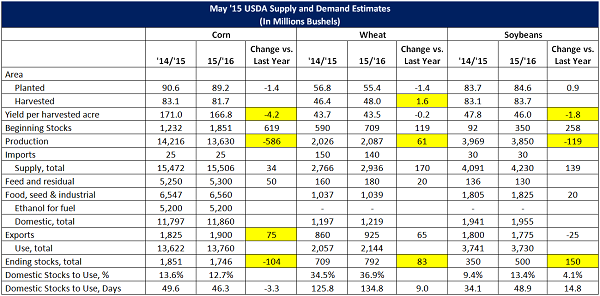

May ’15 USDA World Agriculture Supply and Demand Estimates

*Significant changes are highlighted

’14/’15 Corn

o Exports were increased 25 million but industrial food and seed use was down 50 million leaving ending stocks higher at 1.85 billion bushels.

’15/’16 Corn

o Initial projections for new crop showed production in line with expectations using a trend line yield estimate of 166.8 bushels per acre.

o Feed and residual usage estimates are increased 50 million bushels versus prior year and exports are initially projected 75 million higher.

o Ending stocks were projected at 1.75 billion bushels or 46.3 days of use which was on the low end of private analyst estimates.

’14/’15 Soybeans

o Crush and exports were revised higher by 10 million bushels leaving ending stocks at 350 million.

’15/’16 Soybeans

o Total production was estimated 119 million bushels below last year using trend line yields on the March acreage intentions data.

o Crush was increased 20 million bushels to match growth in livestock numbers and production while exports are 25 million lower as burdensome world supplies limit US soybean competitiveness.

o Ending stocks were projected 500 million bushels or 48.9 days of use. This was on the high side of private estimates.

Other Markets

o US wheat production was below expectations for the new crop period but world wheat production was well above expectations leaving carryout at the highest level in fifteen years.

o World soybean production was estimated at record levels pushing ending stocks to another record high forecast of 96 million metric tons versus 63 million two years ago.

Click below for a downloadable pdf file.

May ’15 USDA World Agriculture Supply and Demand Estimates

*Significant changes are highlighted

’14/’15 Corn

o Exports were increased 25 million but industrial food and seed use was down 50 million leaving ending stocks higher at 1.85 billion bushels.

’15/’16 Corn

o Initial projections for new crop showed production in line with expectations using a trend line yield estimate of 166.8 bushels per acre.

o Feed and residual usage estimates are increased 50 million bushels versus prior year and exports are initially projected 75 million higher.

o Ending stocks were projected at 1.75 billion bushels or 46.3 days of use which was on the low end of private analyst estimates.

’14/’15 Soybeans

o Crush and exports were revised higher by 10 million bushels leaving ending stocks at 350 million.

’15/’16 Soybeans

o Total production was estimated 119 million bushels below last year using trend line yields on the March acreage intentions data.

o Crush was increased 20 million bushels to match growth in livestock numbers and production while exports are 25 million lower as burdensome world supplies limit US soybean competitiveness.

o Ending stocks were projected 500 million bushels or 48.9 days of use. This was on the high side of private estimates.

Other Markets

o US wheat production was below expectations for the new crop period but world wheat production was well above expectations leaving carryout at the highest level in fifteen years.

o World soybean production was estimated at record levels pushing ending stocks to another record high forecast of 96 million metric tons versus 63 million two years ago.

Click below for a downloadable pdf file.

May ’15 USDA World Agriculture Supply and Demand Estimates