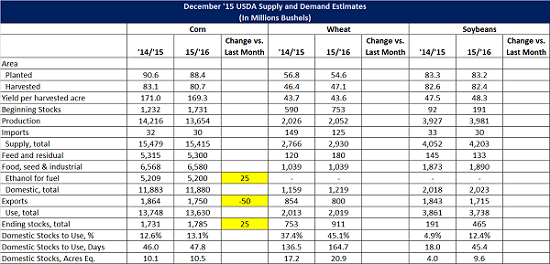

December ’15 USDA World Agriculture Supply and Demand Estimates

*Significant changes are highlighted

’14/’15 Corn

o No change

’15/’16 Corn

o Demand for ethanol was increased 25 million and exports dropped by another 50 million bushels.

o Ending stocks were projected at 1.785 billion bushels or 47.8 days of use and near private estimates.

’14/’15 Soybeans

o No change

’15/’16 Soybeans

o No change

o Ending stocks of 465 million bushels or 45.4 days of use were inline with private estimates.

Other Markets

o World wheat production was increased leaving ending stocks 3.5 million mTs higher.

o Palm oil output is expected lower in Malaysia and Indonesia as El Nino generates dry conditions.

o US beef production is reduced on lower marketing numbers for 2015 and lower placements into 2015. Weights are expected to stay on the high side though maintaining some more limited supply growth.

Click below for downloadable pdf.

December ’15 USDA World Agriculture Supply and Demand Estimates

*Significant changes are highlighted

’14/’15 Corn

o No change

’15/’16 Corn

o Demand for ethanol was increased 25 million and exports dropped by another 50 million bushels.

o Ending stocks were projected at 1.785 billion bushels or 47.8 days of use and near private estimates.

’14/’15 Soybeans

o No change

’15/’16 Soybeans

o No change

o Ending stocks of 465 million bushels or 45.4 days of use were inline with private estimates.

Other Markets

o World wheat production was increased leaving ending stocks 3.5 million mTs higher.

o Palm oil output is expected lower in Malaysia and Indonesia as El Nino generates dry conditions.

o US beef production is reduced on lower marketing numbers for 2015 and lower placements into 2015. Weights are expected to stay on the high side though maintaining some more limited supply growth.

Click below for downloadable pdf.

December ’15 USDA World Agriculture Supply and Demand Estimates