January ’17 USDA World Agriculture Supply and Demand

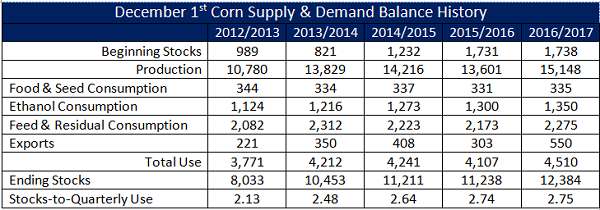

’15/’16 Corn

’15/’16 Corn

- No significant changes

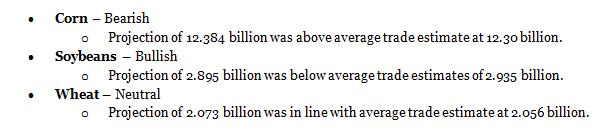

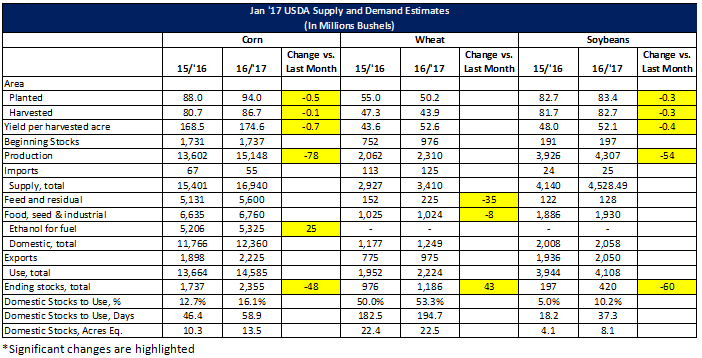

- Production was reduced by 78 million predominately from lower yields but also slightly less acres.

- Ending stocks at 2.355 billion bushels or 58.9 days of use was slightly below average private estimates.

- No significant changes

- Production was reduced by 78 million on a combination of lower yields less acreage.

- Ending stocks at 420 million bushels or 37.3 days of use was well below private estimates.

- No significant changes.

- Feed and residual usage declined by 35 million based on the most recent stocks surveys.

- Ending stocks at 1,186 million bushels was above with private estimates.

- Brazilian soybean production was increased by about 75 million bushels to 3.82 million total or up about 275 million bushels from last season’s weather reduced production.

- US Winter Wheat seeding was down a sharply by nearly 4 million acres at 32.4 million and the lowest ever surveyed.

- US red meat production was revised higher mainly on an increase of pork production leaving total red meat supplies up 4% versus 2016 and 8% versus 2015. US per capita consumption of meat is estimated to near record levels achieved in 2004.