Biweekly U.S. Oil Rig Count Update – 9/2/15

According to Baker Hughes, U.S. oil rig counts continued to increase slightly throughout the second half of August, increasing by two during the week ending Aug 21st and an additional one during the week ending Aug 28th to a total of 675. Oil rig counts have increased throughout eight of the past nine weeks, reaching a 17 week high during the week ending Aug 28th.

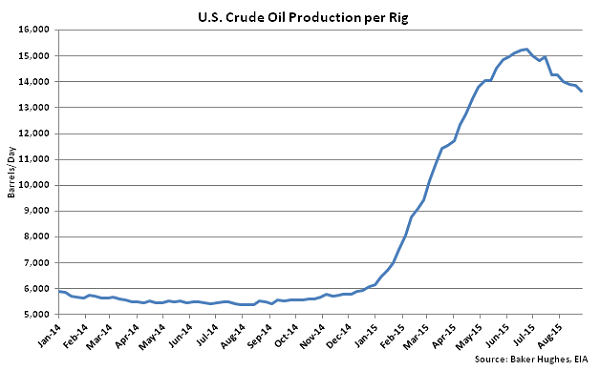

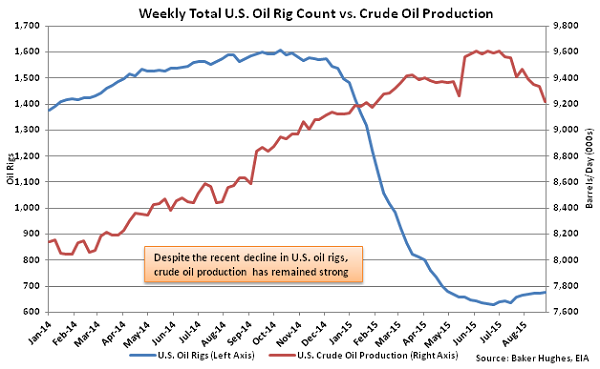

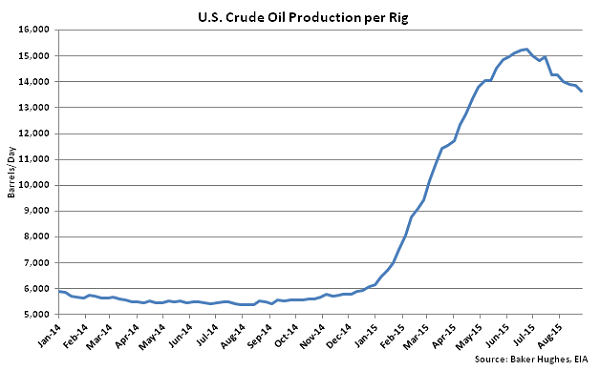

Despite the recent gains, U.S. oil rig counts remain down 54.5% since the beginning of 2015. Crude oil production figures remain higher on a YOY basis but have declined from recent high output levels as production per rig has regressed from the five year high experienced in late Jun ’15. The trend of declining crude oil production is expected to continue as drilling productivity estimates show declining production in coming months throughout areas accounting for 95% of recent production gains.

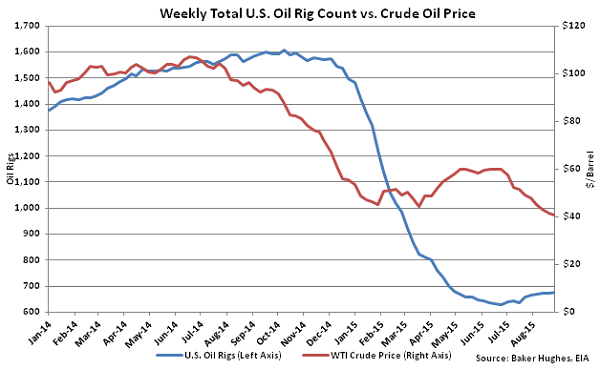

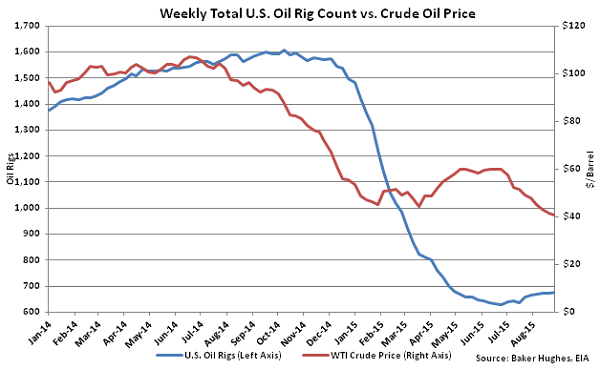

U.S. Oil Rig Counts Declined in Response to Depressed Crude Oil Prices

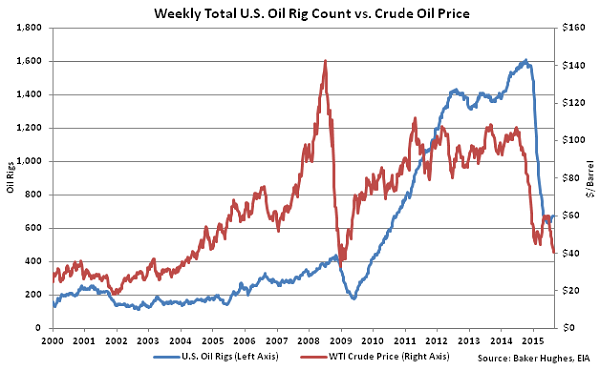

U.S. Oil Rig Counts Peaked in Late 2014, Prior to the Recent Declines

U.S. Oil Rig Counts Peaked in Late 2014, Prior to the Recent Declines

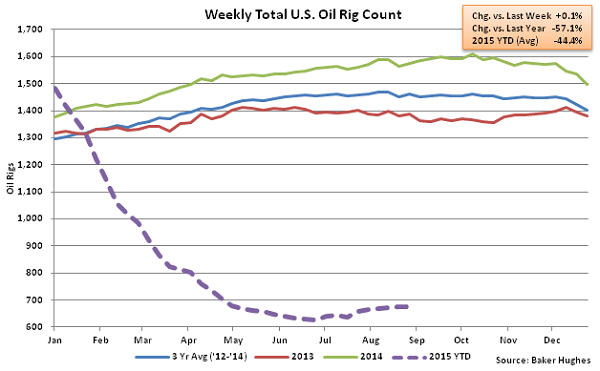

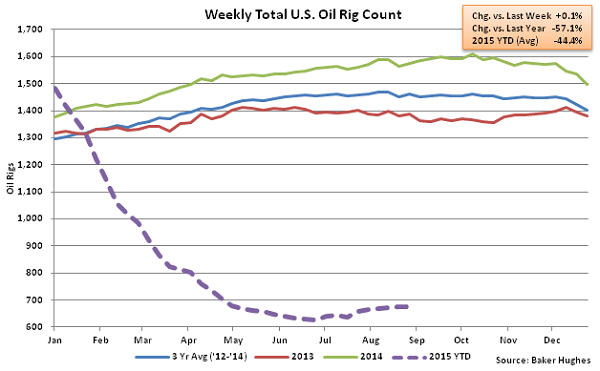

Aug 28th U.S. Oil Rigs Increased 0.1% From the Previous Week but Remain Down 57.1% YOY

Aug 28th U.S. Oil Rigs Increased 0.1% From the Previous Week but Remain Down 57.1% YOY

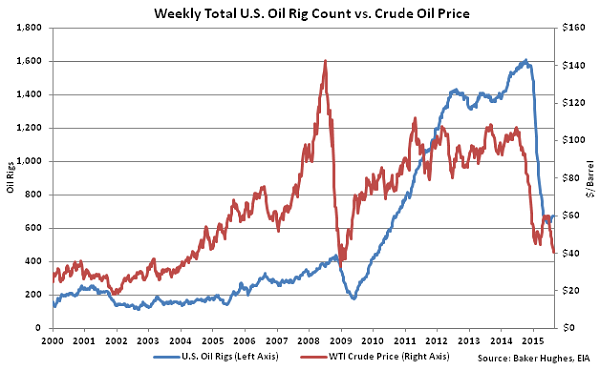

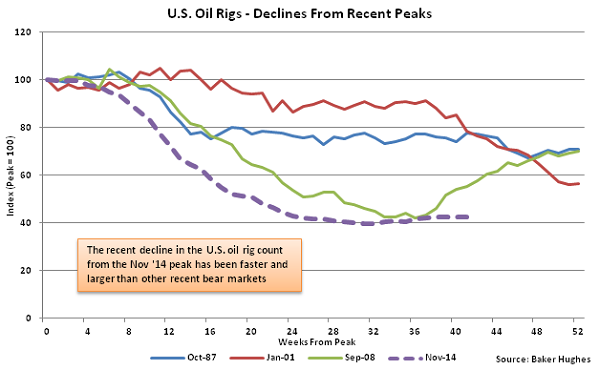

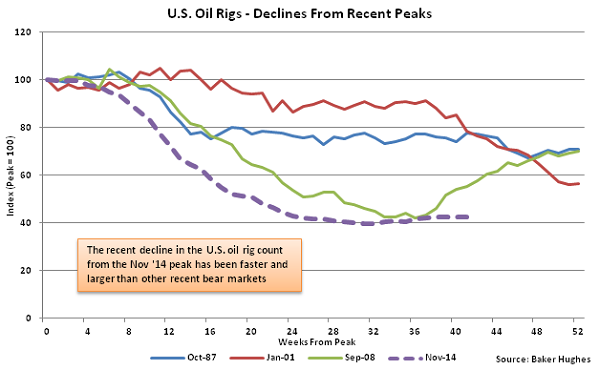

The Recent Decline in U.S. Oil Rig Counts Since the Nov ’14 Peak has Been Significant

The Recent Decline in U.S. Oil Rig Counts Since the Nov ’14 Peak has Been Significant

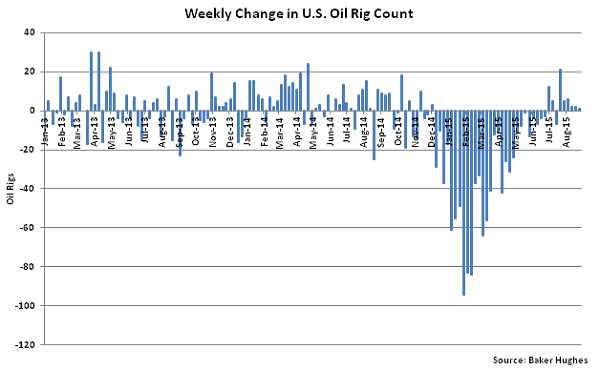

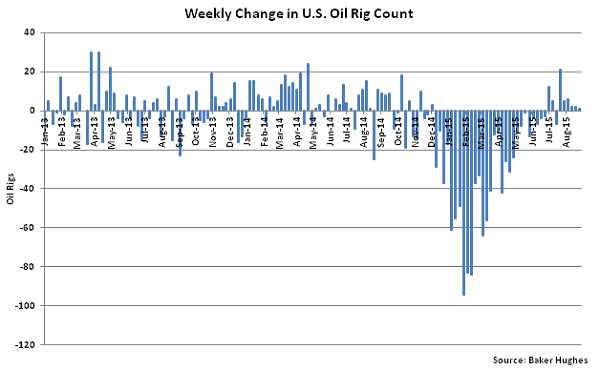

Declines in U.S. Oil Rig Counts Have Decelerated Since February

Declines in U.S. Oil Rig Counts Have Decelerated Since February

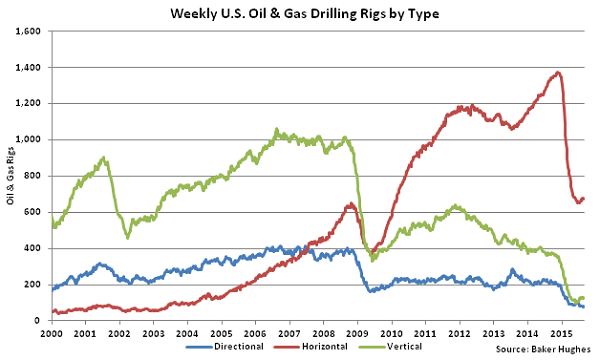

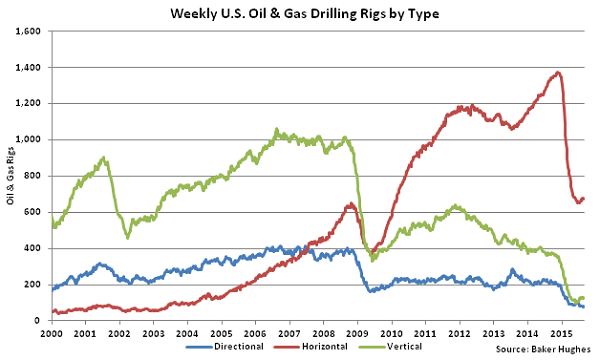

Declines in Vertical Rigs Remain the Most Significant on a Percentage Basis

Declines in Vertical Rigs Remain the Most Significant on a Percentage Basis

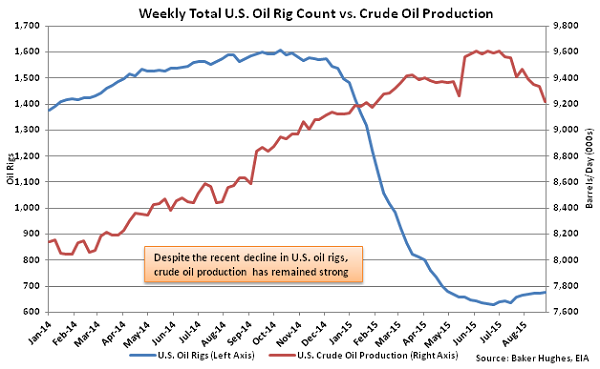

Crude Oil Production Has Declined From Recent Peak Output Levels but Remains up 6.8% YOY

Crude Oil Production Has Declined From Recent Peak Output Levels but Remains up 6.8% YOY

Crude Oil Production per Rig Continues to Decline From the Recent Five Year High

Crude Oil Production per Rig Continues to Decline From the Recent Five Year High

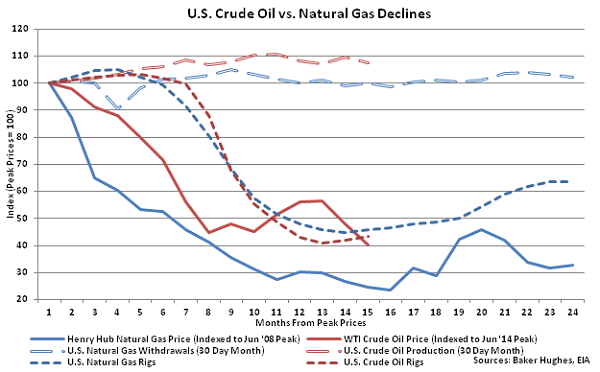

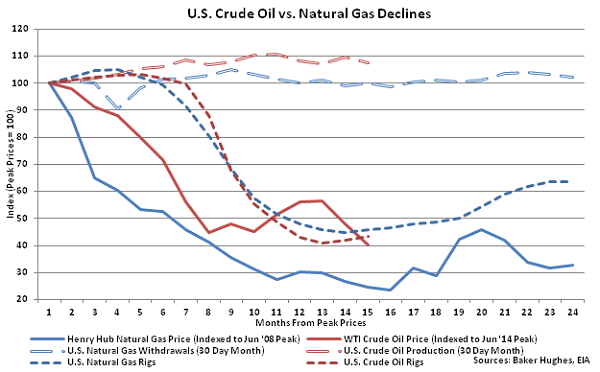

Resilient Production Despite a Collapse in Price & Rigs on Same Trajectory as ’08 Natural Gas

Resilient Production Despite a Collapse in Price & Rigs on Same Trajectory as ’08 Natural Gas

U.S. Oil Rig Counts Peaked in Late 2014, Prior to the Recent Declines

U.S. Oil Rig Counts Peaked in Late 2014, Prior to the Recent Declines

Aug 28th U.S. Oil Rigs Increased 0.1% From the Previous Week but Remain Down 57.1% YOY

Aug 28th U.S. Oil Rigs Increased 0.1% From the Previous Week but Remain Down 57.1% YOY

The Recent Decline in U.S. Oil Rig Counts Since the Nov ’14 Peak has Been Significant

The Recent Decline in U.S. Oil Rig Counts Since the Nov ’14 Peak has Been Significant

Declines in U.S. Oil Rig Counts Have Decelerated Since February

Declines in U.S. Oil Rig Counts Have Decelerated Since February

Declines in Vertical Rigs Remain the Most Significant on a Percentage Basis

Declines in Vertical Rigs Remain the Most Significant on a Percentage Basis

Crude Oil Production Has Declined From Recent Peak Output Levels but Remains up 6.8% YOY

Crude Oil Production Has Declined From Recent Peak Output Levels but Remains up 6.8% YOY

Crude Oil Production per Rig Continues to Decline From the Recent Five Year High

Crude Oil Production per Rig Continues to Decline From the Recent Five Year High

Resilient Production Despite a Collapse in Price & Rigs on Same Trajectory as ’08 Natural Gas

Resilient Production Despite a Collapse in Price & Rigs on Same Trajectory as ’08 Natural Gas