U.S. Commercial Disappearance Update – Jul ’15

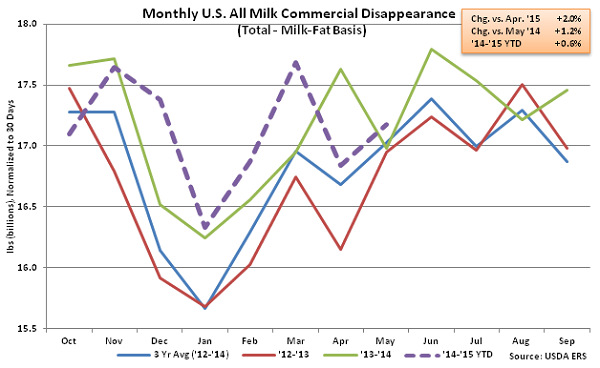

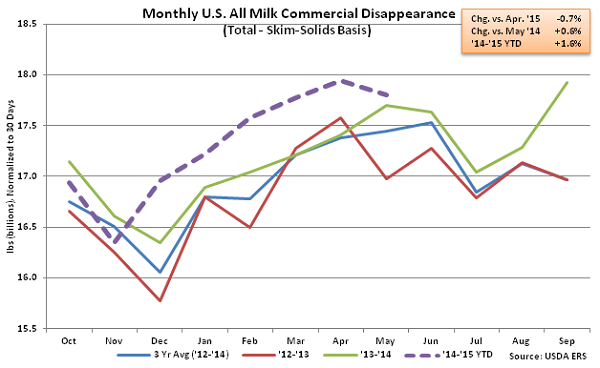

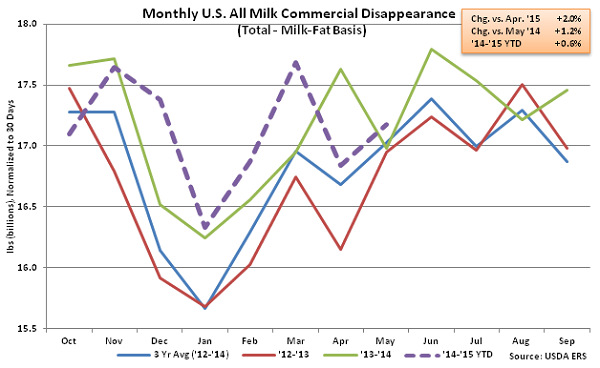

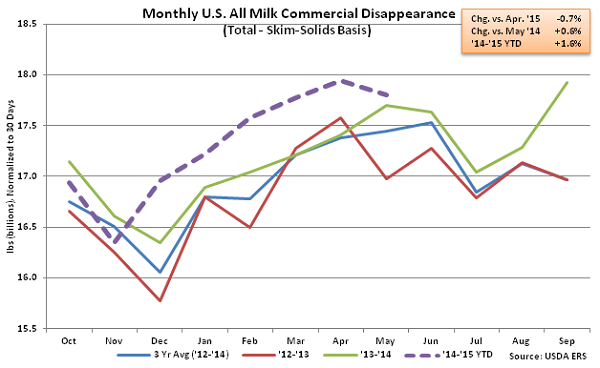

All Milk – YOY Disappearance Increases on Skim-Solids and Milk-Fat Bases

According to USDA, May ’15 U.S. commercial disappearance for milk used in all products increased YOY on both a milk-fat and skim-solids basis, finishing up 1.2% and 0.6%, respectively. The monthly YOY increase in commercial disappearance on a milk-fat basis was the fifth experienced in the past six months while commercial disappearance increased for the sixth consecutive month on a skim-solids basis. Domestic demand continued to outpace international demand, finishing up 3.1% YOY on a milk-fat basis and 1.7% YOY on a skim-solids basis. ’14-’15 YTD commercial disappearance for milk used in all products is up 0.6% YOY on a milk-fat basis and 1.6% YOY on a skim-solids basis through the first eight months of the production season, with domestic demand up 3.2% on a milk-fat basis and 2.9% on a skim-solids basis over the same period.

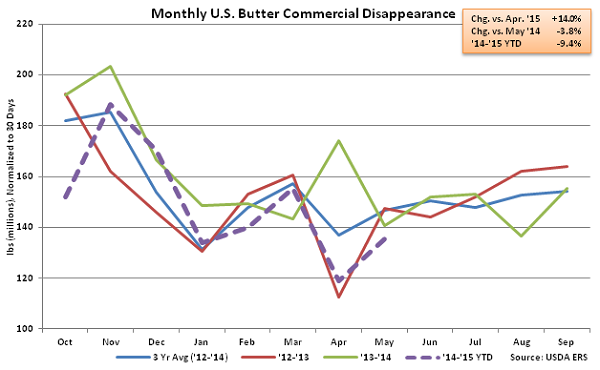

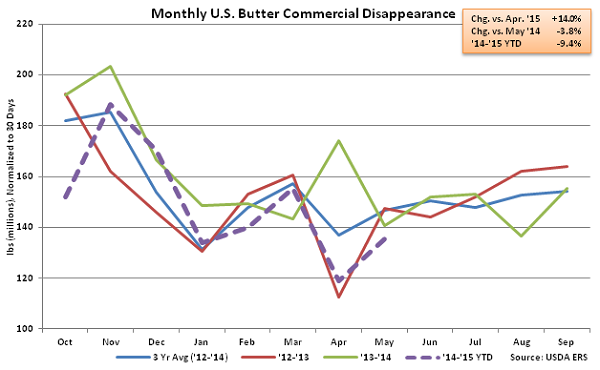

Butter – YOY Disappearance Remains Lower on Continued Weak Exports

May ’15 U.S. butter commercial disappearance increased 14.0% MOM on a daily average basis but remained lower YOY, finishing 3.8% below the previous year. The monthly YOY decline was the eighth experienced in the last ten months. Domestic butter demand remained fairly strong, increasing by 2.1% YOY however international demand continued to struggle, finishing down 79.4% YOY. U.S. butterfat exports have declined YOY for 13 consecutive months as U.S. butter prices have traded at a premium to international prices and the USD has appreciated vs. rival currencies. ’14-’15 YTD U.S. butter commercial disappearance is down 9.4% YOY through the first eight months of the production season, with domestic demand down 1.2% and international demand down 77.9% over the period.

Butter – YOY Disappearance Remains Lower on Continued Weak Exports

May ’15 U.S. butter commercial disappearance increased 14.0% MOM on a daily average basis but remained lower YOY, finishing 3.8% below the previous year. The monthly YOY decline was the eighth experienced in the last ten months. Domestic butter demand remained fairly strong, increasing by 2.1% YOY however international demand continued to struggle, finishing down 79.4% YOY. U.S. butterfat exports have declined YOY for 13 consecutive months as U.S. butter prices have traded at a premium to international prices and the USD has appreciated vs. rival currencies. ’14-’15 YTD U.S. butter commercial disappearance is down 9.4% YOY through the first eight months of the production season, with domestic demand down 1.2% and international demand down 77.9% over the period.

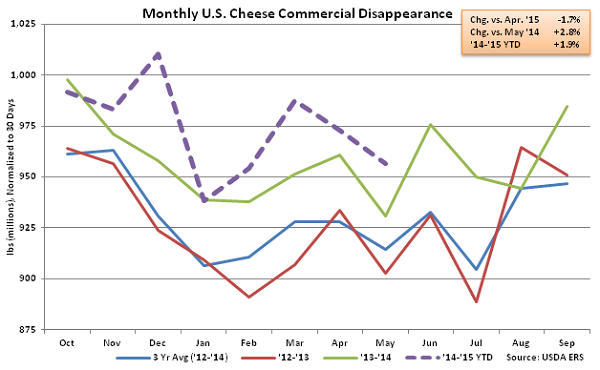

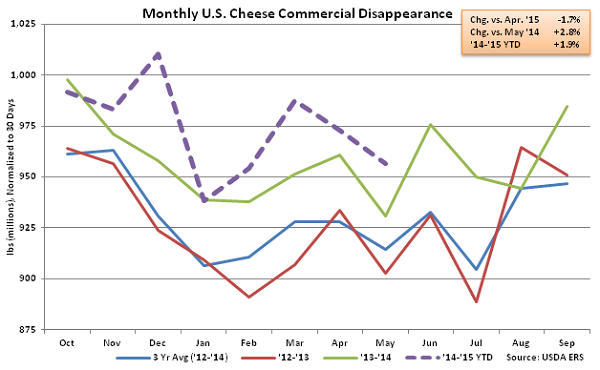

Cheese – Disappearance Remains Strong, Reaches New May Record High

May ’15 U.S. cheese commercial disappearance increased YOY for the fourth consecutive month, finishing 2.8% higher than the previous year and setting a new record high for the month of May. Other-than-American cheese disappearance was particularly strong, increasing by 6.5% YOY, while American cheese disappearance declined by 2.8% YOY. Domestic cheese demand remained higher on a YOY basis, increasing 3.6%, while export volumes declined for the eighth consecutive month on a YOY basis, falling 7.6%. ’14-’15 YTD U.S. cheese commercial disappearance is up 1.9% YOY through the first eight months of the production season.

Cheese – Disappearance Remains Strong, Reaches New May Record High

May ’15 U.S. cheese commercial disappearance increased YOY for the fourth consecutive month, finishing 2.8% higher than the previous year and setting a new record high for the month of May. Other-than-American cheese disappearance was particularly strong, increasing by 6.5% YOY, while American cheese disappearance declined by 2.8% YOY. Domestic cheese demand remained higher on a YOY basis, increasing 3.6%, while export volumes declined for the eighth consecutive month on a YOY basis, falling 7.6%. ’14-’15 YTD U.S. cheese commercial disappearance is up 1.9% YOY through the first eight months of the production season.

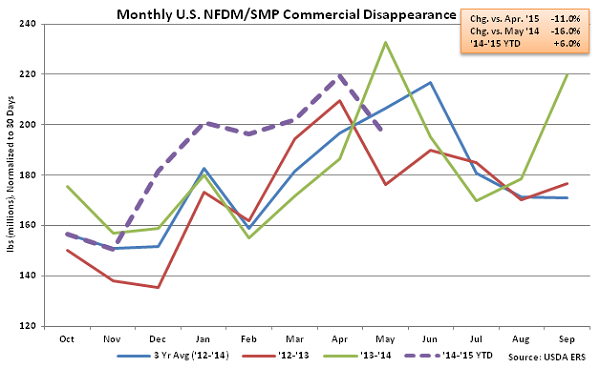

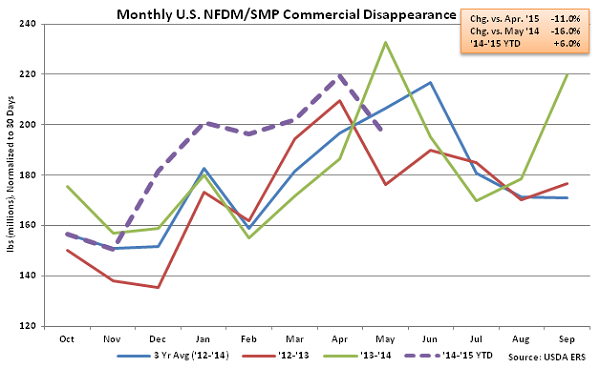

NFDM/SMP – YOY Disappearance Declines for First Time in Six Months on Weak Domestic Demand

May ’15 U.S. NFDM/SMP commercial disappearance declined YOY for the first time in six months, finishing 16.0% lower than the previous year. U.S. NFDM/SMP domestic commercial disappearance declined YOY for the first time in ten months, finishing 36.4% below the record high May disappearance experienced last year, while NFDM/SMP exports increased slightly, finishing 0.4% higher than a year ago. Despite the YOY decline, ’14-’15 YTD U.S. NFDM/SMP commercial disappearance remains up 6.0% YOY through the first eight months of the production season.

NFDM/SMP – YOY Disappearance Declines for First Time in Six Months on Weak Domestic Demand

May ’15 U.S. NFDM/SMP commercial disappearance declined YOY for the first time in six months, finishing 16.0% lower than the previous year. U.S. NFDM/SMP domestic commercial disappearance declined YOY for the first time in ten months, finishing 36.4% below the record high May disappearance experienced last year, while NFDM/SMP exports increased slightly, finishing 0.4% higher than a year ago. Despite the YOY decline, ’14-’15 YTD U.S. NFDM/SMP commercial disappearance remains up 6.0% YOY through the first eight months of the production season.

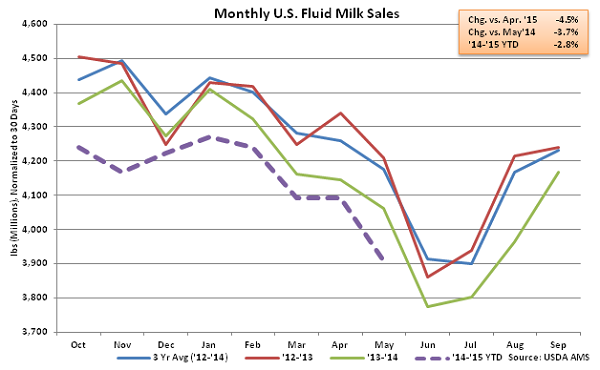

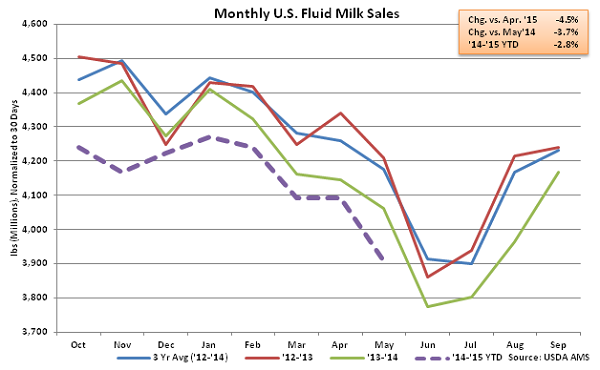

Fluid Milk Sales – YOY Sales Continue to Decline

May ’15 U.S. fluid milk sales of 4.04 billion pounds continued to decline on a YOY basis, falling 3.7%. Monthly fluid milk sales have declined YOY for 17 consecutive months at an average rate of 2.8% over the period. YOY declines in fluid milk sales are on top of historically weak demand last production season. ’13-’14 annual fluid milk sales declined 2.4% YOY, which was the largest annual YOY decline on record. ’14-’15 YTD fluid milk sales are down 2.8% YOY through the first eight months of the production season.

Fluid Milk Sales – YOY Sales Continue to Decline

May ’15 U.S. fluid milk sales of 4.04 billion pounds continued to decline on a YOY basis, falling 3.7%. Monthly fluid milk sales have declined YOY for 17 consecutive months at an average rate of 2.8% over the period. YOY declines in fluid milk sales are on top of historically weak demand last production season. ’13-’14 annual fluid milk sales declined 2.4% YOY, which was the largest annual YOY decline on record. ’14-’15 YTD fluid milk sales are down 2.8% YOY through the first eight months of the production season.

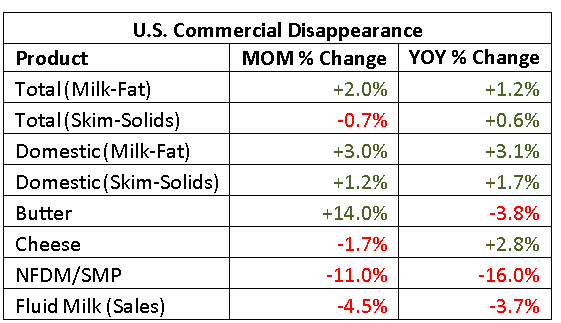

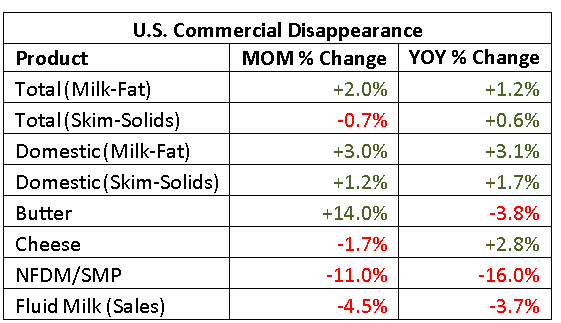

See the table below for a summary of key May ’15 U.S. dairy commercial disappearance figures in addition to the May ’15 U.S. fluid milk sales figure.

See the table below for a summary of key May ’15 U.S. dairy commercial disappearance figures in addition to the May ’15 U.S. fluid milk sales figure.

Butter – YOY Disappearance Remains Lower on Continued Weak Exports

May ’15 U.S. butter commercial disappearance increased 14.0% MOM on a daily average basis but remained lower YOY, finishing 3.8% below the previous year. The monthly YOY decline was the eighth experienced in the last ten months. Domestic butter demand remained fairly strong, increasing by 2.1% YOY however international demand continued to struggle, finishing down 79.4% YOY. U.S. butterfat exports have declined YOY for 13 consecutive months as U.S. butter prices have traded at a premium to international prices and the USD has appreciated vs. rival currencies. ’14-’15 YTD U.S. butter commercial disappearance is down 9.4% YOY through the first eight months of the production season, with domestic demand down 1.2% and international demand down 77.9% over the period.

Butter – YOY Disappearance Remains Lower on Continued Weak Exports

May ’15 U.S. butter commercial disappearance increased 14.0% MOM on a daily average basis but remained lower YOY, finishing 3.8% below the previous year. The monthly YOY decline was the eighth experienced in the last ten months. Domestic butter demand remained fairly strong, increasing by 2.1% YOY however international demand continued to struggle, finishing down 79.4% YOY. U.S. butterfat exports have declined YOY for 13 consecutive months as U.S. butter prices have traded at a premium to international prices and the USD has appreciated vs. rival currencies. ’14-’15 YTD U.S. butter commercial disappearance is down 9.4% YOY through the first eight months of the production season, with domestic demand down 1.2% and international demand down 77.9% over the period.

Cheese – Disappearance Remains Strong, Reaches New May Record High

May ’15 U.S. cheese commercial disappearance increased YOY for the fourth consecutive month, finishing 2.8% higher than the previous year and setting a new record high for the month of May. Other-than-American cheese disappearance was particularly strong, increasing by 6.5% YOY, while American cheese disappearance declined by 2.8% YOY. Domestic cheese demand remained higher on a YOY basis, increasing 3.6%, while export volumes declined for the eighth consecutive month on a YOY basis, falling 7.6%. ’14-’15 YTD U.S. cheese commercial disappearance is up 1.9% YOY through the first eight months of the production season.

Cheese – Disappearance Remains Strong, Reaches New May Record High

May ’15 U.S. cheese commercial disappearance increased YOY for the fourth consecutive month, finishing 2.8% higher than the previous year and setting a new record high for the month of May. Other-than-American cheese disappearance was particularly strong, increasing by 6.5% YOY, while American cheese disappearance declined by 2.8% YOY. Domestic cheese demand remained higher on a YOY basis, increasing 3.6%, while export volumes declined for the eighth consecutive month on a YOY basis, falling 7.6%. ’14-’15 YTD U.S. cheese commercial disappearance is up 1.9% YOY through the first eight months of the production season.

NFDM/SMP – YOY Disappearance Declines for First Time in Six Months on Weak Domestic Demand

May ’15 U.S. NFDM/SMP commercial disappearance declined YOY for the first time in six months, finishing 16.0% lower than the previous year. U.S. NFDM/SMP domestic commercial disappearance declined YOY for the first time in ten months, finishing 36.4% below the record high May disappearance experienced last year, while NFDM/SMP exports increased slightly, finishing 0.4% higher than a year ago. Despite the YOY decline, ’14-’15 YTD U.S. NFDM/SMP commercial disappearance remains up 6.0% YOY through the first eight months of the production season.

NFDM/SMP – YOY Disappearance Declines for First Time in Six Months on Weak Domestic Demand

May ’15 U.S. NFDM/SMP commercial disappearance declined YOY for the first time in six months, finishing 16.0% lower than the previous year. U.S. NFDM/SMP domestic commercial disappearance declined YOY for the first time in ten months, finishing 36.4% below the record high May disappearance experienced last year, while NFDM/SMP exports increased slightly, finishing 0.4% higher than a year ago. Despite the YOY decline, ’14-’15 YTD U.S. NFDM/SMP commercial disappearance remains up 6.0% YOY through the first eight months of the production season.

Fluid Milk Sales – YOY Sales Continue to Decline

May ’15 U.S. fluid milk sales of 4.04 billion pounds continued to decline on a YOY basis, falling 3.7%. Monthly fluid milk sales have declined YOY for 17 consecutive months at an average rate of 2.8% over the period. YOY declines in fluid milk sales are on top of historically weak demand last production season. ’13-’14 annual fluid milk sales declined 2.4% YOY, which was the largest annual YOY decline on record. ’14-’15 YTD fluid milk sales are down 2.8% YOY through the first eight months of the production season.

Fluid Milk Sales – YOY Sales Continue to Decline

May ’15 U.S. fluid milk sales of 4.04 billion pounds continued to decline on a YOY basis, falling 3.7%. Monthly fluid milk sales have declined YOY for 17 consecutive months at an average rate of 2.8% over the period. YOY declines in fluid milk sales are on top of historically weak demand last production season. ’13-’14 annual fluid milk sales declined 2.4% YOY, which was the largest annual YOY decline on record. ’14-’15 YTD fluid milk sales are down 2.8% YOY through the first eight months of the production season.

See the table below for a summary of key May ’15 U.S. dairy commercial disappearance figures in addition to the May ’15 U.S. fluid milk sales figure.

See the table below for a summary of key May ’15 U.S. dairy commercial disappearance figures in addition to the May ’15 U.S. fluid milk sales figure.