughout the first quarter of 2016 however, more recently, slaughter rates have rebounded once again. ’15-’16 annual slaughter rates finished up 3.2% YOY as record seasonal highs were experienced during the heavy slaughter months of April and May. New Zealand cow & heifer slaughter rates declined 3.3% YOY during Jul ’16 but YTD slaughter rates remain up 2.4% throughout the first two months of the ’16-’17 production season.

Slaughter rates have accelerated as New Zealand farmgate milk prices remain below estimated breakeven levels. Fonterra released a ’16-’17 opening farmgate milk price of $4.25/kgMS during late May ’16, which was an increase of $0.35/kgMS from the ’15-’16 production season pay prices but lower than general expectations. The ’16-’17 farmgate milk price forecast was increased by $0.50/kgMS to a total of $4.75/kgMS during Aug ’16, as continued reductions in milk supply are expected to bring global supply and demand back into balance. Producer cashflows will remain under considerable financial pressure into 2017, however, which could result in continued aggressive culling and pullbacks in production levels.

Slaughter rates have accelerated as New Zealand farmgate milk prices remain below estimated breakeven levels. Fonterra released a ’16-’17 opening farmgate milk price of $4.25/kgMS during late May ’16, which was an increase of $0.35/kgMS from the ’15-’16 production season pay prices but lower than general expectations. The ’16-’17 farmgate milk price forecast was increased by $0.50/kgMS to a total of $4.75/kgMS during Aug ’16, as continued reductions in milk supply are expected to bring global supply and demand back into balance. Producer cashflows will remain under considerable financial pressure into 2017, however, which could result in continued aggressive culling and pullbacks in production levels.

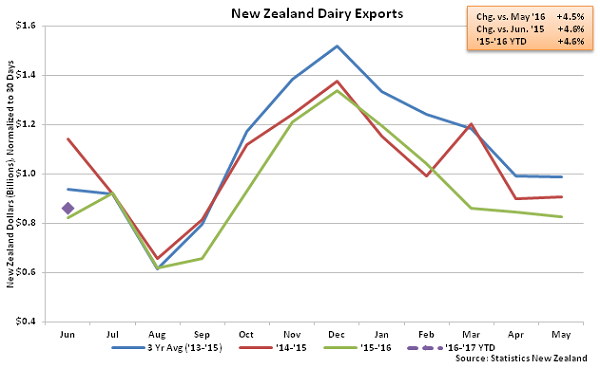

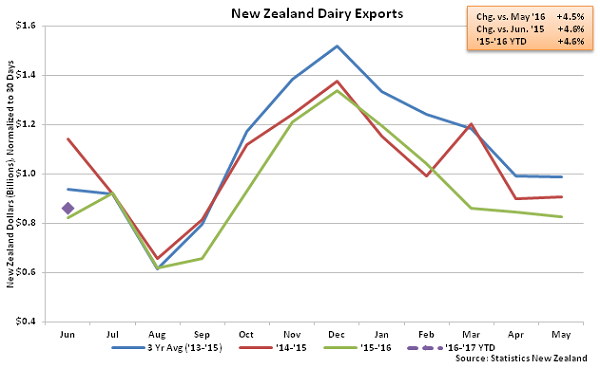

In addition to low farmgate milk prices, weaker export demand for New Zealand dairy products has also become a concern for New Zealand dairy producers over recent months. The ’15-’16 annual value of New Zealand dairy exports finished down 9.3% YOY, reaching a six year low. The total value of New Zealand dairy exports finished 4.6% higher on a YOY basis during Jun ’16, but remained 8.3% below three year average figures.

In addition to low farmgate milk prices, weaker export demand for New Zealand dairy products has also become a concern for New Zealand dairy producers over recent months. The ’15-’16 annual value of New Zealand dairy exports finished down 9.3% YOY, reaching a six year low. The total value of New Zealand dairy exports finished 4.6% higher on a YOY basis during Jun ’16, but remained 8.3% below three year average figures.

Despite warnings of an El Niño event potentially resulting in dry conditions across New Zealand, better than anticipated growing conditions have resulted in only moderate YOY declines in milk production over recent months. ’15-’16 annual New Zealand milk production finished down just 1.9%, significantly less than Fonterra’s Mar ’16 projected annual YOY decline in milk collections of 4.0%.

Despite warnings of an El Niño event potentially resulting in dry conditions across New Zealand, better than anticipated growing conditions have resulted in only moderate YOY declines in milk production over recent months. ’15-’16 annual New Zealand milk production finished down just 1.9%, significantly less than Fonterra’s Mar ’16 projected annual YOY decline in milk collections of 4.0%.

Timely rainfall was experienced across the majority of New Zealand during the early months of 2016, reducing seasonally higher than average soil moisture deficits experienced in late 2015. Improving weather conditions contributed to YOY declines in New Zealand cow & heifer slaughter rates throughout the first quarter of 2016 however, more recently, slaughter rates have rebounded once again. ’15-’16 annual slaughter rates finished up 3.2% YOY as record seasonal highs were experienced during the heavy slaughter months of April and May. New Zealand cow & heifer slaughter rates declined 3.3% YOY during Jul ’16 but YTD slaughter rates remain up 2.4% throughout the first two months of the ’16-’17 production season.

Timely rainfall was experienced across the majority of New Zealand during the early months of 2016, reducing seasonally higher than average soil moisture deficits experienced in late 2015. Improving weather conditions contributed to YOY declines in New Zealand cow & heifer slaughter rates throughout the first quarter of 2016 however, more recently, slaughter rates have rebounded once again. ’15-’16 annual slaughter rates finished up 3.2% YOY as record seasonal highs were experienced during the heavy slaughter months of April and May. New Zealand cow & heifer slaughter rates declined 3.3% YOY during Jul ’16 but YTD slaughter rates remain up 2.4% throughout the first two months of the ’16-’17 production season.

Slaughter rates have accelerated as New Zealand farmgate milk prices remain below estimated breakeven levels. Fonterra released a ’16-’17 opening farmgate milk price of $4.25/kgMS during late May ’16, which was an increase of $0.35/kgMS from the ’15-’16 production season pay prices but lower than general expectations. The ’16-’17 farmgate milk price forecast was increased by $0.50/kgMS to a total of $4.75/kgMS during Aug ’16, as continued reductions in milk supply are expected to bring global supply and demand back into balance. Producer cashflows will remain under considerable financial pressure into 2017, however, which could result in continued aggressive culling and pullbacks in production levels.

Slaughter rates have accelerated as New Zealand farmgate milk prices remain below estimated breakeven levels. Fonterra released a ’16-’17 opening farmgate milk price of $4.25/kgMS during late May ’16, which was an increase of $0.35/kgMS from the ’15-’16 production season pay prices but lower than general expectations. The ’16-’17 farmgate milk price forecast was increased by $0.50/kgMS to a total of $4.75/kgMS during Aug ’16, as continued reductions in milk supply are expected to bring global supply and demand back into balance. Producer cashflows will remain under considerable financial pressure into 2017, however, which could result in continued aggressive culling and pullbacks in production levels.

In addition to low farmgate milk prices, weaker export demand for New Zealand dairy products has also become a concern for New Zealand dairy producers over recent months. The ’15-’16 annual value of New Zealand dairy exports finished down 9.3% YOY, reaching a six year low. The total value of New Zealand dairy exports finished 4.6% higher on a YOY basis during Jun ’16, but remained 8.3% below three year average figures.

In addition to low farmgate milk prices, weaker export demand for New Zealand dairy products has also become a concern for New Zealand dairy producers over recent months. The ’15-’16 annual value of New Zealand dairy exports finished down 9.3% YOY, reaching a six year low. The total value of New Zealand dairy exports finished 4.6% higher on a YOY basis during Jun ’16, but remained 8.3% below three year average figures.