Chinese Dairy Imports Update – Apr ’16

Executive Summary

Chinese dairy import figures provided by GTIS were recently updated with values spanning through Mar ’16. Highlights from the updated report include:

• Total Chinese dairy import volumes increased on a YOY basis for the eighth consecutive month during Mar ‘16, finishing up 46.8%.

• Chinese dairy import volumes originating from within the EU-28 increased to a new monthly record high during Mar ’16.

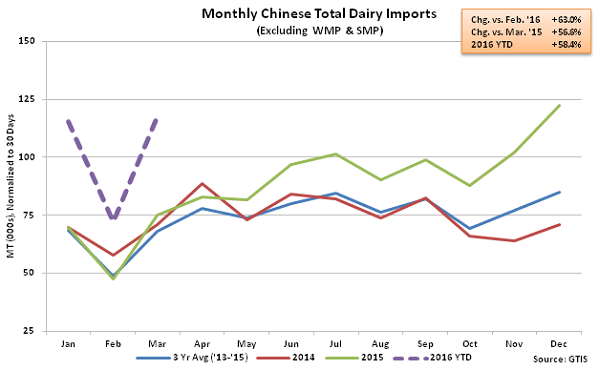

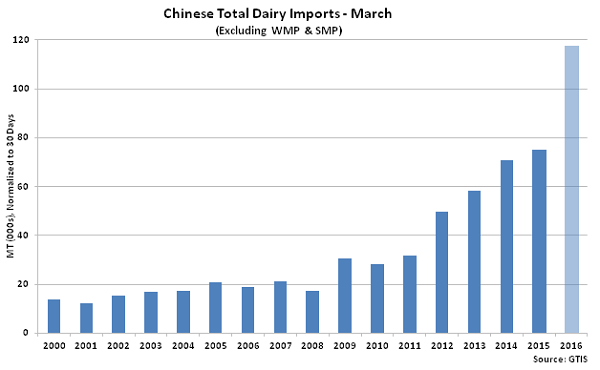

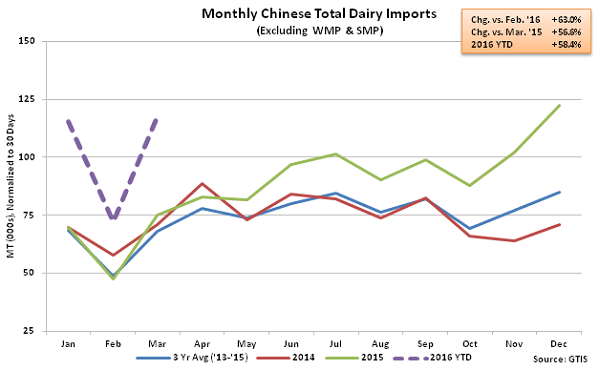

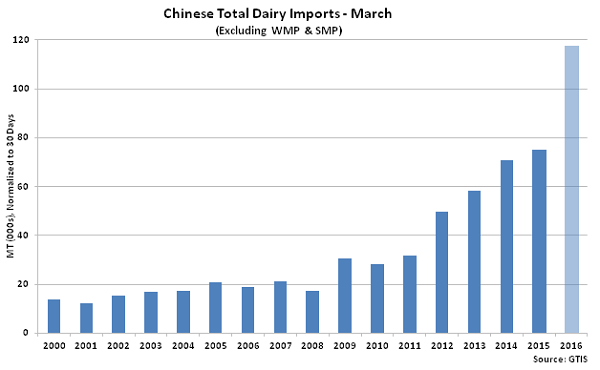

• Mar ’16 Chinese dairy imports excluding whole milk powder and skim milk powder remained particularly strong, finishing up 56.6% YOY to a new record high for the month of March.

Additional Report Details

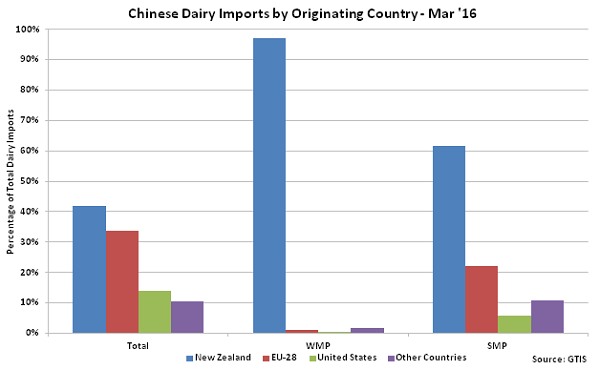

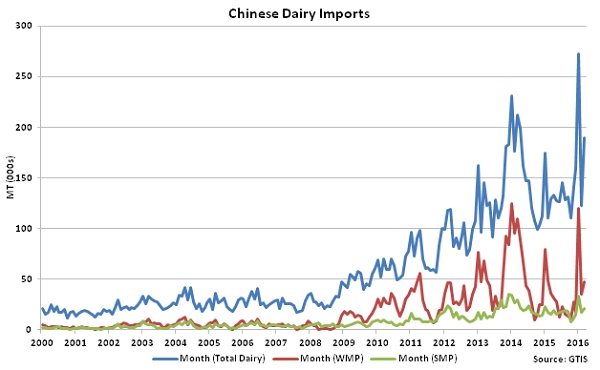

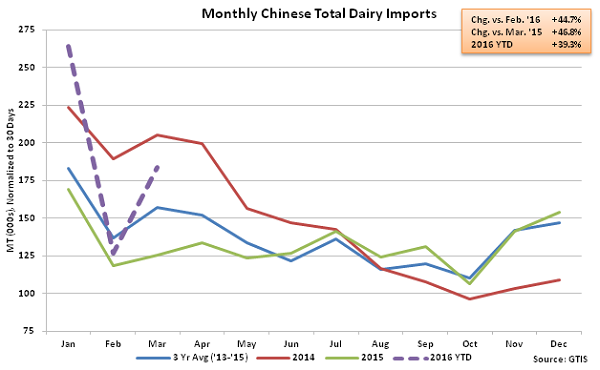

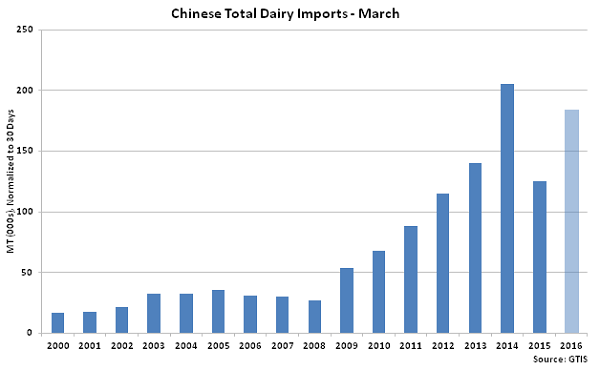

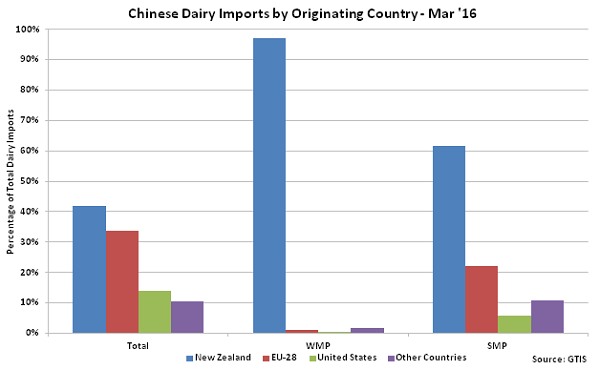

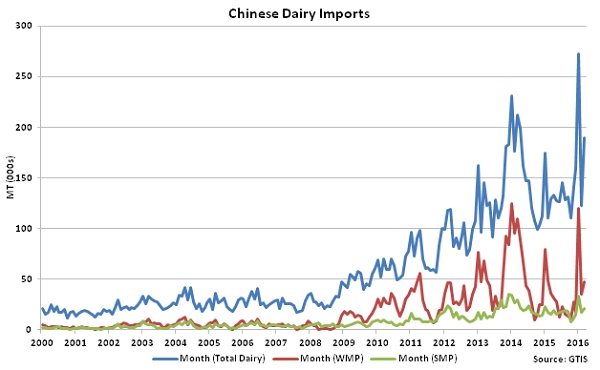

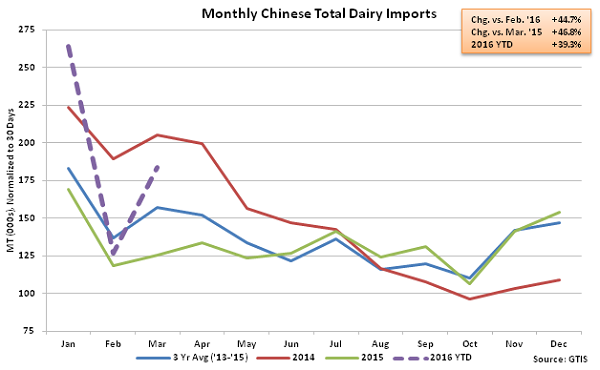

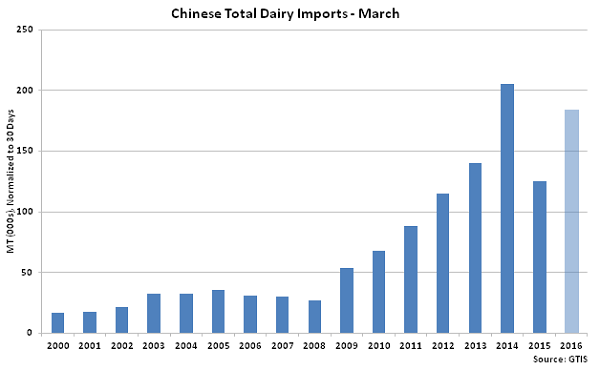

According to GTIS, Mar ’16 total Chinese dairy import volumes increased 44.7% MOM on a daily average basis and 46.8% YOY, finishing at the second highest level for the month of March on record. Total Chinese dairy import volumes have increased YOY for eight consecutive months through March. The February – March MOM increase in import volumes of 44.7% was significantly larger than the ten year average seasonal increase of 15.3%. Chinese dairy import volumes originating from New Zealand consisted of over 40% of total import volumes for the third consecutive month, while import volumes originating from within the EU-28 increased to a new monthly record high during Mar ’16.

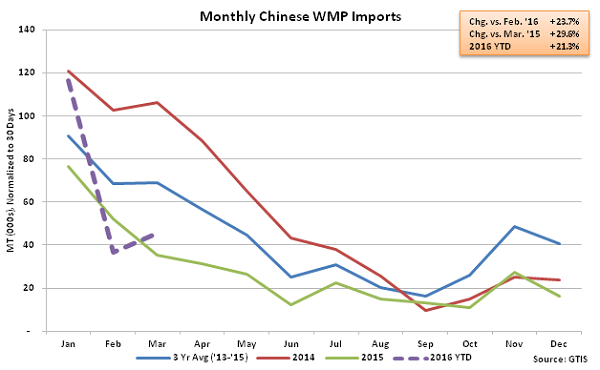

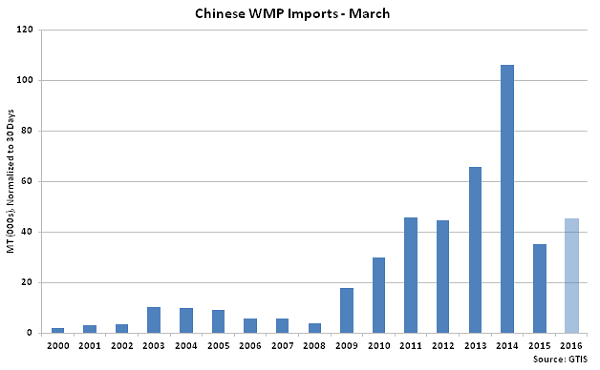

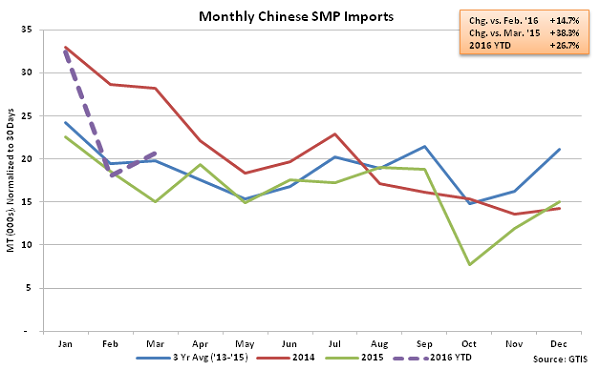

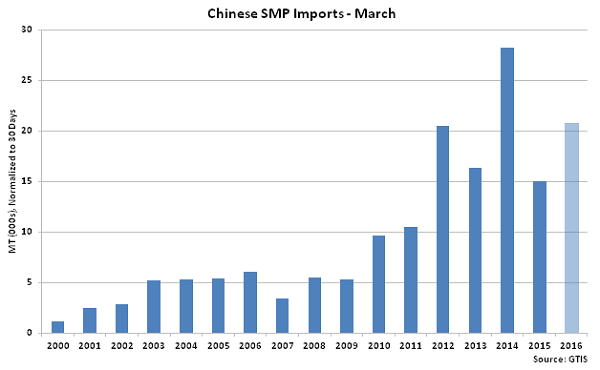

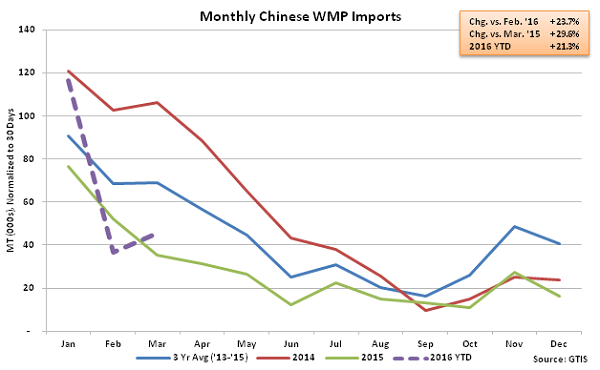

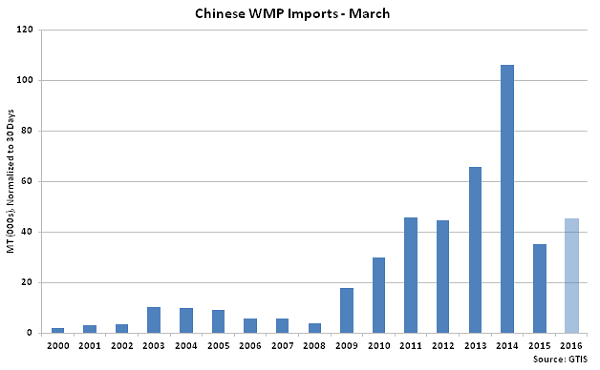

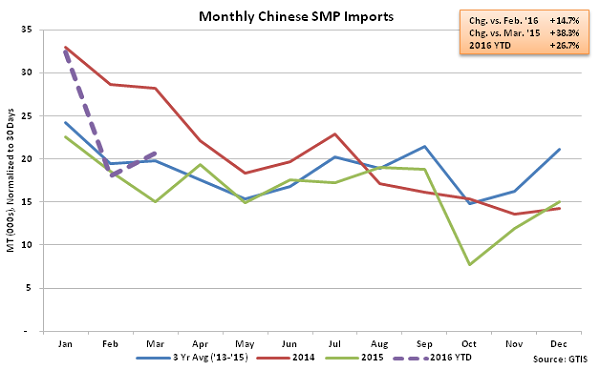

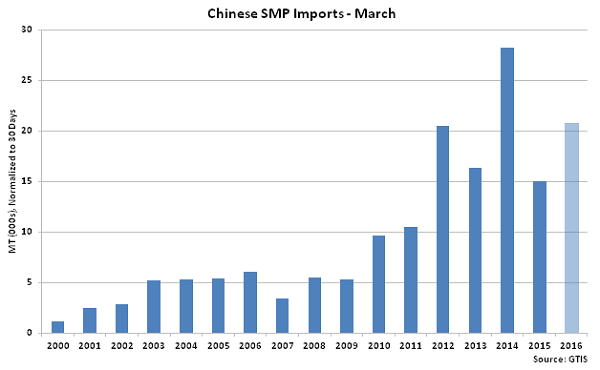

Mar ’16 Chinese powder imports followed the same general trend exhibited across overall dairy import volumes, increasing on both a MOM and YOY basis. Mar ’16 Chinese whole milk powder (WMP) and skim milk powder (SMP) import volumes increased 29.6% and 38.3% YOY, respectively, but remained below seasonal highs experienced during 2014. Mar ’16 Chinese dairy imports excluding WMP and SMP remained strong, increasing by 56.6% YOY and finishing at a new record high for the month of March.

Mar ’16 Total Chinese Dairy Import Volumes Remained Below the January Highs

Mar ’16 Total Chinese Dairy Import Volumes Increased 44.7% MOM and 46.8% YOY

Mar ’16 Total Chinese Dairy Import Volumes Increased 44.7% MOM and 46.8% YOY

Chinese Dairy Import Volumes Were the Second Largest on Record for the Month of March

Chinese Dairy Import Volumes Were the Second Largest on Record for the Month of March

Mar ’16 Chinese WMP Import Volumes Increased 23.7% MOM and 29.6% YOY

Mar ’16 Chinese WMP Import Volumes Increased 23.7% MOM and 29.6% YOY

Chinese WMP Imports Were the Fourth Largest on Record for the Month of March

Chinese WMP Imports Were the Fourth Largest on Record for the Month of March

Mar ’16 Chinese SMP Import Volumes Increased 14.7% MOM and 38.3% YOY

Mar ’16 Chinese SMP Import Volumes Increased 14.7% MOM and 38.3% YOY

Chinese SMP Imports Were the Second Largest on Record for the Month of March

Chinese SMP Imports Were the Second Largest on Record for the Month of March

Mar ’16 Chinese Dairy Imports Excluding WMP & SMP Increased 63.0% MOM and 56.6% YOY

Mar ’16 Chinese Dairy Imports Excluding WMP & SMP Increased 63.0% MOM and 56.6% YOY

Chinese Dairy Imports Excluding WMP & SMP Finished at a March Record High

Chinese Dairy Imports Excluding WMP & SMP Finished at a March Record High

New Zealand Accounted for Over 40% of the Total Mar ’16 Chinese Dairy Import Volumes

New Zealand Accounted for Over 40% of the Total Mar ’16 Chinese Dairy Import Volumes

Mar ’16 Total Chinese Dairy Import Volumes Increased 44.7% MOM and 46.8% YOY

Mar ’16 Total Chinese Dairy Import Volumes Increased 44.7% MOM and 46.8% YOY

Chinese Dairy Import Volumes Were the Second Largest on Record for the Month of March

Chinese Dairy Import Volumes Were the Second Largest on Record for the Month of March

Mar ’16 Chinese WMP Import Volumes Increased 23.7% MOM and 29.6% YOY

Mar ’16 Chinese WMP Import Volumes Increased 23.7% MOM and 29.6% YOY

Chinese WMP Imports Were the Fourth Largest on Record for the Month of March

Chinese WMP Imports Were the Fourth Largest on Record for the Month of March

Mar ’16 Chinese SMP Import Volumes Increased 14.7% MOM and 38.3% YOY

Mar ’16 Chinese SMP Import Volumes Increased 14.7% MOM and 38.3% YOY

Chinese SMP Imports Were the Second Largest on Record for the Month of March

Chinese SMP Imports Were the Second Largest on Record for the Month of March

Mar ’16 Chinese Dairy Imports Excluding WMP & SMP Increased 63.0% MOM and 56.6% YOY

Mar ’16 Chinese Dairy Imports Excluding WMP & SMP Increased 63.0% MOM and 56.6% YOY

Chinese Dairy Imports Excluding WMP & SMP Finished at a March Record High

Chinese Dairy Imports Excluding WMP & SMP Finished at a March Record High

New Zealand Accounted for Over 40% of the Total Mar ’16 Chinese Dairy Import Volumes

New Zealand Accounted for Over 40% of the Total Mar ’16 Chinese Dairy Import Volumes