U.S. Dairy Cow Slaughter Update – Jan ’16

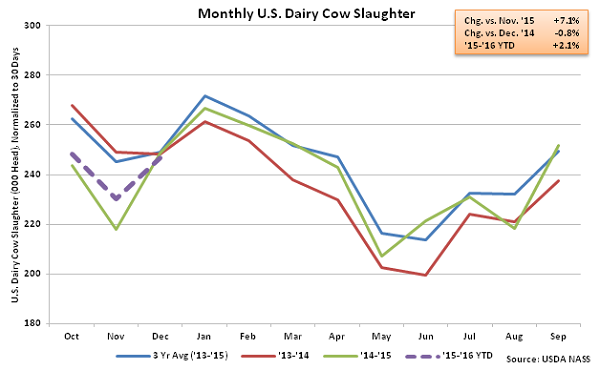

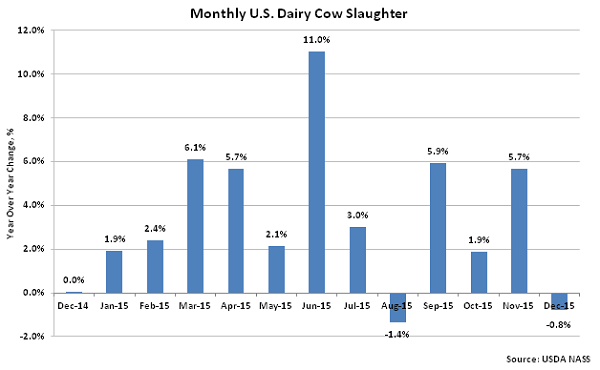

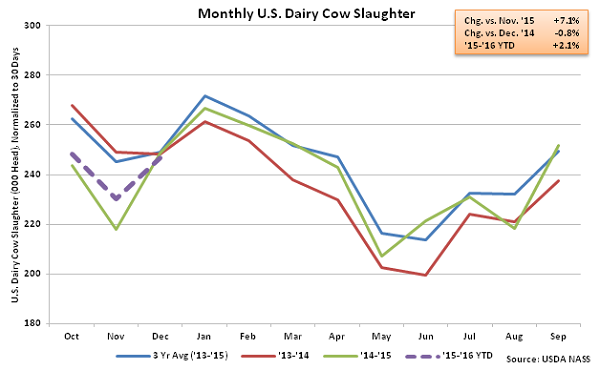

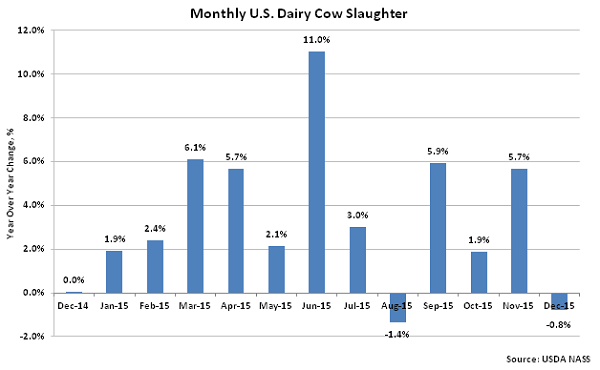

According to USDA, Dec ’15 U.S. dairy cow slaughter of 254,800 head increased 7.1% MOM on a daily average basis but declined 0.8% YOY. U.S. dairy cow slaughter rates have increased seasonally by an average of 2.3% MOM on a daily average basis from November – December over the past three years. Despite the YOY decline, ’15-’16 YTD dairy cow slaughter remains up 2.1% YOY throughout the first quarter of the production season.

The monthly YOY decline in dairy cow slaughter was only the second experienced in the past 13 months and the first experienced in the past four months. The U.S. milk cow herd held steady MOM during Nov ’15 at 9,313,000 head, which remained 29,000 head more than November of last year.

The monthly YOY decline in dairy cow slaughter was only the second experienced in the past 13 months and the first experienced in the past four months. The U.S. milk cow herd held steady MOM during Nov ’15 at 9,313,000 head, which remained 29,000 head more than November of last year.

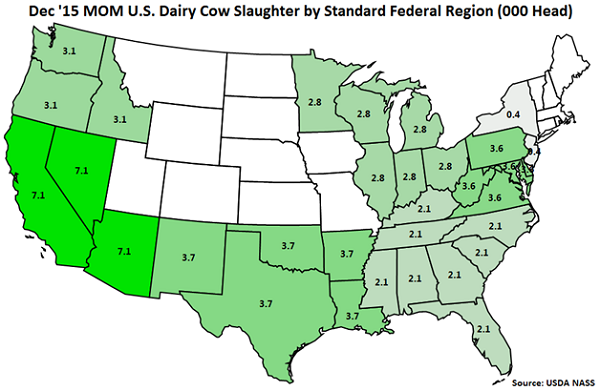

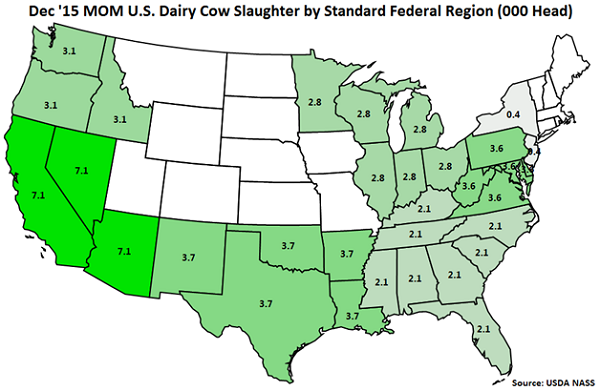

The most significant MOM increase in dairy cow slaughter was exhibited in Standard Federal Region 9 (Arizona, California, Hawaii and Nevada), followed by Standard Federal Region 6 (Arkansas, Louisiana, New Mexico, Oklahoma and Texas). No MOM declines in dairy cow slaughter were exhibited throughout the month.

The most significant MOM increase in dairy cow slaughter was exhibited in Standard Federal Region 9 (Arizona, California, Hawaii and Nevada), followed by Standard Federal Region 6 (Arkansas, Louisiana, New Mexico, Oklahoma and Texas). No MOM declines in dairy cow slaughter were exhibited throughout the month.

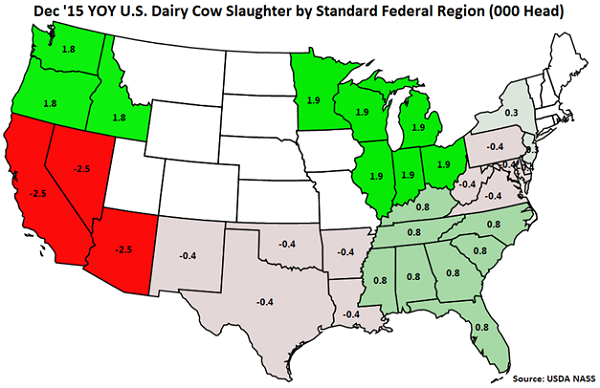

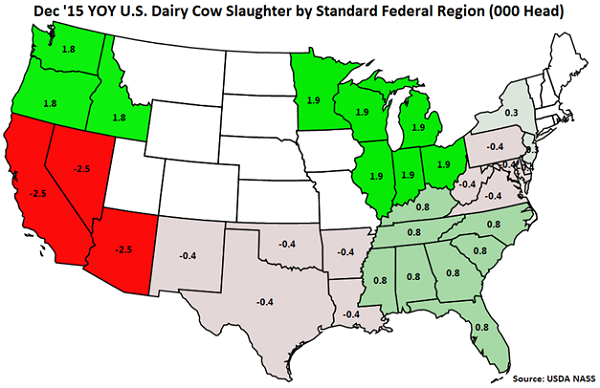

The largest YOY decline in dairy cow slaughter was exhibited in Standard Federal Region 9 (Arizona, California, Hawaii and Nevada), followed by Standard Federal Region 6 (Arkansas, Louisiana, New Mexico, Oklahoma and Texas) and Standard Federal Region 3 (Delaware, Maryland, Pennsylvania, Virginia and West Virginia). YOY increases in dairy cow slaughter were led by Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin), followed by Standard Federal Region 10 (Alaska, Idaho, Oregon and Washington).

The largest YOY decline in dairy cow slaughter was exhibited in Standard Federal Region 9 (Arizona, California, Hawaii and Nevada), followed by Standard Federal Region 6 (Arkansas, Louisiana, New Mexico, Oklahoma and Texas) and Standard Federal Region 3 (Delaware, Maryland, Pennsylvania, Virginia and West Virginia). YOY increases in dairy cow slaughter were led by Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin), followed by Standard Federal Region 10 (Alaska, Idaho, Oregon and Washington).

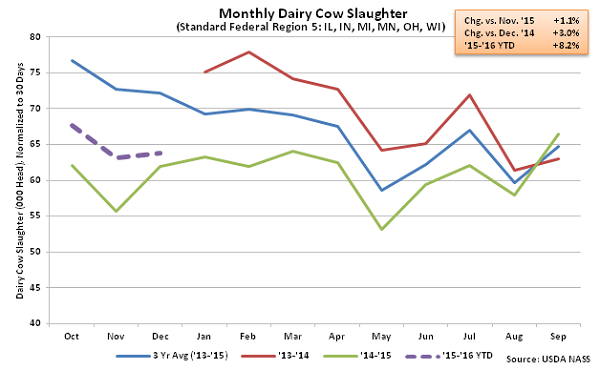

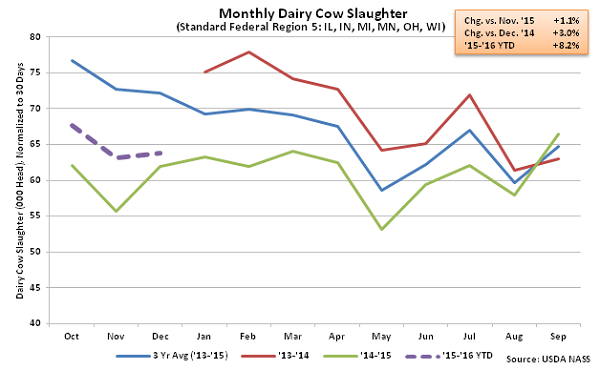

Dairy cow slaughter rates declined 3.0% YOY and 1.1% MOM on a daily average basis within Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin). The YOY increase in dairy cow slaughter exhibited within Standard Federal Region 5 was the fourth experienced in a row. ’15-’16 YTD dairy cow slaughter is up 2.1% YOY throughout the first quarter of the production season within Standard Federal Region 5.

Dairy cow slaughter rates declined 3.0% YOY and 1.1% MOM on a daily average basis within Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin). The YOY increase in dairy cow slaughter exhibited within Standard Federal Region 5 was the fourth experienced in a row. ’15-’16 YTD dairy cow slaughter is up 2.1% YOY throughout the first quarter of the production season within Standard Federal Region 5.

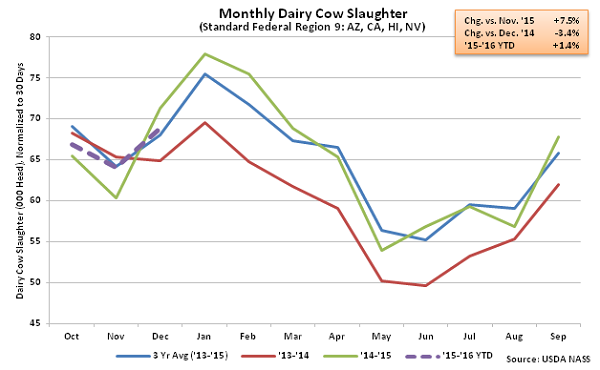

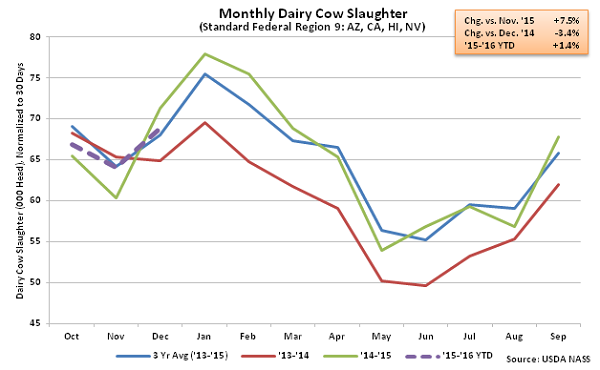

Dairy cow slaughter increased 7.5% MOM on a daily average basis but declined 3.4% YOY within Standard Federal Region 9 (Arizona, California, Hawaii and Nevada). The YOY decline in dairy cow slaughter within Standard Federal Region 9 was the first experienced in the past 13 months. ’15-’16 YTD dairy cow slaughter remains up 2.1% YOY throughout the first quarter of the production season within Standard Federal Region 9.

Dairy cow slaughter increased 7.5% MOM on a daily average basis but declined 3.4% YOY within Standard Federal Region 9 (Arizona, California, Hawaii and Nevada). The YOY decline in dairy cow slaughter within Standard Federal Region 9 was the first experienced in the past 13 months. ’15-’16 YTD dairy cow slaughter remains up 2.1% YOY throughout the first quarter of the production season within Standard Federal Region 9.

The monthly YOY decline in dairy cow slaughter was only the second experienced in the past 13 months and the first experienced in the past four months. The U.S. milk cow herd held steady MOM during Nov ’15 at 9,313,000 head, which remained 29,000 head more than November of last year.

The monthly YOY decline in dairy cow slaughter was only the second experienced in the past 13 months and the first experienced in the past four months. The U.S. milk cow herd held steady MOM during Nov ’15 at 9,313,000 head, which remained 29,000 head more than November of last year.

The most significant MOM increase in dairy cow slaughter was exhibited in Standard Federal Region 9 (Arizona, California, Hawaii and Nevada), followed by Standard Federal Region 6 (Arkansas, Louisiana, New Mexico, Oklahoma and Texas). No MOM declines in dairy cow slaughter were exhibited throughout the month.

The most significant MOM increase in dairy cow slaughter was exhibited in Standard Federal Region 9 (Arizona, California, Hawaii and Nevada), followed by Standard Federal Region 6 (Arkansas, Louisiana, New Mexico, Oklahoma and Texas). No MOM declines in dairy cow slaughter were exhibited throughout the month.

The largest YOY decline in dairy cow slaughter was exhibited in Standard Federal Region 9 (Arizona, California, Hawaii and Nevada), followed by Standard Federal Region 6 (Arkansas, Louisiana, New Mexico, Oklahoma and Texas) and Standard Federal Region 3 (Delaware, Maryland, Pennsylvania, Virginia and West Virginia). YOY increases in dairy cow slaughter were led by Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin), followed by Standard Federal Region 10 (Alaska, Idaho, Oregon and Washington).

The largest YOY decline in dairy cow slaughter was exhibited in Standard Federal Region 9 (Arizona, California, Hawaii and Nevada), followed by Standard Federal Region 6 (Arkansas, Louisiana, New Mexico, Oklahoma and Texas) and Standard Federal Region 3 (Delaware, Maryland, Pennsylvania, Virginia and West Virginia). YOY increases in dairy cow slaughter were led by Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin), followed by Standard Federal Region 10 (Alaska, Idaho, Oregon and Washington).

Dairy cow slaughter rates declined 3.0% YOY and 1.1% MOM on a daily average basis within Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin). The YOY increase in dairy cow slaughter exhibited within Standard Federal Region 5 was the fourth experienced in a row. ’15-’16 YTD dairy cow slaughter is up 2.1% YOY throughout the first quarter of the production season within Standard Federal Region 5.

Dairy cow slaughter rates declined 3.0% YOY and 1.1% MOM on a daily average basis within Standard Federal Region 5 (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin). The YOY increase in dairy cow slaughter exhibited within Standard Federal Region 5 was the fourth experienced in a row. ’15-’16 YTD dairy cow slaughter is up 2.1% YOY throughout the first quarter of the production season within Standard Federal Region 5.

Dairy cow slaughter increased 7.5% MOM on a daily average basis but declined 3.4% YOY within Standard Federal Region 9 (Arizona, California, Hawaii and Nevada). The YOY decline in dairy cow slaughter within Standard Federal Region 9 was the first experienced in the past 13 months. ’15-’16 YTD dairy cow slaughter remains up 2.1% YOY throughout the first quarter of the production season within Standard Federal Region 9.

Dairy cow slaughter increased 7.5% MOM on a daily average basis but declined 3.4% YOY within Standard Federal Region 9 (Arizona, California, Hawaii and Nevada). The YOY decline in dairy cow slaughter within Standard Federal Region 9 was the first experienced in the past 13 months. ’15-’16 YTD dairy cow slaughter remains up 2.1% YOY throughout the first quarter of the production season within Standard Federal Region 9.