U.S. Dry Product Stocks Update – Jan ’16

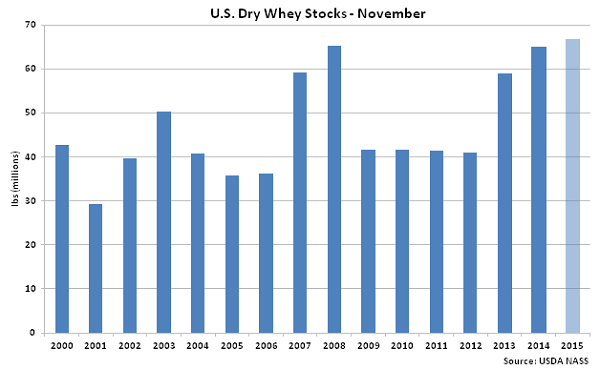

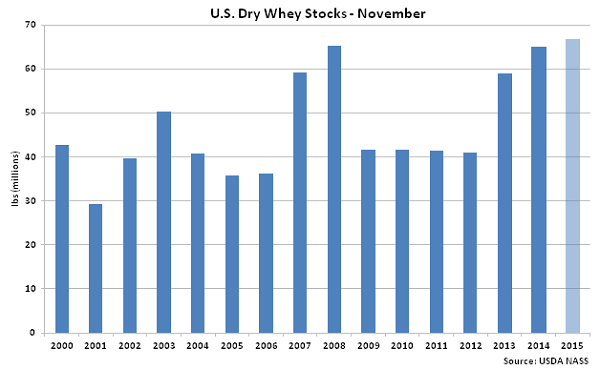

Dry Whey – Stocks Finish at a Record High for the Month of November

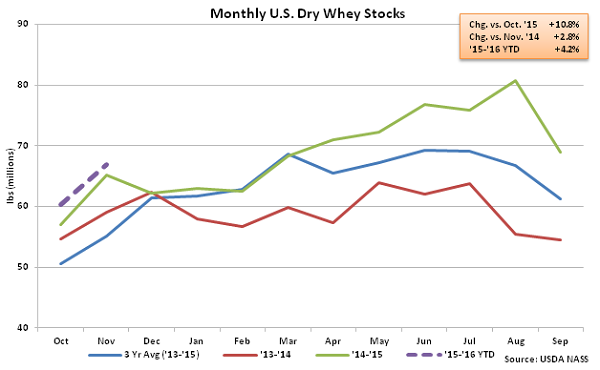

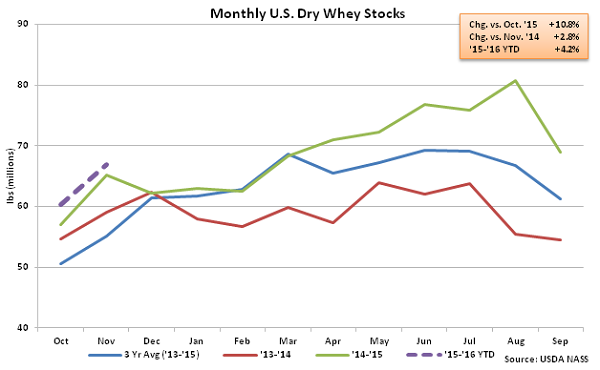

Nov ’15 month-end dry whey stocks remained higher on a YOY basis, finishing 2.8% above the previous year as production continues to expand. Nov ’15 total dry whey stocks of 66.9 million lbs also finished 10.8% above the previous month and 21.5% above the three year average November month-end dry whey stocks, finishing at a record high for the month of November. The MOM increase of 10.8%, or 6.5 million lbs, was significantly larger than the ten year average October – November seasonal increase in dry whey stocks of 2.0%, or 1.0 million lbs.

Nov ’15 month-end dry whey stocks remained higher on a YOY basis, finishing 2.8% above the previous year as production continues to expand. Nov ’15 total dry whey stocks of 66.9 million lbs also finished 10.8% above the previous month and 21.5% above the three year average November month-end dry whey stocks, finishing at a record high for the month of November. The MOM increase of 10.8%, or 6.5 million lbs, was significantly larger than the ten year average October – November seasonal increase in dry whey stocks of 2.0%, or 1.0 million lbs.

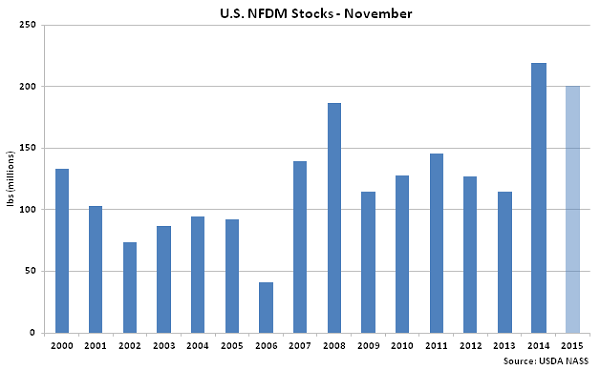

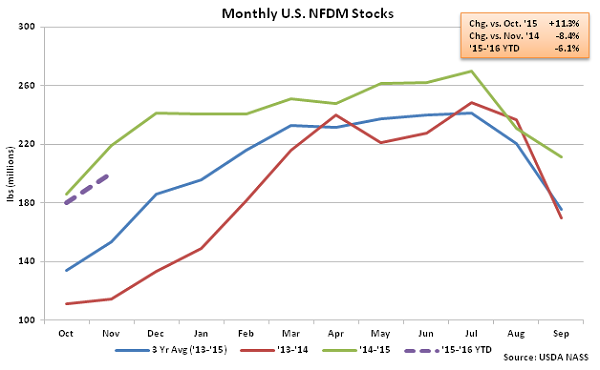

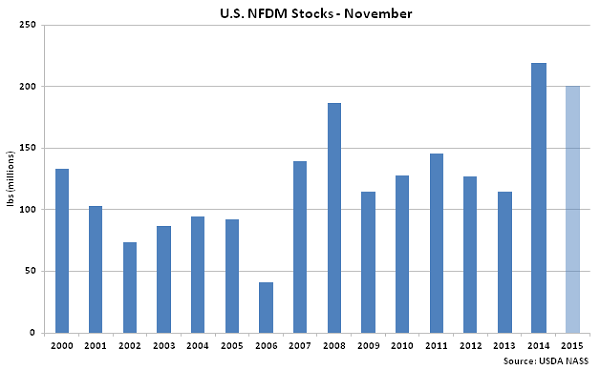

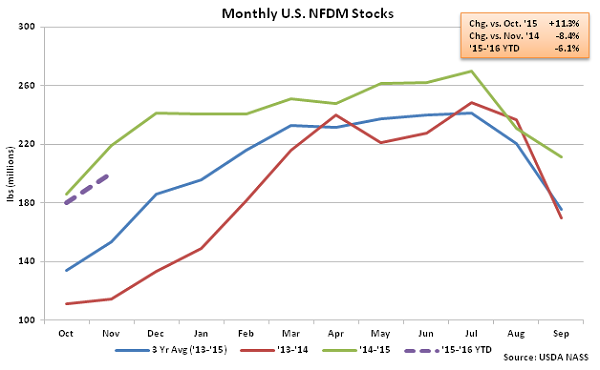

NFDM – Stocks Finish at the Second Largest November Stocks Level on Record

NFDM – Stocks Finish at the Second Largest November Stocks Level on Record

Nov ’15 month-end NFDM stocks of 200.5 million pounds finished 8.4% below the previous year’s record November stocks but remained at the second largest November figure on record. Nov ’15 month-end NFDM stocks increased MOM by 11.3%, or 20.4 million pounds, which was consistent with the ten year average October – November seasonal increase in NFDM stocks of 11.2%, or 12.8 million lbs. Nov ’15 NFDM production declined YOY for the second consecutive month, contributing to the YOY decline in stocks. Despite the YOY decline, NFDM stocks remained significantly higher than the three year average November NFDM stocks, finishing up 30.8%.

Nov ’15 month-end NFDM stocks of 200.5 million pounds finished 8.4% below the previous year’s record November stocks but remained at the second largest November figure on record. Nov ’15 month-end NFDM stocks increased MOM by 11.3%, or 20.4 million pounds, which was consistent with the ten year average October – November seasonal increase in NFDM stocks of 11.2%, or 12.8 million lbs. Nov ’15 NFDM production declined YOY for the second consecutive month, contributing to the YOY decline in stocks. Despite the YOY decline, NFDM stocks remained significantly higher than the three year average November NFDM stocks, finishing up 30.8%.

Nov ’15 month-end dry whey stocks remained higher on a YOY basis, finishing 2.8% above the previous year as production continues to expand. Nov ’15 total dry whey stocks of 66.9 million lbs also finished 10.8% above the previous month and 21.5% above the three year average November month-end dry whey stocks, finishing at a record high for the month of November. The MOM increase of 10.8%, or 6.5 million lbs, was significantly larger than the ten year average October – November seasonal increase in dry whey stocks of 2.0%, or 1.0 million lbs.

Nov ’15 month-end dry whey stocks remained higher on a YOY basis, finishing 2.8% above the previous year as production continues to expand. Nov ’15 total dry whey stocks of 66.9 million lbs also finished 10.8% above the previous month and 21.5% above the three year average November month-end dry whey stocks, finishing at a record high for the month of November. The MOM increase of 10.8%, or 6.5 million lbs, was significantly larger than the ten year average October – November seasonal increase in dry whey stocks of 2.0%, or 1.0 million lbs.

NFDM – Stocks Finish at the Second Largest November Stocks Level on Record

NFDM – Stocks Finish at the Second Largest November Stocks Level on Record

Nov ’15 month-end NFDM stocks of 200.5 million pounds finished 8.4% below the previous year’s record November stocks but remained at the second largest November figure on record. Nov ’15 month-end NFDM stocks increased MOM by 11.3%, or 20.4 million pounds, which was consistent with the ten year average October – November seasonal increase in NFDM stocks of 11.2%, or 12.8 million lbs. Nov ’15 NFDM production declined YOY for the second consecutive month, contributing to the YOY decline in stocks. Despite the YOY decline, NFDM stocks remained significantly higher than the three year average November NFDM stocks, finishing up 30.8%.

Nov ’15 month-end NFDM stocks of 200.5 million pounds finished 8.4% below the previous year’s record November stocks but remained at the second largest November figure on record. Nov ’15 month-end NFDM stocks increased MOM by 11.3%, or 20.4 million pounds, which was consistent with the ten year average October – November seasonal increase in NFDM stocks of 11.2%, or 12.8 million lbs. Nov ’15 NFDM production declined YOY for the second consecutive month, contributing to the YOY decline in stocks. Despite the YOY decline, NFDM stocks remained significantly higher than the three year average November NFDM stocks, finishing up 30.8%.