Atten Babler Meat FX Indexes – May ’15

The Atten Babler Commodities Meat Foreign Exchange (FX) Indexes remained at or near record high levels during Apr ’15. The USD/Domestic Meat Importer FX Index increased to a new record high, however the USD/Meat Exporter FX Index and USD/Meat Importer FX Index fell by 0.9 points and 2.5 points, respectively throughout the month. Despite the declines, the USD/Meat Exporter FX Index and USD/Meat Importer FX Index remain at the second highest and third highest figures on record, respectively.

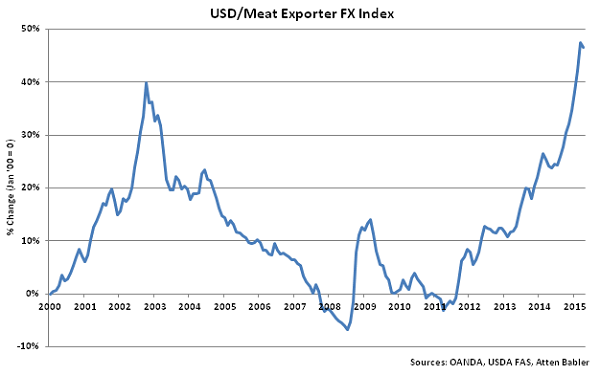

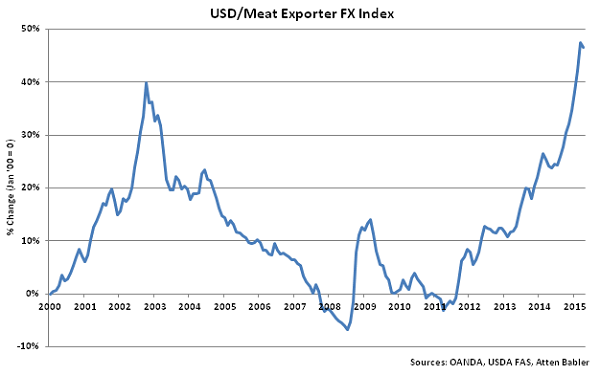

USD/Meat Exporter FX Index:

The USD/Meat Exporter FX Index declined 0.9 points in Apr ’15 from the record high experienced in Mar ’15 to a value of 146.6. The USD/Meat Exporter FX Index remains at the second highest figure on record and has increased 24.7 points since the beginning of 2014 and 16.2 points throughout the past six months. A strengthening USD/Meat Exporter FX Index reduces the competitiveness of U.S. meat relative to other exporting regions, ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Brazilian real and Argentine peso has accounted for the majority of the gains since the beginning of 2014, despite the Brazilian real strengthening against the USD in Apr ’15.

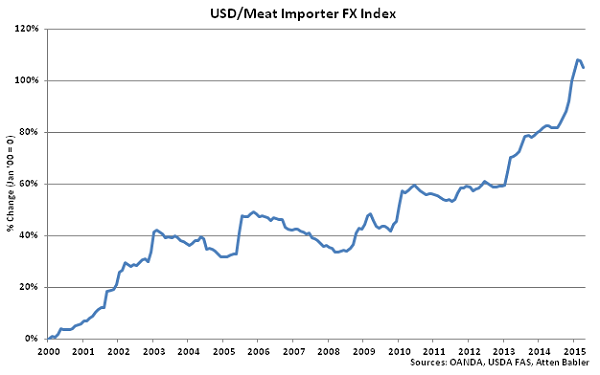

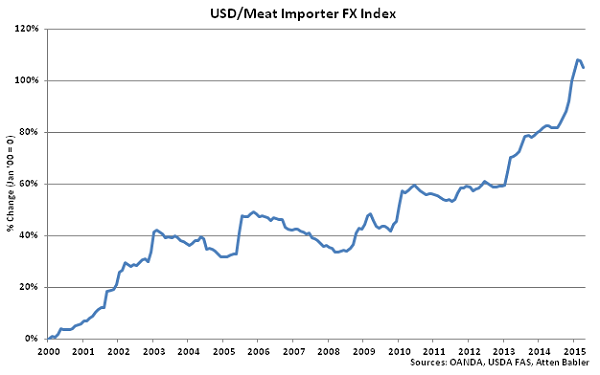

USD/Meat Importer FX Index:

The USD/Meat Importer FX Index declined 2.5 points in Apr ’15 from the record high experienced in Mar ’15 to a value of 205.3. The USD/Meat Importer FX Index remains at the third highest figure on record and has increased 25.5 points since the beginning of 2014 and 17.3 points throughout the past six months. A strengthening USD/Meat Importer FX Index results in less purchasing power for major meat importing countries, making U.S. meat more expensive to import. USD appreciation against the Russian ruble and Angolan kwanza has accounted for the majority of the gains since the beginning of 2014, despite the Russian ruble strengthening against the USD over the past two months.

USD/Meat Importer FX Index:

The USD/Meat Importer FX Index declined 2.5 points in Apr ’15 from the record high experienced in Mar ’15 to a value of 205.3. The USD/Meat Importer FX Index remains at the third highest figure on record and has increased 25.5 points since the beginning of 2014 and 17.3 points throughout the past six months. A strengthening USD/Meat Importer FX Index results in less purchasing power for major meat importing countries, making U.S. meat more expensive to import. USD appreciation against the Russian ruble and Angolan kwanza has accounted for the majority of the gains since the beginning of 2014, despite the Russian ruble strengthening against the USD over the past two months.

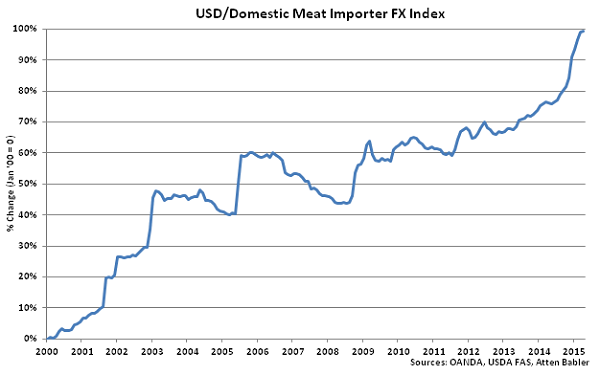

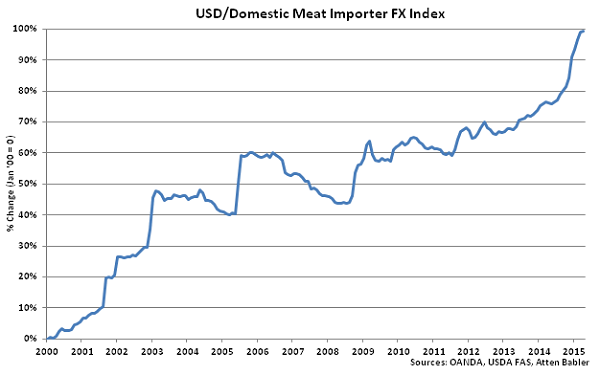

USD/Meat Domestic Importer FX Index:

The USD/Domestic Meat Importer FX Index increased 0.2 points in Apr ’15 to a new high value of 199.2. The USD/Domestic Meat Importer FX Index has increased 25.7 points since the beginning of 2014 and 17.7 points throughout the past six months. A strengthening USD/Domestic Meat Importer FX Index results in less purchasing power for the traditional buyers of U.S. meat, ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Angolan kwanza, Mexican peso and Ghanaian cedi has accounted for the majority of the gains since the beginning of 2014, despite the Mexican peso strengthening against the USD in Apr ’15.

USD/Meat Domestic Importer FX Index:

The USD/Domestic Meat Importer FX Index increased 0.2 points in Apr ’15 to a new high value of 199.2. The USD/Domestic Meat Importer FX Index has increased 25.7 points since the beginning of 2014 and 17.7 points throughout the past six months. A strengthening USD/Domestic Meat Importer FX Index results in less purchasing power for the traditional buyers of U.S. meat, ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Angolan kwanza, Mexican peso and Ghanaian cedi has accounted for the majority of the gains since the beginning of 2014, despite the Mexican peso strengthening against the USD in Apr ’15.

USD/Meat Importer FX Index:

The USD/Meat Importer FX Index declined 2.5 points in Apr ’15 from the record high experienced in Mar ’15 to a value of 205.3. The USD/Meat Importer FX Index remains at the third highest figure on record and has increased 25.5 points since the beginning of 2014 and 17.3 points throughout the past six months. A strengthening USD/Meat Importer FX Index results in less purchasing power for major meat importing countries, making U.S. meat more expensive to import. USD appreciation against the Russian ruble and Angolan kwanza has accounted for the majority of the gains since the beginning of 2014, despite the Russian ruble strengthening against the USD over the past two months.

USD/Meat Importer FX Index:

The USD/Meat Importer FX Index declined 2.5 points in Apr ’15 from the record high experienced in Mar ’15 to a value of 205.3. The USD/Meat Importer FX Index remains at the third highest figure on record and has increased 25.5 points since the beginning of 2014 and 17.3 points throughout the past six months. A strengthening USD/Meat Importer FX Index results in less purchasing power for major meat importing countries, making U.S. meat more expensive to import. USD appreciation against the Russian ruble and Angolan kwanza has accounted for the majority of the gains since the beginning of 2014, despite the Russian ruble strengthening against the USD over the past two months.

USD/Meat Domestic Importer FX Index:

The USD/Domestic Meat Importer FX Index increased 0.2 points in Apr ’15 to a new high value of 199.2. The USD/Domestic Meat Importer FX Index has increased 25.7 points since the beginning of 2014 and 17.7 points throughout the past six months. A strengthening USD/Domestic Meat Importer FX Index results in less purchasing power for the traditional buyers of U.S. meat, ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Angolan kwanza, Mexican peso and Ghanaian cedi has accounted for the majority of the gains since the beginning of 2014, despite the Mexican peso strengthening against the USD in Apr ’15.

USD/Meat Domestic Importer FX Index:

The USD/Domestic Meat Importer FX Index increased 0.2 points in Apr ’15 to a new high value of 199.2. The USD/Domestic Meat Importer FX Index has increased 25.7 points since the beginning of 2014 and 17.7 points throughout the past six months. A strengthening USD/Domestic Meat Importer FX Index results in less purchasing power for the traditional buyers of U.S. meat, ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Angolan kwanza, Mexican peso and Ghanaian cedi has accounted for the majority of the gains since the beginning of 2014, despite the Mexican peso strengthening against the USD in Apr ’15.