U.S. Livestock Cold Storage Update – Jun ’16

Executive Summary

U.S. cold storage figures provided by USDA were recently updated with values spanning through May ’16. Highlights from the updated report include:

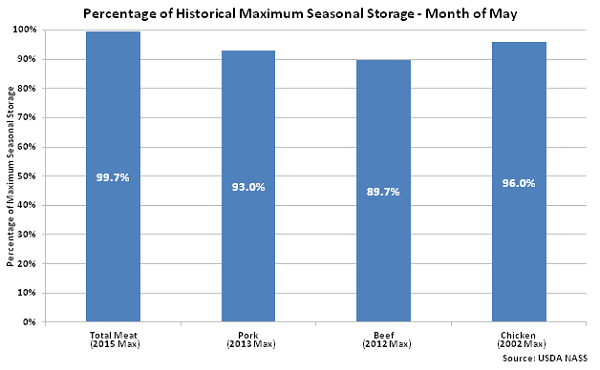

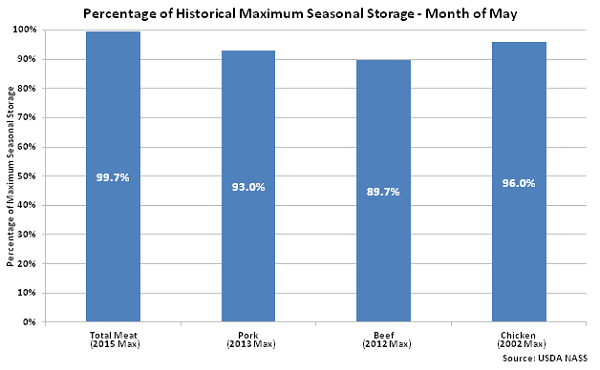

• U.S. pork and beef stocks each declined YOY for the fourth consecutive month during May ’16 but remained within 15% of historical maximum storage levels for the month of May.

• U.S. chicken stocks remained higher on a YOY basis for the 18th consecutive month during May ’16, finishing up 8.6% to a 14 year high for the month of May.

• May ’16 combined U.S. pork, beef and chicken remained 5.3% below the monthly record high experienced in Oct ’15 but just 0.3% below the record high seasonal level experienced during the previous year.

Additional Report Details

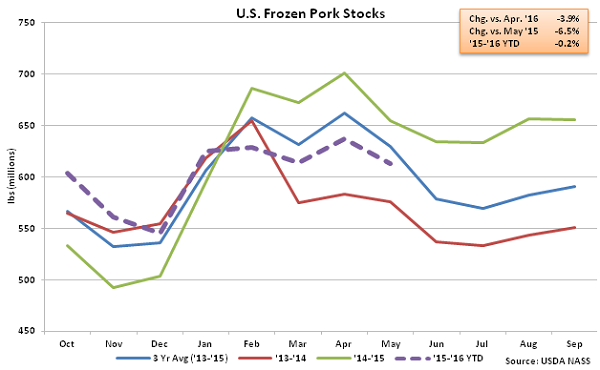

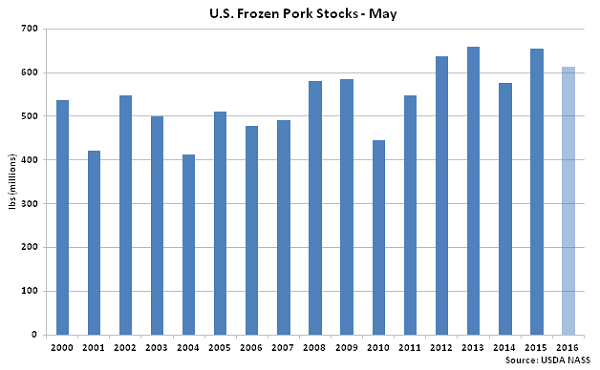

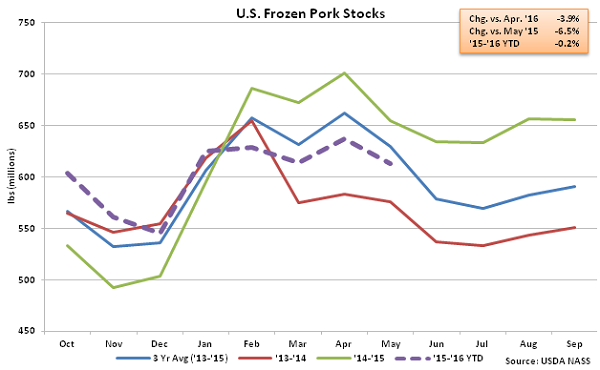

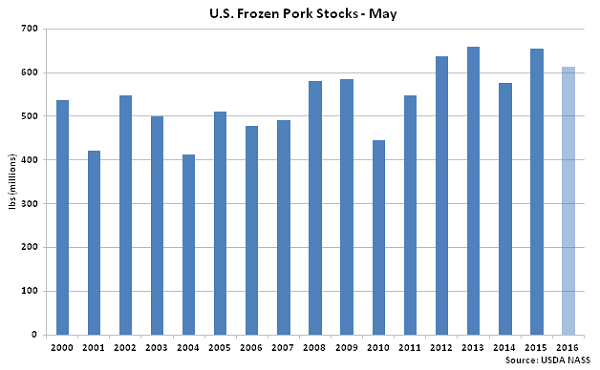

Pork – Stocks Decline on a YOY Basis for the Fourth Consecutive Month, Finish Down 6.5%

According to USDA, May ’16 U.S. frozen pork stocks of 612.7 million pounds declined 3.9% MOM and 6.5% YOY, finishing at a five month low. Pork stocks had increased YOY for 12 consecutive months prior to the four most recent YOY declines experienced from Feb ’16 – May ’16. The MOM decline in pork stocks of 24.6 million pounds, or 3.9%, was smaller than the ten year average April – May seasonal decline in stocks of 35.0 million pounds, or 5.8%, however May ’16 pork stocks finished 2.7% below three year average figures for the month of May.

According to USDA, May ’16 U.S. frozen pork stocks of 612.7 million pounds declined 3.9% MOM and 6.5% YOY, finishing at a five month low. Pork stocks had increased YOY for 12 consecutive months prior to the four most recent YOY declines experienced from Feb ’16 – May ’16. The MOM decline in pork stocks of 24.6 million pounds, or 3.9%, was smaller than the ten year average April – May seasonal decline in stocks of 35.0 million pounds, or 5.8%, however May ’16 pork stocks finished 2.7% below three year average figures for the month of May.

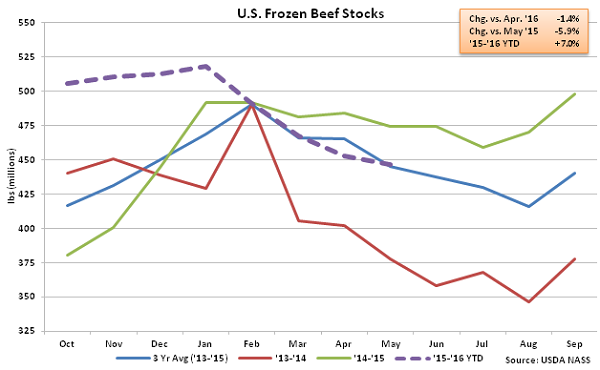

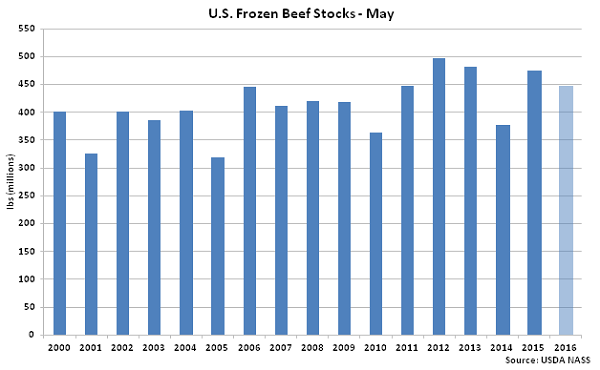

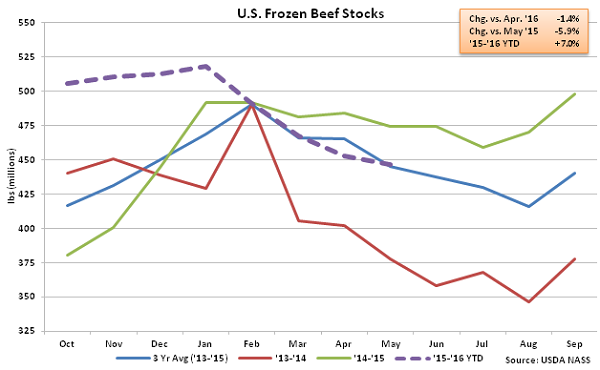

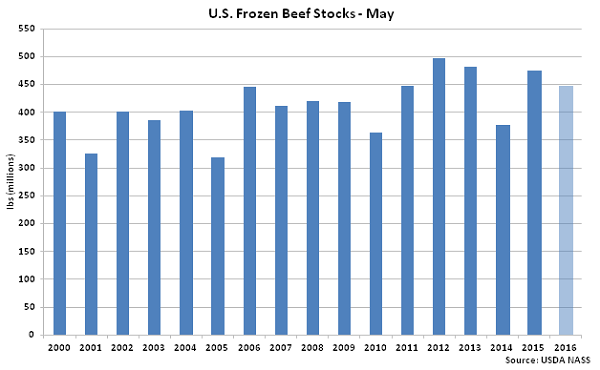

Beef – Stocks Decline to New 17 Month Low, Finish Down 5.9% YOY

Beef – Stocks Decline to New 17 Month Low, Finish Down 5.9% YOY

May ’16 U.S. frozen beef stocks of 446.7 million pounds declined 1.4% MOM and 5.9% YOY, finishing at a new 17 month low. Beef stocks had increased YOY for 14 consecutive months prior to the four most recent YOY declines experienced from Feb ’16 – May ’16. The MOM decline in beef stocks of 6.4 million pounds, or 1.4%, was consistent with the ten year average April – May decline in beef stocks of 7.4 million pounds, or 1.6%. Despite reaching a 17 month low on an absolute basis, May ’16 beef stocks remain 0.4% above three year average figures for the month of May.

May ’16 U.S. frozen beef stocks of 446.7 million pounds declined 1.4% MOM and 5.9% YOY, finishing at a new 17 month low. Beef stocks had increased YOY for 14 consecutive months prior to the four most recent YOY declines experienced from Feb ’16 – May ’16. The MOM decline in beef stocks of 6.4 million pounds, or 1.4%, was consistent with the ten year average April – May decline in beef stocks of 7.4 million pounds, or 1.6%. Despite reaching a 17 month low on an absolute basis, May ’16 beef stocks remain 0.4% above three year average figures for the month of May.

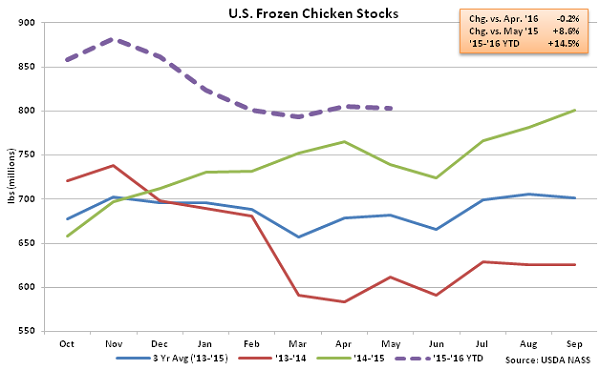

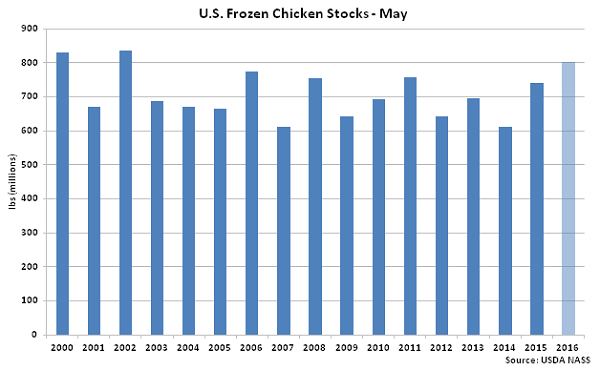

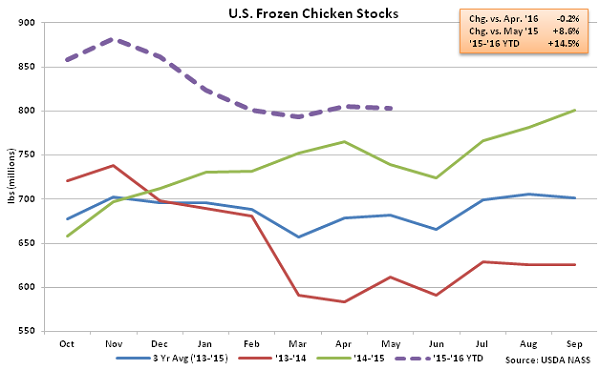

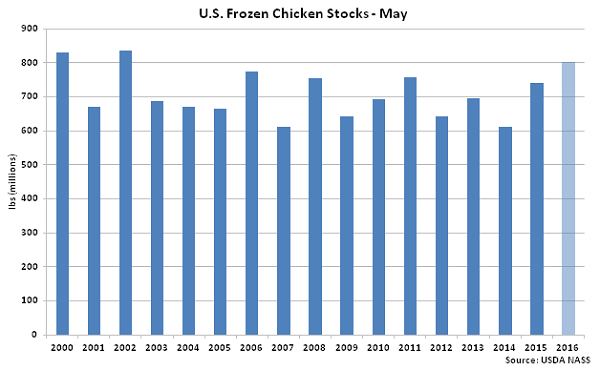

Chicken – Stocks Reach a 14 Year High for the Month of May, Finish up 8.6% YOY

Chicken – Stocks Reach a 14 Year High for the Month of May, Finish up 8.6% YOY

May ’16 U.S. frozen chicken stocks of 803.2 million pounds declined 0.2% MOM but remained 8.6% higher on a YOY basis, finishing at a 14 year high for the month of May. Chicken stocks increased YOY for the 18th month in a row after nine consecutive months of YOY declines were experienced from Mar ’14 – Nov ’14. Stocks have built as the Russian import ban continues to negatively affect U.S. broiler exports. U.S. broiler export volumes have declined by 9.7% YOY since the ban was announced. May ’16 chicken stocks finished 17.8% higher than three year average figures for the month of May.

May ’16 U.S. frozen chicken stocks of 803.2 million pounds declined 0.2% MOM but remained 8.6% higher on a YOY basis, finishing at a 14 year high for the month of May. Chicken stocks increased YOY for the 18th month in a row after nine consecutive months of YOY declines were experienced from Mar ’14 – Nov ’14. Stocks have built as the Russian import ban continues to negatively affect U.S. broiler exports. U.S. broiler export volumes have declined by 9.7% YOY since the ban was announced. May ’16 chicken stocks finished 17.8% higher than three year average figures for the month of May.

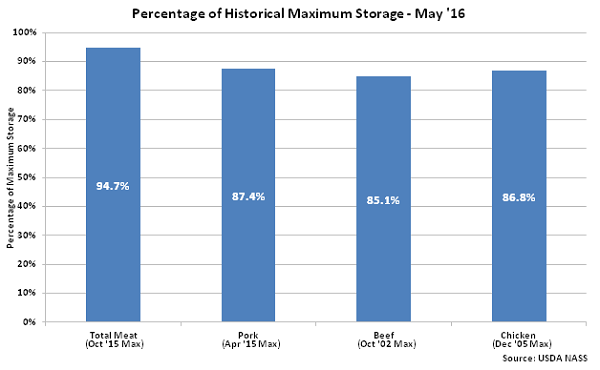

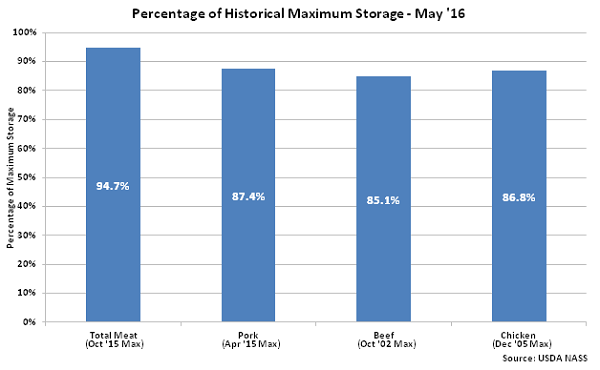

Overall, combined May ’16 U.S. pork, beef and chicken stocks remained 5.3% below the monthly record high experienced in Oct ’15. Individually, May ’16 U.S. pork, beef and chicken stocks each finished within 15% of historical maximum storage levels.

Overall, combined May ’16 U.S. pork, beef and chicken stocks remained 5.3% below the monthly record high experienced in Oct ’15. Individually, May ’16 U.S. pork, beef and chicken stocks each finished within 15% of historical maximum storage levels.

May ’16 combined U.S. pork, beef and chicken stocks finished 0.3% below the record high storage level for the month of May experienced during the previous year. Pork and chicken stocks each finished within 10% of historical maximum storage levels for the month of May while beef stocks finished within 15% of historical May storage levels.

May ’16 combined U.S. pork, beef and chicken stocks finished 0.3% below the record high storage level for the month of May experienced during the previous year. Pork and chicken stocks each finished within 10% of historical maximum storage levels for the month of May while beef stocks finished within 15% of historical May storage levels.

According to USDA, May ’16 U.S. frozen pork stocks of 612.7 million pounds declined 3.9% MOM and 6.5% YOY, finishing at a five month low. Pork stocks had increased YOY for 12 consecutive months prior to the four most recent YOY declines experienced from Feb ’16 – May ’16. The MOM decline in pork stocks of 24.6 million pounds, or 3.9%, was smaller than the ten year average April – May seasonal decline in stocks of 35.0 million pounds, or 5.8%, however May ’16 pork stocks finished 2.7% below three year average figures for the month of May.

According to USDA, May ’16 U.S. frozen pork stocks of 612.7 million pounds declined 3.9% MOM and 6.5% YOY, finishing at a five month low. Pork stocks had increased YOY for 12 consecutive months prior to the four most recent YOY declines experienced from Feb ’16 – May ’16. The MOM decline in pork stocks of 24.6 million pounds, or 3.9%, was smaller than the ten year average April – May seasonal decline in stocks of 35.0 million pounds, or 5.8%, however May ’16 pork stocks finished 2.7% below three year average figures for the month of May.

Beef – Stocks Decline to New 17 Month Low, Finish Down 5.9% YOY

Beef – Stocks Decline to New 17 Month Low, Finish Down 5.9% YOY

May ’16 U.S. frozen beef stocks of 446.7 million pounds declined 1.4% MOM and 5.9% YOY, finishing at a new 17 month low. Beef stocks had increased YOY for 14 consecutive months prior to the four most recent YOY declines experienced from Feb ’16 – May ’16. The MOM decline in beef stocks of 6.4 million pounds, or 1.4%, was consistent with the ten year average April – May decline in beef stocks of 7.4 million pounds, or 1.6%. Despite reaching a 17 month low on an absolute basis, May ’16 beef stocks remain 0.4% above three year average figures for the month of May.

May ’16 U.S. frozen beef stocks of 446.7 million pounds declined 1.4% MOM and 5.9% YOY, finishing at a new 17 month low. Beef stocks had increased YOY for 14 consecutive months prior to the four most recent YOY declines experienced from Feb ’16 – May ’16. The MOM decline in beef stocks of 6.4 million pounds, or 1.4%, was consistent with the ten year average April – May decline in beef stocks of 7.4 million pounds, or 1.6%. Despite reaching a 17 month low on an absolute basis, May ’16 beef stocks remain 0.4% above three year average figures for the month of May.

Chicken – Stocks Reach a 14 Year High for the Month of May, Finish up 8.6% YOY

Chicken – Stocks Reach a 14 Year High for the Month of May, Finish up 8.6% YOY

May ’16 U.S. frozen chicken stocks of 803.2 million pounds declined 0.2% MOM but remained 8.6% higher on a YOY basis, finishing at a 14 year high for the month of May. Chicken stocks increased YOY for the 18th month in a row after nine consecutive months of YOY declines were experienced from Mar ’14 – Nov ’14. Stocks have built as the Russian import ban continues to negatively affect U.S. broiler exports. U.S. broiler export volumes have declined by 9.7% YOY since the ban was announced. May ’16 chicken stocks finished 17.8% higher than three year average figures for the month of May.

May ’16 U.S. frozen chicken stocks of 803.2 million pounds declined 0.2% MOM but remained 8.6% higher on a YOY basis, finishing at a 14 year high for the month of May. Chicken stocks increased YOY for the 18th month in a row after nine consecutive months of YOY declines were experienced from Mar ’14 – Nov ’14. Stocks have built as the Russian import ban continues to negatively affect U.S. broiler exports. U.S. broiler export volumes have declined by 9.7% YOY since the ban was announced. May ’16 chicken stocks finished 17.8% higher than three year average figures for the month of May.

Overall, combined May ’16 U.S. pork, beef and chicken stocks remained 5.3% below the monthly record high experienced in Oct ’15. Individually, May ’16 U.S. pork, beef and chicken stocks each finished within 15% of historical maximum storage levels.

Overall, combined May ’16 U.S. pork, beef and chicken stocks remained 5.3% below the monthly record high experienced in Oct ’15. Individually, May ’16 U.S. pork, beef and chicken stocks each finished within 15% of historical maximum storage levels.

May ’16 combined U.S. pork, beef and chicken stocks finished 0.3% below the record high storage level for the month of May experienced during the previous year. Pork and chicken stocks each finished within 10% of historical maximum storage levels for the month of May while beef stocks finished within 15% of historical May storage levels.

May ’16 combined U.S. pork, beef and chicken stocks finished 0.3% below the record high storage level for the month of May experienced during the previous year. Pork and chicken stocks each finished within 10% of historical maximum storage levels for the month of May while beef stocks finished within 15% of historical May storage levels.