U.S. Cheese Production Trends Update – Dec ’15

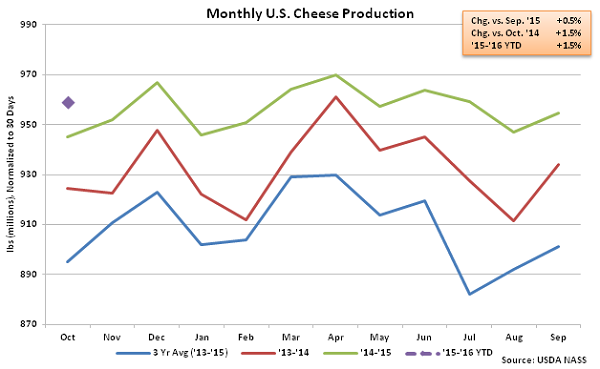

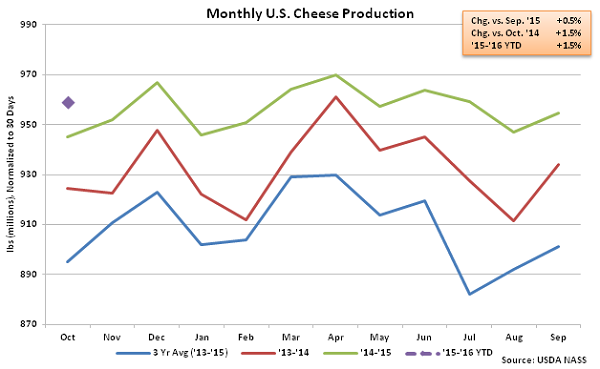

U.S. cheese production remained strong through Oct ’15, increasing by 1.5% YOY and finishing at a new record high for the month of October. Total cheese production has increased YOY for 31 consecutive months through Oct ’15.

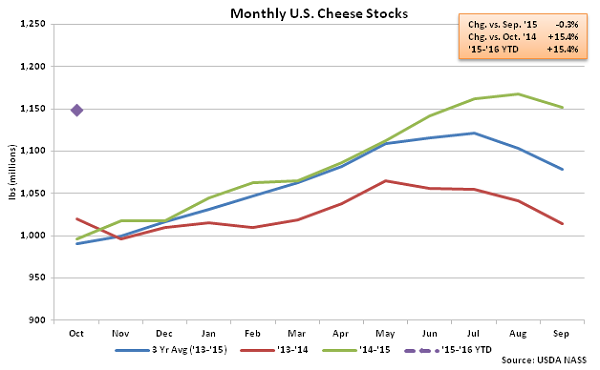

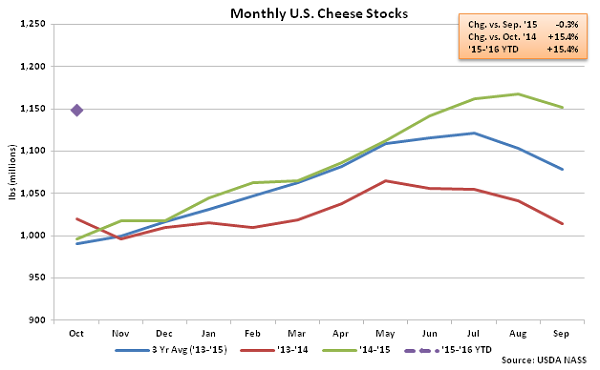

Continued growth in U.S. cheese production has contributed to a significant build in cheese stocks, despite robust domestic demand. Oct ’15 cheese stocks increased YOY for the 12th consecutive month, finishing at a 32 year high for the month of October. Oct ’15 U.S. cheese stocks finished 15.4% higher than the previous year, which was the largest percentage increase experienced in the past five and a half years.

Continued growth in U.S. cheese production has contributed to a significant build in cheese stocks, despite robust domestic demand. Oct ’15 cheese stocks increased YOY for the 12th consecutive month, finishing at a 32 year high for the month of October. Oct ’15 U.S. cheese stocks finished 15.4% higher than the previous year, which was the largest percentage increase experienced in the past five and a half years.

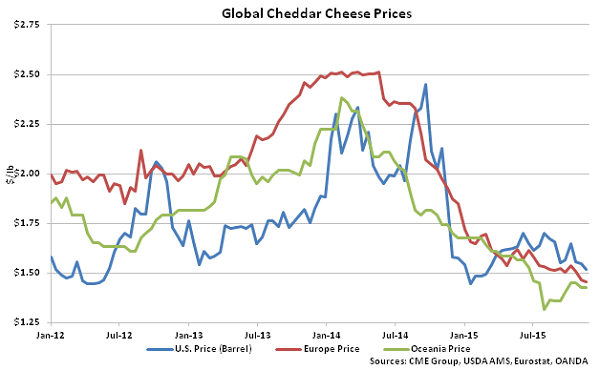

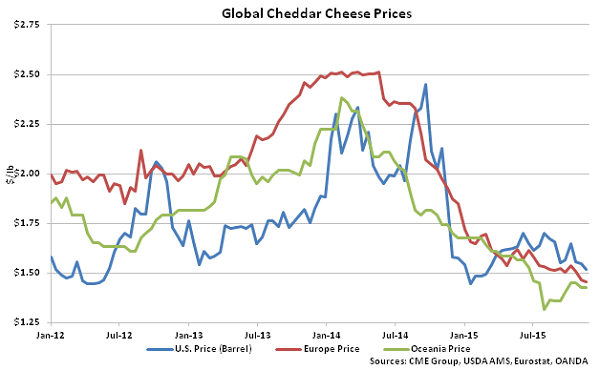

Despite continued production growth and increases in cheese stocks, U.S. cheddar cheese prices maintained a premium to international cheddar cheese prices for the eighth consecutive month during Nov ’15. U.S. cheddar cheese prices traded at a 4.9% premium to average European cheddar cheese prices and a 7.3% premium to average Oceania cheddar cheese prices throughout Nov ’15.

Despite continued production growth and increases in cheese stocks, U.S. cheddar cheese prices maintained a premium to international cheddar cheese prices for the eighth consecutive month during Nov ’15. U.S. cheddar cheese prices traded at a 4.9% premium to average European cheddar cheese prices and a 7.3% premium to average Oceania cheddar cheese prices throughout Nov ’15.

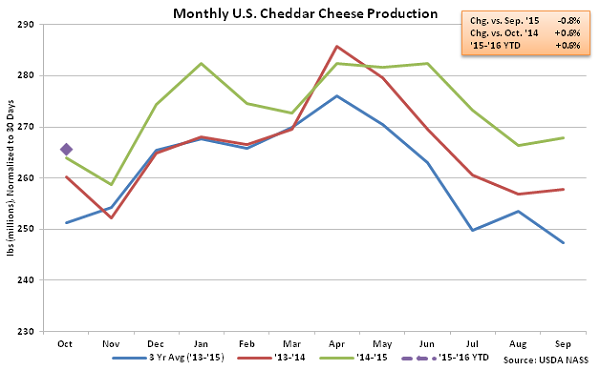

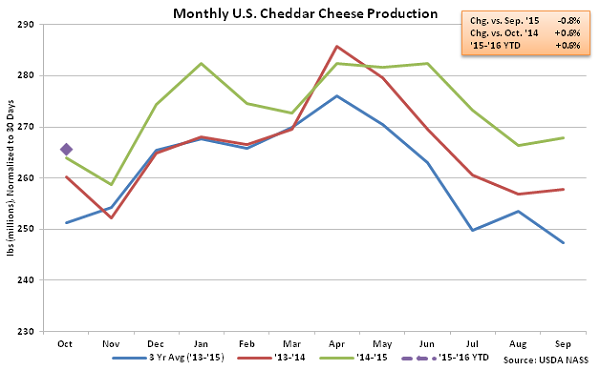

U.S. cheddar cheese prices have not been affected as much as total U.S. cheese fundamentals would suggest due to a continued reduction in cheddar cheese production relative to total cheese output. Oct ’15 U.S. cheddar cheese production increased YOY at a rate of just 0.6% while other-than-cheddar cheese production increased by 1.8%.

U.S. cheddar cheese prices have not been affected as much as total U.S. cheese fundamentals would suggest due to a continued reduction in cheddar cheese production relative to total cheese output. Oct ’15 U.S. cheddar cheese production increased YOY at a rate of just 0.6% while other-than-cheddar cheese production increased by 1.8%.

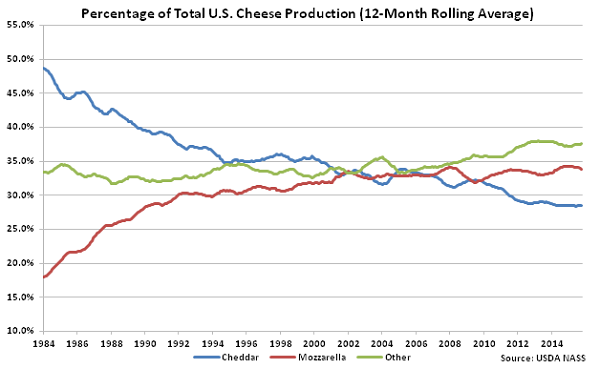

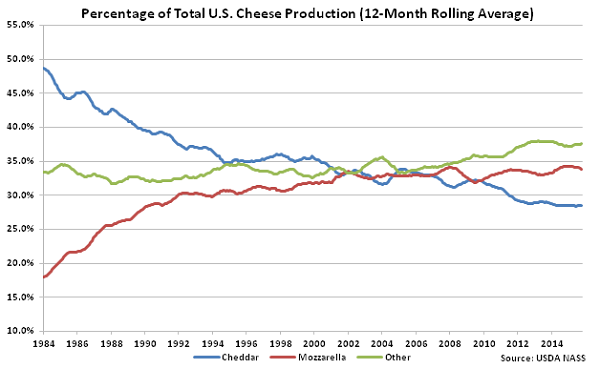

The decrease in relative cheddar cheese production has been an ongoing trend as growth in mozzarella and other cheese production has outpaced growth in cheddar production. Cheddar cheese accounted for just 28.5% of total U.S. cheese production during 2014, which was an all-time low.

The decrease in relative cheddar cheese production has been an ongoing trend as growth in mozzarella and other cheese production has outpaced growth in cheddar production. Cheddar cheese accounted for just 28.5% of total U.S. cheese production during 2014, which was an all-time low.

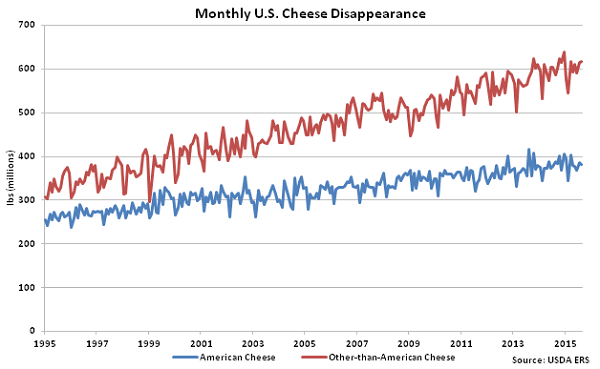

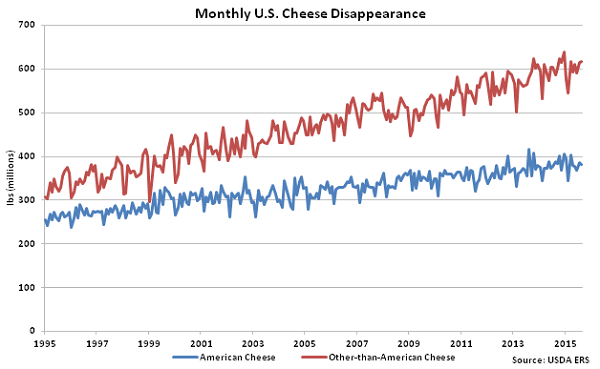

Production of mozzarella and other cheese types has increased as demand has continued to outpace that of cheddar cheese. U.S. commercial disappearance of American type cheeses (cheddar, colby, Monterey and Jack) has increased at a compound annual growth rate (CAGR) of 2.0% since figures were initially published in 1995 while commercial disappearance of other-than-American cheeses increased at a CAGR of 3.1% over the same period.

Production of mozzarella and other cheese types has increased as demand has continued to outpace that of cheddar cheese. U.S. commercial disappearance of American type cheeses (cheddar, colby, Monterey and Jack) has increased at a compound annual growth rate (CAGR) of 2.0% since figures were initially published in 1995 while commercial disappearance of other-than-American cheeses increased at a CAGR of 3.1% over the same period.

As cheddar cheese continues to account for a smaller percentage of total U.S. cheese production, cheddar cheese prices may deviate further from what total U.S. cheese fundamentals would suggest. Accounting for trends in cheese production can provide a better picture of the dynamics driving recently maintained U.S. cheddar cheese price premiums.

As cheddar cheese continues to account for a smaller percentage of total U.S. cheese production, cheddar cheese prices may deviate further from what total U.S. cheese fundamentals would suggest. Accounting for trends in cheese production can provide a better picture of the dynamics driving recently maintained U.S. cheddar cheese price premiums.

Continued growth in U.S. cheese production has contributed to a significant build in cheese stocks, despite robust domestic demand. Oct ’15 cheese stocks increased YOY for the 12th consecutive month, finishing at a 32 year high for the month of October. Oct ’15 U.S. cheese stocks finished 15.4% higher than the previous year, which was the largest percentage increase experienced in the past five and a half years.

Continued growth in U.S. cheese production has contributed to a significant build in cheese stocks, despite robust domestic demand. Oct ’15 cheese stocks increased YOY for the 12th consecutive month, finishing at a 32 year high for the month of October. Oct ’15 U.S. cheese stocks finished 15.4% higher than the previous year, which was the largest percentage increase experienced in the past five and a half years.

Despite continued production growth and increases in cheese stocks, U.S. cheddar cheese prices maintained a premium to international cheddar cheese prices for the eighth consecutive month during Nov ’15. U.S. cheddar cheese prices traded at a 4.9% premium to average European cheddar cheese prices and a 7.3% premium to average Oceania cheddar cheese prices throughout Nov ’15.

Despite continued production growth and increases in cheese stocks, U.S. cheddar cheese prices maintained a premium to international cheddar cheese prices for the eighth consecutive month during Nov ’15. U.S. cheddar cheese prices traded at a 4.9% premium to average European cheddar cheese prices and a 7.3% premium to average Oceania cheddar cheese prices throughout Nov ’15.

U.S. cheddar cheese prices have not been affected as much as total U.S. cheese fundamentals would suggest due to a continued reduction in cheddar cheese production relative to total cheese output. Oct ’15 U.S. cheddar cheese production increased YOY at a rate of just 0.6% while other-than-cheddar cheese production increased by 1.8%.

U.S. cheddar cheese prices have not been affected as much as total U.S. cheese fundamentals would suggest due to a continued reduction in cheddar cheese production relative to total cheese output. Oct ’15 U.S. cheddar cheese production increased YOY at a rate of just 0.6% while other-than-cheddar cheese production increased by 1.8%.

The decrease in relative cheddar cheese production has been an ongoing trend as growth in mozzarella and other cheese production has outpaced growth in cheddar production. Cheddar cheese accounted for just 28.5% of total U.S. cheese production during 2014, which was an all-time low.

The decrease in relative cheddar cheese production has been an ongoing trend as growth in mozzarella and other cheese production has outpaced growth in cheddar production. Cheddar cheese accounted for just 28.5% of total U.S. cheese production during 2014, which was an all-time low.

Production of mozzarella and other cheese types has increased as demand has continued to outpace that of cheddar cheese. U.S. commercial disappearance of American type cheeses (cheddar, colby, Monterey and Jack) has increased at a compound annual growth rate (CAGR) of 2.0% since figures were initially published in 1995 while commercial disappearance of other-than-American cheeses increased at a CAGR of 3.1% over the same period.

Production of mozzarella and other cheese types has increased as demand has continued to outpace that of cheddar cheese. U.S. commercial disappearance of American type cheeses (cheddar, colby, Monterey and Jack) has increased at a compound annual growth rate (CAGR) of 2.0% since figures were initially published in 1995 while commercial disappearance of other-than-American cheeses increased at a CAGR of 3.1% over the same period.

As cheddar cheese continues to account for a smaller percentage of total U.S. cheese production, cheddar cheese prices may deviate further from what total U.S. cheese fundamentals would suggest. Accounting for trends in cheese production can provide a better picture of the dynamics driving recently maintained U.S. cheddar cheese price premiums.

As cheddar cheese continues to account for a smaller percentage of total U.S. cheese production, cheddar cheese prices may deviate further from what total U.S. cheese fundamentals would suggest. Accounting for trends in cheese production can provide a better picture of the dynamics driving recently maintained U.S. cheddar cheese price premiums.