U.S. Dairy Cow Slaughter Update – Sep ’16

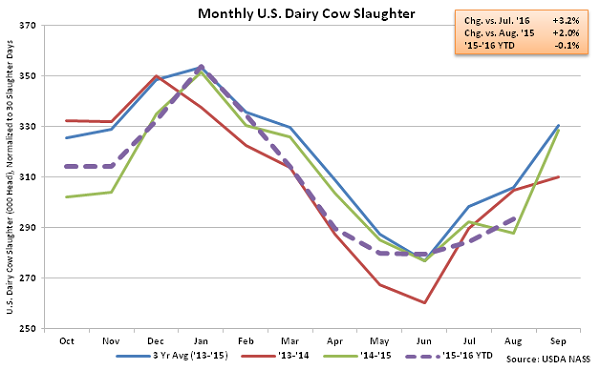

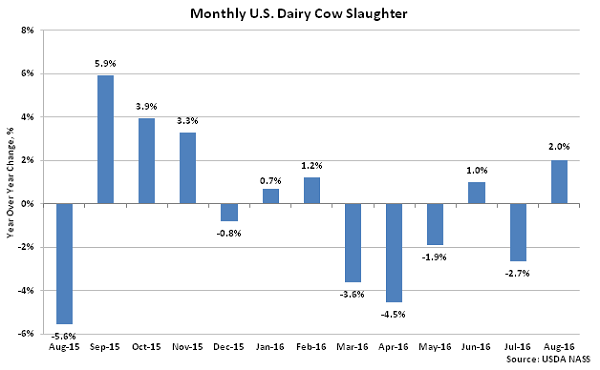

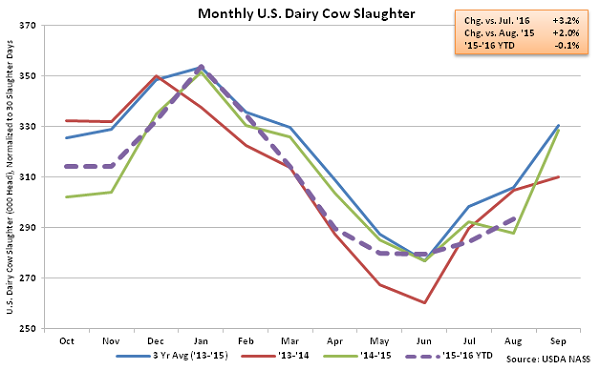

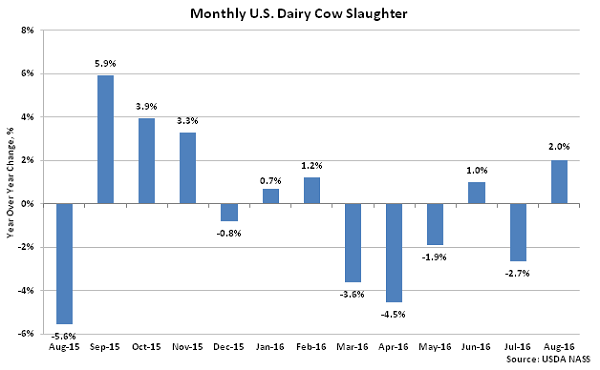

According to USDA, Sep ’16 U.S. dairy cow slaughter of 244,600 head increased 3.2% MOM and 2.0% YOY when normalized for slaughter days. The YOY increase in U.S. dairy cow slaughter rates was only the second experienced throughout the past six months and the largest experienced throughout the past nine months on a percentage basis however the seasonal increase in slaughter rates of 3.2% was less than half of the ten year average July – August increase of 6.9%.

’15-’16 YTD dairy cow slaughter remains down 0.1% YOY throughout the first 11 months of the production season as rates have fallen 1.7% below the previous year levels over the past six months. The decline in slaughter rates exhibited throughout the past six months has contributed to the U.S. milk cow herd finishing at the highest figure experienced throughout the past 20 years during Aug ’16. The total U.S. milk cow herd currently stands at 9.36 million head, which is 45,000 head more than August of last year.

’15-’16 YTD dairy cow slaughter remains down 0.1% YOY throughout the first 11 months of the production season as rates have fallen 1.7% below the previous year levels over the past six months. The decline in slaughter rates exhibited throughout the past six months has contributed to the U.S. milk cow herd finishing at the highest figure experienced throughout the past 20 years during Aug ’16. The total U.S. milk cow herd currently stands at 9.36 million head, which is 45,000 head more than August of last year.

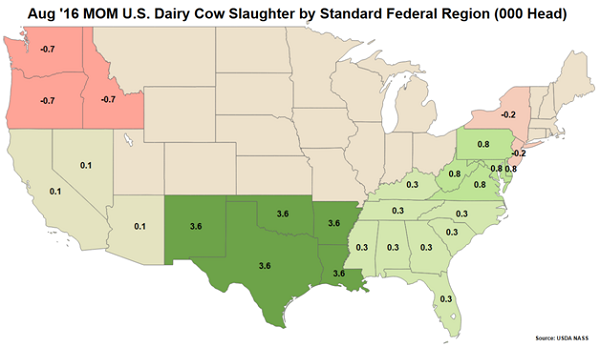

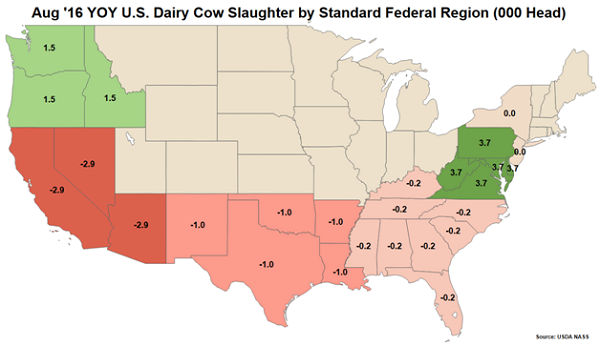

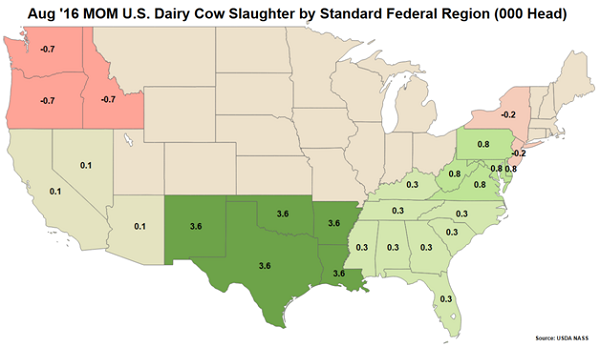

The most significant MOM increase in dairy cow slaughter was exhibited in Standard Federal Region 6 (Arkansas, Louisiana, New Mexico, Oklahoma and Texas) while slaughter rates declined most significantly on a MOM basis in Standard Federal Region 10 (Alaska, Idaho, Oregon and Washington). Figures for Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin) were withheld to avoid disclosing data for individual operators.

The most significant MOM increase in dairy cow slaughter was exhibited in Standard Federal Region 6 (Arkansas, Louisiana, New Mexico, Oklahoma and Texas) while slaughter rates declined most significantly on a MOM basis in Standard Federal Region 10 (Alaska, Idaho, Oregon and Washington). Figures for Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin) were withheld to avoid disclosing data for individual operators.

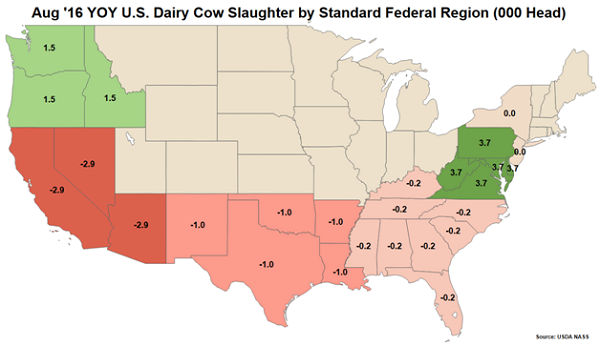

The largest YOY increase in dairy cow slaughter was exhibited in Standard Federal Region 3 (Delaware, Maryland, Pennsylvania, Virginia and West Virginia), followed by Standard Federal Region 10 (Alaska, Idaho, Oregon and Washington) while slaughter declined most significantly on a YOY basis within Standard Federal Region 9 (Arizona, California, Hawaii and Nevada).

The largest YOY increase in dairy cow slaughter was exhibited in Standard Federal Region 3 (Delaware, Maryland, Pennsylvania, Virginia and West Virginia), followed by Standard Federal Region 10 (Alaska, Idaho, Oregon and Washington) while slaughter declined most significantly on a YOY basis within Standard Federal Region 9 (Arizona, California, Hawaii and Nevada).

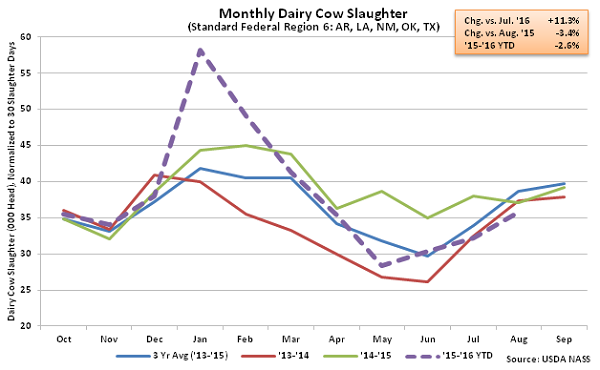

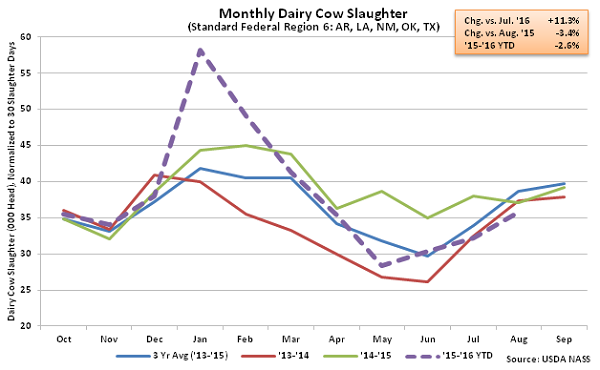

Dairy cow slaughter within Standard Federal Region 6 (Arkansas, Louisiana, New Mexico, Oklahoma and Texas) increased 11.3% MOM but remained 3.4% lower YOY. Monthly slaughter rates had reached record high levels during Jan ’16 as effects from Winter Storm Goliath were experienced, however slaughter levels have declined by a total of 11.1% YOY throughout the past six months.

Dairy cow slaughter within Standard Federal Region 6 (Arkansas, Louisiana, New Mexico, Oklahoma and Texas) increased 11.3% MOM but remained 3.4% lower YOY. Monthly slaughter rates had reached record high levels during Jan ’16 as effects from Winter Storm Goliath were experienced, however slaughter levels have declined by a total of 11.1% YOY throughout the past six months.

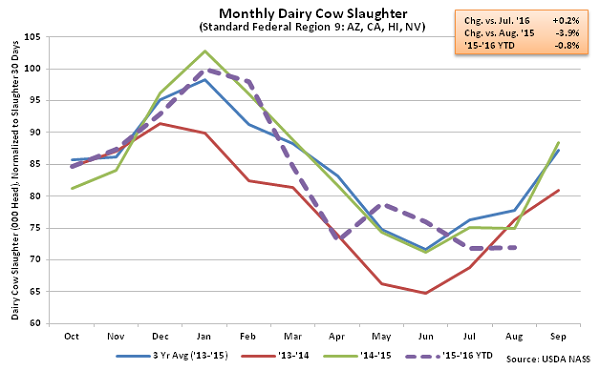

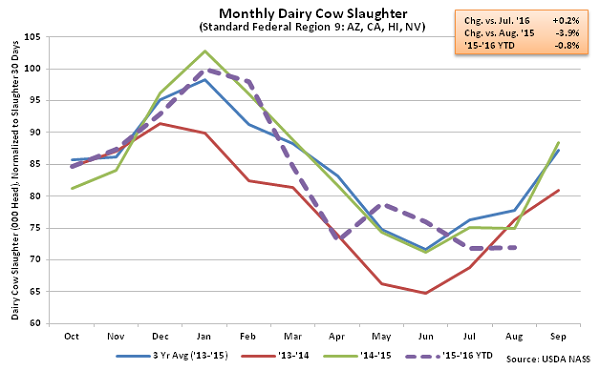

Dairy cow slaughter within Standard Federal Region 9 (Arizona, California, Hawaii and Nevada) increased 0.2% MOM but finished down 3.9% YOY when normalized for slaughter days. ’15-’16 YTD dairy cow slaughter is down 0.8% YOY throughout the first 11 months of the production season within Standard Federal Region 9.

Dairy cow slaughter within Standard Federal Region 9 (Arizona, California, Hawaii and Nevada) increased 0.2% MOM but finished down 3.9% YOY when normalized for slaughter days. ’15-’16 YTD dairy cow slaughter is down 0.8% YOY throughout the first 11 months of the production season within Standard Federal Region 9.

’15-’16 YTD dairy cow slaughter remains down 0.1% YOY throughout the first 11 months of the production season as rates have fallen 1.7% below the previous year levels over the past six months. The decline in slaughter rates exhibited throughout the past six months has contributed to the U.S. milk cow herd finishing at the highest figure experienced throughout the past 20 years during Aug ’16. The total U.S. milk cow herd currently stands at 9.36 million head, which is 45,000 head more than August of last year.

’15-’16 YTD dairy cow slaughter remains down 0.1% YOY throughout the first 11 months of the production season as rates have fallen 1.7% below the previous year levels over the past six months. The decline in slaughter rates exhibited throughout the past six months has contributed to the U.S. milk cow herd finishing at the highest figure experienced throughout the past 20 years during Aug ’16. The total U.S. milk cow herd currently stands at 9.36 million head, which is 45,000 head more than August of last year.

The most significant MOM increase in dairy cow slaughter was exhibited in Standard Federal Region 6 (Arkansas, Louisiana, New Mexico, Oklahoma and Texas) while slaughter rates declined most significantly on a MOM basis in Standard Federal Region 10 (Alaska, Idaho, Oregon and Washington). Figures for Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin) were withheld to avoid disclosing data for individual operators.

The most significant MOM increase in dairy cow slaughter was exhibited in Standard Federal Region 6 (Arkansas, Louisiana, New Mexico, Oklahoma and Texas) while slaughter rates declined most significantly on a MOM basis in Standard Federal Region 10 (Alaska, Idaho, Oregon and Washington). Figures for Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin) were withheld to avoid disclosing data for individual operators.

The largest YOY increase in dairy cow slaughter was exhibited in Standard Federal Region 3 (Delaware, Maryland, Pennsylvania, Virginia and West Virginia), followed by Standard Federal Region 10 (Alaska, Idaho, Oregon and Washington) while slaughter declined most significantly on a YOY basis within Standard Federal Region 9 (Arizona, California, Hawaii and Nevada).

The largest YOY increase in dairy cow slaughter was exhibited in Standard Federal Region 3 (Delaware, Maryland, Pennsylvania, Virginia and West Virginia), followed by Standard Federal Region 10 (Alaska, Idaho, Oregon and Washington) while slaughter declined most significantly on a YOY basis within Standard Federal Region 9 (Arizona, California, Hawaii and Nevada).

Dairy cow slaughter within Standard Federal Region 6 (Arkansas, Louisiana, New Mexico, Oklahoma and Texas) increased 11.3% MOM but remained 3.4% lower YOY. Monthly slaughter rates had reached record high levels during Jan ’16 as effects from Winter Storm Goliath were experienced, however slaughter levels have declined by a total of 11.1% YOY throughout the past six months.

Dairy cow slaughter within Standard Federal Region 6 (Arkansas, Louisiana, New Mexico, Oklahoma and Texas) increased 11.3% MOM but remained 3.4% lower YOY. Monthly slaughter rates had reached record high levels during Jan ’16 as effects from Winter Storm Goliath were experienced, however slaughter levels have declined by a total of 11.1% YOY throughout the past six months.

Dairy cow slaughter within Standard Federal Region 9 (Arizona, California, Hawaii and Nevada) increased 0.2% MOM but finished down 3.9% YOY when normalized for slaughter days. ’15-’16 YTD dairy cow slaughter is down 0.8% YOY throughout the first 11 months of the production season within Standard Federal Region 9.

Dairy cow slaughter within Standard Federal Region 9 (Arizona, California, Hawaii and Nevada) increased 0.2% MOM but finished down 3.9% YOY when normalized for slaughter days. ’15-’16 YTD dairy cow slaughter is down 0.8% YOY throughout the first 11 months of the production season within Standard Federal Region 9.