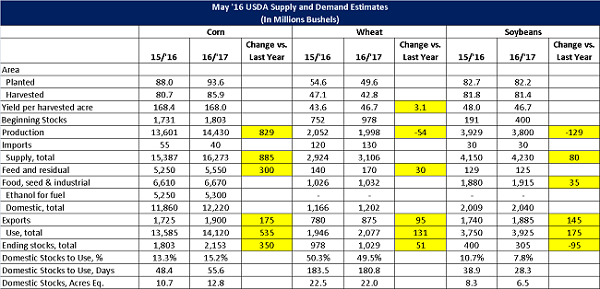

May ’16 USDA World Agriculture Supply and Demand Estimates

*Significant changes are highlighted

’15/’16 Corn

• Modest increase in exports left ending stocks slightly lower but near trade estimates.

’16/’17 Corn

• Production was in line with expectations using March acreage estimates and trend yields.

• Feed and residual is estimated 300 million higher versus current market year. The highest in nine years.

• Exports are projected 175 million above the current marketing year.

• Overall usage was considerably higher than private trade average estimates.

• Ending stocks at 2.153 billion bushels or 55.6 days of use was below private estimates but a 29 year high.

’15/’16 Soybeans

• Crush was increased 10 million bushels and exports 35 million leaving ending stocks 45 million lower and on the bottom end of trade estimates.

’16/’17 Soybeans

• Production was again in line with expectations using March acreage and trend yields.

• Crush is projected 35 million bushels higher versus the current marketing year and a record high.

• Exports are projected 145 million bushels higher versus the current marketing year and also a record.

• Overall usage and especially exports were well above private trade estimates.

• Ending stocks at 305 million bushels or 28.3 days of use was well below the range of private estimates.

’15/’16 Wheat

• No significant changes.

’16/’17 Wheat

• Production was estimated only marginally lower than last year despite 10% less acres and was above private estimates based on near record yields.

• Feed and residual usage was increased 30 million and exports 145 million bushels.

• Ending stocks at 1,029 million bushels or 180.8 days of use slightly above private estimates.

Click below for a downloadable pdf.

May ’16 USDA World Agriculture Supply and Demand Estimates

*Significant changes are highlighted

’15/’16 Corn

• Modest increase in exports left ending stocks slightly lower but near trade estimates.

’16/’17 Corn

• Production was in line with expectations using March acreage estimates and trend yields.

• Feed and residual is estimated 300 million higher versus current market year. The highest in nine years.

• Exports are projected 175 million above the current marketing year.

• Overall usage was considerably higher than private trade average estimates.

• Ending stocks at 2.153 billion bushels or 55.6 days of use was below private estimates but a 29 year high.

’15/’16 Soybeans

• Crush was increased 10 million bushels and exports 35 million leaving ending stocks 45 million lower and on the bottom end of trade estimates.

’16/’17 Soybeans

• Production was again in line with expectations using March acreage and trend yields.

• Crush is projected 35 million bushels higher versus the current marketing year and a record high.

• Exports are projected 145 million bushels higher versus the current marketing year and also a record.

• Overall usage and especially exports were well above private trade estimates.

• Ending stocks at 305 million bushels or 28.3 days of use was well below the range of private estimates.

’15/’16 Wheat

• No significant changes.

’16/’17 Wheat

• Production was estimated only marginally lower than last year despite 10% less acres and was above private estimates based on near record yields.

• Feed and residual usage was increased 30 million and exports 145 million bushels.

• Ending stocks at 1,029 million bushels or 180.8 days of use slightly above private estimates.

Click below for a downloadable pdf.

May ’16 USDA World Agriculture Supply and Demand Estimates