U.S. Livestock Cold Storage Update – Nov ’15

Pork – Stocks Remain Significantly Higher on YOY Basis, Finish up 13.1%

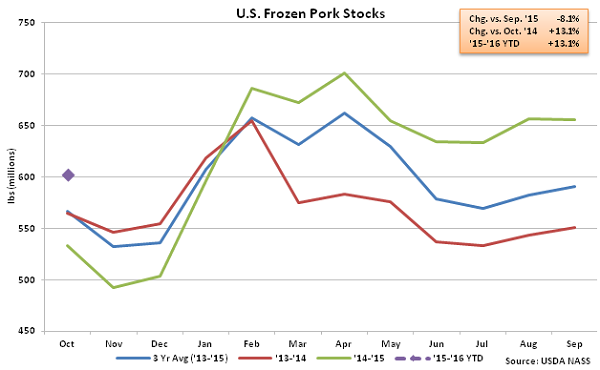

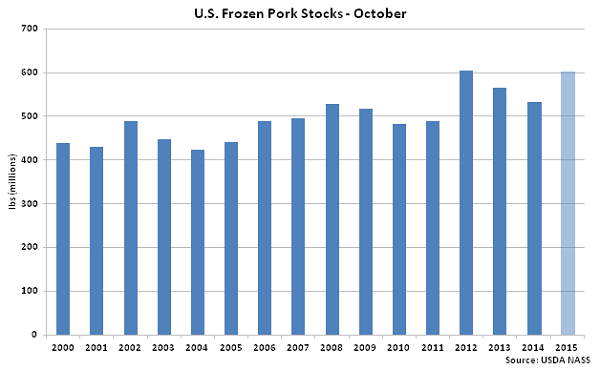

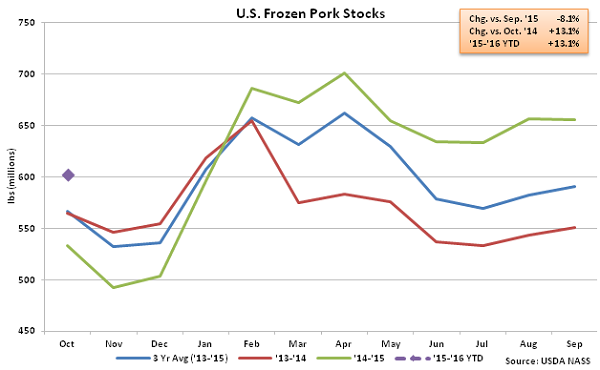

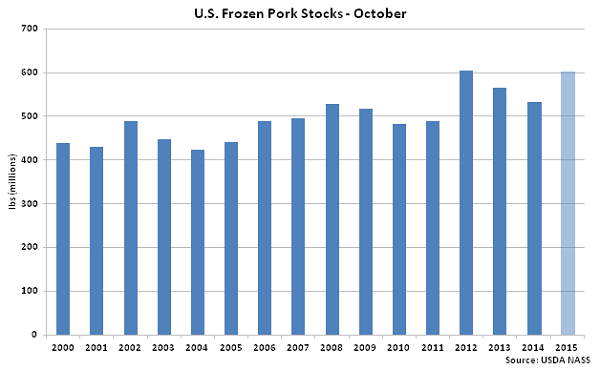

According to USDA, Oct ’15 U.S. frozen pork stocks of 602.7 million pounds declined by 8.1% MOM but remained 13.1% higher YOY, finishing at the second highest October figure on record. Pork stocks have increased YOY for nine month in a row after 11 consecutive months of YOY declines were experienced from Mar ’14 – Jan ’15. Oct ’15 pork stocks finished 6.3% higher than the three year average October pork stocks.

According to USDA, Oct ’15 U.S. frozen pork stocks of 602.7 million pounds declined by 8.1% MOM but remained 13.1% higher YOY, finishing at the second highest October figure on record. Pork stocks have increased YOY for nine month in a row after 11 consecutive months of YOY declines were experienced from Mar ’14 – Jan ’15. Oct ’15 pork stocks finished 6.3% higher than the three year average October pork stocks.

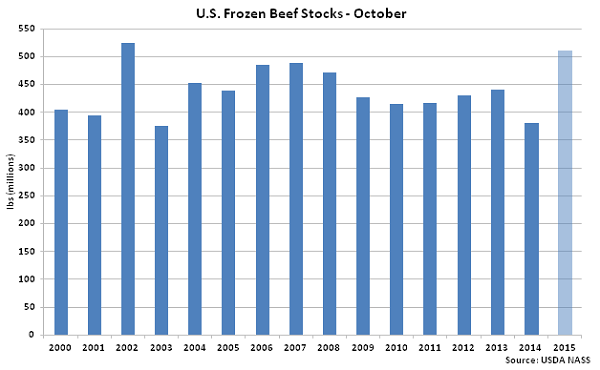

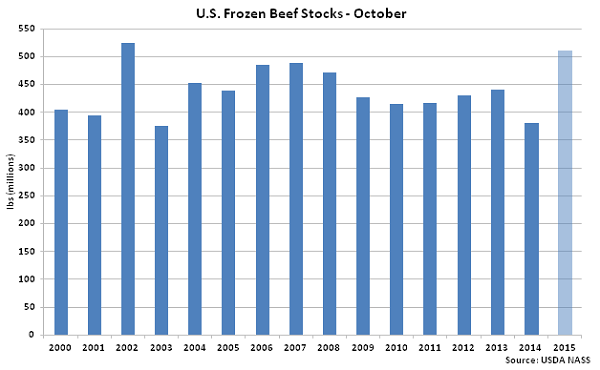

Beef – Stocks Increase to New Three and a Half Year High, Finish up 34.3% YOY

Beef – Stocks Increase to New Three and a Half Year High, Finish up 34.3% YOY

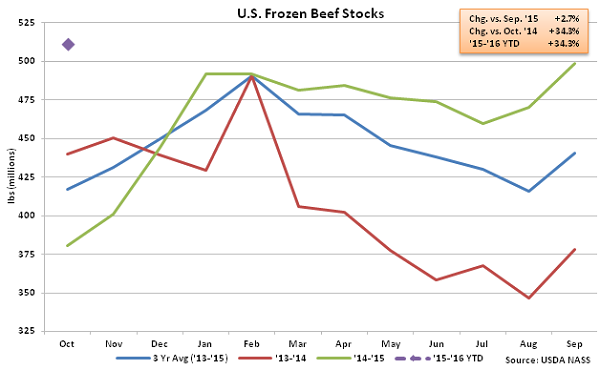

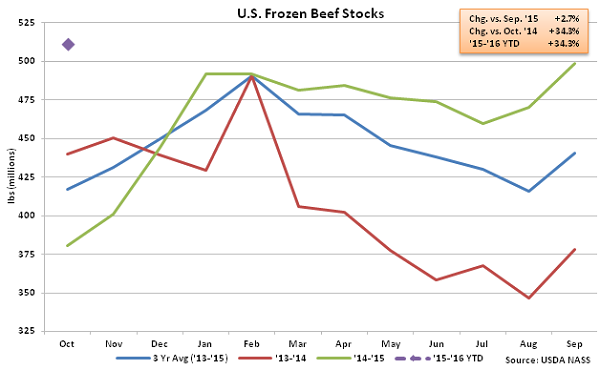

Oct ’15 U.S. frozen beef stocks of 511.6 million pounds increased 2.7% MOM and 34.3% YOY to a 13 year high for the month of October. The monthly YOY increase in beef stocks was the 11th experienced in a row after nine consecutive months of YOY declines were experienced from Mar ’14 – Nov ’14. The MOM increase in beef stocks of 13.2 million pounds, or 2.7%, was larger than the ten year average September – October increase in beef stocks of 2.1 million pounds, or 0.5%. Oct ’15 beef stocks finished 22.6% higher than the three year average October beef stocks and are at a three and a half year high on an absolute basis.

Oct ’15 U.S. frozen beef stocks of 511.6 million pounds increased 2.7% MOM and 34.3% YOY to a 13 year high for the month of October. The monthly YOY increase in beef stocks was the 11th experienced in a row after nine consecutive months of YOY declines were experienced from Mar ’14 – Nov ’14. The MOM increase in beef stocks of 13.2 million pounds, or 2.7%, was larger than the ten year average September – October increase in beef stocks of 2.1 million pounds, or 0.5%. Oct ’15 beef stocks finished 22.6% higher than the three year average October beef stocks and are at a three and a half year high on an absolute basis.

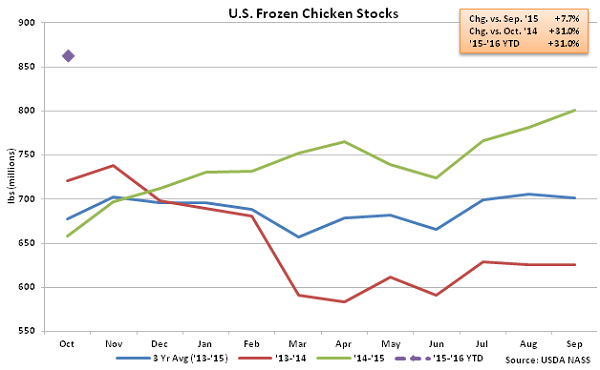

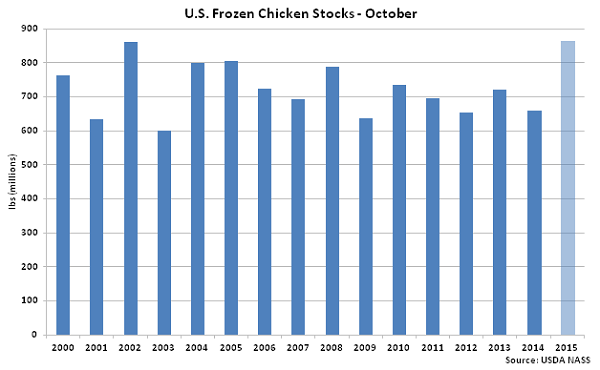

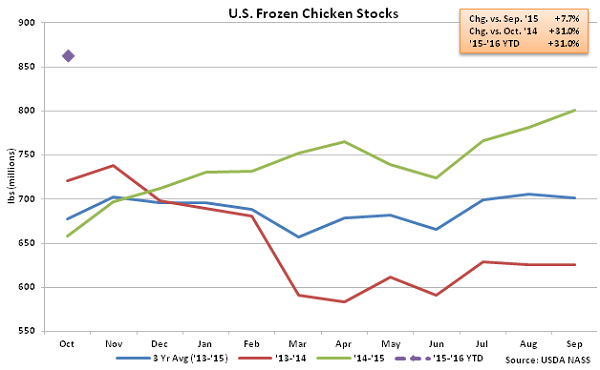

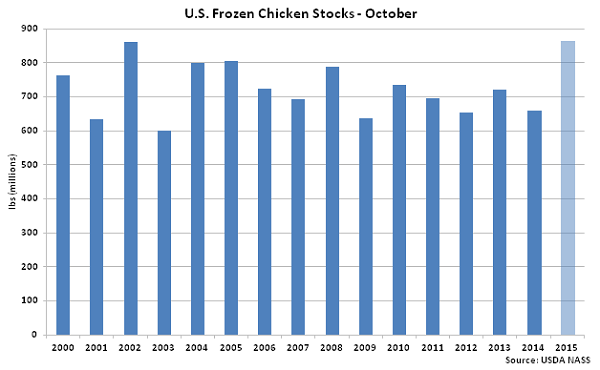

Chicken – Stocks Finish at New Record High for the Month of October, up 31.0% YOY

Chicken – Stocks Finish at New Record High for the Month of October, up 31.0% YOY

Oct ’15 U.S. frozen chicken stocks of 862.7 million pounds increased 7.7% MOM and 31.0% YOY to a new record high for the month of October. Chicken stocks increased YOY for the 11th month in a row after nine consecutive months of YOY declines were experienced from Mar ’14 – Nov ’14. The MOM increase in chicken stocks of 61.8 million pounds, or 7.7%, was significantly larger than the ten year average September – October seasonal increase of 25.7 million pounds, or 3.7%. Stocks have built as the Russian import ban continues to negatively affect U.S. broiler exports. U.S. broiler export volumes have declined by 9.7% YOY since the ban was announced. Oct ’15 chicken stocks finished 27.3% higher than the three year average October chicken stocks and are at a nine and a half year high on an absolute basis.

Oct ’15 U.S. frozen chicken stocks of 862.7 million pounds increased 7.7% MOM and 31.0% YOY to a new record high for the month of October. Chicken stocks increased YOY for the 11th month in a row after nine consecutive months of YOY declines were experienced from Mar ’14 – Nov ’14. The MOM increase in chicken stocks of 61.8 million pounds, or 7.7%, was significantly larger than the ten year average September – October seasonal increase of 25.7 million pounds, or 3.7%. Stocks have built as the Russian import ban continues to negatively affect U.S. broiler exports. U.S. broiler export volumes have declined by 9.7% YOY since the ban was announced. Oct ’15 chicken stocks finished 27.3% higher than the three year average October chicken stocks and are at a nine and a half year high on an absolute basis.

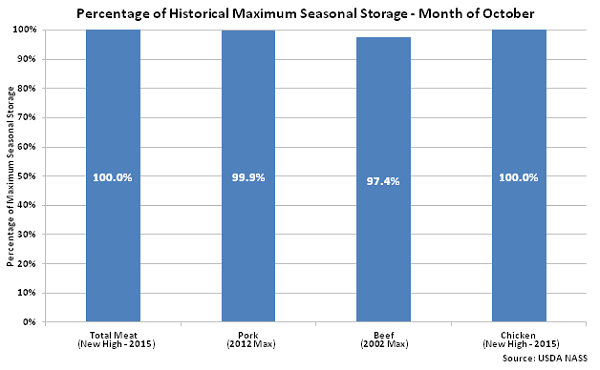

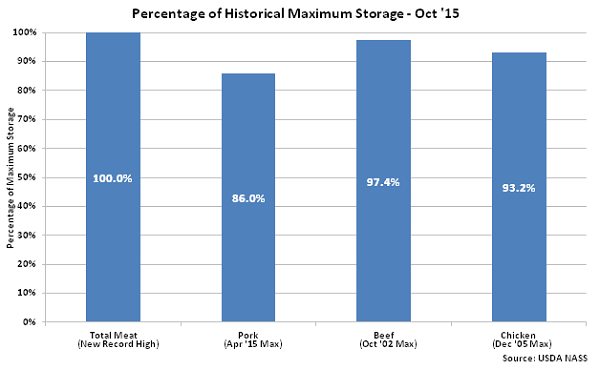

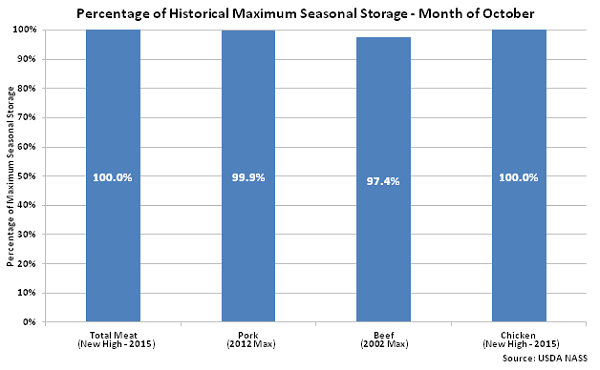

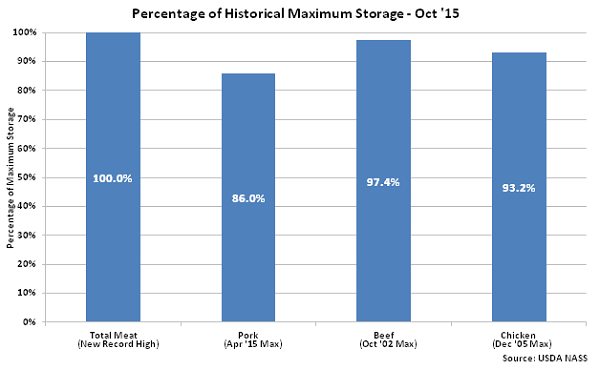

Overall, combined Oct ’15 U.S. pork, beef and chicken stocks set a new monthly record high. Individually, Oct ’15 U.S. beef and chicken stocks were above 90% of historical maximum storage levels, while pork stocks were also relatively high, finishing above 85% of historical maximum storage levels.

Overall, combined Oct ’15 U.S. pork, beef and chicken stocks set a new monthly record high. Individually, Oct ’15 U.S. beef and chicken stocks were above 90% of historical maximum storage levels, while pork stocks were also relatively high, finishing above 85% of historical maximum storage levels.

Individually, Oct ’15 U.S. chicken stocks set a new record high for the month of October, while pork and beef stocks finished within three percent of historical maximum storage levels for the month of October.

Individually, Oct ’15 U.S. chicken stocks set a new record high for the month of October, while pork and beef stocks finished within three percent of historical maximum storage levels for the month of October.

According to USDA, Oct ’15 U.S. frozen pork stocks of 602.7 million pounds declined by 8.1% MOM but remained 13.1% higher YOY, finishing at the second highest October figure on record. Pork stocks have increased YOY for nine month in a row after 11 consecutive months of YOY declines were experienced from Mar ’14 – Jan ’15. Oct ’15 pork stocks finished 6.3% higher than the three year average October pork stocks.

According to USDA, Oct ’15 U.S. frozen pork stocks of 602.7 million pounds declined by 8.1% MOM but remained 13.1% higher YOY, finishing at the second highest October figure on record. Pork stocks have increased YOY for nine month in a row after 11 consecutive months of YOY declines were experienced from Mar ’14 – Jan ’15. Oct ’15 pork stocks finished 6.3% higher than the three year average October pork stocks.

Beef – Stocks Increase to New Three and a Half Year High, Finish up 34.3% YOY

Beef – Stocks Increase to New Three and a Half Year High, Finish up 34.3% YOY

Oct ’15 U.S. frozen beef stocks of 511.6 million pounds increased 2.7% MOM and 34.3% YOY to a 13 year high for the month of October. The monthly YOY increase in beef stocks was the 11th experienced in a row after nine consecutive months of YOY declines were experienced from Mar ’14 – Nov ’14. The MOM increase in beef stocks of 13.2 million pounds, or 2.7%, was larger than the ten year average September – October increase in beef stocks of 2.1 million pounds, or 0.5%. Oct ’15 beef stocks finished 22.6% higher than the three year average October beef stocks and are at a three and a half year high on an absolute basis.

Oct ’15 U.S. frozen beef stocks of 511.6 million pounds increased 2.7% MOM and 34.3% YOY to a 13 year high for the month of October. The monthly YOY increase in beef stocks was the 11th experienced in a row after nine consecutive months of YOY declines were experienced from Mar ’14 – Nov ’14. The MOM increase in beef stocks of 13.2 million pounds, or 2.7%, was larger than the ten year average September – October increase in beef stocks of 2.1 million pounds, or 0.5%. Oct ’15 beef stocks finished 22.6% higher than the three year average October beef stocks and are at a three and a half year high on an absolute basis.

Chicken – Stocks Finish at New Record High for the Month of October, up 31.0% YOY

Chicken – Stocks Finish at New Record High for the Month of October, up 31.0% YOY

Oct ’15 U.S. frozen chicken stocks of 862.7 million pounds increased 7.7% MOM and 31.0% YOY to a new record high for the month of October. Chicken stocks increased YOY for the 11th month in a row after nine consecutive months of YOY declines were experienced from Mar ’14 – Nov ’14. The MOM increase in chicken stocks of 61.8 million pounds, or 7.7%, was significantly larger than the ten year average September – October seasonal increase of 25.7 million pounds, or 3.7%. Stocks have built as the Russian import ban continues to negatively affect U.S. broiler exports. U.S. broiler export volumes have declined by 9.7% YOY since the ban was announced. Oct ’15 chicken stocks finished 27.3% higher than the three year average October chicken stocks and are at a nine and a half year high on an absolute basis.

Oct ’15 U.S. frozen chicken stocks of 862.7 million pounds increased 7.7% MOM and 31.0% YOY to a new record high for the month of October. Chicken stocks increased YOY for the 11th month in a row after nine consecutive months of YOY declines were experienced from Mar ’14 – Nov ’14. The MOM increase in chicken stocks of 61.8 million pounds, or 7.7%, was significantly larger than the ten year average September – October seasonal increase of 25.7 million pounds, or 3.7%. Stocks have built as the Russian import ban continues to negatively affect U.S. broiler exports. U.S. broiler export volumes have declined by 9.7% YOY since the ban was announced. Oct ’15 chicken stocks finished 27.3% higher than the three year average October chicken stocks and are at a nine and a half year high on an absolute basis.

Overall, combined Oct ’15 U.S. pork, beef and chicken stocks set a new monthly record high. Individually, Oct ’15 U.S. beef and chicken stocks were above 90% of historical maximum storage levels, while pork stocks were also relatively high, finishing above 85% of historical maximum storage levels.

Overall, combined Oct ’15 U.S. pork, beef and chicken stocks set a new monthly record high. Individually, Oct ’15 U.S. beef and chicken stocks were above 90% of historical maximum storage levels, while pork stocks were also relatively high, finishing above 85% of historical maximum storage levels.

Individually, Oct ’15 U.S. chicken stocks set a new record high for the month of October, while pork and beef stocks finished within three percent of historical maximum storage levels for the month of October.

Individually, Oct ’15 U.S. chicken stocks set a new record high for the month of October, while pork and beef stocks finished within three percent of historical maximum storage levels for the month of October.