U.S. Cattle on Feed Update – Apr ’16

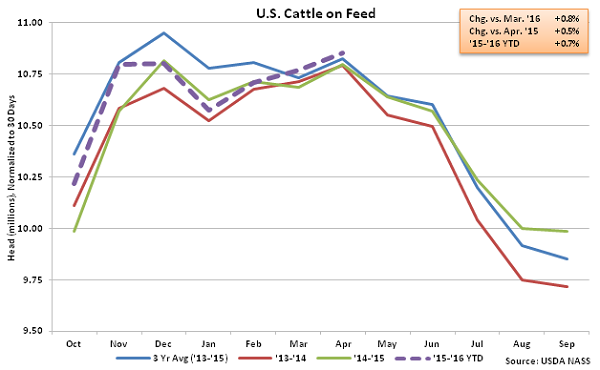

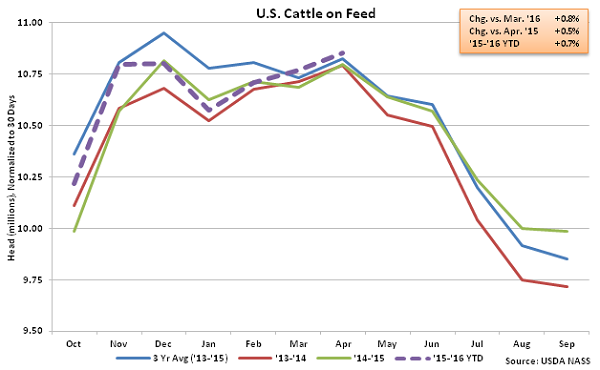

According to USDA, cattle and calves on feed for slaughter market in the U.S. for feedlots with capacity of 1,000 or more head totaled 10.85 million head on April 1, 2016, finishing 0.5% above the previous year. The Apr ’16 U.S. cattle on feed supply was up 56,000 head from April 1st of last year.

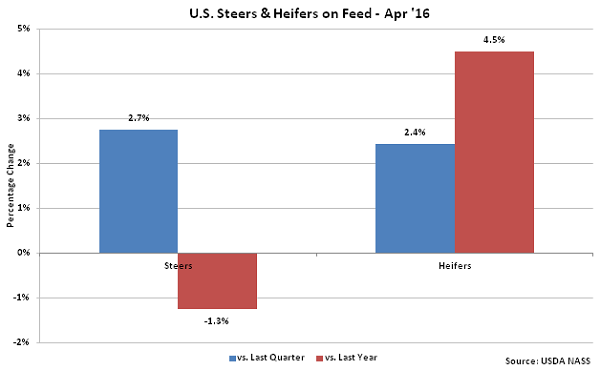

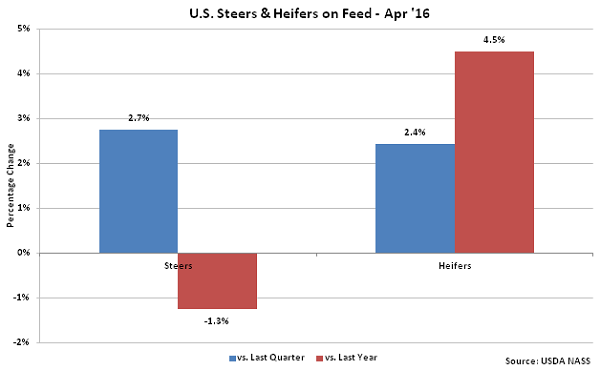

The cattle on feed inventory included 7.36 million steers and steer calves, down 1.3% from 2015 levels, and 3.49 million heifers and heifer calves, up 4.5% from the previous year.

The cattle on feed inventory included 7.36 million steers and steer calves, down 1.3% from 2015 levels, and 3.49 million heifers and heifer calves, up 4.5% from the previous year.

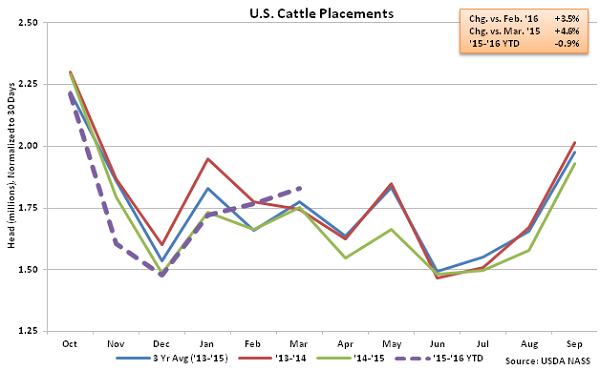

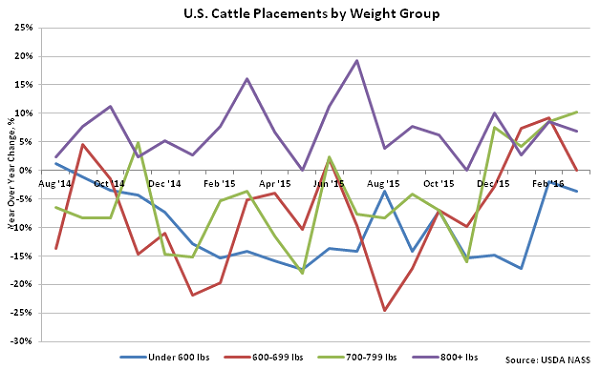

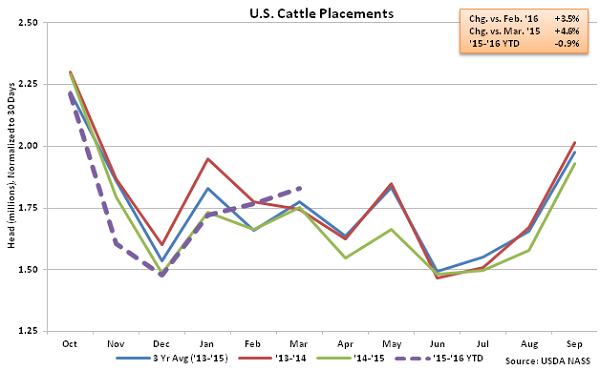

Placements in feedlots during Mar ’16 totaled 1.89 million head, up 83,000 head, or 4.6%, from March of last year. Placements for those weighing 700-799 pounds increased the most YOY, finishing up 10.2%, while placements for those 800 pounds or more increased by 6.9%. Placements for those weighing 600-699 pounds were flat YOY while those under 600 pounds remained lower on a YOY basis, finishing down 3.6%. Placements in feedlots declined 4.5% throughout the ’14-’15 production season and are down an additional 0.9% YTD throughout the first half of the ’15-’16 production season, despite the most recent YOY gain.

Placements in feedlots during Mar ’16 totaled 1.89 million head, up 83,000 head, or 4.6%, from March of last year. Placements for those weighing 700-799 pounds increased the most YOY, finishing up 10.2%, while placements for those 800 pounds or more increased by 6.9%. Placements for those weighing 600-699 pounds were flat YOY while those under 600 pounds remained lower on a YOY basis, finishing down 3.6%. Placements in feedlots declined 4.5% throughout the ’14-’15 production season and are down an additional 0.9% YTD throughout the first half of the ’15-’16 production season, despite the most recent YOY gain.

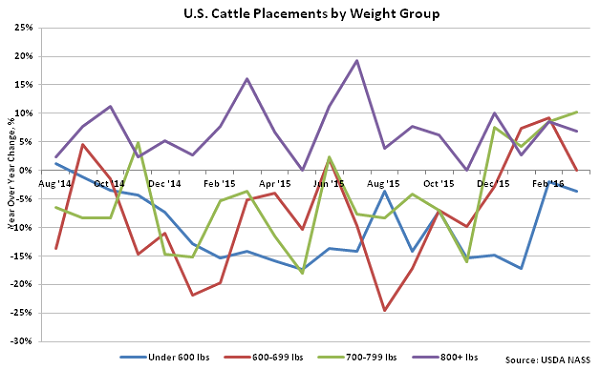

After deferred placements of heavier animals during the summer of 2014, weights from Aug ’14 – Mar ’16 indicate a continued trend towards heavier placements. Placements for those weighing 800 pounds or more have increased by 6.9% YOY over the 20 month period.

After deferred placements of heavier animals during the summer of 2014, weights from Aug ’14 – Mar ’16 indicate a continued trend towards heavier placements. Placements for those weighing 800 pounds or more have increased by 6.9% YOY over the 20 month period.

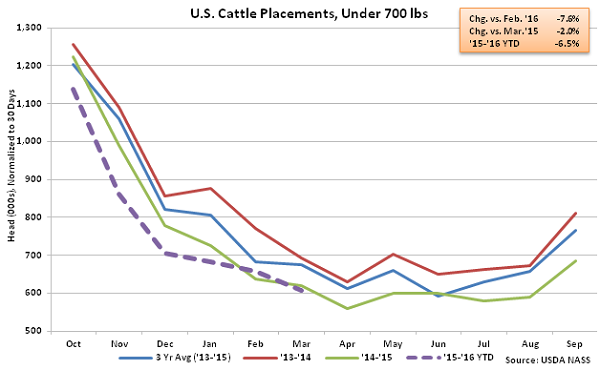

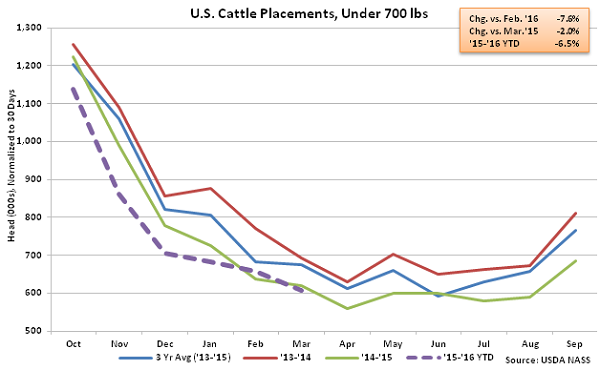

Mar ’16 cattle placements under 700 pounds declined by 13,000 head, or 2.0%, YOY, finishing lower on a YOY basis for the 17th time in the past 18 months. Cattle placements under 700 pounds were generally higher throughout the ’13-’14 production season, finishing up 4.7% YOY, however ’14-’15 placements under 700 pounds finished down 11.1% YOY to the lowest annual figure on record. ’15-’16 YTD placements under 700 pounds are down an additional 6.5% YOY throughout the first half of the production season.

Mar ’16 cattle placements under 700 pounds declined by 13,000 head, or 2.0%, YOY, finishing lower on a YOY basis for the 17th time in the past 18 months. Cattle placements under 700 pounds were generally higher throughout the ’13-’14 production season, finishing up 4.7% YOY, however ’14-’15 placements under 700 pounds finished down 11.1% YOY to the lowest annual figure on record. ’15-’16 YTD placements under 700 pounds are down an additional 6.5% YOY throughout the first half of the production season.

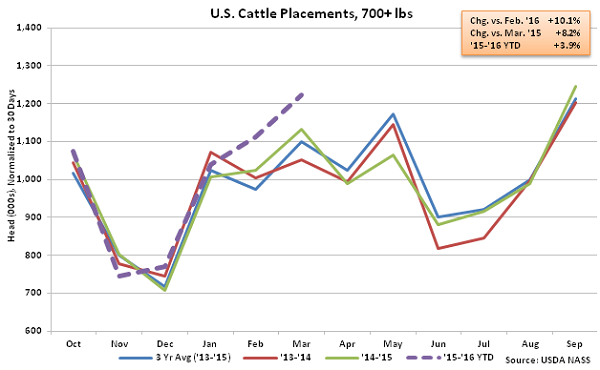

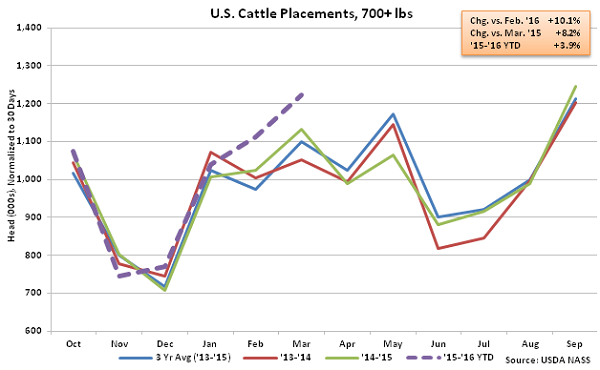

Mar ’16 cattle placements 700 pounds or heavier finished up 96,000 head, or 8.2% YOY. Cattle placements 700 pounds or heavier finished the ’13-’14 production season down 3.3% after declining 9.0% over the second half of the production season but gained back a portion of the previous year declines throughout the ’14-’15 production season, finishing up 1.0% YOY. ’15-’16 YTD placements 700 pounds or heavier are up an additional 3.9% YOY throughout the first half of the production season.

Mar ’16 cattle placements 700 pounds or heavier finished up 96,000 head, or 8.2% YOY. Cattle placements 700 pounds or heavier finished the ’13-’14 production season down 3.3% after declining 9.0% over the second half of the production season but gained back a portion of the previous year declines throughout the ’14-’15 production season, finishing up 1.0% YOY. ’15-’16 YTD placements 700 pounds or heavier are up an additional 3.9% YOY throughout the first half of the production season.

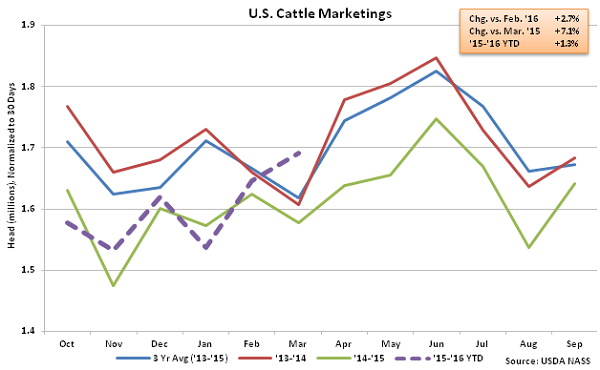

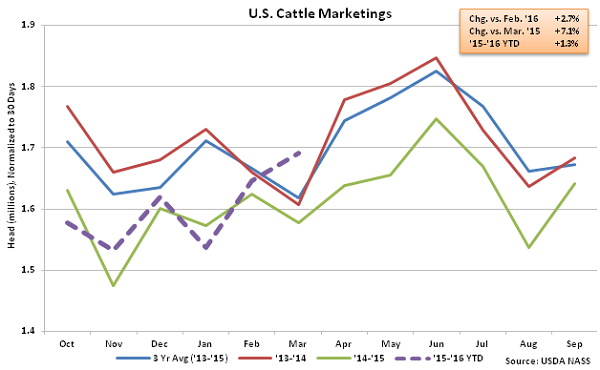

Marketings of fed cattle during Mar ’16 totaled 1.75 million head, up 116,000 head, or 7.1%, from March of last year. Marketings have increased on a YOY basis over four of the past five months. Other disappearance totaled 62,000 head during Mar ’16, down 7,000 head, or 10.1% on a YOY basis.

Marketings of fed cattle during Mar ’16 totaled 1.75 million head, up 116,000 head, or 7.1%, from March of last year. Marketings have increased on a YOY basis over four of the past five months. Other disappearance totaled 62,000 head during Mar ’16, down 7,000 head, or 10.1% on a YOY basis.

The cattle on feed inventory included 7.36 million steers and steer calves, down 1.3% from 2015 levels, and 3.49 million heifers and heifer calves, up 4.5% from the previous year.

The cattle on feed inventory included 7.36 million steers and steer calves, down 1.3% from 2015 levels, and 3.49 million heifers and heifer calves, up 4.5% from the previous year.

Placements in feedlots during Mar ’16 totaled 1.89 million head, up 83,000 head, or 4.6%, from March of last year. Placements for those weighing 700-799 pounds increased the most YOY, finishing up 10.2%, while placements for those 800 pounds or more increased by 6.9%. Placements for those weighing 600-699 pounds were flat YOY while those under 600 pounds remained lower on a YOY basis, finishing down 3.6%. Placements in feedlots declined 4.5% throughout the ’14-’15 production season and are down an additional 0.9% YTD throughout the first half of the ’15-’16 production season, despite the most recent YOY gain.

Placements in feedlots during Mar ’16 totaled 1.89 million head, up 83,000 head, or 4.6%, from March of last year. Placements for those weighing 700-799 pounds increased the most YOY, finishing up 10.2%, while placements for those 800 pounds or more increased by 6.9%. Placements for those weighing 600-699 pounds were flat YOY while those under 600 pounds remained lower on a YOY basis, finishing down 3.6%. Placements in feedlots declined 4.5% throughout the ’14-’15 production season and are down an additional 0.9% YTD throughout the first half of the ’15-’16 production season, despite the most recent YOY gain.

After deferred placements of heavier animals during the summer of 2014, weights from Aug ’14 – Mar ’16 indicate a continued trend towards heavier placements. Placements for those weighing 800 pounds or more have increased by 6.9% YOY over the 20 month period.

After deferred placements of heavier animals during the summer of 2014, weights from Aug ’14 – Mar ’16 indicate a continued trend towards heavier placements. Placements for those weighing 800 pounds or more have increased by 6.9% YOY over the 20 month period.

Mar ’16 cattle placements under 700 pounds declined by 13,000 head, or 2.0%, YOY, finishing lower on a YOY basis for the 17th time in the past 18 months. Cattle placements under 700 pounds were generally higher throughout the ’13-’14 production season, finishing up 4.7% YOY, however ’14-’15 placements under 700 pounds finished down 11.1% YOY to the lowest annual figure on record. ’15-’16 YTD placements under 700 pounds are down an additional 6.5% YOY throughout the first half of the production season.

Mar ’16 cattle placements under 700 pounds declined by 13,000 head, or 2.0%, YOY, finishing lower on a YOY basis for the 17th time in the past 18 months. Cattle placements under 700 pounds were generally higher throughout the ’13-’14 production season, finishing up 4.7% YOY, however ’14-’15 placements under 700 pounds finished down 11.1% YOY to the lowest annual figure on record. ’15-’16 YTD placements under 700 pounds are down an additional 6.5% YOY throughout the first half of the production season.

Mar ’16 cattle placements 700 pounds or heavier finished up 96,000 head, or 8.2% YOY. Cattle placements 700 pounds or heavier finished the ’13-’14 production season down 3.3% after declining 9.0% over the second half of the production season but gained back a portion of the previous year declines throughout the ’14-’15 production season, finishing up 1.0% YOY. ’15-’16 YTD placements 700 pounds or heavier are up an additional 3.9% YOY throughout the first half of the production season.

Mar ’16 cattle placements 700 pounds or heavier finished up 96,000 head, or 8.2% YOY. Cattle placements 700 pounds or heavier finished the ’13-’14 production season down 3.3% after declining 9.0% over the second half of the production season but gained back a portion of the previous year declines throughout the ’14-’15 production season, finishing up 1.0% YOY. ’15-’16 YTD placements 700 pounds or heavier are up an additional 3.9% YOY throughout the first half of the production season.

Marketings of fed cattle during Mar ’16 totaled 1.75 million head, up 116,000 head, or 7.1%, from March of last year. Marketings have increased on a YOY basis over four of the past five months. Other disappearance totaled 62,000 head during Mar ’16, down 7,000 head, or 10.1% on a YOY basis.

Marketings of fed cattle during Mar ’16 totaled 1.75 million head, up 116,000 head, or 7.1%, from March of last year. Marketings have increased on a YOY basis over four of the past five months. Other disappearance totaled 62,000 head during Mar ’16, down 7,000 head, or 10.1% on a YOY basis.