U.S. Dry Product Stocks Update – Jan ’17

Dry Whey – Stocks Remain Higher on a YOY Basis Despite Lower Production, Finish up 6.0%

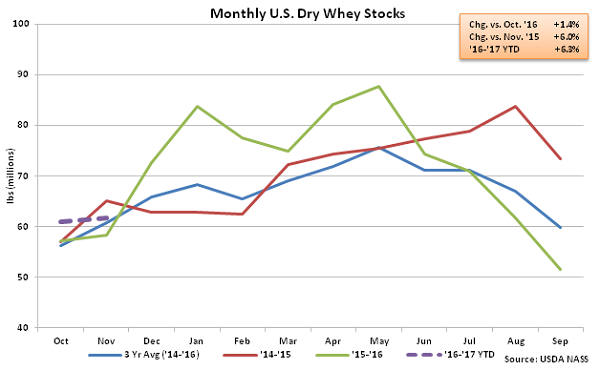

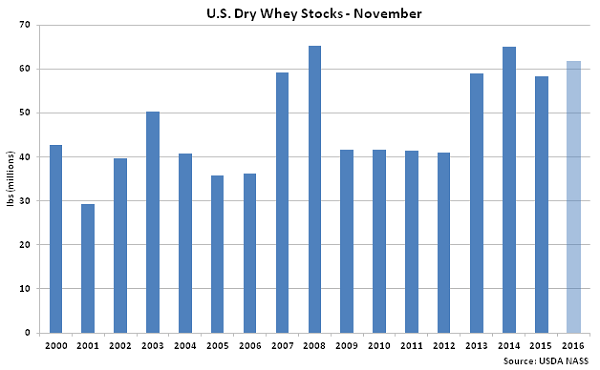

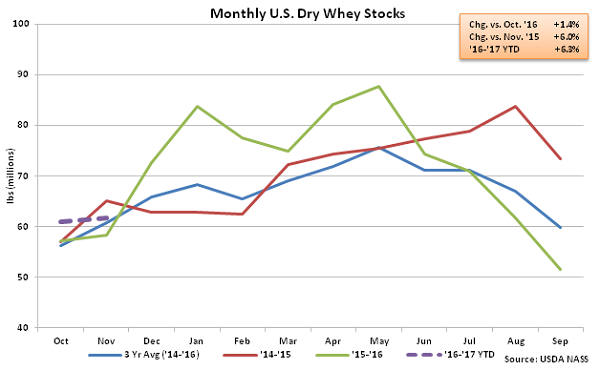

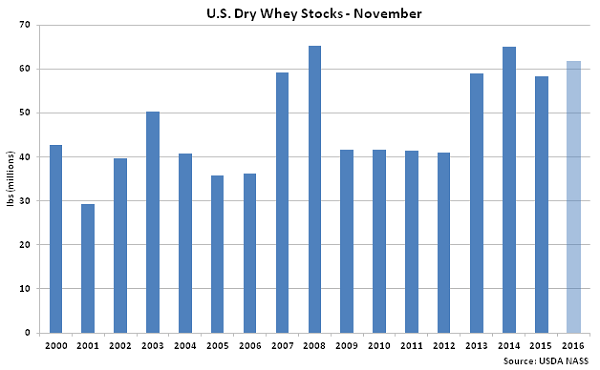

Nov ’16 month-end dry whey stocks of 61.8 million pounds increased 1.4% MOM while also finishing 6.0% higher on a YOY basis. Dry whey stocks finished higher on a YOY basis despite production declining by 6.9% on a YOY basis throughout the month. Previous year dry whey production and stock figures were both revised significantly lower during the most recent report. The MOM increase in dry whey stocks of 0.8 million pounds, or 1.4%, was significantly lower than the three year average October – November seasonal increase in dry whey stocks of 4.5 million pounds, or 8.1%. Despite the lower than average seasonal increase, dry whey stocks remained 1.5% above three year average figures for the month of November.

Nov ’16 month-end dry whey stocks of 61.8 million pounds increased 1.4% MOM while also finishing 6.0% higher on a YOY basis. Dry whey stocks finished higher on a YOY basis despite production declining by 6.9% on a YOY basis throughout the month. Previous year dry whey production and stock figures were both revised significantly lower during the most recent report. The MOM increase in dry whey stocks of 0.8 million pounds, or 1.4%, was significantly lower than the three year average October – November seasonal increase in dry whey stocks of 4.5 million pounds, or 8.1%. Despite the lower than average seasonal increase, dry whey stocks remained 1.5% above three year average figures for the month of November.

Nonfat Dry Milk – Stocks Remain Higher on a YOY Basis, Finish up 8.5% YOY

Nonfat Dry Milk – Stocks Remain Higher on a YOY Basis, Finish up 8.5% YOY

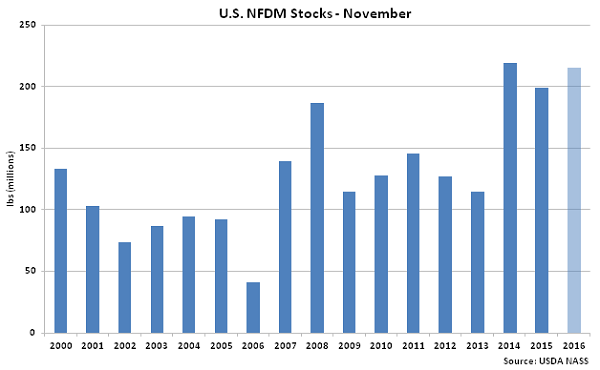

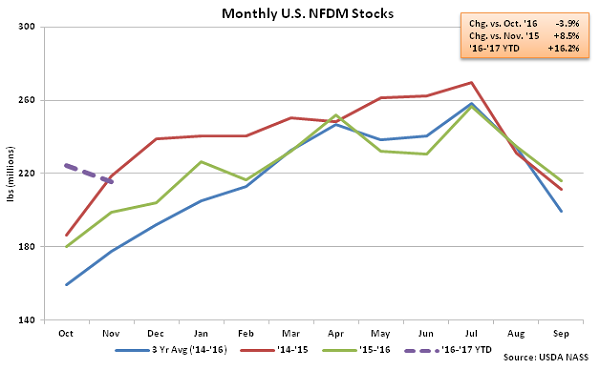

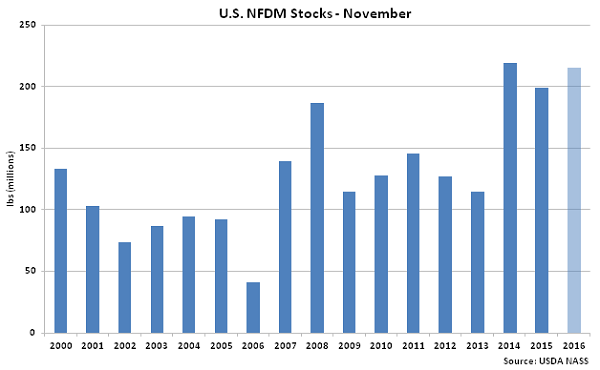

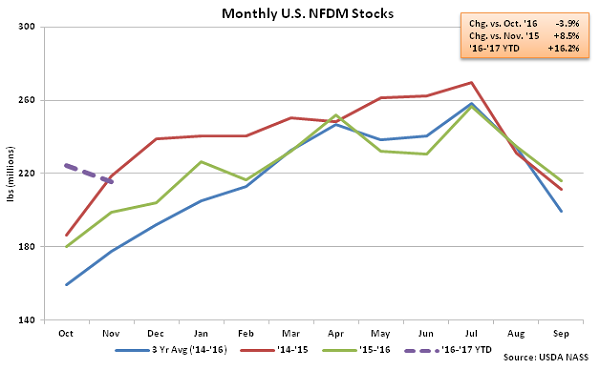

Nov ’16 month-end nonfat dry milk (NFDM) stocks of 215.8 million pounds remained higher on a YOY basis for the fourth consecutive month, finishing 8.5% higher than the previous year. NFDM stocks remained higher on a YOY basis despite production declining by 0.9% on a YOY basis throughout the month. Nov ’16 month-end NFDM stocks declined MOM by 8.8 million pounds, or 3.9%, however, which was a contraseasonal move when compared to the three year average October – November seasonal increase in NFDM stocks of 18.2 million pounds, or 10.3%. Despite the contraseasonal decline, Nov ’16 NFDM stocks finished 21.7% above three year average figures for the month of November.

Nov ’16 month-end nonfat dry milk (NFDM) stocks of 215.8 million pounds remained higher on a YOY basis for the fourth consecutive month, finishing 8.5% higher than the previous year. NFDM stocks remained higher on a YOY basis despite production declining by 0.9% on a YOY basis throughout the month. Nov ’16 month-end NFDM stocks declined MOM by 8.8 million pounds, or 3.9%, however, which was a contraseasonal move when compared to the three year average October – November seasonal increase in NFDM stocks of 18.2 million pounds, or 10.3%. Despite the contraseasonal decline, Nov ’16 NFDM stocks finished 21.7% above three year average figures for the month of November.

Nov ’16 month-end dry whey stocks of 61.8 million pounds increased 1.4% MOM while also finishing 6.0% higher on a YOY basis. Dry whey stocks finished higher on a YOY basis despite production declining by 6.9% on a YOY basis throughout the month. Previous year dry whey production and stock figures were both revised significantly lower during the most recent report. The MOM increase in dry whey stocks of 0.8 million pounds, or 1.4%, was significantly lower than the three year average October – November seasonal increase in dry whey stocks of 4.5 million pounds, or 8.1%. Despite the lower than average seasonal increase, dry whey stocks remained 1.5% above three year average figures for the month of November.

Nov ’16 month-end dry whey stocks of 61.8 million pounds increased 1.4% MOM while also finishing 6.0% higher on a YOY basis. Dry whey stocks finished higher on a YOY basis despite production declining by 6.9% on a YOY basis throughout the month. Previous year dry whey production and stock figures were both revised significantly lower during the most recent report. The MOM increase in dry whey stocks of 0.8 million pounds, or 1.4%, was significantly lower than the three year average October – November seasonal increase in dry whey stocks of 4.5 million pounds, or 8.1%. Despite the lower than average seasonal increase, dry whey stocks remained 1.5% above three year average figures for the month of November.

Nonfat Dry Milk – Stocks Remain Higher on a YOY Basis, Finish up 8.5% YOY

Nonfat Dry Milk – Stocks Remain Higher on a YOY Basis, Finish up 8.5% YOY

Nov ’16 month-end nonfat dry milk (NFDM) stocks of 215.8 million pounds remained higher on a YOY basis for the fourth consecutive month, finishing 8.5% higher than the previous year. NFDM stocks remained higher on a YOY basis despite production declining by 0.9% on a YOY basis throughout the month. Nov ’16 month-end NFDM stocks declined MOM by 8.8 million pounds, or 3.9%, however, which was a contraseasonal move when compared to the three year average October – November seasonal increase in NFDM stocks of 18.2 million pounds, or 10.3%. Despite the contraseasonal decline, Nov ’16 NFDM stocks finished 21.7% above three year average figures for the month of November.

Nov ’16 month-end nonfat dry milk (NFDM) stocks of 215.8 million pounds remained higher on a YOY basis for the fourth consecutive month, finishing 8.5% higher than the previous year. NFDM stocks remained higher on a YOY basis despite production declining by 0.9% on a YOY basis throughout the month. Nov ’16 month-end NFDM stocks declined MOM by 8.8 million pounds, or 3.9%, however, which was a contraseasonal move when compared to the three year average October – November seasonal increase in NFDM stocks of 18.2 million pounds, or 10.3%. Despite the contraseasonal decline, Nov ’16 NFDM stocks finished 21.7% above three year average figures for the month of November.