New Zealand Milk Production Update – Oct ’16

Executive Summary

New Zealand milk production figures provided by Dairy Companies Association of New Zealand (DCANZ) were recently updated with values spanning through Sep ’16. Highlights from the updated report include:

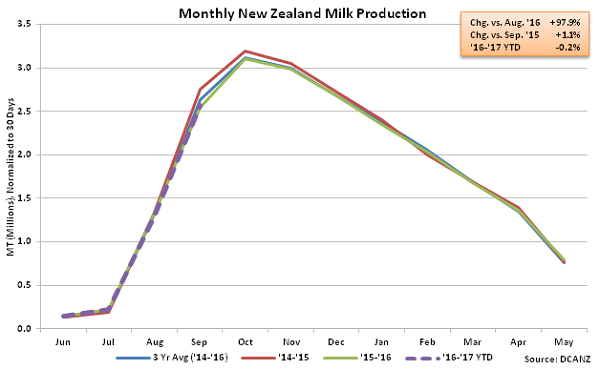

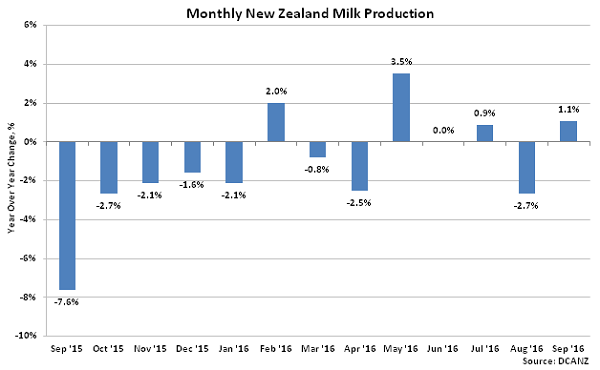

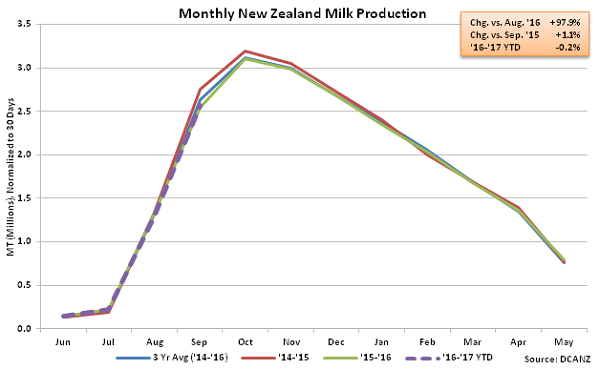

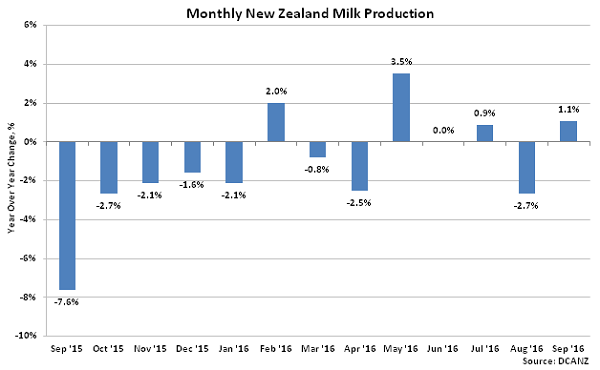

• New Zealand milk production volumes continued to increase seasonally while also finishing up 1.1% on a YOY basis during Sep ’16. Production volumes will continue to increase seasonally until highs are reached during the month of October.

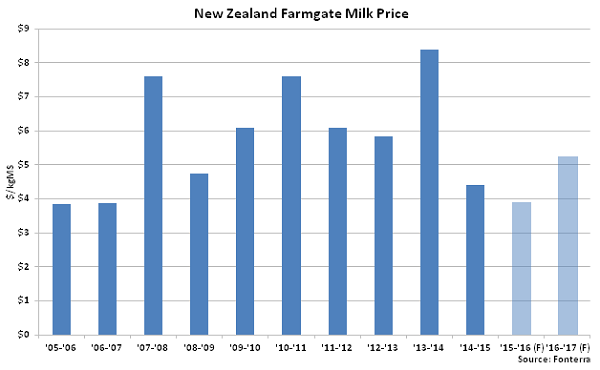

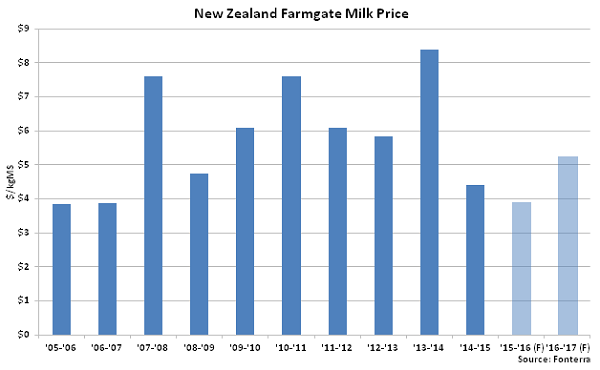

• ’16-’17 New Zealand farmgate milk price projections were raised by a total of $1.00/kgMS throughout the past two months to a value of $5.25/kgMS but remain near estimated breakeven levels.

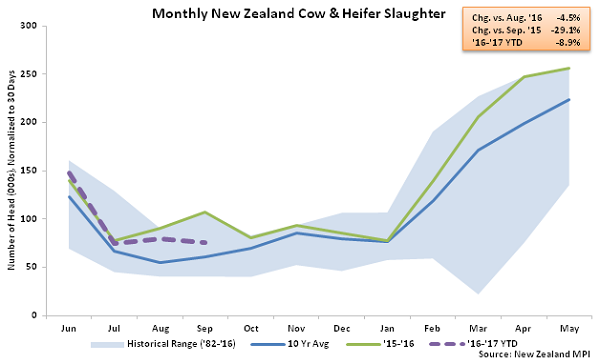

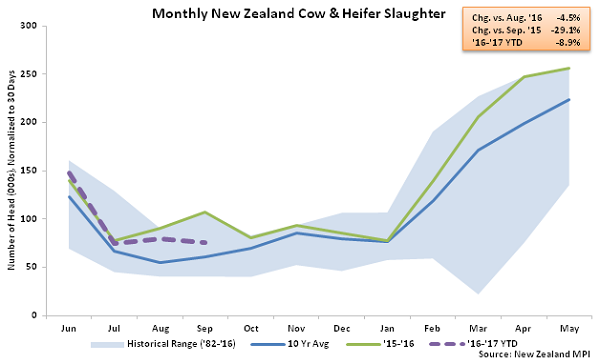

• New Zealand cow & heifer slaughter rates reached a record annual high during the ’15-’16 production season but have declined by 8.9% on a YOY basis throughout the first third of the ’16-’17 production season. New Zealand cow & heifer slaughter rates declined by 29.1% YOY during Sep ’16 but remain above three year average figures.

Additional Report Details

According to DCANZ, Sep ’16 New Zealand milk production volumes increased to a nine month high seasonally while also finishing higher on a YOY basis, increasing by 1.1%. New Zealand milk production typically reaches seasonal lows during the months of June and July as farmers dry off their herds in preparation for spring calving before increasing production volumes until seasonal highs are reached during the month of October.

The Sep ’16 YOY increase in New Zealand milk production was against a sharp decline in production experienced during the previous year. Sep ’15 production levels declined 7.5% YOY, which was the largest decline experienced in over three years. Production declined significantly during Sep ’15 due in part to wet weather affecting forage conditions across New Zealand. According to Fonterra, wet weather conditions have once again been experienced throughout the North Island throughout Oct ’16, which is expected to result in declines in production over coming months.

The Sep ’16 YOY increase in New Zealand milk production was against a sharp decline in production experienced during the previous year. Sep ’15 production levels declined 7.5% YOY, which was the largest decline experienced in over three years. Production declined significantly during Sep ’15 due in part to wet weather affecting forage conditions across New Zealand. According to Fonterra, wet weather conditions have once again been experienced throughout the North Island throughout Oct ’16, which is expected to result in declines in production over coming months.

New Zealand farmgate milk prices reached a nine year low during the ’15-’16 production season as concerns over a potential El Niño event mounted while global milk supplies expanded significantly, particularly from within the EU-28. More recently, the ’16-’17 farmgate milk price forecast was increased by a total of $1.00/kgMS to a value of $5.25/kgMS as continued reductions in milk supply are expected to bring global supply and demand back into balance.

New Zealand farmgate milk prices reached a nine year low during the ’15-’16 production season as concerns over a potential El Niño event mounted while global milk supplies expanded significantly, particularly from within the EU-28. More recently, the ’16-’17 farmgate milk price forecast was increased by a total of $1.00/kgMS to a value of $5.25/kgMS as continued reductions in milk supply are expected to bring global supply and demand back into balance.

New Zealand slaughter rates accelerated throughout the final months of the ’15-’16 production season, reaching record seasonal highs. Overall, ’15-’16 annual New Zealand cow & heifer slaughter rates finished up 3.2% YOY, reaching a record annual high. New Zealand cow & heifer slaughter rates have declined by 8.9% in total over the first third of the ’16-’17 production season, however, as a 29.1% YOY decline in slaughter rates was experienced during Sep ’16. Despite the significant YOY increase in slaughter rates, Sep ’16 cow & heifer slaughter remained 3.3% above three year average figures and 25.3% above ten year average figures.

New Zealand slaughter rates accelerated throughout the final months of the ’15-’16 production season, reaching record seasonal highs. Overall, ’15-’16 annual New Zealand cow & heifer slaughter rates finished up 3.2% YOY, reaching a record annual high. New Zealand cow & heifer slaughter rates have declined by 8.9% in total over the first third of the ’16-’17 production season, however, as a 29.1% YOY decline in slaughter rates was experienced during Sep ’16. Despite the significant YOY increase in slaughter rates, Sep ’16 cow & heifer slaughter remained 3.3% above three year average figures and 25.3% above ten year average figures.

The Sep ’16 YOY increase in New Zealand milk production was against a sharp decline in production experienced during the previous year. Sep ’15 production levels declined 7.5% YOY, which was the largest decline experienced in over three years. Production declined significantly during Sep ’15 due in part to wet weather affecting forage conditions across New Zealand. According to Fonterra, wet weather conditions have once again been experienced throughout the North Island throughout Oct ’16, which is expected to result in declines in production over coming months.

The Sep ’16 YOY increase in New Zealand milk production was against a sharp decline in production experienced during the previous year. Sep ’15 production levels declined 7.5% YOY, which was the largest decline experienced in over three years. Production declined significantly during Sep ’15 due in part to wet weather affecting forage conditions across New Zealand. According to Fonterra, wet weather conditions have once again been experienced throughout the North Island throughout Oct ’16, which is expected to result in declines in production over coming months.

New Zealand farmgate milk prices reached a nine year low during the ’15-’16 production season as concerns over a potential El Niño event mounted while global milk supplies expanded significantly, particularly from within the EU-28. More recently, the ’16-’17 farmgate milk price forecast was increased by a total of $1.00/kgMS to a value of $5.25/kgMS as continued reductions in milk supply are expected to bring global supply and demand back into balance.

New Zealand farmgate milk prices reached a nine year low during the ’15-’16 production season as concerns over a potential El Niño event mounted while global milk supplies expanded significantly, particularly from within the EU-28. More recently, the ’16-’17 farmgate milk price forecast was increased by a total of $1.00/kgMS to a value of $5.25/kgMS as continued reductions in milk supply are expected to bring global supply and demand back into balance.

New Zealand slaughter rates accelerated throughout the final months of the ’15-’16 production season, reaching record seasonal highs. Overall, ’15-’16 annual New Zealand cow & heifer slaughter rates finished up 3.2% YOY, reaching a record annual high. New Zealand cow & heifer slaughter rates have declined by 8.9% in total over the first third of the ’16-’17 production season, however, as a 29.1% YOY decline in slaughter rates was experienced during Sep ’16. Despite the significant YOY increase in slaughter rates, Sep ’16 cow & heifer slaughter remained 3.3% above three year average figures and 25.3% above ten year average figures.

New Zealand slaughter rates accelerated throughout the final months of the ’15-’16 production season, reaching record seasonal highs. Overall, ’15-’16 annual New Zealand cow & heifer slaughter rates finished up 3.2% YOY, reaching a record annual high. New Zealand cow & heifer slaughter rates have declined by 8.9% in total over the first third of the ’16-’17 production season, however, as a 29.1% YOY decline in slaughter rates was experienced during Sep ’16. Despite the significant YOY increase in slaughter rates, Sep ’16 cow & heifer slaughter remained 3.3% above three year average figures and 25.3% above ten year average figures.