Weekly DOE Ethanol Update – 1/19/17

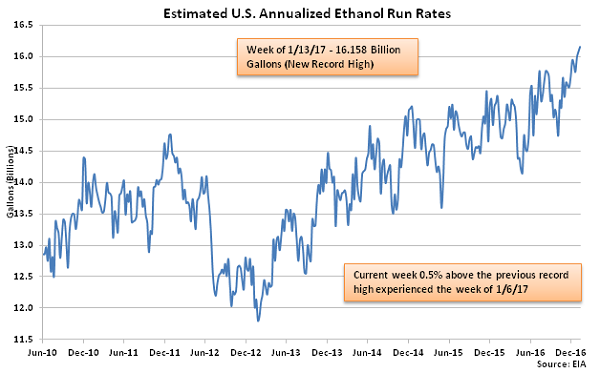

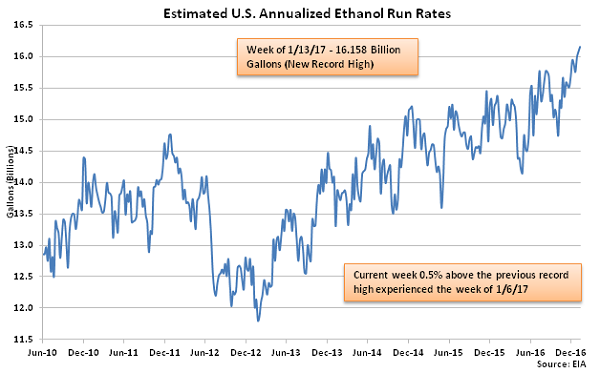

Jan 13th Ethanol Run Rates up 0.5% From the Previous Week, Reaching a New Record High

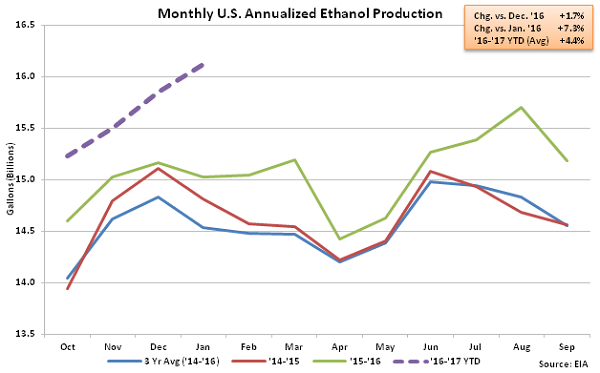

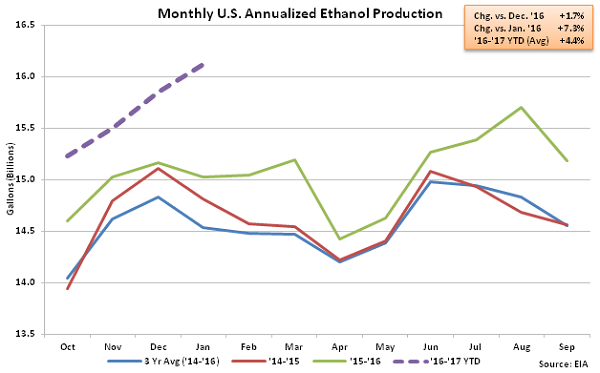

Jan ’17 Ethanol Production up 1.7% MOM and 7.3% YOY Through Two Weeks

Jan ’17 Ethanol Production up 1.7% MOM and 7.3% YOY Through Two Weeks

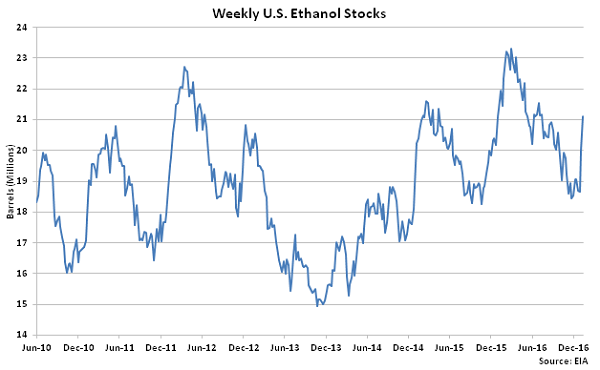

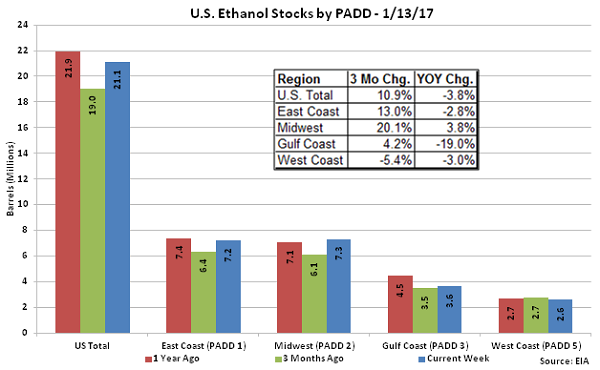

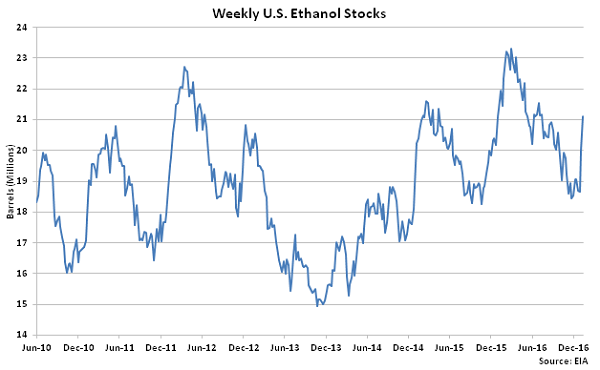

Jan 13th Ethanol Stocks up 5.5% From the Previous Week

Jan 13th Ethanol Stocks up 5.5% From the Previous Week

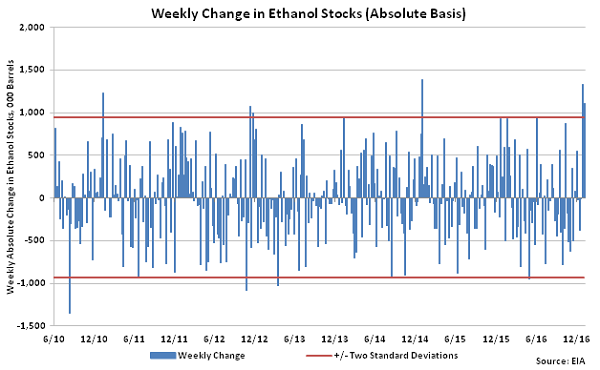

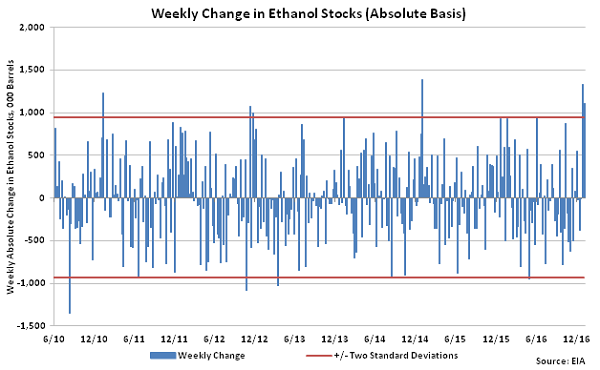

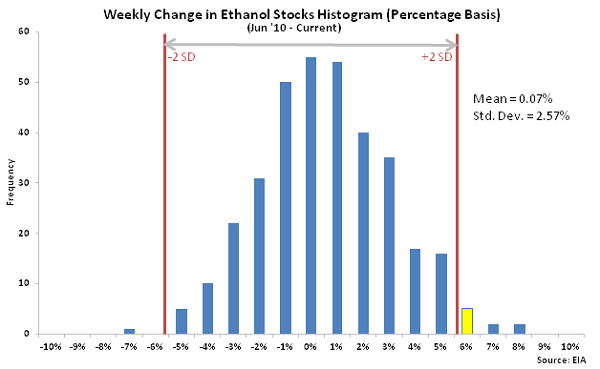

Jan 13th Weekly Increase in Ethanol Stocks was the Fourth Largest on Record

Jan 13th Weekly Increase in Ethanol Stocks was the Fourth Largest on Record

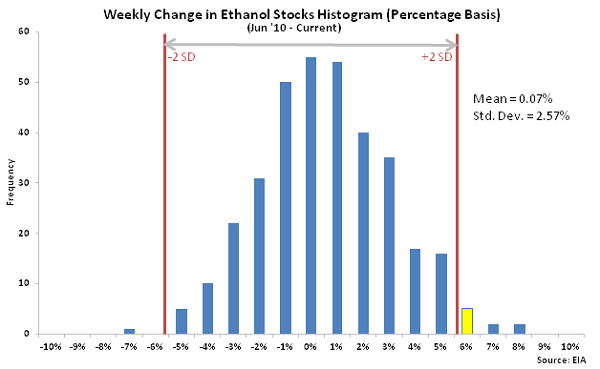

Jan 13th Weekly Increase in Ethanol Stocks of 5.5% was Greater Than a Two-Sigma Event

Jan 13th Weekly Increase in Ethanol Stocks of 5.5% was Greater Than a Two-Sigma Event

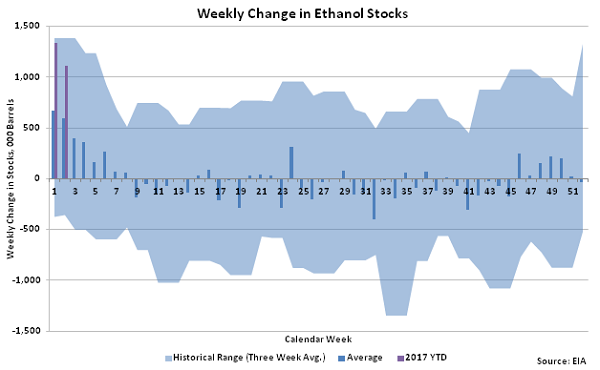

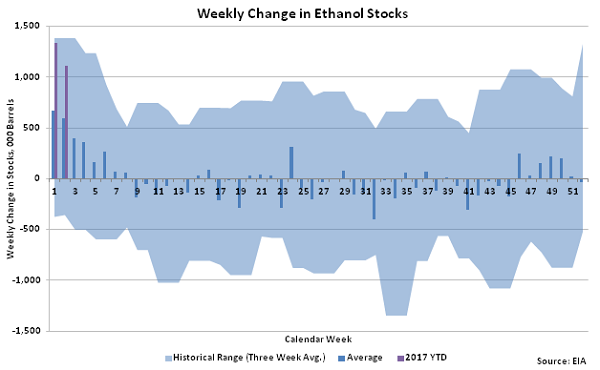

Ethanol Stocks Typically Build Most Significantly Throughout the First Two Weeks of the Year

Ethanol Stocks Typically Build Most Significantly Throughout the First Two Weeks of the Year

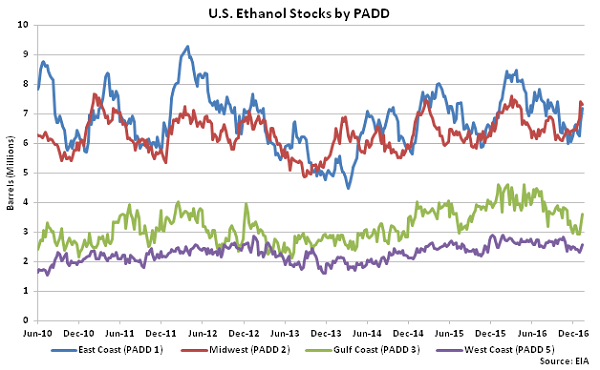

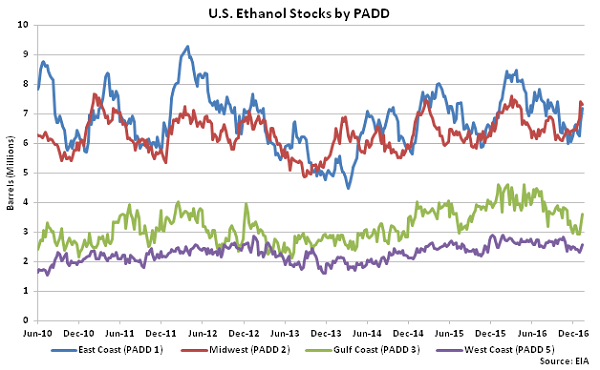

Jan 13th Weekly Increase in Ethanol Stocks Greatest on the Gulf Coast

Jan 13th Weekly Increase in Ethanol Stocks Greatest on the Gulf Coast

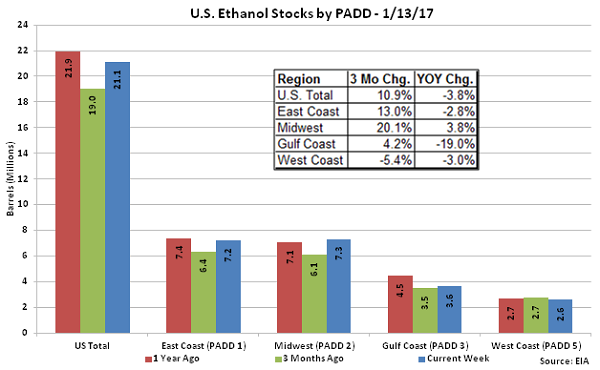

Jan 13th Total Ethanol Stocks Remain Down 3.8% YOY, Gulf Coast Stocks Down 19.0%

Jan 13th Total Ethanol Stocks Remain Down 3.8% YOY, Gulf Coast Stocks Down 19.0%

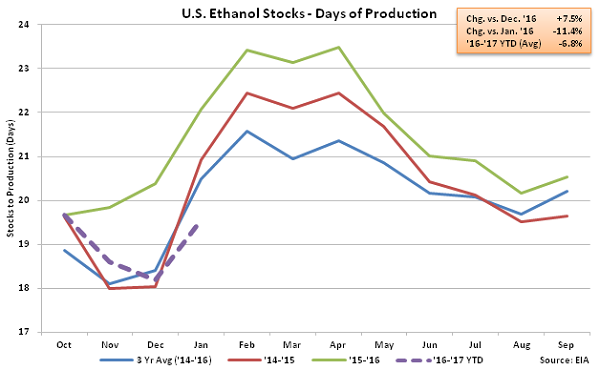

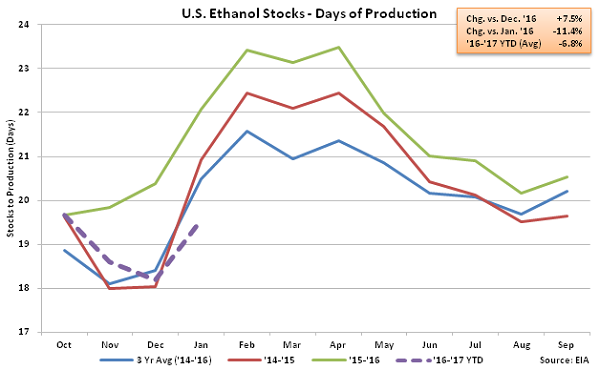

Jan ’17 Ethanol Stocks-to-Production up 7.5% MOM, Down 11.4% YOY Through Two Weeks

Jan ’17 Ethanol Stocks-to-Production up 7.5% MOM, Down 11.4% YOY Through Two Weeks

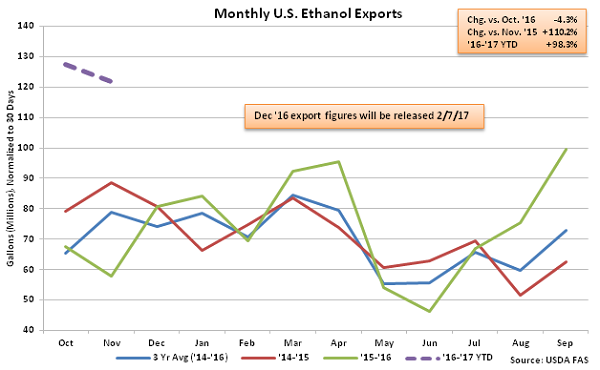

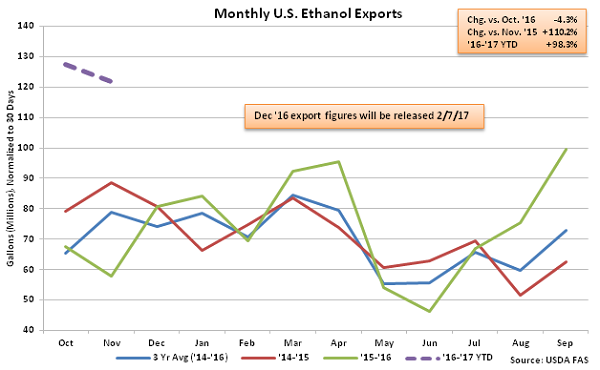

Nov ’16 Ethanol Exports Finished Down 4.3% MOM but up 110.2% YOY

Nov ’16 Ethanol Exports Finished Down 4.3% MOM but up 110.2% YOY

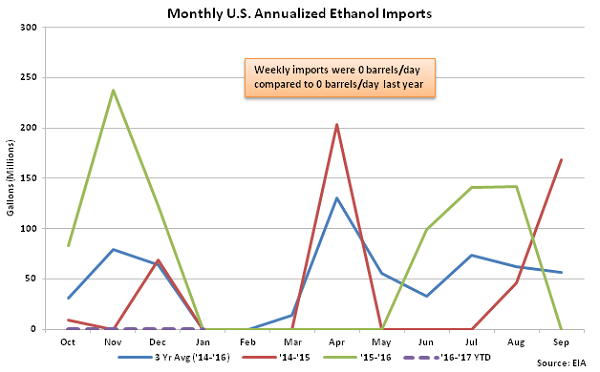

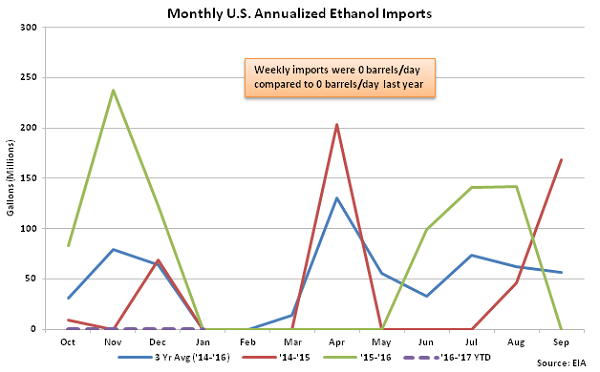

Jan ’17 Annualized Ethanol Imports Remained at Minimal Levels Through Two Weeks

Jan ’17 Annualized Ethanol Imports Remained at Minimal Levels Through Two Weeks

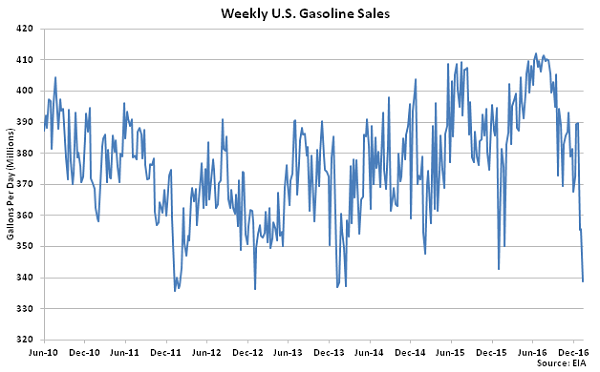

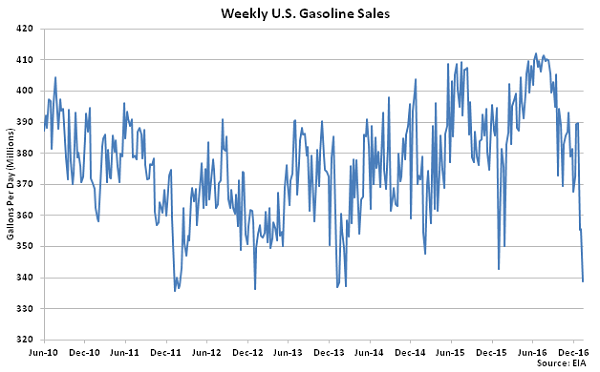

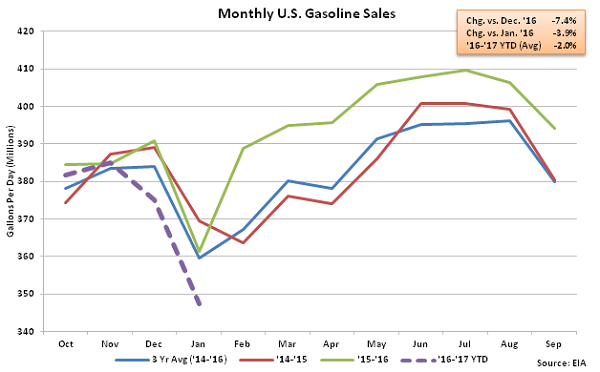

Jan 13th Gasoline Sales Down 4.7% From the Previous Week, Reaching a Two Year Low

Jan 13th Gasoline Sales Down 4.7% From the Previous Week, Reaching a Two Year Low

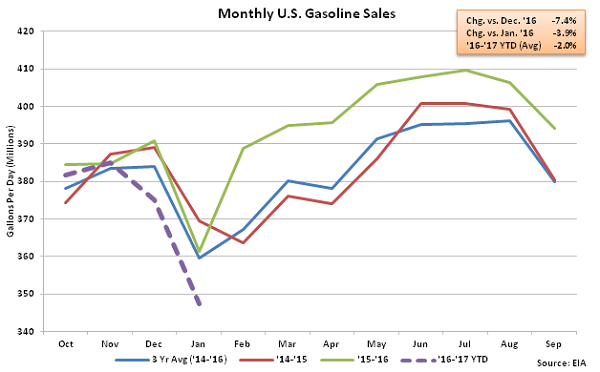

Jan ’17 Gasoline Sales Down 7.4% MOM and 3.9% YOY Through Two Weeks

Jan ’17 Gasoline Sales Down 7.4% MOM and 3.9% YOY Through Two Weeks

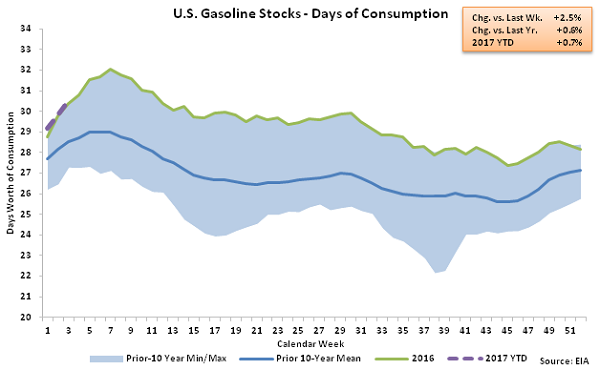

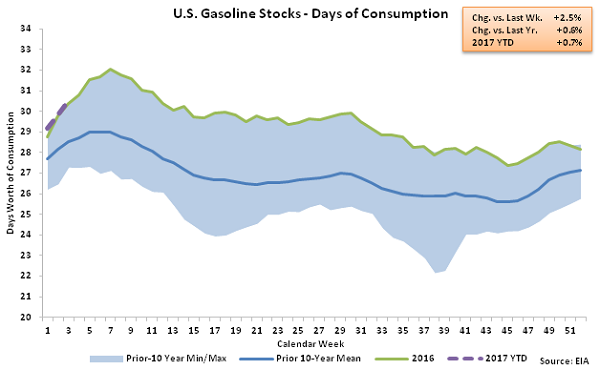

Jan 13th Gasoline Stocks-to-Consumption up 2.5% Week-Over-Week and 0.6% YOY

Jan 13th Gasoline Stocks-to-Consumption up 2.5% Week-Over-Week and 0.6% YOY

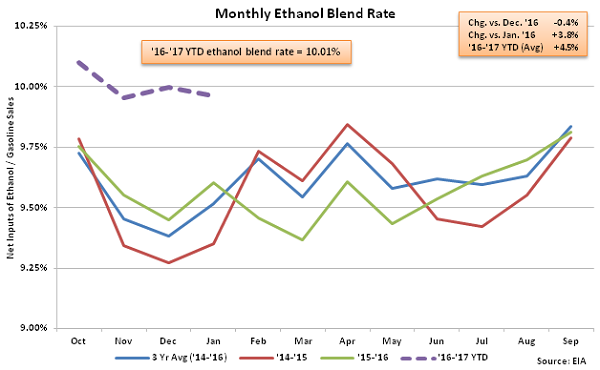

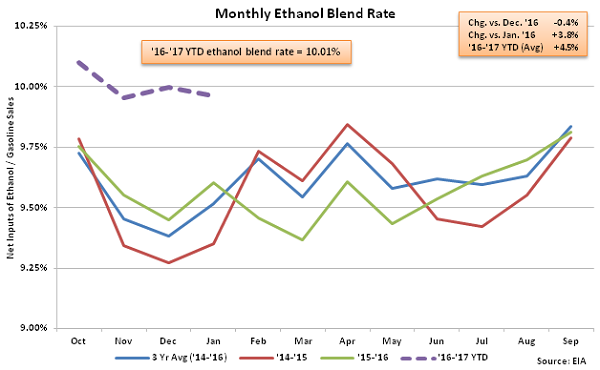

Jan ’17 Ethanol Blend Rate Down 0.4% MOM but up 3.8% YOY Through Two Weeks

Jan ’17 Ethanol Blend Rate Down 0.4% MOM but up 3.8% YOY Through Two Weeks

Jan ’17 Ethanol Production up 1.7% MOM and 7.3% YOY Through Two Weeks

Jan ’17 Ethanol Production up 1.7% MOM and 7.3% YOY Through Two Weeks

Jan 13th Ethanol Stocks up 5.5% From the Previous Week

Jan 13th Ethanol Stocks up 5.5% From the Previous Week

Jan 13th Weekly Increase in Ethanol Stocks was the Fourth Largest on Record

Jan 13th Weekly Increase in Ethanol Stocks was the Fourth Largest on Record

Jan 13th Weekly Increase in Ethanol Stocks of 5.5% was Greater Than a Two-Sigma Event

Jan 13th Weekly Increase in Ethanol Stocks of 5.5% was Greater Than a Two-Sigma Event

Ethanol Stocks Typically Build Most Significantly Throughout the First Two Weeks of the Year

Ethanol Stocks Typically Build Most Significantly Throughout the First Two Weeks of the Year

Jan 13th Weekly Increase in Ethanol Stocks Greatest on the Gulf Coast

Jan 13th Weekly Increase in Ethanol Stocks Greatest on the Gulf Coast

Jan 13th Total Ethanol Stocks Remain Down 3.8% YOY, Gulf Coast Stocks Down 19.0%

Jan 13th Total Ethanol Stocks Remain Down 3.8% YOY, Gulf Coast Stocks Down 19.0%

Jan ’17 Ethanol Stocks-to-Production up 7.5% MOM, Down 11.4% YOY Through Two Weeks

Jan ’17 Ethanol Stocks-to-Production up 7.5% MOM, Down 11.4% YOY Through Two Weeks

Nov ’16 Ethanol Exports Finished Down 4.3% MOM but up 110.2% YOY

Nov ’16 Ethanol Exports Finished Down 4.3% MOM but up 110.2% YOY

Jan ’17 Annualized Ethanol Imports Remained at Minimal Levels Through Two Weeks

Jan ’17 Annualized Ethanol Imports Remained at Minimal Levels Through Two Weeks

Jan 13th Gasoline Sales Down 4.7% From the Previous Week, Reaching a Two Year Low

Jan 13th Gasoline Sales Down 4.7% From the Previous Week, Reaching a Two Year Low

Jan ’17 Gasoline Sales Down 7.4% MOM and 3.9% YOY Through Two Weeks

Jan ’17 Gasoline Sales Down 7.4% MOM and 3.9% YOY Through Two Weeks

Jan 13th Gasoline Stocks-to-Consumption up 2.5% Week-Over-Week and 0.6% YOY

Jan 13th Gasoline Stocks-to-Consumption up 2.5% Week-Over-Week and 0.6% YOY

Jan ’17 Ethanol Blend Rate Down 0.4% MOM but up 3.8% YOY Through Two Weeks

Jan ’17 Ethanol Blend Rate Down 0.4% MOM but up 3.8% YOY Through Two Weeks